Social•Feb 20, 2026

Cooling Volatility Triggers Machine Re‑Leverage, Expect Upward Grind

Volatility is cooling. 30D realized volatility (yellow line) just rolled over and is now below 90D (blue line). When short-term vol drops, the machines re-lever. Vol control funds start buying. Right now, the signal says grind higher until proven otherwise.

By Kurt S. Altrichter

Social•Feb 19, 2026

McGough’s CVNA Sell Call Beats CNBC’s Coverage

Great SELL call by McGough @HedgeyeRetail on $CVNA that CNBC failed, once again, to cover

By Keith McCullough

Social•Feb 19, 2026

Steve Cohen's Hedge Fund Delivers $3.4B Payday, 2025 Top

Mets owner Steve Cohen got a $3.4 billion payday from his hedge fund last year. Here are the top earners in 2025: https://t.co/ZRuqldhcBZ https://t.co/p6eqszYRZM

By Nishant Kumar

Social•Feb 19, 2026

Quant Hedge Fund Alpha Closes After 25 Years

A $2 billion quantitative hedge fund that recently added “Alpha” to its name, is calling it quits after three consecutive years of losses and roughly 25-year run https://t.co/69PJrwEni7

By Nishant Kumar

Social•Feb 18, 2026

Retail Shorts Ahead as High‑Income Spending Slips

The show panelists (don't be shocked, they are bullish) love retail/consumer stocks - we shorted $COST and $WMT in the last 24 hours. We are looking for more consumer shorts. We believe lower home and stock prices will take away from the...

By Doug Kass

Social•Feb 18, 2026

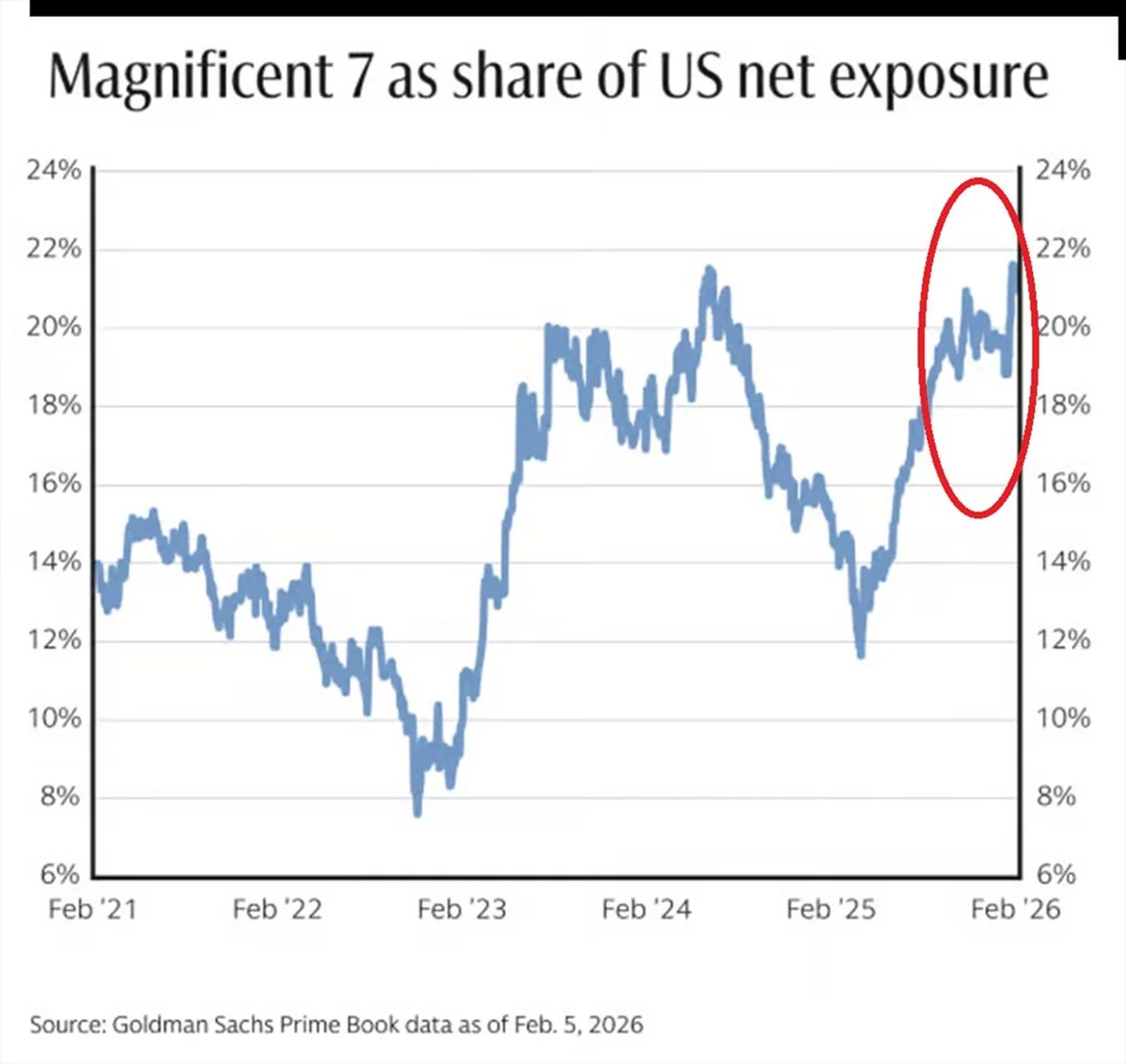

Record Hedge Fund Bet on Magnificent 7 Risks Collapse

⚠️Almost everybody is piling into the SAME TRADE: Hedge fund net allocation to Magnificent 7 stocks is up to a RECORD 22%. This is more than DOUBLE the level seen in 2022. At the same time, these stocks remain among the most popular...

By Global Markets Investor (newsletter author)

Social•Feb 17, 2026

SKEW Below 140 Signals Institutional Hedge Unwind

SKEW just closed below 140. Falling $SKEW = institutions unwinding tail-risk hedges (OTM puts get cheaper) and/or quietly reducing equity exposure. Past cycles: Sustained declines often marked distribution phases — rallies fade as protection demand evaporates and complacency builds. If it...

By Kurt S. Altrichter

Social•Feb 17, 2026

Balance Reversion and Momentum: Mix Market-Making with Market-Taking

"You have market-making strategies or market-taking strategies. You want to balance across them because market-making strategies tend to be reversion and market-taking strategies tend to be momentum." - Bobby Jain (EP.497) With thanks to @AlphaSenseInc, @MorningstarInc, and Ridgeline.

By Ted Seides

Social•Feb 16, 2026

2025 Profitability Snapshot: Sector Returns & Excess Gains

In my sixth data update, I look at business profitability in 2025, across sectors, industries and regions, scaled to revenues (profit margins) and to invested capital (accounting returns). I use the latter to compute and compare excess returns. https://t.co/L3PDmph4VA

By Aswath Damodaran

Social•Feb 16, 2026

Investors Shift From S&P 500 to Alternatives, Gains Accelerate

Rotation away from S&P500 (flat on the year) into other assets like foreign stocks, US value, etc up 10-15% seems to be accelerating...

By Meb Faber

Social•Feb 16, 2026

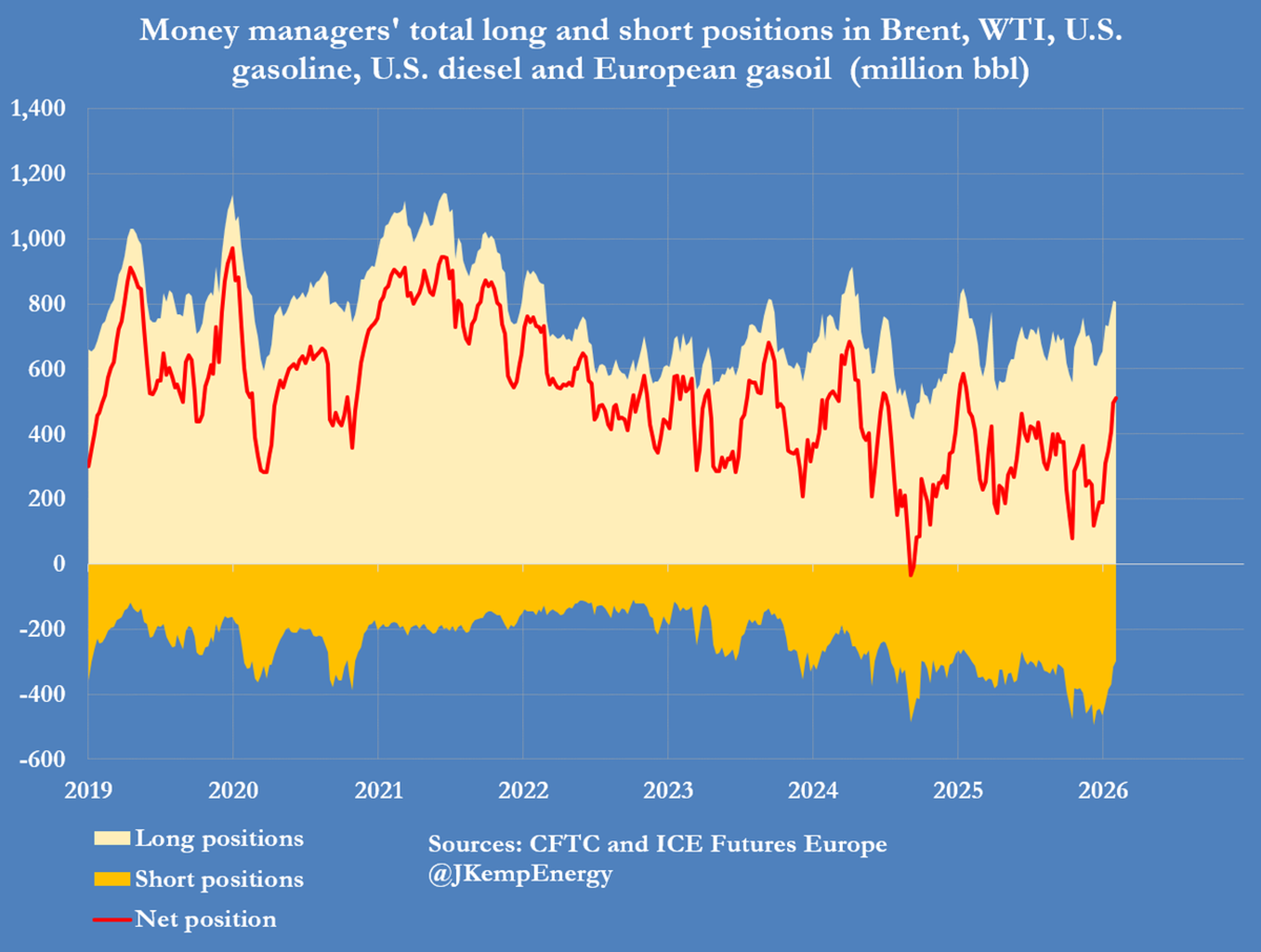

Investors Bet on Oil Amid Growing Supply Threats

Oil investors bullish on proliferating supply threats Investors are increasingly bullish about the outlook for oil prices as potential risks to production and tanker traffic multiply - including threats of U.S. military action against Iran and stricter sanctions enforcement. Hedge funds and...

By John Kemp

Social•Feb 16, 2026

Bobby Jain Launches $6B Multi‑strat Amid Portfolio Shift

Hedge fund portfolios are being shaped by the shift from banks, multi-manager scale, and public/private convergence. Bobby Jain (CEO/CIO, Jain Global) on launching a $6B multi-strat, talent & risk management, and portfolio construction. https://t.co/BfZsVcl2vY With thanks to @AlphaSenseInc, @MorningstarInc, and Ridgeline.

By Ted Seides

Social•Feb 15, 2026

Baillie Gifford Defends CoStar Amid Questionable 5‑year Returns

https://t.co/5Dz4e0JITs Baillie Gifford backs CoStar in activist battle Perhaps unnamed Baillie Gifford rep should look at the 5 year chart. Hard to see “repeatedly demonstrated” value creation over past 5 years. Happy to take your call so you can...

By Daniel S. Loeb