FinovateEurope 2026 to Gather 1,000+ Fintech and Banking Decision-Makers in London

•January 24, 2026

0

Companies Mentioned

Why It Matters

FinovateEurope serves as a critical hub where traditional financial institutions and emerging fintech innovators converge, accelerating technology adoption and partnership opportunities across the sector.

Key Takeaways

- •Over 1,000 fintech and banking leaders attending

- •More than 30 live seven‑minute product demos

- •100+ speakers from major banks and venture firms

- •Audience‑voted “Best of Show” awards spotlight innovation

- •App‑driven networking includes roundtables, one‑to‑one meetings

Pulse Analysis

FinovateEurope has become a bellwether for the pace of digital transformation in financial services. By gathering a concentrated mix of banks, asset managers, and venture‑backed startups in a single London venue, the conference creates a micro‑ecosystem where emerging technologies are vetted in real time. The live demo format forces companies to distill complex solutions into seven‑minute showcases, offering attendees a rapid pulse on innovations ranging from AI‑driven fraud detection to open‑banking APIs. This intensity not only highlights the most market‑ready products but also drives competitive pressure that accelerates product iteration across the industry.

The event’s speaker roster underscores the strategic importance of fintech collaboration for legacy institutions. Executives from Citi, Raiffeisen, and Rabobank are sharing insights on venture investments, transformation roadmaps, and open‑innovation frameworks, signaling a shift from siloed development to ecosystem‑centric growth. Their participation validates the relevance of fintech partnerships in achieving cost efficiencies, enhancing customer experience, and meeting regulatory expectations. Moreover, the audience‑voted "Best of Show" awards provide a crowd‑sourced endorsement that can catapult emerging firms into the radar of potential corporate partners and investors.

Beyond the formal program, FinovateEurope’s networking infrastructure—bolstered by a purpose‑built app—facilitates high‑value interactions that often translate into strategic alliances or funding rounds. One‑to‑one meetings, roundtables, and informal social sessions create fertile ground for serendipitous deals that might not emerge in larger, less focused conferences. As banks continue to modernize legacy stacks and fintechs seek scale, the event’s blend of education, demonstration, and connection positions it as a pivotal catalyst for the next wave of financial innovation.

FinovateEurope 2026 to Gather 1,000+ Fintech and Banking Decision-Makers in London

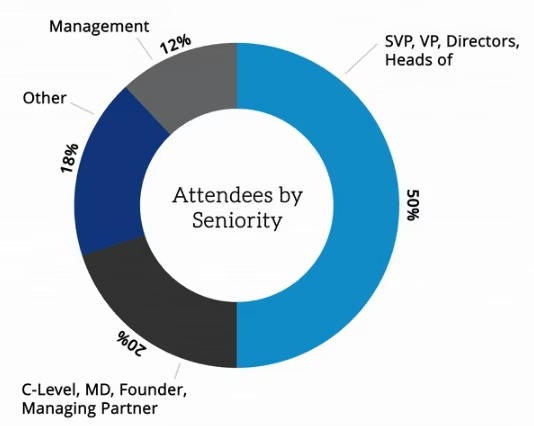

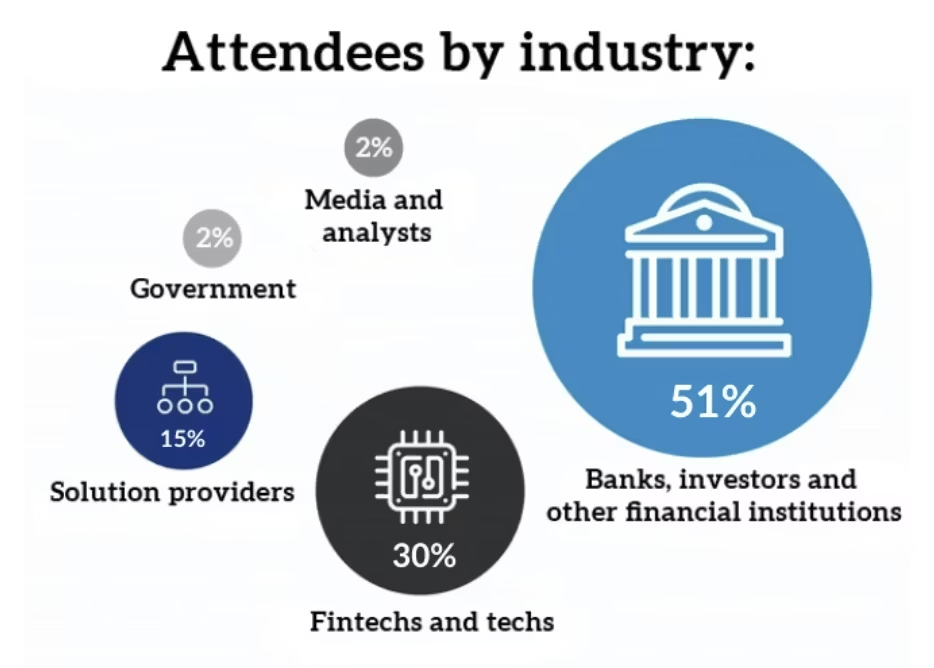

FinovateEurope will take place on 10–11 February 2026 at the InterContinental London – The O2, bringing together more than 1,000 participants from across the financial services and fintech sectors. The event is expected to include over 600 senior executives, directors, and decision‑makers from banks, investment firms, and financial institutions.

The programme will feature more than 30 live fintech demos, alongside a two‑day agenda focused on developments in financial technology and digital financial services.

A gathering of industry leaders

The 2025 edition of FinovateEurope drew representatives from institutions including HSBC, Barclays, Lloyds Banking Group, Citi, Bank of America, JPMorgan Asset Management, BNP Paribas, and Commerzbank. Speakers from these and other organisations participated in main‑stage sessions and thematic tracks addressing shifts in financial services and technology adoption.

The 2026 agenda will include more than 100 speakers, including Victor Alexiev, Global Head Venture Investments and Partnerships at Citi; Vanja Tokic, Senior Expert Transformation Manager at Raiffeisen Bank International; Jacek Wieclawski, Head of Innovation, Markets at Rabobank; Dimitri Masin, CEO at Gradient Labs; Greta Anderson, Principal at Balderton Capital; and others.

Live demos remain a core feature

Live product demonstrations remain central to the Finovate format. More than 30 companies are scheduled to present seven‑minute demos of their technologies, covering areas such as payments, lending, customer experience, and infrastructure.

Audience voting at the end of the first day will determine the recipients of the “Best of Show” awards. At the 2025 event, the awards went to Keyless, R34dy, and Tweezr, recognised for solutions in authentication, integration, and legacy system management.

Networking and peer exchange

Alongside the conference programme, FinovateEurope includes structured and informal networking opportunities, including one‑to‑one meetings, roundtable discussions, and social sessions at the end of each day.

Participants will also have access to a dedicated event app ahead of the conference, designed to support meeting scheduling, contact exchange, and post‑event follow‑up.

Industry perspective

“One of my favourite parts about Finovate is that it’s the Goldilocks of conferences — big enough that your schedule fills up, but small enough for serendipitous encounters,” said Jason Henrichs, CEO of Alloy Labs.

0

Comments

Want to join the conversation?

Loading comments...