News•Feb 10, 2026

Trinity Hunt-Backed Supreme Group Snaps up Healthcare Creative Agency Broth

Supreme Group, a healthcare and life‑sciences marketing platform backed by Trinity Hunt Partners, has acquired New York‑based creative agency Broth. Broth, founded in 2018, serves as the agency of record for several leading pharma and biotech brands. The terms of the transaction were not disclosed. The deal expands Supreme Group’s service offering within the healthcare communications sector.

By PE Hub

News•Feb 10, 2026

19 States Offer Tax Credits for Private School Scholarship Donations

Eighteen states now offer tax credits for donations to scholarship‑granting organizations that fund private‑school tuition, mirroring Ohio's program. Ohio’s credit, introduced in 2021, has cost the state over $80 million in lost revenue and reduced tax collections by $21 million in fiscal 2024...

By CPA Practice Advisor

News•Feb 10, 2026

EPA Will Revoke 'Endangerment Finding' That Underpins All Climate Regulation This Week

The EPA announced plans to rescind the 2009 endangerment finding that declared greenhouse gases a threat to public health, a cornerstone of U.S. climate regulation. The move, submitted to the Office of Management and Budget, represents the Trump administration’s most...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Who Wrangled the Best Trade Deal From Donald Trump?

President Donald Trump recently secured trade agreements with Argentina and India, offering limited tariff reductions to facilitate U.S. exports. Both deals faced immediate domestic backlash: Indian farmer unions called the pact a “total surrender” and French officials described the EU‑U.S....

By The Economist – Finance & Economics

News•Feb 10, 2026

Sen. Bernie Sanders to Kick Off California Billionaire Tax Campaign

Senator Bernie Sanders will launch a campaign to place a one‑time 5% billionaire tax on California’s November ballot. The measure seeks to raise funds to offset federal healthcare cuts, protecting over 3 million working‑class residents. Supporters must collect roughly 875,000 signatures...

By CPA Practice Advisor

News•Feb 10, 2026

StanChart CFO Abruptly Exits for Apollo

Standard Chartered announced that group CFO Diego De Giorgi is leaving immediately to join Apollo Global Management as a partner and head of EMEA. Peter Burrill, the bank's group head of central finance, will serve as interim CFO while a permanent replacement is...

By CFO Dive

News•Feb 10, 2026

Washington’s Millionaires Tax Advances in State Senate with Some Changes

Washington Senate Ways and Means Committee approved a revised millionaire’s tax bill, preserving a 9.9% levy on earnings above $1 million starting in 2028. The measure is projected to generate roughly $3.5 billion annually from about 30,000 high‑income taxpayers. Amendments include expanding...

By CPA Practice Advisor

News•Feb 10, 2026

Blue & Co. Joins Forces with D & Co. In Texas

Blue & Co., a top‑60 accounting firm, announced the acquisition of Texas‑based D & Co., adding more than 40 healthcare‑focused employees and six directors to its roster. The deal, effective Feb. 1, expands Blue & Co.’s footprint into Lubbock, Dallas, Fort Worth and Waco,...

By CPA Practice Advisor

News•Feb 10, 2026

How Is New Paid Family Leave Law in Minnesota Holding Up?

Minnesota’s paid family and medical leave program launched on Jan. 1 and delivered over $30 million in benefits during its first month, approving 13,700 claims. Early demand was buoyed by a surge of child‑bonding applications, a phenomenon known as the “baby bump.”...

By CPA Practice Advisor

News•Feb 10, 2026

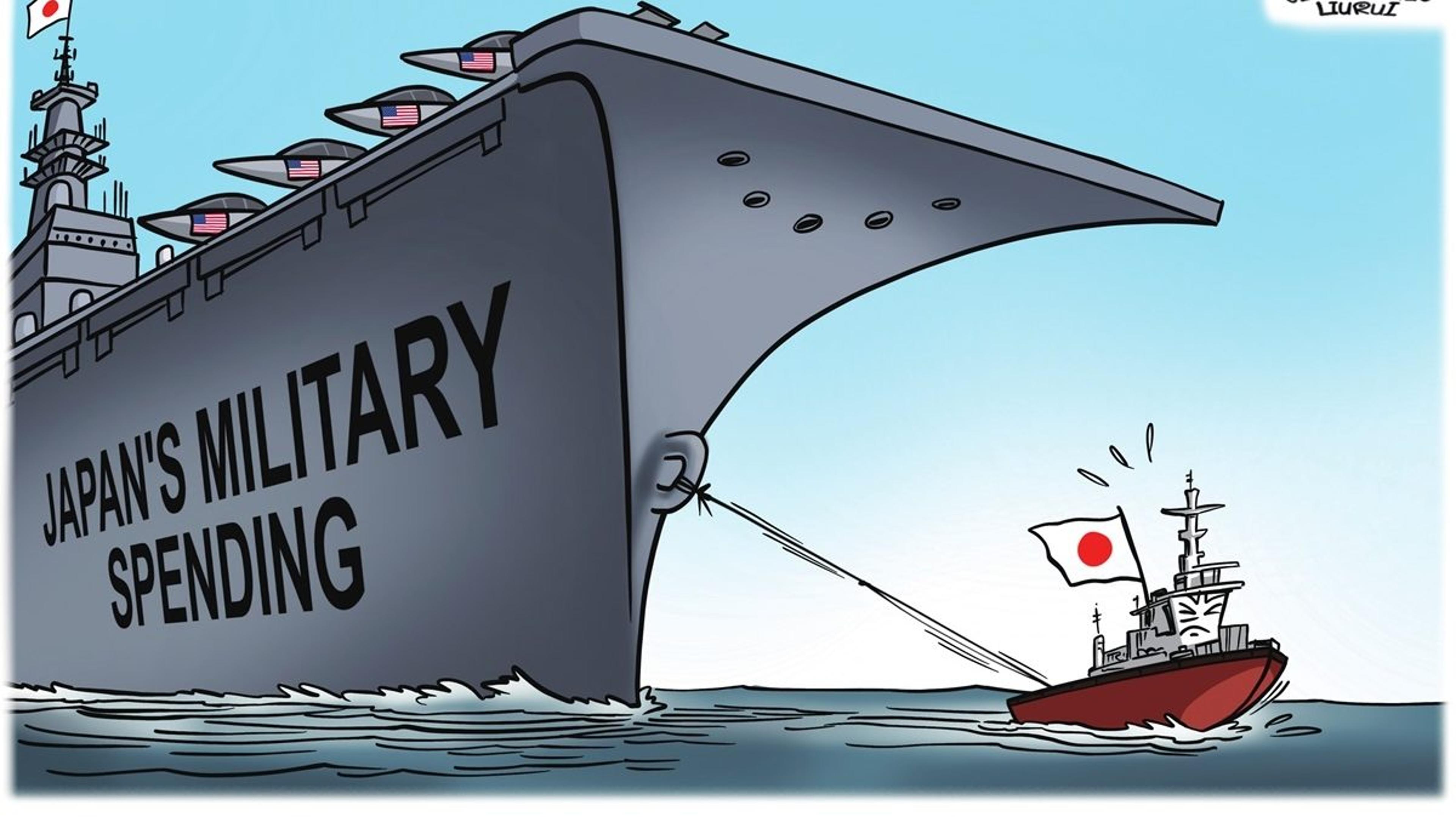

China’s US Treasurys Exit Could Limit Japan’s Military Spending

China is directing state‑owned banks to cut U.S. Treasury holdings to roughly $750 billion by 2025, halving its 2010 peak. The reduction removes a major buyer from the market, shifting the financing burden toward Japan, the world’s largest foreign‑reserve holder. Japan’s...

By Asia Times – Defense

News•Feb 10, 2026

Leah Partners with PwC UK on Agentic AI

Leah, the creator of Leah Agentic OS, has teamed up with PwC UK to embed its enterprise‑grade, domain‑native agentic AI platform into global business services. The partnership combines PwC's industry and functional expertise with Leah's OS to design, deploy, and...

By CPA Practice Advisor

News•Feb 10, 2026

KPS Capital to Acquire Manufacturer Wells

Private equity firm KPS Capital Partners announced it will acquire The Wells Companies, a Minnesota‑based provider of architectural and structural precast concrete solutions. Wells brings design‑assist, engineering, manufacturing, and on‑site installation capabilities across 13 strategically located U.S. facilities. Dan Juntunen,...

By PE Hub

News•Feb 10, 2026

CFOs to Prioritize Growth Functions, Technology and AI in 2026

CFOs are reshaping 2026 budgets to favor growth‑driving functions, technology and artificial intelligence, according to Gartner’s survey of over 300 finance leaders. More than half plan higher spending on sales and IT, with 28% targeting double‑digit growth, while marketing follows...

By CPA Practice Advisor

News•Feb 10, 2026

Citrin Cooperman Adds Browne Consulting Group in Massachusetts

Citrin Cooperman, a top‑20 accounting firm, announced its first M&A transaction of 2026, acquiring Boston‑based Browne Consulting Group. The deal adds roughly 60 professionals with deep expertise in life‑science and biotech advisory services. Financial terms were not disclosed. The acquisition...

By CPA Practice Advisor

News•Feb 10, 2026

LMI Invests in Ara Partners’ Energy and Infrastructure Investment Platforms

LMI has announced a strategic investment in Ara Partners' energy and infrastructure investment platforms. The partnership will allow both firms to co‑invest and share deal flow across their respective mandates. By aligning with Ara Partners, LMI aims to deepen its...

By PE Hub

News•Feb 10, 2026

Permira Acquires A Majority Stake in TeamViewer

Private equity firm Permira has completed a majority acquisition of Germany‑based enterprise software provider TeamViewer through a public tender offer, while the company remains listed on the Frankfurt Stock Exchange. The deal, finalized in January 2026, gives Permira control to...

By Finance Monthly

News•Feb 10, 2026

Coca-Cola Forecasts Modest Growth Amid Demand Concerns

Coca‑Cola projects 2026 organic revenue growth of 4%‑5% and comparable earnings per share growth of 7%‑8%, despite a modest decline in overall beverage demand. Quarterly results showed adjusted earnings of 58 cents per share and net sales of $11.82 billion, slightly...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

ACCA Future-Proofs Finance Professionals with New Tech-Focused Certificates

The episode explains ACCA's launch of a four‑part Technology in Finance certificate series, aimed at equipping accountants with practical skills in data analytics, cybersecurity, AI, and organisational transformation. It highlights that 50 % of finance leaders worry about skill gaps as...

By Accountancy Age

News•Feb 10, 2026

Disappointing Holiday Season: December Retail Sales Were Flat, Falling Well Short of Estimate

December retail sales were flat month‑over‑month, missing the 0.4% gain economists expected after a 0.6% rise in November. Year‑over‑year sales rose 2.4%, trailing the 2.7% inflation rate, indicating real spending erosion. The slowdown was driven by harsh weather, lingering tariff...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Sources: Crypto Exchange Kraken Has Fired Its CFO, Stephanie Lemmerman, Ahead of Its Long-Awaited IPO; Lemmerman Joined Kraken From Dapper...

Kraken, the New York‑based crypto exchange, has terminated CFO Stephanie Lemmerman just weeks before its long‑awaited initial public offering. Lemmerman, who came from Dapper Labs in November 2024, was responsible for steering the firm’s financial reporting and regulatory compliance. The...

By Techmeme

News•Feb 10, 2026

First Quantum Credit Outlook Improves on Cobre Panama Progress

S&P Global Ratings upgraded First Quantum Minerals' credit outlook to positive, citing tangible progress toward restarting the Cobre Panama copper mine. The agency now expects the mine to resume operations in the first half of 2026, with a production ramp‑up later...

By MINING.com

News•Feb 10, 2026

ZCG-Backed Unimed Picks up Regenboog Shipping Pharmacy

Unimed, backed by private‑equity firm ZCG, has completed the acquisition of Regenboog Shipping Pharmacy, a Dutch distributor of pharmaceuticals and medical devices for the maritime industry. The deal adds a specialized supply‑chain platform to Unimed’s portfolio, giving it direct access...

By PE Hub

News•Feb 10, 2026

TBL Accountants Joins Xeinadin, Strengthening Southend Office and Support for Local Businesses

Xeinadin has bolstered its Southend office by integrating TBL Accountants, adding a team with over 50 years of expertise in accounting, tax, VAT, payroll and business consultancy for owner‑managed firms and charities. The merger expands client access to national tax...

By Accountancy Age

News•Feb 10, 2026

SPS Commerce Embeds Agentic AI Into Supply Chain Execution

Supply chain network SPS Commerce launched MAX, an agentic AI suite embedded in its platform, to automate and coordinate retail trading workflows. MAX offers Chat, Monitor, and Connect capabilities that surface risks, guide resolutions, and interact with external systems via...

By ERP Today

News•Feb 10, 2026

General Atlantic to Acquire Franchise European Wax Center in $330m Take-Private Deal

General Atlantic, which first invested in European Wax Center in 2018, announced a $330 million take‑private transaction to acquire the remaining shares it does not already own. The deal will give General Atlantic 100 percent ownership of the U.S. waxing‑services franchise. Closing...

By PE Hub

News•Feb 10, 2026

Tax Advice Has Become a Deal Risk Discipline — Not a Cost-Saving Exercise

Tax advice has moved from a cost‑saving exercise to a core deal‑risk discipline, with large corporates and private‑equity sponsors demanding certainty over clever tax tricks. Advisors now focus on historic tax positions that can surface during acquisitions, IPOs or refinancings,...

By Finance Monthly

News•Feb 10, 2026

Lightyear Capital Eyes Demand for Mobile Parking; New Catalyst Provides Capital to Ferghana, as Private Markets Firms Continue to Team...

Lightyear Capital announced plans to carve out PayByPhone, the mobile parking platform, from its current owner Corpay. The move reflects growing private‑equity interest in technology‑driven parking solutions as cities seek smarter street‑parking management. At the same time, New Catalyst has...

By PE Hub

News•Feb 10, 2026

CVS Tops Quarterly Estimates, Reaffirms Profit Outlook as Turnaround Plan Takes Effect

CVS Health posted fourth‑quarter earnings that beat expectations, with adjusted EPS $1.09 versus the $0.99 forecast and revenue $105.69 billion versus $103.59 billion expected. The company reaffirmed its 2026 profit guidance of $7‑$7.20 per share and a revenue target of at least...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Jim Cramer Says “You Better Believe NVIDIA (NVDA)’s Getting a Big Cut” Of the AI CapEx By Mega-Cap Tech

Jim Cramer highlighted NVIDIA as the primary beneficiary of the massive AI‑focused capital expenditures announced by mega‑cap technology firms. He noted that while some spend will go to Broadcom and Marvell, the bulk will flow to NVIDIA, helping the stock...

By Yahoo Finance – Finance News

News•Feb 10, 2026

Michael Saylor Downplays Strategy Credit Risk as Bitcoin Tumbles: 'We'll Refinance the Debt'

Strategy Investment, led by Michael Saylor, holds 714,644 bitcoins valued at roughly $49 billion, making it the largest corporate Bitcoin owner. Despite Bitcoin’s recent 15% slide to $60,000, Saylor dismissed credit‑risk concerns, saying the firm will refinance its $8 billion debt and...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Inside the Deal: Eudia’s $105M Series A to Transform Legal Work Through AI-Powered Augmented Intelligence

Eudia, a Palo Alto‑based legal‑tech startup, closed a Series A round of up to $105 million in February 2025, led by General Catalyst and backed by a slate of prominent investors. The funding follows an 18‑month stealth period and comes as the company...

By Finance Monthly

News•Feb 10, 2026

I only Shop for 2, but Buying in Bulk Saves Me Money. Here Are 10 Things I Always Get at...

Longtime Costco shopper Rebecca Kaplan outlines how buying in bulk for a two‑person household slashes grocery costs. She highlights ten staple items—eggs, chicken nuggets, canned tuna, white bread, toilet paper, laundry and dishwasher detergent, drinks, protein pasta, and novelty snacks—along...

By Business Insider – Markets Insider

News•Feb 10, 2026

Graphite One Announces Final Terms of Previously Announced Marketed Equity Offering

Graphite One Inc. announced final terms for a best‑efforts public offering of 17,142,000 units at C$1.75 per unit, targeting C$30 million in gross proceeds. Each unit comprises one common share and a warrant to buy an additional share at C$2.25 for...

By Business Insider – Markets Insider

News•Feb 10, 2026

Car Dealers Worry Prices Are Getting Too High for Shaky Economy

Car dealers warn that rising new‑vehicle prices threaten sales in 2026. Average new‑car price now $50,000, monthly payment $750, loan terms 70 months, while consumer confidence hits an 11‑year low. Dealers plan to increase inventory of cheaper trims and used...

By CPA Practice Advisor

News•Feb 10, 2026

Lone Star Completes $3.8bn Take-Private Acquisition of Industrial Firm Hillenbrand

Private equity firm Lone Star has completed its $3.8 billion take‑private acquisition of Hillenbrand, an Indiana‑based industrial equipment provider. The deal, announced earlier this year, will keep Hillenbrand operating under its existing name with Kim Ryan continuing as president and CEO....

By PE Hub

News•Feb 10, 2026

U.S.-UK Transatlantic Taskforce Hosts Industry Engagement in London

HM Treasury hosted U.S. Treasury officials and regulators in London on 26 January 2026 for senior‑level industry engagement of the Transatlantic Taskforce for Markets of the Future. The dialogue explored ways to tighten capital‑market links and coordinate on digital‑asset policy. The Taskforce,...

By HM Treasury – Atom feed

News•Feb 10, 2026

Corporate Report: Supplementary Estimates 2025-26

HM Treasury released the Supplementary Estimates for the 2025‑26 fiscal year, presented to the House of Commons on 10 February 2026. The documents request parliamentary authority for voted expenditure across all government departments, covering resources, capital projects and cash needs....

By HM Treasury – Atom feed

News•Feb 10, 2026

Sagewind-Backed By Light Acquires Dignitas Technologies

Light, a portfolio company of Sagewind Capital, has acquired Dignitas Technologies, an Orlando‑based provider of modeling, simulation and training solutions. Dignitas specializes in system and software analysis, design, development, testing, and mission rehearsal applications. The financial terms were not disclosed,...

By PE Hub

News•Feb 10, 2026

Michigan Governor Floats ‘Sales Tax Holiday’ for School Supplies, Property Tax Refund for Seniors

Michigan Governor Gretchen Whitmer is set to unveil a budget proposal that includes a sales‑tax holiday on school supplies and a property‑tax refund for seniors. The holiday would suspend the 6% sales tax on clothing, classroom items and computers, while...

By CPA Practice Advisor

News•Feb 10, 2026

How Affordability Led to a Chasm Between Stock Prices, Consumer Optimism

U.S. stock indices have surged while consumer sentiment has plunged to near‑record lows since 2022, breaking a 25‑year correlation between market performance and household confidence. Economists attribute the split to worsening affordability, with consumer prices up 26% since 2019 and...

By CNBC – US Top News & Analysis

News•Feb 10, 2026

Oregon Democrats’ Bill to Add $300M to State’s Budget by Ending 3 Trump Tax Breaks Advances

Oregon Democrats moved Senate Bill 5107 forward, aiming to raise more than $300 million for the state’s 2025‑27 budget by repealing several Trump‑era tax breaks and adding new credits. The bill eliminates the accelerated depreciation deduction, costing corporations an estimated $267 million...

By CPA Practice Advisor

News•Feb 10, 2026

Sign Up for DealBook

The New York Times is promoting its DealBook newsletter, a daily briefing that aggregates the most critical business and policy news. Curated by veteran journalist Andrew Ross Sorkin and his team, the email delivers concise analysis of market moves, major...

By The New York Times – DealBook

News•Feb 10, 2026

TSMC Approves US$44.96 Billion Budget Amid AI Boom

Taiwan Semiconductor Manufacturing Co (TSMC) approved a US$44.96 billion capital budget to expand advanced, mature and specialty technology capacity, upgrade packaging, and build new fabs. The plan includes upgrading its Kumamoto plant to 3‑nanometer production to meet surging AI demand. The...

By Focus Taiwan (CNA) – English News

News•Feb 10, 2026

Liquidity as a Real-Time Operating System: Kyriba on the Future of Treasury

Treasury leaders are shifting from isolated point solutions to a single, real‑time operating system that unifies cash, debt, investments and risk across dozens of banks and multiple ERP platforms. Kyriba’s Tom Callway argues that the missing piece is a connectivity...

By ERP Today

News•Feb 10, 2026

Circit Secures $22 Million Growth Equity Funding for Audit Technology

Circit announced a $22 million growth equity round led by Ten Coves Capital to scale its audit‑confirmation platform. The funding backs a network already adopted by over 400 audit firms—including all Top 20 global networks—and connects more than 30,000 banks, funds and...

By CPA Practice Advisor

News•Feb 10, 2026

Irena Radović: Speech - Regional Conference "AML/CFT and Anti-Fraud Procedures for Instant Payments"

Governor Irena Radović opened a regional conference in Podgorica, highlighting the Western Balkans’ push toward instant payments and deeper SEPA integration. She noted that more than forty central banks are collaborating to prepare for the July 2026 launch of Montenegro’s TIPS Clone...

By Bank for International Settlements (BIS) – Press releases

News•Feb 10, 2026

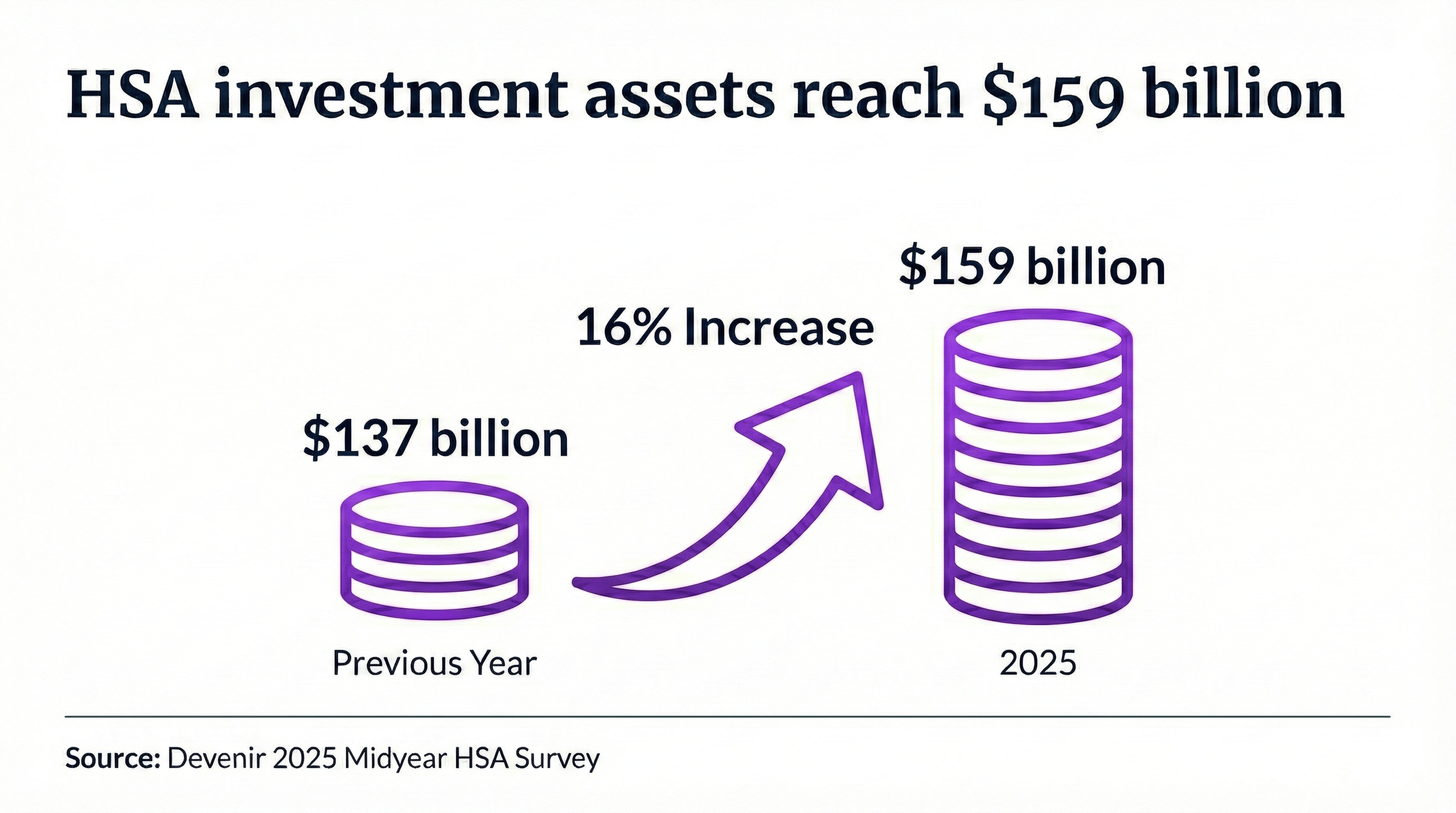

Health Savings Accounts Gain Popularity as Investment Vehicles

Health savings accounts (HSAs) are increasingly being used as investment vehicles, with 4 million accounts – about 10% of all HSAs – holding invested assets, a 23% year‑over‑year rise. Total HSA assets grew 16% to $159 billion, and investment‑linked assets now represent...

By Employee Benefit News

News•Feb 10, 2026

Zanaga Iron Lines up $25M in Deal with Red Arc

Zanaga Iron (LON:ZIOC) signed a binding term sheet with Red Arc Minerals for an initial up‑to‑$25 million cash tranche to finance engineering and pre‑production work on its Congolese iron‑ore project. The agreement gives Red Arc a 20% stake in the project’s subsidiary Jumelles,...

By MINING.com

News•Feb 10, 2026

Leverage Trading in Cryptocurrency: How It Works, Risks, and Where Indians Can Trade Safely

Leverage trading has moved from niche desks to mainstream Indian crypto investors in 2026, driven by clearer regulatory guidance and FIU‑IND compliant platforms. By borrowing funds, traders can control positions many times larger than their capital, magnifying both profit potential...

By Finance Monthly

News•Feb 10, 2026

Why Law Firms Are Increasingly Investing in Managed IT Support

Law firms are turning to managed IT support to counter escalating cyber threats, meet strict compliance mandates, and sustain uninterrupted client service. Subscription‑based models replace ad‑hoc repairs, delivering predictable budgeting and scalable resources. Proactive monitoring curtails downtime, while secure remote‑work...

By Finance Monthly