Deals•Feb 17, 2026

GE HealthCare Secures Extended Funding From BARDA

GE HealthCare announced an extension of its financing agreement with the U.S. Biomedical Advanced Research and Development Authority (BARDA). The new arrangement provides additional capital to support the company's development of medical imaging and diagnostic technologies. Financial terms were not disclosed.

MarketScreener – Press Releases

Deals•Feb 17, 2026

Eagle Leasing Acquires West Brothers Trailers and Containers4Less

Eagle Leasing, backed by private equity firm Kinderhook, announced the acquisition of West Brothers Trailers and Containers4Less, expanding its Rent‑A‑Container network. The deal, reported on February 17, 2026, adds trailer and container services to Eagle Leasing’s portfolio, strengthening its position...

PE Hub

Deals•Feb 17, 2026

Beneteau Acquires Sailing Atlantic Services

French boatbuilder Beneteau announced the acquisition of Sailing Atlantic Services, a provider of sailing services. The deal, disclosed on February 17, 2026, expands Beneteau's portfolio and strengthens its position in the maritime market. Financial terms were not disclosed.

MarketScreener – Press Releases

Deals•Feb 17, 2026

UHY Acquires CMJ LLP to Expand Presence in Upstate New York

UHY, a top‑25 U.S. accounting and advisory firm, announced the acquisition of Queensbury‑based CPA firm CMJ LLP, adding its construction and financial services expertise to UHY’s national platform. CMJ’s founders Paul A. Curtis and William A. Jeffreys will join UHY...

CPA Practice Advisor

Deals•Feb 17, 2026

Cherry Bekaert Acquires California Accounting Firm Richardson Kontogouris Emerson LLP

Cherry Bekaert, a global advisory, tax and assurance firm, announced the acquisition of the business and assets of Richardson Kontogouris Emerson LLP, a California-based public accounting and advisory firm. The transaction expands Cherry Bekaert’s presence on the West Coast and adds RKE’s...

CPA Practice Advisor

Deals•Feb 17, 2026

Ardonagh Group Acquires Majority Stake in Hong Kong Broker RMIB

Ardonagh Group, a global independent insurance broker, announced the acquisition of a majority stake in Hong Kong-based Risk Management Insurance Brokerage Limited (RMIB). The deal expands Ardonagh’s presence in Asia, strengthening its employee benefits and specialist risk advisory capabilities. RMIB’s...

Reinsurance News

Deals•Feb 17, 2026

MTN to Acquire Remaining Stake in IHS Towers for $2.2 Billion

MTN Group announced it will acquire the remaining stake in IHS Towers, valuing the transaction at $2.2 billion and bringing its total investment in the tower operator to $6.2 billion. The deal gives MTN full control of IHS Towers' African infrastructure assets,...

Bloomberg – Technology (sitewide)

Deals•Feb 17, 2026

Major Craft Brewer Explores Sale, Potentially Impacting 220,000 Investors

A leading craft brewer is reportedly exploring a sale, which could result in the loss of investments for approximately 220,000 shareholders. The potential transaction is still in early stages, with no acquirer identified and deal terms undisclosed.

Inc.

Deals•Feb 17, 2026

Six Biotech Companies File for HKEX IPOs

Six biotechnology firms have filed for initial public offerings on the Hong Kong Stock Exchange, signaling a push into Asian capital markets. The filings were announced on February 17, 2026.

Endpoints News

Deals•Feb 17, 2026

Robinhood Ventures Fund I Launches Roadshow for NYSE IPO

Robinhood Ventures Fund I (RVI) announced today that it has filed a Form N‑2 registration statement and launched a roadshow for its initial public offering of 40 million common shares of beneficial interest at $25 per share. The offering includes 35 million...

FX News Group — Feed

Deals•Feb 17, 2026

KKR Commits $1.5B Equity to Global Technical Realty

KKR has made an additional $1.5 billion equity commitment to Global Technical Realty, the European build‑to‑suit data‑center platform it helped launch in 2020. The investment bolsters the platform’s growth and underscores private‑equity interest in data‑center infrastructure.

PE Hub

Deals•Feb 17, 2026

Yatra Promoter Sells 1.8% Stake for Rs 45 Crore in Bulk Deal

Yatra's promoter has sold a 1.8% stake in the travel booking platform for Rs 45 crore in a bulk transaction, marking a secondary share sale.

Entrackr

Deals•Feb 17, 2026

Mobilise App Lab to Raise ₹20 Cr via IPO on NSE Emerge

Mobilise App Lab, a SaaS‑based enterprise software provider, announced an IPO on NSE Emerge to raise ₹20 crore by issuing 25.12 lakh equity shares at a price band of ₹75‑₹80 per share. CapitalVentures will act as the book‑running lead manager (underwriter) and the...

The Hindu Business Line — Markets

Deals•Feb 17, 2026

MusicBird Acquires Majid Jordan Publishing Catalog

Switzerland-based music rights company MusicBird announced it has acquired the publishing catalog of Toronto-based R&B duo Majid Jordan, adding over 2,000 songs to its portfolio. The deal includes the duo’s publishers’ and writers’ shares, covering hits such as 'Her' and...

Music Business Worldwide (MBW)

Deals•Feb 17, 2026

PG&E to Issue up to $4.6B in Debt in 2026 to Fund Capital Plan

Pacific Gas and Electric (PG&E) announced it will issue up to $4.6 billion in debt in 2026 as part of its five‑year $73 billion capital plan, aiming to achieve investment‑grade credit ratings and fund large‑load growth driven by data centers and EV...

Utility Dive (Industry Dive)

Deals•Feb 17, 2026

ABP and Vesteda Launch €400m Venture for Affordable Dutch Rental Housing

ABP and Vesteda have announced a new joint venture with €400 million of capital to develop affordable mid‑market rental homes in high‑pressure urban areas of the Netherlands. The partnership aims to create a sustainable platform for delivering rental housing and address...

CRE Herald

Deals•Feb 17, 2026

Maslow Capital Lends £116.6m for Wembley PBSA Development

Maslow Capital has extended a £116.6 million loan to finance a 609‑bed purpose‑built student accommodation (PBSA) project in Wembley, London. This second transaction between Maslow Capital and the developer underpins three PBSA schemes totaling 1,247 beds.

CRE Herald

Deals•Feb 17, 2026

MAI Capital Management Acquires LOC Investment Advisors for $750M

MAI Capital Management announced the acquisition of LOC Investment Advisors, a West Virginia‑based fee‑only RIA with $759 million in assets, in a deal valued at $750 million. The purchase expands MAI’s footprint in West Virginia and Florida and marks its 20th acquisition...

WealthManagement.com – ETFs

Deals•Feb 17, 2026

GDA Luma Invests $30M in Pat McGrath Labs, Securing Controlling Stake

US‑based financial firm GDA Luma announced a $30 million investment in makeup‑artistry label Pat McGrath Labs, comprising $10 million debtor‑in‑possession financing and $20 million post‑emergence working capital. The deal gives GDA Luma a controlling interest, while founder Pat McGrath retains a significant stake and moves to chief creative...

The Business of Fashion (BoF)

Deals•Feb 17, 2026

Warner Bros Rejects Paramount’s Revised Offer, Grants One Week to Negotiate

Paramount Pictures has submitted a revised acquisition offer for Warner Bros, which the studio has rejected while granting a one‑week window to continue negotiations. The move signals ongoing M&A talks between the two entertainment giants, with deal terms still undisclosed.

BusinessLIVE (South Africa) – RSS hub

Deals•Feb 17, 2026

Continental General Insurance Acquires 91,000 Policies From Guaranty Associations

Austin-based Continental General Insurance Company announced the acquisition of approximately 91,000 final expense, life, annuity, and accident & health policies from the state life and health insurance guaranty associations. The transaction, effective Jan. 1, 2026, expands Continental General’s portfolio and...

Reinsurance News

Deals•Feb 17, 2026

Forrestania Resources to Acquire MacPhersons Reward From Beacon Mining for A$5M Cash and 36M Shares

Forrestania Resources has signed a binding heads-of-agreement to acquire the MacPhersons Reward assets from Beacon Mining, a subsidiary of Beacon Minerals. The transaction includes a cash payment of A$5 million and the issuance of 36 million Forrestania shares valued at...

Mining Technology

Deals•Feb 17, 2026

Beirne Wealth Consulting Services Acquires Visa Shares

Beirne Wealth Consulting Services LLC has purchased shares of Visa Inc., marking a new investment in the payments giant. The transaction details, including the stake size and purchase price, were not disclosed.

DefenseWorld/DW

Deals•Feb 17, 2026

BTG Pactual Acquires 48% Stake in Meutudo to Boost Retail Strategy

Brazilian investment bank BTG Pactual announced the acquisition of a 48% stake in fintech platform Meutudo, aiming to strengthen its retail strategy. The deal, disclosed on February 17, 2026, expands BTG Pactual’s presence in the consumer finance market.

Fintech Futures

Deals•Feb 17, 2026

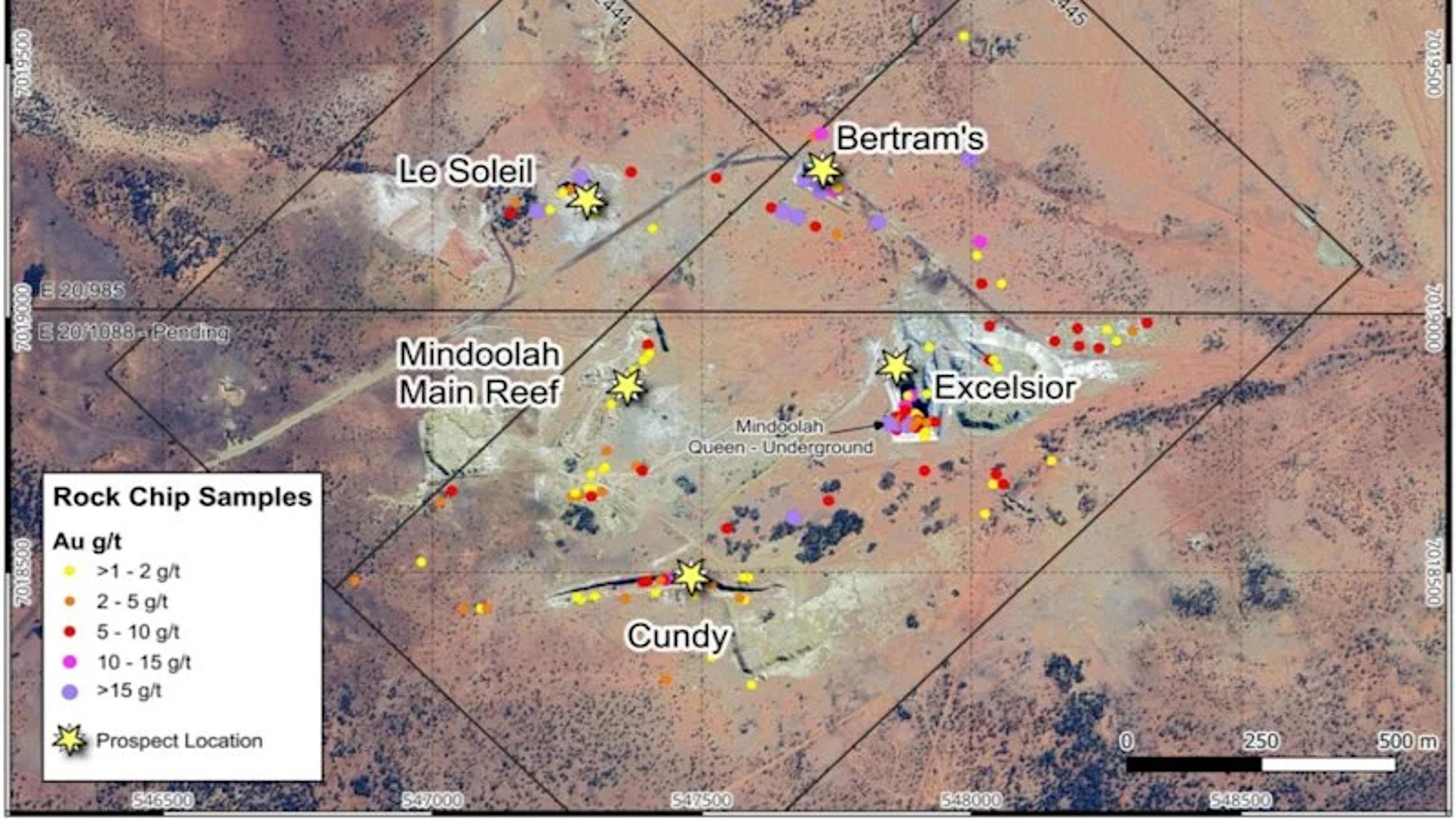

King River Resources Secures Option to Acquire Mindoolah Gold Project for Up to A$600,000

King River Resources announced it has secured an exclusive option to acquire the historic Mindoolah gold project in Western Australia’s Murchison region. The option costs A$225,000 and gives the right to purchase the project outright for A$600,000 cash before 30 June 2026.

Sydney Morning Herald – Business

Deals•Feb 17, 2026

Colrain Capital LLC Acquires 109,700 Shares of Comcast Corporation

Colrain Capital LLC announced the acquisition of 109,700 shares of Comcast Corporation, representing a minority stake in the telecom giant. The transaction was disclosed on February 17, 2026, with the deal value not disclosed.

DefenseWorld/DW

Deals•Feb 17, 2026

Taylor Maritime Agrees to Sell 51st Handysize Vessel

London-listed dry bulk owner Taylor Maritime announced an agreement to sell another handysize vessel, marking its 51st disposal since 2023. The financial terms of the latest sale were not disclosed, but the company has raised over $820 million from vessel sales...

Splash 247

Deals•Feb 17, 2026

Crestwood Advisors Group LLC Acquires Invesco QQQ Shares

Crestwood Advisors Group LLC has acquired shares of the Invesco QQQ exchange-traded fund (ticker QQQ). The transaction was announced on February 17, 2026, and the deal value was not disclosed.

DefenseWorld/DW

Deals•Feb 17, 2026

IFOREX Announces IPO on London Stock Exchange for End of February

Fintech trading and betting platform iFOREX announced it will float on the London Stock Exchange by the end of February 2026, after an eight‑month delay. The notice was released on 17 February, confirming the upcoming IPO.

Investment Week – ETFs

Deals•Feb 17, 2026

Marushika Technology Sets IPO Allotment Date as GMP Jumps

Marushika Technology's initial public offering is set to allocate shares soon, with the GMP index rising on the news. The article outlines steps investors can take to track the IPO status and highlights the upcoming allotment date.

Mint (LiveMint) – Markets

Deals•Feb 17, 2026

Chesnara to Acquire Scottish Widows Europe

UK consolidator Chesnara announced it will acquire Scottish Widows Europe, a Luxembourg-based closed life business, expanding its presence in the European insurance market.

InsuranceERM

Deals•Feb 17, 2026

PhonePe Announces $15B IPO

PhonePe, the Indian digital payments platform, is planning an initial public offering with a target valuation of $15 billion. The IPO, announced in February 2026, could reshape the competitive landscape with rival Paytm and trigger a sector re‑rating. The filing signals...

The Economic Times – Markets

Deals•Feb 17, 2026

Elliott Builds >10% Stake in Norwegian Cruise Line, Plans Board Nomination

Activist investor Elliott has acquired a stake of more than 10% in Norwegian Cruise Line, prompting a 6% pre‑market rise in the company's shares. Elliott intends to push for changes, including nominating a director to the board.

MarketWatch – Top Stories

Deals•Feb 17, 2026

Abode Seeks Investors for £80m Student Housing Projects

UK student accommodation provider Abode announced it is raising capital for two purpose‑built student accommodation (PBSA) schemes, each valued at £80 million. The company is seeking investors to fund the development of the projects, aiming to meet growing demand for student...

Property Week – Technology & Data (UK)

Deals•Feb 17, 2026

YourTRIBE Secures £116.6m Maslow Loan for Wembley PBSA Scheme

YourTRIBE, a student accommodation provider, has secured a £116.6 million loan from Maslow to fund the Wembley purpose-built student accommodation (PBSA) scheme. The financing will support the development of the new student housing project in Wembley.

Property Week – Technology & Data (UK)

Deals•Feb 17, 2026

Debenhams Confirms £35m Capital Raise to Fund Turnaround

Debenhams announced a £35 million capital raise to support its turnaround plan, prompting a sharp drop in its share price. The funds are intended to bolster working capital and fund strategic initiatives, though details of the investors were not disclosed.

City A.M. — Economics

Deals•Feb 17, 2026

SDI Group Acquires PRP Optoelectronics for £9.3m

SDI Group plc announced the acquisition of PRP Optoelectronics Ltd for a total consideration of £11.3 million in cash, plus up to £0.9 million deferred, excluding £2.8 million of net cash. The deal adds micro‑LED and LED array capabilities to SDI’s Industrial &...

Semiconductor Today

Deals•Feb 17, 2026

Sirius Secures New Equity to Expand German Portfolio

Sirius announced a new equity raise to fund its expansion into defence-linked real estate in Germany. The capital raise will support the company's portfolio growth in the region. Deal details such as amount and investors were not disclosed.

CRE Herald

Deals•Feb 17, 2026

British International Investment Invests ₹43 Crore in Turno to Boost EV Battery Infrastructure

British International Investment (BII) announced a fresh ₹43 crore infusion into Turno, an Indian EV battery infrastructure firm, to support its new ElectricGo e‑bus business and expand clean mobility financing. The investment marks BII’s continued climate finance commitments in India.

The Hindu BusinessLine – Companies

Deals•Feb 17, 2026

Wheaton to Acquire BHP's Silver Stream for $4.3B

Mining giant BHP announced a major silver streaming deal, selling a portion of its silver production to Wheaton for $4.3 billion. The transaction comes as copper becomes BHP's primary revenue driver, boosting its half‑year earnings. The deal is expected to strengthen...

Mining Magazine

Deals•Feb 17, 2026

Precious Shipping Acquires 20-Year-Old MR Product Tanker

Precious Shipping, a Thai dry bulk shipowner, announced it is acquiring a 20‑year‑old MR product tanker, marking its entry into the product tanker market and expanding its fleet beyond dry bulk vessels. The move diversifies the company's operations into liquid...

Seatrade Maritime

Deals•Feb 17, 2026

JRI Announces Rights Offering to Raise Capital

JRI announced a rights offering, allowing existing shareholders to purchase additional shares at a discount. The offering aims to raise capital and is expected to be priced below the current market price, prompting the stock to trade at a discount.

Seeking Alpha – ETFs & Funds

Deals•Feb 17, 2026

Alt-Coffee Startup Koppie Raises Undisclosed Follow-On Funding From DOEN Ventures

Belgian alt-coffee startup Koppie announced it has secured an undisclosed follow-on investment from DOEN Ventures, bringing its total funding to over €2 million. The capital will be used to scale production capacity to 1,000 tons by 2026 for launch partners.

AgFunderNews

Deals•Feb 17, 2026

Citadel Raises $1.25B via Two-Part U.S. Bond Sale

Citadel’s financing vehicle raised $1.25 billion through a two‑part U.S. bond issuance, highlighting the growing trend of mega‑funds tapping capital‑markets for working‑capital and operational needs. The debt financing reflects Citadel’s shift toward a corporate‑style financing model, enabling it to fund strategy...

HedgeCo.net – Blogs

Deals•Feb 17, 2026

Blue Bird to Buy Out Girardin’s Stake in Micro Bird

Blue Bird announced it will purchase Girardin’s ownership stake in Micro Bird, consolidating its position in the school‑bus market. The deal, valued at an undisclosed amount, will make Blue Bird the sole owner of Micro Bird.

Automotive World – Autonomous Driving

Deals•Feb 17, 2026

Carlsberg to Launch IPO for Its Indian Operations

Carlsberg announced plans to list its Indian business via an initial public offering, aiming to capitalize on rising sales in the market. The IPO, slated for later this year, will raise capital to fund further expansion, though the valuation and...

The Economic Times (India) – RSS hub

Deals•Feb 17, 2026

Allianz Global Investors Secures Over €1 Billion for Infrastructure Credit Fund

Allianz Global Investors announced that its Allianz Infrastructure Credit Opportunities Fund II closed its third closing, securing €1.007 billion in commitments from institutional investors. The fund will invest in senior and junior debt across energy, transportation, communications and other infrastructure projects,...

Crowdfund Insider

Deals•Feb 17, 2026

Macquarie Asset Management to Acquire Qube Holdings in A$11.7B Deal

Macquarie Asset Management announced it will acquire Qube Holdings, Australia's largest integrated ports and logistics provider, in a cash transaction valuing Qube at approximately A$11.7 billion (US$8.3 billion). The deal, disclosed on February 17, 2026, represents a 28% premium to Qube's November...

The Maritime Executive

Deals•Feb 17, 2026

British Business Bank Commits £45m as Cornerstone Investment in Redrice Ventures’ New Fund

British Business Bank has made a £45 million cornerstone commitment to Redrice Ventures’ fund, which aims to raise £75 million to back purpose‑driven consumer brands and B2B technology. The investment is part of the bank’s Enterprise Capital Funds programme to boost early‑stage...

UKTN (UK Tech News)

Deals•Feb 17, 2026

BHP Secures $4.3B Upfront Payment in Silver‑streaming Deal with Wheaton Precious Metals

Australian mining giant BHP entered a silver‑streaming agreement with Wheaton Precious Metals, receiving an upfront cash payment of $4.3 billion in exchange for delivering silver from its Antamina mine. The deal provides BHP with immediate financing while Wheaton secures future silver...

CNBC – Top News & Analysis