News•Feb 11, 2026

ESMA Publishes Report on Cross-Border Marketing of Funds Including Statistics on Notifications

The European Securities and Markets Authority (ESMA) released its third report on marketing requirements for the cross‑border distribution of funds, adding for the first time detailed statistics on fund notifications. The analysis shows that national marketing rules have remained largely unchanged since the 2023 report. Luxembourg and Ireland dominate the notification landscape, responsible for 59% and 30% of all cross‑border fund marketing filings respectively. UCITS notifications represent 56% of the total, while alternative investment funds (AIFs) account for the remaining 44%.

By ESMA – Press

News•Feb 11, 2026

ESAs Publish Joint Guidelines on ESG Stress Testing

The European Supervisory Authorities (EBA, EIOPA and ESMA) released joint Guidelines on ESG stress testing, offering a unified framework for national banking and insurance supervisors. The document outlines how to embed environmental, social and governance risks into existing stress‑test models...

By ESMA – Press

News•Feb 11, 2026

Principles for Risk-Based Supervision: A Critical Pillar for ESMA’s Simplification and Burden Reduction Efforts

ESMA has published a set of Principles for Risk‑Based Supervision to create a unified supervisory culture across the EU. The framework outlines how regulators should identify, assess, prioritize and address risks to investor protection, financial stability and market order. By...

By ESMA – Press

News•Feb 11, 2026

ESMA’s Digital and Data Strategies Support Supervision of EU Financial Markets

The European Securities and Markets Authority (ESMA) has launched a new Digital Strategy for 2026‑2028 and refreshed its Data Strategy covering 2023‑2028. Both roadmaps aim to accelerate digital transformation, simplify supervisory reporting and harness data‑driven insights across the European System...

By ESMA – Press

News•Feb 11, 2026

ESMA Promotes Clarity in Communications on ESG Strategies

On 14 January 2026, the European Securities and Markets Authority (ESMA) issued its second thematic note addressing sustainability‑related claims, specifically ESG integration and ESG exclusions. The guidance highlights the varied interpretations of these terms and warns that ambiguous usage can...

By ESMA – Press

News•Feb 11, 2026

The European Supervisory Authorities and UK Financial Regulators Sign Memorandum of Understanding on Oversight of Critical ICT Third-Party Service Providers...

The European Supervisory Authorities (EBA, EIOPA and ESMA) have signed a Memorandum of Understanding with the Bank of England, the Prudential Regulation Authority and the Financial Conduct Authority to coordinate oversight of critical ICT third‑party service providers under the Digital...

By ESMA – Press

News•Feb 11, 2026

ESMA Signs Memorandum of Understanding with the Reserve Bank of India

ESMA has signed a memorandum of understanding with the Reserve Bank of India to cooperate on the recognition of Indian central counterparties. The MoU satisfies the Article 25 requirement of the European Market Infrastructure Regulation, allowing the Clearing Corporation of India...

By ESMA – Press

News•Feb 11, 2026

ESMA Launches Selection Process for Its Next Chair

The European Securities and Markets Authority (ESMA) has opened the selection process for its next Chair, a full‑time, independent role based in Paris. The Chair will preside over the Board of Supervisors and Management Board, steering ESMA’s strategic direction amid...

By ESMA – Press

News•Feb 11, 2026

Join Us for ESMA’s Conference “A New Era for EU Capital Markets” On 21 May 2026

The European Securities and Markets Authority (ESMA) will host a high‑level conference titled “A new era for EU capital markets” on 21 May 2026 in Paris, marking its 15‑year anniversary. The event gathers senior policymakers, regulators, market‑infrastructure leaders and investors...

By ESMA – Press

News•Feb 11, 2026

Gilead Dips as ‘Strong’ Earnings Outweighed by High Expectations for New HIV Drug

Gilead Sciences reported a strong fourth‑quarter, with product sales reaching $7.9 billion, a 5% year‑over‑year increase, and its flagship HIV treatments Biktarvy and Descovy surpassing analyst forecasts. The company projected full‑year sales of $29.6‑$30 billion and EPS of $8.45‑$8.85, staying within consensus...

By BioPharma Dive

News•Feb 11, 2026

Goldman Sachs Ramps up India Push as Investment Banking Bets Pay Off

Goldman Sachs has accelerated its India strategy, injecting roughly $500 million into its local franchise over the past three years. The push has lifted the firm to fourth place in equity offerings and fifth in M&A league tables, overtaking long‑time rivals...

By The Hindu BusinessLine – Markets

News•Feb 11, 2026

XOMA Royalty: Preferreds Still Offer Compelling Income Despite Call Risk

XOMA Royalty Corporation’s 8.375% cumulative preferred (XOMAO) trades at an attractive 8.3% yield, positioning it as a high‑income vehicle. The company added 24 royalty‑related assets in 2025, expanding its cash‑flow base from biotech milestones and licensing fees. Management highlights the...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Bristow Group: Strong Long-Term Setup, Near-Term Execution Still Key

Bristow Group (VTOL) is positioned for medium‑term growth, capitalising on robust offshore energy demand in Brazil, Africa and the Caribbean. Recent debt refinancing and stronger free‑cash flow have shored up its balance sheet, enabling planned share buybacks and a 2026...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Dow Hits Record as Retail Sales Stall | Closing Bell

The Dow Jones Industrial Average closed at a fresh all‑time high, buoyed by strong earnings from industrial and financial stocks. At the same time, the latest retail sales data showed flat growth, indicating a pause in consumer spending. Despite the...

By Yahoo Finance – Finance News

News•Feb 11, 2026

Job Dislocation—Managing the Financial Impact of Unexpected Job Loss

The article outlines the fundamentals of retirement accounts, covering employer‑sponsored plans like 401(k)s, 403(b)s, and government TSPs, as well as individual IRAs. It highlights key features such as tax advantages, contribution limits, catch‑up contributions, and employer matching, while noting new...

By FINRA – News Releases

News•Feb 11, 2026

Know Before You Share: Be Mindful of Data Aggregation Risks

Financial data aggregators consolidate accounts into a single dashboard, using either APIs or screen‑scraping to retrieve information. While APIs provide scoped, credential‑free access, many providers still rely on screen‑scraping, which requires users to share login details. The article highlights privacy,...

By FINRA – News Releases

News•Feb 11, 2026

Advance-Fee Frauds Keep Dropping the FINRA Name—Don’t Fall for “Regulator” Imposter Ploys

Fraudsters are increasingly impersonating FINRA and its executives, using authentic‑looking logos, signatures, and fake email domains to lure victims into advance‑fee scams. The scams typically demand payment for alleged regulatory or tax charges tied to worthless securities or nonexistent inheritances,...

By FINRA – News Releases

News•Feb 11, 2026

Initial Coin Offerings (ICOs)—What to Know Now and Time-Tested Tips for Investors

Initial Coin Offerings (ICOs) and related crypto asset sales remain popular but are largely unregulated, often bypassing the disclosure standards required for securities. The guide outlines the spectrum of crypto assets—from native coins and ERC‑20 tokens to NFTs, stablecoins, and...

By FINRA – News Releases

News•Feb 11, 2026

Stock Up on Information Before Buying Stock

Investors face over 20,000 ticker symbols, making accidental purchases a real risk. Confusing symbols—like Zoom Technologies (ZOOM), Zoom Video Communications (ZM), and Zoom Telephonics (ZMTP)—illustrate why confirming the intended security is essential. Thorough research via the SEC's EDGAR database helps...

By FINRA – News Releases

News•Feb 11, 2026

It Pays to Pay Attention to Your Brokerage Account Statements

Investors are urged to review brokerage account statements and trade confirmations each month or quarter to verify accuracy. Unaddressed errors can be presumed authorized, jeopardizing SIPC protection and exposing investors to unauthorized activity. The article outlines when to contact brokers,...

By FINRA – News Releases

News•Feb 11, 2026

Following the Crowd: Investing and Social Media

Investors, especially those under 35, are turning to social media for investment ideas, with 60% of young investors citing it as an information source. The article presents five practical tips—evaluate sources, keep emotions out of decisions, understand day‑trader, margin and...

By FINRA – News Releases

News•Feb 10, 2026

Moderna Says FDA Refuses to Review Its Application for Experimental Flu Shot

Moderna announced that the FDA will not begin a review of its experimental mRNA‑1010 flu vaccine, citing concerns over the trial's comparator design rather than safety or efficacy. The decision triggered a roughly 7% drop in Moderna’s after‑hours share price....

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Ford Reports Worst Quarterly Earnings Miss in Four Years, Guides for Better 2026

Ford is expected to post its worst quarterly earnings miss in four years, with adjusted EPS forecast at 19 cents and automotive revenue projected at $41.8 billion, a 6.8% decline YoY. The earnings drop represents more than a 50% fall in...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

FCA Seeks Views on How to Help Close the Protection Gap

The UK Financial Conduct Authority (FCA) has released interim findings from its competition review of pure protection insurance, highlighting that while the market functions well for existing policyholders, 58% of adults remain uninsured. The review notes stable premiums, a wide...

By UK FCA – News

News•Feb 10, 2026

OFSI and Partners Clamp Down on the Abuse of Cryptoassets

UK’s Office of Financial Sanctions Implementation (OFSI) announced a coordinated crackdown on the misuse of cryptoassets for money‑laundering and sanctions evasion, working alongside law‑enforcement agencies and regulatory partners. The initiative includes heightened monitoring, enforcement actions, and the release of updated...

By UK FCA – News

News•Feb 10, 2026

Next Steps for Establishing a Bond Consolidated Tape Provider

The FCA has signed a contract with Etrading Software (ETS) to build a UK bond consolidated tape, aiming to deliver a high‑quality data stream for investors. The tape will improve price discovery, liquidity, and market transparency, supporting the UK’s competitive...

By UK FCA – News

News•Feb 10, 2026

Emil the Seal Hijacks Waterloo Station to Warn Commuters About Investment Scams

The FCA staged a pop‑up ATM at London Waterloo featuring its mascot Emil the Seal to promote its new Firm Checker tool. The stunt highlighted that around 700,000 adults lost money to investment scams in the past year. The interactive...

By UK FCA – News

News•Feb 10, 2026

AI Live Testing: How It Can Support Safe and Responsible AI Deployment

The UK Financial Conduct Authority (FCA) has opened a second application window for its AI Live Testing programme, inviting firms to trial AI‑driven services in real‑world market conditions with regulatory oversight and technical support from Advai. The initiative targets companies...

By UK FCA – News

News•Feb 10, 2026

The FCA’s Long Term Review Into AI and Retail Financial Services: Designing for the Unknown

Sheldon Mills announced that the FCA is undertaking a long‑term review of artificial intelligence in retail financial services, with findings to be presented to the board this summer. The review will explore how generative AI, multimodal models and autonomous agents...

By UK FCA – News

News•Feb 10, 2026

Falling Cost of Premium Finance Saving Consumers Around £157m a Year

UK insurers have reduced the cost of premium finance, saving consumers about £157 million a year. Interest rates on financed insurance dropped an average 4.1 percentage points since 2022, cutting typical motor policy costs by £8 and home policies by £3...

By UK FCA – News

News•Feb 10, 2026

Regulators Announce First Firms to Join Scale-Up Unit

The Prudential Regulation Authority and Financial Conduct Authority have unveiled the first cohort of their joint Scale‑up Unit, targeting fast‑growing financial firms. Six institutions – Allica Bank, ClearBank, Monument Bank, Nottingham Building Society, OakNorth Bank and Zopa Bank – will...

By UK FCA – News

News•Feb 10, 2026

Upper Tribunal Finds that Banque Havilland Devised a Plan to Harm the Qatari Economy

The Upper Tribunal upheld the FCA’s ruling that Rangecourt S.A., formerly Banque Havilland, and former executives Edmund Rowland and Vladimir Bolelyy acted without integrity by devising a scheme to devalue the Qatari riyal. The Tribunal confirmed fines of £4 million for...

By UK FCA – News

News•Feb 10, 2026

FCA and SRA Joint Message to Professional Representatives on Motor Finance Commission Claims: Dealing with Multiple Representation and Excessive Termination...

The FCA and SRA have jointly warned claims‑management firms and law firms handling motor‑finance redress that clients must not be represented by multiple agents on the same claim and should not face excessive termination fees. They cite cases where up...

By UK FCA – News

News•Feb 10, 2026

FCA and SRA Issue Joint Warning to Firms Representing Motor Finance Commission Claims

The Financial Conduct Authority and the Solicitors Regulation Authority have issued a joint warning to claims‑management companies and law firms handling motor‑finance commission claims, demanding verification that consumers are not already represented and prohibiting excessive termination fees. Any exit charge...

By UK FCA – News

News•Feb 10, 2026

FCA Stops Advantage Wealth Management Ltd From Carrying Out Regulated Activities and Imposes Assets Restriction

The Financial Conduct Authority has placed Advantage Wealth Management Ltd (AWM) under strict restrictions, requiring written FCA consent before any asset disposal or regulated activity. The regulator cited concerns over how customers' investments were shifted into cash, inadequate financial resources,...

By UK FCA – News

News•Feb 10, 2026

Gemini Payments UK Ltd and Gemini Intergalactic UK Ltd Exit the UK Market

Gemini Payments UK Ltd and Gemini Intergalactic UK Ltd announced a complete market exit, closing all UK customer accounts on 6 April 2026. The e‑money arm will operate normally until 4 March, after which accounts shift to withdrawal‑only mode from 5 March. Crypto‑asset services...

By UK FCA – News

News•Feb 10, 2026

Independent Assessment to Support Establishment of a Future Entity

The Financial Conduct Authority (FCA) has released a letter to trade associations announcing KPMG’s appointment to conduct an independent assessment of proposals for a Future Entity that would set standards for UK open‑banking APIs. The assessment will evaluate governance, technical...

By UK FCA – News

News•Feb 10, 2026

FCA Fines Two Individuals a Combined £108,731 for Insider Dealing

The FCA fined Dipesh Kerai (£52,731) and Bhavesh Hirani (£56,000) for insider dealing in Bidstack Group Plc shares, totalling £108,731 in penalties. Hirani, then interim CFO, leaked confidential details of a major advertising deal to Kerai, who bought 1.3 million shares before the...

By UK FCA – News

News•Feb 10, 2026

HTX (Formerly Huobi): Legal Proceedings Information

The UK Financial Conduct Authority (FCA) initiated legal proceedings on 21 October 2025 against Huobi Global S.A. and several unidentified individuals linked to the HTX cryptocurrency exchange. The case was filed in the Chancery Division of the High Court, and on 4 February 2026...

By UK FCA – News

News•Feb 10, 2026

Lyft Stock Falls 15% on Disappointing Fourth-Quarter Results, Rider Numbers

Lyft reported fourth‑quarter revenue of $1.59 billion, missing the $1.76 billion consensus, and saw active riders and total rides fall short of estimates. The miss triggered a 15% plunge in the stock during extended trading. The board approved an additional $1 billion share‑repurchase...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Fund Manager FINQ Lets AI Run US ETFs

FINQ has introduced two U.S. large‑cap equity ETFs—AIUP and AINT—where an artificial‑intelligence model exclusively selects, weights and rebalances holdings. The AI engine ranks every S&P 500 component daily using market, financial and textual data, guiding long‑only and long‑short exposures respectively. The...

By PYMNTS

News•Feb 10, 2026

Ssense Founders Can Buy Back Company, Court Rules

Montréal‑based luxury e‑commerce platform Ssense will be reclaimed by its founders after a Quebec Superior Court dismissed lenders' request for a forced asset sale. The court approved a founder‑led buyback valued at $78 million, including a $58.5 million cash payment and assumption...

By BetaKit (Canada)

News•Feb 10, 2026

Sharp's Plan to Sell Japan LCD Plant to Parent Foxconn Falls Through

Sharp announced that its plan to sell the Kameyama No. 2 LCD panel plant in Mie Prefecture to parent company Foxconn has collapsed, prompting a shutdown slated for August. The company will cut 1,170 jobs through early‑retirement packages and record a...

By Japan Today – Business

News•Feb 10, 2026

Honda Reports Declining Profit

Honda Motor Co announced a 42% plunge in profit for the nine months through December, falling to 465.4 billion yen from 805.2 billion yen a year earlier. Sales dipped 2.2% to 15.98 trillion yen, yet the company kept its full‑year profit forecast of...

By Japan Today – Business

News•Feb 10, 2026

Estée Lauder Sues Walmart Alleging 'Despicable' Sale of Counterfeit Beauty Products

Estée Lauder has filed a federal lawsuit against Walmart, alleging that the retailer’s online marketplace allowed counterfeit versions of its La Mer, Le Labo, Clinique, Aveda and Tom Ford products to be sold. The beauty giant says it purchased and tested several items that...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Bitcoin Plunge: Bitwise CIO Cites 'the Four-Year Cycle' As No. 1 Reason for Losses

Bitcoin fell below $61,000, its lowest level in about 16 months, prompting Bitwise Asset Management’s CIO Matt Hougan to point to the market’s four‑year cycle as the primary driver of the decline. He noted that investors are also rotating into...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

KPMG Starts Tax AI Accelerator Program

KPMG has launched a Tax AI Accelerator Program to help corporate tax departments adopt generative AI. The initiative provides hands‑on training, a secure Azure OpenAI‑based sandbox called Digital Gateway, and access to KPMG’s “Think, Prompt, Check” framework. More than a...

By CPA Practice Advisor

News•Feb 10, 2026

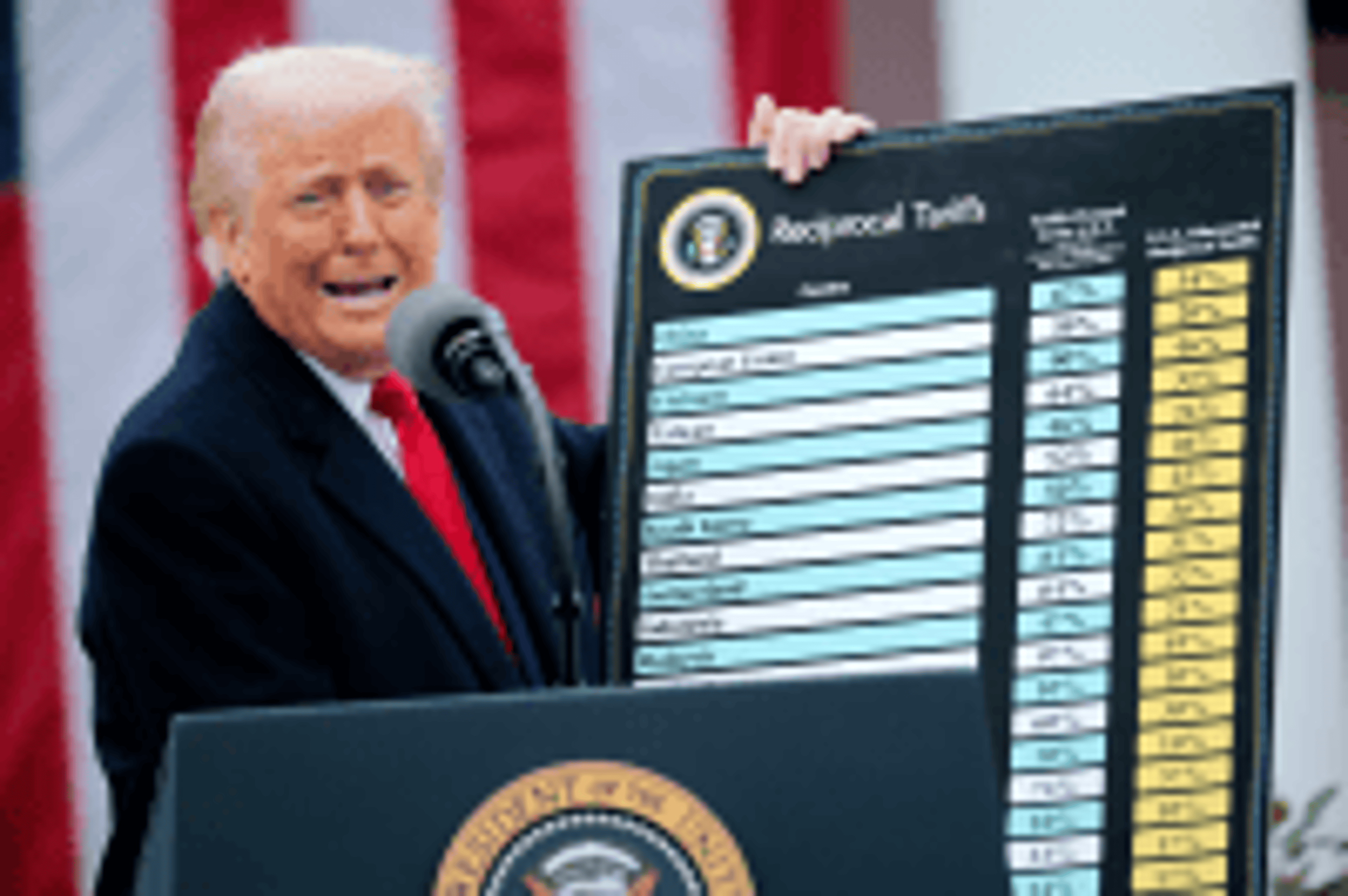

Report Finds Trump’s Tariffs Cost U.S. Households $1,000 on Average in 2025

The Tax Foundation reports that Trump‑era tariffs added an average $1,000 to U.S. household expenses in 2025, rising to $1,300 in 2026. A weighted average tariff rate of 13.5% pushed the effective rate to 9.9%, the highest since 1946. Companies...

By CPA Practice Advisor

News•Feb 10, 2026

Deloitte: Shining a Spotlight on Strategic Internal Audit

Deloitte’s internal audit leader Mike Schor argues that internal audit must shed its "gotcha" image and become a strategic partner to the CFO. He recommends a proactive branding effort that showcases audit capabilities and aligns the function with finance’s broader...

By CFO Dive

News•Feb 10, 2026

MPE Partners Sells MSHS and Pacific Power Group

MPE Partners has completed the sale of MSHS and Pacific Power Group, a combined entity that provides maintenance, repair and overhaul services for power generation, marine propulsion and national security applications. The merged firm, led by President and CEO David...

By PE Hub