🎯Today's Finance Pulse

Updated 28m agoWhat's happening: Atlassian taps LinkedIn CFO James Chuong as new finance chief

James Chuong, who has served nearly five years as LinkedIn’s chief financial officer, will become Atlassian’s CFO on March 30. His compensation package includes a $600,000 base salary, a 75% target bonus, a $22 million RSU grant and a $2 million signing bonus. The move follows the announced departure of long‑time Atlassian CFO Joe Binz this summer.

Also developing:

By the numbers: AlayaCare raises $50M growth capital facility

News•Feb 13, 2026

New Rules for M&A Financing, Loans Against Shares

The Reserve Bank of India issued final guidelines allowing banks to fund acquisitions only when the acquirer already controls the target and seeks to increase its stake from 26% to 90%. Borrowers must have at least ₹500 crore net worth, three years of profit and, if unlisted, an investment‑grade rating. The bank‑level ceiling for acquisition finance rose to 20% of eligible capital, and retail loan limits against shares were lifted to ₹1 crore with higher LTV ratios for various securities. The rules take effect on April 1, 2026.

By The Economic Times (India) – Economy

Social•Feb 13, 2026

Investors Choose Safe Bonds, Accepting Low Real Returns

One way to interpret recent price action in the bond market is that large pools of investment capital have made the determination that a 3.6%-4.1% guaranteed nominal return over the next 5-10 years is preferable to taking on the risk/reward...

By Quinn Thompson

News•Feb 13, 2026

Tariffs, Supplier Fire Continue to Batter Ford

Ford Motor Co. reported a roughly $2 billion tariff hit in 2025, double the amount projected just months earlier, after a miscommunication about the effective date of auto‑part tariff offsets. A fire at Novelis’ Oswego aluminum plant added another $2 billion headwind,...

By Supply Chain Dive

Social•Feb 13, 2026

Incentive Pay Boosts Advisor Revenue and Client Growth

This #WeekendReading kicks off with the news that @CharlesSchwab's latest RIA compensation report finds that while base salaries remain the largest component of advisor compensation, firms that offer incentive pay have seen more revenue and client growth in recent years than...

By Michael Kitces

News•Feb 13, 2026

Health Cover to Be Bundled with Pension Schemes, Says PFRDA Chief

India’s PFRDA is piloting pension plans that bundle health insurance, allowing up to 30% of the retirement corpus to be earmarked for medical expenses. ICICI, Axis and Tata‑backed funds are testing the “Swasthya” product, which could leverage pooled investors to...

By The Hindu Business Line – All

News•Feb 13, 2026

SpaceX Said to Weigh Dual-Class IPO Shares to Empower Musk

SpaceX is weighing a dual‑class share structure for its anticipated 2026 IPO, echoing a model Elon Musk previously floated for Tesla. The two‑tier system would grant a select class of shares superior voting rights, enabling insiders to steer the company...

By Bloomberg – Markets

News•Feb 13, 2026

Lawmakers Seek to Penalize DoD if It Fails to Pass a Clean Audit

Lawmakers introduced the RECEIPTS Act, which would penalize the Department of Defense by transferring its Defense Finance and Accounting Service functions if a clean full audit is not achieved by December 2028, while rewarding success with up to $10 billion in...

By Federal News Network

News•Feb 13, 2026

Operations, Tech and Talent Leadership Moves Across the Market

A wave of senior appointments swept the aerospace, defense and technology services sector this week, with AAR Corp. naming former Boeing and Deutsche Bank veteran Dylan Wolin as CFO and BAE Systems hiring ex‑Collins Aerospace chief digital officer Mona Bates...

By Washington Technology

News•Feb 13, 2026

Analyst Report: Altria Group Inc.

Altria Group, a legacy tobacco conglomerate, is confronting a shrinking base of smokers, which is pressuring its traditional cigarette revenues. The company’s core brands include Philip Morris USA and John Middleton cigars, while its smoke‑free portfolio features NJOY, U.S. Smokeless Tobacco and...

By Yahoo Finance – News Index

News•Feb 13, 2026

Biopharma Money Raised: Jan. 1-Feb. 12, 2026

BioWorld’s latest brief highlights three emerging biotech advances. Researchers pinpointed the SCAN network as a central circuit disrupted in Parkinson’s disease, offering a new therapeutic target. Astellas presented promising preclinical data on ASP-2246, an mRNA‑encoded NeuroD1 candidate aimed at neural...

By BioWorld (Citeline) – Featured Feeds

News•Feb 13, 2026

Humana Approaches $1B Acquisition of Florida Primary Care Company: Bloomberg

Humana is negotiating a roughly $1 billion purchase of Florida‑based MaxHealth, a primary‑care network focused on adults and seniors. MaxHealth is owned by Arsenal Capital Partners’ Best Value Healthcare, and the deal would deepen Humana’s primary‑care footprint after recent growth in...

By Becker’s Hospital Review

News•Feb 13, 2026

McLeod Russel Reports Narrowing of Q3 Net Loss at ₹36.41 Crore, Revenue Rises 20%

McLeod Russel narrowed its Q3 consolidated net loss to ₹36.41 crore, down from ₹87.33 crore a year earlier, while revenue from operations climbed 20% to ₹445.45 crore. The company acknowledged continued financial stress, citing outstanding inter‑corporate deposits and ongoing legal actions. Lenders have...

By The Hindu BusinessLine – Companies

News•Feb 13, 2026

BSE Gets Sebi Nod to Launch 'Focused Midcap Index' Futures and Options Contracts

The Bombay Stock Exchange (BSE) has secured SEBI approval to roll out cash‑settled futures and options on its new Focused Midcap Index, which tracks the top 20 mid‑cap companies by free‑float market capitalisation. The contracts will be monthly, expiring on...

By The Economic Times – Markets

News•Feb 13, 2026

CFOs On the Move: Week Ending Feb. 13

A wave of CFO appointments and departures unfolded this week, spanning automakers, retail, crypto, and fintech. General Motors hired Lucid veteran Claudia Gast to steer strategy and technology partnerships, while Warby Parker tapped former Macy’s CFO Adrian Mitchell. Kraken dismissed...

By CFO.com

News•Feb 13, 2026

How Match Group’s CFO Runs the Finance Function Behind Modern Dating

Match Group CFO Steve Bailey, marking his first year in the role, has tightened capital discipline across a portfolio that includes Tinder, Hinge and dozens of international brands. He introduced the PRISM framework to standardize ROI measurement for a $600 million marketing...

By CFO.com

News•Feb 13, 2026

Market Regulator Sebi Floats Proposal to Revamp ETF Price Band Framework

The Securities and Exchange Board of India (SEBI) has issued a consultation paper proposing a overhaul of ETF price‑band rules. It recommends moving the base‑price reference from T‑2 closing NAV to T‑1 data or recent indicative NAV, and introducing dynamic,...

By Business Standard – Markets

Blog•Feb 13, 2026

FCPA Priorities Whitepaper

Ground Truth Intelligence released a whitepaper outlining the Department of Justice’s refreshed FCPA enforcement agenda after a 180‑day pause and June 2025 guidance. The DOJ is shifting resources toward corruption that threatens U.S. national security, economic competitiveness, and organized‑crime links,...

By Corporate Compliance Insights

News•Feb 13, 2026

Bhatia Communications Sets Record Date for Third Interim Dividend Payable in FY26

Bhatia Communications & Retail announced February 20 as the record date for its third interim dividend for FY 2025‑26, offering Rs 0.01 per equity share. The dividend is payable to shareholders holding shares before that date. The announcement follows a December‑quarter earnings beat,...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

Morgan Stanley Said to Consider $500 Million India Fund, Shifts some Assets

Morgan Stanley Investment Management is exploring a $500 million continuation fund focused on India, intending to transfer eight healthcare‑related assets, including Omega Hospitals and RG Scientific, into the new vehicle. The move signals the firm’s effort to provide existing investors an...

By The Economic Times – Markets

Social•Feb 13, 2026

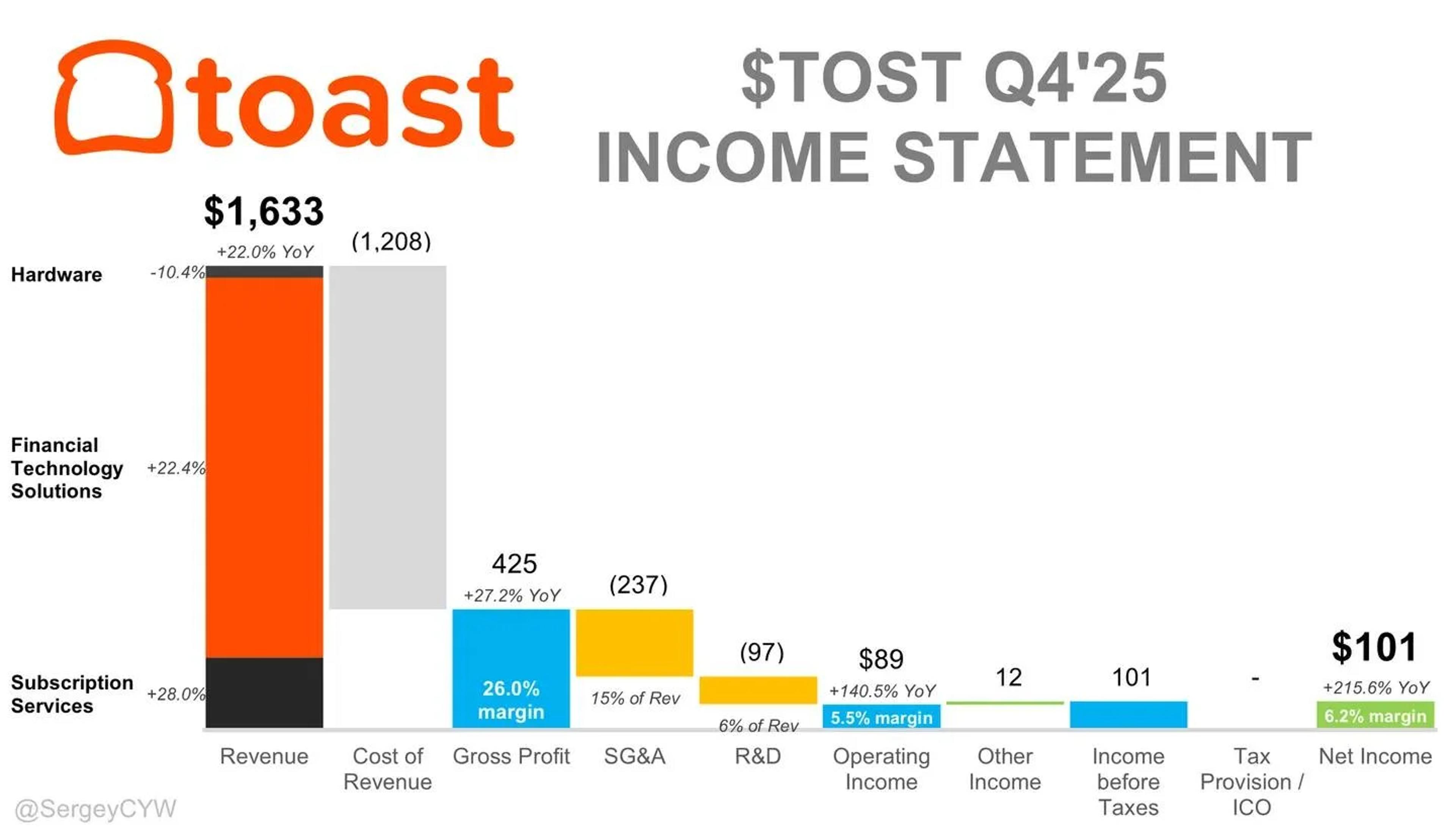

TOST Q4 Margins Surge, Profit Spikes over 200%

$TOST Q4: Operating income +140% YoY, net income +216% YoY. Margins expanding across the board. Revenue came in at $1.63B, up 22% YoY. Growth moderated vs +25% last quarter, but profitability stepped up meaningfully. Gross profit grew 27% YoY with gross margin...

By Sergey CYW

News•Feb 13, 2026

Wipro, Infosys, TCS and 9 Other Stocks Hit 52-Week Lows and Slip up to 20% in a Month

A wave of weakness hit India’s blue‑chip segment as the Sensex slumped nearly 1,048 points, pushing nine BSE 200 stocks to fresh 52‑week lows. Leading IT giants Wipro, L&T Technology Services, TCS and Infosys each fell between 14% and 19% over...

By The Economic Times – Markets

Social•Feb 13, 2026

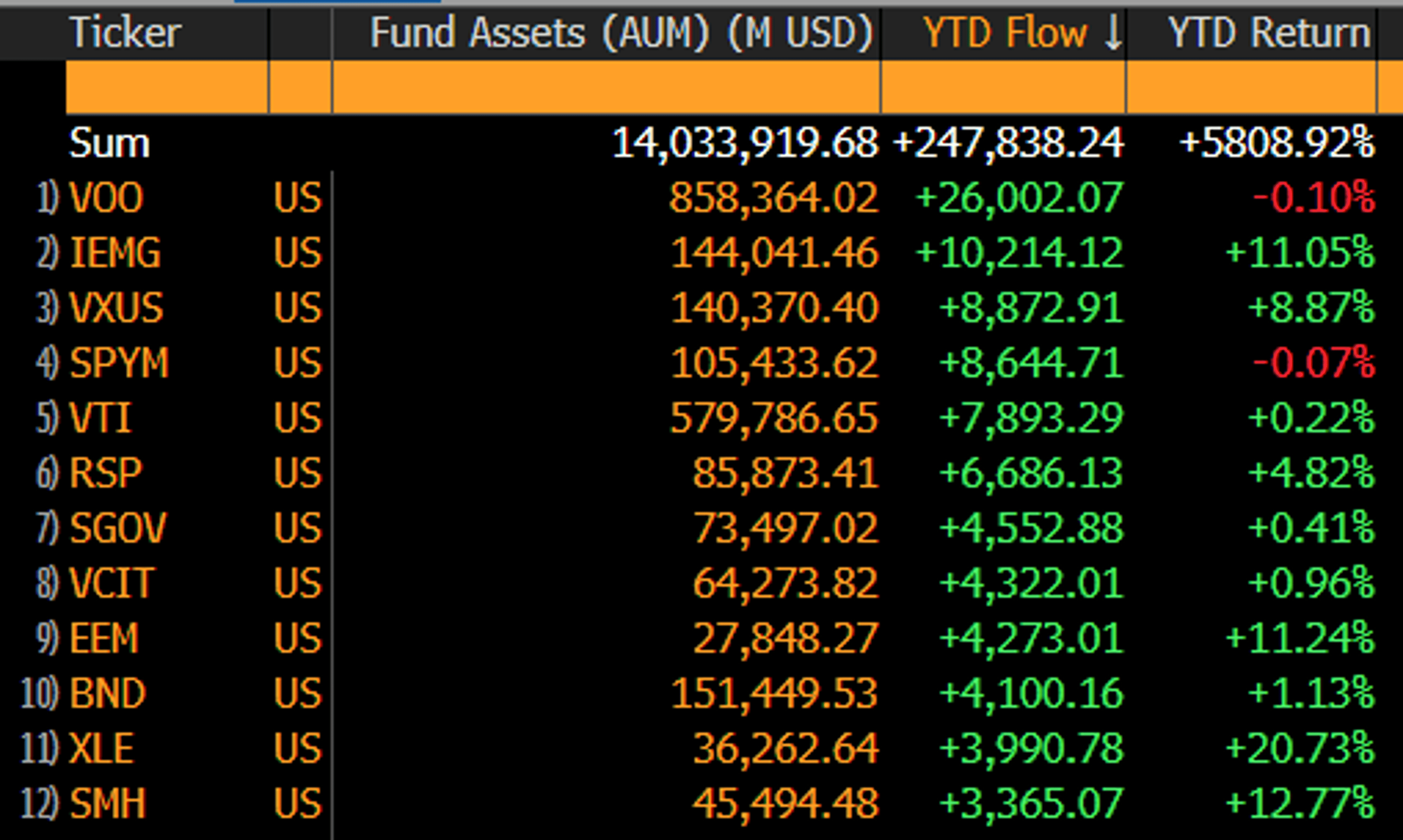

ETFs Rake $250B in 28 Days, EM Overtakes Gold

There's only been 28 trading days this year and ETFs have already pulled in about $250b. More than double any other start to a year. Up until 2020, $250b was what they averaged for a YEAR. That's $9b/day pace, or...

By Eric Balchunas

News•Feb 13, 2026

EIL Q3 Profit Soars over 3x YoY to Rs 302 Crore

Engineers India Ltd (EIL) posted a net profit of Rs 302 crore for Q3 FY2025‑26, more than three times its profit a year earlier. The surge was driven by a dramatic rise in turnkey contract earnings, which jumped to Rs 273.68 crore from Rs 18.92 crore,...

By The Economic Times – Markets

Social•Feb 13, 2026

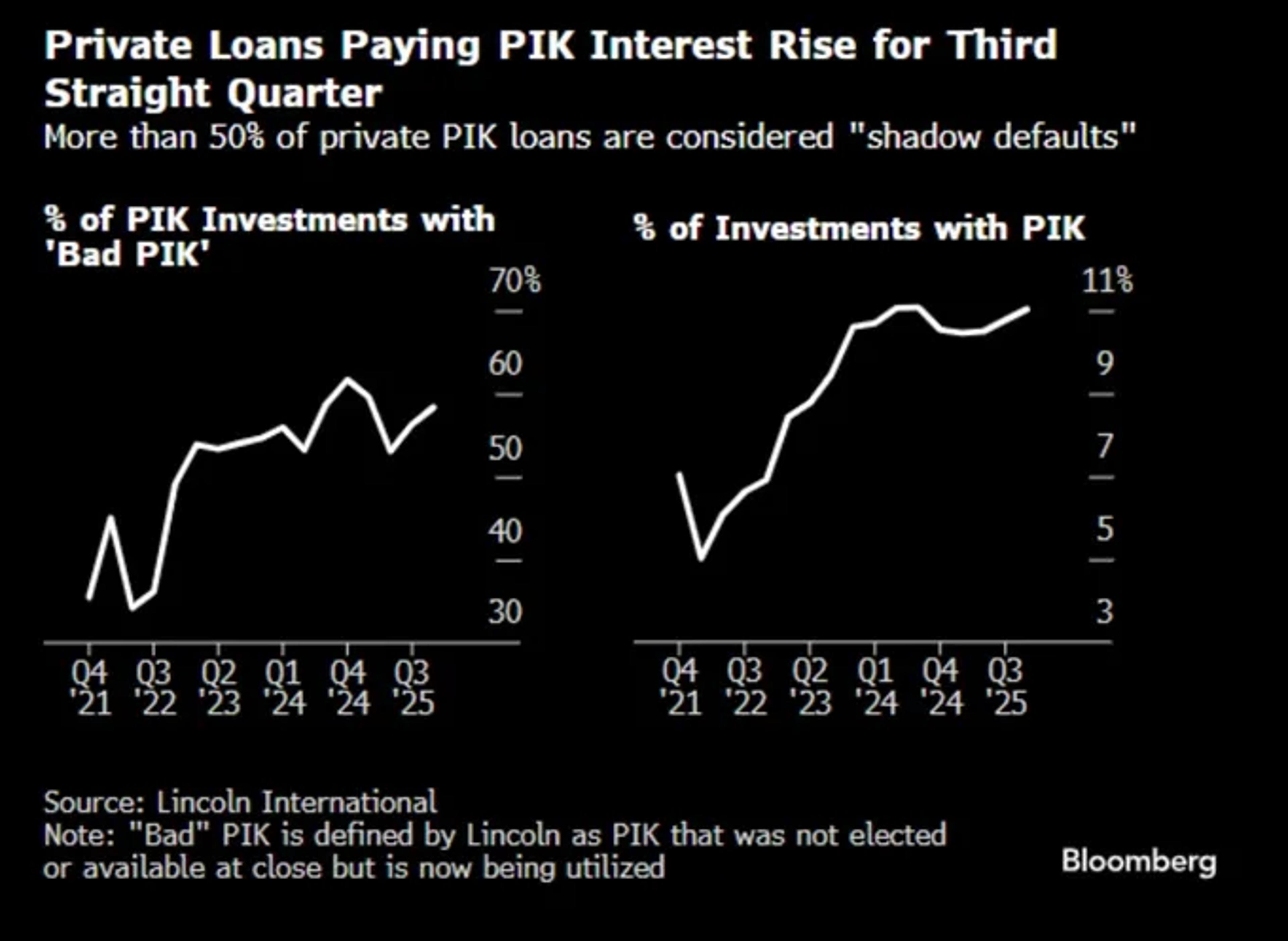

Most Private Credit PIK Is Bad Yet Labeled Performing

58% of PIK in private credit is "bad PIK" per Lincoln. Borrower stops paying cash. Lender accepts more debt instead. Everyone marks it at par. This is called "performing."

By JunkBondInvestor

News•Feb 13, 2026

Sebi Eases Reporting Norms for Brokers, Extends Exemptions to Primary Dealers

The Securities and Exchange Board of India (SEBI) released a consultation paper proposing to relax the naming, tagging and reporting requirements for bank and demat accounts held by stockbrokers. The draft aligns primary dealers with the exemptions already granted to...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

PNGS Reva Diamond IPO to Hit Dalal Street Soon: Check 5 Key Risks Ahead of the Offer Launch

The PNGS Reva Diamond Limited is set to launch a fresh‑share IPO on Dalal Street valued at roughly ₹380 crore. The issue comprises 0.98 crore new shares priced between ₹367 and ₹386 each, with the bidding period running from February 24 to February 26,...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

Coinbase Swings to Surprise Loss Amid Crypto Exodus, but Says Traders Are Buying the Dip

Coinbase reported a surprise fourth‑quarter loss as crypto trading volumes continued to shrink, marking the first quarterly deficit in years. Despite the loss, the stock steadied and rose modestly in after‑hours trading, bouncing off a two‑year low. Management used the...

By MarketWatch – Top Stories

Social•Feb 13, 2026

Gemini Miscalculates Google’s Massive Depreciation Drag

Coming up on @thestreetpro More Tales From Nvidia: The Depreciation "Tail and Spike" Will Be Painful to Mag7 Profits (Issue #178!) * As free cash flow is plummeting... I decided to ask the AI about itself. In this case, I asked Google Gemini about...

By Doug Kass

News•Feb 13, 2026

Kwality Wall's Listing Date Announced as HUL Gets Trading Approval for Demerged Entity

Hindustan Unilever Ltd received BSE and NSE approvals to list its de‑merged ice‑cream arm, Kwality Wall’s, on February 16, issuing 2.34 billion shares. The spin‑off creates India’s first pure‑play listed ice‑cream company, with a one‑for‑one share allocation to HUL shareholders as of...

By The Economic Times – Markets

News•Feb 13, 2026

US Dollar Credit Supply: Primary Market Shows Strong Start to 2026

US dollar primary market began 2026 with robust corporate issuance, totaling $56 bn in January, driven largely by technology, media and telecom (TMT) firms contributing $24 bn. Banks led the financial sector, printing $134 bn of senior non‑preferred bonds, a $20 bn year‑to‑date increase...

By ING — THINK Economics

News•Feb 13, 2026

Done Deal: UMG’s Downtown Acquisition Approved by EU Competition Regulator

The European Commission approved Universal Music Group’s $775 million acquisition of Downtown Music Holdings, conditional on divesting the Curve royalty‑accounting business. The decision ends a year‑long antitrust review and clears the way for UMG to integrate Downtown’s distribution and publishing services,...

By Music Business Worldwide (MBW)

News•Feb 13, 2026

Ola Electric Q3 Results: Loss Narrows YoY to Rs 487 Crore; Revenue Falls 55%

Ola Electric reported a narrower Q3 FY26 loss of Rs 487 crore versus Rs 564 crore a year earlier. Revenue from operations plunged 55% year‑on‑year to Rs 470 crore, driven by a steep decline in automotive sales. Unit deliveries fell to about 32,680, down from 84,029,...

By The Economic Times – Markets

News•Feb 13, 2026

Rates Spark: Dutch Pension Funds May Prepare Early for 2027 Transitions

Almost €1 trillion of Dutch pension assets are slated to transition by 2027, but early hedge rebalancing has already begun. Smaller funds moved interest‑rate hedges in December 2025, while larger players like PMT and PFZW are timing their flows for the first...

By ING — THINK Economics

Social•Feb 13, 2026

38% of Clients Drive 75% of Capitec Revenue

𝟯𝟴% 𝗼𝗳 𝗰𝘂𝘀𝘁𝗼𝗺𝗲𝗿𝘀 𝗴𝗲𝗻𝗲𝗿𝗮𝘁𝗲 𝟳𝟱% 𝗼𝗳 𝗖𝗮𝗽𝗶𝘁𝗲𝗰’𝘀 𝗿𝗲𝘃𝗲𝗻𝘂𝗲 Capitec’s interim results for the period ending August 2025 show a very clear picture of where the bank’s income is really coming from: 🔸Non-interest income = R13,358 bn 🔸Net interest income = R...

By Talk Cents

Social•Feb 13, 2026

Key Market Moves: Listings, Earnings, Acquisitions, Renames

Major News to Track on February 13, 2026: 1. Hock Soon Capital Main Market Listing 2. LPI Capital FY2025 Results 3. Lotte Chemical Titan Full-Year Earnings 4. Oriental Holdings Hospitality Acquisition 5. Berjaya Land Corporate Renaming ↓↓↓

By David Chuah

News•Feb 12, 2026

Tax Fraud Blotter: Pandemic Pandemonium

Recent federal cases reveal a wave of tax fraud spanning the pandemic era, from a Florida tax preparer who filed 458 false returns costing the IRS $12.9 million to a Georgia group that siphoned $1.3 million in COVID‑related credits. A mining business...

By Accounting Today

Social•Feb 13, 2026

High ROE Fuels Rapid Book Growth and Higher Valuations

"We have shown over the past couple of years that Return-on-Equity readings for companies are very high, and very supportive of equity prices as the high ROE promotes rapid growth of corporate book value, and consequently higher market valuations." -...

By Sam Ro

Social•Feb 13, 2026

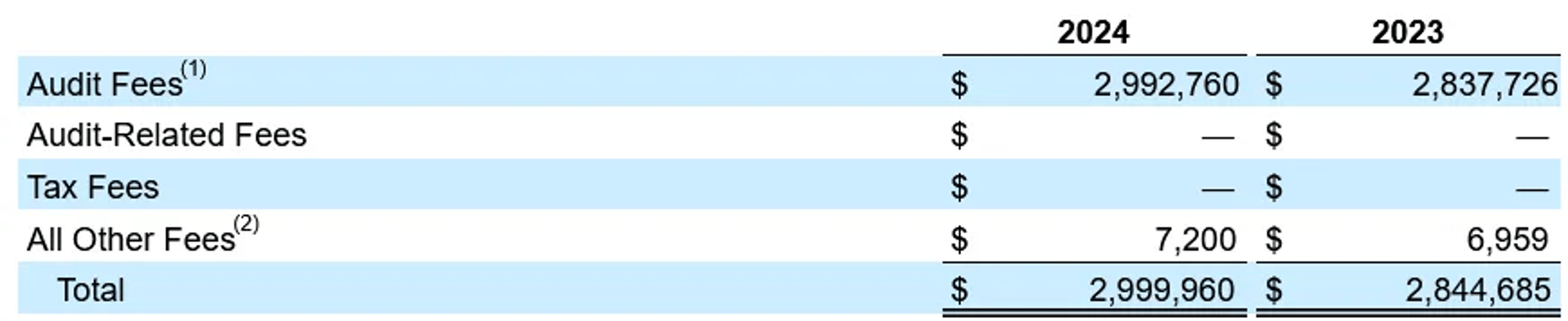

Expensify's $3M Audit Fee Highlights Costly Compliance

Expensify paid $3M in audit fees in 2024. Insane. They had 115 employees and $140M of revenue...They are not complicated. The auditors could have literally redone the books for that much. Hope AI drives audit costs down (but not holding my breath...

By OnlyCFO

News•Feb 12, 2026

IRS Gives Guidance on Energy Tax Credits, Prohibited Foreign Entities

The IRS and Treasury issued Notice 2026‑15 to clarify how the One Big Beautiful Bill Act’s new foreign‑entity restrictions apply to clean‑energy tax credits. The notice defines “prohibited foreign entity,” outlines a material‑assistance cost‑ratio calculation, and provides interim safe‑harbor tables for Sections 45Y, 48E and 45X. Taxpayers can...

By Accounting Today

Social•Feb 13, 2026

S&P Erases Almost All 2026 Gains Amid AI Hype

Forget Trump's AI HYPE. The S&P Index has now given up nearly all its 2026 gains. https://t.co/GAL0TbU7KG

By Steve Hanke

Social•Feb 13, 2026

Banks' Inflation Forecasts Politicized, Yield Soft Surprises

Another SOFT inflation surrpise... It has become a bit of a theme, and we are increasingly convinced that inflation forecasting has become a "politicized arena" within banks, given how incredibly stubborn they have been in their wrong lean on this.

By Andreas Steno Larsen

News•Feb 12, 2026

Xero Sees 'Emotional Tax' On Small Business From Financial Stress

Xero’s Emotional Tax Return 2026 Report reveals that 81 % of U.S. small‑business owners feel more stressed than in prior years, losing the equivalent of 33 working days annually to financial worry. Rising costs (44 %) and unpredictable demand (28 %) are the...

By Accounting Today

Social•Feb 13, 2026

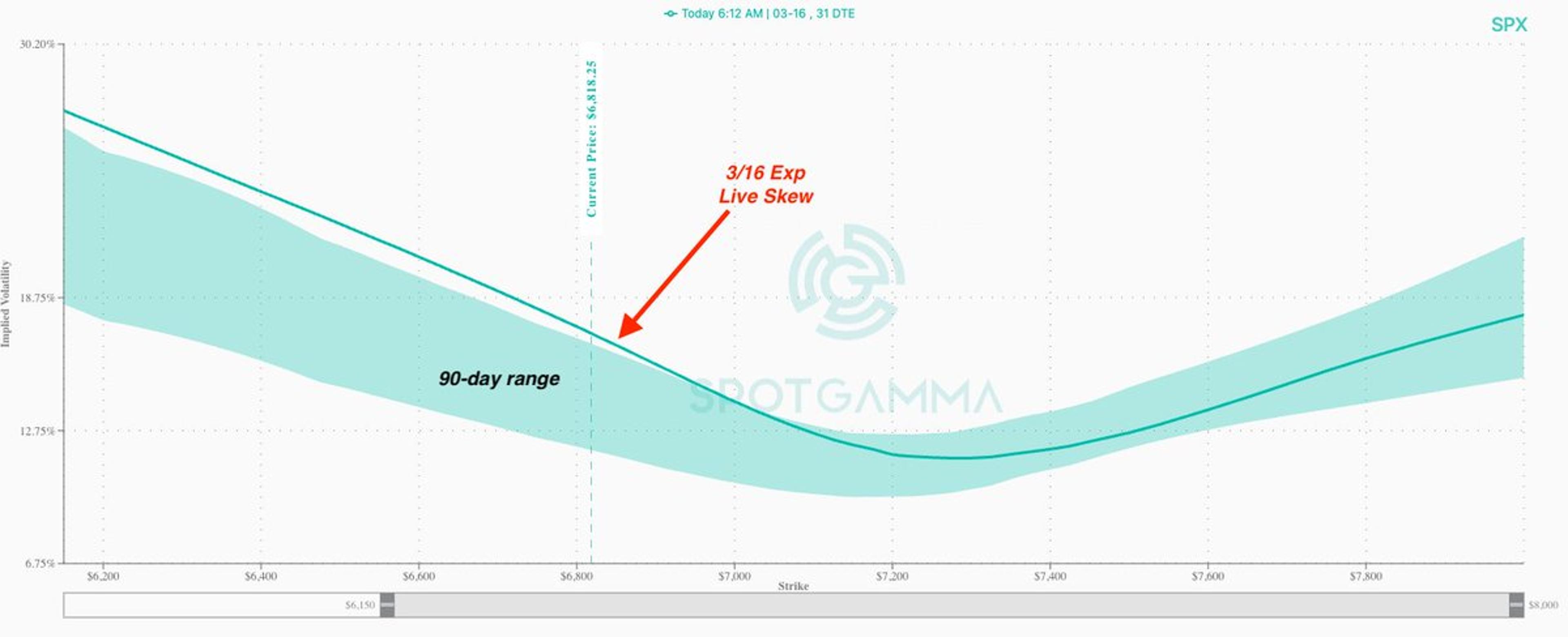

Rising SPX Put Skew May Push VIX to 30

SPX put skew is really starting to warm up here, while ATM IV remains relatively subdued. If SPX 30) https://t.co/p9qsHp8nHk

By Brent Kochuba

Social•Feb 13, 2026

Turn FP&A From Reactive to Predictive with AI

⚡ From forecast to action — is your FP&A team predictive or reactive? At the Digital North American FP&A Circle, leaders from Sony, Mars, High Liner Foods & Wolters Kluwer CCH Tagetik shared how they embed predictive AI into decisions: https://t.co/Gmlh8jmMgB #aiinfinance

By Larysa Melnychuk

Social•Feb 13, 2026

Fintechs Must Prioritize Financial Health Over Services

#FlashbackFriday | In 2020, I argued that fintechs should stop selling financial services and start selling financial health, this wasn’t a buzzword, but a different way of thinking about the financial sector itself: https://t.co/bL1ZTqv4Uf Yesterday’s future. Progress optional. https://t.co/s7x485LBB3

By Dave Birch

Social•Feb 13, 2026

EIB's Grid Debt Shift Sparks Skepticism in Europe

The European Investment Bank plans to advance electricity capacity by moving grid debt off bank books & monetizing future revenues I'm not holding my breath. This is Europe, after all. https://t.co/UHQ7GprVvL #PowerGrids #EnergyInfrastructure #Europe #EIB #Electricity #EnergyTransition

By Art Berman Blog

Social•Feb 12, 2026

Alphabet Q4: Search Rebounds 17%, Cloud Drives 48% Revenue

Alphabet Q4 2025: Search reaccelerated to 17%. Cloud hit 48% at 30% margins. Full breakdown live for SCIS members: https://steadycompounding.com/investing/alphabet-q4-2025/

By Thomas Chua (Steady Compounding)

Social•Feb 12, 2026

Biotech IPOs Deliver Median -15% Return, Outperforming Losses

Humbling 30 year Biotech stats shared by @verdadcap in a recent report: Just over 1,000 biotechs hit $200M mkt cap at some point. Of those, 67% have lost value (had cumulative negative returns), vs 48% for all other US companies....

By Bruce Booth

Social•Feb 12, 2026

Capital Markets Reshape Translational Therapeutics Landscape

The Catalyst Machine | Ep. 931 How Capital Markets Quietly Rewired Translational Therapeutics https://t.co/lWNRxW0wuQ https://t.co/l14X2JfrLX

By BowTiedBiotech

Social•Feb 12, 2026

SEC Calls for Congressional Law to Strengthen Authority

NEW FROM THE SEC: “We need a good law coming out of Congress that would undergird our efforts. The SEC has pretty broad authority to interpret and have exemptions under various securities laws. That has been the missing link here.” https://t.co/Fye5ETsEk2

By Wendy O