🎯Today's Asia Stocks Pulse

Updated 1d agoWhat's happening: Bank of India and Bank of Maharashtra break out with 8% upside as Nifty tops 25,800

The Nifty 50 recorded a third straight gain, moving above the 25,500 support level and the 25,800 resistance, driven by consumer, financial and metal stocks. Bank of India and Bank of Maharashtra each posted decisive breakouts from consolidation zones, prompting buy recommendations that cite roughly an 8% upside. Both banks now trade above all major exponential moving averages and show strong RSI readings.

Also developing:

- •Asian shares climb on Nvidia‑driven rally as US markets surge

- •Tech boost lifts Asia markets amid Iran tensions and Fed rate uncertainty

- •Asian stocks rise as US tech gains offset geopolitical risks

News•Feb 13, 2026

Pulse of the Street: Tech Rout, Muted Earnings Singe Indian Markets

Indian equities broke their recent rally as a broad technology sell‑off combined with mixed earnings commentary and profit‑taking pressured the benchmark indices. The IT sector led the decline, slipping sharply amid global chip‑maker weakness. Meanwhile, consumer‑focused stocks and a handful of financials showed relative resilience, creating a clear sectoral rotation. Overall market sentiment turned cautious, reflecting both external tech pressures and domestic earnings uncertainty.

By Mint (LiveMint) – Markets

Social•Feb 14, 2026

China's January Financing Jumps 2.4% Year‑over‑year, Beating Forecasts

1/5 According to Caixin, China’s aggregate financing grew slightly faster than expected in January, rising by RMB 7.22 trillion. This was 2.4% more than in January 2025 and 10.4% more than in January 2024. It is equal to 5.1% of annual...

By Michael Pettis

Social•Feb 14, 2026

China's Railway Investment Climbs 5.5% in January

Xinhua: "China's railway sector completed 46.3 billion yuan (about 6.67 billion U.S. dollars) in fixed-asset investment in January, up 5.5 percent year on year." https://t.co/g109GF2REm

By Michael Pettis

News•Feb 13, 2026

BSE Gets Sebi Nod to Launch 'Focused Midcap Index' Futures and Options Contracts

The Bombay Stock Exchange (BSE) has secured SEBI approval to roll out cash‑settled futures and options on its new Focused Midcap Index, which tracks the top 20 mid‑cap companies by free‑float market capitalisation. The contracts will be monthly, expiring on...

By The Economic Times – Markets

Social•Feb 14, 2026

China EV Sales Dip, Exports Surge 70% Abroad

China EV Sales Drop for First Time Since February 2024—Chinese exports of EVs and hybrids rise 70% in 2025 as automakers shift their focus overseas @ivy_jiahuihuang https://t.co/PdiFmEGPXg https://t.co/PdiFmEGPXg

By Jonathan Cheng

News•Feb 13, 2026

Market Regulator Sebi Floats Proposal to Revamp ETF Price Band Framework

The Securities and Exchange Board of India (SEBI) has issued a consultation paper proposing a overhaul of ETF price‑band rules. It recommends moving the base‑price reference from T‑2 closing NAV to T‑1 data or recent indicative NAV, and introducing dynamic,...

By Business Standard – Markets

News•Feb 13, 2026

With Competitors Hot on Its Heels, How Can Singapore's Port Stay the Course?

Singapore’s port recorded a historic 3.22 billion gross tonnes of vessel arrivals and 44.66 million TEUs in 2025, marking 3.5% and 8.6% growth respectively over 2024. The hub remains second only to Shanghai, with Ningbo‑Zhoushan closing the gap, while contributing roughly 7%...

By CNA (Channel NewsAsia) – Business

News•Feb 13, 2026

Bhatia Communications Sets Record Date for Third Interim Dividend Payable in FY26

Bhatia Communications & Retail announced February 20 as the record date for its third interim dividend for FY 2025‑26, offering Rs 0.01 per equity share. The dividend is payable to shareholders holding shares before that date. The announcement follows a December‑quarter earnings beat,...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

Morgan Stanley Said to Consider $500 Million India Fund, Shifts some Assets

Morgan Stanley Investment Management is exploring a $500 million continuation fund focused on India, intending to transfer eight healthcare‑related assets, including Omega Hospitals and RG Scientific, into the new vehicle. The move signals the firm’s effort to provide existing investors an...

By The Economic Times – Markets

News•Feb 13, 2026

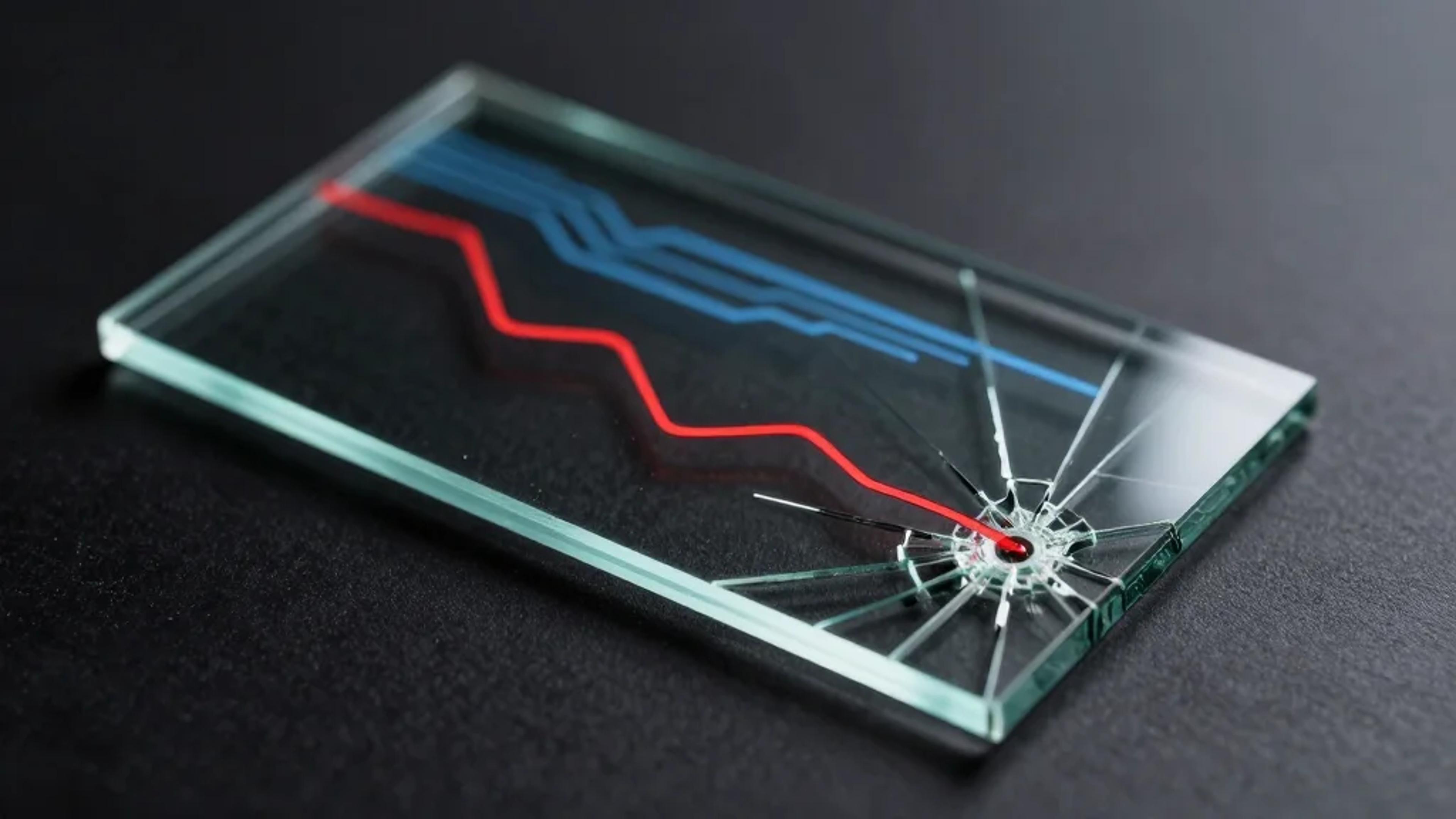

Wipro, Infosys, TCS and 9 Other Stocks Hit 52-Week Lows and Slip up to 20% in a Month

A wave of weakness hit India’s blue‑chip segment as the Sensex slumped nearly 1,048 points, pushing nine BSE 200 stocks to fresh 52‑week lows. Leading IT giants Wipro, L&T Technology Services, TCS and Infosys each fell between 14% and 19% over...

By The Economic Times – Markets

News•Feb 13, 2026

EIL Q3 Profit Soars over 3x YoY to Rs 302 Crore

Engineers India Ltd (EIL) posted a net profit of Rs 302 crore for Q3 FY2025‑26, more than three times its profit a year earlier. The surge was driven by a dramatic rise in turnkey contract earnings, which jumped to Rs 273.68 crore from Rs 18.92 crore,...

By The Economic Times – Markets

News•Feb 13, 2026

India Bond Traders Seek Buybacks as Yields Climb Despite Switch

Indian bond traders are pressing the government for buybacks as 10‑year yields climb despite a recent debt‑switch operation. The benchmark 10‑year yield rose to 6.6878%, up about five basis points after the Treasury swapped ₹755 billion of FY27 bonds for longer‑term...

By The Economic Times – Markets

News•Feb 13, 2026

Sebi Eases Reporting Norms for Brokers, Extends Exemptions to Primary Dealers

The Securities and Exchange Board of India (SEBI) released a consultation paper proposing to relax the naming, tagging and reporting requirements for bank and demat accounts held by stockbrokers. The draft aligns primary dealers with the exemptions already granted to...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

Gainers & Losers: TCS, SpiceJet & Bajaj Finance Among 6 Top Movers on Friday

Indian markets closed sharply lower on Friday, with the Nifty slipping 1.3% to 25,471 and the Sensex dropping 1.25% to 82,627. The sell‑off was led by consumer, IT and energy stocks, as the Nifty IT index fell 1.4% amid heightened...

By The Economic Times – Markets

News•Feb 13, 2026

PNGS Reva Diamond IPO to Hit Dalal Street Soon: Check 5 Key Risks Ahead of the Offer Launch

The PNGS Reva Diamond Limited is set to launch a fresh‑share IPO on Dalal Street valued at roughly ₹380 crore. The issue comprises 0.98 crore new shares priced between ₹367 and ₹386 each, with the bidding period running from February 24 to February 26,...

By Mint (LiveMint) – Markets

News•Feb 13, 2026

Senco's Stellar Q3 Topline Growth Driven by Gold Price Rally; Likely to Close FY with ₹8,000 Cr Revenue: MD

Senco Gold & Diamonds reported a 39% same‑store sales surge in Q3, driven primarily by a 65% rally in gold prices over the past year. Despite the topline boost, Q3 volumes slipped 3% YoY and nine‑month volumes fell 10%. EBITDA...

By The Economic Times – Markets

News•Feb 13, 2026

Kwality Wall's Listing Date Announced as HUL Gets Trading Approval for Demerged Entity

Hindustan Unilever Ltd received BSE and NSE approvals to list its de‑merged ice‑cream arm, Kwality Wall’s, on February 16, issuing 2.34 billion shares. The spin‑off creates India’s first pure‑play listed ice‑cream company, with a one‑for‑one share allocation to HUL shareholders as of...

By The Economic Times – Markets

News•Feb 13, 2026

Ola Electric Q3 Results: Loss Narrows YoY to Rs 487 Crore; Revenue Falls 55%

Ola Electric reported a narrower Q3 FY26 loss of Rs 487 crore versus Rs 564 crore a year earlier. Revenue from operations plunged 55% year‑on‑year to Rs 470 crore, driven by a steep decline in automotive sales. Unit deliveries fell to about 32,680, down from 84,029,...

By The Economic Times – Markets

News•Feb 13, 2026

Rupee Closes Nearly Flat, Modest Depreciation Bias Lingers

India’s rupee ended Friday essentially unchanged, closing at 90.6350 per dollar, a slight dip from the prior session. The currency faced pressure from weak domestic equities, elevated interbank dollar demand, and maturing non‑deliverable forward contracts, while the Reserve Bank of...

By The Economic Times – Markets

News•Feb 13, 2026

Market Highlights: Sensex Settles 1,048 Pts Lower, Nifty Below 25,500; HUL, Eternal Drop 4% Each

Indian benchmarks tumbled on Friday, with the Sensex shedding 1,048 points and the Nifty slipping below the 25,500 mark. A broad sell‑off was led by the IT index, which fell more than 5% as investors fretted over AI‑driven disruption and...

By The Economic Times – Markets

News•Feb 13, 2026

Dollar Rises Against Dong on Black Market

The Vietnamese dollar rose 0.5% on the black market to VND 26,547 per U.S. dollar, while the official Vietcombank rate stayed at VND 26,160. The State Bank of Vietnam trimmed its reference rate marginally to VND 25,049. Globally, the greenback is set for...

By VNExpress – Companies (subset)

News•Feb 13, 2026

Singaporeans to Get Nearly $400 in Vouchers, up to $316 in Cash as Cost-of-Living Support

Singapore's 2026 budget introduces a Cost‑of‑Living Special Payment, granting eligible adults up to S$400 cash and providing every household with S$500 in Community Development Council vouchers. The cash payout targets citizens earning up to S$100,000 and owning no more than...

By VNExpress – Companies (subset)

News•Feb 13, 2026

Patriot Lines up Global Copper-Silver Assets for the AI-Driven Surge

Patriot Resources, an ASX‑listed junior, has assembled a global copper‑silver portfolio aimed at capitalising on the AI‑driven data‑centre boom. The company recently secured the high‑grade Tassa silver‑gold project in Peru for $500,000 and is advancing drilling that has returned multiple...

By The Age – Business

News•Feb 12, 2026

Surge in ANZ, CBA Helps Drive ASX Higher; AMP, Temple & Webster Tumble

Australian equities rose 0.3% to 9,043.5 as a surge in bank stocks lifted the S&P/ASX 200. ANZ Bank reported a $1.9 bn profit for the December quarter, sending its shares up 8.5% and sparking gains across Commonwealth, Westpac and NAB. In contrast,...

By Sydney Morning Herald – Business

Social•Feb 12, 2026

LG Electronics IPO Plummets: Profit Falls 61%

LG Electronic - IPO Stock : Bad News Profit Slumps 61% 🚨 Net Profit slumps 61.6% to Rs 89.6 crore Vs Rs 233 crore Revenue down 6.4% to Rs 4,114 crore Vs Rs 4,396 crore EBITDA slumps 42.4% to Rs 196 crore Vs...

By Champ Trader

Social•Feb 11, 2026

Promoters May Offload Up to 3% of Netweb Technologies

#BlockDeal | Sources say that promoters likely to sell up to 3% stake in #NetwebTechnologies via block deals

By Yogesh Mantri

News•Feb 11, 2026

New Deputy Finance Minister Guns for 5.6% First-Quarter GDP Growth

Indonesia’s newly appointed deputy finance minister, Juda Agung, entered office on February 5 after serving as Bank Indonesia’s deputy governor. Within days he announced an ambitious revision to the first‑quarter 2026 GDP target, nudging it from the baseline 5.5 percent to 5.6 percent....

By The Jakarta Post – Business (site)

Social•Feb 11, 2026

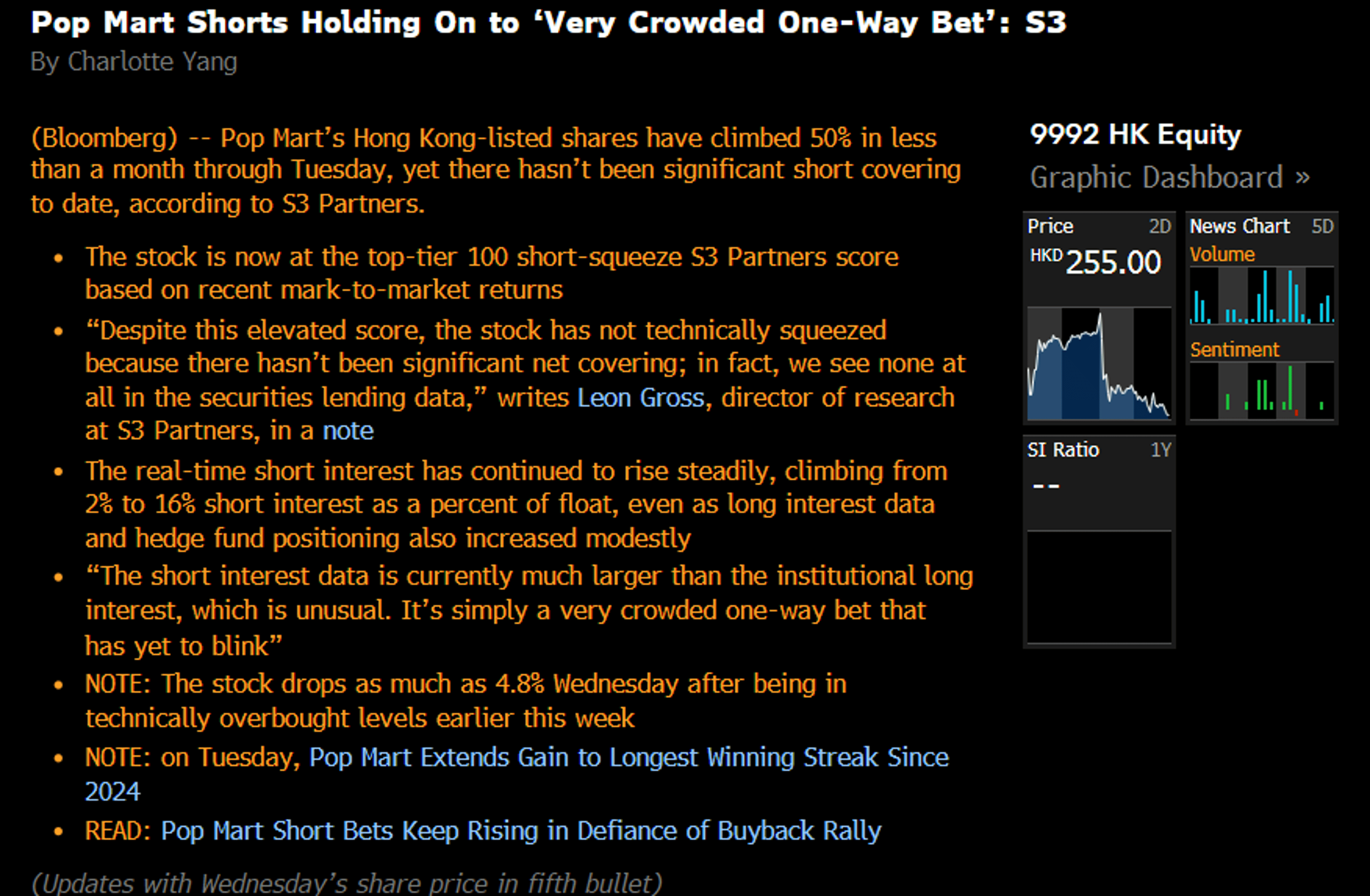

Pop Mart Rallies 50% with Minimal Short Covering

For those of you still watching where this bull-bear battle goes for Pop Mart, S3 Partners just said they have not seen much short covering despite the shares over 50% rally in less than a month through Tuesday https://t.co/oArFfDeiSH

By Charlotte Yang

News•Feb 11, 2026

Mahindra & Mahindra Q3 PAT Rises 33% to ₹3,931 Crore

Mahindra & Mahindra reported a 33% jump in standalone profit after tax to ₹3,931 crore for Q3 FY26, while revenue rose 26% to ₹38,942 crore. Vehicle sales increased 23% to 302,238 units, and the farm‑equipment segment posted a 20.2% margin on ₹10,200 crore...

By The Hindu BusinessLine – Markets

News•Feb 11, 2026

Sensex, Nifty Trade Flat as Investors Await CPI Data; Auto, Healthcare Stocks Outperform

Indian equities traded in a narrow range on Wednesday as investors awaited the January CPI release, leaving the Sensex down 156 points (0.19%) and the Nifty 50 slipping 26 points (0.10%). Auto and healthcare stocks outperformed, with Eicher Motors gaining...

By The Hindu BusinessLine – Markets

Social•Feb 11, 2026

Toyota‑Elliott Dispute over Toyota Industries Deal Lacks Key Financials

This @NikkeiAsia article just out on Toyota Group's "clash" with Elliott on the disposition of Toyota Industries is shameful. There are a bunch of very basic quotes. There is no mention of book value. There is no mention of the...

By Travis Lundy

Social•Feb 11, 2026

China's Consumer Inflation Cools, Producer Prices Keep Falling

China’s Consumer Inflation Eases, Producer Prices Stay in Decline The consumer-price index rose 0.2% from a year earlier in January, cooling from December’s 0.8% increase https://t.co/7xOyvC2ByN https://t.co/7xOyvC2ByN

By Jonathan Cheng

News•Feb 11, 2026

Q3 Results Today Live: M&M, Divi’s Lab, Ashok Leyland, Lenskart, LG Electronics, Godrej, Patanjali Foods, AstraZeneca to Announce Q3 Results,...

India’s Q3 earnings season saw several blue‑chip stocks post strong results, lifting market sentiment. Eicher Motors led gains with a 7% share surge after reporting 22.9% revenue growth and higher EBITDA margins. Apollo Hospitals and Titan also delivered double‑digit profit...

By The Hindu BusinessLine – Markets

Social•Feb 11, 2026

AI Restrictions Trap Chinese Startups, Hurt US Innovation

“If Beijing forces Chinese AI innovation to remain fully domestic, Chinese startups face permanent capital constraints. If Washington blocks all China-adjacent AI deals, American firms lose access to innovative Chinese technologies.” https://t.co/zD3VCYdTdC

By Jonathan Cheng

Social•Feb 11, 2026

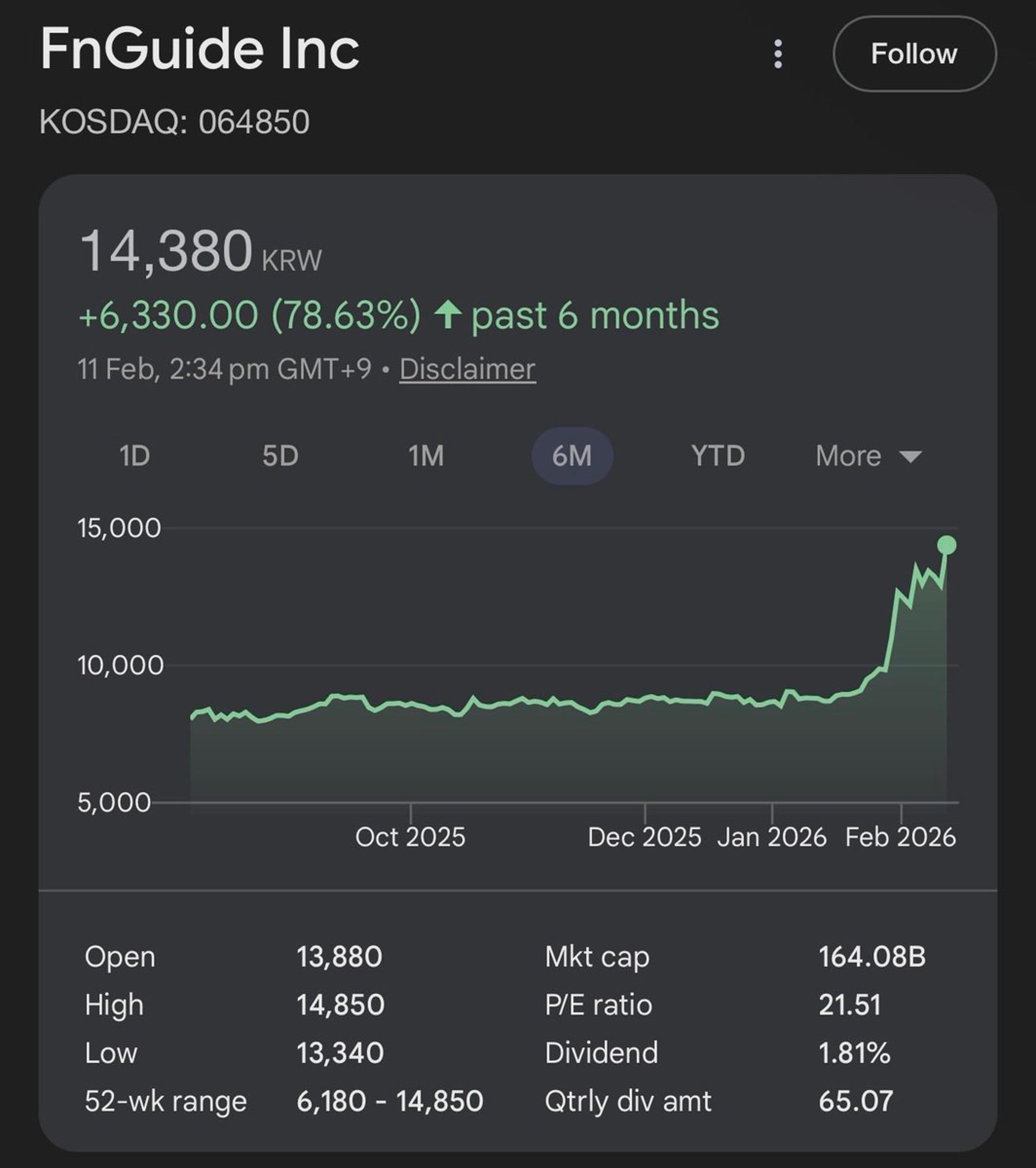

FnGuide Surges 11% as Demand Shows No Signs

FnGuide up another +11% today. Feel’s like there’s almost no end to the demand for the stock. https://t.co/mqJYQH1Dd1

By Michael Fritzell

Blog•Feb 11, 2026

India Is Kicking Trump's Butt on the Trade Deal, TACO Time (Again)

The White House has issued an updated U.S.–India trade factsheet, removing a reference to India cutting tariffs on pulses and softening language around digital services commitments. The document also shifts wording from India “intending” to purchase more U.S. goods to...

By investingLive – Asia-Pacific News Wrap

News•Feb 11, 2026

Country Garden Shares Edge up After Regulators Hold Back on Fines over Debt Disclosures

Country Garden shares rose about 1.8% after the Shanghai Stock Exchange issued a circulated criticism for delayed debt disclosures but stopped short of imposing fines. The regulator flagged failures across three reporting periods and recorded disciplinary action against the firm...

By South China Morning Post — Markets

News•Feb 11, 2026

Japan to Boost Aid for Video Games and Anime as New Pillar of Growth

Japan announced a major increase in government support for its content industries, including video games and anime, to accelerate overseas expansion. Overseas sales of Japanese media reached ¥5.8 trillion in 2023, and the government aims to lift annual export revenue to...

By The Japan Times – Business

Social•Feb 11, 2026

Goldman Sachs Gains Ground in Indian Deal Market

Goldman Sachs has played on the fringes of Indian dealmaking for years. A big push to take market share from its Wall Street rivals is starting to bear fruit https://t.co/wB4mwz8dvu Anto Anthony @ScanlanDavid

By Lulu Yilun Chen

News•Feb 11, 2026

Metrobank Sees Private Wealth Investors Turning Choosier in 2026

Metrobank reports private wealth investors in the Philippines becoming more selective in 2026, focusing on disciplined, opportunity‑driven allocation. High‑net‑worth clients favor Asian and emerging‑market equities, especially AI‑linked semiconductor stocks, while keeping equities overweight versus fixed income. Fixed‑income exposure is added...

By Philippine Daily Inquirer – Business

News•Feb 11, 2026

Critical Minerals Deal Benefit Goes Beyond Mining

The Philippines and the United States have signed a critical minerals agreement that goes beyond raw‑material extraction, targeting downstream processing, power generation, logistics and chemical handling. The Department of Trade and Industry says the pact adopts a whole‑of‑government approach to...

By Philippine Daily Inquirer – Business

News•Feb 11, 2026

Goldman Sachs Ramps up India Push as Investment Banking Bets Pay Off

Goldman Sachs has accelerated its India strategy, injecting roughly $500 million into its local franchise over the past three years. The push has lifted the firm to fourth place in equity offerings and fifth in M&A league tables, overtaking long‑time rivals...

By The Hindu BusinessLine – Markets

Social•Feb 11, 2026

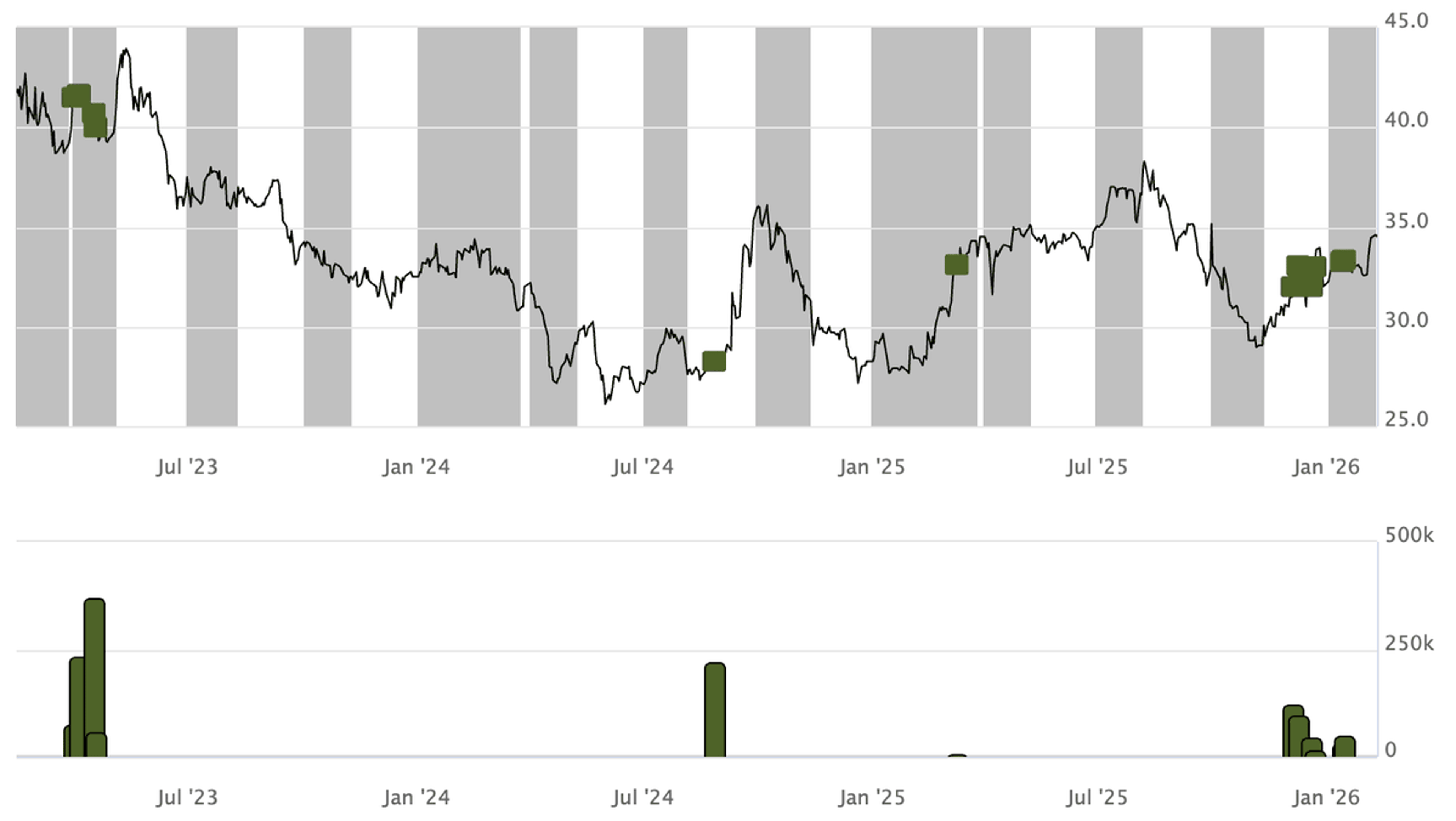

Insider Buys Cebu Air as China Visa‑Free Opens

Insider buying in Cebu Air CEB PM. Comes right after the Philippines introduced visa-free entry for Chinese nationals. Source: Smart Insider https://t.co/QYnTMGfGiz

By Michael Fritzell

News•Feb 11, 2026

Stock Market Live: Stock to Buy Today: Lumax Auto Technologies

Lumax Auto Technologies saw its share price surge over 11% this week, breaking the intermediate resistance at ₹1,560 and establishing a new support level. The stock is currently trading around ₹1,640, with analysts projecting a target of ₹1,880‑₹1,900 in the...

By The Hindu BusinessLine – Markets

Blog•Feb 11, 2026

PBOC Sets USD/ CNY Mid-Point Today at 6.9438 (Vs. Estimate at 6.9109)

The People’s Bank of China (PBOC) set the USD/CNY midpoint at 6.9438 on Tuesday, notably higher than the Reuters estimate of 6.9109. The central bank maintains its +/-2% trading band around the reference rate, with the yuan closing the previous...

By investingLive – Asia-Pacific News Wrap

Podcast•Feb 11, 2026•0 min

PETER LEWIS'MONEY TALK - Wednesday 11 February 2026

In this episode, Peter Lewis discusses Japan’s post‑election economic challenge: reviving growth without reigniting inflation that has already driven staple prices, like rice, to double. He is joined by Richard Harris of Port Shelter Investment Management and Tony Nash of...

By Peter Lewis’ Money Talk

News•Feb 11, 2026

Bank of Japan Quietly Embarks on ETF Sale Set to Last a Century

The Bank of Japan has started selling its massive ETF portfolio, roughly 95 trillion yen ($610 billion). The unwind will be deliberately gradual, with estimates suggesting the process could extend for decades, even up to a century. By reducing its holdings...

By Nikkei Asia – Top Stories

News•Feb 11, 2026

Singapore Beats Estimates with 5% GDP Growth in 2025 Amid AI Challenges

Singapore’s economy expanded 5% in 2025, surpassing the 4.8% forecast, largely thanks to a surge in AI‑driven manufacturing output. Global demand for artificial‑intelligence‑enabled products lifted factory orders and export volumes. While the growth outperformed expectations, policymakers warned that rapid AI...

By Nikkei Asia – Top Stories

News•Feb 11, 2026

China State Gold Miner Zijin Eyes Global Top 3 as Geopolitical Risks Grow

China's state‑owned Zijin Mining Group announced an aggressive push to rank among the world’s top three gold and copper producers, primarily through overseas acquisitions. The strategy emphasizes gold and copper as core minerals for future growth while acknowledging heightened geopolitical...

By Nikkei Asia – Top Stories

News•Feb 11, 2026

Fujitsu to Boost Server Production in Japan, Eyeing Sovereign AI Demand

Fujitsu announced it will begin manufacturing artificial‑intelligence servers at its Ishikawa plant in March 2026, expanding domestic production capacity. The new line emphasizes component‑origin tracking to guard against data‑leak risks, a feature aimed at sovereign AI deployments. This move aligns...

By Nikkei Asia – Top Stories