🎯Today's Finance Pulse

Updated 1h agoWhat's happening: ESMA fines trade repository REGIS‑TR €1.374 million for EMIR and SFTR breaches

The European Securities and Markets Authority imposed a €1.374 million penalty on REGIS‑TR after finding seven violations of the European Market Infrastructure Regulation and the Securities Financing Transactions Regulation. This is the first enforcement action involving SFTR breaches and the largest fine ever levied on a trade repository. ESMA said the sanctions underscore its commitment to market integrity.

Also developing:

Podcast•Feb 11, 2026•0 min

PETER LEWIS'MONEY TALK - Wednesday 11 February 2026

In this episode, Peter Lewis discusses Japan’s post‑election economic challenge: reviving growth without reigniting inflation that has already driven staple prices, like rice, to double. He is joined by Richard Harris of Port Shelter Investment Management and Tony Nash of Complete Intelligence, who analyze the risks to Japanese equities and bond markets, while ADB economist John Beirne offers a macro view on regional growth prospects and policy options. The guests highlight the delicate balance between fiscal stimulus, monetary tightening, and structural reforms needed to restore consumer purchasing power. They also explore investment strategies that can hedge against inflation while capturing any upside from a potential policy shift.

By Peter Lewis’ Money Talk

News•Feb 10, 2026

Moderna Says FDA Refuses to Review Its Application for Experimental Flu Shot

Moderna announced that the FDA will not begin a review of its experimental mRNA‑1010 flu vaccine, citing concerns over the trial's comparator design rather than safety or efficacy. The decision triggered a roughly 7% drop in Moderna’s after‑hours share price....

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Ford Reports Worst Quarterly Earnings Miss in Four Years, Guides for Better 2026

Ford is expected to post its worst quarterly earnings miss in four years, with adjusted EPS forecast at 19 cents and automotive revenue projected at $41.8 billion, a 6.8% decline YoY. The earnings drop represents more than a 50% fall in...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Next Steps for Establishing a Bond Consolidated Tape Provider

The FCA has signed a contract with Etrading Software (ETS) to build a UK bond consolidated tape, aiming to deliver a high‑quality data stream for investors. The tape will improve price discovery, liquidity, and market transparency, supporting the UK’s competitive...

By UK FCA – News

News•Feb 10, 2026

FCA Seeks Views on How to Help Close the Protection Gap

The UK Financial Conduct Authority (FCA) has released interim findings from its competition review of pure protection insurance, highlighting that while the market functions well for existing policyholders, 58% of adults remain uninsured. The review notes stable premiums, a wide...

By UK FCA – News

News•Feb 10, 2026

OFSI and Partners Clamp Down on the Abuse of Cryptoassets

UK’s Office of Financial Sanctions Implementation (OFSI) announced a coordinated crackdown on the misuse of cryptoassets for money‑laundering and sanctions evasion, working alongside law‑enforcement agencies and regulatory partners. The initiative includes heightened monitoring, enforcement actions, and the release of updated...

By UK FCA – News

News•Feb 10, 2026

Emil the Seal Hijacks Waterloo Station to Warn Commuters About Investment Scams

The FCA staged a pop‑up ATM at London Waterloo featuring its mascot Emil the Seal to promote its new Firm Checker tool. The stunt highlighted that around 700,000 adults lost money to investment scams in the past year. The interactive...

By UK FCA – News

News•Feb 10, 2026

AI Live Testing: How It Can Support Safe and Responsible AI Deployment

The UK Financial Conduct Authority (FCA) has opened a second application window for its AI Live Testing programme, inviting firms to trial AI‑driven services in real‑world market conditions with regulatory oversight and technical support from Advai. The initiative targets companies...

By UK FCA – News

News•Feb 10, 2026

The FCA’s Long Term Review Into AI and Retail Financial Services: Designing for the Unknown

Sheldon Mills announced that the FCA is undertaking a long‑term review of artificial intelligence in retail financial services, with findings to be presented to the board this summer. The review will explore how generative AI, multimodal models and autonomous agents...

By UK FCA – News

News•Feb 10, 2026

Falling Cost of Premium Finance Saving Consumers Around £157m a Year

UK insurers have reduced the cost of premium finance, saving consumers about £157 million a year. Interest rates on financed insurance dropped an average 4.1 percentage points since 2022, cutting typical motor policy costs by £8 and home policies by £3...

By UK FCA – News

News•Feb 10, 2026

Regulators Announce First Firms to Join Scale-Up Unit

The Prudential Regulation Authority and Financial Conduct Authority have unveiled the first cohort of their joint Scale‑up Unit, targeting fast‑growing financial firms. Six institutions – Allica Bank, ClearBank, Monument Bank, Nottingham Building Society, OakNorth Bank and Zopa Bank – will...

By UK FCA – News

News•Feb 10, 2026

Upper Tribunal Finds that Banque Havilland Devised a Plan to Harm the Qatari Economy

The Upper Tribunal upheld the FCA’s ruling that Rangecourt S.A., formerly Banque Havilland, and former executives Edmund Rowland and Vladimir Bolelyy acted without integrity by devising a scheme to devalue the Qatari riyal. The Tribunal confirmed fines of £4 million for...

By UK FCA – News

News•Feb 10, 2026

FCA and SRA Issue Joint Warning to Firms Representing Motor Finance Commission Claims

The Financial Conduct Authority and the Solicitors Regulation Authority have issued a joint warning to claims‑management companies and law firms handling motor‑finance commission claims, demanding verification that consumers are not already represented and prohibiting excessive termination fees. Any exit charge...

By UK FCA – News

News•Feb 10, 2026

FCA and SRA Joint Message to Professional Representatives on Motor Finance Commission Claims: Dealing with Multiple Representation and Excessive Termination...

The FCA and SRA have jointly warned claims‑management firms and law firms handling motor‑finance redress that clients must not be represented by multiple agents on the same claim and should not face excessive termination fees. They cite cases where up...

By UK FCA – News

News•Feb 10, 2026

FCA Stops Advantage Wealth Management Ltd From Carrying Out Regulated Activities and Imposes Assets Restriction

The Financial Conduct Authority has placed Advantage Wealth Management Ltd (AWM) under strict restrictions, requiring written FCA consent before any asset disposal or regulated activity. The regulator cited concerns over how customers' investments were shifted into cash, inadequate financial resources,...

By UK FCA – News

News•Feb 10, 2026

Gemini Payments UK Ltd and Gemini Intergalactic UK Ltd Exit the UK Market

Gemini Payments UK Ltd and Gemini Intergalactic UK Ltd announced a complete market exit, closing all UK customer accounts on 6 April 2026. The e‑money arm will operate normally until 4 March, after which accounts shift to withdrawal‑only mode from 5 March. Crypto‑asset services...

By UK FCA – News

News•Feb 10, 2026

Independent Assessment to Support Establishment of a Future Entity

The Financial Conduct Authority (FCA) has released a letter to trade associations announcing KPMG’s appointment to conduct an independent assessment of proposals for a Future Entity that would set standards for UK open‑banking APIs. The assessment will evaluate governance, technical...

By UK FCA – News

News•Feb 10, 2026

FCA Fines Two Individuals a Combined £108,731 for Insider Dealing

The FCA fined Dipesh Kerai (£52,731) and Bhavesh Hirani (£56,000) for insider dealing in Bidstack Group Plc shares, totalling £108,731 in penalties. Hirani, then interim CFO, leaked confidential details of a major advertising deal to Kerai, who bought 1.3 million shares before the...

By UK FCA – News

News•Feb 10, 2026

HTX (Formerly Huobi): Legal Proceedings Information

The UK Financial Conduct Authority (FCA) initiated legal proceedings on 21 October 2025 against Huobi Global S.A. and several unidentified individuals linked to the HTX cryptocurrency exchange. The case was filed in the Chancery Division of the High Court, and on 4 February 2026...

By UK FCA – News

News•Feb 10, 2026

Lyft Stock Falls 15% on Disappointing Fourth-Quarter Results, Rider Numbers

Lyft reported fourth‑quarter revenue of $1.59 billion, missing the $1.76 billion consensus, and saw active riders and total rides fall short of estimates. The miss triggered a 15% plunge in the stock during extended trading. The board approved an additional $1 billion share‑repurchase...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Fund Manager FINQ Lets AI Run US ETFs

FINQ has introduced two U.S. large‑cap equity ETFs—AIUP and AINT—where an artificial‑intelligence model exclusively selects, weights and rebalances holdings. The AI engine ranks every S&P 500 component daily using market, financial and textual data, guiding long‑only and long‑short exposures respectively. The...

By PYMNTS

News•Feb 10, 2026

Ssense Founders Can Buy Back Company, Court Rules

Montréal‑based luxury e‑commerce platform Ssense will be reclaimed by its founders after a Quebec Superior Court dismissed lenders' request for a forced asset sale. The court approved a founder‑led buyback valued at $78 million, including a $58.5 million cash payment and assumption...

By BetaKit (Canada)

News•Feb 10, 2026

Sharp's Plan to Sell Japan LCD Plant to Parent Foxconn Falls Through

Sharp announced that its plan to sell the Kameyama No. 2 LCD panel plant in Mie Prefecture to parent company Foxconn has collapsed, prompting a shutdown slated for August. The company will cut 1,170 jobs through early‑retirement packages and record a...

By Japan Today – Business

News•Feb 10, 2026

Honda Reports Declining Profit

Honda Motor Co announced a 42% plunge in profit for the nine months through December, falling to 465.4 billion yen from 805.2 billion yen a year earlier. Sales dipped 2.2% to 15.98 trillion yen, yet the company kept its full‑year profit forecast of...

By Japan Today – Business

News•Feb 10, 2026

Estée Lauder Sues Walmart Alleging 'Despicable' Sale of Counterfeit Beauty Products

Estée Lauder has filed a federal lawsuit against Walmart, alleging that the retailer’s online marketplace allowed counterfeit versions of its La Mer, Le Labo, Clinique, Aveda and Tom Ford products to be sold. The beauty giant says it purchased and tested several items that...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Bitcoin Plunge: Bitwise CIO Cites 'the Four-Year Cycle' As No. 1 Reason for Losses

Bitcoin fell below $61,000, its lowest level in about 16 months, prompting Bitwise Asset Management’s CIO Matt Hougan to point to the market’s four‑year cycle as the primary driver of the decline. He noted that investors are also rotating into...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

KPMG Starts Tax AI Accelerator Program

KPMG has launched a Tax AI Accelerator Program to help corporate tax departments adopt generative AI. The initiative provides hands‑on training, a secure Azure OpenAI‑based sandbox called Digital Gateway, and access to KPMG’s “Think, Prompt, Check” framework. More than a...

By CPA Practice Advisor

Social•Feb 10, 2026

MicroStrategy’s Bitcoin Bet Costs More Than Gold

Did MicroStrategy Make a Bad Bet on Bitcoin? Bitcoin made the headlines, but MicroStrategy’s numbers? Not so pretty. I’d have preferred gold, silver, or even interest-bearing cash. Opportunity cost matters — don’t get caught chasing hype. Bitcoin #PeterSchiff #CryptoNews #Investing #GoldVsBitcoin #FinanceTalk...

By Peter Schiff

News•Feb 10, 2026

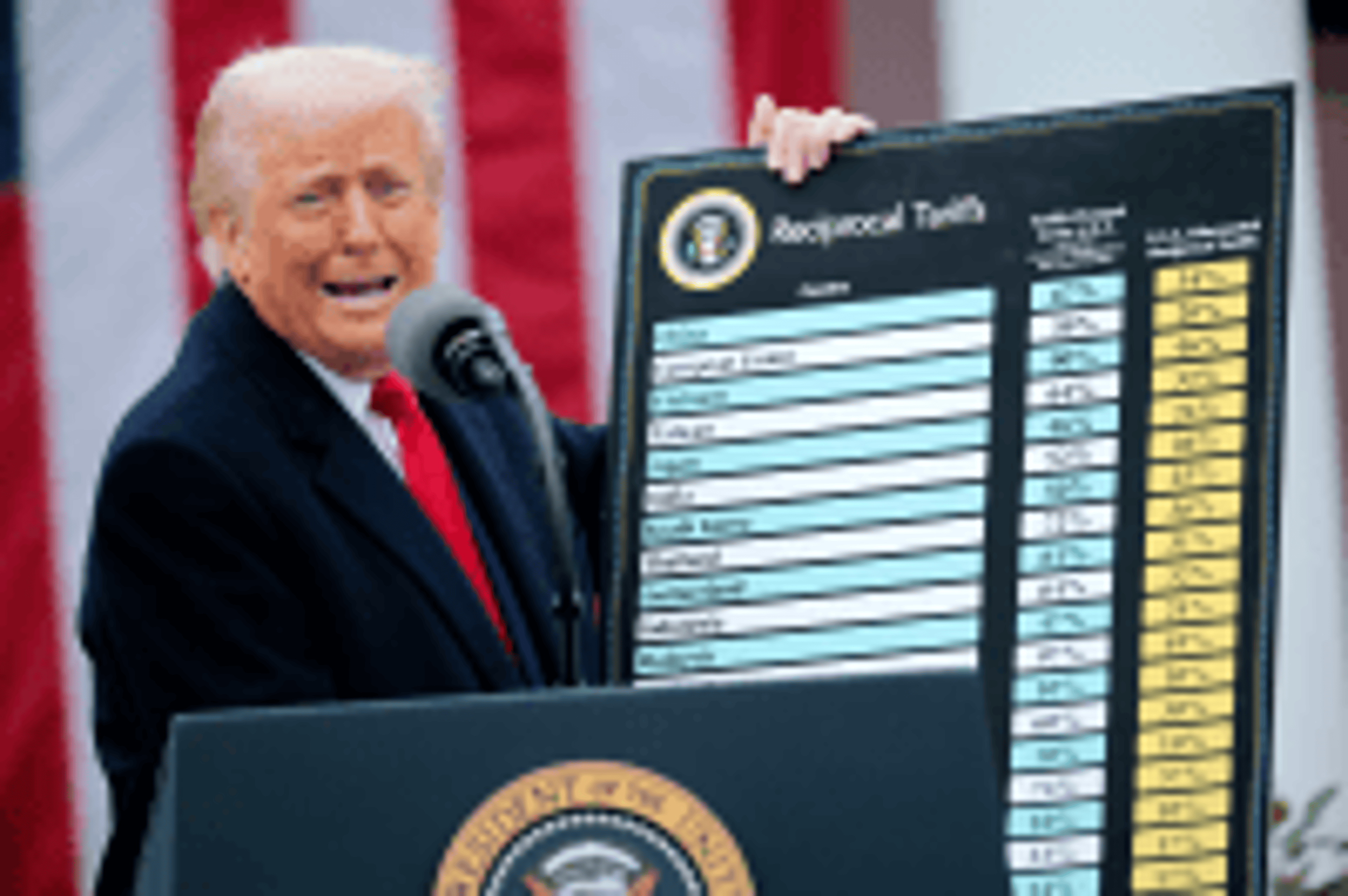

Report Finds Trump’s Tariffs Cost U.S. Households $1,000 on Average in 2025

The Tax Foundation reports that Trump‑era tariffs added an average $1,000 to U.S. household expenses in 2025, rising to $1,300 in 2026. A weighted average tariff rate of 13.5% pushed the effective rate to 9.9%, the highest since 1946. Companies...

By CPA Practice Advisor

News•Feb 10, 2026

Deloitte: Shining a Spotlight on Strategic Internal Audit

Deloitte’s internal audit leader Mike Schor argues that internal audit must shed its "gotcha" image and become a strategic partner to the CFO. He recommends a proactive branding effort that showcases audit capabilities and aligns the function with finance’s broader...

By CFO Dive

News•Feb 10, 2026

MPE Partners Sells MSHS and Pacific Power Group

MPE Partners has completed the sale of MSHS and Pacific Power Group, a combined entity that provides maintenance, repair and overhaul services for power generation, marine propulsion and national security applications. The merged firm, led by President and CEO David...

By PE Hub

News•Feb 10, 2026

Trinity Hunt-Backed Supreme Group Snaps up Healthcare Creative Agency Broth

Supreme Group, a healthcare and life‑sciences marketing platform backed by Trinity Hunt Partners, has acquired New York‑based creative agency Broth. Broth, founded in 2018, serves as the agency of record for several leading pharma and biotech brands. The terms of the...

By PE Hub

News•Feb 10, 2026

19 States Offer Tax Credits for Private School Scholarship Donations

Eighteen states now offer tax credits for donations to scholarship‑granting organizations that fund private‑school tuition, mirroring Ohio's program. Ohio’s credit, introduced in 2021, has cost the state over $80 million in lost revenue and reduced tax collections by $21 million in fiscal 2024...

By CPA Practice Advisor

Social•Feb 10, 2026

Unlock Tax‑Free Wealth: Use a Stocks & Shares ISA

5 reasons why a Stocks & Shares ISA is the best way to build wealth in the UK 🇬🇧 1. Easy to open in minutes 2. You choose how much to invest 3. Access to global ETFs & funds 4. Withdraw anytime, no lock...

By Pastel Portfolio

News•Feb 10, 2026

EPA Will Revoke 'Endangerment Finding' That Underpins All Climate Regulation This Week

The EPA announced plans to rescind the 2009 endangerment finding that declared greenhouse gases a threat to public health, a cornerstone of U.S. climate regulation. The move, submitted to the Office of Management and Budget, represents the Trump administration’s most...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Who Wrangled the Best Trade Deal From Donald Trump?

President Donald Trump recently secured trade agreements with Argentina and India, offering limited tariff reductions to facilitate U.S. exports. Both deals faced immediate domestic backlash: Indian farmer unions called the pact a “total surrender” and French officials described the EU‑U.S....

By The Economist – Finance & Economics

Social•Feb 10, 2026

Historical Base Rates Reveal AI Growth Realities

We have a new report out today, "Bayes and Base Rates: How History Can Guide Our Assessment of the Future." -We place projected sales growth rates of some artificial intelligence (AI) businesses in the context of history. - We review...

By Michael Mauboussin

Social•Feb 10, 2026

Join Free Hands‑on AI Workshop for Finance, Sales, Ops Leaders

If you lead a finance, sales, service, or ops team and you're still trying to figure out where agentic AI fits, this is the room you want to be in. I'm keynoting at Microsoft Times Square on Feb 26 with Harvard...

By Allie Miller

News•Feb 10, 2026

Sen. Bernie Sanders to Kick Off California Billionaire Tax Campaign

Senator Bernie Sanders will launch a campaign to place a one‑time 5% billionaire tax on California’s November ballot. The measure seeks to raise funds to offset federal healthcare cuts, protecting over 3 million working‑class residents. Supporters must collect roughly 875,000 signatures...

By CPA Practice Advisor

Social•Feb 10, 2026

PE Overvalued Saa

Entrepreneurs: private equity firms OVERVALUED SaaS companies during 2020-21. NOW, those “overvalued” companies are getting marked down 30-60% 🤯 If you’re an investor = BUY distressed assets LOW If you’re a startup founder = CASHFLOW CASHFLOW

By Sherrard Harrington

Social•Feb 10, 2026

NFP Outlook: Expectation Management Raises 23K vs 15K

#NFP tomorrow. After yesterday's verbal managing of expectations from Hassett and Miran. Will NFP hit 23K ? 15K ?

By Ashraf Laidi

News•Feb 10, 2026

StanChart CFO Abruptly Exits for Apollo

Standard Chartered announced that group CFO Diego De Giorgi is leaving immediately to join Apollo Global Management as a partner and head of EMEA. Peter Burrill, the bank's group head of central finance, will serve as interim CFO while a permanent replacement is...

By CFO Dive

Social•Feb 10, 2026

Falling Software Valuations Demand 409A Repricing Decisions

Software valuations are falling which means 409As that are getting updated now will fall too. Should you reprice underwater stock options? Here is everything to consider: https://t.co/VumYhlVzRr

By OnlyCFO

Blog•Feb 10, 2026

Iconic Bourbon, Vodka Brands Spared From Chapter 7 Liquidation

A Texas bankruptcy judge ordered Chapter 11 trustees to take over Stoli USA and its bourbon affiliate Kentucky Owl, halting a planned conversion to Chapter 7 liquidation. The move followed objections from senior lender Fifth Third Bank and a negotiated settlement among...

By TheStreet

News•Feb 10, 2026

Washington’s Millionaires Tax Advances in State Senate with Some Changes

Washington Senate Ways and Means Committee approved a revised millionaire’s tax bill, preserving a 9.9% levy on earnings above $1 million starting in 2028. The measure is projected to generate roughly $3.5 billion annually from about 30,000 high‑income taxpayers. Amendments include expanding...

By CPA Practice Advisor

Blog•Feb 10, 2026

Corruption Index: Yep, Things Are Bad

Transparency International released its 2025 Corruption Perceptions Index, showing the global average score slipping to 42 and 122 of 182 countries falling below the 50‑point threshold for widespread public‑sector corruption. Only five nations now score above 80, a sharp decline...

By Radical Compliance

News•Feb 10, 2026

Blue & Co. Joins Forces with D & Co. In Texas

Blue & Co., a top‑60 accounting firm, announced the acquisition of Texas‑based D & Co., adding more than 40 healthcare‑focused employees and six directors to its roster. The deal, effective Feb. 1, expands Blue & Co.’s footprint into Lubbock, Dallas, Fort Worth and Waco,...

By CPA Practice Advisor

News•Feb 10, 2026

How Is New Paid Family Leave Law in Minnesota Holding Up?

Minnesota’s paid family and medical leave program launched on Jan. 1 and delivered over $30 million in benefits during its first month, approving 13,700 claims. Early demand was buoyed by a surge of child‑bonding applications, a phenomenon known as the “baby bump.”...

By CPA Practice Advisor

News•Feb 10, 2026

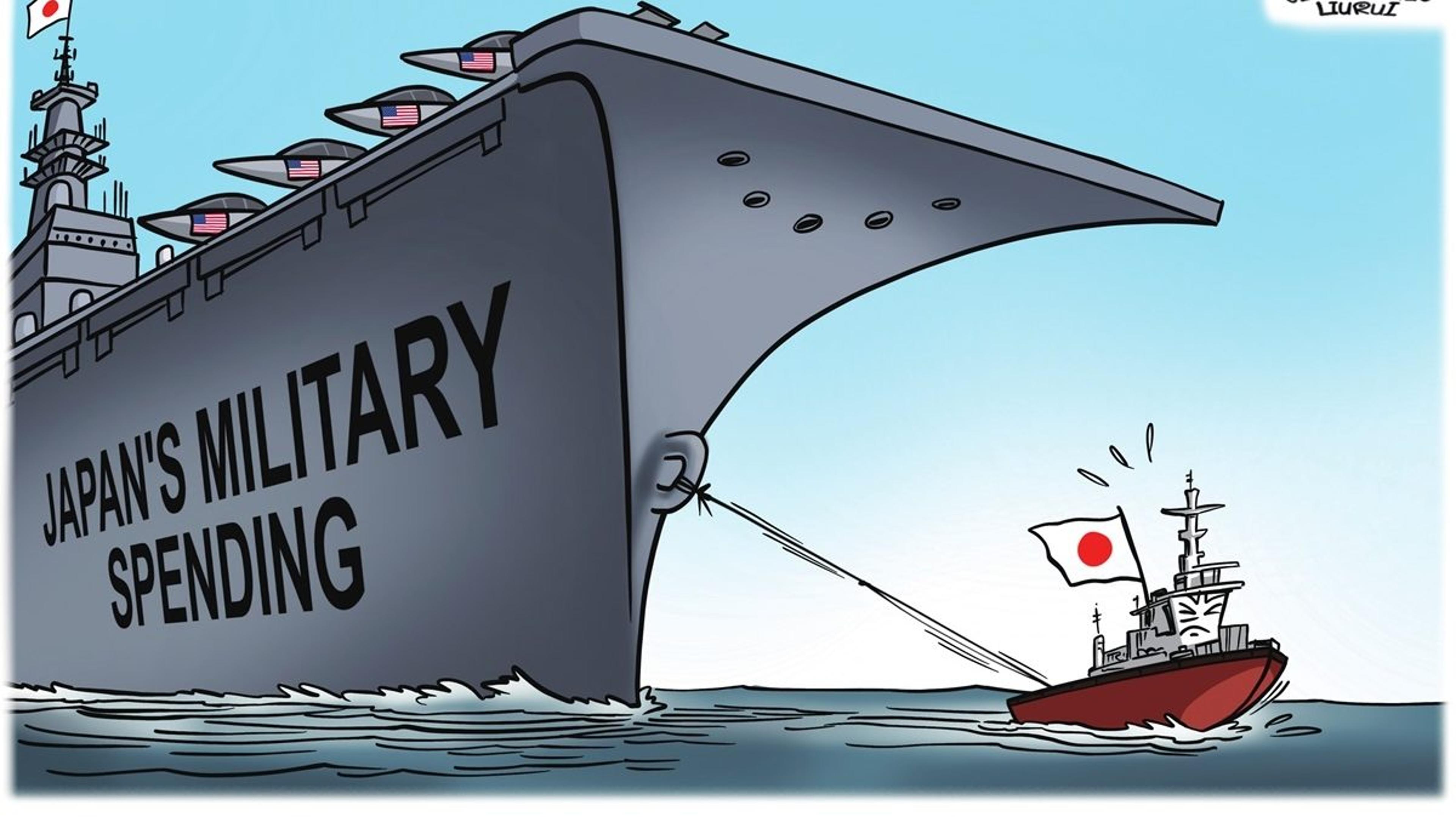

China’s US Treasurys Exit Could Limit Japan’s Military Spending

China is directing state‑owned banks to cut U.S. Treasury holdings to roughly $750 billion by 2025, halving its 2010 peak. The reduction removes a major buyer from the market, shifting the financing burden toward Japan, the world’s largest foreign‑reserve holder. Japan’s...

By Asia Times – Defense

News•Feb 10, 2026

Leah Partners with PwC UK on Agentic AI

Leah, the creator of Leah Agentic OS, has teamed up with PwC UK to embed its enterprise‑grade, domain‑native agentic AI platform into global business services. The partnership combines PwC's industry and functional expertise with Leah's OS to design, deploy, and...

By CPA Practice Advisor