Talk Your Book: The Three A’s of the U.S. Economy

•February 9, 2026

0

Why It Matters

Understanding the three A’s helps investors anticipate structural shifts in earnings and market dynamics, while the Motley Fool’s long‑term playbook offers a practical path to capture those trends.

Key Takeaways

- •Asset prices, AI, affluent consumers drive market trends

- •AI may level playing field for midsize firms

- •Motley Fool strategy emphasizes long‑term diversified holdings

- •Regulation could shield software firms from AI disruption

- •Capital efficiency correlates with superior long‑term returns

Pulse Analysis

The U.S. economy is increasingly defined by three interlocking forces: rising asset prices, rapid AI adoption, and a growing affluent consumer base. Together they create a feedback loop that lifts equity valuations while reshaping demand patterns across sectors. Investors who recognize how these "three A’s" interact can better position portfolios for both growth and resilience, especially as AI begins to influence pricing power and operational efficiency.

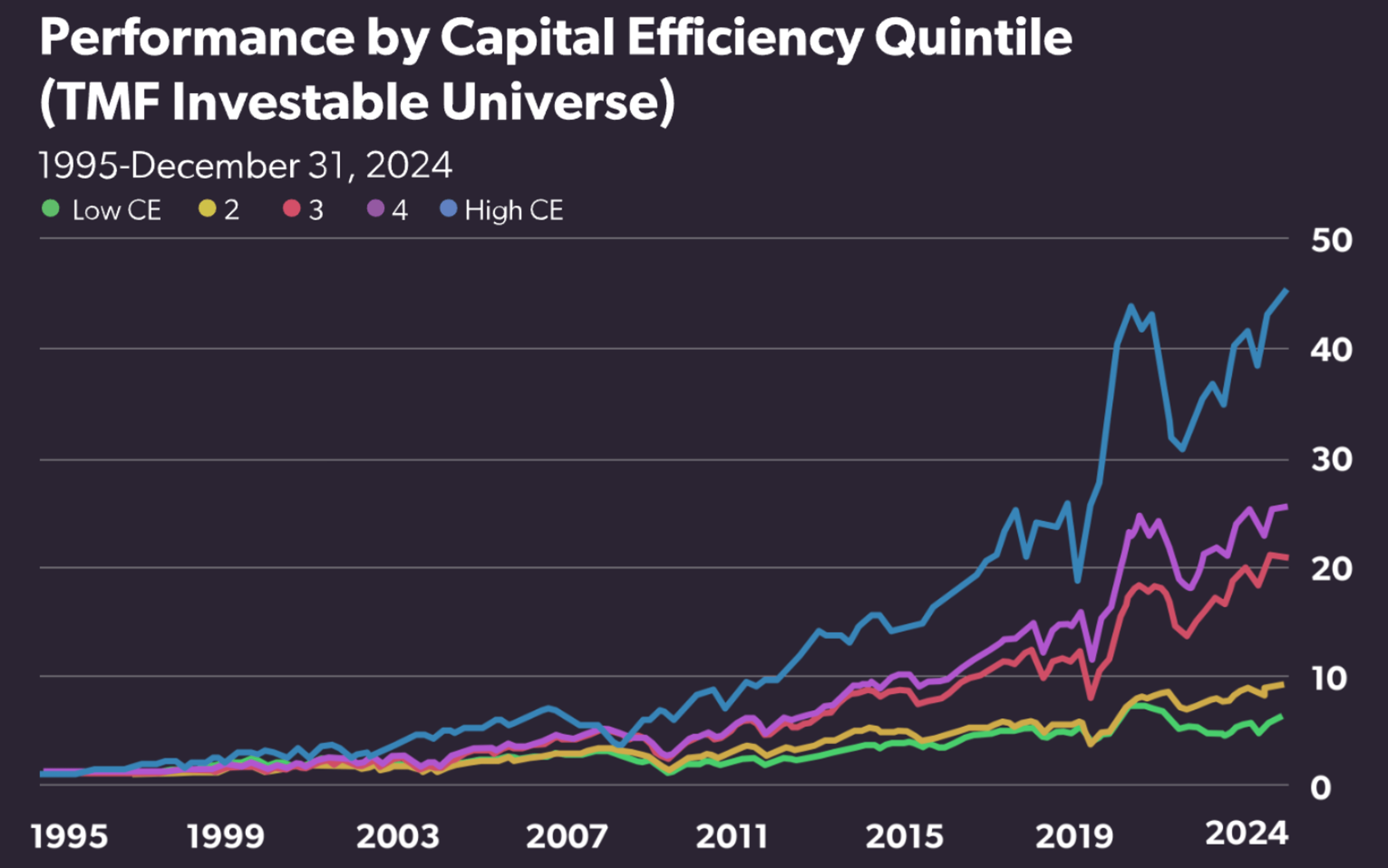

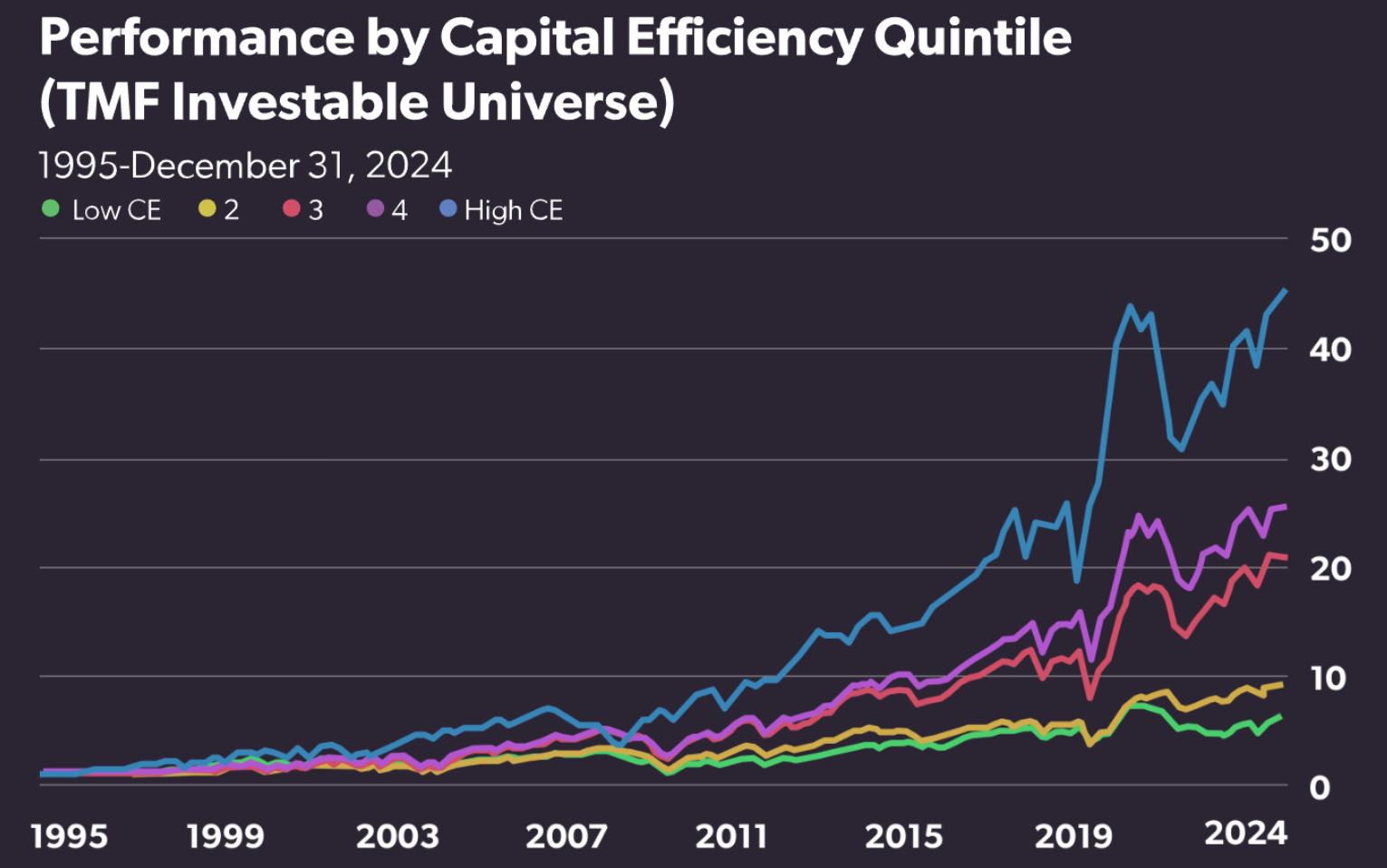

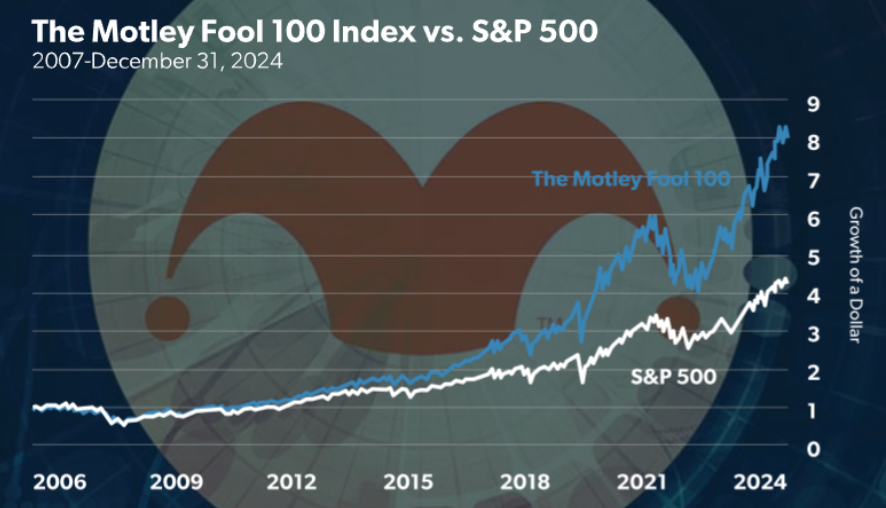

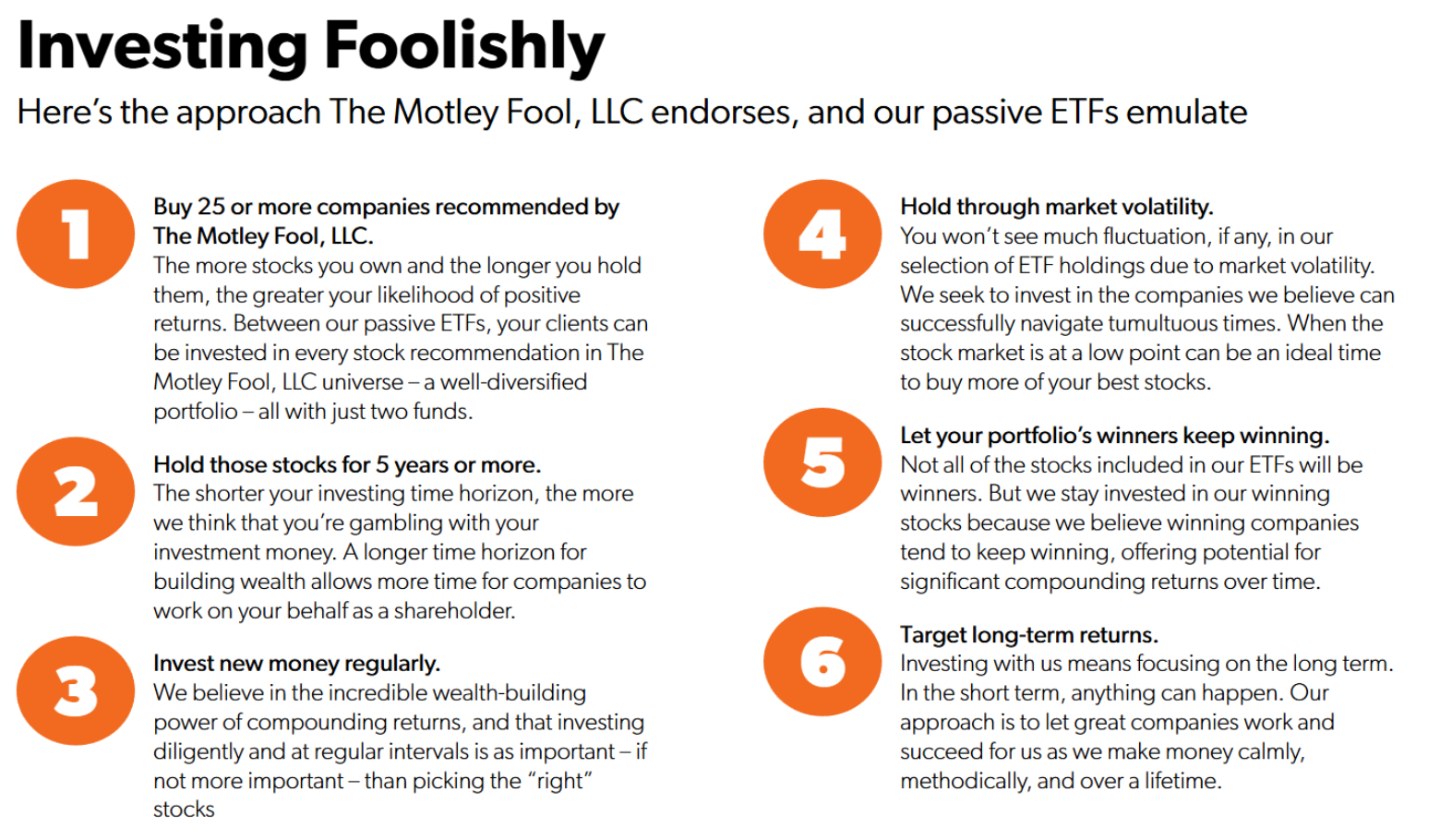

Valuing the world’s largest companies now requires a lens that blends traditional fundamentals with capital efficiency metrics. Research cited in the episode shows that firms in the highest capital‑efficiency quintile have consistently outperformed broader markets since the mid‑1990s. The Motley Fool’s approach leverages this insight, recommending a basket of at least 25 high‑quality stocks held for five years or more, with regular contributions and a disciplined stance through volatility. This long‑term, diversified methodology aims to capture compounding returns while minimizing the impact of short‑term market noise.

Regulatory scrutiny and AI disruption present a dual challenge for software and tech firms. While AI can democratize capabilities for smaller players, it also threatens incumbents whose business models rely on legacy software. Thoughtful regulation could provide a safety net, preserving competitive balance and protecting intellectual property. For investors, the key takeaway is to seek companies with strong moat characteristics, adaptable AI strategies, and exposure to affluent consumer spending, ensuring they remain well‑positioned in an evolving economic landscape.

Talk Your Book: The Three A’s of the U.S. Economy

Today’s Talk Your Book

On today’s show we discuss:

-

The three A’s driving markets: asset prices, AI, and the affluent consumer

-

The broadening out we are seeing in the market

-

How to think about valuing the largest companies in the world

-

Is AI the tool that levels the playing field for small and mid‑sized companies?

-

The thesis behind Motley Fool Asset Management portfolios

-

Can regulation protect software companies from being replaced by AI?

-

The power of looking for great companies and letting them work for you over the long term

Listen here:

https://podcasts.thecompoundnews.com/show/animalspirits/

Charts

0

Comments

Want to join the conversation?

Loading comments...