SatVu Raises £30M to Accelerate Its Constellation

•February 18, 2026

0

Companies Mentioned

Why It Matters

The capital infusion enables SatVu to quickly rebuild and expand its satellite fleet, positioning it to capture growing market demand for thermal imagery and secure a strategic foothold in defense and climate monitoring sectors.

Key Takeaways

- •SatVu secured £30M equity funding to expand HotSat constellation.

- •Total equity financing now reaches £60M across multiple investors.

- •HotSat-2 slated for SpaceX Transporter-16 launch by March 2026.

- •Thermal imaging demand rising in defense, economics, climate sectors.

- •New capital funds long-lead components, aiming for cash break-even.

Pulse Analysis

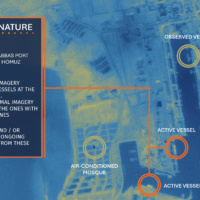

Thermal‑infrared satellite imaging is emerging as a critical data source for governments and enterprises seeking real‑time insight into ground‑level activity. Unlike traditional optical or radar sensors, high‑resolution thermal payloads can detect heat signatures through clouds and at night, making them invaluable for border surveillance, infrastructure monitoring, and climate change assessments. SatVu’s HotSat platform, with a 3.5‑metre ground‑sample distance, fills a niche where customers first flag anomalies using optical or SAR data and then task a thermal sensor for detailed follow‑up, a workflow known as "tip‑and‑cue" that is gaining traction across multiple verticals.

The £30 million raise reflects a broader confidence in space‑based thermal services, highlighted by participation from the NATO Innovation Fund and the British Business Bank. These public‑sector investors signal strategic interest in ensuring allied capabilities have reliable, high‑resolution heat‑mapping assets. Existing backers such as Lockheed Martin and Molten Ventures also underscore the commercial viability of SatVu’s technology. The capital will be allocated to long‑lead component procurement, satellite integration, and the scheduled 2026 launches, reducing reliance on future financing rounds and accelerating revenue generation.

Looking ahead, SatVu’s ability to achieve cash‑break‑even with just two or three satellites could reshape the economics of niche Earth‑observation constellations. By leveraging a lean cost structure and targeting premium customers in defense, economic intelligence, and climate monitoring, the company is poised to capture a growing share of a market projected to exceed $5 billion by 2030. Successful deployment of HotSat‑2 and HotSat‑3 will not only validate the technology after HotSat‑1’s failure but also cement SatVu’s position as a go‑to provider for high‑resolution thermal data, potentially prompting further strategic partnerships and follow‑on funding.

SatVu Raises £30M to Accelerate its Constellation

UK-based thermal imaging company SatVu announced yesterday that it raised £30M ($40.7M) to meet two goals: accelerating deployment of its HotSat constellation, and fulfilling demand from across the market.

The round included:

-

New investor capital from the NATO Innovation Fund, the British Business Bank, Space Frontiers Fund II, and Presto Tech Horizons;

-

Funds from existing investors such as Molten Ventures, Adara Ventures, Ridgeline Ventures, Noa, Lockheed Martin, Seraphim Space Fund, and Stellar Ventures.

The round brings SatVu’s total equity financing to £60M ($81.4M).

On fire: SatVu sent one satellite to orbit—called HotSat-1—in 2023. The satellite operated for about six months before suffering an on-orbit failure. Demand for thermal imagery has been so great, however, that SatVu is seizing the opportunity to not just get back to orbit, but to grow faster than originally planned, according to CEO Anthony Baker.

“We think we can be cash break-even, even with one or two satellites, by controlling our costs. So we’ve always been very, very careful with that,” Baker told Payload. “But we raised more money to accelerate that program…You never know when the funding gods will decide, ‘This is a bad year.’”

The company has two launches on the books for 2026.

-

HotSat-2 is scheduled to fly on SpaceX’s Transporter-16 flight, which is targeting a launch no earlier than March 29;

-

HotSat-3 may launch on another Transporter mission before the end of the year.

In the meantime, SatVu is using the new capital to buy up long lead-time components of its imaging payload, with the idea of funding future deployments with a mix of revenue and later funding rounds.

All eyes on: Lucky for SatVu, demand for its thermal images has pushed higher across the board. Baker explained that in every vertical—defense, economic monitoring, and climate applications—the need for high-resolution thermal imaging has only grown since HotSat-1 first launched.

Demand is soaring in part due to increasing adoption of the “tip-and-cue” method of EO acquisition, where customers are expected to use optical or SAR data to identify changes on the ground, and then task SatVu’s high-resolution cameras—down to 3.5 m—to take a closer look.

The post SatVu Raises £30M to Accelerate its Constellation appeared first on Payload.

0

Comments

Want to join the conversation?

Loading comments...