Deals•Feb 18, 2026

Benefit Street Partners Issues $502.6M US CLO Arranged by Bank of America

Benefit Street Partners (BSP) issued its second US CLO of the year, raising $502.6 million. Bank of America acted as the arranger for the transaction, marking a notable debt financing deal in the CLO market.

Creditflux

Deals•Feb 18, 2026

Steel Dynamics and SGH Raise $11B Bid for BlueScope Steel's North American Assets

Indiana-based Steel Dynamics, together with private equity firm SGH, announced an increased takeover bid of $11 billion for BlueScope Steel’s North American assets. The bid targets BlueScope’s North American operations, including the North Star mill, to unlock value and support U.S....

Dealbreaker

Deals•Feb 18, 2026

CBRE Investment Management Commits €500M to IPUT’s Dublin Office Growth

CBRE Investment Management (CBRE IM) announced a €500 million capital commitment to IPUT, marking the first tranche to fund the developer’s near‑term prime office pipeline in Dublin. The investment supports IPUT’s growth strategy for new office projects.

CRE Herald

Deals•Feb 18, 2026

Faeth Goes Public via Merger with Sensei, Raising $200M

Faeth announced its public listing through a merger with Sensei, generating $200 million from a stock sale. The transaction marks Faeth's entry into the public markets.

Endpoints News

Deals•Feb 18, 2026

Nimbus Capital Invests $15M in Chimera Wallet in Strategic Partnership

Nimbus Capital announced a $15 million strategic partnership with Chimera Wallet to expand DeFi infrastructure on Bitcoin. The investment will support Chimera’s development of Bitcoin‑native financial tools, including swaps, lending, and Visa card integration.

Business Insider – Markets Insider

Deals•Feb 18, 2026

Gencom Acquires Ritz‑Carlton Central Park South for $320M

Miami‑based investment firm Gencom bought the 253‑key Ritz‑Carlton Central Park South hotel in Manhattan from Westbrook Partners for about $320 million, financing the deal with a $235 million loan from Banco Inbursa. The acquisition adds to Gencom’s growing New York luxury hotel portfolio...

The Real Deal – Tech

Deals•Feb 18, 2026

Supreme Court Clears Aakash Educational Services to Proceed with Rights Issue

The Supreme Court has permitted Aakash Educational Services to move forward with a rights issue, enabling the company to raise additional capital from existing shareholders. The approval removes a regulatory hurdle and sets the stage for the fundraising, though the...

The Economic Times (India) – RSS hub

Deals•Feb 18, 2026

Ssense Founders Approve Buyout as Transaction Closes

Luxury fashion e‑commerce platform Ssense announced that its founders have approved a buyout, finalising the transaction. The deal closed on February 18, 2026, marking a significant ownership change for the retailer.

The Business of Fashion (BoF)

Deals•Feb 18, 2026

SBI Funds Management to Launch $1.5B IPO in March

India's top asset manager, SBI Funds Management, announced plans to file for an initial public offering in March, targeting a $1.5 billion raise. The filing is expected to be submitted in March, marking a significant expansion of the company's capital base.

The Economic Times – Markets

Deals•Feb 18, 2026

Merit Acquires Former Commonwealth Firm, Adding $208M Practice in Pennsylvania

Merit announced the acquisition of a former Commonwealth firm, expanding its Pennsylvania footprint with a $208 million practice. The deal enhances Merit’s service offerings and market presence in the region.

InvestmentNews – ETFs (tag)

Deals•Feb 18, 2026

Lydian Energy Secures $689M Debt Financing for US Solar and BESS Projects

Lydian Energy announced it has secured $689 million in financing to develop three U.S. projects—a 150 MW/733 MWh BESS in Utah and solar PV projects in New Mexico and Texas. The financing, comprising construction‑to‑term, tax‑credit bridge, co‑investment bridge loans and a letter of...

Energy Storage News

Deals•Feb 18, 2026

Vantage Data Centers Secures $2.4B Private Credit Facility From Ares Management

Vantage Data Centers, a hyperscale data centre campus provider, has secured a US$2.4 billion private credit facility arranged by Ares Management Corporation. The financing will be used to refinance existing debt and support development and operation of its North America portfolio.

The Asset – ETF tag

Deals•Feb 18, 2026

AAM 15 Management Acquires Home2 Suites Tampa Brandon From Floridays Development Co.

Berkadia arranged the sale of the 125‑key Home2 Suites Tampa Brandon hotel on behalf of a related company of Floridays Development Co. to Massachusetts‑based AAM 15 Management LLC. The acquisition expands AAM’s Florida portfolio to 1,952 keys across 14 properties.

Hotel Business

Deals•Feb 18, 2026

Gray Media Completes WBBJ Deal

Gray Media has completed the acquisition of WBBJ, a local television station, expanding its broadcast portfolio. The transaction was announced on February 18, 2026, and the financial terms were not disclosed.

Radio & TV Business Report (RBR+TVBR)

Deals•Feb 18, 2026

Brazil's SP Ventures Secures $100M Fund Backing From IDB Lab and JICA

Brazilian venture capital firm SP Ventures announced it aims to close a $100 million fund this year after securing commitments from development finance institution IDB Lab and the Japan International Cooperation Agency (JICA). The fund will target agtech investments.

LatinFinance

Deals•Feb 18, 2026

Sun Investment Group Secures €32.5M Debt Financing From NORD/LB for 59MW Polish Solar Portfolio

Sun Investment Group has secured a €32.5 million debt financing package from NORD/LB, with Capcora as financial adviser, to develop 32 solar farms totaling 59 MW in Poland. The farms are slated for operation in 2026‑2027 and will benefit from...

reNEWS

Deals•Feb 18, 2026

Superloop Acquires Lynham Networks for $165M

Australian ISP Superloop announced it will acquire Lynham Networks, the parent of Lightning Broadband, for $165 million in cash. The acquisition adds roughly 54,000 FTTP lots to Superloop’s smart‑communities portfolio, expanding its wholesale fibre network across multiple states. The deal is...

ARN (Australia)

Deals•Feb 18, 2026

Berniq Airways Secures $238mn Capital Increase

Libya's Berniq Airways announced a $238 million capital increase to fund fleet expansion and strengthen its balance sheet. The fundraising, reported on Feb 18, 2026, aims to support the airline's growth in the region.

ch-aviation News

Deals•Feb 18, 2026

Philippines Treasury Raises P107.07B in 10‑Year Bond Auction

The Philippine Bureau of the Treasury raised P107.07 billion in a 10‑year Treasury bond auction, awarding a portion of its P300‑billion offer after receiving P328.47 billion in bids. The auction, held on Feb 18 2026, saw yields settle at 5.893 percent, reflecting strong demand and...

Philstar – Business

Deals•Feb 18, 2026

Monte Dei Paschi Moves to Take Mediobanca Private

Italian bank Banca Monte dei Paschi di Siena announced plans to take Mediobanca private, aiming to delist the investment bank from the stock exchange. The move sparked a rise in Mediobanca's share price. Deal terms and valuation were not disclosed.

Handelsblatt (English)

Deals•Feb 18, 2026

Quantum Capital Raises $2.3 Billion for New Energy Fund

Quantum Capital announced that it has raised $2.3 billion to date for its new energy-focused venture fund, marking a major influx of capital for clean‑tech investments. The fundraising round attracted commitments from a range of institutional investors, and the firm also...

The Wall Street Journal – Markets

Deals•Feb 18, 2026

Blackstone, EQT, and CVC Submit Acquisition Offers for Volkswagen Unit

Private equity firms Blackstone, EQT and CVC have each submitted acquisition offers for a Volkswagen unit, intensifying competition for the German automaker's subsidiary. The bids come as Volkswagen evaluates strategic options for the unit, with the firms aiming to expand...

Financial Times – Work & Careers

Deals•Feb 18, 2026

IFC Invests $150M with Banque Misr to Scale Green Finance in Egypt

The International Finance Corporation (IFC) announced a $150 million investment with Egypt’s Banque Misr to scale green finance across energy efficiency, renewable energy, sustainable transport and green buildings. The partnership, signed during IFC’s Vice President for Africa’s visit, also earmarks 20 %...

Wamda

Deals•Feb 18, 2026

Inocea Group Acquires Two UK Fleet Oilers

The UK Ministry of Defence has sold two fleet oilers to private maritime services provider Inocea Group. Announced on February 18, 2026, the deal transfers the vessels for commercial operation. Deal value was not disclosed.

The Maritime Executive

Deals•Feb 18, 2026

Silverline Technologies Secures ₹80 Crore Investment From Trueledger Technologies FZE

Silverline Technologies' board approved an ₹80 crore capital infusion from Trueledger Technologies FZE, marking a strategic investment to support its growth. The deal, announced on February 18, 2026, will bolster Silverline's operations and expansion plans.

The Hindu BusinessLine – Companies

Deals•Feb 18, 2026

United Maritime Sells €13 Million Stake in Norwegian ECV Joint Venture

Nasdaq‑listed Greek bulker owner United Maritime agreed to sell its equity interest in a Norwegian joint venture developing an energy construction vessel for about €13 million, generating a €1.7 million profit. The transaction is expected to close by the end of May...

Splash 247

Deals•Feb 18, 2026

Statiq Raises $18M in Equity‑debt Round Led by Tenacity Ventures

India’s EV‑charging network provider Statiq announced a new $18 million funding round, led by Tenacity Ventures, with participation from Y Combinator, Shell Ventures and RCD Holdings. The mixed equity‑debt round will fund expansion of its charging infrastructure across Tier‑1 and Tier‑2 cities...

ET EnergyWorld (The Economic Times)

Deals•Feb 18, 2026

Dexters Acquires Tatlers Estate Agency to Expand London Footprint

Dexters has completed the acquisition of Tatlers, a long‑standing London estate agency, adding three high‑street offices to its portfolio. The deal comes ahead of a leadership transition as CEO Andy Shepherd prepares to hand over to Ash Kashyap. No financial...

Property Industry Eye – Technology (UK)

Deals•Feb 18, 2026

Paloma Acquisition Corp. I Prices $150M IPO on Nasdaq

Paloma Acquisition Corp. I announced the pricing of its $150 million initial public offering, with units slated to begin trading on Nasdaq under the ticker PALOU on February 19, 2026. The SPAC, led by sponsor team CEO Anna Nahajski‑Staples, CFO Peter Preston and...

SPACInsider

Deals•Feb 18, 2026

MetLife Acquires Luxury Providencia Office Building From Banmerchant for $95M

Banmerchant has sold a high‑end office building in Providencia to MetLife following a US$95 million investment. The transaction highlights a tightening Chilean office market, with vacancy rates falling to single digits for the first time since 2020.

Diario Financiero (Chile) — RSS

Deals•Feb 17, 2026

OX2 Secures Project Financing From DNB Carnegie and UniCredit for 189MW Fageråsen Wind Farm

Swedish renewable energy developer OX2 has secured long‑term project financing from DNB Carnegie and UniCredit for its 189 MW Fageråsen onshore wind farm in Malung‑Sälen, Sweden. The financing supports the construction of the 27‑turbine project, which also includes a 200 MWh battery...

reNEWS

Deals•Feb 17, 2026

Crestwood Advisors Group LLC Acquires Invesco QQQ Shares

Crestwood Advisors Group LLC has acquired shares of the Invesco QQQ exchange-traded fund (ticker QQQ). The transaction was announced on February 17, 2026, and the deal value was not disclosed.

DefenseWorld/DW

Deals•Feb 17, 2026

Mitesco Secures Finance Partner for Centcore Data Center Build-Out

Florida-based Mitesco announced it has secured a finance partner to fund the construction of its Centcore data center. The partnership will provide the capital needed for the build-out, supporting Mitesco's expansion in the data center market. The deal was announced...

Data Center Dynamics

Deals•Feb 17, 2026

Taylor Maritime Agrees to Sell 51st Handysize Vessel

London-listed dry bulk owner Taylor Maritime announced an agreement to sell another handysize vessel, marking its 51st disposal since 2023. The financial terms of the latest sale were not disclosed, but the company has raised over $820 million from vessel sales...

Splash 247

Deals•Feb 17, 2026

Colrain Capital LLC Acquires 109,700 Shares of Comcast Corporation

Colrain Capital LLC announced the acquisition of 109,700 shares of Comcast Corporation, representing a minority stake in the telecom giant. The transaction was disclosed on February 17, 2026, with the deal value not disclosed.

DefenseWorld/DW

Deals•Feb 17, 2026

Edward Jones Completes Acquisition of Natixis IM's Overlay-Management Capabilities

Edward Jones announced the completion of its acquisition of Natixis IM's overlay-management capabilities, enabling the firm to manage overlay services for its U.S. UMA in-house. The move, alongside a new partnership with fixed-income platform Moment, expands Edward Jones' cash-flow optimization...

WealthManagement.com – ETFs

Deals•Feb 17, 2026

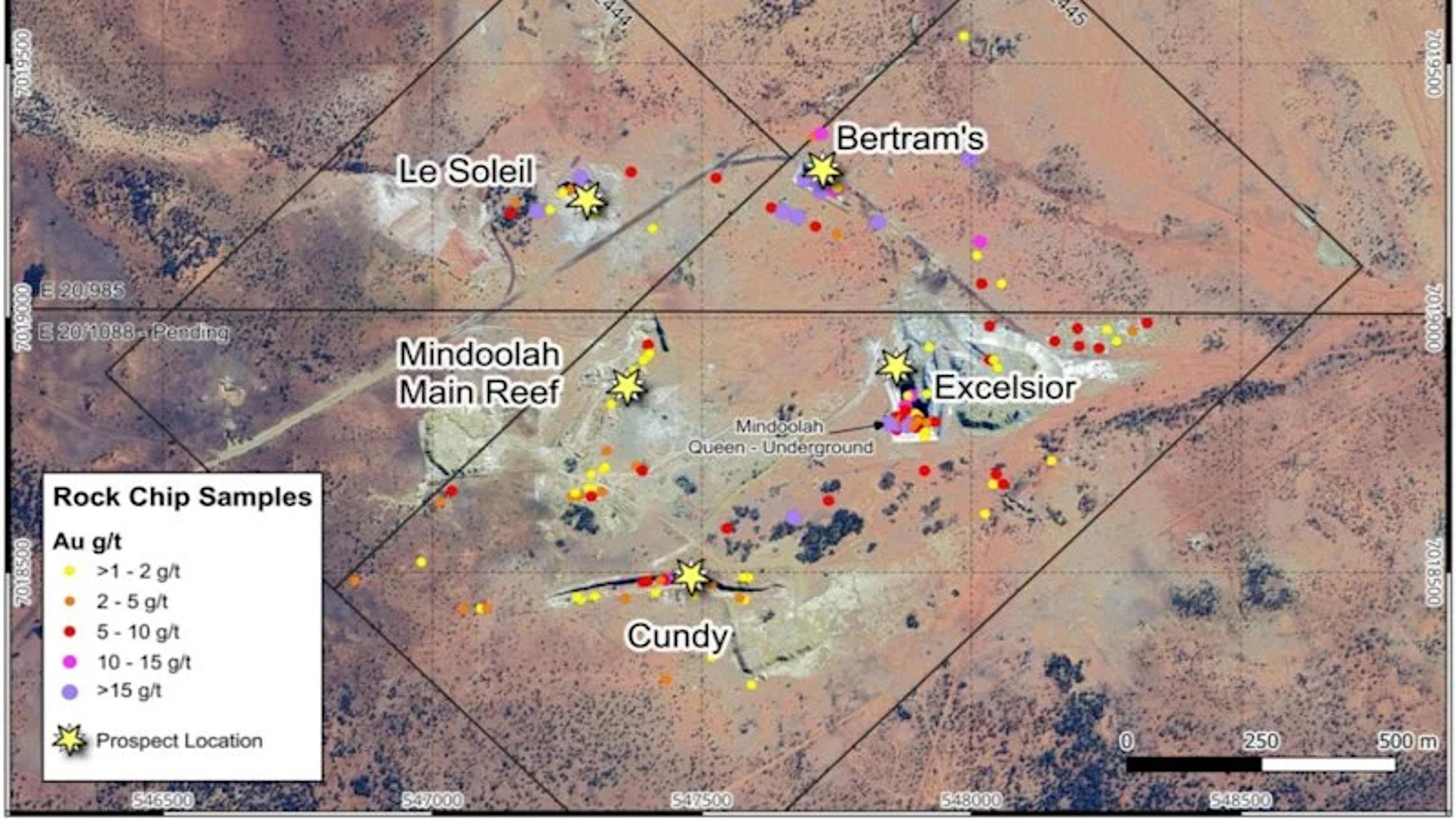

King River Resources Secures Option to Acquire Mindoolah Gold Project for Up to A$600,000

King River Resources announced it has secured an exclusive option to acquire the historic Mindoolah gold project in Western Australia’s Murchison region. The option costs A$225,000 and gives the right to purchase the project outright for A$600,000 cash before 30 June 2026.

Sydney Morning Herald – Business

Deals•Feb 17, 2026

BTG Pactual Acquires 48% Stake in Meutudo to Boost Retail Strategy

Brazilian investment bank BTG Pactual announced the acquisition of a 48% stake in fintech platform Meutudo, aiming to strengthen its retail strategy. The deal, disclosed on February 17, 2026, expands BTG Pactual’s presence in the consumer finance market.

Fintech Futures

Deals•Feb 17, 2026

SDI Group Acquires PRP Optoelectronics for £9.3m

SDI Group plc announced the acquisition of PRP Optoelectronics Ltd for a total consideration of £11.3 million in cash, plus up to £0.9 million deferred, excluding £2.8 million of net cash. The deal adds micro‑LED and LED array capabilities to SDI’s Industrial &...

Semiconductor Today

Deals•Feb 17, 2026

Utility Global Secures $100M Series D Funding to Accelerate Industrial Decarbonization

Utility Global announced a $100 million Series D financing round led by Ara Partners and APG Asset Management. The capital will fund the deployment of its H2Gen® technology for large‑scale hydrogen production and decarbonization across hard‑to‑abate industrial sectors.

VC News Daily

Deals•Feb 17, 2026

Debenhams Confirms £35m Capital Raise to Fund Turnaround

Debenhams announced a £35 million capital raise to support its turnaround plan, prompting a sharp drop in its share price. The funds are intended to bolster working capital and fund strategic initiatives, though details of the investors were not disclosed.

City A.M. — Economics

Deals•Feb 17, 2026

Hotel Trio Healdsburg Sold for $38 Million

Hotel Trio Healdsburg, a boutique hotel in Sonoma County, California, has been sold for $38 million, marking a notable transaction in the hospitality sector.

Hotel News Resource

Deals•Feb 17, 2026

Beirne Wealth Consulting Services Acquires Visa Shares

Beirne Wealth Consulting Services LLC has purchased shares of Visa Inc., marking a new investment in the payments giant. The transaction details, including the stake size and purchase price, were not disclosed.

DefenseWorld/DW

Deals•Feb 17, 2026

Forrestania Resources to Acquire MacPhersons Reward From Beacon Mining for A$5M Cash and 36M Shares

Forrestania Resources has signed a binding heads-of-agreement to acquire the MacPhersons Reward assets from Beacon Mining, a subsidiary of Beacon Minerals. The transaction includes a cash payment of A$5 million and the issuance of 36 million Forrestania shares valued at...

Mining Technology

Deals•Feb 17, 2026

Silicon Valley Bank Provides $9.5M Growth‑capital Facility to Realta Fusion

Silicon Valley Bank, a division of First Citizens Bank, announced a $9.5 million growth‑capital facility for fusion‑energy startup Realta Fusion. The funding aims to support the company's development of high‑temperature superconducting magnet technology. The deal was disclosed on February 17,...

VC News Daily

Deals•Feb 17, 2026

Continental General Insurance Acquires 91,000 Policies From Guaranty Associations

Austin-based Continental General Insurance Company announced the acquisition of approximately 91,000 final expense, life, annuity, and accident & health policies from the state life and health insurance guaranty associations. The transaction, effective Jan. 1, 2026, expands Continental General’s portfolio and...

Reinsurance News

Deals•Feb 17, 2026

ME Funding Secures $340.7M Asset-Backed Securitization From Massage Envy Franchise Revenue

ME Funding announced the issuance of $340.7 million in asset‑backed securities backed by franchise and development revenue from Massage Envy. The series 2026‑1 notes, managed by Massage Envy Franchising and structured by Barclays Capital, will mature in April 2056 and are expected to...

Asset Securitization Report

Deals•Feb 17, 2026

Warner Bros Rejects Paramount’s Revised Offer, Grants One Week to Negotiate

Paramount Pictures has submitted a revised acquisition offer for Warner Bros, which the studio has rejected while granting a one‑week window to continue negotiations. The move signals ongoing M&A talks between the two entertainment giants, with deal terms still undisclosed.

BusinessLIVE (South Africa) – RSS hub

Deals•Feb 17, 2026

Blue Bird to Buy Out Girardin’s Stake in Micro Bird

Blue Bird announced it will purchase Girardin’s ownership stake in Micro Bird, consolidating its position in the school‑bus market. The deal, valued at an undisclosed amount, will make Blue Bird the sole owner of Micro Bird.

Automotive World – Autonomous Driving

Deals•Feb 17, 2026

GDA Luma Invests $30M in Pat McGrath Labs, Securing Controlling Stake

US‑based financial firm GDA Luma announced a $30 million investment in makeup‑artistry label Pat McGrath Labs, comprising $10 million debtor‑in‑possession financing and $20 million post‑emergence working capital. The deal gives GDA Luma a controlling interest, while founder Pat McGrath retains a significant stake and moves to chief creative...

The Business of Fashion (BoF)