🎯Today's Asia Stocks Pulse

Updated 9m agoWhat's happening: India targets ₹80,000 crore divestment, spurring PSU rally

The Indian government has announced an ₹80,000‑crore dis‑investment target for the next fiscal year. The plan, which combines strategic stake sales and asset monetisation, has lifted public‑sector undertaking stocks and boosted equity markets. Industry leaders have welcomed the move as a way to unlock value in formerly state‑owned firms.

Also developing:

- •JSW Infra to raise ~₹6,325 crore via share issue to meet 25% public stake rule

- •Timken India posts 14% YoY revenue rise, broker rates Accumulate

- •Asian markets mixed as AI concerns weigh on Wall Street

- •Asian stocks dip, oil climbs amid Iran tension

News•Feb 9, 2026

BSE Q3 Profit Jumps 174% to ₹602 Crore on Strong Trading, Higher Income

India’s oldest exchange, BSE, posted a 174% year‑on‑year jump in Q3 FY26 net profit to ₹602 crore, driven by robust trading activity and higher operating income. Revenue from operations surged 62% to ₹1,244 crore. Sequentially, profit rose 8% from Q2 while revenue grew 16%, indicating steady momentum. The results underscore a revitalised Indian equity market and BSE’s strengthening financial footing.

By The Hindu BusinessLine – Markets

News•Feb 9, 2026

SBI Surges to Record High as Markets Rally on US Trade Deal Optimism

India’s equity markets closed sharply higher on Feb 9, 2026, with the Sensex up 0.58% and the Nifty up 0.68%, driven by optimism over an interim India‑US trade framework and strong earnings from State Bank of India (SBI). SBI surged 7.63%...

By The Hindu BusinessLine – Markets

News•Feb 9, 2026

Takaichi's Victory Could Fast-Track Taiwan-Japan EPA: Expert

Japanese Prime Minister Sanae Takaichi secured a landslide win in the lower‑house election, giving her party a dominant 316‑seat majority. The victory is expected to accelerate negotiations on a Taiwan‑Japan Economic Partnership Agreement, according to University of Tokyo expert Lim...

By Focus Taiwan (CNA) – English News

News•Feb 9, 2026

Broker’s Call: Tata Steel (Hold)

Tata Steel posted Q3 FY26 revenue of ₹57,000 crore, down 3% QoQ, while volumes rose 4%. Consolidated EBITDA slipped 11% to ₹8,200 crore, with weaker pricing and widening losses in the UK and Netherlands. A cost‑transformation programme delivered ₹8.6 billion of savings and...

By The Hindu BusinessLine – Markets

News•Feb 9, 2026

Broker’s Call: Hero MotoCorp (Buy)

Motilal Oswal reiterates a Buy on Hero MotoCorp, setting a ₹6,804 target versus the current ₹5,755.20 price. The company posted Q3 FY26 profit of ₹14.4 billion, marginally above forecasts, helped by higher other income while margins held steady despite an EV rollout. Analysts project...

By The Hindu BusinessLine – Markets

News•Feb 9, 2026

Taiwan to Freeze Fuel Prices over Lunar New Year, Gas Rates Through February

Taiwan's Executive Yuan announced a temporary freeze on gasoline and diesel prices from Feb 16‑23 and will keep natural gas and LPG rates unchanged through the end of February to smooth consumer costs during the Lunar New Year. The decision follows...

By Focus Taiwan (CNA) – English News

News•Feb 9, 2026

Taiwan's January Exports Rise for 27th Straight Month, Hit New High

Taiwan’s January exports jumped 69.9% year‑on‑year to a record $65.77 billion, marking the 27th straight month of growth. Imports also rose sharply, yielding an $18.89 billion trade surplus, up 87.7%. The surge was led by AI‑related tech, information and audio/video products, and...

By Focus Taiwan (CNA) – English News

News•Feb 9, 2026

Mufin Green Finance Raises ₹125 Crore Through NCD Placement

Mufin Green Finance Ltd has raised ₹125 crore by issuing secured, rated non‑convertible debentures (NCDs) to LC Capital India Private Ltd. The private placement, announced on February 9, 2026, will fund expansion across multiple lending verticals, including electric‑vehicle, solar, mediclaim premium, corporate, and...

By The Hindu BusinessLine – Markets

News•Feb 9, 2026

Rupee Falls 9 Paise to Close at 90.74 Against US Dollar

The Indian rupee closed at 90.74 per U.S. dollar on Monday, down 9 paise after a volatile session that swung between a high of 90.37 and a low of 90.77. Traders linked the movement to the newly announced India‑U.S. interim trade...

By The Hindu BusinessLine – Markets

News•Feb 9, 2026

Supermicro Secures 1st Syndicated Loan in Taiwan

U.S.-based AI server maker Super Micro Computer secured its first syndicated loan in Taiwan, amounting to $1.765 billion. The loan was administered by CTBC Bank and attracted participation from 21 financial institutions, resulting in an almost 1.8‑times oversubscription. Lenders cited Supermicro’s...

By Focus Taiwan (CNA) – English News

News•Feb 9, 2026

Zydus Lifesciences Posts 30% Revenue Jump in Q3, Net Profit up 9%

Zydus Lifesciences reported a 30% year‑on‑year revenue increase to ₹68.6 bn in Q3 FY2025‑26, driven by strong performance across pharmaceuticals, consumer wellness and medtech. Adjusted net profit rose 9% to ₹11.1 bn, while EBITDA grew 31% to ₹18.2 bn, lifting margins to 26.5%....

By The Hindu BusinessLine – Markets

News•Feb 9, 2026

Taiwan Shares Soar over 600 Points After U.S. Rally

Taiwan’s benchmark Taiex index closed 1.96% higher at 32,404 points, gaining over 600 points after a late‑week U.S. market rally. The surge was led by AI‑related chips and electronics firms, with MediaTek up 7% and Winbond jumping 10%, while TSMC...

By Focus Taiwan (CNA) – English News

Blog•Feb 9, 2026

Gradual End of Bank Dominance in India

India’s household financial portfolio is shifting away from traditional safe assets toward equities and managed funds. Between March 2021 and March 2025, bank deposits fell from roughly 47.5% to 43.5% of total financial assets, while mutual‑fund and pension holdings rose...

By Prof. Jayanth R. Varma’s Financial Markets Blog

News•Feb 9, 2026

Muyuan IPO Feeds Into Hong Kong’s Public Market Rebound

China’s leading hog breeder Muyuan Foods raised roughly HKD 10.7 billion (US$1.4 billion) in its Hong Kong H‑share offering, pricing at HKD 39 per share. The IPO was heavily subscribed, with domestic demand 5.88 times and the international tranche 8.62 times, and attracted...

By KrASIA

Blog•Feb 9, 2026

ASEAN Inc.: One Portfolio, Seven Markets — and a Clear Test of Southeast Asia’s Investment Story

The episode breaks down the ASEAN Inc. portfolio—a $1 million, equally weighted allocation across seven U.S.-listed ETFs covering Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, and a regional ASEAN‑40 fund—and shows it delivered a 21.3% annualized total return through February 2026, beating...

By The International Investor

Podcast•Feb 9, 2026•18 min

Money and Me: S-REITs Are Back - But Not All Recoveries Are Equal

The episode examines the resurgence of Singapore REITs (S-REITs), highlighted by the iEdge S-REIT Leaders Index posting a 16.3% gain in 2025—the strongest performance since 2019. Host Michelle Martin and REIT specialist Kenny Loh discuss which property sectors are leading...

By Your Money with Michelle Martin (MONEY FM 89.3)

Blog•Feb 8, 2026

Carabao (CBG TB)

Carabao Energy Drink (CBG TB) is being touted as Thailand’s equivalent to Monster Beverage, trading at roughly 12 times forward earnings. The forward P/E of 12× is well below the global energy‑drink peer average, indicating a potential valuation discount. Carabao commands about...

By Asian Century Stocks

News•Feb 7, 2026

Japan Monthly Household Spending in 2025 up 0.9%

Japan's average monthly household spending rose 0.9% year‑on‑year in 2025, marking the first increase after three consecutive years of decline. The gain was driven by higher outlays on education, entertainment and automobiles, while food expenses fell 1.2% as consumers curtailed...

By Japan Today – Business

Blog•Feb 7, 2026

China’s Property Developers: The Other Side of the Coin

The episode revisits Panda Perspectives' May 2025 deep‑dive on Chinese property developers, evaluating how its thesis—that state‑owned enterprises (SOEs) would outpace privately owned developers (POEs) across balance sheets, funding, land banks, margins, and market share—has held up after nine months. The...

By Panda Perspectives – China Weekly Wrap

News•Feb 6, 2026

Toyota Names New CEO After Reporting Drop in Profits

Toyota announced a 43% drop in quarterly profit and named its CFO, Kenta Kon, as the new chief executive and president effective April. Kon, a veteran with expertise in automated driving, will replace Koji Sato, who will stay on as...

By Japan Today – Business

News•Feb 6, 2026

Sony Hikes Forecasts Even as PlayStation Falters

Sony raised its FY2025‑26 profit forecast to 1.13 trillion yen, citing a weaker yen and offsetting a slowdown in PlayStation sales. Operating profit is projected to grow 20.6% with revenues reaching 12.3 trillion yen. Despite a 16% decline in PS5 sales and...

By Japan Today – Business

Blog•Feb 5, 2026

Inside China’s EV Boom: Why the World’s Most Competitive EV Market Is in China

China remains the world’s largest electric‑vehicle market, with millions of EVs on its streets daily. The ecosystem features a dense mix of legacy manufacturers like BYD and tech entrants such as Xiaomi and Huawei, each launching high‑performance or software‑centric models....

By China Last Night (KraneShares Research)

News•Feb 4, 2026

Energy Storage Players Great Power, Sunwoda and Deye Technology File Hong Kong Listing Applications

Three Chinese energy‑storage firms—Great Power, Sunwoda and Deye Technology—have filed or updated Main Board IPO applications on the Hong Kong Stock Exchange. Great Power targets RMB 10 billion revenue in 2025 and expects a profit turnaround. Sunwoda refiles its prospectus, showing RMB 56 billion...

By Energy Storage News

Blog•Feb 4, 2026

KOSPI Surges +1.57%: Hardware Sovereignty (Samsung)

In this episode LoRosha analyzes the February 4 Asian market session, highlighting a 1.57% rise in the KOSPI driven by Samsung Electronics breaking the 169,000 KRW mark and reaching a $720 billion market cap. He argues that despite heavy foreign net...

By LoRosha’s Investment Desk

Blog•Feb 2, 2026

Markets Say “Wrong Kevin”, Xiaomi & Ford Could Partner Up

Asian equity markets slumped after President‑Trump‑appointed Fed nominee Kevin Warsh signaled hawkish policy, prompting a broad risk‑off that also lifted the U.S. dollar. Meanwhile, the renminbi hit a 52‑week high at 6.94 per dollar even as commodity futures and semiconductor...

By China Last Night (KraneShares Research)

Podcast•Feb 2, 2026•15 min

Money and Me: When Gold Breaks, AI Bites Back, and Japan Shakes the World

In this episode, host Michelle Martin and guest Simon Ree, founder of Tao of Trading, dissect a volatile market landscape where gold and silver have sharply retreated after a steep rally, and Microsoft’s stock fell despite strong earnings, raising concerns...

By Your Money with Michelle Martin (MONEY FM 89.3)

Blog•Jan 31, 2026

China’s Industrial Inflection

The episode examines China’s fixed asset investment (FAI) slump in 2025 and the government’s new policy push in January 2026 to shift spending from traditional construction toward smarter factories and digital infrastructure. It argues that this pivot could turn FAI...

By Panda Perspectives – China Weekly Wrap

News•Jan 30, 2026

Report on Initial Public Offering Applications, Delisting and Suspensions (January 2026)

The Hong Kong Stock Exchange processed 474 IPO applications in January 2026, with 415 still under review and only 19 having reached listing status. No applications were rejected or returned, reflecting a streamlined review under the Enhanced Application Timeframe, which...

By HKEX – Market Communications (RSS‑enabled page)

Social•Jan 27, 2026

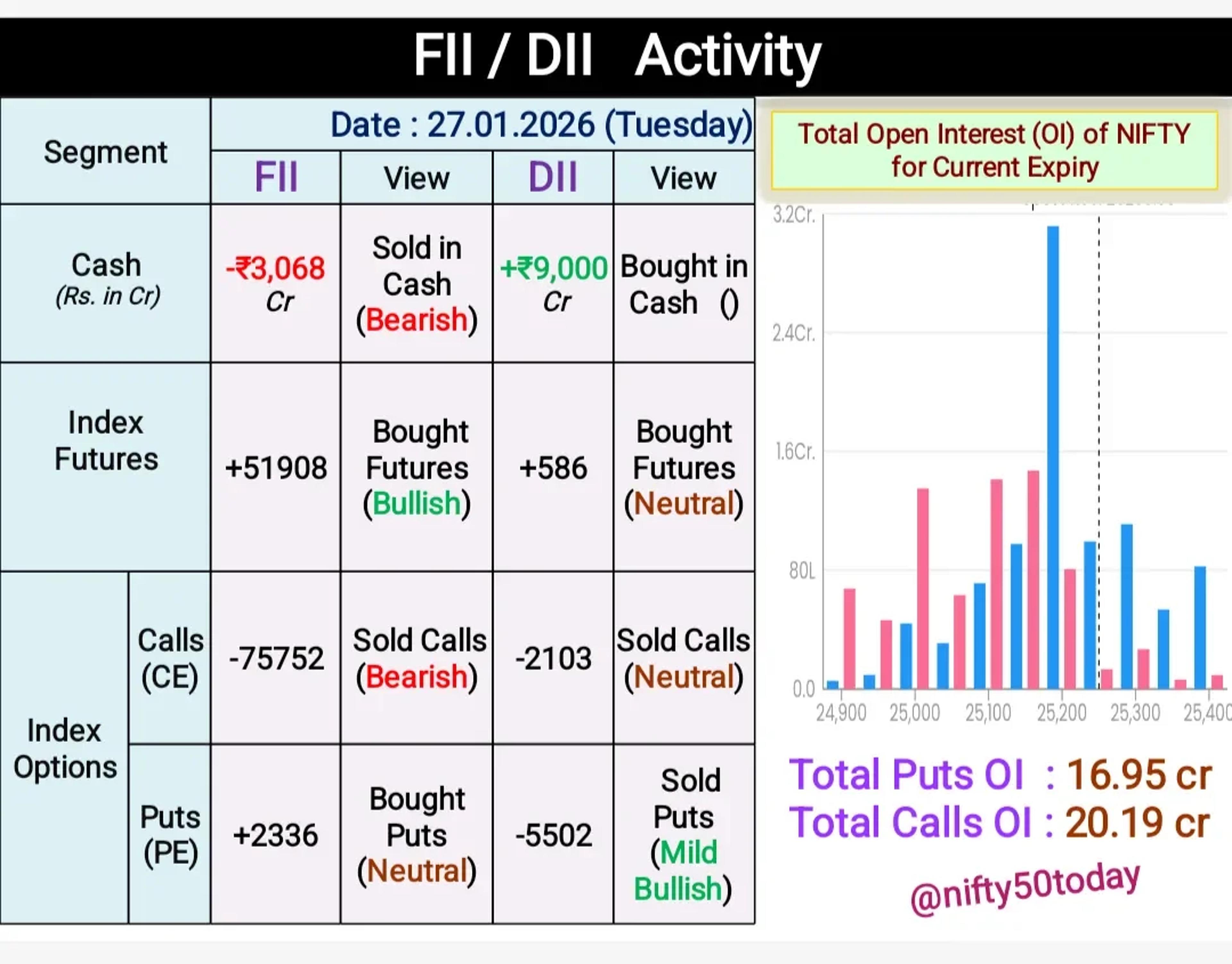

DIIs Buy Heavy as FIIs Sell; Put/Call Ratio 0

𝗙𝗜𝗜 / 𝗗𝗜𝗜 𝗮𝗰𝘁𝗶𝘃𝗶𝘁𝘆: 27th January ✔️#FIIs sold worth ₹3,068 cr and #DIIs bought of ₹9,000 cr in cash market. ✔️FIIs sold worth ₹784 cr in Index Options and sold Futures of ₹2,998 cr. 📊𝐓𝐨𝐭𝐚𝐥 𝐏𝐮𝐭𝐬: 16.95 cr 📊𝐓𝐨𝐭𝐚𝐥 𝐂𝐚𝐥𝐥𝐬: 20.19...

By Nifty Today

Blog•Jan 26, 2026

Asian Macro Initial Thoughts, Australia & India Re-Open. Currencies, Tariffs and Earnings on the Agenda as Gold & Silver Rally.

The episode surveys the volatile Asian macro landscape, highlighting Trump‑triggered tariff threats to South Korea, shifting US immigration policy, and Xi’s military purge, while noting strong performances in emerging‑market currencies like the ringgit and Singapore dollar. It reviews the earnings...

By Asian Market Sense

Blog•Jan 25, 2026

China Weekly Wrap: Markets, Macro & Tech

The episode reviews the latest China market dynamics, highlighting a split performance where Shenzhen‑focused growth stocks outperformed while Shanghai mega‑caps and state‑heavy sectors lagged. Offshore Hong Kong showed modest gains with defensive sectors leading, and regional momentum was driven by...

By Panda Perspectives – China Weekly Wrap

Blog•Jan 25, 2026

E Ink (8069 TT)

E Ink remains the unrivaled supplier of e‑paper displays, controlling virtually the entire global market. The company trades at a lofty 16× price‑to‑earnings multiple, reflecting investor optimism despite modest growth. A breakthrough colour‑display technology is poised to expand its addressable...

By Asian Century Stocks

Blog•Jan 17, 2026

The RMB Weakness that Wasn't

In this episode the hosts dissect the recent breach of the 7.00 RMB per USD threshold, a move they had forecast despite official resistance. They revisit their earlier stance against a "balance‑sheet recession" narrative, argue that the fundamentals still support further...

By Panda Perspectives – China Weekly Wrap

Podcast•Jan 16, 2026•21 min

Market View: Is the AI Trade Back On?

The episode examines whether the AI trade is resurging, focusing on the surge in semiconductor stocks and banks benefiting from AI‑related demand. It analyzes TSMC’s record earnings and what they reveal about the durability of AI‑driven chip supply chains, while...

By Your Money with Michelle Martin (MONEY FM 89.3)

Podcast•Jan 14, 2026•26 min

Could a Cap on Credit-Card Rates Really Hurt Consumers?

The episode examines President Trump's proposal to impose a temporary 10% cap on credit‑card interest rates, exploring the arguments from big banks that such a limit could restrict credit availability and disproportionately affect vulnerable borrowers. It also touches on soaring...

By BBC World Service – World Business Report

Blog•Jan 14, 2026

The Dollar Consolidates While Japan Steps Up Its Intervention Threats and Decision Day for the SCOTUS

The U.S. dollar is in a consolidating phase, hovering around JPY158.6 after a brief push toward JPY159.5, as Japanese authorities intensify verbal warnings of possible market intervention. In North America, traders await U.S. PPI, retail sales data and comments from...

By Marc to Market

Podcast•Jan 14, 2026•22 min

Market View: Profits, Premium Seats & a Check-In Button

In this episode, Michelle Martin and Ryan Huang dissect the paradox of strong earnings reports—JPMorgan Chase’s higher revenue but lower profit and Delta Air Lines’ premium‑travel‑driven profit surge—yet both stocks fell as market expectations outpaced results. They also examine notable...

By Your Money with Michelle Martin (MONEY FM 89.3)