News•Feb 16, 2026

Telkom Indonesia Revisits NeutraDC Sale Plans - Report

Telkom Indonesia is re‑engaging advisors to sell a majority stake in its data‑center subsidiary NeutraDC, targeting a valuation between $1 billion and $1.5 billion. The company previously explored a sale in 2022 and considered minority stakes in 2024, with Goldman Sachs and Mindiri Sekuritas now leading the process. NeutraDC operates 29 data centres across Indonesia and Singapore and recently signed an MOU to build cross‑border infrastructure linking Japan, Indonesia and Singapore. The revived transaction reflects Telkom’s strategy to monetize non‑core assets while funding growth in core telecom services.

By Data Center Dynamics

News•Feb 16, 2026

ACH Volume Is Soaring. Here's How that Threatens Banks.

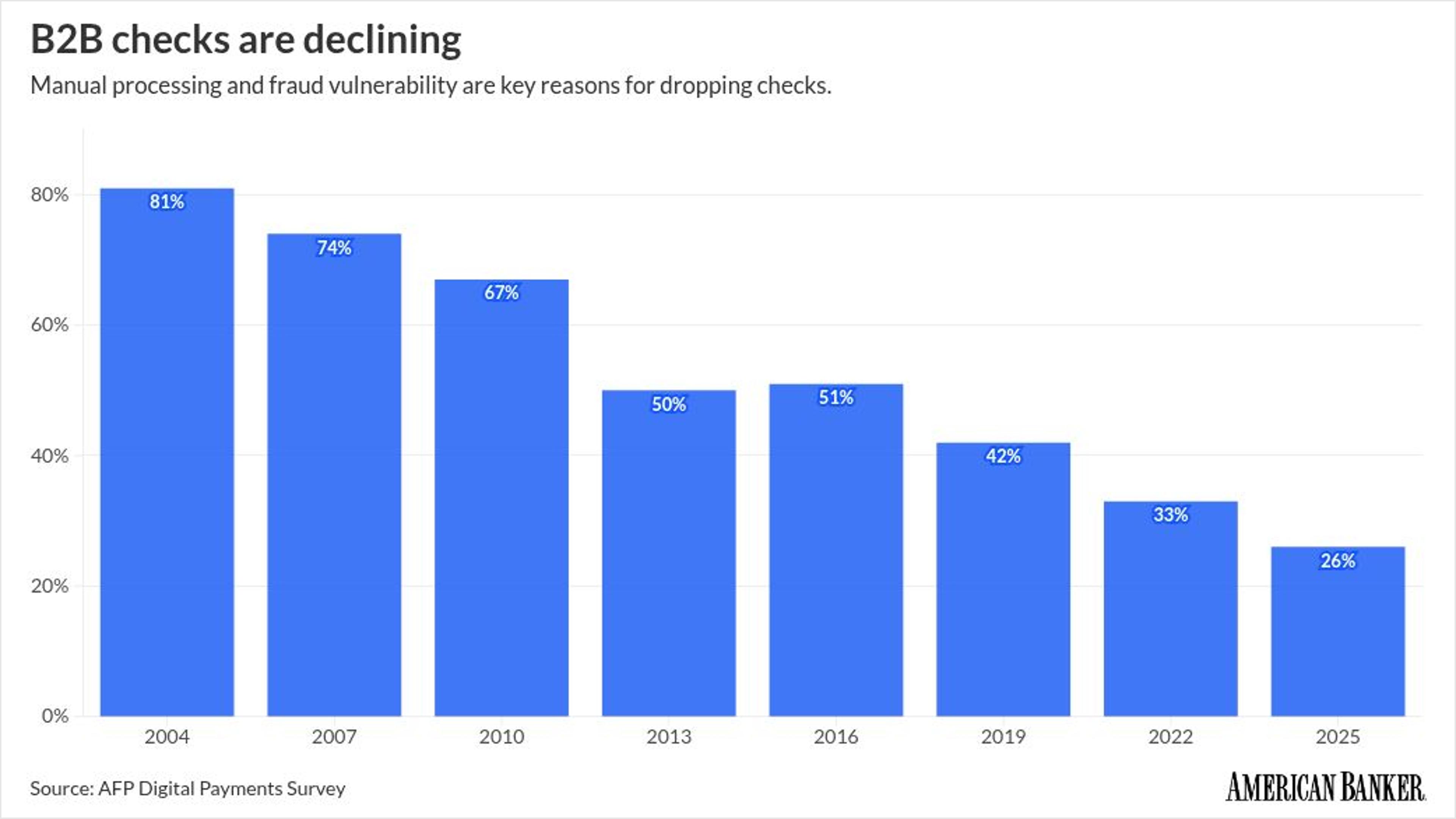

ACH network volume surged in 2025, reaching 35.2 billion payments worth $93 trillion, a 5 percent rise year‑over‑year. Person‑to‑person transfers grew 19.8 percent and business‑to‑business payments rose 9.9 percent, while check usage in B2B fell to 26 percent. Nacha has proposed lifting the same‑day ACH transaction...

By American Banker

News•Feb 16, 2026

Software Maker Dassault Systèmes Falls 8% as AI Fears Persist; Europe Markets Edge Higher

European markets edged higher after the Munich Security Conference, but software giant Dassault Systèmes slumped 8% as lingering AI skepticism dampened investor sentiment. The conference underscored Europe’s push for greater defense spending and strategic autonomy, lifting defense‑related equities. Meanwhile, NatWest kicked...

By CNBC – US Top News & Analysis

News•Feb 16, 2026

EQS-CMS: Henkel AG & Co. KGaA: Release of a Capital Market Information

Henkel AG & Co. KGaA disclosed its weekly share‑buyback activity for 9‑13 February 2026, repurchasing 17,000 preferred shares and 18,000 ordinary shares on the XETR. The preferred‑share buyback cost €1.37 million at an average price of €80.56, while the ordinary‑share buyback cost €1.34 million...

By Business Insider – Markets Insider

News•Feb 16, 2026

Cregis at iFX EXPO Dubai 2026: Shaping the Next Era of Enterprise Payments and Digital Asset Infrastructure

Cregis showcased its upgraded Cregis Payment Engine at iFX EXPO Dubai 2026, positioning the solution as a multi‑chain, multi‑currency platform for enterprise payments. The engine promises near‑real‑time cross‑border settlement, automated routing, and real‑time compliance monitoring, targeting use cases such as...

By Business Insider – Markets Insider

News•Feb 16, 2026

Firms Report Improved Financial Performance Linked to Use of Embedded Finance

A new PYMNTS Intelligence study of 515 senior leaders shows embedded finance is now a strategic imperative for mid‑size and large firms. Nearly 90% of respondents prioritize strengthening customer and employee relationships, while 75% plan technology upgrades within the next...

By PYMNTS

News•Feb 16, 2026

Stablecoin Payments Show Up at Checkout Despite Crypto Markets Slump

Despite a broad crypto market downturn, stablecoin‑linked cards are gaining traction at U.S. checkout counters. Monthly payment flows through these cards have surpassed $1.5 billion, and annualized spend now tops $18 billion. The growth is driven by card networks embedding stablecoins as...

By PYMNTS

News•Feb 16, 2026

Rethinking SARs in the Fight Against Financial Crime

Suspicious Activity Reports (SARs) remain the cornerstone of global AML frameworks, yet many institutions misunderstand their purpose, treating them as accusations rather than suspicion flags. Regulatory pressure and soaring transaction volumes have driven firms to prioritize filing speed over narrative...

By Fintech Global

News•Feb 16, 2026

The Spreadsheet Trap in Financial Crime Risk

Spreadsheets have long been the default tool for financial crime risk assessments, prized for their flexibility and low cost. However, they cannot enforce governance, version control, or audit trails required by modern compliance frameworks. As institutions expand across products and...

By Fintech Global

News•Feb 16, 2026

A Practical Guide to Completing Identity Verification for Your Clients

In this Accountancy Age episode, the hosts walk listeners through the two‑step Companies House identity verification process that directors and persons with significant control (PSCs) must complete before filing confirmation statements. They explain how ACSPs report verifications, obtain the 11‑character...

By Accountancy Age

News•Feb 16, 2026

EToro Launches Shareholder Engagement Initiative in Partnership with Stockperks

eToro has launched a shareholder engagement initiative in partnership with Stockperks, a loyalty‑rewards marketplace for public companies. The program invites eligible eToro shareholders to receive exclusive educational content, event invitations, and direct access to company leaders and market experts. By...

By The Fintech Times

News•Feb 16, 2026

A Blueprint for the Predictive Firm: Moving Beyond Manual Data Reconciliation

The episode explores how leading accountancy firms are shifting from retrospective reporting to predictive, real‑time visibility by consolidating fragmented tech stacks into unified platforms. It highlights the £300k technology investment benchmark needed to eliminate manual data reconciliation, improve margin protection...

By Accountancy Age

News•Feb 16, 2026

Insurance Broker M&A Stabilizes After Surge

Insurance brokerage M&A activity has settled into a lower‑than‑peak but sustainable level. Total reported transactions fell 12% in 2025 to 691, aligning with a ten‑year average of 686 when the 2021‑22 surge is excluded. Private‑equity‑backed (PE‑hybrid) firms continue to dominate,...

By Business Insurance

News•Feb 16, 2026

Suits Arise as Tariff Questions Raise D&O Risk

Securities class-action lawsuits are emerging as tariff uncertainty under the Trump administration creates new D&O exposure. Although overall federal securities filings fell 10.7% in 2025, four suits specifically cited tariff‑related misstatements, targeting companies such as Dow, CarMax and Tronox. Insurers...

By Business Insurance

News•Feb 16, 2026

BI, Litmus Partner on Composite Insurer Ratings

Business Insurance has partnered with Litmus Analysis to publish a composite rating table for North American commercial‑line insurers. Litmus uses its proprietary Litmus Composite Score (LCS) to blend A.M. Best, Fitch, Moody’s and S&P ratings into a single numerical outcome,...

By Business Insurance

News•Feb 16, 2026

Koxa, Bottomline Announce ERP Embedded Banking Partnership

Koxa and Bottomline have formed a partnership to embed banking services directly within ERP systems, leveraging Koxa’s platform and Bottomline’s Commercial Digital Banking API framework. The joint solution lets banks offer integrated payments, approvals, reconciliation and statement access without building...

By Crowdfund Insider

News•Feb 14, 2026

FFSM: Sensible SMID Strategy, Competitive Returns, Worth Shotlisting

Fidelity Fundamental Small‑Mid Cap ETF (FFSM) is an actively managed, non‑transparent fund that combines quantitative screening with fundamental research. Since its 2024 strategy shift, FFSM has outperformed the S&P 500 and several SMID peers such as IJH and SMMD, driven by...

By Seeking Alpha – ETFs & Funds

News•Feb 14, 2026

Andhra Pradesh Budget 2026-27 Worth ₹3.32 Lakh Crore — What's in for Women, Govt Employees, Health, Agriculture

Andhra Pradesh unveiled its FY 2026‑27 budget at ₹3.32 lakh crore, marking a roughly 8% increase over the previous year. The plan earmarks substantial allocations for women‑focused initiatives, government employee welfare, health infrastructure, and agricultural support. Health spending is set to rise 15%,...

By Mint (India) – Economy

News•Feb 14, 2026

UTF Vs. ASGI: Why A 6% Discount And Rate Cut Cycle Make UTF The Obvious Choice

Cohen & Steers Infrastructure Fund (UTF) received a Buy rating, while abrdn Global Infrastructure Income Fund (ASGI) was placed on Hold due to its premium valuation. UTF trades at a 6 % discount to NAV and carries 29.7 % leverage, positioning it to...

By Seeking Alpha – ETFs & Funds

News•Feb 13, 2026

Edward Shugrue III and the Emerging Playbook Redefining Distressed Office Tower Ownership

Edward L. Shugrue III of RiverPark Funds outlines a new playbook for distressed office towers, highlighting how mezzanine lenders are moving from passive financing to ownership control. He cites the Worldwide Plaza case, where a $1.7 billion asset is now valued around $350 million, illustrating...

By CEOWORLD magazine

News•Feb 13, 2026

Badger Meter Declares Regular Quarterly Dividend and Expands Share Repurchase Authorization

Badger Meter’s board approved a regular quarterly cash dividend of $0.40 per share, payable on March 13, 2026. It also increased its share‑repurchase authorization by $75 million, bringing the total program to $150 million through November 30, 2028. In the first quarter of...

By Business Wire — Executive Appointments

News•Feb 13, 2026

Figures on Automotive Securitization Tapes: Definitions Report - February 2026

The Fixed‑Asset Securitization Tracker (FAST) released its February 2026 Definitions report, detailing the data fields used in automotive securitization tapes. The document supplies precise definitions, code tables, and cross‑references to related transaction disclosures. By standardizing terminology, the report aims to simplify...

By DBRS Morningstar – Research/News

News•Feb 13, 2026

New Rules for M&A Financing, Loans Against Shares

The Reserve Bank of India issued final guidelines allowing banks to fund acquisitions only when the acquirer already controls the target and seeks to increase its stake from 26% to 90%. Borrowers must have at least ₹500 crore net worth, three...

By The Economic Times (India) – Economy

News•Feb 13, 2026

Tariffs, Supplier Fire Continue to Batter Ford

Ford Motor Co. reported a roughly $2 billion tariff hit in 2025, double the amount projected just months earlier, after a miscommunication about the effective date of auto‑part tariff offsets. A fire at Novelis’ Oswego aluminum plant added another $2 billion headwind,...

By Supply Chain Dive

News•Feb 13, 2026

Health Cover to Be Bundled with Pension Schemes, Says PFRDA Chief

India’s PFRDA is piloting pension plans that bundle health insurance, allowing up to 30% of the retirement corpus to be earmarked for medical expenses. ICICI, Axis and Tata‑backed funds are testing the “Swasthya” product, which could leverage pooled investors to...

By The Hindu Business Line – All

News•Feb 13, 2026

SpaceX Said to Weigh Dual-Class IPO Shares to Empower Musk

SpaceX is weighing a dual‑class share structure for its anticipated 2026 IPO, echoing a model Elon Musk previously floated for Tesla. The two‑tier system would grant a select class of shares superior voting rights, enabling insiders to steer the company...

By Bloomberg – Markets

News•Feb 13, 2026

Lawmakers Seek to Penalize DoD if It Fails to Pass a Clean Audit

Lawmakers introduced the RECEIPTS Act, which would penalize the Department of Defense by transferring its Defense Finance and Accounting Service functions if a clean full audit is not achieved by December 2028, while rewarding success with up to $10 billion in...

By Federal News Network

News•Feb 13, 2026

Operations, Tech and Talent Leadership Moves Across the Market

A wave of senior appointments swept the aerospace, defense and technology services sector this week, with AAR Corp. naming former Boeing and Deutsche Bank veteran Dylan Wolin as CFO and BAE Systems hiring ex‑Collins Aerospace chief digital officer Mona Bates...

By Washington Technology

News•Feb 13, 2026

Analyst Report: Altria Group Inc.

Altria Group, a legacy tobacco conglomerate, is confronting a shrinking base of smokers, which is pressuring its traditional cigarette revenues. The company’s core brands include Philip Morris USA and John Middleton cigars, while its smoke‑free portfolio features NJOY, U.S. Smokeless Tobacco and...

By Yahoo Finance – News Index

News•Feb 13, 2026

Biopharma Money Raised: Jan. 1-Feb. 12, 2026

BioWorld’s latest brief highlights three emerging biotech advances. Researchers pinpointed the SCAN network as a central circuit disrupted in Parkinson’s disease, offering a new therapeutic target. Astellas presented promising preclinical data on ASP-2246, an mRNA‑encoded NeuroD1 candidate aimed at neural...

By BioWorld (Citeline) – Featured Feeds

News•Feb 13, 2026

Humana Approaches $1B Acquisition of Florida Primary Care Company: Bloomberg

Humana is negotiating a roughly $1 billion purchase of Florida‑based MaxHealth, a primary‑care network focused on adults and seniors. MaxHealth is owned by Arsenal Capital Partners’ Best Value Healthcare, and the deal would deepen Humana’s primary‑care footprint after recent growth in...

By Becker’s Hospital Review

News•Feb 13, 2026

McLeod Russel Reports Narrowing of Q3 Net Loss at ₹36.41 Crore, Revenue Rises 20%

McLeod Russel narrowed its Q3 consolidated net loss to ₹36.41 crore, down from ₹87.33 crore a year earlier, while revenue from operations climbed 20% to ₹445.45 crore. The company acknowledged continued financial stress, citing outstanding inter‑corporate deposits and ongoing legal actions. Lenders have...

By The Hindu BusinessLine – Companies

News•Feb 13, 2026

BSE Gets Sebi Nod to Launch 'Focused Midcap Index' Futures and Options Contracts

The Bombay Stock Exchange (BSE) has secured SEBI approval to roll out cash‑settled futures and options on its new Focused Midcap Index, which tracks the top 20 mid‑cap companies by free‑float market capitalisation. The contracts will be monthly, expiring on...

By The Economic Times – Markets

News•Feb 13, 2026

CFOs On the Move: Week Ending Feb. 13

A wave of CFO appointments and departures unfolded this week, spanning automakers, retail, crypto, and fintech. General Motors hired Lucid veteran Claudia Gast to steer strategy and technology partnerships, while Warby Parker tapped former Macy’s CFO Adrian Mitchell. Kraken dismissed...

By CFO.com

News•Feb 13, 2026

How Match Group’s CFO Runs the Finance Function Behind Modern Dating

Match Group CFO Steve Bailey, marking his first year in the role, has tightened capital discipline across a portfolio that includes Tinder, Hinge and dozens of international brands. He introduced the PRISM framework to standardize ROI measurement for a $600 million marketing...

By CFO.com

News•Feb 13, 2026

Market Regulator Sebi Floats Proposal to Revamp ETF Price Band Framework

The Securities and Exchange Board of India (SEBI) has issued a consultation paper proposing a overhaul of ETF price‑band rules. It recommends moving the base‑price reference from T‑2 closing NAV to T‑1 data or recent indicative NAV, and introducing dynamic,...

By Business Standard – Markets

News•Feb 13, 2026

Bhatia Communications Sets Record Date for Third Interim Dividend Payable in FY26

Bhatia Communications & Retail announced February 20 as the record date for its third interim dividend for FY 2025‑26, offering Rs 0.01 per equity share. The dividend is payable to shareholders holding shares before that date. The announcement follows a December‑quarter earnings beat,...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

Morgan Stanley Said to Consider $500 Million India Fund, Shifts some Assets

Morgan Stanley Investment Management is exploring a $500 million continuation fund focused on India, intending to transfer eight healthcare‑related assets, including Omega Hospitals and RG Scientific, into the new vehicle. The move signals the firm’s effort to provide existing investors an...

By The Economic Times – Markets

News•Feb 13, 2026

Wipro, Infosys, TCS and 9 Other Stocks Hit 52-Week Lows and Slip up to 20% in a Month

A wave of weakness hit India’s blue‑chip segment as the Sensex slumped nearly 1,048 points, pushing nine BSE 200 stocks to fresh 52‑week lows. Leading IT giants Wipro, L&T Technology Services, TCS and Infosys each fell between 14% and 19% over...

By The Economic Times – Markets

News•Feb 13, 2026

EIL Q3 Profit Soars over 3x YoY to Rs 302 Crore

Engineers India Ltd (EIL) posted a net profit of Rs 302 crore for Q3 FY2025‑26, more than three times its profit a year earlier. The surge was driven by a dramatic rise in turnkey contract earnings, which jumped to Rs 273.68 crore from Rs 18.92 crore,...

By The Economic Times – Markets

News•Feb 13, 2026

Sebi Eases Reporting Norms for Brokers, Extends Exemptions to Primary Dealers

The Securities and Exchange Board of India (SEBI) released a consultation paper proposing to relax the naming, tagging and reporting requirements for bank and demat accounts held by stockbrokers. The draft aligns primary dealers with the exemptions already granted to...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

PNGS Reva Diamond IPO to Hit Dalal Street Soon: Check 5 Key Risks Ahead of the Offer Launch

The PNGS Reva Diamond Limited is set to launch a fresh‑share IPO on Dalal Street valued at roughly ₹380 crore. The issue comprises 0.98 crore new shares priced between ₹367 and ₹386 each, with the bidding period running from February 24 to February 26,...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

Coinbase Swings to Surprise Loss Amid Crypto Exodus, but Says Traders Are Buying the Dip

Coinbase reported a surprise fourth‑quarter loss as crypto trading volumes continued to shrink, marking the first quarterly deficit in years. Despite the loss, the stock steadied and rose modestly in after‑hours trading, bouncing off a two‑year low. Management used the...

By MarketWatch – Top Stories

News•Feb 13, 2026

Kwality Wall's Listing Date Announced as HUL Gets Trading Approval for Demerged Entity

Hindustan Unilever Ltd received BSE and NSE approvals to list its de‑merged ice‑cream arm, Kwality Wall’s, on February 16, issuing 2.34 billion shares. The spin‑off creates India’s first pure‑play listed ice‑cream company, with a one‑for‑one share allocation to HUL shareholders as of...

By The Economic Times – Markets

News•Feb 13, 2026

US Dollar Credit Supply: Primary Market Shows Strong Start to 2026

US dollar primary market began 2026 with robust corporate issuance, totaling $56 bn in January, driven largely by technology, media and telecom (TMT) firms contributing $24 bn. Banks led the financial sector, printing $134 bn of senior non‑preferred bonds, a $20 bn year‑to‑date increase...

By ING — THINK Economics

News•Feb 13, 2026

Done Deal: UMG’s Downtown Acquisition Approved by EU Competition Regulator

The European Commission approved Universal Music Group’s $775 million acquisition of Downtown Music Holdings, conditional on divesting the Curve royalty‑accounting business. The decision ends a year‑long antitrust review and clears the way for UMG to integrate Downtown’s distribution and publishing services,...

By Music Business Worldwide (MBW)

News•Feb 13, 2026

Ola Electric Q3 Results: Loss Narrows YoY to Rs 487 Crore; Revenue Falls 55%

Ola Electric reported a narrower Q3 FY26 loss of Rs 487 crore versus Rs 564 crore a year earlier. Revenue from operations plunged 55% year‑on‑year to Rs 470 crore, driven by a steep decline in automotive sales. Unit deliveries fell to about 32,680, down from 84,029,...

By The Economic Times – Markets

News•Feb 13, 2026

Rates Spark: Dutch Pension Funds May Prepare Early for 2027 Transitions

Almost €1 trillion of Dutch pension assets are slated to transition by 2027, but early hedge rebalancing has already begun. Smaller funds moved interest‑rate hedges in December 2025, while larger players like PMT and PFZW are timing their flows for the first...

By ING — THINK Economics

News•Feb 12, 2026

Tax Fraud Blotter: Pandemic Pandemonium

Recent federal cases reveal a wave of tax fraud spanning the pandemic era, from a Florida tax preparer who filed 458 false returns costing the IRS $12.9 million to a Georgia group that siphoned $1.3 million in COVID‑related credits. A mining business...

By Accounting Today

News•Feb 12, 2026

IRS Gives Guidance on Energy Tax Credits, Prohibited Foreign Entities

The IRS and Treasury issued Notice 2026‑15 to clarify how the One Big Beautiful Bill Act’s new foreign‑entity restrictions apply to clean‑energy tax credits. The notice defines “prohibited foreign entity,” outlines a material‑assistance cost‑ratio calculation, and provides interim safe‑harbor tables for Sections 45Y, 48E and 45X. Taxpayers can...

By Accounting Today