Electronics Exporters Can Grab a Greater Share of the US, EU Markets: Niti Aayog Report

•February 13, 2026

0

Why It Matters

The tariff advantage and new trade pacts create a realistic pathway for India to expand high‑value exports, reshaping global supply chains and supporting its $500 bn manufacturing ambition.

Key Takeaways

- •US/EU tariffs favor Indian electronics exporters

- •India holds ~1% of global electronics market

- •Policy push aims for component‑led manufacturing

- •Target: $500 bn electronics output by FY2030

- •Trade deals open $1.6 tn market opportunity

Pulse Analysis

The United States and the European Union together represent a $1.6 trillion electronics market, roughly one‑third of global demand. Recent trade developments—the conclusion of the India‑EU Free Trade Agreement and a modest 18 % U.S. tariff on Indian products—give India a pricing edge over rivals such as China, Vietnam, Mexico and Thailand, whose tariffs sit at 19‑25 %. This differential reduces landed costs for Indian components, creating a timely window for exporters to expand market share in the world’s most lucrative regions.

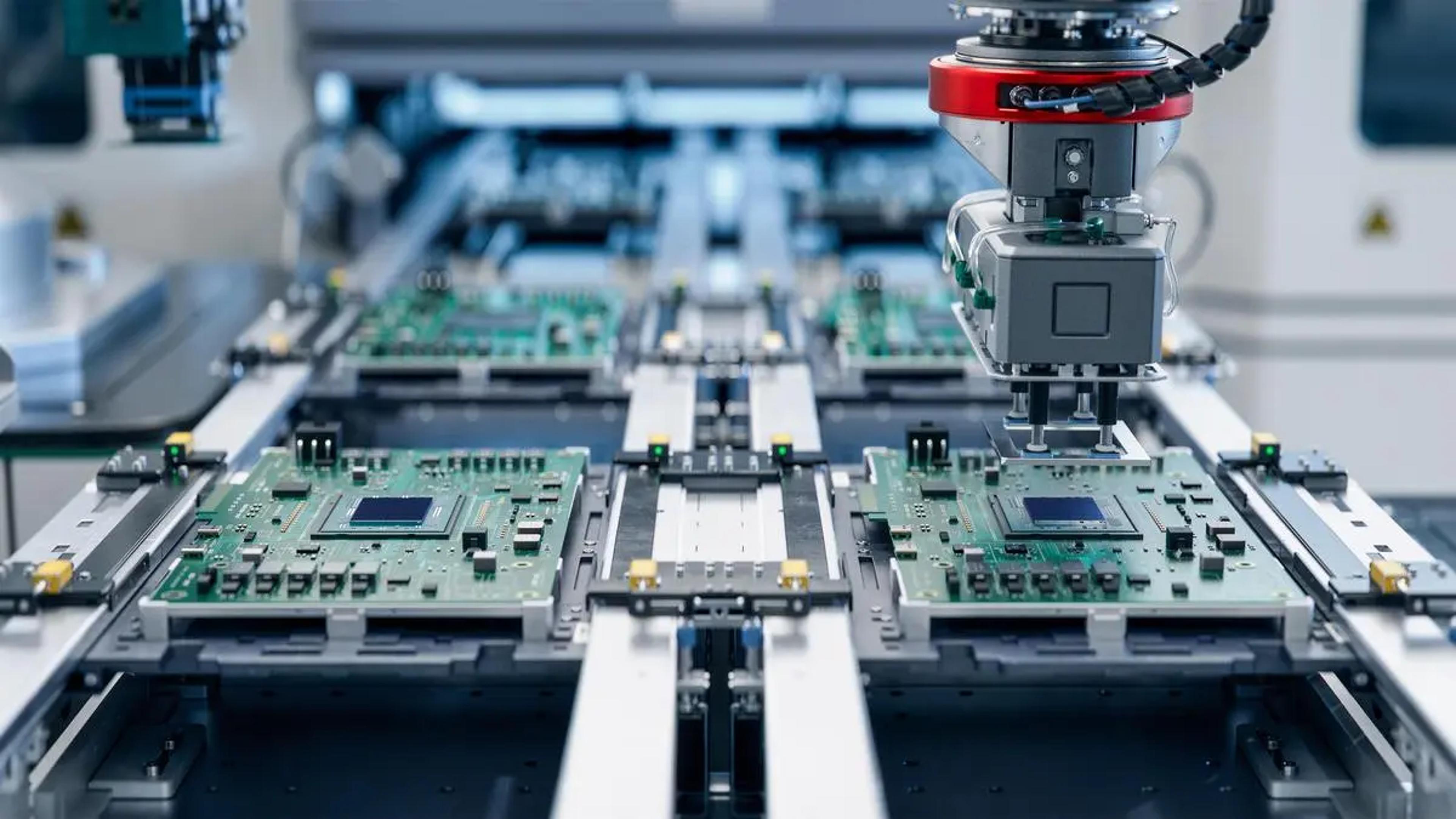

Niti Aayog’s report stresses that India must move beyond assembly‑centric growth toward component‑led manufacturing to capture this opportunity. Initiatives such as the Electronics Component Manufacturing Scheme, the semiconductor mission, and customs‑duty rationalisation aim to boost domestic R&D, technology transfer and scale‑up of integrated‑circuit production. However, structural cost gaps, fragmented logistics and limited export finance still constrain competitiveness. Aligning fiscal incentives with ecosystem development, simplifying regulations, and securing predictable domestic procurement are seen as essential steps to close the gap with China, Taiwan and Hong Kong.

The $500 billion manufacturing ambition set for FY 2030 hinges on converting tariff advantages into sustained export volumes. For multinational investors, the emerging Indian electronics ecosystem offers a lower‑cost sourcing alternative and a foothold in two of the world’s largest consumer markets. Success will depend on coordinated trade, fiscal and logistics reforms that lower overall cost structures and improve supply‑chain reliability. If achieved, India could lift its global electronics share from 1 % toward a meaningful position, reshaping the competitive landscape and reinforcing its strategic importance in the post‑pandemic tech economy.

Electronics exporters can grab a greater share of the US, EU markets: Niti Aayog report

Urges shift from assembly‑led gains to component‑led manufacturing · Updated · February 13 2026 at 09:37 PM · New Delhi

India’s electronics sector is positioned for a major export surge to the US and the European Union, leveraging strategic trade pacts to capture a larger slice of their $1.6 trillion combined market, according to Niti Aayog’s trade‑watch quarterly report released on Friday.

The conclusion of the India‑EU Free Trade Agreement and lower reciprocal tariffs imposed by the US on Indian suppliers compared to those from China, Vietnam, Mexico and Thailand presents a timely opportunity for Indian electronics manufacturers to deepen their penetration into the two markets, the report noted.

“The United States and the EU together account for a substantial share of global demand in the electronics sector, with a combined market size of approximately $1.6 trillion. This represents around one‑third of total global electronics demand, highlighting the strategic importance of these markets for India’s electronics export ambitions,” the report stated.

Tariff edge

At present, the US imports electronics largely from countries such as China, Mexico, Vietnam, Malaysia, and Thailand. However, reciprocal tariff rates applied by the US on these suppliers remain higher than those imposed on India—around 20 % on China and Vietnam, 25 % on Mexico, and nearly 19 % on Thailand—compared with a relatively lower tariff rate of 18 % for India, the report added.

“This relative tariff advantage, both in the US and the EU, improves India’s cost competitiveness and presents a timely opportunity for Indian electronics manufacturers to scale up exports and capture a larger share of global electronics trade,” the report said.

India’s share in the $4.6 trillion global market for electronics is just about 1 %, based on 2024 exports worth $42 billion from the country. Key markets for high‑tech components like integrated circuits and semiconductors remain dominated by China, Hong Kong, and Taiwan.

$500‑billion ambition

The study noted that recent policy initiatives—including the Electronics Component Manufacturing Scheme, the semiconductor mission, customs‑duty rationalisation, and support for e‑commerce exports—signal a strategic push to move India up the electronics value chain. However, India’s electronics strategy must transition from assembly‑led gains to component‑led manufacturing, it said.

“On the supply side, incentives need to be aligned toward domestic value addition, sustained R&D, and ecosystem deepening supported by anchor investments that transfer technology, improve standards, and generate stable demand for local suppliers,” the study suggested.

It added that coordinated fiscal, trade, and logistics reforms are essential to close persistent structural cost gaps and improve cost competitiveness.

“On the demand side, while recent FTAs improve external market access, greater emphasis is required on predictable domestic procurement, export finance, and regulatory simplification to attract investments especially in a turbulent geopolitical environment. These measures can anchor India’s transition from a manufacturing base to a globally competitive electronics ecosystem and support the $500 bn manufacturing ambition by FY 2030,” it said.

Published on February 13 2026

0

Comments

Want to join the conversation?

Loading comments...