LARGE CAP STOCKS PULSE

Friday, February 20, 2026

Market Intelligence for Large Cap Stocks Professionals

🎯 Today's Large Cap Stocks PulseUpdated 1h ago

What's happening: Amazon unveils $200B capex plan, boosting AI chip partner Marvell

Amazon announced a $200 billion capital‑expenditure budget for 2026, up $70 billion from the prior year, with a sizable portion earmarked for AI‑focused data‑center capacity. AWS’s custom‑chip business now generates over $10 billion in revenue and is expanding at triple‑digit rates, driven by its Trainium accelerator line. The company also reaffirmed its five‑year partnership with Marvell Technology.

🚀 Top Large Cap Stocks Headlines

Booking Holdings Announces a Massive 25-for-1 Stock Split. Here's What Investors Need to Know

This marks the first time in its history that the company has initiated a forward stock split.

Motley Fool Investing

Earnings Call Transcript: Deere & Company Q1 2026 Sees Strong Earnings Beat

Investing.com – News

Amazon Just Shared Great News for This AI Chipmaker (Hint: Not Nvidia)

Amazon is spending $200 billion on AI data centers this year, and this company could receive a good chunk of it.

Motley Fool Investing

Overlooked and Undervalued: Why Novo Nordisk Stock Deserves Attention

Novo Nordisk looks attractively priced even though 2026 is likely to be a tough year.

Motley Fool Investing

Roper Technologies Announces Dividend

SARASOTA, Fla., Feb. 19, 2026 (GLOBE NEWSWIRE) -- Roper Technologies, Inc. (Nasdaq: ROP) announced that its Board of Directors has approved a dividend of $0.91 per share payable on April 22, 2026 to stockholders of record on April 6, 2026. About Roper Technologies Roper Technologies is a constituent of the Nasdaq 100, S&P 500, and Fortune 1000. Roper has a proven, long-term track record of compounding cash flow and shareholder value. The Company operates market leading businesses that design and develop vertical software and technology enabled products for a variety of defensible niche markets. Roper utilizes a disciplined, analytical, and process-driven approach to redeploy its excess capital toward high-quality acquisitions. Additional information about Roper is available on the Company’s website at www.ropertech.com. Contact information: Investor Relations 941-556-2601 [email protected]

The Manila Times Business

💬 Top Large Cap Stocks Social Posts

Thread by @Global_markets_investor

🚨US market concentration BUBBLE in one chart: The top 10 US stocks make up a record 40% of the S&P 500 market value. At the same time, the weight of the largest stock in the S&P 500 relative to the 75th percentile stock is ~770x, an all-time high.👇 https://globalmarketsinvestor.beehiiv.com/p/the-us-stock-market-has-peaked

by Global Markets Investor (newsletter author)•

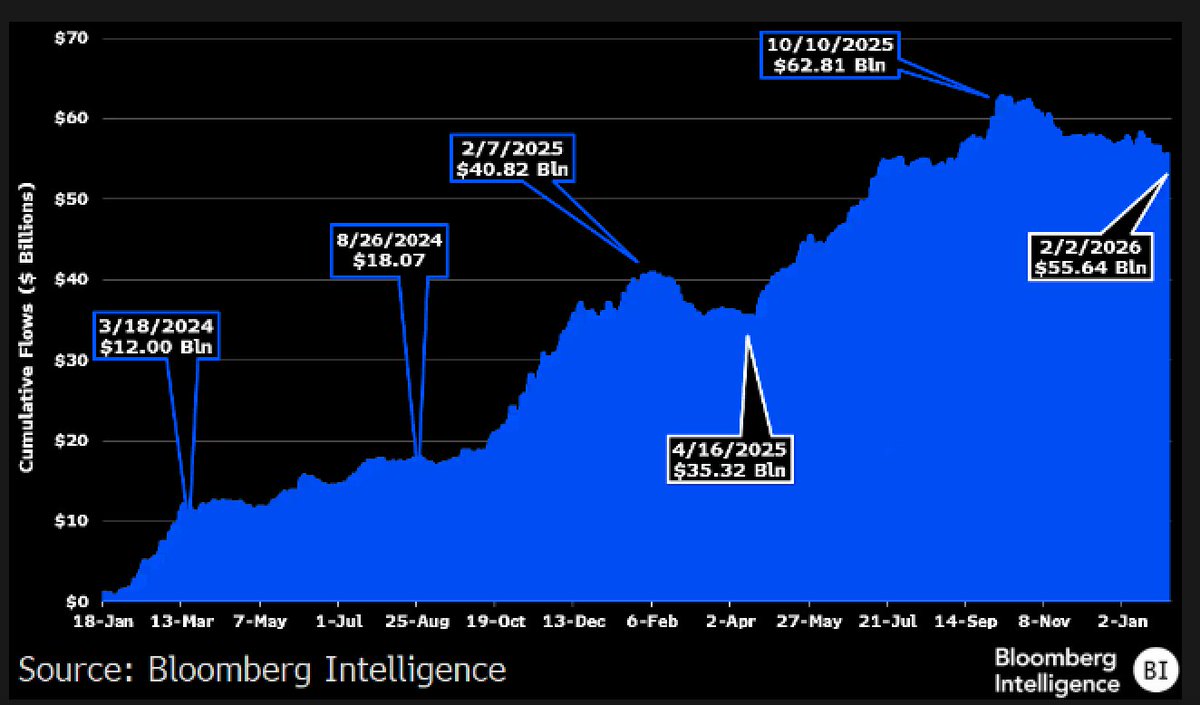

Tweet by @EricBalchunas

Bitcoin ETFs' cumulative net inflows (the most imp number) peaked at +$63b in October. Today it's +$53b. That's NET NET +$53b in only two years. Our (more bullish than most of our peers) prediction was $5-15b in first year. This is imp context to consider when looking/writing about the $8b in outflows since 45% decline and/or the relationship bt btc and Wall street, which has been overwhelmingly positive. Thank you for your attention to this matter. h/t @JSeyff re chart

by Eric Balchunas•