Strategic Insight: Carbon Health’s Boom, Bust, and Bankruptcy

•February 9, 2026

0

Why It Matters

Understanding Carbon Health’s rise and fall offers a cautionary tale for investors and healthcare leaders about the perils of scaling too quickly without sustainable economics. It underscores the need for rigorous due diligence in health‑tech ventures, especially as the sector continues to attract massive capital in the post‑pandemic era.

Strategic Insight: Carbon Health’s Boom, Bust, and Bankruptcy

[

](https://substackcdn.com/image/fetch/$s_!0et6!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd4a3f007-de72-446b-8a40-03bc319a5a11_2752x1536.png)

This is the third installment in a series examining high-profile collapses in healthcare technology. Previously: After Olive: Why Healthcare Leaders Don’t Trust AI Promises and IBM Watson Health: Yet Another 10 Year Tale of Woe.

Together, these analyses form a body of work tracing a pattern that healthcare leaders and investors ignore at their peril.

Executive Summary

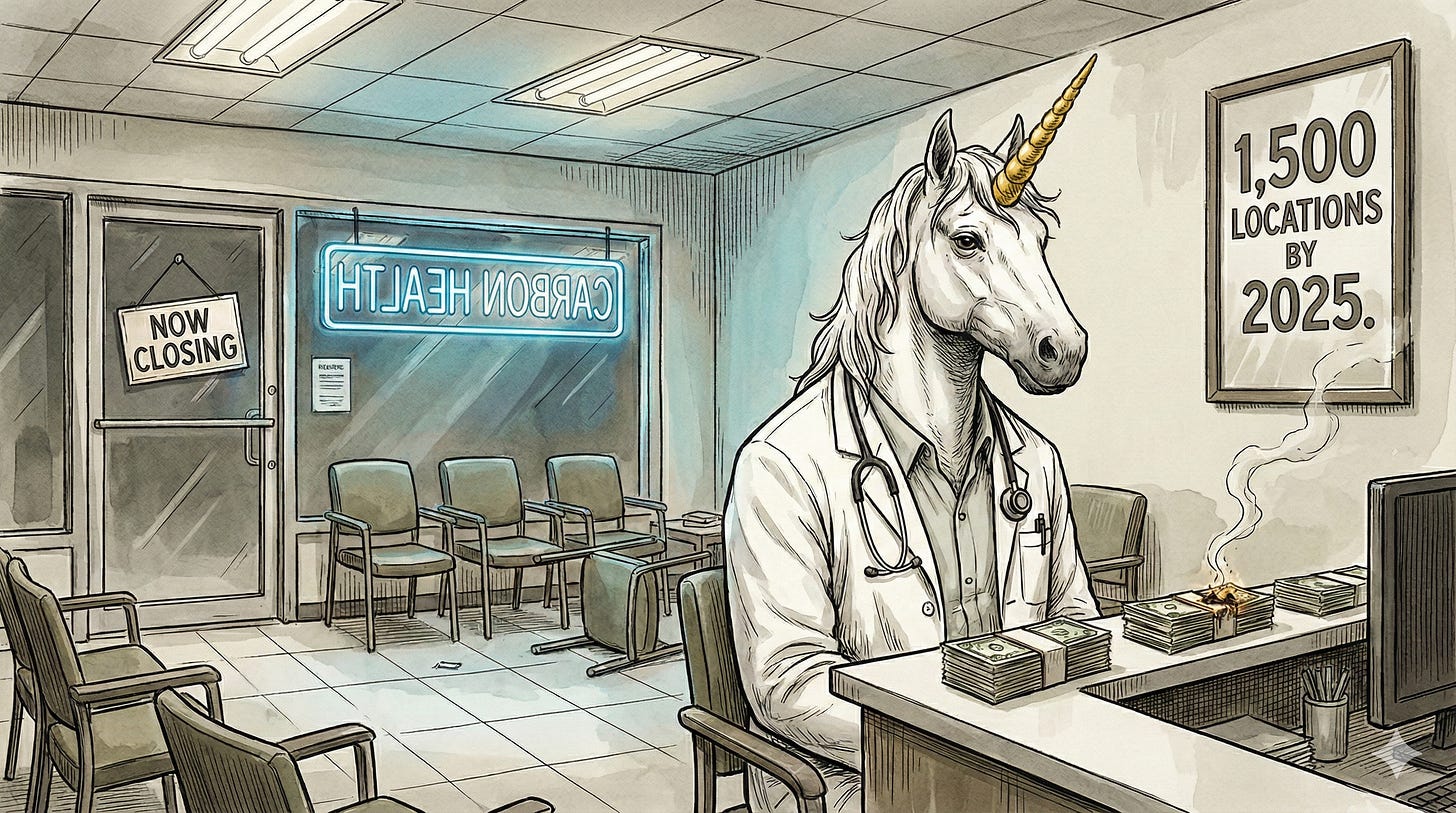

Pandemic-Fueled Rise: Carbon Health rode a COVID-19 windfall to rapid prominence. In 2020–21, it expanded from a handful of clinics to over 80 locations, leveraging pop-up testing sites and telehealth surges. The company raised $128 million in 2020, then a $350 million Series D in mid-2021 at a $3.3 billion valuation. Leadership boldly aimed to reach 1,500 clinics by 2025 to become “the largest primary care provider in the U.S.” By 2023, CVS Health had invested $100 million in Carbon, which had 125 clinics across 13 states and served over 1 million patients. In total, over $600 million in venture funding flowed into Carbon’s vision of a tech-enabled, nationwide primary care network.

Paid subscribers can get access to the detailed history and analysis of this case study.

0

Comments

Want to join the conversation?

Loading comments...