Social•Feb 14, 2026

Key Signals Founders Need Before Raising Next Round

$40M raised. Series A ready. Episode 232 dives into the real signals founders should look for before raising more capital 👇 https://t.co/0CcjGEIVb9 #SaaS #AI https://t.co/S1vxKwuxiB

By Ben Murray

Social•Feb 14, 2026

Stocks Are only Cheap During Economic or Business Crises

There are really only two times when stocks become "cheap": collectively, - usually when the health of the economy is in question, - and, more narrowly, when the viability of a business or its industry is in question. You...

By Lawrence Hamtil

Social•Feb 14, 2026

Energy Leads US Sector Gains; Financials Fall

🇺🇸 US Sector Performance in 2026 📈 $XLE Energy up 22% $XLB Basic Materials up 18% $XLP Consumer Defensive up 16% $XLI industrials up 12.8% $XLU Utilities up 9% $XLRE Real Estate up 8% $XLV Healthcare up 2% $XLY Consumer Retail -2% $XLK Technology -2.5% $XLF Financials -5%

By Peter Sin Guili

Social•Feb 14, 2026

Turn Excel Into a Text Mining Powerhouse

Each week I send out a free analytics tutorial to 39,009 professionals. This week is Part 3 in a series on mining free-form text data using Python in Excel. Think about this for a second. Production quality, reproducible text mining inside an Excel...

By David Langer (Dave on Data)

Social•Feb 14, 2026

AI Threat Looms Over $3.5T Credit Market

Credit markets could be the next AI casualty. A UBS analyst flags the $3.5T leveraged loan and private credit space as vulnerable, with AI disruption moving faster than expected. Up to $120B in fresh defaults this year would turn the AI boom...

By Spiros Margaris

Social•Feb 14, 2026

Provincial Revenues Forecast 2‑3% Growth, Lagging Economy

1/4 SCMP: "Major provinces are budgeting for 2 to 3 per cent growth this year in general public operating revenue, broadly in line with last year but below broader economic growth targets, Fitch Ratings said in a research note." https://t.co/HwyAPw042O

By Michael Pettis

Social•Feb 14, 2026

China Cracks Down on Hidden Corporate IOU Market

1/3 Very interesting Caixin article on attempts by Chinese regulators to get their arms around "the opaque market for corporate IOUs that has allowed big-name companies to defer payments to suppliers on a massive scale." https://t.co/FIJywKAtIX

By Michael Pettis

Social•Feb 14, 2026

China's January Financing Jumps 2.4% Year‑over‑year, Beating Forecasts

1/5 According to Caixin, China’s aggregate financing grew slightly faster than expected in January, rising by RMB 7.22 trillion. This was 2.4% more than in January 2025 and 10.4% more than in January 2024. It is equal to 5.1% of annual...

By Michael Pettis

Social•Feb 14, 2026

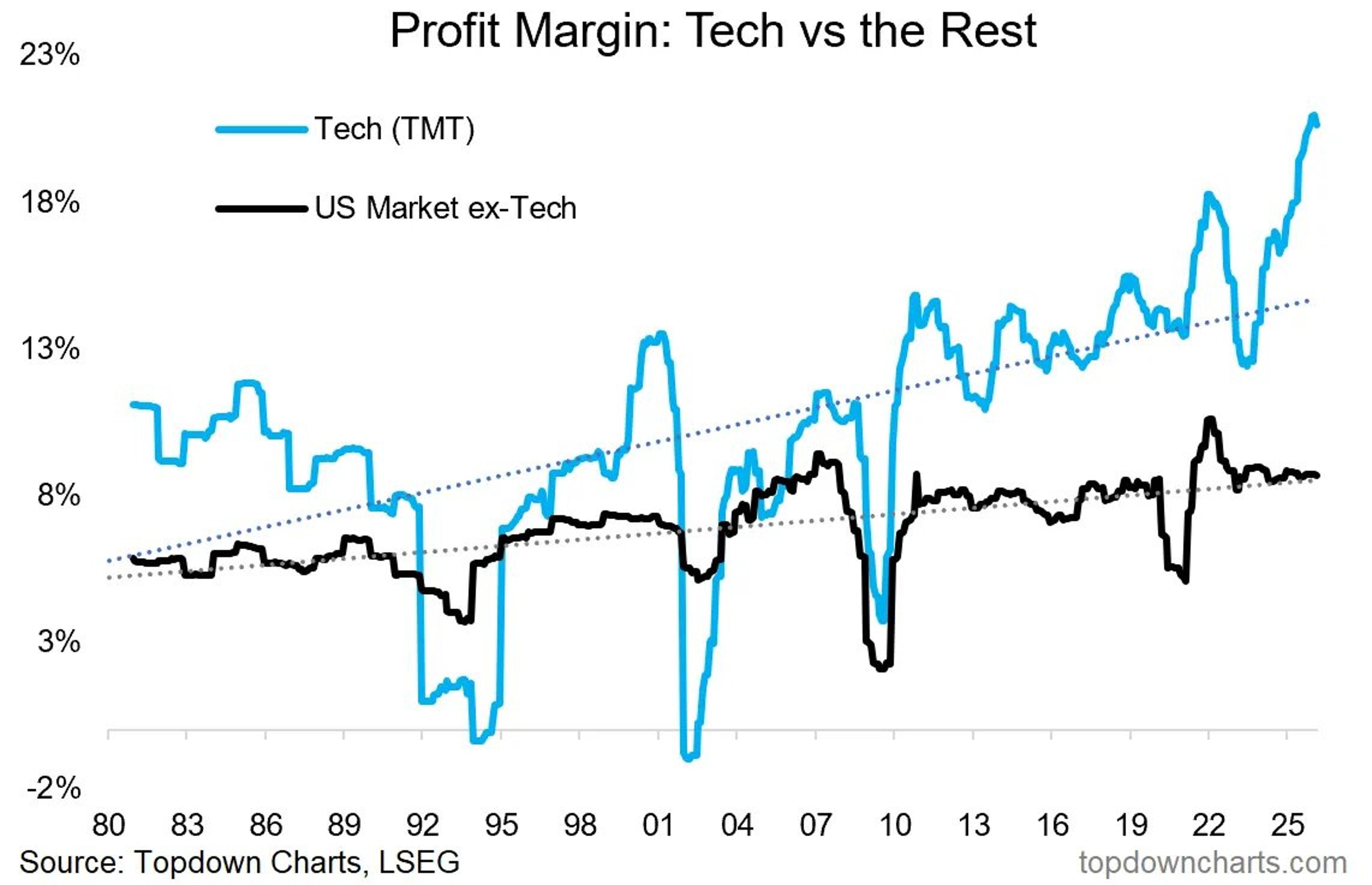

Tech Stocks' Valuations Soar, Yet Margins Remain Stretched

Biggest strength for Tech Stocks. and their biggest weakness? (stretched valuations are underpinned by stretched profit margins) https://t.co/JyYGvhtRlC

By Callum Thomas

Social•Feb 14, 2026

Malaysia Beats Forecast, Yet MSMEs Face Headwinds

Malaysia’s Economic Outlook & Risks Full-year performance exceeds government’s upper ceiling based on 4Q 2025 data Outperformance —► Hawkish BNM bias. Chatter of tougher operating conditions on the ground, especially for micro, small and medium enterprises (MSMEs) including F&B sector are leading many...

By David Chuah

Social•Feb 13, 2026

Top 10 SaaS Cloud Multiples at Market Close

This week in enterprise software: Top 10 #SaaS #Cloud multiples as of today's market close

By Jamin Ball

Social•Feb 13, 2026

Early-Stage Startups Don’t Need Costly Big‑4 Audits

Startups ($25M ARR? Get bids from multiple firms. You do NOT need a Big 4 audit. It does not me you are a legit company before the Big 4 did the audit. No one cares. 2nd tier firm is fine 3...

By OnlyCFO

Social•Feb 13, 2026

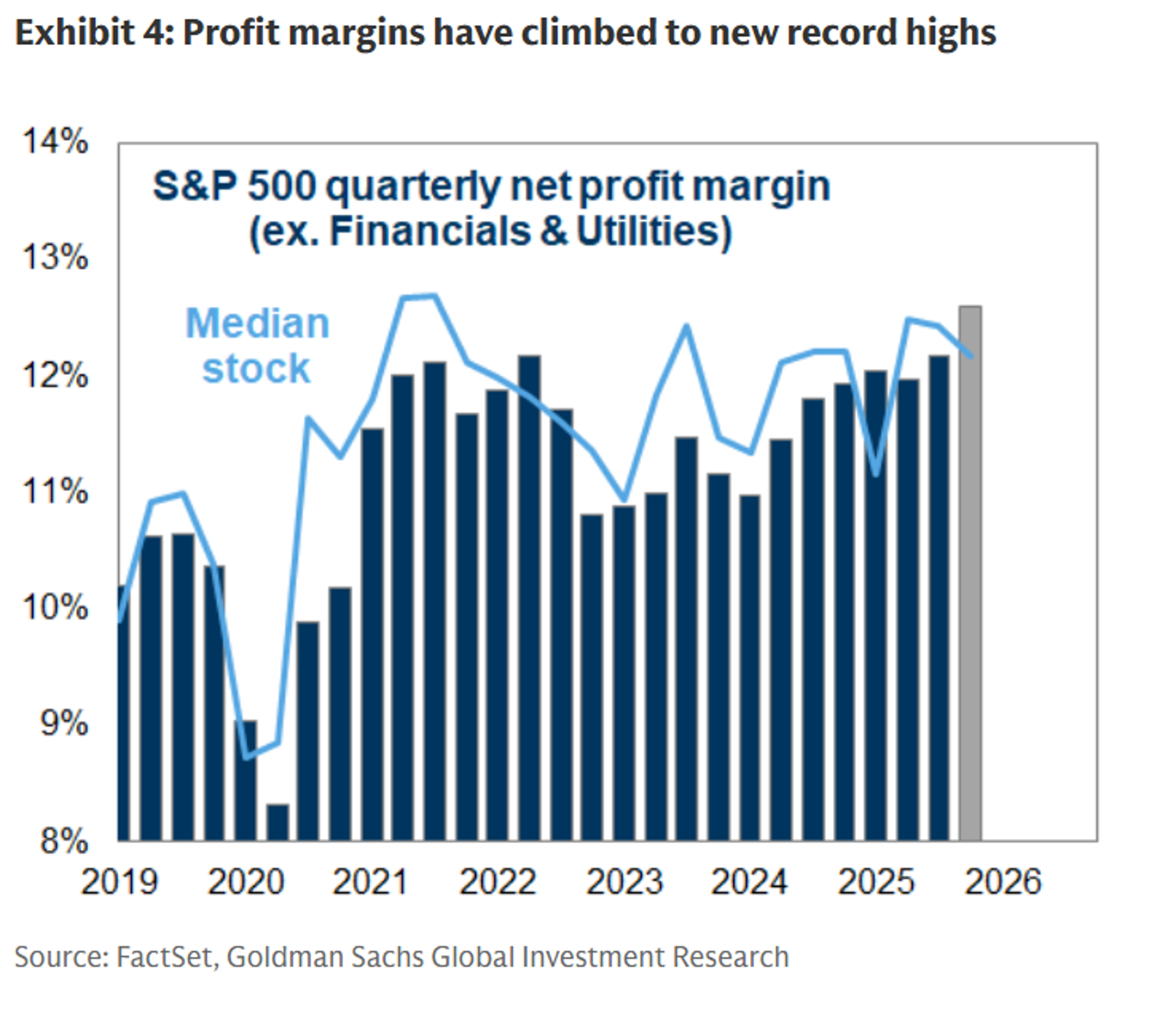

Biggest Stocks Push S&P 500 Margin to Record 12.6%

"The exceptional profitability of the largest stocks boosted the aggregate S&P 500 profit margin to a new record high of 12.6% in 4Q" - Goldman https://t.co/5fnYCaoDhm

By Gunjan Banerji

Social•Feb 13, 2026

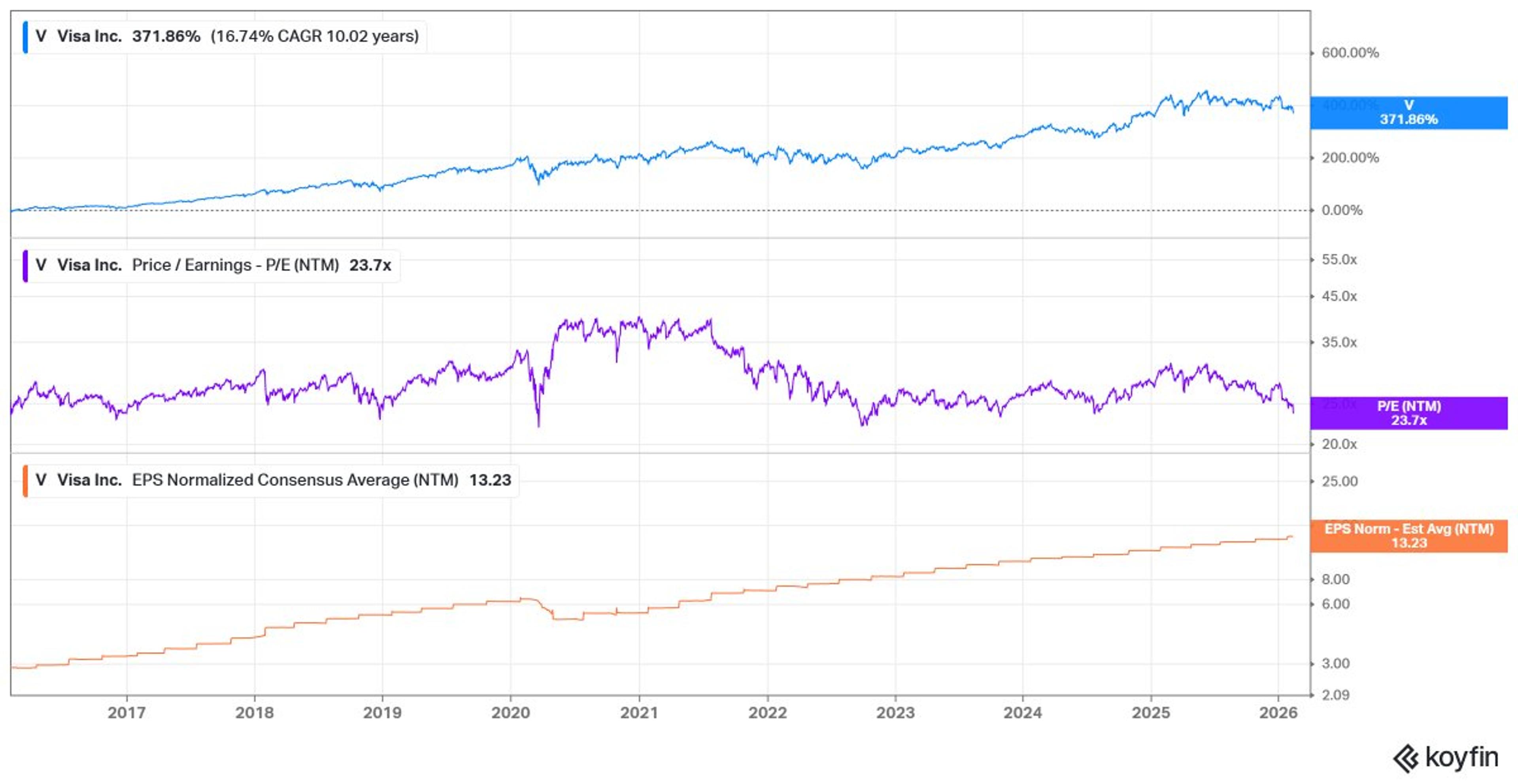

Visa's TSR Mirrors Earnings Growth, P/E Stays Flat

Visa total return the last decade or so basically all earnings growth; P/E unchanged while change in EPS estimates roughly equal TSR https://t.co/wYh3Mkz7Aq

By Lawrence Hamtil

Social•Feb 13, 2026

Ford Faces $900M Tariff Blow, Highlighting US Corporate Pain

Ford just disclosed an additional $900M tariff hit in its Q4 results. TARIFFS = BAD NEWS FOR AMERICAN CORPORATIONS. https://t.co/kau61WOizz

By Steve Hanke

Social•Feb 13, 2026

Investors Choose Safe Bonds, Accepting Low Real Returns

One way to interpret recent price action in the bond market is that large pools of investment capital have made the determination that a 3.6%-4.1% guaranteed nominal return over the next 5-10 years is preferable to taking on the risk/reward...

By Quinn Thompson

Social•Feb 13, 2026

Incentive Pay Boosts Advisor Revenue and Client Growth

This #WeekendReading kicks off with the news that @CharlesSchwab's latest RIA compensation report finds that while base salaries remain the largest component of advisor compensation, firms that offer incentive pay have seen more revenue and client growth in recent years than...

By Michael Kitces

Social•Feb 13, 2026

High ROE Fuels Rapid Book Growth and Higher Valuations

"We have shown over the past couple of years that Return-on-Equity readings for companies are very high, and very supportive of equity prices as the high ROE promotes rapid growth of corporate book value, and consequently higher market valuations." -...

By Sam Ro

Social•Feb 13, 2026

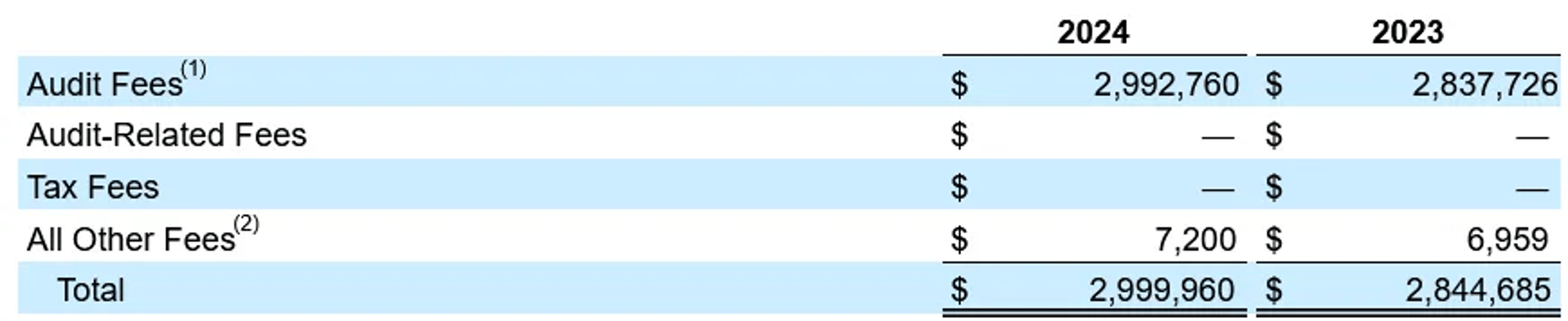

Expensify's $3M Audit Fee Highlights Costly Compliance

Expensify paid $3M in audit fees in 2024. Insane. They had 115 employees and $140M of revenue...They are not complicated. The auditors could have literally redone the books for that much. Hope AI drives audit costs down (but not holding my breath...

By OnlyCFO

Social•Feb 13, 2026

S&P Erases Almost All 2026 Gains Amid AI Hype

Forget Trump's AI HYPE. The S&P Index has now given up nearly all its 2026 gains. https://t.co/GAL0TbU7KG

By Steve Hanke

Social•Feb 13, 2026

Banks' Inflation Forecasts Politicized, Yield Soft Surprises

Another SOFT inflation surrpise... It has become a bit of a theme, and we are increasingly convinced that inflation forecasting has become a "politicized arena" within banks, given how incredibly stubborn they have been in their wrong lean on this.

By Andreas Steno Larsen

Social•Feb 13, 2026

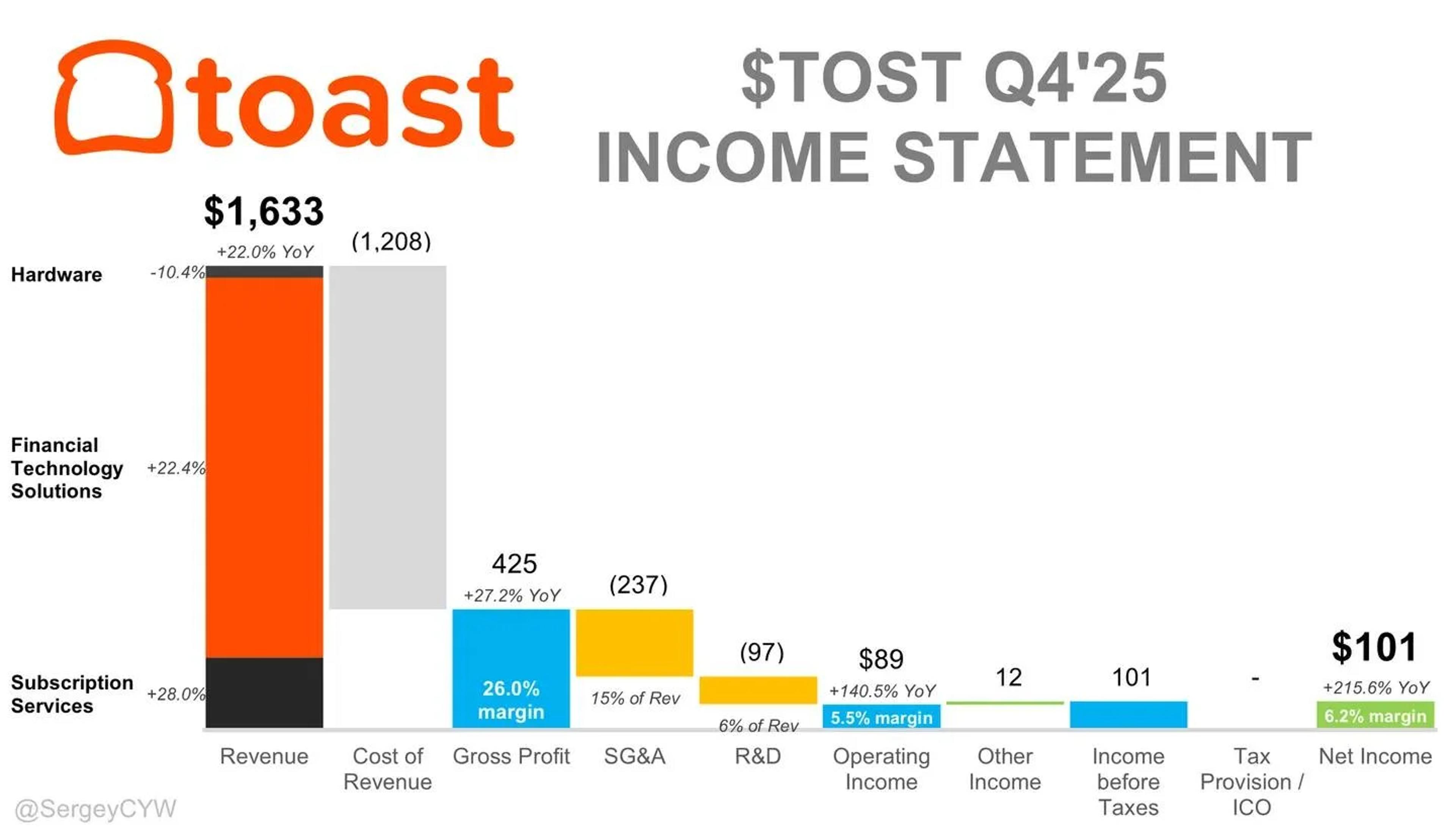

TOST Q4 Margins Surge, Profit Spikes over 200%

$TOST Q4: Operating income +140% YoY, net income +216% YoY. Margins expanding across the board. Revenue came in at $1.63B, up 22% YoY. Growth moderated vs +25% last quarter, but profitability stepped up meaningfully. Gross profit grew 27% YoY with gross margin...

By Sergey CYW

Social•Feb 13, 2026

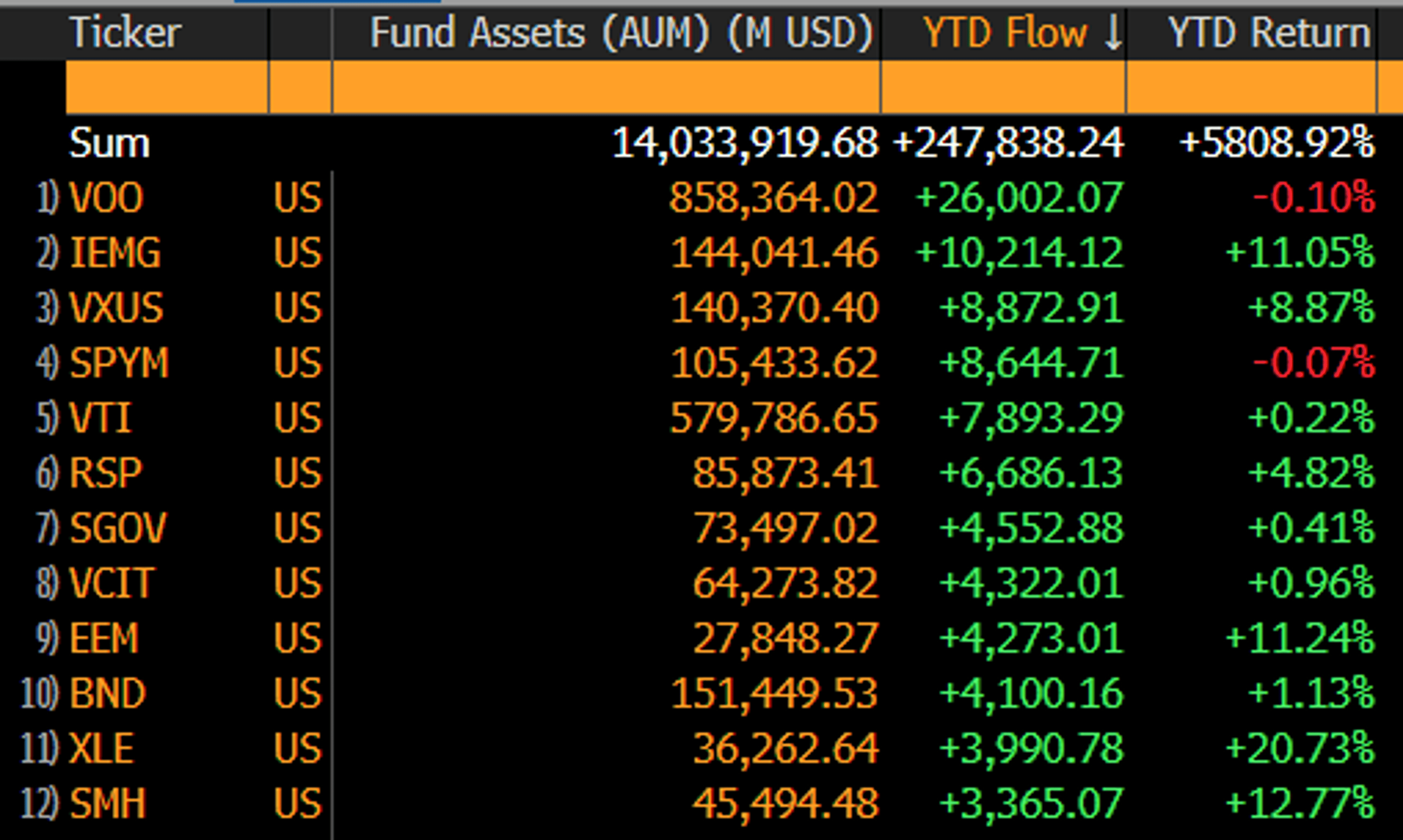

ETFs Rake $250B in 28 Days, EM Overtakes Gold

There's only been 28 trading days this year and ETFs have already pulled in about $250b. More than double any other start to a year. Up until 2020, $250b was what they averaged for a YEAR. That's $9b/day pace, or...

By Eric Balchunas

Social•Feb 13, 2026

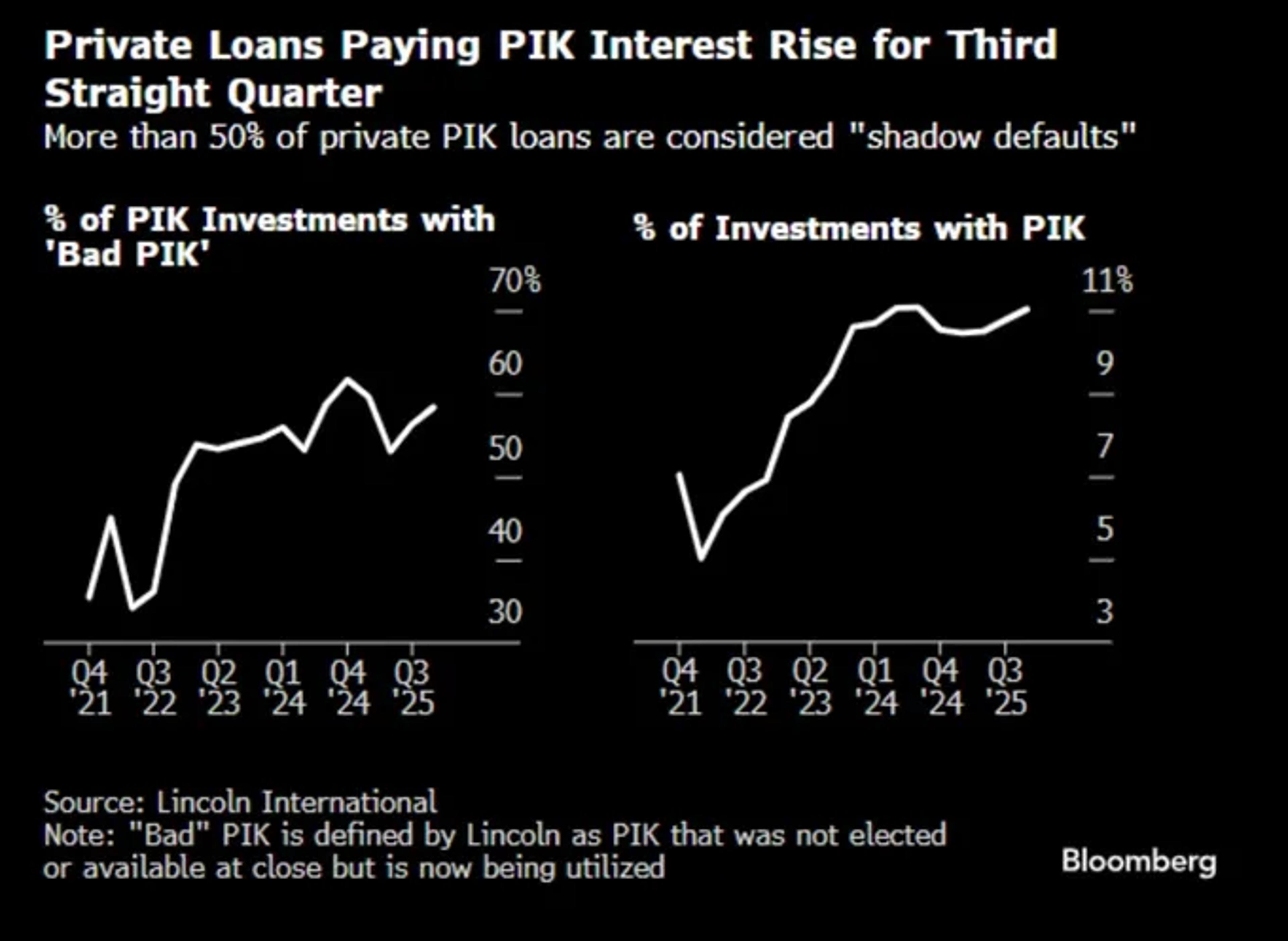

Most Private Credit PIK Is Bad Yet Labeled Performing

58% of PIK in private credit is "bad PIK" per Lincoln. Borrower stops paying cash. Lender accepts more debt instead. Everyone marks it at par. This is called "performing."

By JunkBondInvestor

Social•Feb 13, 2026

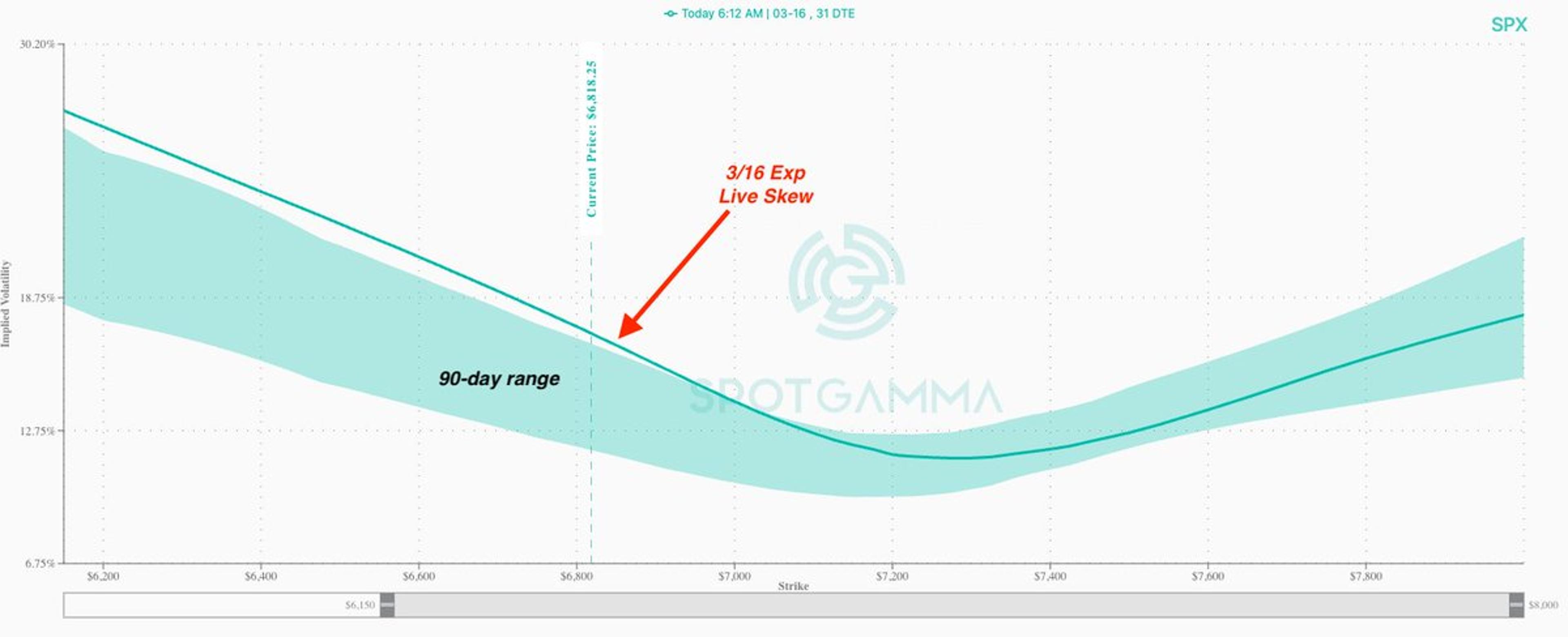

Rising SPX Put Skew May Push VIX to 30

SPX put skew is really starting to warm up here, while ATM IV remains relatively subdued. If SPX 30) https://t.co/p9qsHp8nHk

By Brent Kochuba

Social•Feb 13, 2026

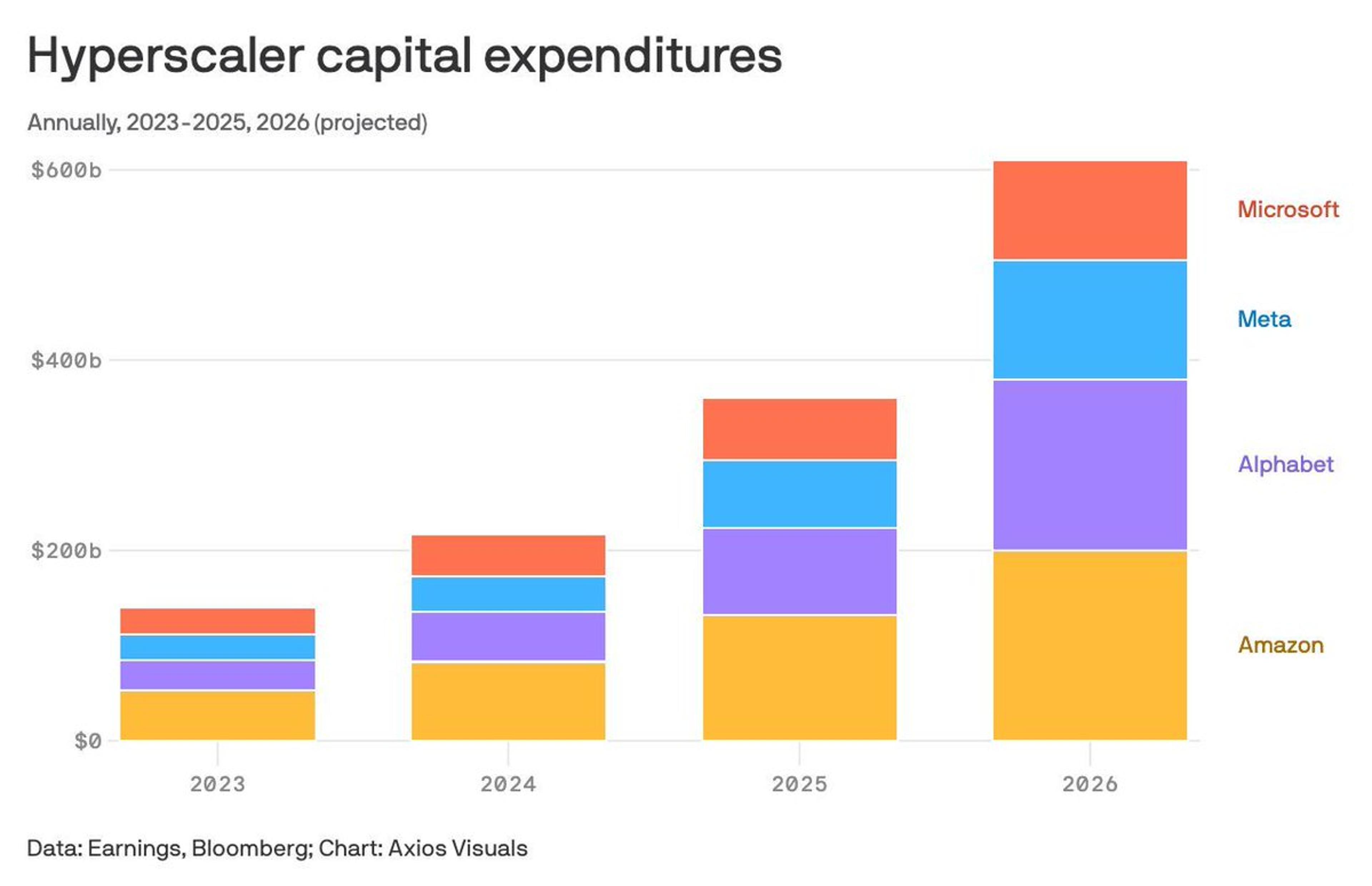

Gemini Miscalculates Google’s Massive Depreciation Drag

Coming up on @thestreetpro More Tales From Nvidia: The Depreciation "Tail and Spike" Will Be Painful to Mag7 Profits (Issue #178!) * As free cash flow is plummeting... I decided to ask the AI about itself. In this case, I asked Google Gemini about...

By Doug Kass

Social•Feb 13, 2026

Turn FP&A From Reactive to Predictive with AI

⚡ From forecast to action — is your FP&A team predictive or reactive? At the Digital North American FP&A Circle, leaders from Sony, Mars, High Liner Foods & Wolters Kluwer CCH Tagetik shared how they embed predictive AI into decisions: https://t.co/Gmlh8jmMgB #aiinfinance

By Larysa Melnychuk

Social•Feb 13, 2026

Fintechs Must Prioritize Financial Health Over Services

#FlashbackFriday | In 2020, I argued that fintechs should stop selling financial services and start selling financial health, this wasn’t a buzzword, but a different way of thinking about the financial sector itself: https://t.co/bL1ZTqv4Uf Yesterday’s future. Progress optional. https://t.co/s7x485LBB3

By Dave Birch

Social•Feb 13, 2026

38% of Clients Drive 75% of Capitec Revenue

𝟯𝟴% 𝗼𝗳 𝗰𝘂𝘀𝘁𝗼𝗺𝗲𝗿𝘀 𝗴𝗲𝗻𝗲𝗿𝗮𝘁𝗲 𝟳𝟱% 𝗼𝗳 𝗖𝗮𝗽𝗶𝘁𝗲𝗰’𝘀 𝗿𝗲𝘃𝗲𝗻𝘂𝗲 Capitec’s interim results for the period ending August 2025 show a very clear picture of where the bank’s income is really coming from: 🔸Non-interest income = R13,358 bn 🔸Net interest income = R...

By Talk Cents

Social•Feb 13, 2026

Key Market Moves: Listings, Earnings, Acquisitions, Renames

Major News to Track on February 13, 2026: 1. Hock Soon Capital Main Market Listing 2. LPI Capital FY2025 Results 3. Lotte Chemical Titan Full-Year Earnings 4. Oriental Holdings Hospitality Acquisition 5. Berjaya Land Corporate Renaming ↓↓↓

By David Chuah

Social•Feb 12, 2026

Capital Markets Reshape Translational Therapeutics Landscape

The Catalyst Machine | Ep. 931 How Capital Markets Quietly Rewired Translational Therapeutics https://t.co/lWNRxW0wuQ https://t.co/l14X2JfrLX

By BowTiedBiotech

Social•Feb 12, 2026

Alphabet Q4: Search Rebounds 17%, Cloud Drives 48% Revenue

Alphabet Q4 2025: Search reaccelerated to 17%. Cloud hit 48% at 30% margins. Full breakdown live for SCIS members: https://steadycompounding.com/investing/alphabet-q4-2025/

By Thomas Chua (Steady Compounding)

Social•Feb 12, 2026

Biotech IPOs Deliver Median -15% Return, Outperforming Losses

Humbling 30 year Biotech stats shared by @verdadcap in a recent report: Just over 1,000 biotechs hit $200M mkt cap at some point. Of those, 67% have lost value (had cumulative negative returns), vs 48% for all other US companies....

By Bruce Booth

Social•Feb 12, 2026

SEC Calls for Congressional Law to Strengthen Authority

NEW FROM THE SEC: “We need a good law coming out of Congress that would undergird our efforts. The SEC has pretty broad authority to interpret and have exemptions under various securities laws. That has been the missing link here.” https://t.co/Fye5ETsEk2

By Wendy O

Social•Feb 12, 2026

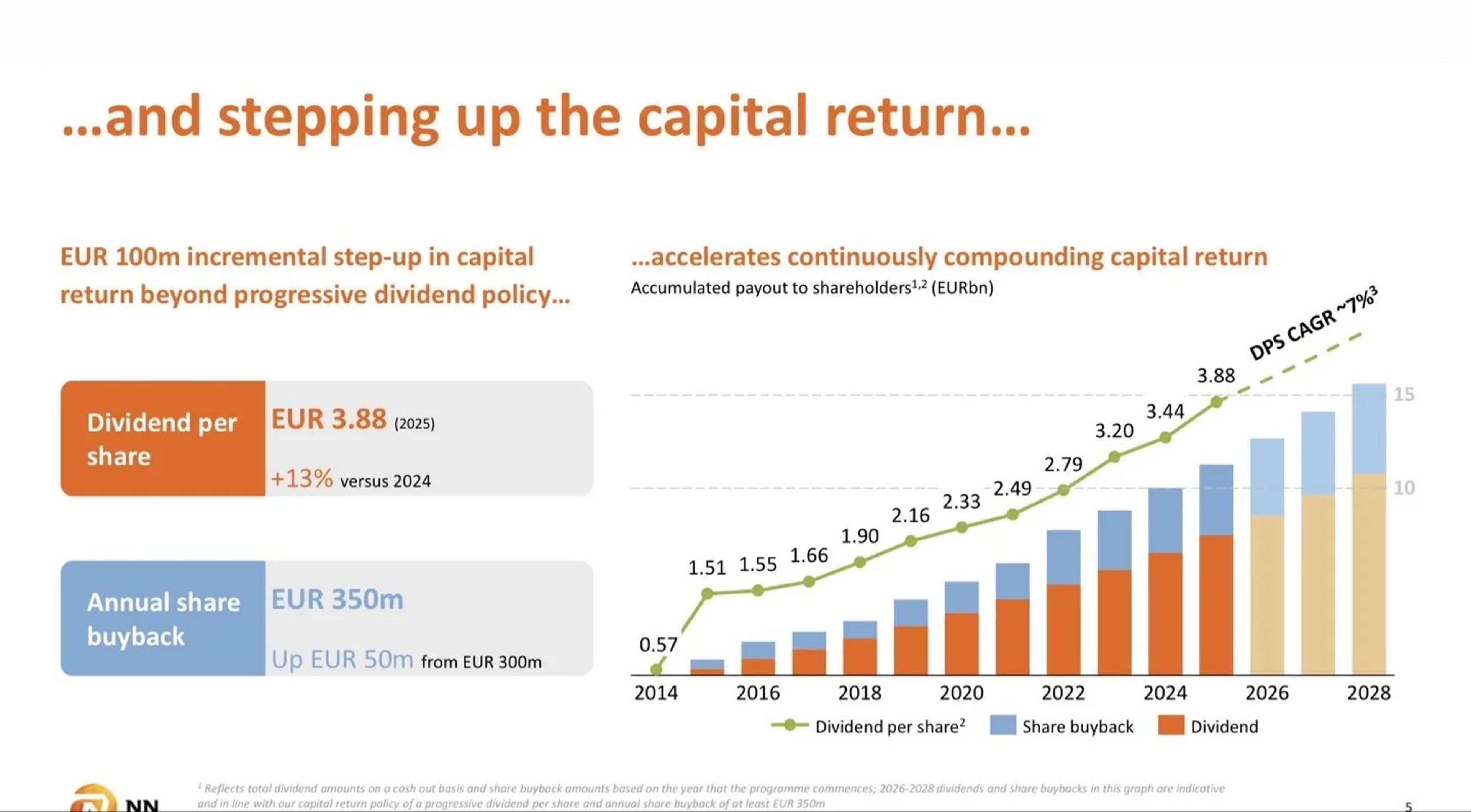

NN Group Boosts 2025 Dividend by 13%

Ka-Boom💥💥 Dutch insurer NN group hikes the total 2025 dividend by 13% 🎉 Discl: long $NN.AS ChartPorn

By European Dividend Growth Investor

Social•Feb 12, 2026

Coinbase CEO Cashes $550M as Stock Plummets 68%

🚨INSIGHT Coinbase CEO Brian Armstrong sold over 1. 5 million $COIN shares between April 2025 and January 2026 Armstrong netted $550 million from the sales $COIN is currently down 68% from its ATH https://t.co/Zo6H4SdkNg

By That Martini Guy

Social•Feb 12, 2026

LG Electronics IPO Plummets: Profit Falls 61%

LG Electronic - IPO Stock : Bad News Profit Slumps 61% 🚨 Net Profit slumps 61.6% to Rs 89.6 crore Vs Rs 233 crore Revenue down 6.4% to Rs 4,114 crore Vs Rs 4,396 crore EBITDA slumps 42.4% to Rs 196 crore Vs...

By Champ Trader

Social•Feb 11, 2026

Forecasting Trends, NAV Squeeze Mechanics, Active ETF Surge

🆓 Wednesday links: focusing on forecasting, how NAV squeezing works, and the rise of the active ETF. https://t.co/bgzuhBy1Uq image: https://t.co/JRCEGjVQN2 https://t.co/PSs8BSV9vG

By Tadas Viskanta

Social•Feb 11, 2026

Valuation Blends SaaS Metrics with Deal Structuring

Valuation is understandably one of the most top-of-mind topics founders want to cover in our conversations. Something we often emphasize is that there are two sides of valuation: the objective side based on core SaaS metrics, and the subjective side influenced...

By Michael Lyon

Social•Feb 11, 2026

US Household Debt Peaks at $18.8T, Delinquencies Surge

US household debt just hit $18.8 TRILLION. Consumer delinquencies are at their HIGHEST LEVEL in nearly a DECADE. Not a good sign. https://t.co/PHcOGrhvOc

By Steve Hanke

Social•Feb 11, 2026

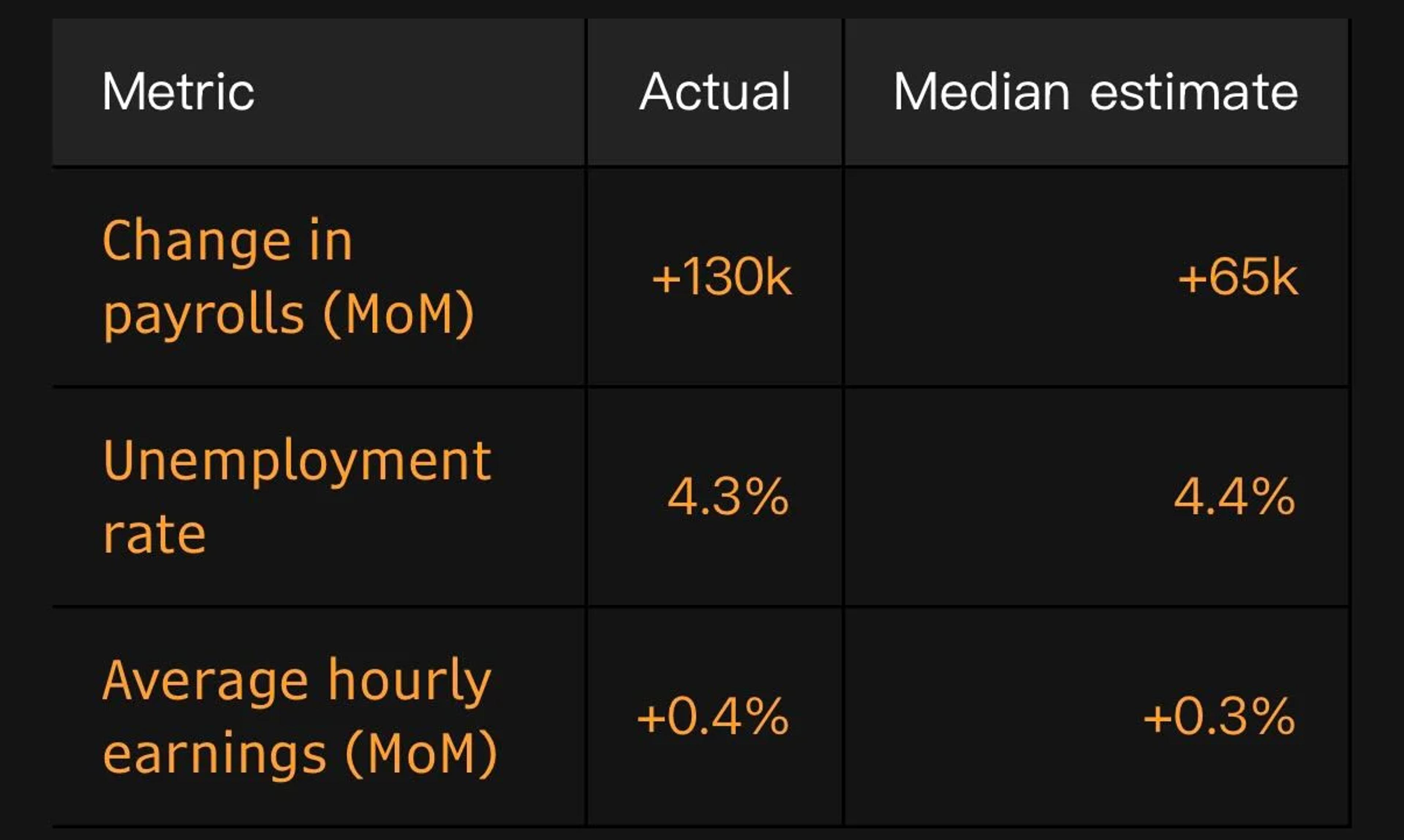

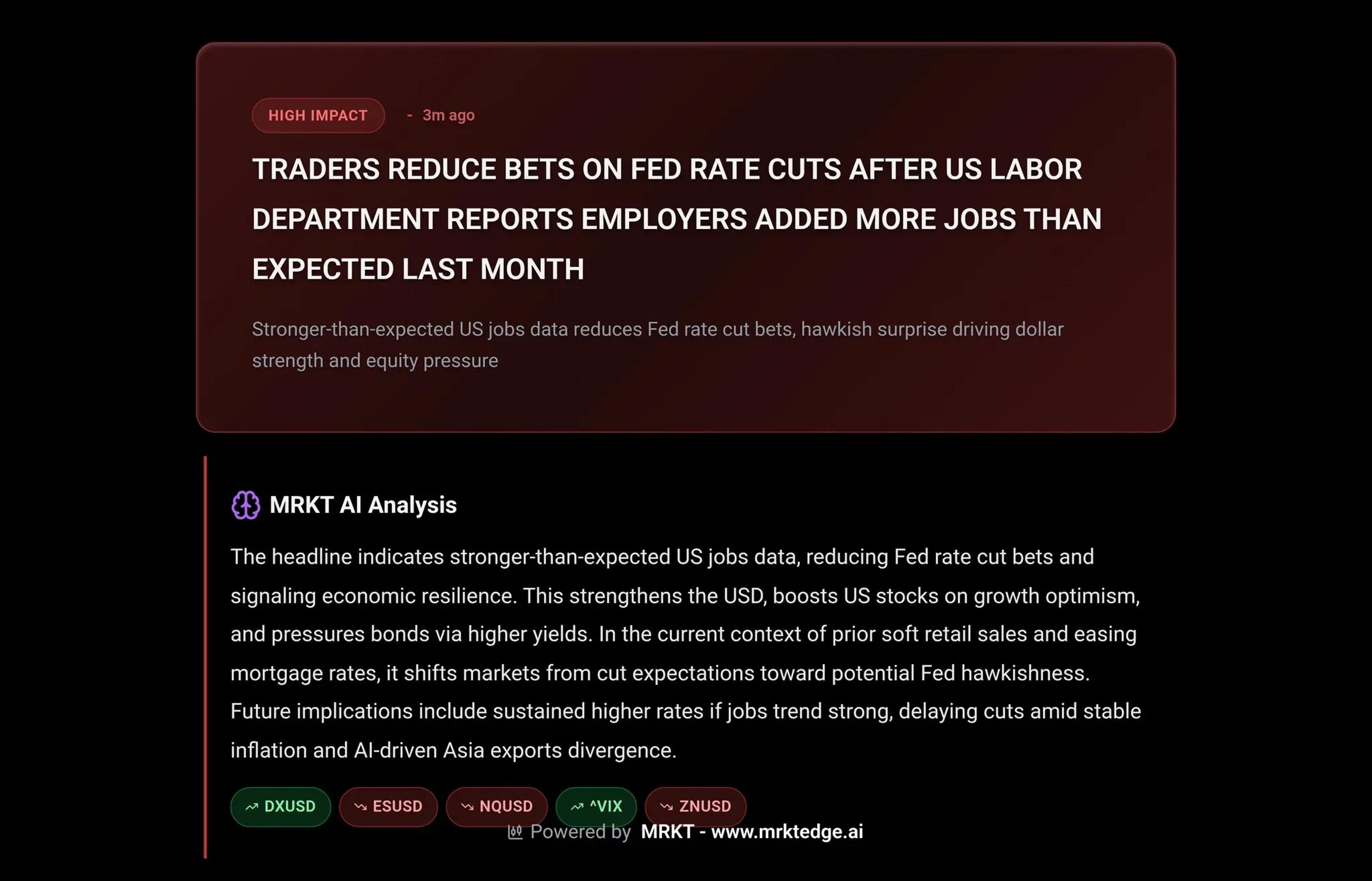

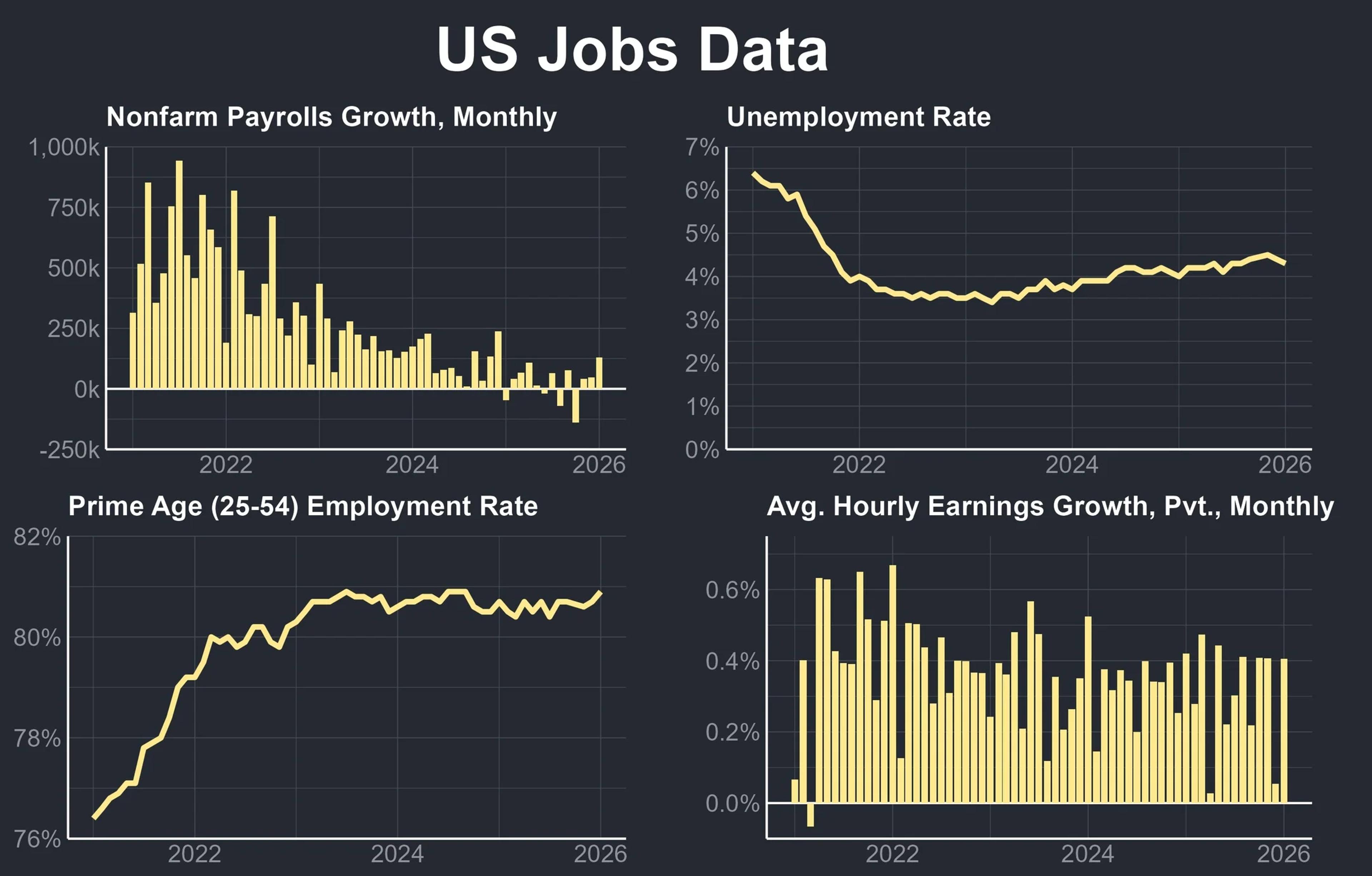

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

Social•Feb 11, 2026

Shareholder Rejects Netflix Deal, Backs Paramount Bid

Small Warner Bros. Discovery Shareholder Blasts ‘Flawed, Inferior’ Netflix Offer and Backs Paramount’s Hostile Bid — but Will It Matter? https://t.co/NGSPvAdqOW via @variety

By Todd Spangler

Social•Feb 11, 2026

SaaS Must Evolve Into AI‑Powered Revenue Workflow Platforms

Is the SaaSpocalypse just a market correction or a crisis of defensibility? The pillars and moats we’ve leaned on for a decade are eroding in real-time: Systems of Action are no longer defensible. When anyone can use LLM + AI Agents to...

By Ray Rike

Social•Feb 11, 2026

Strong NFP Spurs Fed Pause, Dollar Gains, Market Pullback

NFP BREAKDOWN : Unemployment rate dropped to 4.3% while headline number crushed the expectations. In simple words , this was a much solid NFP all across the board. FED pause will continue. Profit taking in Gold , SPX , NASDAQ on reduced rate cut...

By tradeloq

Social•Feb 11, 2026

US Adds 130k Jobs, Unemployment Slips to 4.3%

NEW US JOBS DATA: Non-farm Payrolls: +130k Unemployment Rate: 4.3% (-0.1%) Prime Age (25-54) Employment-Population Ratio: 80.9% (+0.2%) Average Hourly Earnings: +0.4% Annual Benchmark Revisions: -898k

By Joseph Politano

Social•Feb 11, 2026

January Jobs Surge 130K, Beating Forecasts, Unemployment Dips

January Non-Farm Payrolls print at 130K vs expected 66K - previously 48K Unemployment holds ticks lower to 4.3% #NFP

By Michael Boutros

Social•Feb 11, 2026

Business Professionals Need Data Analysis Skills, Not Analyst Titles

I teach professionals data analysis. Not to be Data Analysts. Why? Because most analyses are conducted by business professionals, not IT. And with Copilot in Excel, that's only going to increase, not decrease.

By David Langer (Dave on Data)

Social•Feb 11, 2026

Promoters May Offload Up to 3% of Netweb Technologies

#BlockDeal | Sources say that promoters likely to sell up to 3% stake in #NetwebTechnologies via block deals

By Yogesh Mantri

Social•Feb 11, 2026

Banks Poured $429B Into Steel; Capital Isn’t the Hurdle

"Between 2016 and mid-2023, 354 banks provided $429 billion to the 100 biggest steel producers, suggesting that finding capital isn’t the main challenge." https://www.bloomberg.com/news/articles/2026-02-11/banks-backing-green-steel-fund-false-solutions-report-says

By Akshat Rathi

Social•Feb 11, 2026

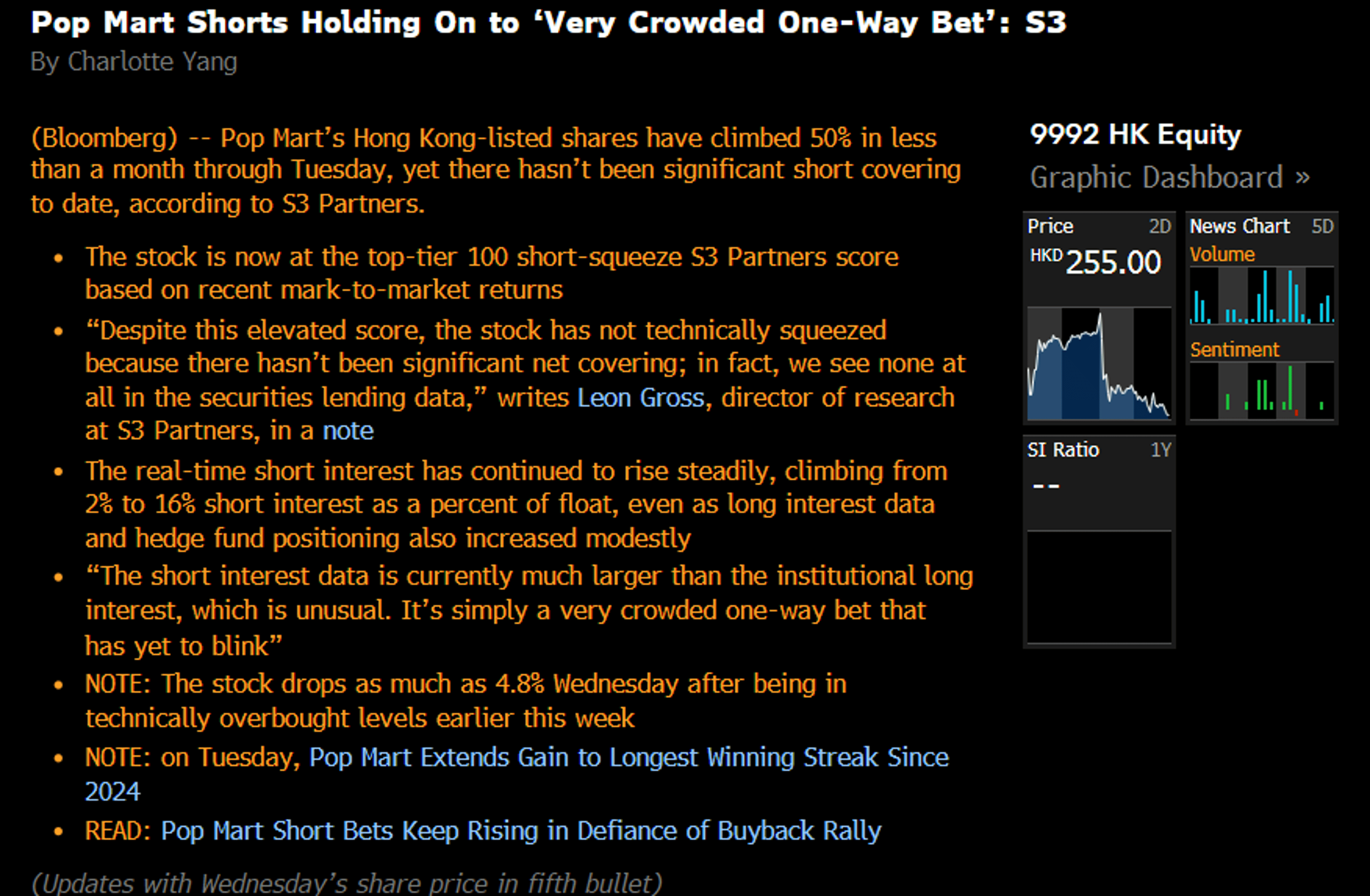

Pop Mart Rallies 50% with Minimal Short Covering

For those of you still watching where this bull-bear battle goes for Pop Mart, S3 Partners just said they have not seen much short covering despite the shares over 50% rally in less than a month through Tuesday https://t.co/oArFfDeiSH

By Charlotte Yang