Next US-China Trade Talks Tipped in Advance of Trump-Xi Summit as Fragile Truce Holds

•February 10, 2026

0

Why It Matters

Maintaining the trade truce stabilizes global supply chains and influences market sentiment, while any breakthrough could reshape U.S.‑China economic relations ahead of a pivotal election cycle.

Key Takeaways

- •Treasury staff visited China to prep next trade talks.

- •Talks aim to preserve fragile tariff truce before April summit.

- •Soybean purchases and critical minerals are negotiation focal points.

- •Tech export controls lower priority; China seeks self‑sufficiency.

- •Both sides chase domestic‑friendly wins ahead of US midterms.

Pulse Analysis

The upcoming Trump‑Xi summit marks a rare window for diplomatic momentum after a series of low‑key meetings in Geneva, London, Stockholm, Madrid and Kuala Lumpur. By dispatching senior Treasury officials to Beijing, the United States signals its intent to institutionalize communication channels that survived the tariff escalations of 2024‑25. This preparatory phase is less about sweeping policy overhauls and more about cementing incremental gains that can be presented as tangible successes to domestic audiences, especially with the November midterm elections looming.

Key agenda items reflect the pragmatic calculus of both capitals. Washington is pressing China for higher soybean imports to bolster the farm belt, while simultaneously countering Beijing’s dominance in rare‑earth and other critical minerals through a newly announced U.S. alliance. Beijing, in turn, prioritizes its self‑sufficiency drive, relegating tech export controls to a secondary tier. The negotiations are expected to produce numerical commitments on agricultural, energy and manufactured goods, offering each side political cover without jeopardizing broader strategic competition.

For businesses, the talks carry immediate relevance. A sustained tariff truce preserves cost predictability for manufacturers reliant on cross‑border supply chains, while any progress on soybean trade could affect commodity pricing and farm income forecasts. Moreover, the handling of critical‑minerals cooperation may influence investment flows into battery and clean‑energy sectors. While a grand reset remains unlikely, the transactional nature of the dialogue provides a modest but meaningful buffer against market volatility, underscoring the importance of monitoring these negotiations as a barometer for global trade health.

Next US-China trade talks tipped in advance of Trump-Xi summit as fragile truce holds

Article

Any coming high-level trade talks between Beijing and Washington will be in preparation for US President Donald Trump’s visit to China in April, analysts say, as both sides wish to keep a fragile trade truce intact, even though significant breakthroughs in the bilateral relationship remain up in the air.

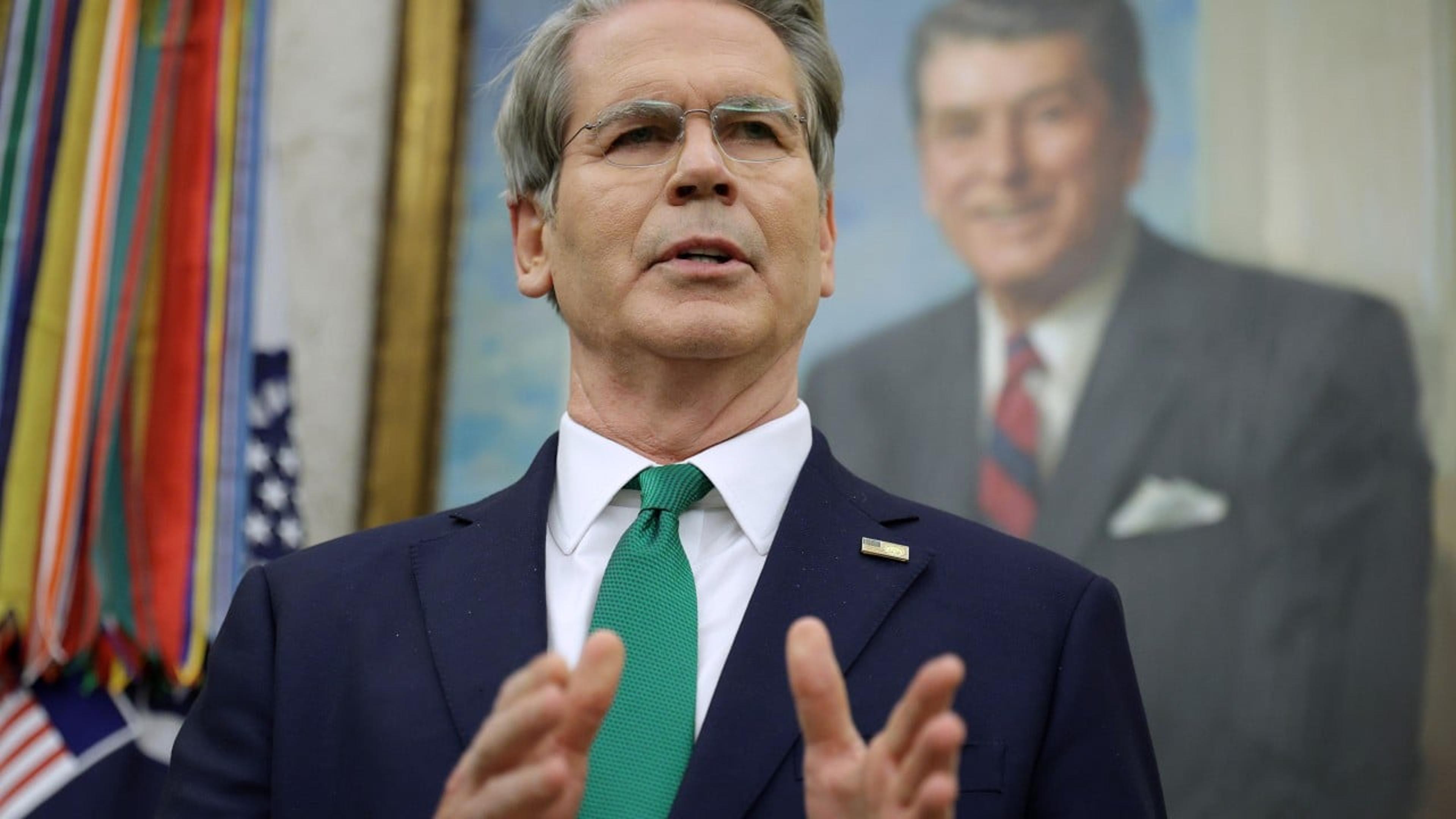

On Monday evening in the US, Secretary of the Treasury Scott Bessent posted on social media that senior Treasury staff had travelled to China last week, “to strengthen channels of communication and advance the dialogue between our nations”.

The delegation discussed preparations for the next high-level China‑US trade talks, with Vice‑Premier He Lifeng and Bessent leading their respective sides, according to the post.

“We look forward to continued constructive engagement between both sides, and to maintain our positive forward momentum over the coming weeks as we approach our next face‑to‑face engagement,” Bessent wrote.

Bessent and He have become the principal negotiators between the world’s two largest economies over the past several months, with threats, posturing, trade‑crushing tariffs and counter‑threats roiling markets and paralysing company planners.

Beginning in Geneva in May, the two held trade talks in London, Stockholm, Madrid and Kuala Lumpur last year. They also met last month on the sidelines of the World Economic Forum in Davos, Switzerland.

Recent functional bilateral talks should be aimed at addressing specific concerns in preparation for Trump’s visit to China in early April, according to Wang Yiwei, director of the Institute of International Affairs at Renmin University.

Beijing may also take the opportunity to voice some of its new concerns, including the critical‑minerals alliance recently launched by the US to counter China’s dominance in the sector, while the US would want China to buy more soybeans, Wang added.

“China’s purchases of US soybeans or ‘support’ to the US economy are crucial, as this year’s midterm election is particularly important for the [Trump administration],” he said.

Nick Marro, global trade lead at the Economist Intelligence Unit, said it was clear that both sides wanted to retain as much momentum as they could in the lead‑up to Trump’s visit to China.

“There seems to be a really strong appetite to maintain that fragile trade truce that we saw struck in late 2025,” he said.

‘We have a deal’: Trump claims breakthrough after ‘12 out of 10’ talks with Xi Jinping

‘We have a deal’: Trump claims breakthrough after ‘12 out of 10’ talks with Xi Jinping

The Trump administration is becoming much more sensitive to potential disruptions coming from the president’s trade and tariff agenda, with the midterm elections looming in November, Marro said. But he was taking a cautious outlook on what deliverables to expect when the two presidents sit down in April.

“I think, at best, we could see this continuation of a detente in tariff policy,” he added.

Wang Dan, China director at Eurasia Group, said the next round of talks would be transactional, not a grand reset of the relationship.

“Both sides will look for deliverables that can be packaged as wins they can present at home,” she said. “This could include numerical commitments for soybeans, energy and manufactured goods from the US.”

Tech export controls would be part of the agenda but a lower priority for China, since tech self‑sufficiency takes precedence, she added.

David Perdue, US ambassador to China, said at an event organised by the China Council for the Promotion of International Trade in Beijing on Monday that the US was “not closing the door to doing business with China”.

“As President Trump has said, we want to trade with China, we need to trade, but that trade should be balanced and with full reciprocity,” Perdue said. “I’m very optimistic about the year ahead and also clear‑eyed. The challenges are real.”

0

Comments

Want to join the conversation?

Loading comments...