U.S. Secretary Of State: Brazil & China To 'Trade In Own Currencies & Get Around The Dollar'

•February 10, 2026

0

Why It Matters

The move toward non‑dollar trade threatens the U.S. dollar's dominance and the leverage it provides through sanctions, reshaping global financial power balances. For investors in gold and silver, reduced dollar reliance could drive demand for these safe‑haven assets, making the episode especially relevant as markets anticipate heightened volatility and price appreciation.

U.S. Secretary Of State: Brazil & China To 'Trade In Own Currencies & Get Around The Dollar'

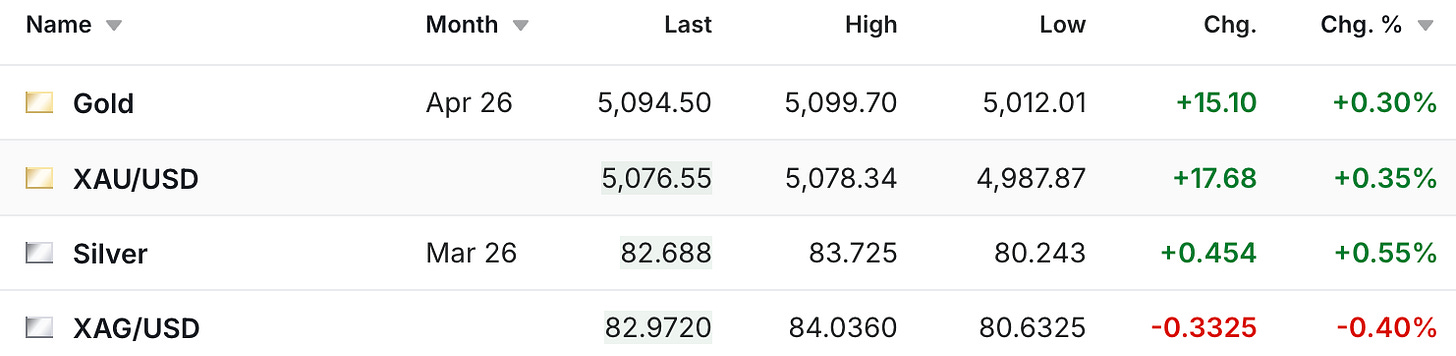

It’s somewhat of a quiet morning in terms of the gold and silver pricing, at least relative to what we’ve grown accustomed to over the past year, with the gold futures up $15 to $5,094, while the silver futures are up 45 cents to $82.69.

[

](https://substackcdn.com/image/fetch/$s_!Sru4!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F68b4d9d4-1485-4772-87e2-8c020804124b_1482x362.png)

I chuckled as I was writing that first paragraph, as I was remembering back about 10 years ago when gold being up $15 in a day would have had the whole precious metals industry buzzing. Yet now it’s almost as if a $15 move in the gold price is essentially a ‘flat’ day in the market, and similar with silver, where anything less than a dollar up or down feels like an opportunity to catch your breath.

So get a breather while you can, because on a day where not too much is happening with the pricing, the world is waking up to U.S. Secretary of State Marco Rubio explaining what’s going to drive the gold and silver volatility over the next few years and decades, and in my own opinion, likely driving the prices of both metals significantly higher over time.

[

](https://x.com/ricwe123/status/2021135998508204436)

Today, Brazil, in our hemisphere, the largest country in the Western Hemisphere south of us, cut a trade deal with China.

They’re going to from now on do trade in their own currencies and get right around the dollar.

They’re creating a secondary economy in the world, totally independent of the United States.

We won’t have to talk about sanctions in five years because there’ll be so many countries transacting in currencies other than the dollar, that we won’t have the ability to sanction them.

Keep in mind, that’s not from uncle Chuckie’s gold and silver garage blog. That’s the current secretary of state, and it also falls in line with and helps explain some of the recent comments we’ve heard from Trump, Scott Bessent, and Howard Lutnik about their plans and seriousness around securing the strategic metals that they need.

Additionally, if these countries are going to be transacting outside of the dollar, what do you think could be viewed as one of the currencies that they might sell dollars to buy?

0

Comments

Want to join the conversation?

Loading comments...