Social•Feb 20, 2026

Accounting Rules Reveal Shutdown’s Massive Real GDP Loss

A fun(?) 🧵 on how nerdy government accounting rules had a big impact on Q4 GDP. And how they reflect how wasteful the 43-day government shutdown was. TL;DR: Small reduction in nominal federal spending in Q4. But a big decline in what we got for our dollars. So real down a lot.

By Jason Furman

Social•Feb 20, 2026

Cooling Volatility Triggers Machine Re‑Leverage, Expect Upward Grind

Volatility is cooling. 30D realized volatility (yellow line) just rolled over and is now below 90D (blue line). When short-term vol drops, the machines re-lever. Vol control funds start buying. Right now, the signal says grind higher until proven otherwise.

By Kurt S. Altrichter

Social•Feb 20, 2026

Most Weekly BDC Discounts Are Mispriced—Learn Why

Everyone has a BDC take this week. Most of them are wrong. If you don't understand how they trade, what drives the discount, or why NAV isn't what you think it is, start here. https://www.junkbondinvestor.com/p/the-bdc-primer-part-1

By JunkBondInvestor

Social•Feb 20, 2026

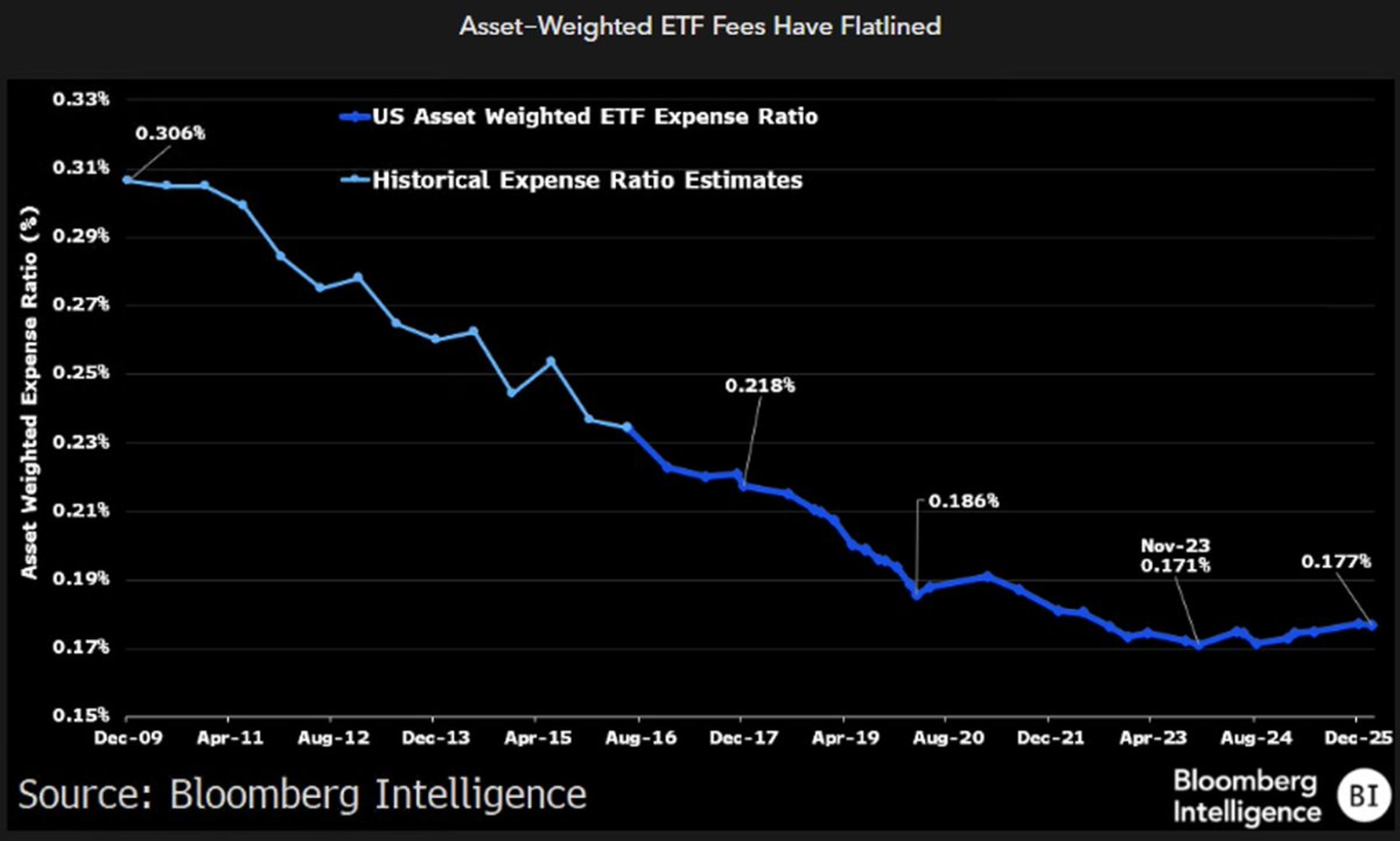

ETF Fees Halt Decline as Higher‑cost Products Gain Traction

The race to zero has hit a wall as the asset weighted average ETF fee has finally stopped its descent and even reversed a bit (this chart is one of the scariest, albeit slow moving ones for Wall St, equiv...

By Eric Balchunas

Social•Feb 19, 2026

Buybacks Drop as Capex Takes Priority, ESO Dilution Fades

There are two reasons why buybacks are falling and likely to fall more 1. CApex as a use of FCF is deemed more important than share count reduction or SBC dilution offset 2. To the extent stocks fade the ESO awards provided...

By Andy Constan

Social•Feb 19, 2026

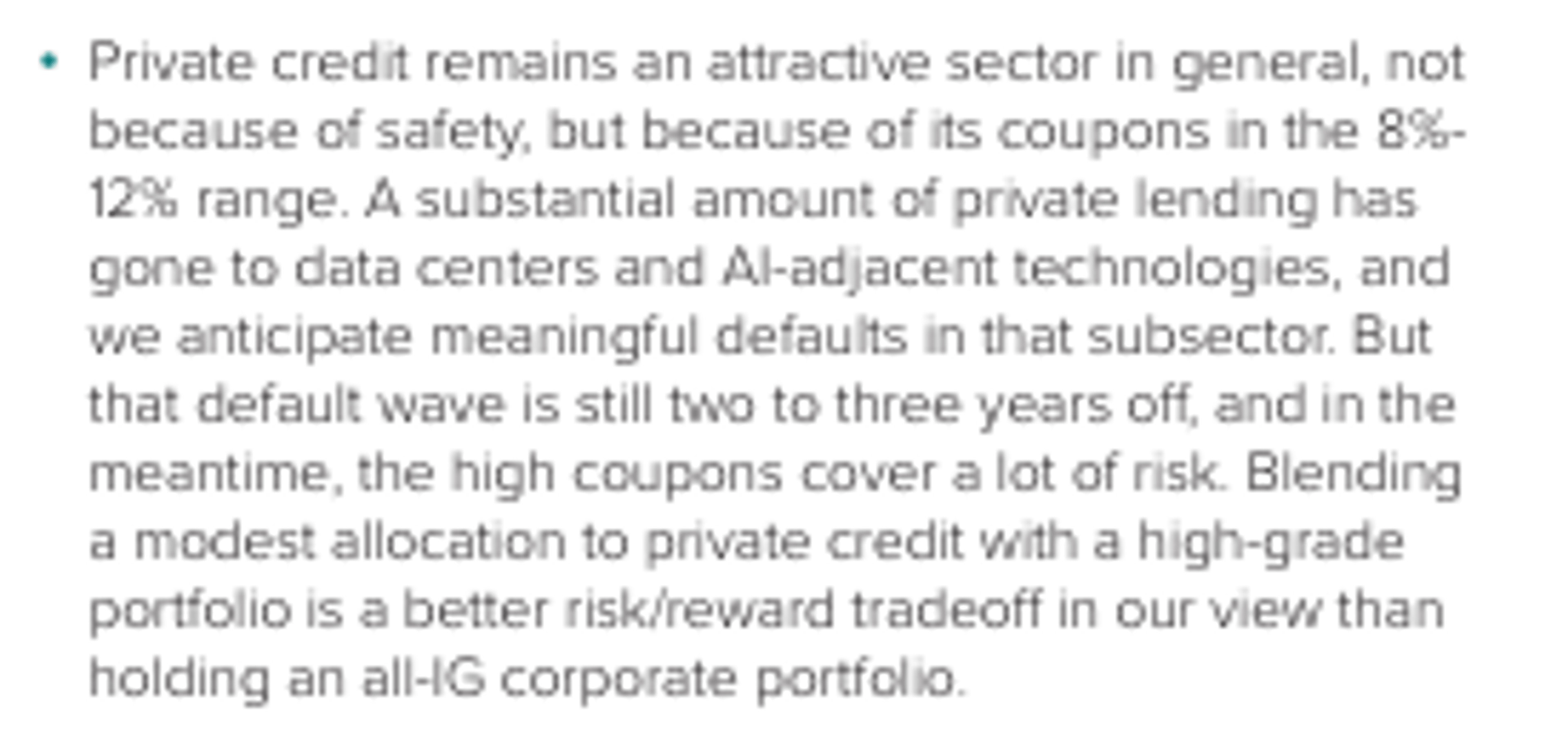

Discussing 2026 Credit Outlook, Including Private Credit

I will be joining @CNBC's @michaelsantoli this afternoon at 430p ET for a discussion of the credit markets--including, yes, private credit. Snip from our Outlook 2026. https://t.co/u8NP4oAYoL https://t.co/umYLiLDzTY

By Guy LeBas

Social•Feb 19, 2026

Bipartisan Push for 3% GDP Deficit Cap Gains Momentum

I Love and Endorse the Bipartisan 3 % of GDP Budget Deficit Solution In the House of Representatives there is now a bipartisan bill in the works to enact, and a growing agreement that we need, a 3% cap on the budget...

By Ray Dalio

Social•Feb 19, 2026

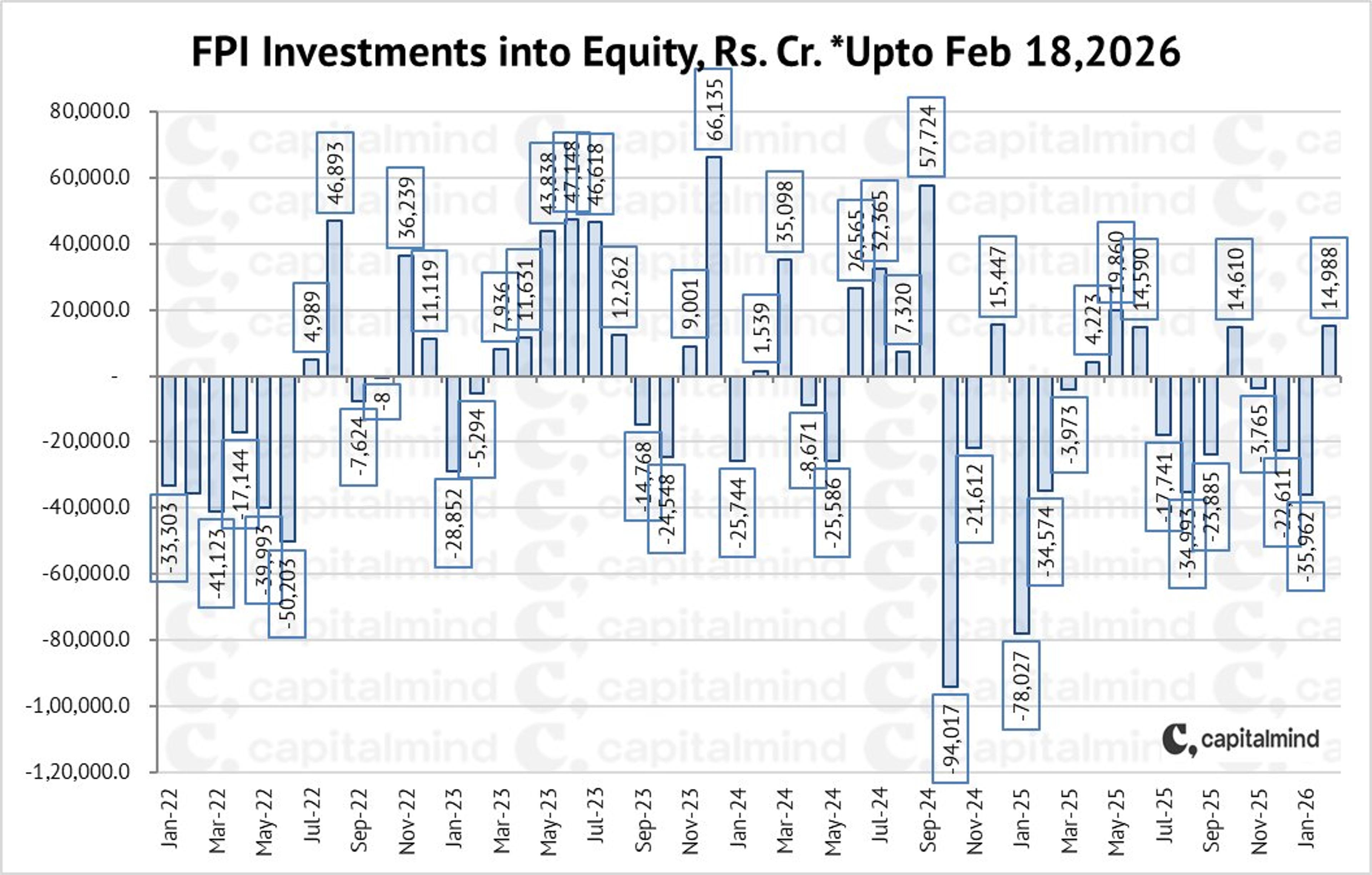

FPIs Add ₹14,000 Cr Equity in February

FPIs have finally started some buying, it looks like - in equity, they've added about 14,000 cr. in Feb this far: https://t.co/6Ag6kWbKnh

By Deepak Shenoy

Social•Feb 19, 2026

Quant Hedge Fund Alpha Closes After 25 Years

A $2 billion quantitative hedge fund that recently added “Alpha” to its name, is calling it quits after three consecutive years of losses and roughly 25-year run https://t.co/69PJrwEni7

By Nishant Kumar

Social•Feb 19, 2026

Fuel Subsidy Masks Real Service Cost Surge

1.6% is a statistical illusion for the urban middle class While headline inflation is stable, the "unprotected" service sector is aggressive: Personal Care & Misc. → 6.6% Education → 3.2% Cause→Effect: Subsidized fuel (-0.7%) masks the reality of rising service labor costs. If you...

By David Chuah

Social•Feb 19, 2026

Tencent's Tiny Wildlight Stake Dwarfed by Massive Cash Flow

Tencent's free cash flow last quarter was US$13B, so the amount they invested in Wildlight is (probably) minuscule for them. They and competitor Netease are in plenty of other deals that are not made public, both in the West...

By Serkan Toto

Social•Feb 19, 2026

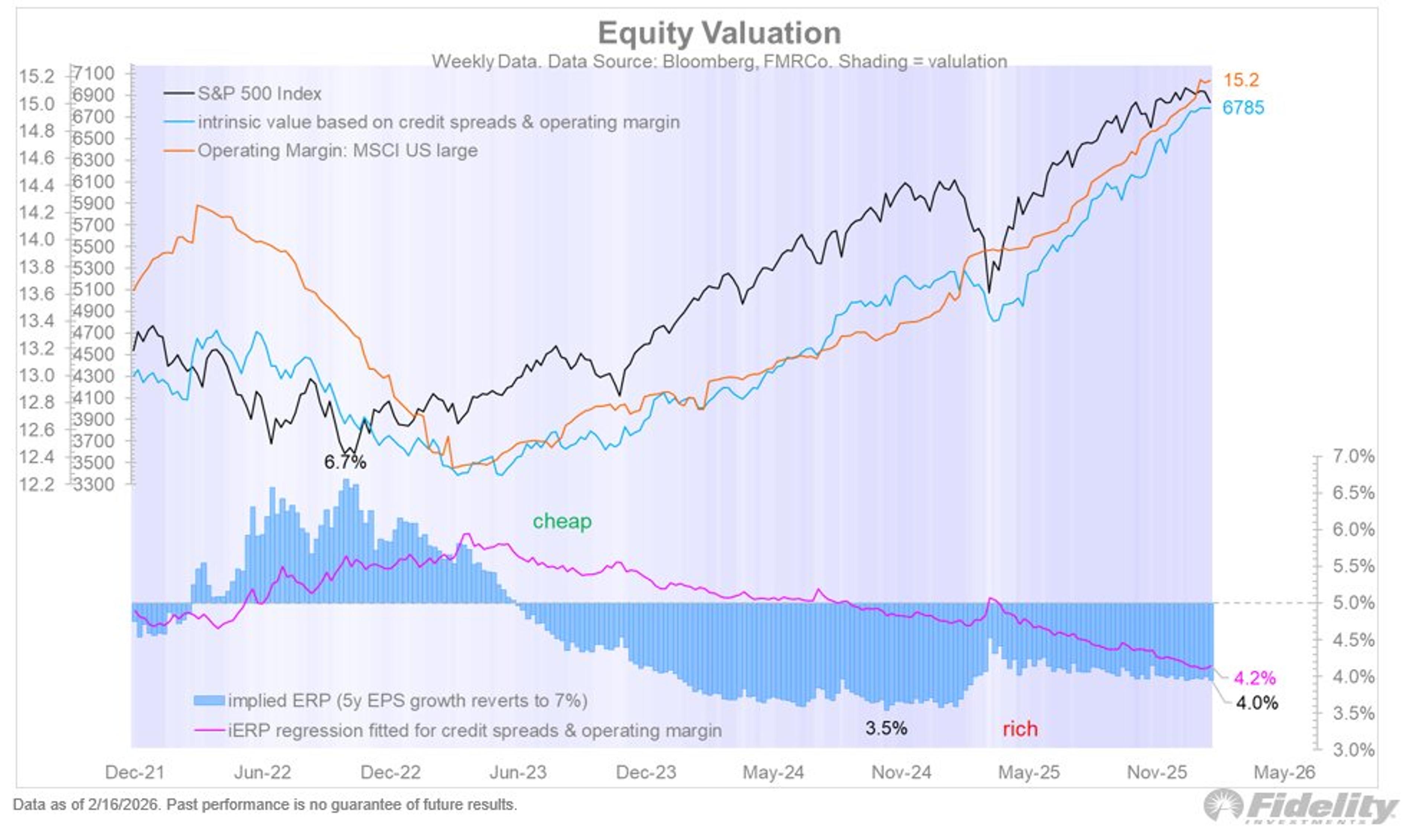

Rising Capex May Curb Buybacks, Pressure Valuations

With credit spreads low and profit margins seemingly on the rise, valuations seem OK at current levels. These two variables are important drivers for the equity risk premium, which is currently at 4.0% according to my version of the DCF...

By Jurrien Timmer

Social•Feb 19, 2026

Japan Deep‑Value Activism: Why Now Is the Time

It was great to join @alxlowen and Dale Gillham of @Wealthwithin in the studio in Melbourne recently to discuss Senjin Capital’s Japan-focused deep value shareholder activist investment strategy for the The ALx Report and Talking Wealth. Dale brings a wealth...

By Jamie Halse

Social•Feb 19, 2026

Blue Owl Stops Redemptions, Highlighting Exit Liquidity Risk

BLUE OWL PERMANENTLY HALTS REDEMPTIONS AT PRIVATE CREDIT FUND AIMED AT RETAIL INVESTORS — FT Being long scarcity might lead to illiquidity, but being long illiquidity doesn’t necessarily mean you’re long scarcity You’re long exit liquidity

By Jeff Park

Social•Feb 19, 2026

SPAC Activity Slumps: 21 IPOs, Just One Deal

Month-to-date SPAC statistics: IPOs: 21 Definitive agreements: 1 As Jerry Seinfeld said, "That's not gonna be good for anybody."

By Julian Klymochko