🎯Today's Finance Pulse

Updated 5m agoWhat's happening: ESMA fines trade repository REGIS‑TR €1.374 million for EMIR and SFTR breaches

The European Securities and Markets Authority imposed a €1.374 million penalty on REGIS‑TR after finding seven violations of the European Market Infrastructure Regulation and the Securities Financing Transactions Regulation. This is the first enforcement action involving SFTR breaches and the largest fine ever levied on a trade repository. ESMA said the sanctions underscore its commitment to market integrity.

Also developing:

News•Feb 10, 2026

Global Warming Expected to Drive Structural Growth in ILS Spreads: Solidum Partners

Solidum Partners says global warming will structurally expand ILS spreads. As natural disaster frequency and severity increase, traditional reinsurers face capital constraints under Solvency II, limiting their capacity. ILS instruments, being event‑specific and fully collateralized, can absorb tail risk, leading investors to demand higher spreads. However, rising modeling uncertainty and the need for climate‑linked products present challenges for ILS managers.

By Artemis (ILS/cat bonds)

News•Feb 10, 2026

Ayman M Al-Sayari: Speech - Addressing Financial Crime, Fraud, and Corruption as Barriers to Growth and Stability Session

At the IMF and World Bank Annual Meetings, Saudi Central Bank Governor Ayman Al‑Sayari warned that financial crime siphoned $3.1 trillion globally in 2023 and caused $485 billion in fraud losses. He outlined Saudi Arabia’s multi‑layered response anchored in Vision 2030, including risk‑based...

By Bank for International Settlements (BIS) – Press releases

News•Feb 10, 2026

Dimitar Radev: Bulgaria's Accession to the Euro Area Is the Culmination of a Long Process of Economic Integration, Policy Alignment...

Bulgaria has formally joined the euro area, ending years of operating as a de facto euro economy under a currency‑board arrangement. Governor Dimitar Radev emphasized that the accession reflects a long‑term process of economic integration, policy alignment and shared responsibility, despite...

By Bank for International Settlements (BIS) – Press releases

Podcast•Feb 10, 2026•25 min

#270 Why Almost Every New CFO Feels Like a Fraud, Alan Scholnick, GrowCFO Mentor

In this episode, Kevin Appleby talks with seasoned finance leader and GrowCFO mentor Alan Scholnick about why imposter syndrome is almost universal among newly appointed CFOs, especially during finance transformations. Alan draws on his 30‑year career at IKEA and his...

By GrowCFO Show

News•Feb 10, 2026

DBS' Net Profit Falls 3% to S$11bn Amid Rate Headwinds

DBS Group reported a 3% drop in fourth‑quarter net profit, landing at S$11 billion, as higher interest rates and increased tax expenses weighed on earnings. The decline was amplified by the absence of non‑recurring gains that had boosted prior results. Despite...

By FinanceAsia

News•Feb 10, 2026

Infor Appoints Geoff Thomas to Lead Asia Pacific and Japan Operations

Infor announced that Geoff Thomas will serve as senior vice president and general manager for its Asia Pacific and Japan (APJ) region, overseeing strategy and operations across Japan, ANZ, Southeast and North Asia, and India. Thomas, who previously led Qlik’s...

By ERP Today

News•Feb 10, 2026

Acumatica Summit 2026: Manish Chandak

At Acumatica Summit 2026 in Seattle, Manish Chandak, CEO of Tech Electronics, discussed emerging ERP trends with ERP Today editor Chris Vavra. He emphasized the growing importance of digital replicas that provide real‑time data integration within ERP platforms. Chandak also...

By ERP Today

News•Feb 10, 2026

Warehouse Management Systems Poised for Growth as Distribution Networks Chase E-Commerce Velocity

The U.S. warehouse management system (WMS) market is projected to grow at a 14.34% CAGR through 2031, driving global WMS spending from $4.77 billion in 2026 to $10.89 billion by 2031, with North America holding a 40% share. Cloud‑native platforms now account...

By ERP Today

Social•Feb 10, 2026

Khazanah Review Reveals Massive Shift in Malaysia’s Capital Trajectory

Khazanah just dropped their 2026 Annual Review today, February 10, 2026. And the numbers signal a massive shift in Malaysia’s capital trajectory. If you’re tracking the Ekonomi MADANI agenda or the RM100 billion GEAR-uP initiative, this is the breakdown you need. ↓↓↓

By David Chuah

News•Feb 10, 2026

Revera Energy Secures US$150 Million to Support 3.4GWh of Battery Storage Across Australia and the UK

Revera Energy has closed a $150 million credit facility to fund the development of 3.4 GWh of battery‑storage projects in Australia and the United Kingdom. The financing will enable construction of the 150 MW/300 MWh Bungama Stage 1 battery in South Australia, slated for commercial...

By Energy Storage News

News•Feb 10, 2026

SEC Upholds Fines vs NOW over Disclosure Violation

The Philippine Securities and Exchange Commission affirmed PHP1 million fines for NOW Corp. and its chair Mel Velarde after finding their November 2021 market disclosure misleading. The regulator rejected NOW’s appeal, labeling the statement a "half‑truth" that misled investors about a alleged...

By Philippine Daily Inquirer – Business

News•Feb 10, 2026

GCash Parent Mynt Keeps IPO Option Open

Mynt, the parent of GCash, is keeping an IPO on the table while accelerating its payments, lending and wealth‑management services. The fintech arm delivered P6.1 billion in attributable equity earnings in 2025, a 64% jump year‑on‑year, and its lending subsidiary Fuse...

By Philippine Daily Inquirer – Business

Social•Feb 10, 2026

Capital Returns Outpace Growth, Driving Wealth Inequality

There’s a formula that explains wealth inequality, and it has nothing to do with how hard you work. French economist Thomas Piketty studied 200 years of data across 20 countries and found that returns on capital almost always exceed economic growth. We...

By Ben | Finance & Investing

Social•Feb 10, 2026

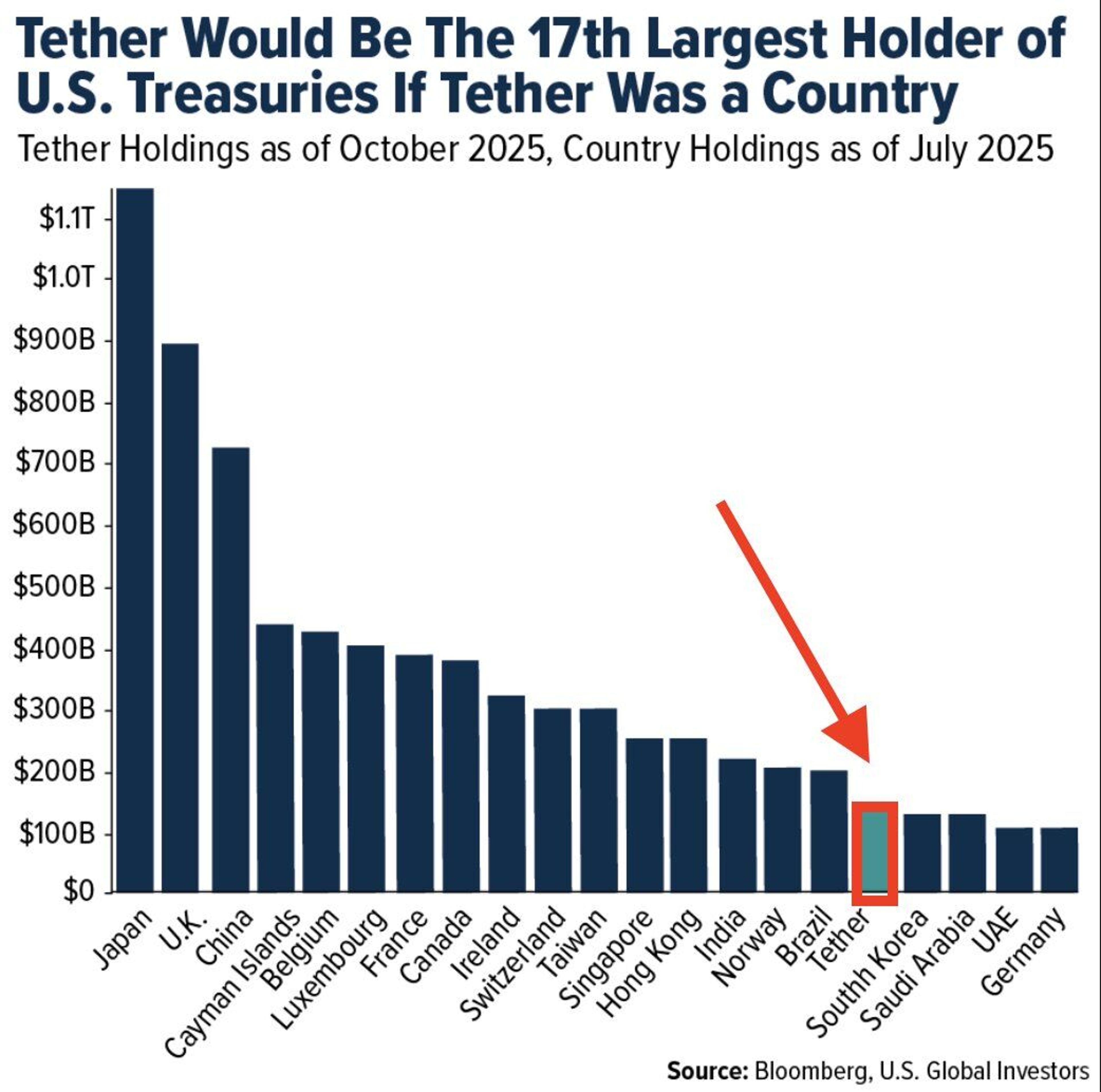

Tether Would Rank 17th in US Treasury Holdings

Who is the world's largest holder of US Treasuries? 🥇 Japan 🥈 United Kingdom 🥉 China But here's the wildest part - if Tether were a country, it would be the 17th largest holder of US Treasuries https://t.co/JoaE6JzFI9

By Kathy Lien

News•Feb 10, 2026

Tesla Exec Raj Jegannathan Leaves Automaker After 13 Years

Tesla Vice President Raj Jegannathan announced his departure after a 13‑year tenure, most recently overseeing IT, AI infrastructure, business applications, and information security. He previously led North American sales following the dismissal of Troy Jones, a period marked by declining...

By CNBC – US Top News & Analysis

Social•Feb 10, 2026

Make Cold Requests Count: Profile or Relevant Message

Most cold connection requests say NOTHING. 2 ways to fix this: 1. Don't send a message (let your profile talk) 2. Send something relevant Both take seconds. Neither is ingenuine.

By Adam Shilton

Social•Feb 10, 2026

UBS's My‑Way Platform Surpasses $30 Bn in Assets

UBS's My-Way platform with USD 30 billion assets: UBS customers have now invested >$30 Bn on the managed portfolio investment platform. #WealthTech #WealthManagement

By Urs Bolt

News•Feb 10, 2026

Pension Credit: Should the Mixed-Age Couples Rule Be Scrapped?

The mixed‑age couples rule, introduced in May 2019, bars pension‑age partners from claiming Pension Credit if their spouse is under 66. The policy affects hundreds of thousands of low‑income couples, stripping them of up to £7,000 a year in benefits....

By MoneyWeek – All

Social•Feb 10, 2026

Foreign Stocks Surge 9.4% Early 2026, Outpacing US

Foreign stocks are off to a scorching start in 2026, continuing their outperformance from 2025: Foreign developed stocks: +9.4% US stocks: +2.2% Will it continue or is this a blip in the otherwise longer underperformance?

By Cullen Roche

News•Feb 9, 2026

IRS Rolls Out New Enhancements to Tax Pro Account

The IRS announced new enhancements to its Tax Pro Account, extending digital capabilities to tax‑professional businesses. The upgrade lets designated representatives manage business CAF access, link CAF numbers to EINs, and view or withdraw active authorizations. These tools aim to...

By CPA Practice Advisor

News•Feb 9, 2026

Former US Officials Warn of Impending 'Widespread Collapse of American Agriculture': 'Our Farmers and Ranchers … Can't Compete with the...

The agricultural sector faces a perfect storm of policy and market pressures, according to a bipartisan letter signed by former heads of the National Corn, Barley, and Soybean Growers associations. The signatories contend that recent tariffs on farm inputs and...

By Yahoo Finance – Finance News

News•Feb 9, 2026

Anaplan Names Laurent Martini Managing Director for EMEA

Anaplan announced Laurent Martini as its new Managing Director for Europe, the Middle East and Africa, effective February 16. Martini, who previously led EMEA sales at Splunk and held senior roles at Pure Storage and Symantec, will report to President...

By ERP Today

News•Feb 9, 2026

KPMG Brings Aboard AI Development Platform PrivateBlok

KPMG announced that the founders and employees of PrivateBlok, an AI development platform from Bangalore with a U.S. office, have joined the firm. The deal, whose financial terms were not disclosed, adds a dedicated AI‑first product team to KPMG’s existing...

By CPA Practice Advisor

News•Feb 9, 2026

Japan Logs Record Current Account Surplus for 2nd Straight Year in 2025

Japan recorded a historic 31.88 trillion yen current‑account surplus in 2025, the second year of record balances and an 11.1 percent rise from the prior year. The surplus was driven by a 4.7 percent jump in primary income from overseas investments and a...

By Japan Today – Business

News•Feb 9, 2026

AICPA Urges Treasury, IRS to Simplify Sec. 951 Documentation Rules

The AICPA sent a letter to the Treasury and IRS urging simplification of the “determine and document” requirement in Notice 2025‑75 related to Section 951 dividend inclusions. The notice obliges U.S. shareholders of controlled foreign corporations to attach a statement to...

By The Tax Adviser (AICPA & CIMA)

News•Feb 9, 2026

Figure’s CFO Supports Treating Stablecoin as Cash

Figure Technology’s CFO Macrina KgIl is urging the Financial Accounting Standards Board to reclassify stablecoins as cash or cash equivalents, rather than intangible assets. The current GAAP treatment creates ambiguity and extra compliance work for firms holding tokens like Tether....

By CFO Dive

News•Feb 9, 2026

Kyndryl CFO Steps Down Ahead of Accounting Review

Kyndryl announced the immediate resignations of CFO David Wyshner and General Counsel Edward Sebold, appointing Harsh Chugh, Bhavna Doega, and Mark Ringe as interim finance chief, corporate controller, and general counsel respectively. The company delayed its Q3 fiscal 2026 10‑Q...

By CFO Dive

Blog•Feb 9, 2026

Let’s Review the IIA’s Guidance on Communicating Audit Results

The Institute of Internal Auditors (IIA) released a new Global Practice Guide on communicating audit results, updating the 2009 guide. The author praises the emphasis on stakeholder needs but criticizes the guide’s requirement to conclude on governance, risk management, and...

By Norman Marks on Governance, Risk Management, and Internal Audit

News•Feb 9, 2026

Kongsberg Maritime Listing Set for April After Demerger Approval

Kongsberg Gruppen received shareholder approval to spin off its maritime division, creating an independent Kongsberg Maritime that will list on Euronext Oslo in April 2026. The new entity will inherit a legacy of 200 years, 8,000 employees in 35 countries,...

By Naval Technology

News•Feb 9, 2026

Hapag-Lloyd Dodges Red Ink in Q4

Hapag‑Lloyd posted a Q4 2025 EBIT of $200 million, a 75% drop from the same quarter a year earlier, yet still managed a full‑year profit of $1.1 billion despite plunging spot rates. Container volumes rose modestly, adding 200,000 TEU in Q4 and...

By Seatrade Maritime

News•Feb 9, 2026

ERP Today Interview: Achyut Jajoo

Salesforce unveiled Agentforce Manufacturing, a suite of pre‑built AI agent templates designed for manufacturers. The solution promises to scale operations without adding headcount by automating routine ERP tasks. Achyut Jajoo, Salesforce’s SVP and GM, highlighted the necessity for ERP systems...

By ERP Today

News•Feb 9, 2026

Efeso Acquires a Majority Stake in Tsetinis Consulting

EFESO Management Consultants completed a majority‑stake acquisition of Austria‑based Tsetinis Consulting in January 2026, with a phased path to full ownership. The cross‑border deal covered Austria, Germany, France and the United States and was executed under a compressed timetable against competing...

By Finance Monthly

News•Feb 9, 2026

Average Income Tax by Area: The Parts of the UK Paying the Most Tax Mapped

Analysis of HMRC data by UHY Hacker Young shows that London and the South East generated 45 % of the UK’s £240.7 billion income‑tax bill in 2022/23. The London borough of Wandsworth paid £4.26 billion, eclipsing the combined £4.23 billion paid by Leeds and...

By MoneyWeek – All

News•Feb 9, 2026

Hims & Hers Stock Crashes After FDA Announces Plans to Take 'Decisive Steps' Against GLP-1 Compounds

Hims & Hers shares plunged up to 27% after the FDA announced it will take decisive steps to restrict non‑FDA‑approved compounded GLP‑1 active pharmaceutical ingredients. The regulator’s move coincides with a lawsuit from Novo Nordisk seeking to block Hims &...

By Yahoo Finance – Finance News

News•Feb 9, 2026

The EBA Launches Consultation on Simplifying the Credit Risk Framework

The European Banking Authority (EBA) has opened a public consultation on its Discussion Paper proposing simplification of the EU credit‑risk framework. The paper, stemming from the 2025 Report on regulatory efficiency, outlines concrete steps to consolidate EBA products, align definitions,...

By EBA – News

News•Feb 9, 2026

IRRBB Management in Emerging Market and Developing Economies: The Role of Derivatives in Supporting Financial Stability and Economic Development

Interest rate risk in the banking book (IRRBB) is emerging as a top priority for banks and regulators across emerging market and developing economies (EMDEs). Monetary tightening and persistent macro‑volatility are making balance‑sheet exposures more fragile, exposing the limits of...

By ISDA — News & analysis feed

Social•Feb 9, 2026

Three Simple Tricks to Instantly Raise Your Prices

3 dumbfoundingly simple ways to raise your prices: (no hostage negotiation skills required) 1. Switch to giving 3 higher price options Make your new entry level option → your current premium option :) 2. Switch to outcomes instead of quantities Increase site conversion 10% is better...

By Adam Shilton

Social•Feb 9, 2026

Alphabet Launches 100‑year GBP Bond, Eyes Currency Debasement

#Alphabet to issue 100-year GBPSterling bond after having issued 50-year $17.5 bn USD bond in November. Also plns to issue CHF bond. They're betting further currency debasement #forex

By Ashraf Laidi

Blog•Feb 9, 2026

ICE at the Facility: How Healthcare Compliance Officers Should Respond

The episode explains how healthcare compliance officers should respond when ICE agents appear on site, emphasizing that unannounced enforcement can occur amid patient care and requires a deliberate, coordinated response. It highlights a leaked ICE memo suggesting agents may enter...

By Compliance Perspectives

Social•Feb 9, 2026

Stripe's Tender Offer Valuation Jumps to $140B

This was an auspiciously-timed quote. @stripe is in talks for a tender offer valuing the company at $140B. That's up from $107B in the fall. https://t.co/3EHL07KS8p

By Nik Milanovic

Social•Feb 9, 2026

Seven Firms Command 35% of SPX Investment Dollars

Employment in S&P 500 companies is 18% of total US employment, but 35 cents of every dollar that goes into the SPX goes to 7 companies. This is a market structure problem and a major issue with our 401k system.

By Tyler Neville

News•Feb 9, 2026

NatWest to Close 32 More Bank Branches – See the Full List

NatWest announced it will shut another 32 high‑street branches across England between May 2026 and February 2027. The closures follow a £115 million investment in its existing network and a strategic pivot toward digital channels as online banking now serves roughly 90 % of...

By MoneyWeek – All

News•Feb 9, 2026

DOL Poised to Move Faster than Congress on Retirement Reform

The U.S. Department of Labor is poised to issue regulations expanding 401(k) access to alternative investments, meeting a February 3 deadline set by a Trump‑era executive order. A final rule could be adopted by year‑end with implementation slated for 2027,...

By Human Resource Executive

News•Feb 9, 2026

Stock Market Week 06/26: RENIXX Declines - Enphase Jumps More Than 35 Percent - Ørsted: Strategic Realignment - Nordex Shares...

The RENIXX slipped 2.2% to 1,195.61 points, ending the week below the 1,200‑point threshold as volatility remains elevated. Enphase Energy surged 35.7% after its earnings beat 2026 revenue expectations despite a Q4 decline. Ørsted announced a €1.44 bn divestiture of its...

By Renewable Energy Industry

News•Feb 9, 2026

Downing Street Resignations Trigger Bond Market Jitters

UK bond markets reacted sharply on Monday after a series of high‑profile Downing Street resignations, with the 10‑year gilt yield climbing to 4.62% – a ten‑basis‑point surge that set a three‑month high. The departures, including communications chief Tim Allan and...

By City A.M. — Markets

Blog•Feb 9, 2026

Repriced Risk in a Rebuilt Regional Bank Subordinated Floater

The episode examines a regional bank that has rebuilt its balance sheet, achieving profitability, capital ratios above 12%, and improved liquidity after addressing over $12 billion of higher‑risk loans. It highlights that despite these fundamentals, the bank’s subordinated floating‑rate notes are...

By Fixed Income Beacon

News•Feb 9, 2026

Is It Time to Open Your First Checking Account?

Opening a first checking account marks a practical step toward financial independence, especially when regular income, bill payments, or a desire for bank relationship emerge. The article highlights benefits such as direct‑deposit convenience, no‑fee options for students, and the security...

By Finance Monthly

News•Feb 9, 2026

Michael Atingi-Ego: Shaping Africa's Future - Intergenerational Leadership, Economic Resilience and the Power of Innovation

Governor Michael Atingi‑Ego’s December 2025 speech honored the late Professor Emmanuel Mutebile while outlining Uganda’s current macroeconomic health and a forward‑looking digital agenda. He highlighted inflation averaging 3.6%, a 9.75% policy rate and 6.3% GDP growth as evidence of disciplined...

By Bank for International Settlements (BIS) – Press releases

Social•Feb 9, 2026

Singapore Family Offices Must Professionalise to Stay Competitive

🇸🇬Singapore’s family offices: Time to professionalise or risk falling behind – Whilst regulatory movements have opened the door for #familyoffices, many SFOs remain under-equipped. @SBRMagazine. #SoutheastAsia #WealthManagement #WealthTech https://t.co/AhGe5VwWFZ

By Urs Bolt

News•Feb 9, 2026

Supermicro Secures 1st Syndicated Loan in Taiwan

U.S.-based AI server maker Super Micro Computer secured its first syndicated loan in Taiwan, amounting to $1.765 billion. The loan was administered by CTBC Bank and attracted participation from 21 financial institutions, resulting in an almost 1.8‑times oversubscription. Lenders cited Supermicro’s...

By Focus Taiwan (CNA) – English News