Mining Stocks Dominate TSXV’s Top Performers List

•February 18, 2026

0

Companies Mentioned

Why It Matters

The performance underscores Canada’s role as the premier financing hub for early‑stage resource companies, signaling strong capital flow into the metals that underpin global supply chains and clean‑energy technologies.

Key Takeaways

- •Mining firms made up 48 of 51 top TSXV performers.

- •Average miner share price rose 443% in 2025.

- •Liquidity doubled, 13.2B shares traded, $1.5B raised.

- •Gold, silver, rare earths drove gains amid high commodity prices.

- •80% of firms located in Tier‑1 mining jurisdictions.

Pulse Analysis

The 2025 TSX Venture 50 rankings highlight a seismic shift toward natural resources as investors chase security of supply and inflation‑hedging assets. Record commodity prices for gold, silver and rare‑earth elements propelled junior miners to extraordinary valuations, dwarfing the broader market’s 331% average gain. By anchoring the list with 48 mining entries, the exchange demonstrates how early‑stage resource firms have become the flagship growth story on Canada’s secondary market, outpacing traditional technology names.

Underlying this rally are macro‑level forces: heightened geopolitical tensions, aggressive industrial policies, and the accelerating energy transition have amplified demand for critical minerals. Junior companies, especially those operating in Tier‑1 jurisdictions like Canada, the United States and Mexico, benefit from stable regulatory environments and proximity to key processing hubs. The sector’s average share‑price jump of 443% was matched by a surge in liquidity, with trading volumes more than doubling and 43 issuers completing capital raises that collectively exceeded $1.5 billion. These capital inflows not only boost balance sheets but also fund exploration pipelines that will feed the next generation of producing mines.

For investors and policymakers, the data signals that Canada’s TSXV is cementing its status as the world’s leading platform for resource‑focused capital formation. The concentration of junior miners provides a deep talent pool and a robust pipeline of future producers, essential for long‑term supply‑chain resilience. While the upside is compelling, stakeholders must monitor valuation pressures and the potential for commodity‑price volatility. Nonetheless, the current momentum suggests a sustained financing cycle for metals and minerals, positioning the sector as a cornerstone of global economic stability.

Mining stocks dominate TSXV’s top performers list

Metals and mining emerged as one of the defining investment themes of 2025, as supply chain security became a central driver of capital allocation. A broad rotation into natural resources lifted valuations across the sector, enabling many mining companies to deliver outsized returns over the course of the year— including those that have yet to reach production.

On Wednesday, the TSX Venture Exchange (TSXV) — Canada’s primary public market for early-stage companies — released its annual ranking of the 50 top-performing issuers. Mining companies dominated the list, accounting for 48 of the 51 entries (including one tie), underscoring the depth of investor appetite for the sector.

The ranking is based on three equally weighted metrics: market capitalization growth, share price appreciation and Canadian consolidated trading value. Most of the listed miners are focused on gold and silver, buoyed by record commodity prices, while others are advancing critical minerals projects tied to advanced technologies and the energy transition.

Together, the mining companies represented a combined market capitalization of $19.9 billion and posted an average share price gain of 443%.

Including the three technology firms that made the cut, the full TSX Venture 50 delivered an average share price increase of 431% in 2025 — surpassing the 333% average market cap growth and 207% average returns recorded a year earlier.

“The sector’s exceptional performance reflects a new global financing cycle driven by geopolitical uncertainties and industrial policy shifts that have increased investor demand for metals and minerals,” exchange operator TMX Group said in a statement.

The sector’s dominance in the Canadian public markets had already been evident. Last year, a ranking of the top 30 performers on the senior TSX exchange over the preceding three-year period showed a strong presence of miners, with as many as 17 making the list.

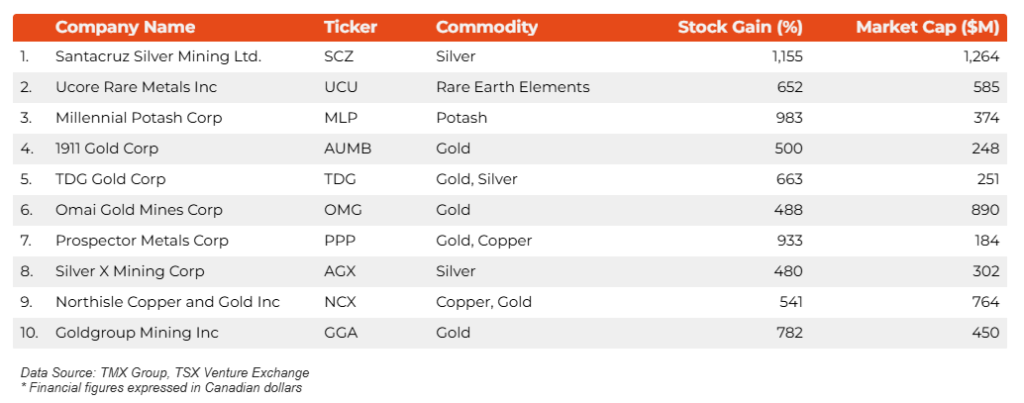

Below is a recap of the top 10 performers, along with their respective gains and market cap by the end of 2025 (for period between Jan. 2 and Dec. 31, 2025):

Topping the list is British Columbia-based Santacruz Silver Mining (TSXV:SCZ), which finished 2025 with a 1,137% market cap growth alongside a 1,103% appreciation in share price. Second-ranked Ucore Rare Metals, a Nova Scotia-headquartered company focusing on high-value light and heavy rare earths, achieved a 1,109% increase in market cap.

The sector’s dominance also reflects the essential role junior miners play as the primary pipeline for future producing assets, driving global exploration and discovery activity across key mining Jurisdictions, TMX said.

Nearly 80% of the companies on the 2026 list operate in the “Tier-1 mining jurisdictions” of Americas, with 16 holding properties in Canada (concentrated in the Yukon Territory and Ontario), 15 in the United States (primarily Nevada and Alaska), and 14 in Mexico.

For the full TSX Venture 50 list, click here.

Record liquidity

On top of share price appreciation, this year’s TSX Venture 50 cohort achieved the strongest liquidity metrics in the program’s history, with 2025 trading volumes doubling year-over-year to exceed 13.2 billion shares traded.

The robust trading activity supports company valuations on TSXV as global investors increasingly recognize Canada as the world’s leading hub for junior mining and high-growth innovation financing, TMX stated.

“Collectively, 43 of the TSX Venture 50 companies completed capital raises during 2025, totaling over $1.5 billion of equity capital raised,” said Robert Peterman, chief commercial officer, TSX & Global Capital Formation.

“At the same time, we saw strong liquidity driven by global investor interest in the materials sector. This liquidity surge demonstrates that TSXV continues its position as the premier destination for early-stage public capital formation, particularly in the resource sector, cementing Canada’s role as the foundation for global resource security and economic resilience.”

0

Comments

Want to join the conversation?

Loading comments...