Social•Feb 19, 2026

Japan Deep‑Value Activism: Why Now Is the Time

It was great to join @alxlowen and Dale Gillham of @Wealthwithin in the studio in Melbourne recently to discuss Senjin Capital’s Japan-focused deep value shareholder activist investment strategy for the The ALx Report and Talking Wealth. Dale brings a wealth of knowledge to the investment discussion. He is a highly respected author, speaker, commentator, and educator on all things financial, so it was a real privilege to discuss what we are doing with him. Alex has unique insights into the Australian investment landscape, and is well worth listening to. We talked about the Japan opportunity, why it exists, why we believe now is the right time to pursue it, and Senjin Capital’s approach to investing in Japan. Please see the link in the comments to the full video on Talking Wealth. If you are a wholesale investor and would like to learn more, please visit Senjin Capital’s website or DM me.

By Jamie Halse

Social•Feb 19, 2026

Blue Owl Stops Redemptions, Highlighting Exit Liquidity Risk

BLUE OWL PERMANENTLY HALTS REDEMPTIONS AT PRIVATE CREDIT FUND AIMED AT RETAIL INVESTORS — FT Being long scarcity might lead to illiquidity, but being long illiquidity doesn’t necessarily mean you’re long scarcity You’re long exit liquidity

By Jeff Park

Social•Feb 19, 2026

SPAC Activity Slumps: 21 IPOs, Just One Deal

Month-to-date SPAC statistics: IPOs: 21 Definitive agreements: 1 As Jerry Seinfeld said, "That's not gonna be good for anybody."

By Julian Klymochko

Social•Feb 18, 2026

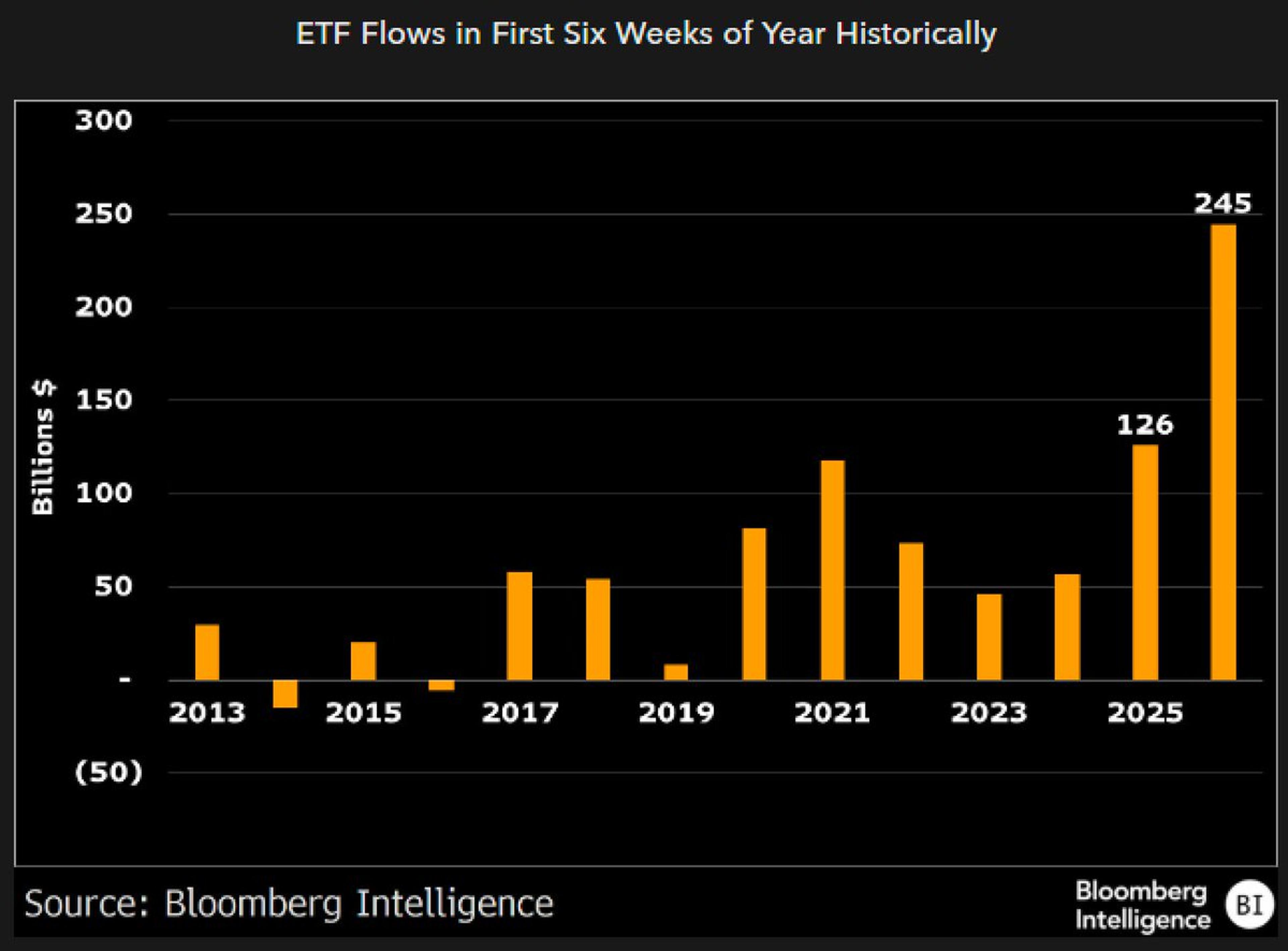

ETF Inflows Double Historic Pace in First Six Weeks

Here's ETF flows for the first six weeks of the year historically. This year is off to the best start almost by double. One reason is growing depth of cash vacuum cleaners. VOO, SPYM hoovering as always but there's already...

By Eric Balchunas

Social•Feb 18, 2026

Lennar’s 13F Reveals 18.5M Opendoor

A note re: $OPEN and $Lennar --- if you back it out, Lennar held 18.5M shares of Opendoor at end of its Q3. The 13F likely indicates either they had some anti-dilution protections or participated in debt-for-equity swap, and that’s why...

By Luke Kawa

Social•Feb 18, 2026

March 2Y Futures Expected Heavy Amid Nasty Roll

Great reminder futures rolls (H25 to M26) are upon us. Bottomline March 2y futs should be heavy. Roll is nasty at -4.5 which should add to the flattening pressure along with front-end auctions next week.

By Ed Bradford

Social•Feb 18, 2026

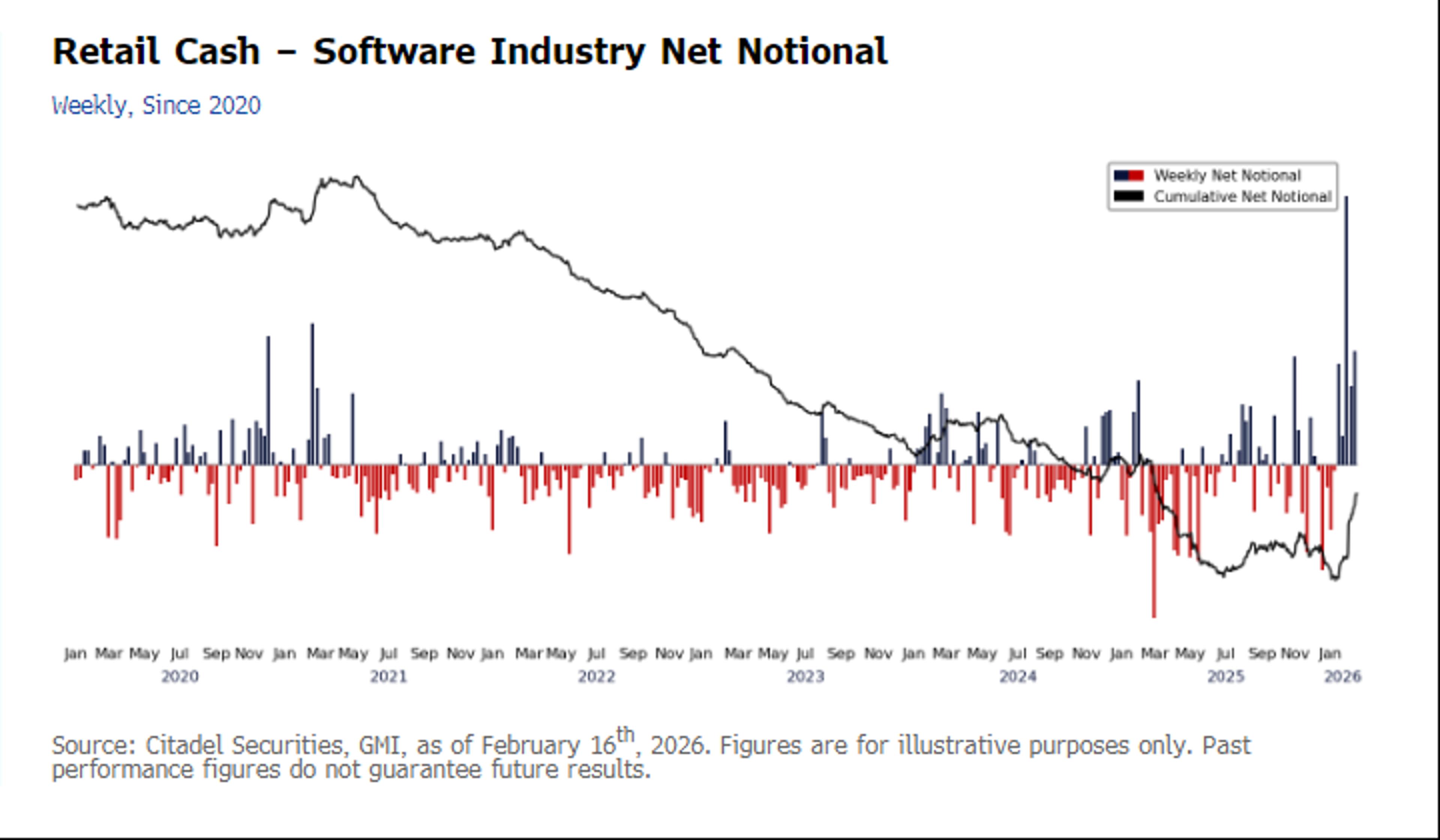

Retail Traders Set Record Demand on Citadel Platform

Citadel on flows, via Bbrg: Retail traders spent a record amount snapping up software shares on Citadel Securities’ platform, according to Scott Rubner, head of equity and equity derivatives strategy at the firm, which began tracking the data in 2017: “Net notional...

By MacroCharts

Social•Feb 18, 2026

Shift to Equal‑weight, Financials, and Cyclical Assets

Wow, the goat is also rotating out of Megacap tech, long equal weight performance vs market cap, long financials for deregulation and curve steepening, and long real cyclical assets Feels good man

By Felix Jauvin

Social•Feb 17, 2026

SKEW Below 140 Signals Institutional Hedge Unwind

SKEW just closed below 140. Falling $SKEW = institutions unwinding tail-risk hedges (OTM puts get cheaper) and/or quietly reducing equity exposure. Past cycles: Sustained declines often marked distribution phases — rallies fade as protection demand evaporates and complacency builds. If it...

By Kurt S. Altrichter

Social•Feb 17, 2026

Rent to Your Business Tax-Free—Only With Proper Paperwork

Influencers: “Rent your house to your business and boom — tax-free money.” What they don’t tell you: 📂 Fair market rent. 📝 Real agendas and minutes. 👥 Actual humans in attendance. 💼 A separate legal entity. 📸 Documentation that doesn’t look like it was created during...

By Prof. Victoria J. Haneman

Social•Feb 17, 2026

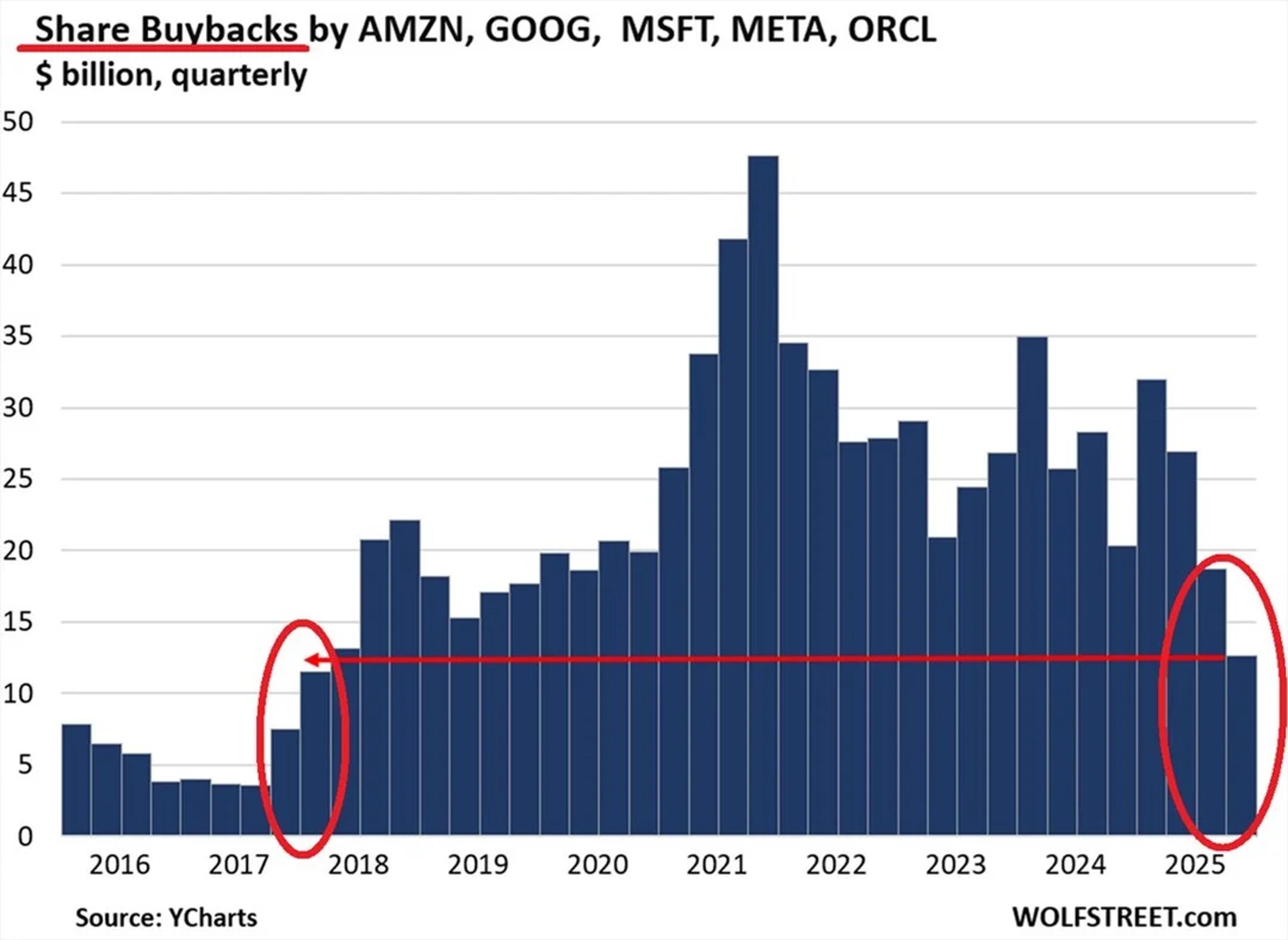

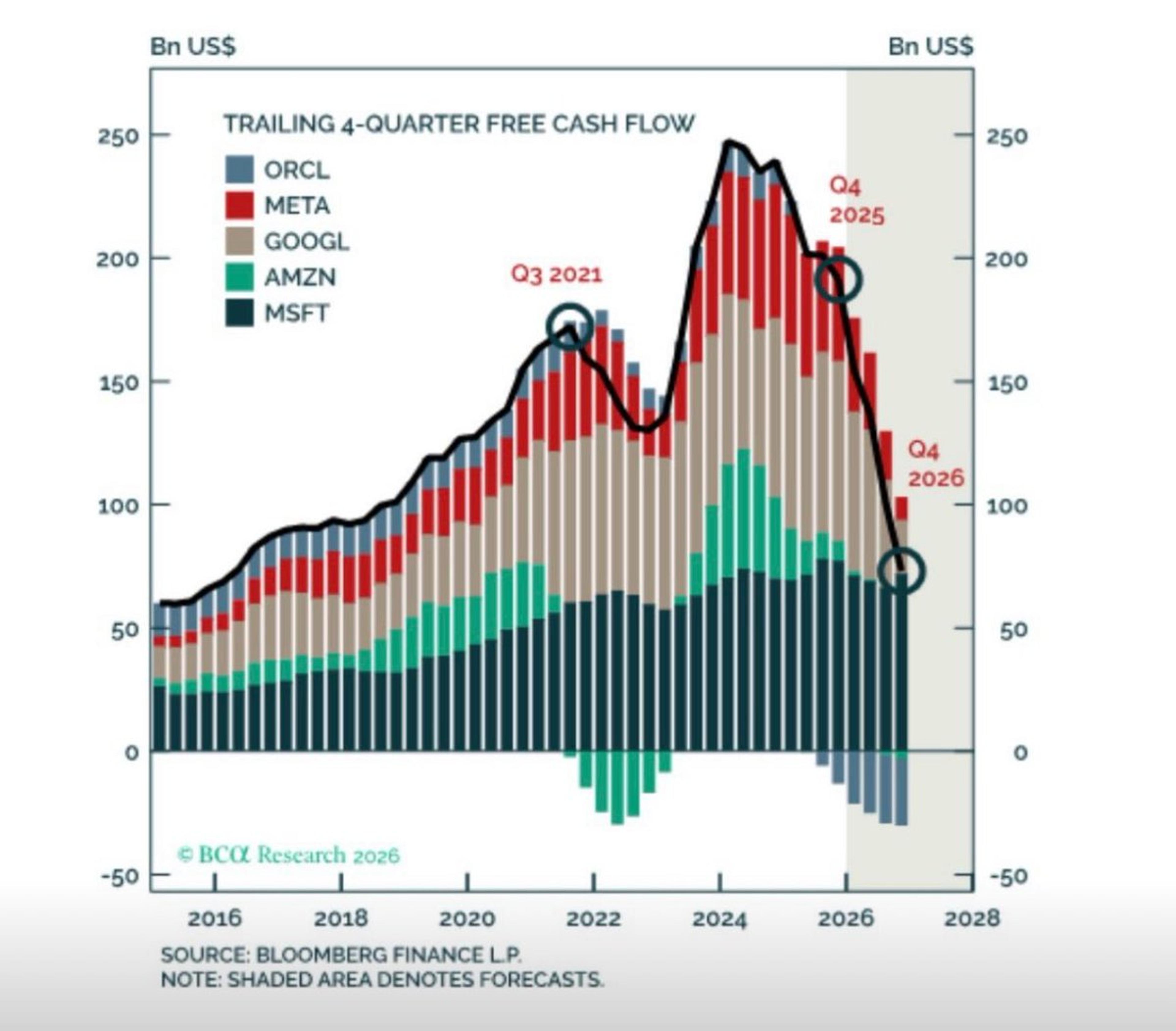

Big Tech Cuts Buybacks, Shifts to AI Spending

‼️The largest US stock buyer since 2009 is STEPPING BACK: Combined buybacks by Amazon, Alphabet, Microsoft, Meta, and Oracle fell to $12.6 billion in Q4 2025, the lowest in 7 YEARS. This marks the 3rd quarterly decline, a -70% DROP from the...

By Global Markets Investor (newsletter author)

Social•Feb 17, 2026

Massive M&A Premiums: MASI, KW, ZIM Deals

Today's M&A notes $MASI to be acquired by $DHR for $180.00 cash, 38.3% premium, $9.9 billion $KW to be acquired by $FFH.to for $10.90 cash, 45.9% premium, $6.5 billion $ZIM to be acquired by $HLAGF for $35.00 cash, 125.8% premium, $4.2 billion https://t.co/ayupP5Rv2J

By Julian Klymochko

Social•Feb 17, 2026

Market Awaiting Decisive Breakout: Support or Resistance?

📺 THIS MARKET NEEDS RESOLUTION The market is stuck in a range. Breakouts fail, breakdowns bounce, and both longs and shorts get frustrated. We need a decisive move that breaks the range and sticks. That could mean: 🔻 A clean break below support $QQQ...

By Scott Redler

Social•Feb 17, 2026

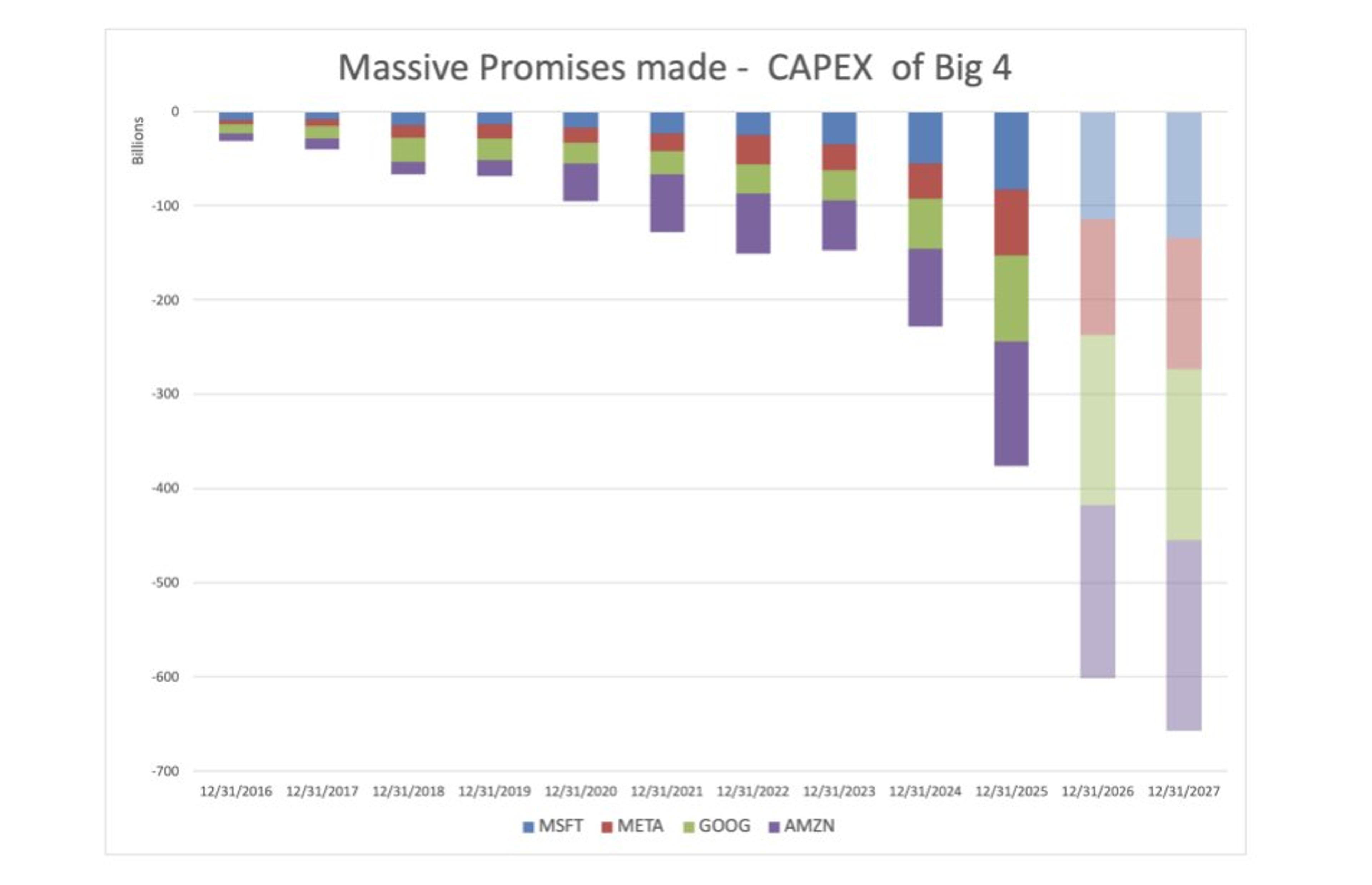

New DSR Highlights Debt‑Equity Promise for Hyperscalers

New DSR released to clients. Part 3 in the Hamburger Series - Hyperscalers. As a reminder the idea is that to get a hamburger today one needs to promise to repay (issue debt and equity) on tuesday. ...

By Andy Constan

Social•Feb 17, 2026

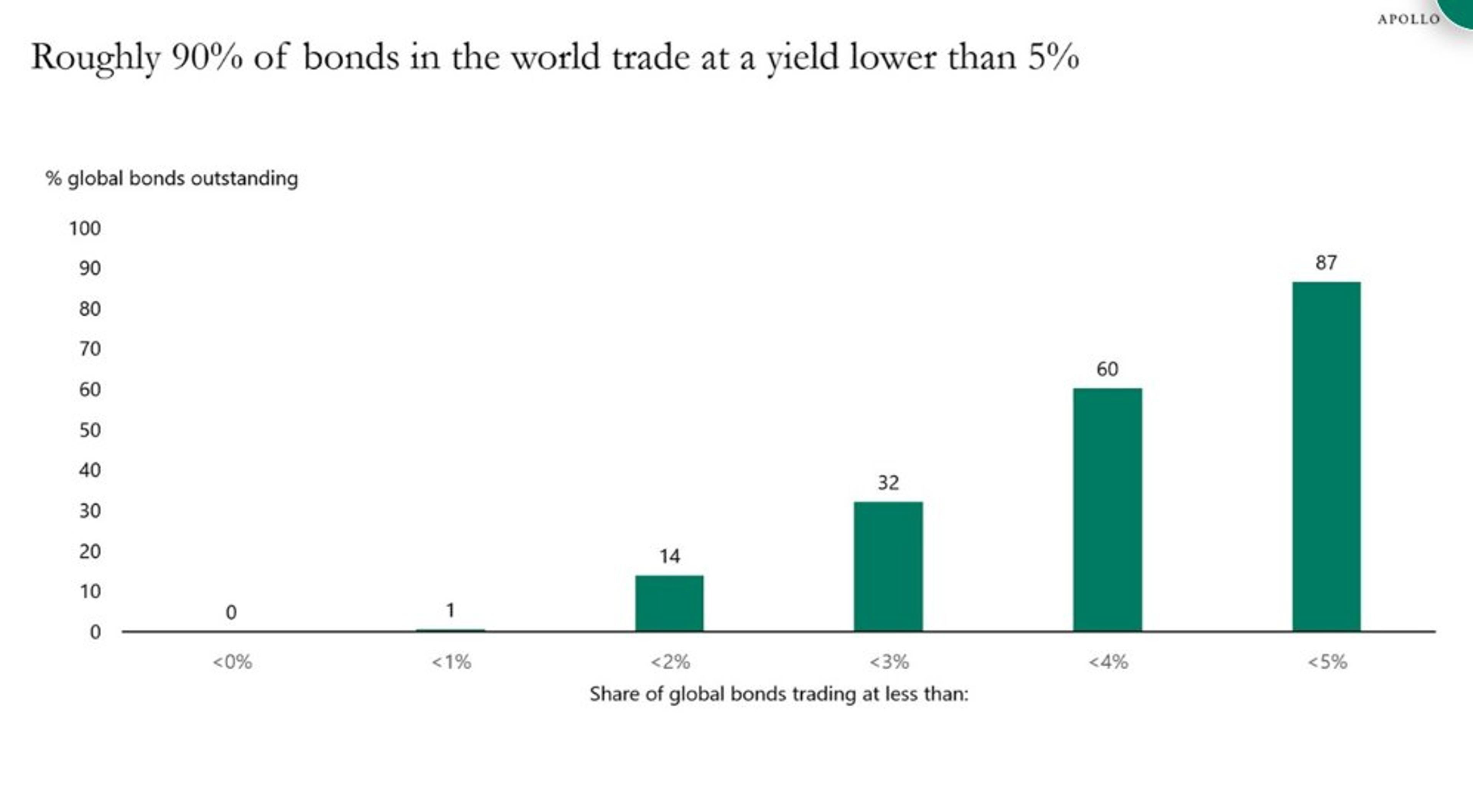

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

Social•Feb 17, 2026

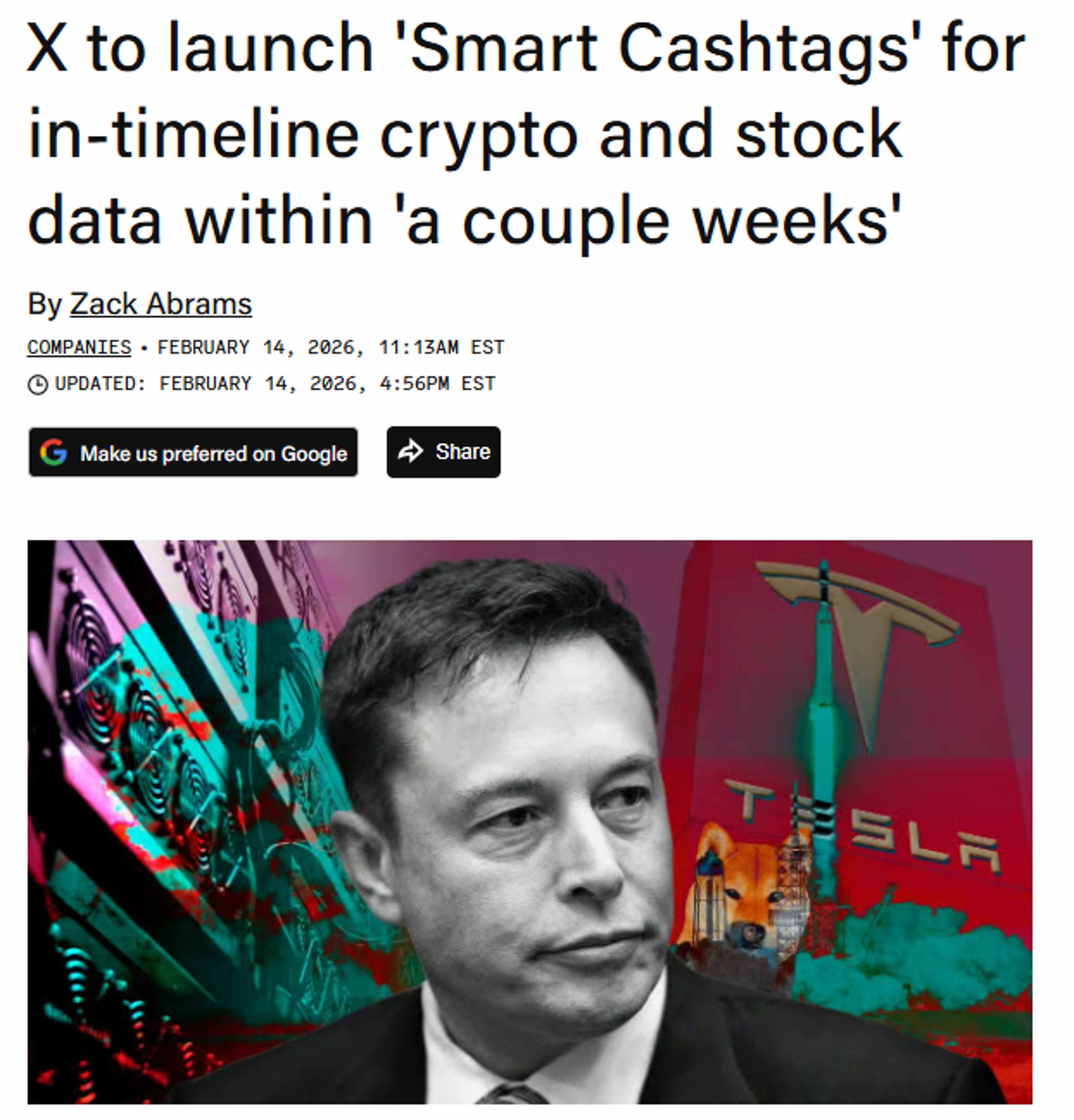

X Adds Finance Tools: Smart Cashtags and Visa‑backed Money

The platform that popularized ragebait is bringing you better gambling: 📉 @X will roll out Smart Cashtags, enabling users to view data on stocks and cryptocurrencies directly from their timeline. 💸 X Money is currently in closed beta with employees. A public...

By Nik Milanovic

Social•Feb 17, 2026

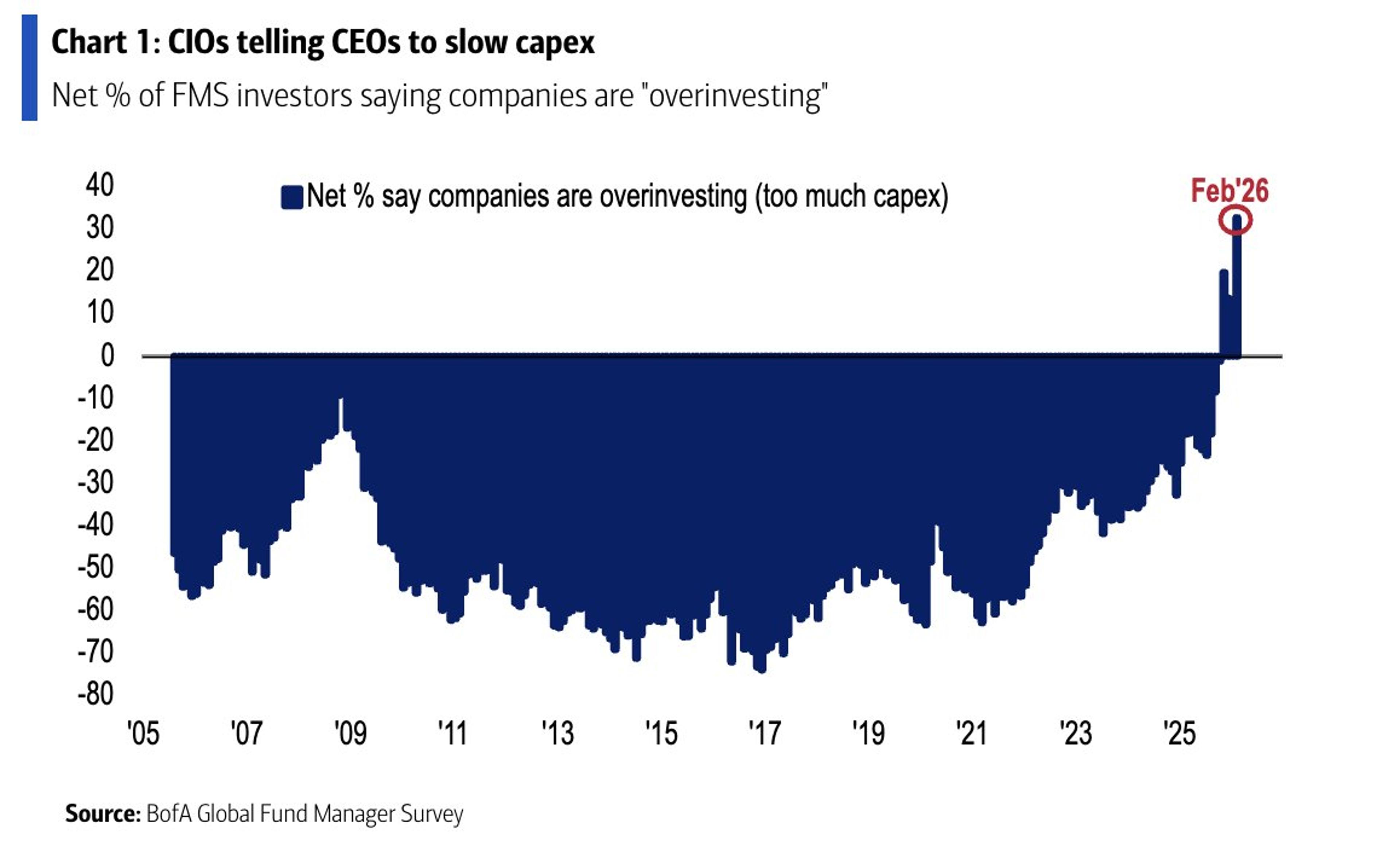

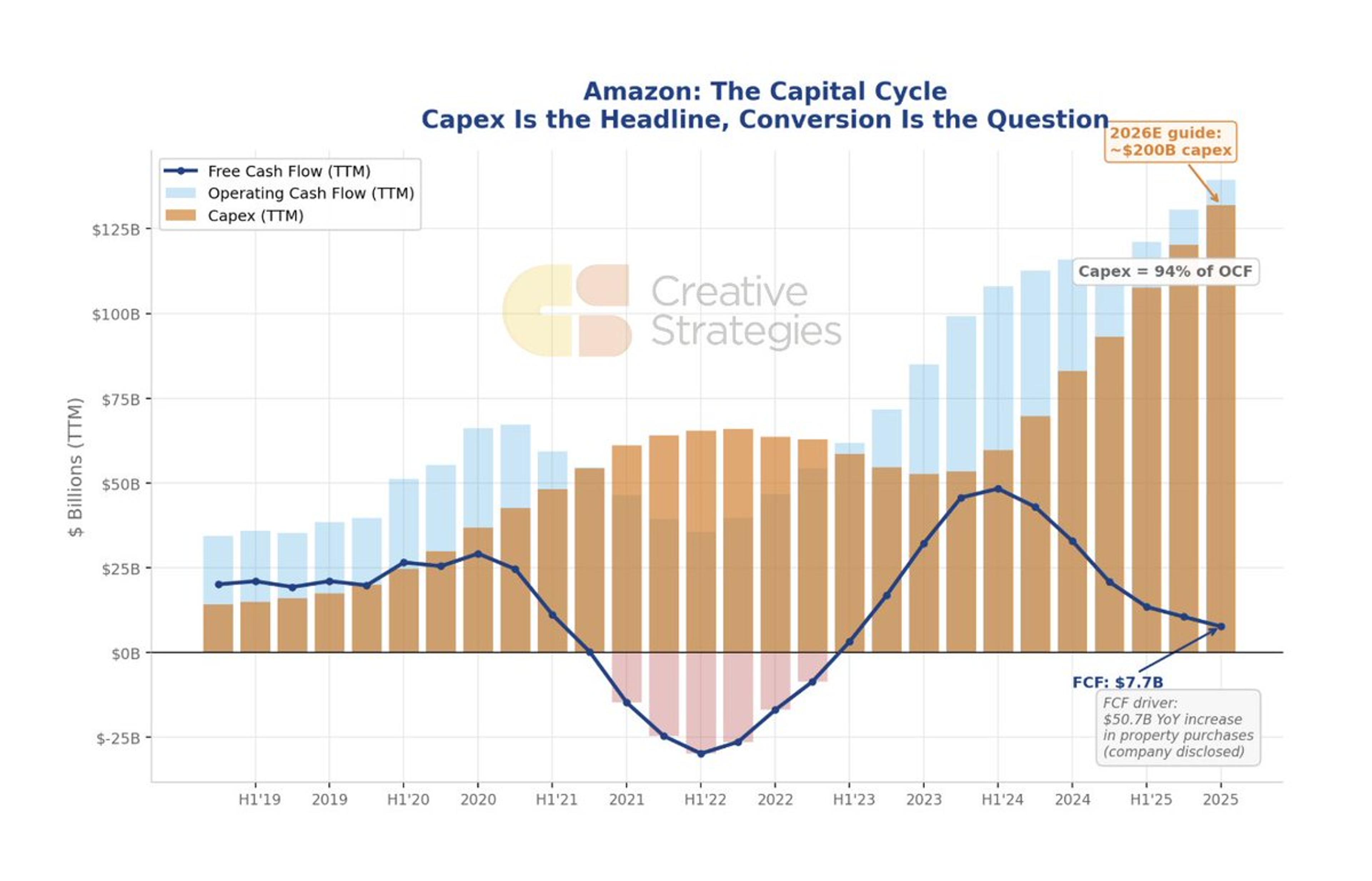

CIOs Push CEOs to Cut Capex, Strengthen Balance Sheets

"capex too hot right now …CIOs telling CEOs to improve balance sheets (35% from 26%) vs. increase capex (20% from 34%) as FMS investors saying corps 'overinvesting' at new record high" - BofA Global Fund Manager Survey https://t.co/ciu0wy6GZP

By Sam Ro

Social•Feb 17, 2026

Know Your Business Meal Deduction Risk Levels

A guide to business meal deductions Lower Risk • Occasional client lunch • Modest amounts • Clean documentation • Clear business relationship Moderate Risk • Frequent meals but defensible revenue • Slightly aggressive % of expenses • Documentation exists but is thin High Risk • Large meals relative to income • vague “business meeting” notes • No attendee names • Receipts missing • Pattern suggest disguised...

By Prof. Victoria J. Haneman

Social•Feb 16, 2026

2025 Profitability Snapshot: Sector Returns & Excess Gains

In my sixth data update, I look at business profitability in 2025, across sectors, industries and regions, scaled to revenues (profit margins) and to invested capital (accounting returns). I use the latter to compute and compare excess returns. https://t.co/L3PDmph4VA

By Aswath Damodaran

Social•Feb 16, 2026

Private Credit Bets on Software Amid AI Uncertainty

Five private credit firms just provided $1.4B for a software buyout of OneStream valued at $6.4B. Same week everyone’s asking whether AI will make these companies obsolete. The market is telling you software is at risk. The lenders are telling you...

By JunkBondInvestor

Social•Feb 16, 2026

Master These 5 SaaS Metrics for Sustainable Growth

Every SaaS leader should master these 5 metrics. Bookings, retention, margins, OPEX, and efficiency — the core numbers behind durable growth and valuation. 🎥 https://t.co/ViVeSCTLXx #SaaS #SaaSMetrics https://t.co/bvoRB24XES

By Ben Murray

Social•Feb 16, 2026

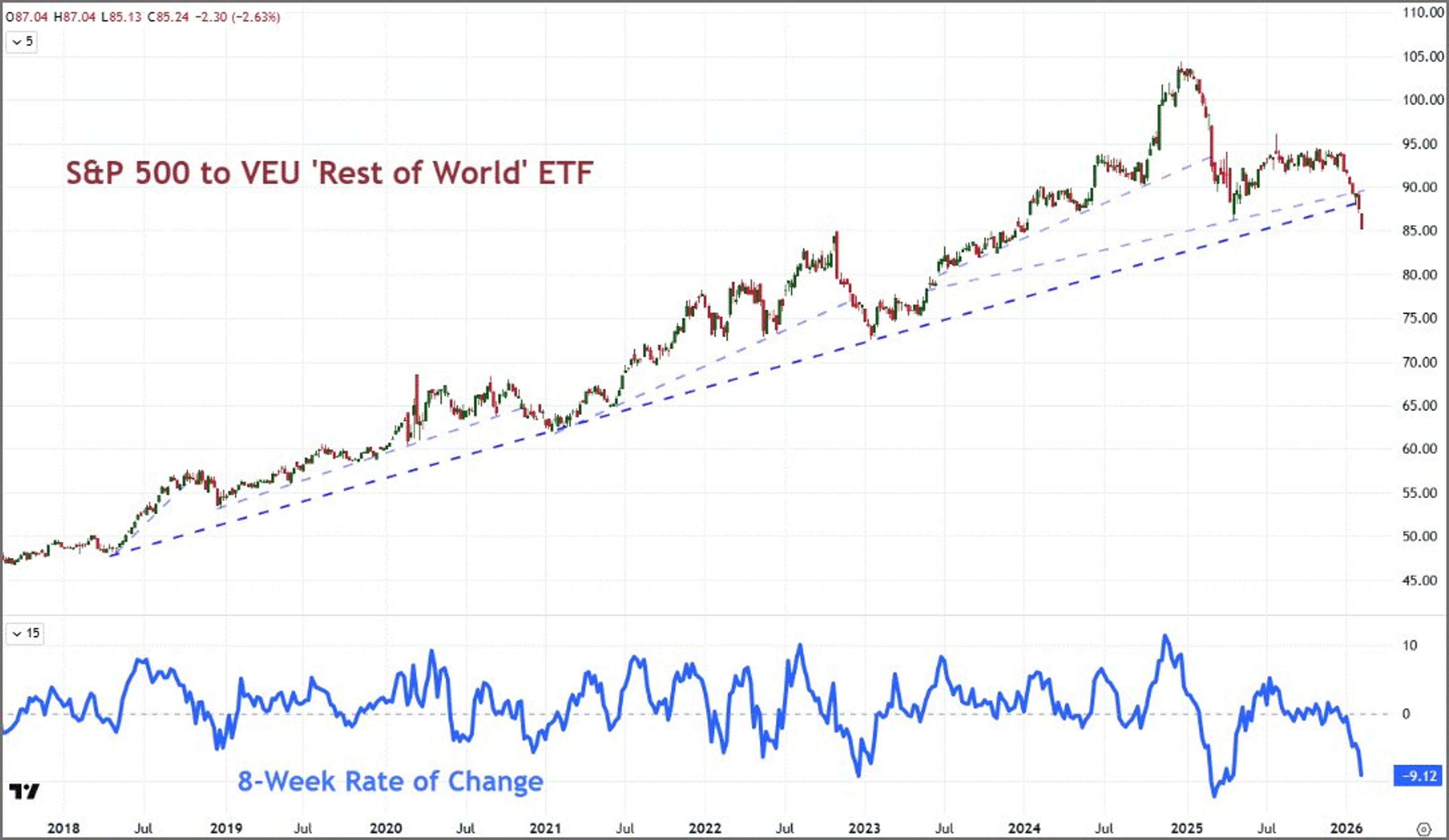

Weekly S&P 500 Chart Review Highlights Key Trends

ICYMI: Weekly S&P500 #ChartStorm blog post https://t.co/B5a4uBC2Q4 Thanks + follow reco to chart sources @MarketCharts @topdowncharts @dailychartbook @MauiBoyMacro @KobeissiLetter @StealthQE4 @HayekAndKeynes

By Callum Thomas

Social•Feb 16, 2026

Sector Rotation Ends; Brace for Upcoming Volatility

Given I timed the sector rotation with precision in Nov & said it would likely run until Feb, and we are here, I'm gonna share what else I also told clients: IN LIEU OF SECTOR ROTATION, THERE WILL BE VOLATILITY™️😉

By Samantha LaDuc

Social•Feb 16, 2026

Alphabet and Meta CDS Explode From Zero to Top Traders

A year ago, CDS on Alphabet and Meta didn't exist. Now they're among the most actively traded single-name contracts in the US market Nobody creates a default insurance market for fun... $GOOG $META

By JunkBondInvestor

Social•Feb 16, 2026

AI Disruption Drives Widening Credit Spreads Ahead of Earnings

AI disruption is hitting IG credit spreads, not just stock prices. Concentrix: BBB-rated, 455,000 call center employees. Paid 130bps concession to refinance. Stock down 24% last week. Spreads doubled in February. Credit markets pricing obsolescence before it shows up in earnings.

By JunkBondInvestor

Social•Feb 16, 2026

Amazon's High Capex-to-FCF Isn't New, Still Managed Well

Working on my $AMZN growth thesis report for this week, and just helpful to point out, that this high capex to FCF is not uncharted territory for Amazon. I get there is more competition this time than e-comm but they...

By Ben Bajarin

Social•Feb 16, 2026

Eight Formulas Cut Reporting From Hours to Minutes

They told me their reports take 6 hours. I showed them 8 formulas. Now it takes 10 minutes. Join my free masterclass with Ramp on February 19th 👉 https://t.co/Aw0QFfIbL0 I've seen this pattern dozens of times. Smart FP&A teams. Good analysts. Solid finance...

By YourCFOGuy

Social•Feb 16, 2026

Reeves Gains Momentum as UK Debt Interest Falls

UK’s Reeves is set to get a boost from falling debt interest https://t.co/iirQy0fcBA via @PhilAldrick https://t.co/R8A0t6Sj29

By Zöe Schneeweiss

Social•Feb 16, 2026

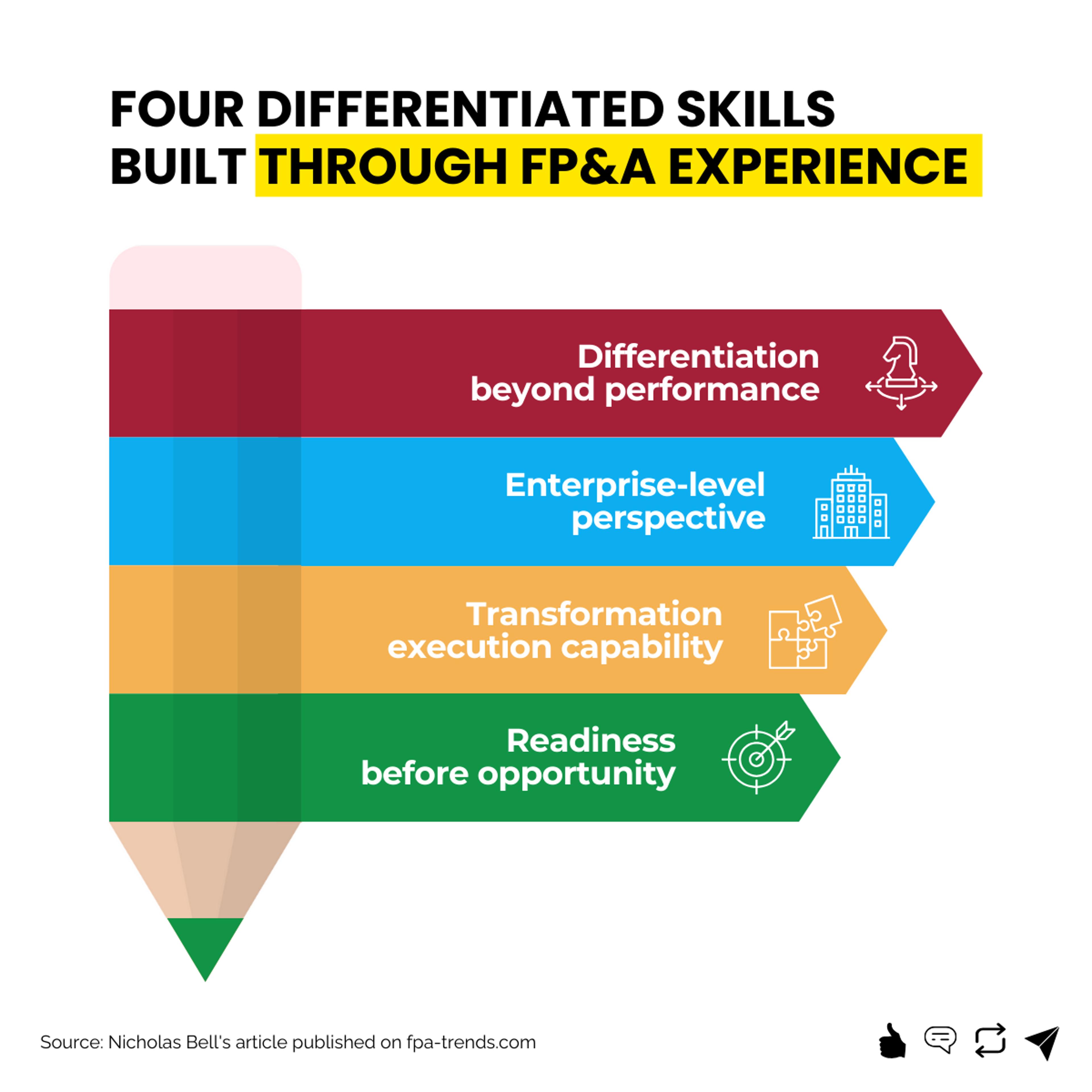

Stand Out in FP&A: Unique Capabilities Beat Plateau

Why do FP&A careers plateau? Not because of performance—but because, at promotion time, top finance talent starts to look alike. Nicholas Bell (Clyde & Co), on the capabilities that set him apart on his path to Head of FP&A. 🔗 https://t.co/w8xraVQKjD #fpatrends #FinanceCareers https://t.co/BYjczXwbsO

By Larysa Melnychuk

Social•Feb 16, 2026

Bobby Jain Launches $6B Multi‑strat Amid Portfolio Shift

Hedge fund portfolios are being shaped by the shift from banks, multi-manager scale, and public/private convergence. Bobby Jain (CEO/CIO, Jain Global) on launching a $6B multi-strat, talent & risk management, and portfolio construction. https://t.co/BfZsVcl2vY With thanks to @AlphaSenseInc, @MorningstarInc, and Ridgeline.

By Ted Seides

Social•Feb 16, 2026

Chamath's SPACs Crash: All Lose Over 90%

Meanwhile Chamath Palihapitiya’s SPAC track record - Chamath became the face of the SPAC boom through his Social Capital Hedosophia deals. Their performance since? • $SPCE: −95% • $OPEN: −98% • $CLOV: −90% • $SOFI: −45% • $AKLI: −95% •...

By Doug Kass

Social•Feb 15, 2026

Start with Reg D, Then Reg CF, Then Reg A+

How to raise capital online: 1: Start with Reg D 506(c) 2: Move into a Reg Cf 3: Move into a Reg A+ This is ordered by the fastest, easiest and most cost effective way to raise online. Companies with...

By Darren Marble

Social•Feb 15, 2026

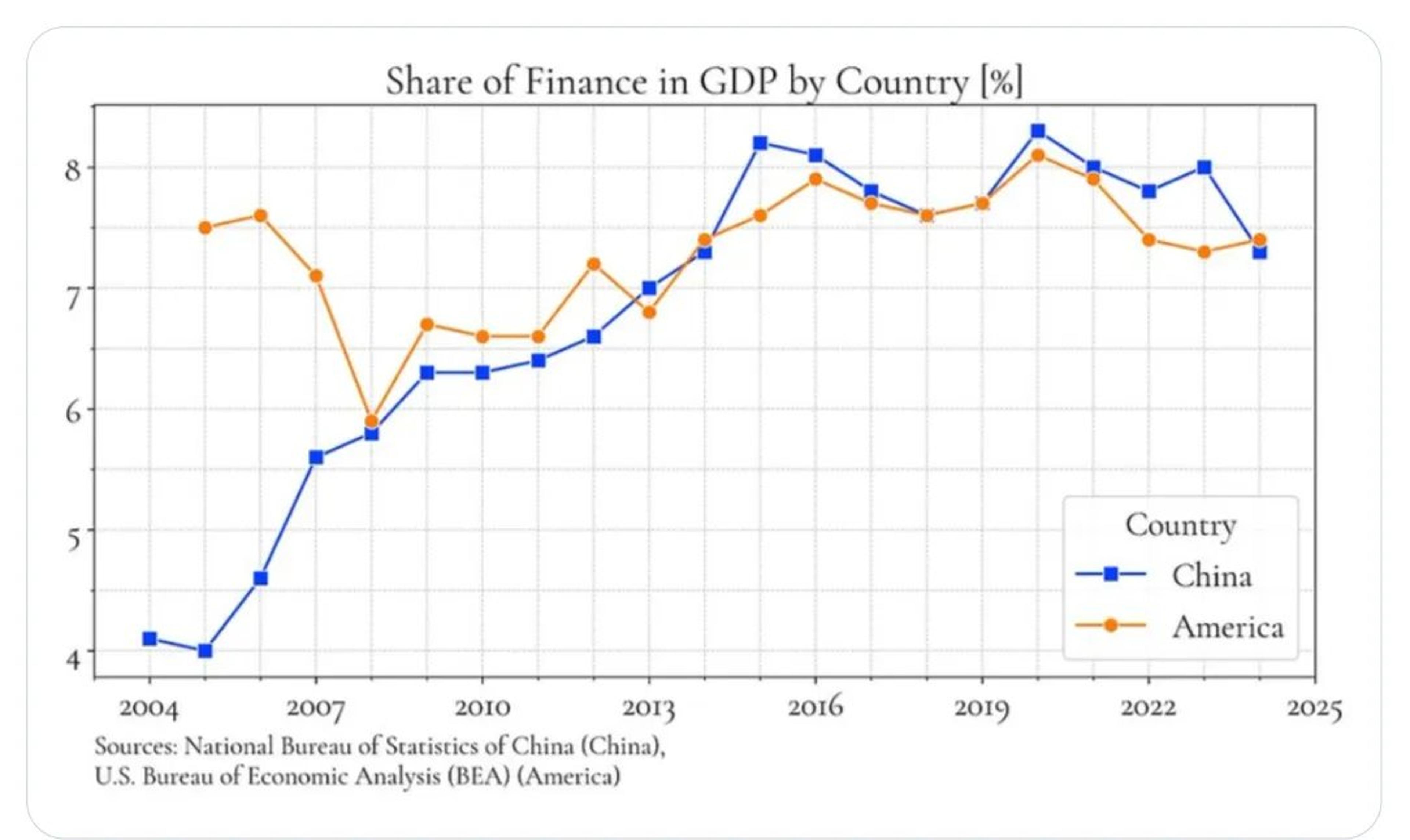

US‑China Gap Lies Beyond Financialization Share of GDP

Whatever the difference between the US and China may be and however you evaluate it, it isn’t in “financialization”, at least not as measured by the share of finance in GDP (h/t twitter account of devarbol for this graph). More...

By Adam Tooze

Social•Feb 15, 2026

S&P's Calm Mask Hiding Rising Dispersion and Volatility

The S&P 500 may appear calm on the surface, yet index-stock dispersion has increased dramatically and SPX has now slipped below the critical 6,900 level. With put skew rising and VIX expiration ahead, volatility risk is building. Read our latest...

By Brent Kochuba

Social•Feb 15, 2026

Volatility Rises, Liquidity Dips, US Premium Deflates

What's on tap for the week ahead? An increased frequency of volatility meets a holiday liquidity gap, while a run of event risk weighs in on the steadily deflating US premium. https://t.co/17IH2lFIn0 https://t.co/AlKhX25xxn

By John Kicklighter

Social•Feb 15, 2026

FTSE250 Awaits Breakout Above 23,585 Amid Sideways Trend

#FTSE250 needs Breakout 23585. Doji going sideways. Support 22816, 22226. RSI 62 not high. 13/21 day EMAs Bullish. Small Up Candle on Weekly and Sideways. Top Bollinger Band 23547. Midpoint Line 23330. Bottom Band 23118.

By WheelieDealer

Social•Feb 15, 2026

DAX Poised for Breakout as MACD Bull Cross Nears

#DAX doji Candle and Sideways. Resistance ATH 25508. Support 24272, 23924. On verge MACD Bull Cross. RSI 53 near Neutral. 13/21 day EMAs Bullish. Doji on Weekly and Sideways. Top Bollinger Band 25113. Midpoint Line 24800. Bottom Band 24500.

By WheelieDealer

Social•Feb 15, 2026

Warner Bros Eyes Paramount Deal Despite Netflix Matching Right

New: Warner Bros. is considering re-engaging with Paramount following its latest offer + pressure from some shareholders. WB still has a binding deal with Netflix, which would have the right to match any offer. Scoop with @MichelleF_Davis https://t.co/WLdpdeS0gc

By Lucas Shaw

Social•Feb 15, 2026

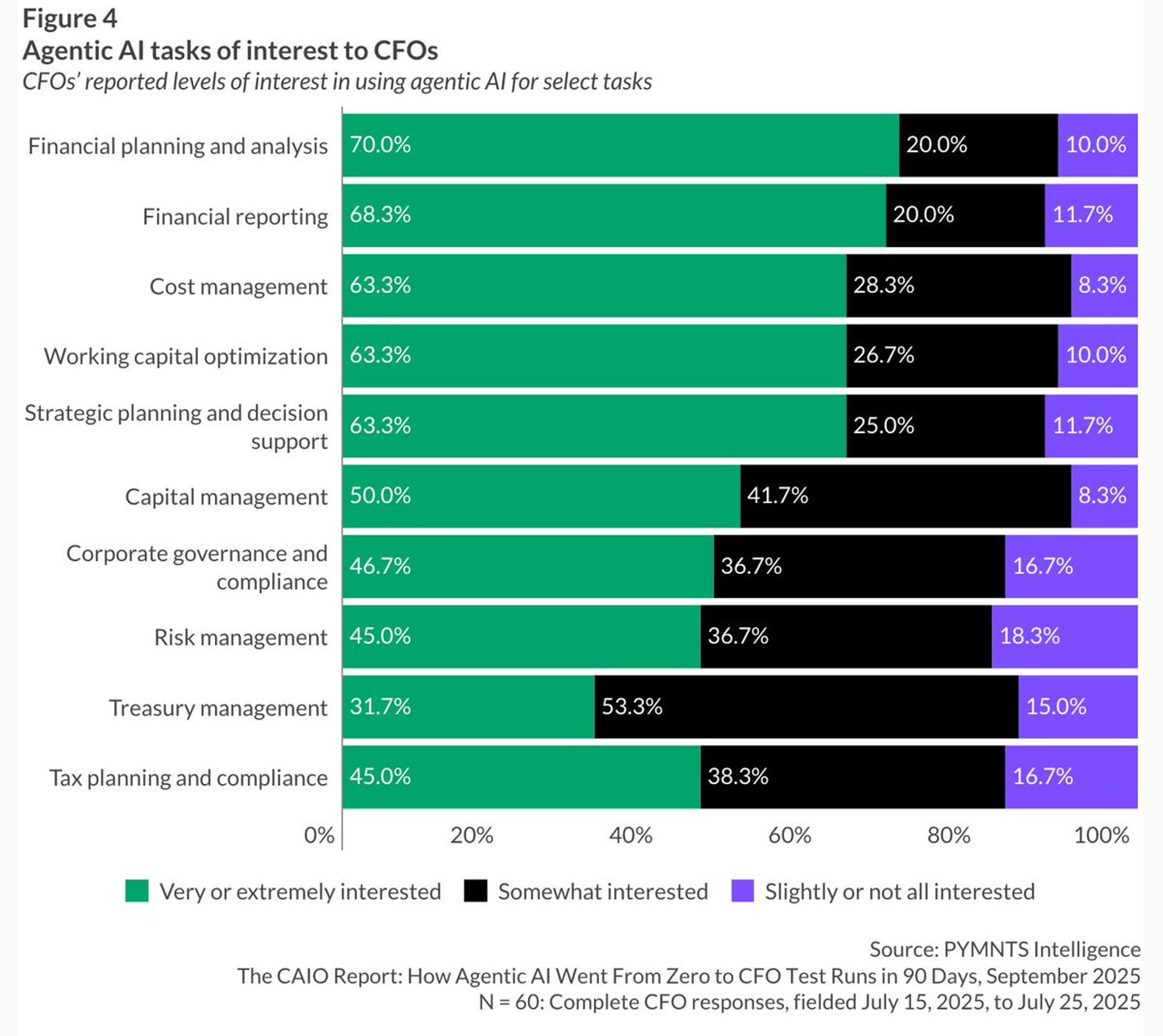

CFOs Embrace Agentic AI for Strategy, Shy From Treasury Risks

How Agentic AI Went From Zero to CFO Test Runs in 90 Days survey by @pymnts https://t.co/6MXgAdb3Fx Enterprise CFOs in the US are interested in using agentic AI for strategic planning, but cautious about using it for treasury, risk and compliance. https://t.co/2NioUOuMrE

By Efi Pylarinou

Social•Feb 15, 2026

Simplify Systems, Not Competition, to Grow Small Business

Most small businesses fail from chaos, not competition. Growth starts with simple systems, clear checklists, and tools for scheduling, invoicing, and bookkeeping. Know your best customers, ask for feedback, and speak in their words. Build a small circle of mentors, track cash flow,...

By Ask Dr. Brown

Social•Feb 15, 2026

Strategists Misread CapEx, Overhype Free Cash Flow

I love how boomer strategists present the chart on free cash flows from the Mag 7 as rocket science. We learned on the first days at university that CapEx means less FCF in that year. Do these guys understand anything whatsoever...

By Andreas Steno Larsen

Social•Feb 15, 2026

Goldman Sachs Makes AI Core of Finance Operations

Goldman Sachs is embedding Anthropic’s Claude into accounting and compliance to automate high volume, rules based back office work. After six months of co building, executives were surprised that AI handled complex financial processes, not just coding tasks. The ambition is clear,...

By Spiros Margaris

Social•Feb 15, 2026

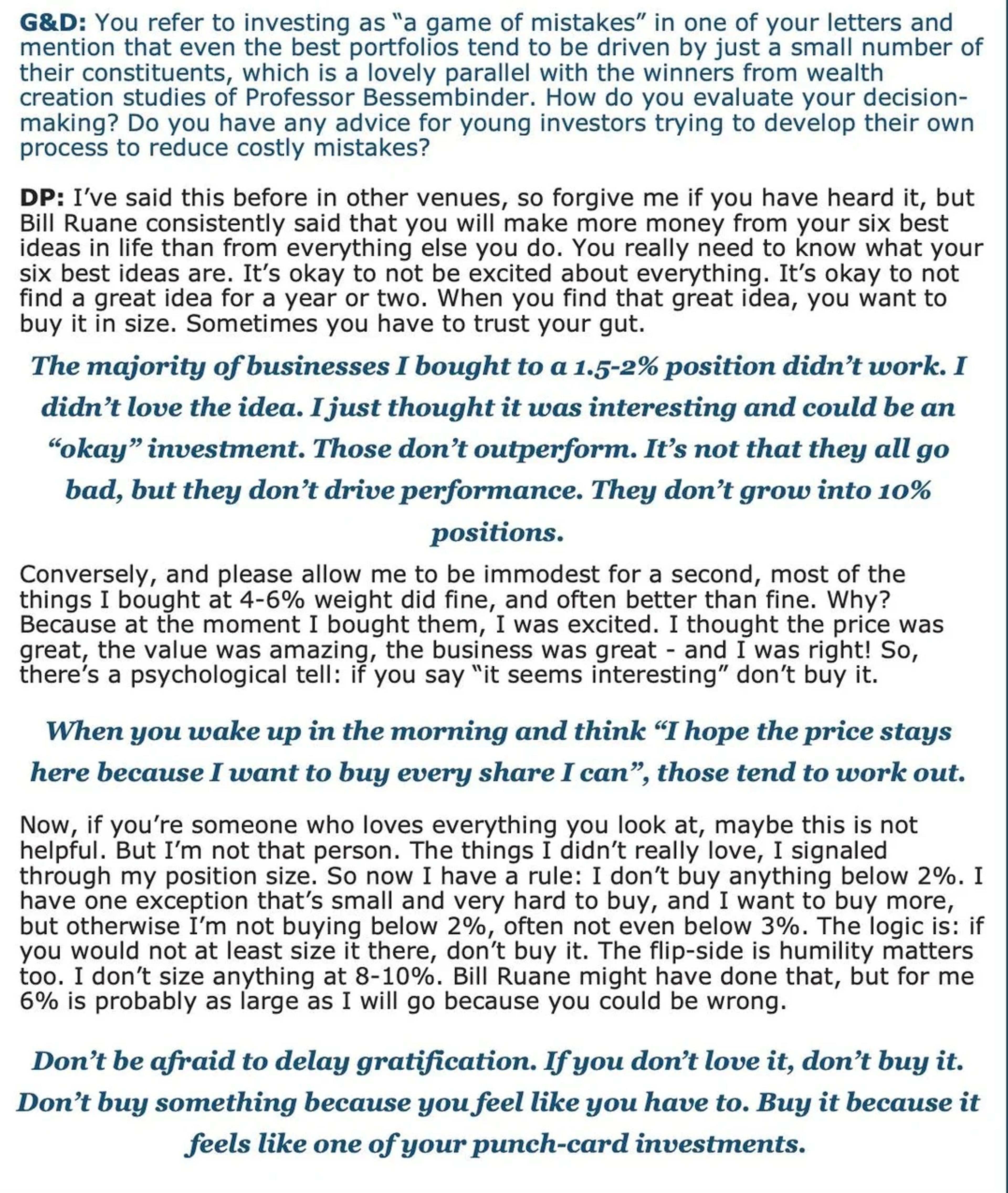

Bet Big on Your Six Best Ideas

David Poppe on capital allocation "You will make more money from your six best ideas in life than from everything else you do. When you find that great idea, you want to buy it in size."

By Matt Harbaugh

Social•Feb 14, 2026

More Analysis, Fewer Dashboards: Solve the Real Problem

I've worked as a Sr. Director of BI and Analytics and I had to learn something the hard way. Despite what business stakeholders say, another dashboard is rarely the right answer to their needs. Why? Because what's behind the ask is a misconception...

By David Langer (Dave on Data)

Social•Feb 14, 2026

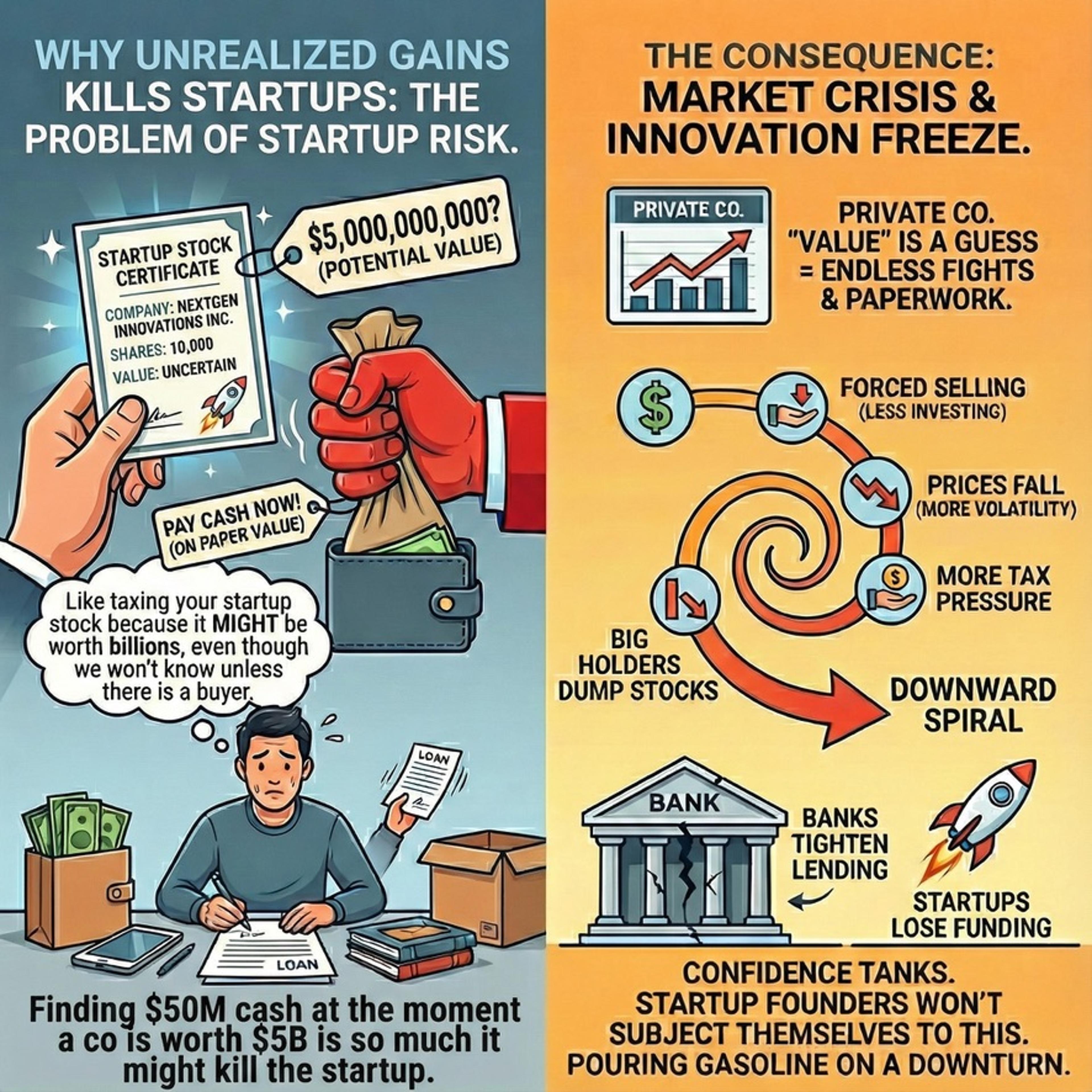

Unrealized Gains Tax Threatens New Investments Globally

Unrealized gains tax is a mega-drag on new investments. The same reason why the California Asset Seizure Tax by SEIU-UHW is going to destroy startups is happening in the Netherlands. https://t.co/jMgP3ieI2G

By Garry Tan

Social•Feb 14, 2026

Burn Rate Equals Risk; VC Burn Rates at Historic Highs

Burn rate = risk. So of course, this is true. These are the highest burn rates in history of VC. Simple fact. https://t.co/IrsIBd0qDC

By Bill Gurley

Social•Feb 14, 2026

Gift High‑basis Assets Now, Transfer Low‑basis at Death

I can think of half a dozen reasons why it is NOT a mistake to gift a house to a child before passing. Why? Because these decisions are fact and portfolio dependent, and always/never advice is rarely reliable when it...

By Prof. Victoria J. Haneman

Social•Feb 14, 2026

REITs Hit Decade‑Low Valuations: Rare Investor Opportunity

REITs are currently trading at their lowest valuations in decades. The vast majority of investors are not positioned to take advantage of this historic opportunity. 🧵Here's a 'Mini Masterclass' on how to take advantage:

By Dividendology

Social•Feb 14, 2026

Buy Manappuram on Pullbacks Amid RBI

Macro: PE flows target Indian NBFCs. RBI cleared Bain's up to 41.7% in Manappuram; ₹43.85bn injected. Risk: regulatory scrutiny. Trading insight: buy Manappuram on pullbacks. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

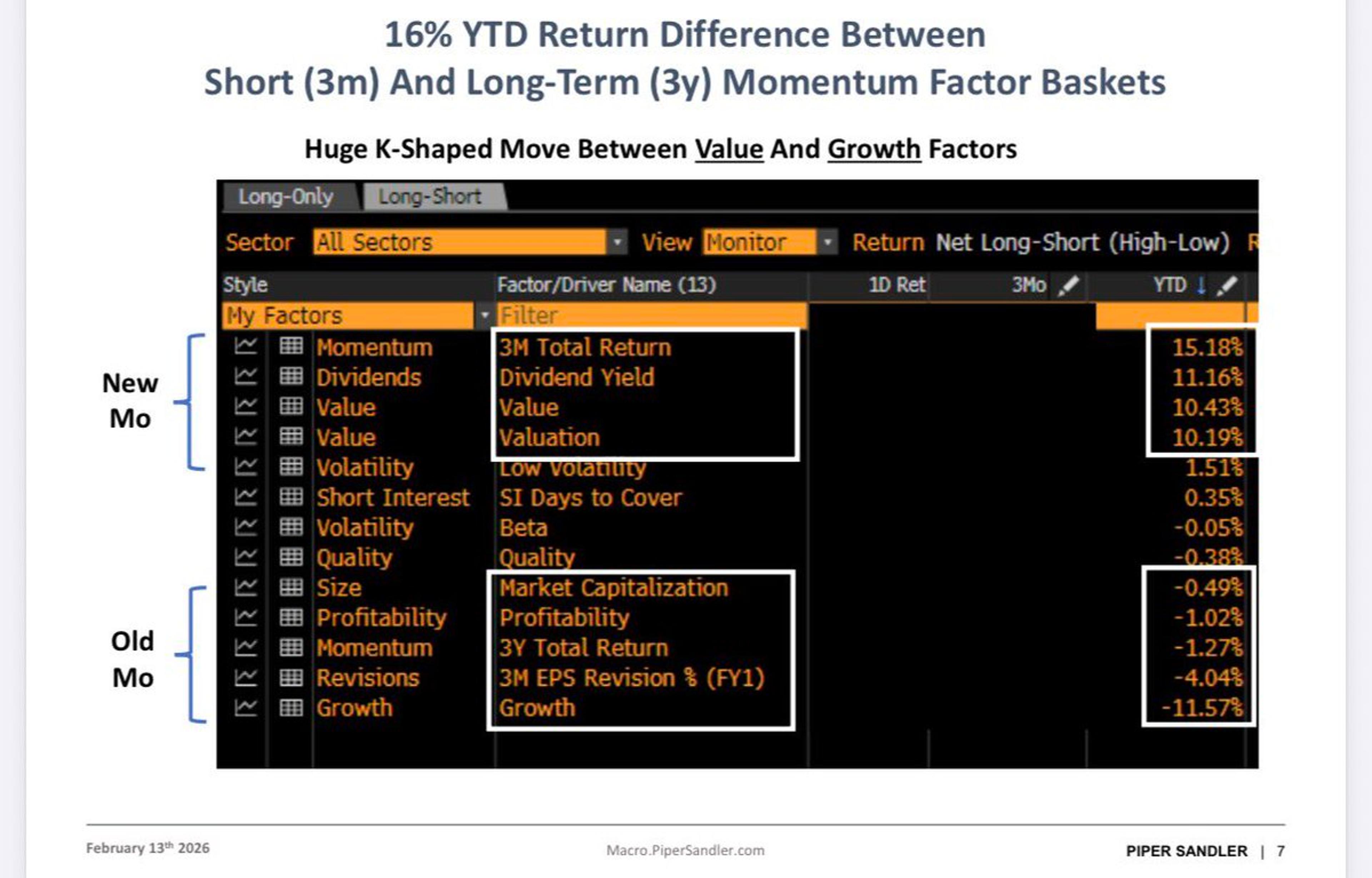

Value Tilt Gains as Momentum Spread Widens 16%

Classic monotonic pattern. When you see this pattern you know with a higher degree of certainty that it is one of THE drivers of how investors are positioning their portfolios. We’ve been recommending a value tilt since last fall, as...

By Michael Kantro