News•Feb 17, 2026

Jefferson Posts $201M Operating Loss in H1

Thomas Jefferson University, owner of Jefferson Health, posted a $201 million operating loss for the first half of fiscal 2026, reflecting a -2.3% operating margin. The loss includes $64.7 million in restructuring expenses tied to a planned layoff of roughly 650 employees. Excluding those costs, the operating loss was $136.3 million (-1.6% margin) even as total operating revenue rose to $8.6 billion, up from $7.5 billion a year earlier. Jefferson Health Plan’s loss narrowed to $90.7 million despite higher membership, while salaries, drug and supply expenses all increased sharply.

By Becker’s Hospital Review

News•Feb 17, 2026

Finance and Sales Teams Don’t Match up on Criteria for Deal Approvals

A CreditSafe survey of over 200 finance and sales leaders reveals a stark mismatch in deal‑approval criteria. While 49% of sales executives rate company size and revenue as very important, only 33% of finance leaders share that view, with finance...

By CFO.com

News•Feb 17, 2026

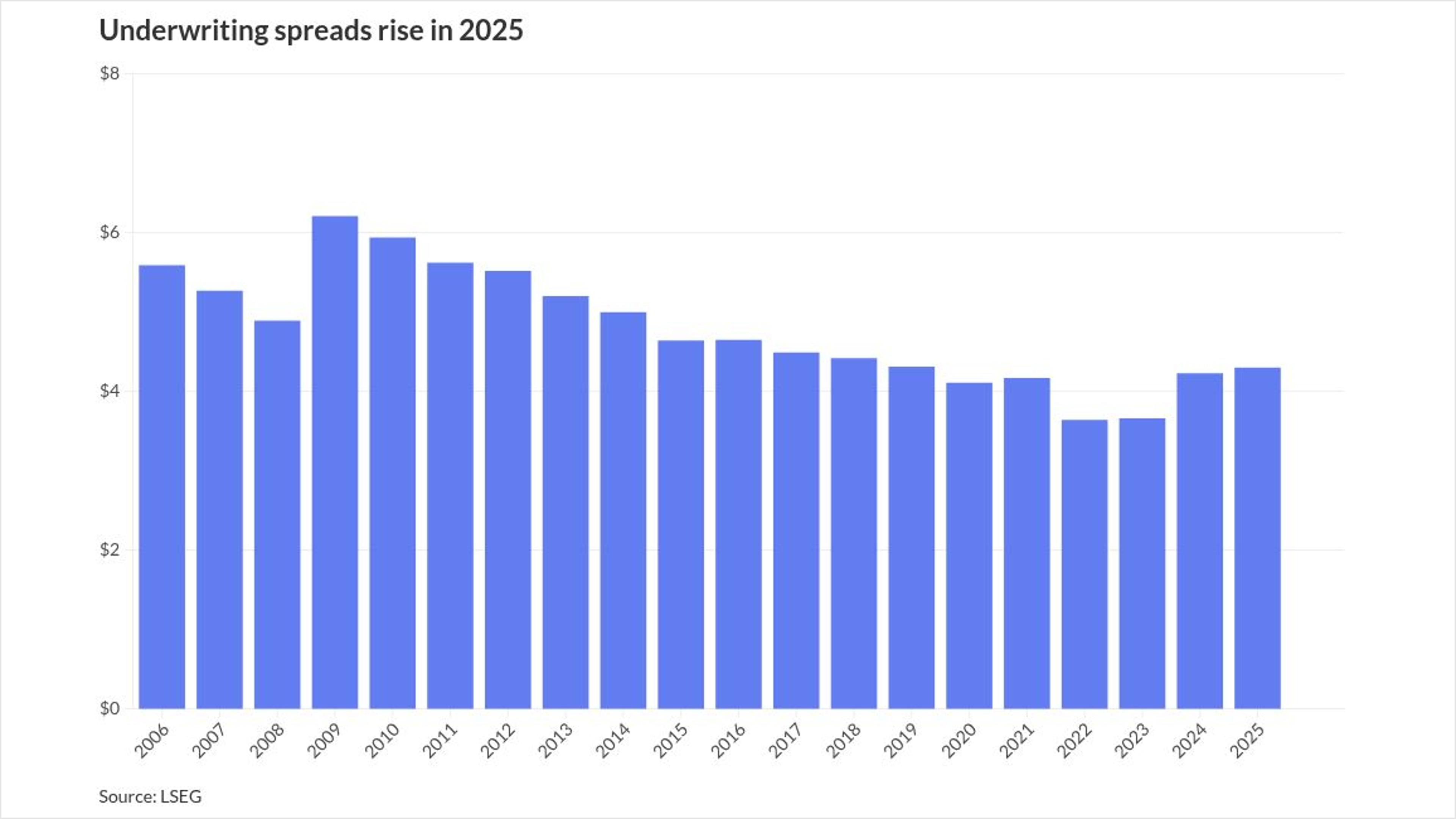

Underwriting Spreads Rise in 2025

Underwriting spreads for municipal bonds rose again in 2025, reaching an average of $4.30 per $1,000, up from $4.23 in 2024. Negotiated‑deal spreads increased to $4.64 while competitive‑deal spreads fell to $1.78. The uptick coincides with record issuance volumes—$586 billion in...

By The Bond Buyer (municipal finance)

News•Feb 17, 2026

International Business Briefs | Kennedy Wilson to Go Private in $1.5bn CEO-Led Deal

Kennedy Wilson agreed to a $1.5 bn CEO‑led buyout, offering a 10.2% premium and targeting a Q2 2026 close. Genuine Parts announced a split into two publicly traded entities—Automotive Parts Group and Industrial Parts Group—set to finalize in Q1 2027 after an activist‑driven settlement. Blackstone‑backed...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 17, 2026

IPO-Bound Kissht's NBFC Arm Gets Crisil Rating Upgrade on Strong Growth

Kissht’s NBFC subsidiary Si Creva Capital Services received a CRISIL rating upgrade, moving its long‑term rating to A‑/Stable and short‑term to A1. The upgrade follows a surge in assets under management, which climbed to Rs 5,533 crore by September 2025, driven by rapid expansion...

By The Economic Times – Markets

News•Feb 17, 2026

SEALSQ Announces FY 2025 Key Preliminary / Unaudited Financials Metrics: Reports 66% Year Over Year Revenue Growth to $18 Million

SEALSQ Corp reported FY 2025 revenue of $18 million, a 66% year‑over‑year increase, while maintaining a cash balance above $425 million. The company posted a net loss of $30‑40 million, reflecting heightened R&D and integration expenses. It highlighted a $200 million plus business pipeline, including...

By GlobeNewswire – Earnings Releases

News•Feb 17, 2026

Cogent Biosciences Reports Recent Business Highlights and Fourth Quarter and Full Year 2025 Financial Results

Cogent Biosciences announced that its lead drug bezuclastinib is on track for multiple FDA submissions in 2026, including NDAs for non‑advanced systemic mastocytosis (Non‑AdvSM), advanced SM (AdvSM) and second‑line GIST. The company reported $901 million in cash, sufficient to fund operations...

By GlobeNewswire – Earnings Releases

News•Feb 17, 2026

Kite Realty Group Reports Fourth Quarter and Full Year 2025 Operating Results and Provides 2026 Guidance

Kite Realty Group (KRG) posted a dramatic turnaround in 2025, reporting net income of $298.7 million ($1.37 per diluted share) versus $4.1 million the prior year. The REIT leased roughly 4.6 million sq ft at a 13.8% comparable cash‑leasing spread and entered two joint‑venture partnerships...

By GlobeNewswire – Earnings Releases

News•Feb 17, 2026

Fund Managers Alarmed over Corporate Spending Even as Optimism at Five-Year High

Fund managers are at a five‑year high of bullishness, yet a record share warn that corporate America is overspending on capital expenditures amid uncertain returns. In Bank of America’s February survey of 162 managers, cash balances rose in February, signaling...

By MarketWatch – Top Stories

News•Feb 17, 2026

Carlyle, BlackRock Buy Cheap Software Loans to Boost CLO Profits

Carlyle Group, BlackRock, Benefit Street Partners and Oak Hill Advisors are buying pools of low‑yield, software‑focused bank loans. The acquisitions are intended to seed new collateralized loan obligations (CLOs) after a year of compressed margins in the loan market. Buyers...

By Bloomberg — Business

News•Feb 17, 2026

Toshiba Weighs Reducing Elevator Unit Stake as Kone Circles

Toshiba Corp. is weighing a partial or full divestiture of its roughly 80% stake in Toshiba Elevator & Building Systems, as Finland’s Kone Oyj signals renewed interest. Kone, which already owns just under 20% of the unit, has begun informal...

By Bloomberg — Business

News•Feb 17, 2026

CleanMax to Float ₹3,100 Crore IPO on Feb 23

CleanMax Enviro Energy Solutions announced a ₹3,100 crore IPO opening on Feb 23, with a price band of ₹1,000‑1,053 per share that values the company at up to ₹12,325 crore. The issue includes a ₹1,200 crore fresh issue and a ₹1,900 crore offer‑for‑sale by promoters,...

By The Hindu BusinessLine – Markets

News•Feb 17, 2026

What CFOs Need From Banks and FinTechs in Cross-Border Payments

Cross‑border payments are undergoing a structural shift as CFOs demand more predictable, liquid, and compliant solutions. FinTech firms have accelerated speed and API‑driven usability, opening new corridors and transparent pricing. At the same time, banks are investing in modern settlement,...

By PYMNTS

News•Feb 17, 2026

DCM Shriram Industries’ Demerger Entities Debut on Bourses

DCM Shriram Industries completed its demerger, launching DCM Shriram Fine Chemicals Ltd and DCM Shriram International Ltd on Indian exchanges. Fine Chemicals opened around 17% below its issue price, while International fell about 18% on the NSE but edged up...

By The Hindu BusinessLine – Markets

News•Feb 17, 2026

CESC Seeks KERC Nod to Bridge Revenue Deficit

Chamundeshwari Electricity Supply Corporation (CESC) has asked the Karnataka Electricity Regulatory Commission (KERC) to approve a plan that bridges a ₹528.1 crore net revenue deficit for FY 2024‑25. The shortfall stems from higher power procurement costs, rising finance expenses and a 5.8%...

By ET EnergyWorld (The Economic Times)

News•Feb 17, 2026

Fibe Crosses Rs 1,200 Cr Revenue in FY25; Profit Spikes 13%

Fibe, the former EarlySalary, posted FY25 operating revenue of Rs 1,228 crore, a 49% increase from the prior year, while net profit rose 13% to Rs 114 crore. Interest on loans remained the dominant revenue stream, exceeding Rs 1,000 crore and representing over...

By Entrackr

News•Feb 17, 2026

Blackstone and EQT to Acquire Spanish Waste Business Urbaser for €5.6bn

Blackstone and EQT have agreed to acquire Spain’s waste‑management firm Urbaser for an enterprise value of €5.6 billion. The purchase price reflects an 11‑times multiple of the company’s projected 2025 EBITDA, underscoring strong confidence in the sector’s cash flow generation. The...

By PE Hub

News•Feb 17, 2026

Naturals Eyes 2028 IPO if Reliance Stake Talks Fail

Naturals, one of India’s largest organised salon chains with about 900 outlets, is negotiating a stake sale with Reliance but talks have stalled over control, with Reliance seeking a 51% stake while Naturals wants to retain 49%. The company reported...

By The Hindu BusinessLine – Markets

News•Feb 17, 2026

Sources: US Healthcare Manufacturer Danaher Is Nearing a Deal to Buy Medtech Company Masimo for ~$10B; Masimo Is in an...

Danaher, a US healthcare conglomerate, is close to finalizing a roughly $10 billion acquisition of Masimo, the maker of pulse‑oximetry and other medical monitoring devices. The deal, still subject to antitrust clearance, would add Masimo’s sensor technology to Danaher’s Life Sciences...

By Techmeme

News•Feb 17, 2026

Industrial AI Shifting as Enterprises Turn Analytics Into Autonomous Action

IFS posted 23% annual recurring revenue growth and a 114% net retention rate for FY 2025, indicating industrial AI is moving from pilot projects to large‑scale operational use. The company’s new IFS Nexus Black and Agent Studio platforms let enterprises...

By ERP Today

News•Feb 17, 2026

UK Software Firm Pinewood's Stock Fell ~31% on February 16 After Apax Withdrew Its £575M Takeover Offer, Citing "Prevailing Challenging...

Apax Partners pulled its £575 million takeover bid for FTSE 250 software firm Pinewood on February 16, citing challenging market conditions. The withdrawal triggered an immediate 31% drop in Pinewood’s share price, the steepest decline in weeks. Analysts view the move as a...

By Techmeme

News•Feb 17, 2026

The Diversification Mirage Inside Today’s Indexes

Indexes are increasingly dominated by a handful of AI‑focused mega‑cap firms, turning passive funds into de‑facto concentrated bets. Peter Corey of Pave warns that investors often mistake broad ETF holdings for true diversification, while underlying exposure remains clustered around the...

By InvestmentNews – ETFs (tag)

News•Feb 17, 2026

FDIS: Consumer Discretionary Dashboard For February

The February Consumer Discretionary Dashboard shows the sector’s services segment trading about 14% below its 11‑year average, while autos and components remain the most overpriced subsector. Fidelity’s FDIS ETF and SPDR’s XLY deliver comparable long‑term Sharpe ratios, but FDIS offers...

By Seeking Alpha – ETFs & Funds

News•Feb 17, 2026

Stocks to Buy in 2026 for Long Term: IGL, Siemens Energy Among 5 Stocks that Could Give 10-40% Return

Brokerage houses have highlighted five Indian equities that could deliver 10‑40% returns by 2026. Motilal Oswal sees Indraprastha Gas (IGL) rising 41% to ₹235 and Siemens Energy up 31% to ₹3,600. Citi maintains a Buy on Lupin with a 15% upside,...

By The Economic Times (India) – RSS hub

News•Feb 17, 2026

Retail Expansion Drives Record Earnings for Baby Bunting

Baby Bunting posted record half‑year sales of $271.4 million, a 4.9% increase year‑on‑year, driven by a mix of new large‑format stores, small‑format openings, and six "store of the future" refurbishments. Online sales climbed to 24.8% of total revenue, up 18%, reflecting...

By Inside Retail Australia

News•Feb 17, 2026

Market Quote of the Day by Sir John Templeton | “The Time of Maximum Pessimism Is the Best Time to...

Sir John Templeton’s adage that the best buying opportunities arise at peak pessimism is highlighted as a timeless investing principle. The article notes that widespread fear compresses valuations, allowing strong companies to be bought at discounts, while emphasizing the need...

By The Economic Times (India) – RSS hub

News•Feb 16, 2026

FX Option Expiries for 17 February 10am New York Cut

Investors received the FX option expiry list for 17 February 10 am New York cut, detailing strike levels and notional amounts across major pairs. EUR/USD options total roughly €2.6 billion at strikes 1.1900, 1.2000 and 1.2025. USD/JPY carries about $2.86 billion at 156.00 and 151.00,...

By ForexLive — Feed

News•Feb 16, 2026

FastFinance: Cost Implications of New HOPD Reporting Rules; Election Year Opportunity on Affordability

HFMA’s FastFinance podcast highlights new off‑campus HOPD reporting requirements that could impose significant cost burdens on health systems. The episode also cites a "Weird Number"—a 3‑5% annual net revenue loss attributed to inefficient electronic health records and billing platforms. Additionally,...

By HFMA – Healthcare Financial Management Association

News•Feb 16, 2026

Big Financial Impacts From Off-Campus HOPD Rule Change

Effective Jan. 1 2028, the Consolidated Appropriations Act of 2026 requires hospitals to assign separate NPIs and submit two provider‑based attestations for each off‑campus hospital outpatient department (HOPD) or lose Medicare OPPS reimbursement. Compliance documentation can be extensive—up to 200 pages per...

By HFMA – Healthcare Financial Management Association

News•Feb 16, 2026

UK-Based Investor Independent Franchise Partners Takes 3% Stake in Universal Music Group Worth $1.2bn+

Independent Franchise Partners (IFP) has acquired a 3.01% stake in Universal Music Group (UMG), valued at roughly €1.09 billion ($1.29 bn). The holding makes IFP the sixth‑largest shareholder and adds to its existing positions in Vivendi, Rightmove and Warner Music, signalling a...

By Music Business Worldwide (MBW)

News•Feb 16, 2026

Fitch Ratings Assigns ‘a’ Rating to Lee County, Florida Airport Revenue Bonds Series 2026

Fitch Ratings assigned an ‘A’ rating to Lee County, Florida’s airport revenue bonds, Series 2026, and affirmed the rating on existing bonds with a stable outlook. The rating reflects a balanced carrier mix serving a leisure‑focused market and enplanements that...

By Airport Improvement Magazine

News•Feb 16, 2026

State Firms Told to Avoid Borrowing when Investing

Thailand's finance ministry has instructed state‑owned enterprises to fund new investments primarily from internal revenues, limiting reliance on borrowing that is classified as public debt. The policy follows a backdrop where public debt stands at 66.1% of GDP, close to...

By Bangkok Post – Investment (subset within Business)

News•Feb 16, 2026

10 Stocks the Best European Fund Managers Have Been Buying and Selling

Leading European large‑cap equity funds rebalanced portfolios in December, increasing exposure to financial services, healthcare and, to a lesser extent, industrials. At the same time, allocations to basic materials, consumer defensive and technology stocks were trimmed. ASML emerged as the...

By Morningstar UK – News

News•Feb 16, 2026

Plus500 CEO, CFO, CMO to Sell 1.5M Shares

Plus500’s chief executive, chief financial officer and chief marketing officer announced the sale of 1,500,000 ordinary shares, representing roughly 2.14% of the company’s issued capital. The transaction will be executed on the secondary market through Goldman Sachs International, with Panmure...

By FX News Group — Feed

News•Feb 16, 2026

Crypto Cost Basis Gaps Create Civil and Criminal Tax Exposure

Crypto taxpayers are increasingly exposed to tax liabilities because many cannot substantiate the cost basis of their digital assets. When the IRS cannot verify basis, it treats the entire proceeds as taxable gain, potentially invoking civil penalties or criminal fraud...

By Accounting Today

News•Feb 16, 2026

Goldman Sachs Doubles Down on Aye Finance Despite Muted Debut; BofA Picks up Stake in EIL in Rs 100 Crore...

Goldman Sachs increased its stake in Aye Finance by buying 16.8 lakh shares for about Rs 22 crore, bringing its total exposure to roughly Rs 91 crore. The NBFC’s IPO was 97 % subscribed, yet the shares opened flat at Rs 128.80, just 0.16 % below the issue...

By The Economic Times – Markets

News•Feb 16, 2026

EU Crypto Reporting Goes Live and Netherlands Immediately Votes on 36% Bitcoin Tax – Even if You Don’t Sell

The Dutch House approved a Box 3 overhaul that will tax the annual change in value of liquid assets such as Bitcoin at a flat 36 % rate, effective Jan 1 2028 pending Senate approval. The regime treats crypto like a marked‑to‑market security, meaning...

By CryptoSlate

News•Feb 16, 2026

Cohu: Maintaining Bearish Stance Post Q4 Earnings Release

Cohu, Inc. posted a Q4 earnings miss despite a 34% surge in recurring bookings and over 12% revenue growth, keeping operating losses and margins under pressure. The company added $290 million of convertible debt, raising dilution concerns, while one‑time inventory charges...

By Seeking Alpha — Site feed

News•Feb 16, 2026

S&P Global: An Undervalued Dividend King For Long-Term Investors

S&P Global (SPGI) is a $133 billion market‑cap provider of credit ratings, benchmarks, analytics and workflow solutions. The company has raised its dividend for 53 consecutive years and trades at a 21.9× P/E, roughly 20% below its five‑year average, implying undervaluation....

By Seeking Alpha — Site feed

News•Feb 16, 2026

Brokers to Approach RBI as Tighter Norms Squeeze Funding for Proprietary Desks

The Reserve Bank of India’s new capital‑market exposure framework, effective April 1 2026, mandates 100 percent collateral backing for all bank loans to brokerage firms and bars banks from financing proprietary trading desks. Brokers plan to petition the RBI for clarifications as the...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

Indian REITs Distribute ₹2,450 Crore to over 3.8 Lakh Unitholders in Q3

India’s five listed REITs paid out over ₹2,450 crore to more than 380,000 unitholders in Q3, covering 185 million square feet of Grade A office and retail space. Since inception, the trusts have distributed over ₹29,100 crore and now hold assets exceeding ₹2.5 lakh crore. The...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

Sundaram AMC Launches Mid-Cap Fund in GIFT City

Sundaram Asset Management Company has launched the Sundaram India Mid Cap GIFT, a USD‑denominated offshore feeder fund that gives global investors direct exposure to India’s mid‑cap equities. The fund is domiciled in GIFT City’s International Financial Services Centre and invests...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

Volkswagen Aims to Cut Costs by 20% by 2028 in Restructuring Plan, Report Says

Volkswagen announced a new restructuring plan aimed at cutting operating costs by 20% by 2028, building on a €10 bn savings target set three years ago. The initiative may involve plant closures and a further reduction of 35,000 jobs by 2030....

By The Guardian » Business

News•Feb 16, 2026

No One Has Cash to “Buy the Dip” But $7.7T Could Rotate Into Bitcoin if Prices Stay Beaten Down

A new analysis argues that most cash is already deployed, leaving little idle liquidity to "buy the dip" in risk assets. Retail portfolios show a cash allocation of 14.4% in January 2026, down from over 20% in 2022, while equity...

By CryptoSlate

News•Feb 16, 2026

Tract’s Fleet Data Centers Seeks $3.8bn to Fuel Nevada Build-Out

Fleet Data Centers, the development arm of Tract, announced a $3.8 billion senior secured note issuance to fund a 230 MW data center campus in Reno, Nevada. The facility, built on a 252‑acre site, is 100 percent leased to an unnamed investment‑grade tenant...

By Data Center Dynamics

News•Feb 16, 2026

Investment Fund for Wales Sees Largest-Ever Deal

British Business Bank’s £130 m Investment Fund for Wales has completed its largest single investment, a £3.5 m injection into engineering services firm Advantiv. The deal, executed by fund manager Foresight Group, marks the 102nd investment since the fund’s 2023 launch. Advantiv...

By UKTN (UK Tech News)

News•Feb 16, 2026

Metaplanet Operating Profit to Rise 81% in 2026 After Soaring 17-Fold Last Year on Options Writing

Metaplanet, Japan’s largest bitcoin treasury firm, posted a 17‑fold jump in operating profit to ¥6.28 bn in 2025, propelled by a surge in options‑writing premiums that lifted revenue 738% to ¥8.9 bn. Despite the earnings boom, a steep bitcoin price decline generated...

By CoinDesk

News•Feb 16, 2026

Eaglestone Management: Experience Forged in Global Infrastructure Finance

Eaglestone Management’s leadership team combines deep project‑finance banking experience with hands‑on infrastructure execution. CEO Pedro Neto brings over 30 years and involvement in more than €50 billion of global projects across energy, transport and concessions. Managing Partner Nuno Gil adds 25...

By CFI.co (Capital Finance International)

News•Feb 16, 2026

Broker’s Call: Ola Electric (Sell)

Emkay Global downgraded Ola Electric Mobility to Sell, slashing its target price by 60% to ₹20 from ₹50. The company posted a weak Q3, with revenue down 55% YoY and a 61% drop in unit volume to 32,000 units, pushing...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

FCA Exchanges Letters on Cooperation with India Regulator, IFSCA

The Financial Conduct Authority (FCA) has signed an Exchange of Letters with India’s International Financial Services Centres Authority (IFSCA), the regulator for GIFT City. The pact commits both bodies to share regulatory knowledge and best‑practice insights, aiming to strengthen links...

By UK FCA – News