🎯Today's Human Resources Pulse

Updated 3h agoWhat's happening: Union sues Berkelouw Books and Harry Hartog over outdated enterprise agreement

The Retail and Fast Food Workers Union has filed a lawsuit against the operators of Berkelouw Books and the Harry Hartog chain, alleging that a 13‑year‑old enterprise agreement fails to provide basic wage loading and penalty rates. More than 100 employees across four Berkelouw and fourteen Harry Hartog stores are demanding a fair contract, while the employers have delayed bargaining and cut pay during December bans.

Also developing:

By the numbers: Take2 raises $14M to boost AI‑powered healthcare hiring

News•Feb 9, 2026

As NICU Cases Rise, Laws and Employers Look to Assist Working Parents

Rising neonatal intensive care unit (NICU) admissions are prompting a wave of state legislation and corporate policy changes aimed at supporting working parents. Over the past year, NICU cases have climbed roughly 15%, leading 12 states to enact NICU-specific leave statutes or broaden existing job‑protection rules. Employers, especially in the health‑care and tech sectors, are adding paid NICU leave benefits to attract and retain talent. Legal analysts caution that navigating the patchwork of state laws will require careful compliance planning.

By Littler – Insights/News

News•Feb 9, 2026

Wage and Hour Spotlight: Dennis M. Brown, Littler Mendelson

Dennis M. Brown, a senior partner at Littler Mendelson, shared his perspective on the evolving wage‑and‑hour litigation landscape. He highlighted increasing federal enforcement actions and the growing complexity of multi‑state compliance. Brown noted that employers are facing heightened scrutiny over...

By Littler – Insights/News

News•Feb 9, 2026

Lawmakers Weigh Government’s Role in Lowering AI Risk to Workers

Lawmakers are evaluating whether the federal government should intervene to mitigate AI‑related risks to workers. During a hearing before the House Subcommittee on Health, Employment, Labor and Pensions, Bradford Kelley of Littler argued that the low number of lawsuits over...

By Littler – Insights/News

News•Feb 9, 2026

More State Lawmakers Threaten Transgender Job Bias Ban Repeals

State lawmakers, primarily Republicans, are introducing a wave of bills to repeal existing bans on transgender and nonbinary workplace bias and harassment protections. The legislative push spans more than 20 states this session, targeting statutes enacted after the 2020 Bostock...

By Littler – Insights/News

News•Feb 9, 2026

Maine Joins Pushback Against Worker Surveillance

Governor Janet Mills signed legislation restricting employers’ electronic surveillance of workers, effective 2026. The law prohibits continuous monitoring without explicit employee consent and mandates transparent data handling practices. It applies to both on‑site and remote work environments, covering video, audio,...

By Littler – Insights/News

News•Feb 9, 2026

E.ON Backs Call for Fairer Fertility Rights at Work and Signs the Fertility Support Pledge

E.ON has signed the national Fertility Support Pledge, aligning its policy with the proposed Fertility Treatment (Right to Time Off) Bill that seeks statutory paid leave for fertility appointments. The energy group already offers unlimited paid fertility leave, flexible working,...

By Employer News (UK)

News•Feb 9, 2026

DOL Poised to Move Faster than Congress on Retirement Reform

The U.S. Department of Labor is poised to issue regulations expanding 401(k) access to alternative investments, meeting a February 3 deadline set by a Trump‑era executive order. A final rule could be adopted by year‑end with implementation slated for 2027,...

By Human Resource Executive

News•Feb 9, 2026

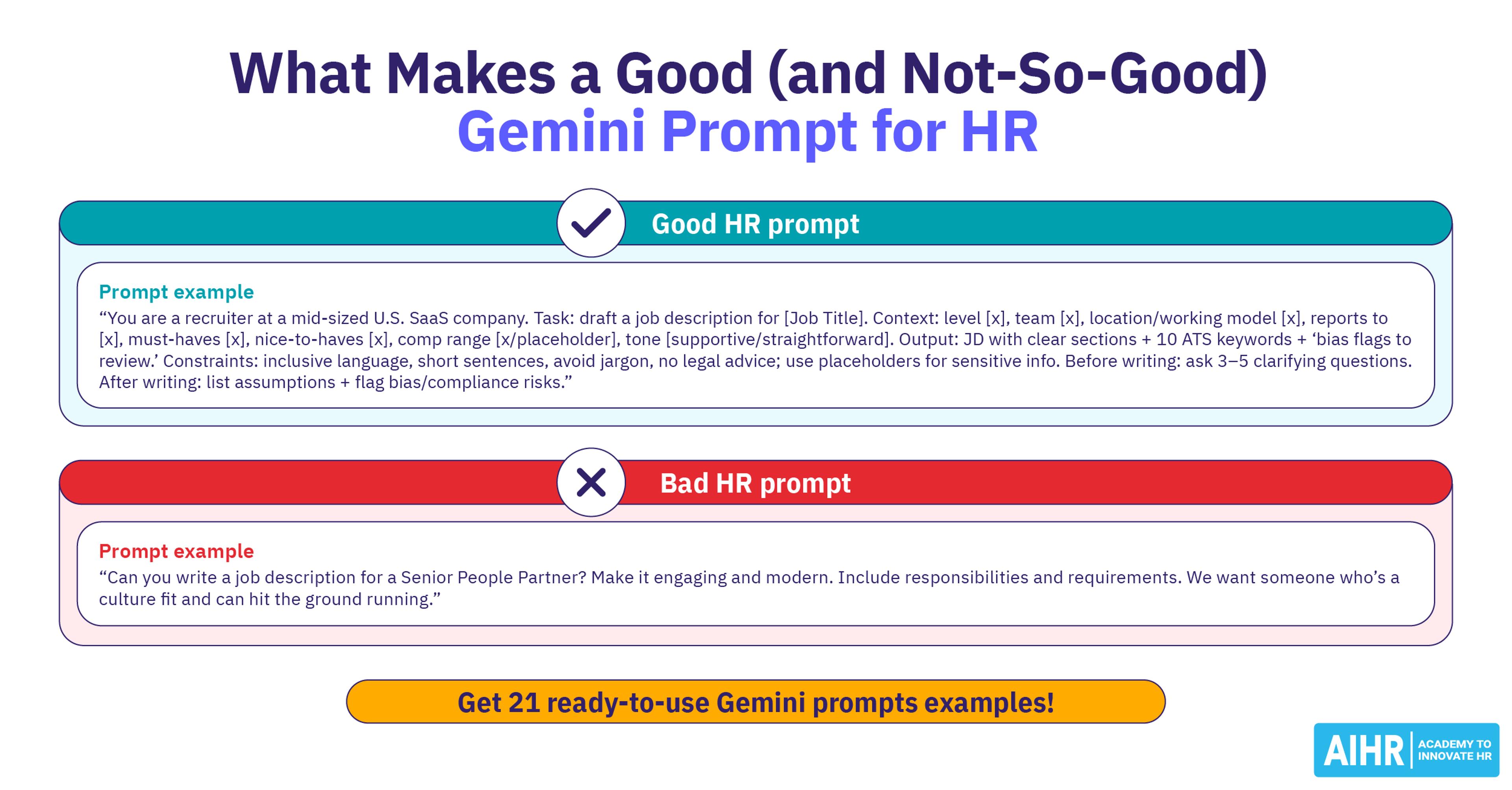

21 Gemini Prompts HR Can Copy and Paste (with Step-by-Step Prompts)

The article introduces 21 ready‑to‑use Gemini prompts designed to streamline repetitive HR tasks such as job postings, interview guides, onboarding docs, and policy updates. It outlines a seven‑step prompt framework—persona, task, context, format, constraints, clarifying questions, and quality check—to produce...

By AIHR Blog

News•Feb 9, 2026

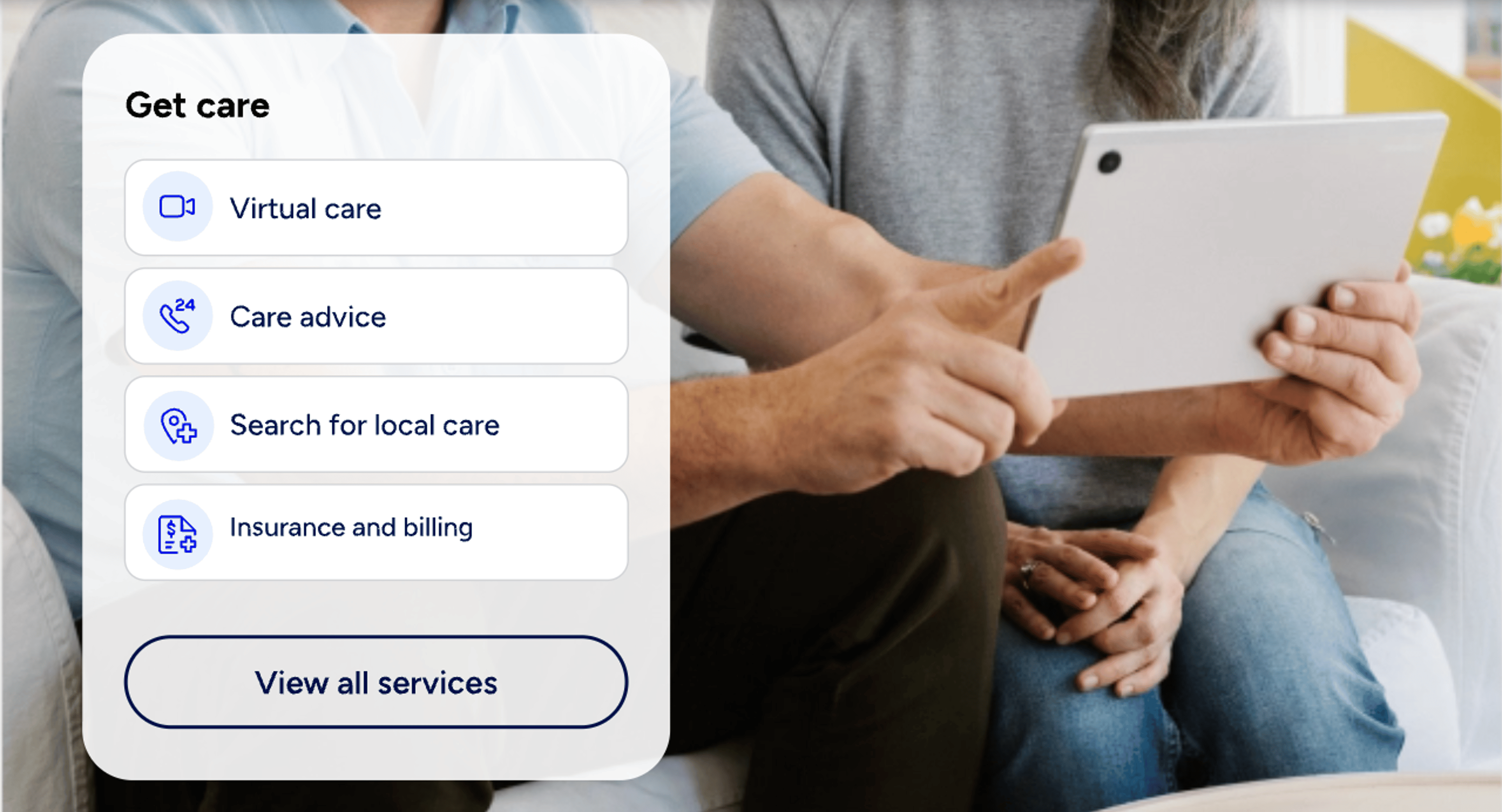

Included Health's New Plan Design Improves Employees' Access to Quality Care

Included Health unveiled an alternative health‑plan design that blends guided care, AI tools, and a copay‑first pricing model to give employees faster, more affordable access to primary care. The plan replaces traditional PPO/HMO choices with a hybrid that offers broader...

By Employee Benefit News

News•Feb 8, 2026

Office Buzz: UK Employers Turn to Beehives to Boost Workplace Wellbeing

UK firms from Manchester to London are installing rooftop beehives as a wellbeing perk, partnering with specialist beekeepers to offer employees hands‑on nature experiences. Companies claim the hives reduce stress, foster teamwork and provide a tangible sustainability story beyond typical...

By The Guardian – Work & careers

News•Feb 8, 2026

7 Steps for Selecting a Training Icebreaker

Training icebreakers are meant to ease participants into sessions, yet many designers misuse them, compromising learning goals. The article outlines seven critical questions to evaluate an icebreaker, covering time allocation, manageability, agenda fit, trust building, fun balance, participant comfort, and...

By HR Bartender

News•Feb 6, 2026

Fourth Circuit Allows Implementation of DEI Executive Orders to Proceed

The Fourth Circuit vacated a district court injunction, allowing President Trump’s Executive Orders 14151 and 14173 on DEI to remain in effect for federal contractors and grant recipients. The court held that plaintiffs lacked standing to challenge the Enforcement Threat Provision, but recognized...

By Littler – Insights/News

News•Feb 6, 2026

California High Court Limits Use of Formatting and “Fine Print” Arguments to Defeat Arbitration

The California Supreme Court ruled that the visual presentation of an arbitration agreement—such as tiny, dense font—does not by itself render the clause substantively unconscionable. While procedural defects may raise a court's scrutiny, substantive unfairness must still be shown. The...

By Littler – Insights/News

News•Feb 6, 2026

Policy Week in Review – February 6, 2026

The Department of Labor raised the minimum wage for federal contractors to $13.65 per hour, with tipped workers covered at $9.55, effective 90 days after publication. The DHS and DOL issued a temporary rule adding up to 64,716 supplemental H‑2B...

By Littler – Insights/News

News•Feb 6, 2026

DOL Notice Indicates Federal Contractor Minimum Wage Does Not Apply to Contracts Entered Into or Renewed After January 29, 2022

The U.S. Department of Labor issued a notice raising the federal contractor minimum wage to $13.65 per hour (and $9.55 cash wage for tipped workers), effective 90 days after its Feb. 9, 2026 publication. Crucially, the notice states that Executive Order 13658...

By Littler – Insights/News

News•Feb 6, 2026

Untangling the Varying Requirements of State and Local Fair Workweek Laws

Predictable‑scheduling (fair workweek) laws now cover major U.S. cities and states, mandating 14‑day advance posting, employee consent for changes, and premium pay for late‑notice shifts. Employers must provide good‑faith schedule estimates, offer open hours to current staff before hiring, and...

By Littler – Insights/News

News•Feb 6, 2026

India’s New Labor Codes: What Global Leaders Managing Indian Teams Need to Know - Session 2

India has rolled out four unified labor codes that replace decades of fragmented employment legislation, fundamentally changing hiring, compensation, and workforce management. The codes aim to simplify compliance, boost ease of doing business, and align with international standards. A webinar...

By Littler – Insights/News

News•Feb 5, 2026

Ohio’s E-Verify Law for Nonresidential Construction Contractors Takes Effect Soon

Effective March 19, 2026, Ohio’s Workforce Integrity Act mandates that all non‑residential construction contractors, subcontractors and labor brokers verify employee eligibility through E‑Verify. The law defines non‑residential projects broadly, covering buildings, highways, bridges and utilities, while exempting residential and agricultural...

By Littler – Insights/News

News•Feb 5, 2026

Prevailing Wage Compliance Workshop: NJ Edition - Short Hills

On April 2, 2026, Littler will host a full‑day Prevailing Wage Compliance Workshop for New Jersey public‑works contractors at the Hilton Short Hills. Led by leading practitioner Russell McEwan, the program covers registration, apprentice rules, certified payroll, audit procedures and subcontractor liability under recent...

By Littler – Insights/News

News•Feb 5, 2026

Dear Littler: Are There Any Concerns About Letting Our Employees Post Videos About Our Products?

A retailer’s marketing manager asks if an employee‑influencer can post a product video on social media. The FTC mandates a clear disclosure of any material connection between the employee and the company, and violations can result in fines. The company...

By Littler – Insights/News

Blog•Feb 5, 2026

Seventh Circuit Holds Asset Sale Does Not Require Exclusion of Contributions From Withdrawal Liability Calculation

The Seventh Circuit ruled that ERISA §4204 does not require excluding contributions tied to assets sold when calculating the maximum annual payment for withdrawal liability. In SuperValu Inc. v. United Food and Commercial Workers, the court affirmed the plan could...

By Employee Benefits & Executive Compensation Blog

News•Feb 4, 2026

Puerto Rico Supreme Court Enforces Private Employment Arbitration Clauses Under Act 100 Discrimination Claims

The Puerto Rico Supreme Court ruled that mandatory arbitration clauses in private employment contracts are enforceable for discrimination claims under Act 100, provided the agreement impacts interstate commerce and thus falls under the Federal Arbitration Act. The decision expressly limits its...

By Littler – Insights/News

Blog•Feb 4, 2026

IRS Issues Updated Safe Harbor Rollover Notices

The IRS released Notice 2026-13 on January 15, 2026, updating the safe‑harbor rollover notices that plan administrators must provide under section 402(f) of the Internal Revenue Code. The new notice replaces the 2020-62 version and incorporates SECURE 2.0 provisions affecting in‑service distributions,...

By Employee Benefits & Executive Compensation Blog

News•Feb 4, 2026

Milan–Cortina 2026: The Employment Law Behind the Winter Olympic and Paralympic Games

Italy will host the Milan‑Cortina 2026 Winter Olympic and Paralympic Games starting February 6, 2026, spotlighting the nation’s capacity for large‑scale event delivery. The Games emphasize gender balance, projecting the highest female athlete participation in Winter Olympic history and increased...

By Littler – Insights/News

Blog•Feb 4, 2026

Why Inclusion Efforts Fail Without Belonging And How Leaders Can Bridge The Gap

The article argues that most inclusion programs focus on representation metrics, which leaves employees feeling disconnected. Guest expert Priya Nalkur emphasizes that true belonging requires self‑awareness, uncomfortable conversations, and a culture of grace. Leaders must move beyond policies to foster...

By Tanveer Naseer

Podcast•Feb 4, 2026•0 min

HREX v 1.07 George Larocque

John Sumser and George LaRocque discuss the rapid evolution of HR technology, emphasizing how market sizing, capital flow, and data-driven decision‑making are reshaping the industry. They highlight recruiting’s lack of accountability, the re‑evaluation of education’s value, and the disruptive impact...

By HR Examiner

Blog•Feb 3, 2026

ISS and Glass Lewis Release Compensation-Related Updates For 2026 Proxy Season

ISS and Glass Lewis have unveiled new compensation‑related voting policies for the 2026 proxy season. ISS extends its pay‑for‑performance quantitative analysis to a five‑year look‑back, gives a favorable view to long‑term time‑based equity awards, adds flexibility for companies receiving less...

By Employee Benefits & Executive Compensation Blog

News•Feb 3, 2026

Your Organization’s Unwritten Rules and How to Fix Them

Organizations run invisible markets that decide who gets resources, visibility, and advancement. Professor Judd Kessler proposes redesigning these hidden rules using the Three Es—Efficiency, Equity, and Ease—to create transparent, merit‑based systems. Real‑world pilots such as Wharton’s Course Match, the National Resident...

By Wharton Knowledge

News•Feb 2, 2026

California Workplace Know Your Rights Notice Requirement Is in Effect

California’s Workplace‑Know‑Your‑Rights Act (SB 294) takes effect on February 1, 2026, obligating every employer to deliver a standalone written notice to all current staff and new hires, then repeat it annually. The notice must outline workers’ compensation, immigration‑related protections, union rights, and Fourth...

By Littler – Insights/News

News•Feb 2, 2026

Royal Mail-Owned Courier Faces Tribunal over Drivers’ Rights

Dozens of eCourier drivers delivering NHS samples are challenging their self‑employment status in an employment tribunal. The 46 workers argue that the company exerts significant control over job allocation, availability, and performance, which should qualify them as workers entitled to...

By The Guardian – Work & careers

News•Jan 30, 2026

Employer Compliance Update: Qualified Overtime and Tip Reporting After the One, Big, Beautiful Bill Act

On July 4, 2025, the One, Big, Beautiful Bill Act (OBBBA) became law, imposing new employer tax reporting requirements for qualified overtime and tipped earnings. Employers must now report qualified overtime compensation and qualified tips separately on employees’ Form W‑2,...

By The Labor & Employment Law Blog (California)

News•Jan 30, 2026

Policy Week in Review – January 30, 2026

The NLRB Division of Advice issued memos recommending dismissal of three charges that stretched Biden‑era precedents, covering a union recognition claim, a Slack criticism case, and an overbroad non‑solicitation clause. The Department of Labor’s EBSA proposed a rule forcing PBM...

By Littler – Insights/News

News•Jan 30, 2026

Travel Time or Working Time? What the Latest CJEU Decision Means for Employers in Germany

Recent CJEU ruling (Case C‑110/24) classifies travel that is tightly organised by the employer as working time for health‑and‑safety purposes. German courts have traditionally focused on the burden of travel, but the EU decision shifts emphasis to employer control, potentially...

By Littler – Insights/News

News•Jan 29, 2026

New Jersey Dramatically Expands Job-Protected Family Leave and Benefits

Effective July 17, 2026, New Jersey will lower the New Jersey Family Leave Act (NJFLA) employer threshold from 30 to 15 employees and cut employee eligibility to three months of service and 250 hours worked. The amendment also requires up to 12...

By Littler – Insights/News

News•Jan 28, 2026

NLRB Region 12 Reinforces Imminent Closure Standard in SolarMovil PR LLC Decision

The NLRB Region 12 regional director dismissed a union representation petition against SolarMovil PR LLC because the solar‑farm project was “imminently and definitely” ending. The decision hinged on concrete evidence such as a fixed‑date contract, 82 % project completion, and lack of future work...

By Littler – Insights/News

News•Jan 28, 2026

Puerto Rico Governor Declares a State of Emergency Due to Influenza Epidemic, Activating Five-Day Paid Leave

Puerto Rico Governor Jenniffer González issued Executive Order 2026‑005 on Jan 27, 2026, declaring a state of emergency in response to an influenza epidemic. The order activates Act No. 37, which adds a special five‑day paid leave for non‑exempt employees who have exhausted vacation and...

By Littler – Insights/News

News•Jan 28, 2026

What Happens to AI Hiring When the Uniform Guidelines Disappear?

The Uniform Guidelines on Employee Selection Procedures, a 50‑year standard for validating hiring tools, face possible rescission, creating uncertainty for AI‑driven recruitment. In January 2026, Eightfold AI was hit with a class‑action lawsuit alleging it compiles consumer‑report‑like dossiers without notice,...

By ERE

Blog•Jan 28, 2026

3 Steps To Craft A Leadership Narrative Your Team Will Rally Around

Effective leadership today hinges on crafting a compelling narrative that links current realities to future possibilities. The article highlights Satya Nadella’s transformation of Microsoft, where a shift from a "know‑it‑all" to a "learn‑it‑all" culture propelled the company from a $300 billion...

By Tanveer Naseer

News•Jan 27, 2026

California Employment News: Employee Benefits 101

In a recent episode of California Employment News, Weintraub Tobin partners Chris Horsley and Ryan Abernethy unpack employer obligations surrounding 401(k) retirement plans, the state‑mandated CalSavers program, and health benefit requirements. They explain fiduciary duties, contribution timelines, and the criteria...

By The Labor & Employment Law Blog (California)

News•Jan 26, 2026

New York Governor Proposes “No Tax on Tips” Legislation

New York Governor Kathy Hochul has proposed eliminating state income tax on up to $25,000 of tipped income for 2026, and Senate Bill S587‑A would codify the deduction. The measure mirrors the federal One Big Beautiful Bill Act’s qualified‑tip deduction but does not include...

By Littler – Insights/News

News•Jan 26, 2026

Merz’s Party Vows to Clamp Down on Germany’s ‘Lifestyle Part-Time Work’

Germany’s Christian Democratic Union business wing is proposing to abolish the statutory right to part‑time work, replacing it with a permission‑based system. The current law guarantees every employee the ability to reduce hours, a provision heavily used by women for...

By The Guardian – Work & careers

News•Jan 23, 2026

The Next Expansion Won’t Fix Hiring

Economic forecasts for 2026 show stronger growth, lower rates and rising AI investment, yet recruiters face a persistent talent shortage. Demand‑driven expansion is creating more job requisitions, but labor supply remains constrained by limited immigration, an aging workforce, and sector‑specific...

By ERE

News•Jan 22, 2026

Why the Eightfold Lawsuit Matters and Doesn't

The episode breaks down the recent class‑action lawsuit against Eightfold AI, which alleges the firm collected job candidates' data without proper notice, consent, or correction rights, potentially violating the Fair Credit Reporting Act (FCRA) and California Consumer Privacy Act (CCPA)....

By HR Examiner

Blog•Jan 22, 2026

Coming Soon: DOL’s Proposed Rules Facilitating Alternative Assets in 401(k) Plans

On January 13, 2026 the U.S. Department of Labor submitted proposed rules to the White House Office of Management and Budget that would allow 401(k) and other defined‑contribution plans to hold alternative assets such as digital currencies, private equity, private credit and...

By Employee Benefits & Executive Compensation Blog

Podcast•Jan 22, 2026•0 min

Global Employment in 2026: A Fragile Stability

The ILO’s 2026 Employment and Social Trends report shows that global labour markets appear stable, with unemployment projected at 4.9%, but this masks deep challenges to decent work, including rising extreme poverty, high informality (57.7% of workers) and stagnant productivity....

By ILO: The Future of Work Podcast

Blog•Jan 21, 2026

4 Leadership Goals To Build A Resilient Team This Year

The article urges leaders to set goals that strengthen team resilience rather than merely chasing revenue or market expansion. It highlights four people‑centric leadership objectives designed to empower employees during volatile conditions. By shifting focus from outcomes to how leaders...

By Tanveer Naseer

Blog•Jan 20, 2026

Planning for Your Next DOL Investigation Just Got Easier

The U.S. Department of Labor’s Employee Benefits Security Administration (EBSA) unveiled its FY 2026 national enforcement projects, marking the most extensive overhaul in recent years. Priorities include cybersecurity safeguards, mental‑health and substance‑use benefit access, No Surprises Act compliance, protection of benefit...

By Employee Benefits & Executive Compensation Blog

News•Jan 20, 2026

Act 55 Takes Effect: An “Express Lane” For UC Claimants Affected by Domestic Violence

Pennsylvania’s new Act 55, effective 2025, adds an “express lane” for unemployment compensation claimants impacted by domestic violence. The law shields claimants who quit or miss work due to safety concerns from disqualification, allowing expedited eligibility determinations. Verification may rely...

By PA Labor & Employment Blog

Blog•Jan 15, 2026

California’s New Restrictions on “Stay-or-Pay” Provisions Require Employers to Review Repayment Agreements

California’s Assembly Bill 692, effective Jan 1 2026, broadly prohibits employers from including stay‑or‑pay provisions that require workers to repay bonuses, training, relocation or other retention incentives upon termination. The law permits narrow exceptions for discretionary sign‑on bonuses and tuition repayment, provided...

By Employee Benefits & Executive Compensation Blog

Blog•Jan 14, 2026

Third Circuit Holds No Deference Due Where Administrator Fails to Articulate an Interpretation of an Ambiguous Plan Term

The Third Circuit ruled that ERISA plan administrators lose judicial deference when they fail to explain how they interpret ambiguous plan terms, as demonstrated in Rombach v. Plumbers Local Union No. 27 Pension Fund. The court held that the plan’s...

By Employee Benefits & Executive Compensation Blog