Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices above $66 a barrel amid heightened geopolitical risk. Figma reported its best quarter yet, posting $304 million in revenue and a 40% year‑over‑year increase. CEO Dylan Field emphasized that AI improvements directly boost the platform, noting that more than 75% of customers with ARR above $10 K now consume AI credits weekly and that weekly active users of the new Figma Make feature rose 70% quarter‑over‑quarter. The company also unveiled an integration with Cloud Code, positioning Figma as a central hub for design‑to‑code workflows. Blue Owl Capital, meanwhile, announced a restriction on withdrawals from one of its flagship private‑credit funds, triggering a sharp sell‑off in its shares and reigniting concerns about liquidity in the $1.8 trillion private‑credit market. Analysts warned that the move could signal deeper stress in a sector already under scrutiny for opaque risk structures. The dual narratives underscore divergent investor themes: Figma’s AI‑centric product expansion may restore confidence in SaaS valuations, while Blue Owl’s withdrawal limits serve as a cautionary tale about hidden credit risks. Both stories suggest that technology adoption and credit‑market transparency will shape capital allocation decisions in the coming months.

By Bloomberg Television

Video•Feb 19, 2026

The Close for Wednesday, Feb. 18, 2026

The Close segment recapped the day’s market outlook, highlighting upcoming earnings from RioCam and IA Financial, a slump in Canadian housing prices, Japan’s $36 bn investment in U.S. energy and minerals, Berkshire Hathaway’s portfolio shift, and General Motors’ $63 m Oshawa plant...

By BNN Bloomberg

Video•Feb 19, 2026

'New Canadian Government Has Really Taken the Opportunity to Focus on Areas We Can Control': Bai

The interview with John Bay, CIO of NEI Investments, centered on today’s market rally, a 3% oil price jump, and the broader impact of geopolitical tensions on North‑American equities. Bay linked the oil surge to stalled Russia‑Ukraine talks and heightened U.S.–Iran...

By BNN Bloomberg

Video•Feb 18, 2026

10-Year T-Note Futures Declined After Hawkish Fed Minutes. 2/18/26

The market focus on February 18 was the decline in 10‑year Treasury note futures after the Federal Reserve released its minutes. Futures slipped for a second straight session, retreating from a two‑and‑a‑half‑month high and trading around the 112.29 level. Two catalysts...

By CME Group

Video•Feb 18, 2026

The One Number That May Explain This Market

The video centers on the 10‑year Treasury yield hovering near the 4% mark, which the presenter describes as the market’s thermostat for the coming trading week. He argues that this single number now dictates cross‑asset flows, influencing everything from tech...

By tastylive (tastytrade)

Video•Feb 16, 2026

💡 Loans vs Bonds Explained for IB Interviews

The video breaks down the fundamental differences between senior loans and bonds, a staple topic in investment‑banking interview prep. It highlights that senior loans are secured and usually carry floating rates tied to LIBOR or its successor, while bonds are unsecured,...

By Wall Street Oasis

Video•Feb 13, 2026

Nasdaq-100 and S&P 500 Futures Finished Lower for a Second Week. 2/13/26

The market focus this week centers on U.S. Treasury yields, which have slumped across the curve—from the 5‑year to the 30‑year—dragging the 10‑year rate to its lowest point since October 28, 2024. The yield plunge helped the dollar close its weakest week...

By CME Group

Video•Feb 12, 2026

Are Tighter Credit Spreads a Concern?

In a recent interview, JP Morgan Asset Management’s fixed‑income strategist Cheyenne Hussein addressed whether tighter credit spreads pose a risk to the U.S. bond market. The conversation was prompted by a strong jobs report and centered on how the data reshapes...

By BNN Bloomberg

Video•Feb 10, 2026

Squawk Box Asia - 11-Feb-26

Squawk Box Asia’s Feb. 11 segment framed artificial intelligence as a transformative force across industries, offering a broad overview of its current capabilities and future potential. The program outlined AI’s applications, from operational efficiencies to new product development, and signaled...

By CNBC International Live

Video•Feb 5, 2026

President Lagarde Presents the Latest Monetary Policy Decisions – 5 February 2026

President Christine Lagarde’s February 5 press conference confirmed that the European Central Bank kept its three key policy rates on hold, emphasizing a data‑dependent stance as inflation eases toward the 2% medium‑term target. The meeting also marked Bulgaria’s accession to...

By European Central Bank

Video•Feb 5, 2026

ECB Governing Council Press Conference - 5 February 2026

The European Central Bank’s Governing Council met on 5 February 2026 and left its three policy rates unchanged, underscoring a data‑dependent, meeting‑by‑meeting approach. The press conference also marked Bulgaria’s formal entry into the euro area on 1 January, bringing the bloc’s membership to...

By European Central Bank

Video•Feb 5, 2026

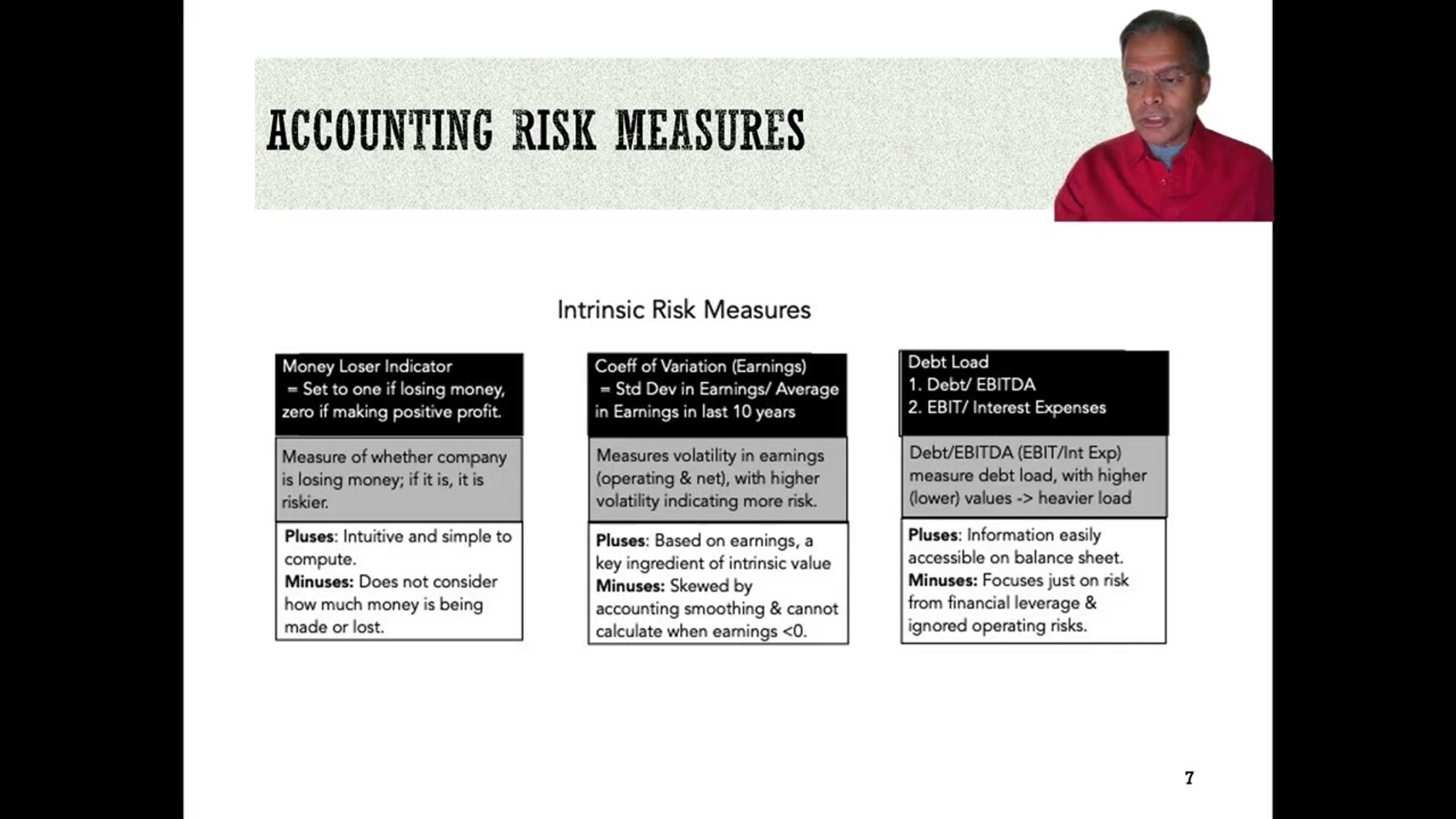

Data Update 5 for 2026: Risk and Hurdle Rates - The 2026 Edition!

The video, the fifth data update for 2026, focuses on how companies’ risk profiles drive hurdle‑rate calculations. After reviewing market‑level performance in earlier updates, the presenter shifts to firm‑level risk divergence and why precise risk measurement is essential for finance...

By Aswath Damodaran

![Positioning for What’s Next in Markets | The Macro Show [FREE EDITION]](/cdn-cgi/image/width=3840,quality=75,format=auto,fit=cover/https://i.ytimg.com/vi/DZrwj2t32yc/maxresdefault.jpg)

Video•Feb 4, 2026

Positioning for What’s Next in Markets | The Macro Show [FREE EDITION]

The Macro Show’s free edition opened with Emma Vlic and Hedgei CEO Keith McCulla outlining their daily decision‑making framework. Their process begins at 4:30 a.m. with AI‑enhanced data feeds, then narrows to three macro signals that drive trade ideas: Asian equity...

By Hedgeye

Video•Feb 3, 2026

BISness Podcast - Shifting Currents in FX & Interest Rate Derivatives

The BIS’s latest triennial survey, conducted in April 2025 amid heightened policy uncertainty, reveals a dramatic expansion in both foreign‑exchange (FX) and interest‑rate derivatives markets. Daily turnover in the FX segment reached $9.5 trillion – roughly 30% higher than the 2022 survey...

By Bank for International Settlements (BIS)

Video•Feb 2, 2026

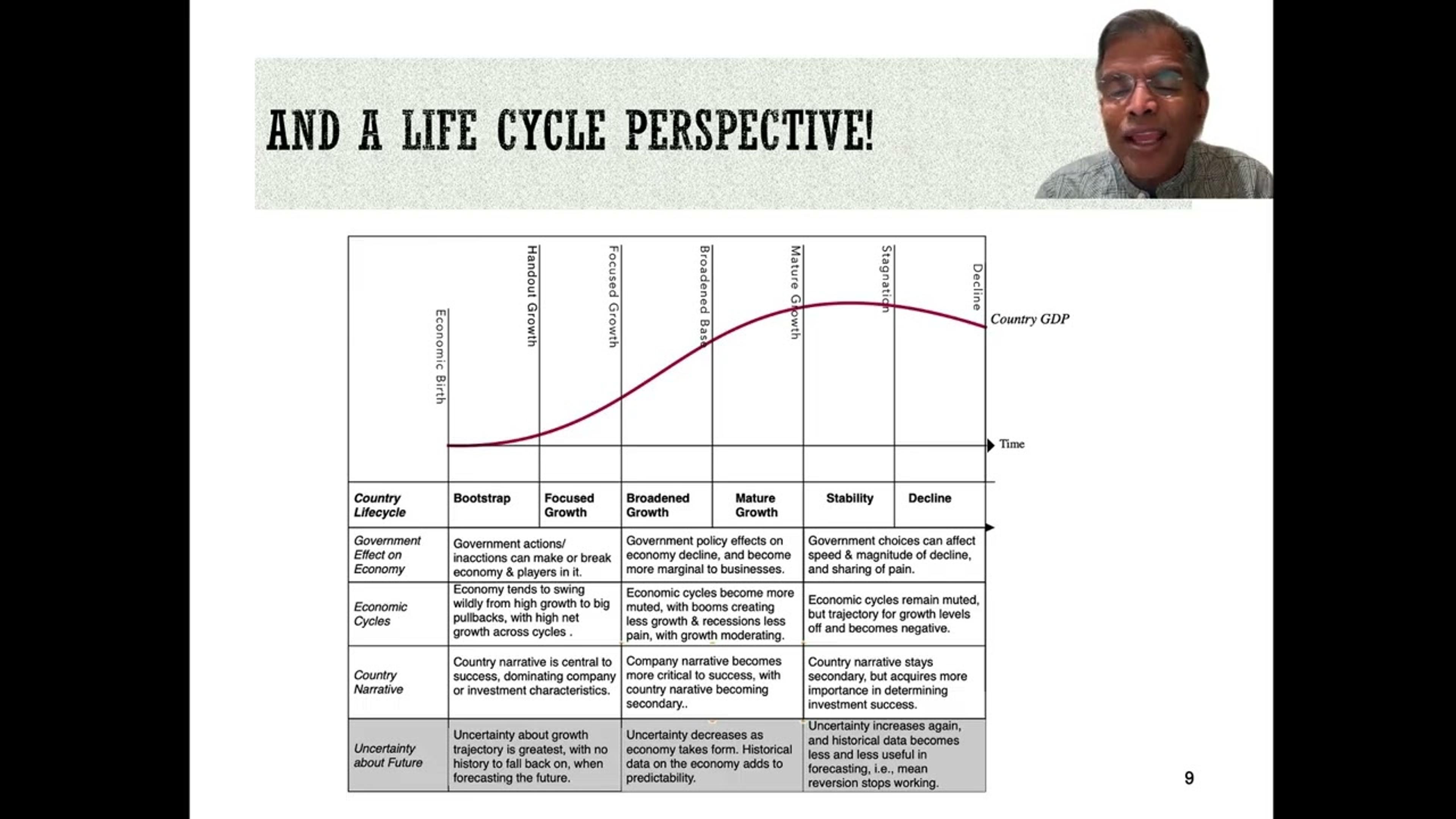

Data Update 4 for 2026: A Tumultuous Year (2025) for Global Markets!

The fourth data update for 2026 examines how global equity markets performed in 2025, converting local‑currency returns into U.S. dollar terms and pairing that analysis with a snapshot of country‑risk metrics, sovereign ratings, and currency movements at the start of...

By Aswath Damodaran