🎯Today's Commodities Pulse

Updated 20m agoWhat's happening: Brazil imposes anti‑dumping duties on Chinese steel

Brazil's foreign trade committee approved five‑year anti‑dumping duties on a range of Chinese steel products, with tariffs from $323 to $670 per ton for cold‑rolled coil and $285 to $710 per ton for hot‑dip galvanized coil. In 2025 the country is set to import 202,000 tons of CRC and 1.42 million tons of HDG from China.

Also developing:

- •Goldman forecasts gold to hit $5,400/oz by end‑2026 on strong demand

- •Nymex natural gas futures dip below $3 per MMBtu

- •Indonesia secures 19% tariff deal with US, palm oil exempt

- •Anglo American posts $3.7B loss after De Beers writedown

Video•Feb 20, 2026

Sky News Gains Rare Access to Bank of England's Gold Vaults

Sky News has been granted rare and exclusive access to the Bank of England's gold vault in London. It's the second largest gold reserves in the world, with around 400,000 bars now worth close to £600 billion. The vast majority is held on behalf of the UK Government and central banks from across the globe. That includes Venezuela's reserves, which has been tied up in a long-running legal battle. Sky's economics and data editor Ed Conway reports. Read more: https://news.sky.com/story/sky-news-gains-rare-access-to-bank-of-englands-gold-vaults-13509266 #bankofengland #gold #skynews SUBSCRIBE to our YouTube channel for more videos: http://www.youtube.com/skynews Follow us on Twitter: https://twitter.com/skynews Like us on Facebook: https://www.facebook.com/skynews Follow us on Instagram: https://www.instagram.com/skynews Follow us on TikTok: https://www.tiktok.com/@skynews For more content go to http://news.sky.com and download our apps: Apple https://itunes.apple.com/gb/app/sky-news/id316391924?mt=8 Android https://play.google.com/store/apps/details?id=com.bskyb.skynews.android&hl=en_GB Sky News Daily podcast is available for free here: https://podfollow.com/skynewsdaily/ To enquire about licensing Sky News content, you can find more information here: https://news.sky.com/info/library-sales

By Sky News

Social•Feb 20, 2026

Structural Conditions Set Stage for Multi-Year Energy Bull

The STRUCTURAL CONDITIONS are right for a multi-year bull energy market, says @ericnuttall That doesn't mean it's started or that it will be a straight line back to $90-$100 oil prices. Prices will remain volatile, cyclical, and politically distorted — even...

By Art Berman Blog

Social•Feb 20, 2026

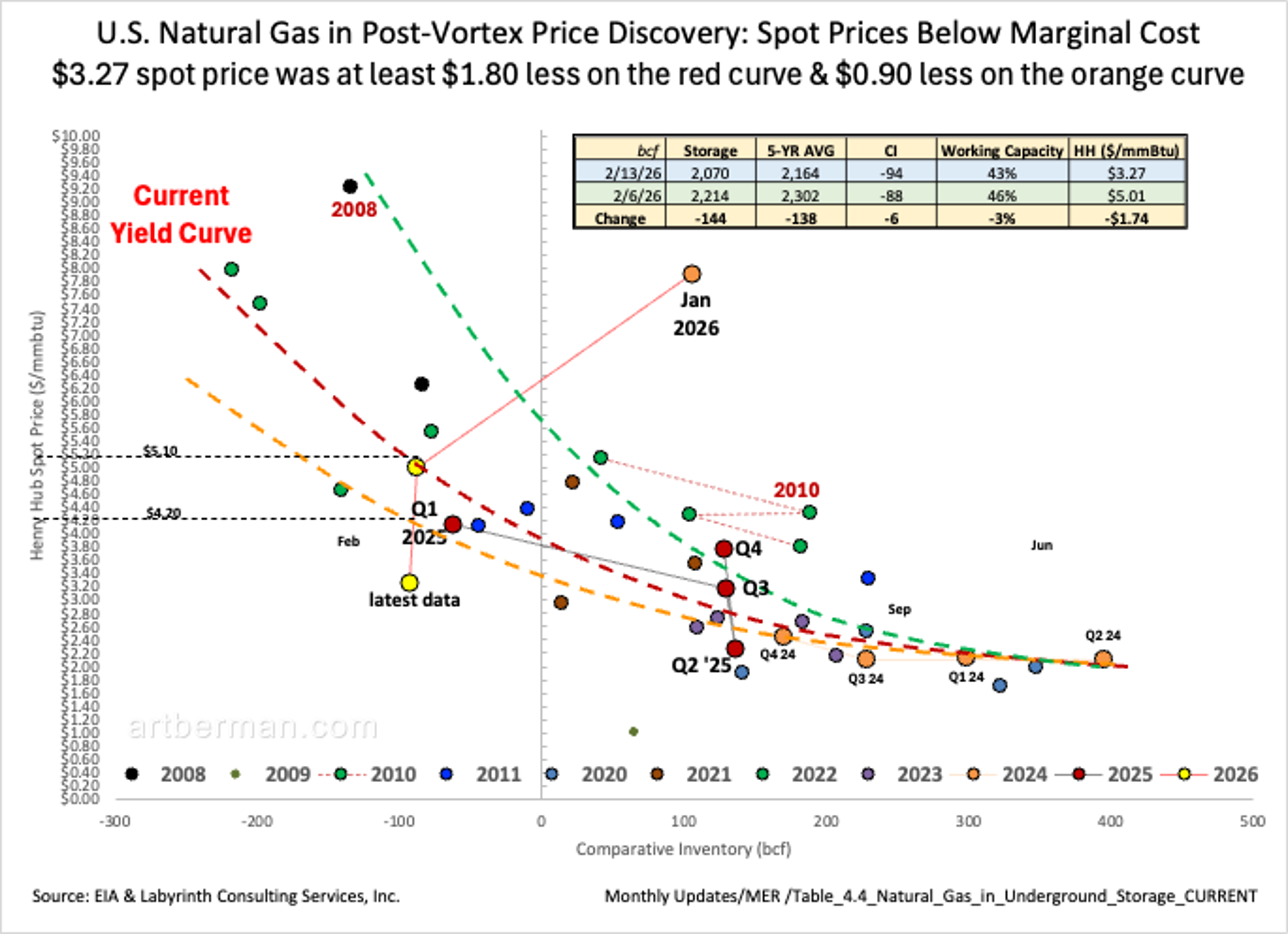

US NatGas Spot Prices Under Marginal Cost Post‑Vortex

U.S. Natural Gas in Post-Vortex Price Discovery: Spot Prices Below Marginal Cost $3.27 spot price was at least $1.80 less on the red curve & $0.90 less on the orange curve #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas #LNG https://t.co/OIY9qxNzmU

By Art Berman Blog

Video•Feb 20, 2026

Stocks Slide as Oil Jumps on Rising US-Iran Tensions | The Close 2/19/2026

The Close highlighted a sharp equity sell‑off on Feb 19, 2026 as Brent crude surged to its highest level since July amid escalating U.S.–Iran tensions. The S&P 500 slipped about 0.6% and the Nasdaq 100 fell roughly 0.7%, while the VIX nudged back...

By Bloomberg Television

Blog•Feb 20, 2026

Gold and Silver Recovering

The episode reviews a recent rally in gold and silver prices, noting modest gains in Europe and unusually low trading volumes on the U.S. Comex market due to a holiday. It highlights the scant speculative interest and low open interest...

By McleodFinance (Alasdair Macleod)

News•Feb 20, 2026

Brazil Imposes Anti-Dumping Duties on Chinese Steel

Brazil’s foreign trade committee approved five‑year anti‑dumping duties on a wide range of Chinese steel products after a 2024 investigation revealed pricing below market levels. The duties range from US$323 to US$670 per ton for cold‑rolled coil and US$285 to...

By Just Auto

News•Feb 20, 2026

GLD: My Second-Largest Portfolio Position, On Path To Become My Largest Holding

GLD remains a buy as its fundamentals stay strong despite recent price swings. The SPDR Gold Shares ETF has generated nearly a ten‑fold return since inception and now manages over $174 billion backed by 1,080 tonnes of gold. Retail physical‑gold sales are...

By Seeking Alpha – ETFs & Funds

Social•Feb 20, 2026

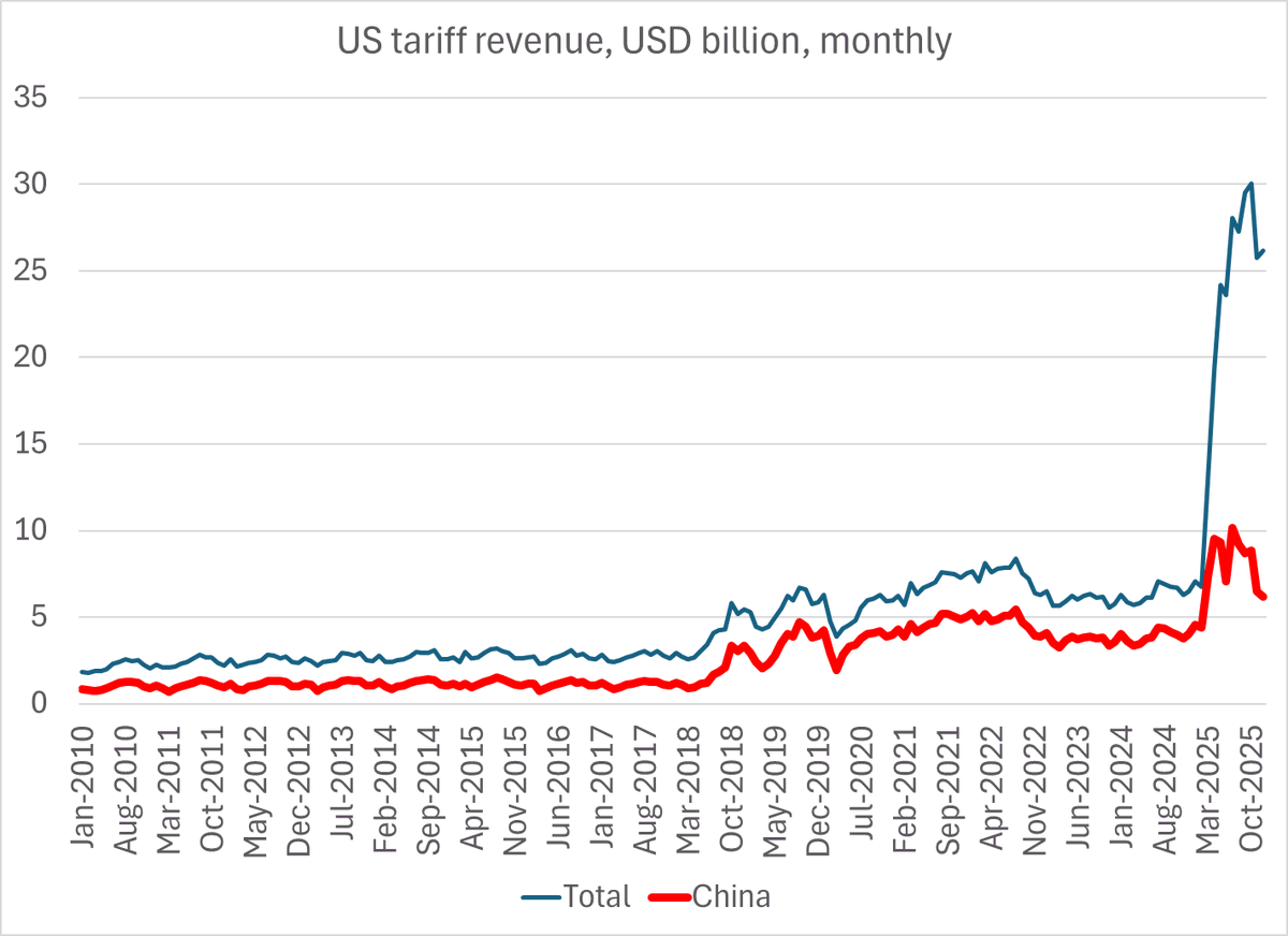

Busan Deal: US Sacrific

The impact of the "Busan" deal is now in the trade data -- the US clearly gave up a bit of tariff revenue (lowering the tariff on China) for a bit of supply chain peace, and the prospect of...

By Brad Setser

News•Feb 20, 2026

Goldman: Gold to Grind Higher to $5,400/Oz by End-2026 on Strong Demand

Goldman Sachs projects gold prices to climb to $5,400 per ounce by the end of 2026, driven primarily by renewed central‑bank buying and modest private‑investor inflows linked to Federal Reserve rate cuts. The forecast assumes a conservative base case with...

By ForexLive — Feed

Social•Feb 20, 2026

Spend $33B on Flexibility, Not Idle Gas Plant

For $33B he could have solved the entire PJM capacity auction challenge with demand flexibility through 2029, but sure overpay for a gas plant that won’t run more than 20% of the year…

By Jigar Shah

News•Feb 20, 2026

Civil War-Torn Sudan Sits On Unexplored Mineral Riches Worth Billions

Sudan, despite a civil war that began in 2023, is courting foreign investors to develop its largely untapped mineral portfolio that includes gold, copper, uranium and rare‑earth elements. Gold production set a new record of 70 tonnes in 2025, generating...

By OilPrice.com – Main

Social•Feb 19, 2026

Gas Turbine Shortage Threatens Big Tech’s Grid‑Independent Power Push

With electric grids across the country already under strain, Big Tech is racing to build and deploy power generation capacity that’s independent of the grid. Indeed, the push for behind-the-meter (BTM) generation was a major theme of the PowerGen conference...

By Robert Bryce

Social•Feb 19, 2026

Buy Newmont on Pullbacks as Gold Rises

Macro: gold up on rate‑cut hopes & geopolitics. Key: Newmont beat as realized $4,216/oz offset 24% output drop. Risk: output erosion, volatility. Trade: buy Newmont on pullbacks. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Video•Feb 19, 2026

Stocks Slide as Oil Spikes on US–Iran Tension | Closing Bell

The closing bell showed U.S. equities slipping as oil prices spiked on renewed U.S.–Iran tensions. The S&P 500 and Nasdaq each fell roughly 0.3%, while the Russell 2000 managed a modest gain, underscoring the market’s mixed reaction to geopolitical risk. Energy‑related concerns lifted...

By Bloomberg Television

Video•Feb 19, 2026

Finding "Goldilocks" Crude Oil Price & ETFs Tying Energy to AI Boom

$70 crude oil will be the "goldilocks" price, says Rob Thummel as the commodity ticks higher due to geopolitical risk. He talks about the risk premium due to tensions between the U.S. and Iran, and how an "oversupply" in oil...

By Schwab Network

Video•Feb 19, 2026

Cash Still Wears the Crown 2 19 26 Cattle Chatter

Cash is still king in the cattle market, with Northwest Iowa seeing trades at $250, reinforcing the strength of negotiated cash. Attention now turns to Friday, which brings two potential market movers: the latest Cattle on Feed report and another...

By Market Talk (Jesse Allen)

Social•Feb 19, 2026

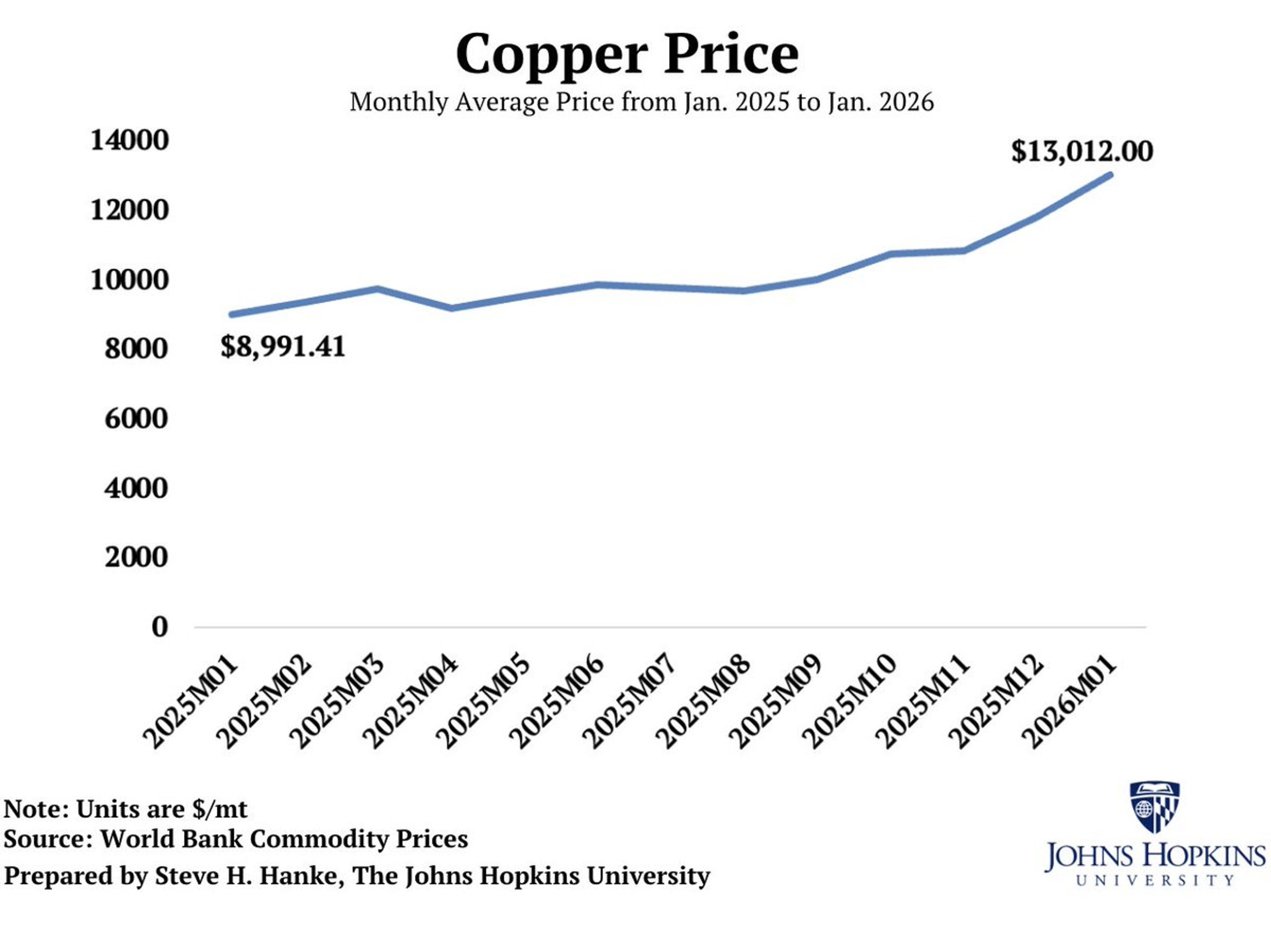

Copper Prices Jump 44% Year‑Over‑Year

Copper prices have surged to an average of $13,012/mt in January 2026 from $8,991/mt a year ago. That's a WHOPPING 44% INCREASE. BUY COPPER, WEAR DIAMONDS. https://t.co/FIhvIikhjQ

By Steve Hanke

Video•Feb 19, 2026

Why U.S. & Iran Tensions Power Energy Price Surge #shorts

Nicole Petallides explains why the latest tensions between the U.S. and Iran led to significant price action to the upside for crude oil and energy-tied stocks. ======== Schwab Network ======== Empowering every investor and trader, every market day. Subscribe to the...

By Schwab Network

Video•Feb 19, 2026

The Close for Wednesday, Feb. 18, 2026

The Close segment recapped the day’s market outlook, highlighting upcoming earnings from RioCam and IA Financial, a slump in Canadian housing prices, Japan’s $36 bn investment in U.S. energy and minerals, Berkshire Hathaway’s portfolio shift, and General Motors’ $63 m Oshawa plant...

By BNN Bloomberg

News•Feb 19, 2026

Market Watch: Nymex Dips Below $3 Amid Mild March Outlook

Nymex natural gas futures for March slipped 1.5 cents to $2.996 per MMBtu on Thursday. This marks the first time the prompt‑month contract has settled below the $3 threshold since mid‑October. Despite short‑term expectations of cooler weather early next week, analysts...

By Energy Intelligence

News•Feb 19, 2026

Spot Cash Electricity Prices, Feb. 19, 2026

On February 19, 2026, the U.S. spot cash electricity market posted a 3.2% increase in average price, reaching $58.4 per megawatt‑hour. The rise reflected higher natural‑gas forward curves and a dip in wind generation across the Midwest. Day‑ahead trading volumes...

By Energy Intelligence

News•Feb 19, 2026

Ausenco to Lead Feasibility Study at Ikkari Project

Rupert Resources has engaged Auscenco Engineering to head the feasibility study for the Ikkari gold project in northern Finland, a multi‑million‑ounce development slated for completion by mid‑2027. The study builds on recent optimisation work that delivered over 95% gold recoveries...

By Engineering & Mining Journal (E&MJ)

Deals•Feb 19, 2026

Vale Sells Control of Thompson Nickel Complex to Investor Group for up to $200M Injection

Brazilian miner Vale announced the sale of its 18.9% stake in the Thompson nickel complex in Manitoba to a consortium of Exiro Minerals, Orion Resource Partners and the Canada Growth Fund. The investors will form a new company, Exiro Nickel,...

MINING.com – Gold

Video•Feb 18, 2026

China's Critical Minerals Chokehold

In early February, the Trump administration convened an unprecedented critical‑minerals ministerial in Washington, drawing more than 55 nations to confront China’s near‑total control of rare‑earth elements and related supply chains. The summit marked the first large‑scale, multilateral U.S. effort to...

By Council on Foreign Relations

Video•Feb 18, 2026

Feb 18 | Closing Market Report

The February 18 closing market report from Illinois Public Media covered three core themes: the current state of the corn and soybean markets, recent changes to federal crop‑insurance subsidies, and a weather outlook that highlighted fire risk across the Southern Plains....

By farmdoc (University of Illinois)

Video•Feb 18, 2026

Why Renewables Are Booming Despite the Politics | Ep245: Miguel Stilwell D'Andrade

The episode of "Cleaning Up" spotlights why renewable energy is thriving despite political headwinds, featuring Miguel Stilwell d'Andrade, CEO of EDP and its renewables arm. He frames the surge in U.S. power demand—driven by data centers and industrialization—as a catalyst...

By Cleaning Up with Michael Liebreich

Deals•Feb 17, 2026

Wheaton to Acquire BHP's Silver Stream for $4.3B

Mining giant BHP announced a major silver streaming deal, selling a portion of its silver production to Wheaton for $4.3 billion. The transaction comes as copper becomes BHP's primary revenue driver, boosting its half‑year earnings. The deal is expected to strengthen...

Mining Magazine

Deals•Feb 17, 2026

BHP Secures $4.3B Upfront Payment in Silver‑streaming Deal with Wheaton Precious Metals

Australian mining giant BHP entered a silver‑streaming agreement with Wheaton Precious Metals, receiving an upfront cash payment of $4.3 billion in exchange for delivering silver from its Antamina mine. The deal provides BHP with immediate financing while Wheaton secures future silver...

CNBC – Top News & Analysis

Deals•Feb 17, 2026

Genesis Minerals to Acquire Magnetic Resources for $449M

Australian gold miner Genesis Minerals announced a cash‑and‑stock acquisition of Magnetic Resources valued at approximately A$639 million ($449 million). The deal, payable in cash and new Genesis shares, will give Genesis ownership of the Lady Julie project in the Laverton gold district,...

MINING.com – Gold

Deals•Feb 17, 2026

Forrestania Resources to Acquire MacPhersons Reward From Beacon Mining for A$5M Cash and 36M Shares

Forrestania Resources has signed a binding heads-of-agreement to acquire the MacPhersons Reward assets from Beacon Mining, a subsidiary of Beacon Minerals. The transaction includes a cash payment of A$5 million and the issuance of 36 million Forrestania shares valued at...

Mining Technology

Deals•Feb 17, 2026

AFRY to Acquire Mining Consultancy AMC to Boost Mining & Metals Growth

Swedish engineering firm AFRY announced it will acquire AMC, a leading independent mining consultancy, to strengthen its mining and metals capabilities and expand into key markets such as Australia and Canada. The transaction involves AFRY acquiring 100% of the shares...

International Mining (IM-Mining)

Deals•Feb 17, 2026

Precious Shipping Acquires 20-Year-Old MR Product Tanker

Precious Shipping, a Thai dry bulk shipowner, announced it is acquiring a 20‑year‑old MR product tanker, marking its entry into the product tanker market and expanding its fleet beyond dry bulk vessels. The move diversifies the company's operations into liquid...

Seatrade Maritime

Deals•Feb 12, 2026

JERA Completes $1.5B Haynesville Shale Acquisition From Williams and GeoSouthern Energy

JERA Co., Inc., via JERA Americas, closed its $1.5 billion acquisition of the South Mansfield upstream asset in Louisiana’s Haynesville shale, buying it from Williams and GeoSouthern Energy affiliates. The deal expands JERA’s U.S. upstream portfolio and supports its low‑carbon LNG...

World Oil – News

Deals•Feb 11, 2026

Harbour Energy Completes $3.2 Bn Acquisition of LLOG Exploration

Harbour Energy has completed its $3.2 bn acquisition of LLOG Exploration Company LLC, adding a deepwater oil portfolio in the U.S. Gulf. The deal, financed with $2.7 bn in cash and $0.5 bn in newly issued Harbour shares, expands Harbour’s offshore presence across...

World Oil – News

Deals•Feb 11, 2026

German Mining Startup Hades Raises €15M in Seed Round

German mining startup Hades announced a €15 million seed round, valuing the company at €67.5 million. The round was co‑led by HV Capital and Headline, with participation from existing investors Project A and Visionaries Tomorrow. The funding will be used to expand...

Sifted

Deals•Feb 11, 2026

St Barbara Agrees to Sell 50% of Simberi to Lingbao Gold and Kumul for up to A$470M

St Barbara announced it has agreed to sell a combined 50% stake in its Simberi gold project in Papua New Guinea to China’s Lingbao Gold Group and PNG’s Kumul Mineral Holdings for up to A$470 million in staged cash payments and...

MINING.com

Deals•Feb 11, 2026

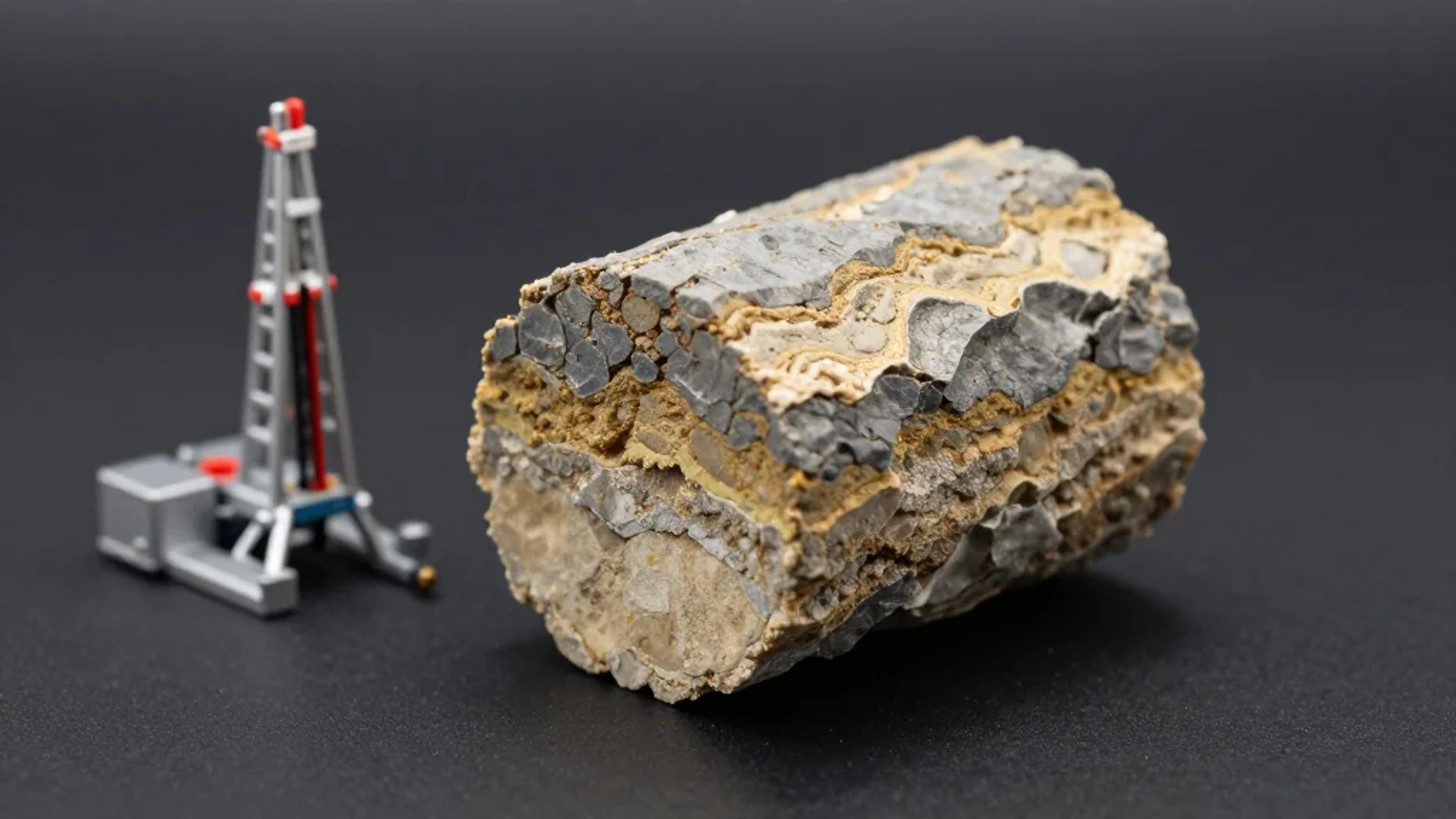

Elemental Energies Acquires Applied Petroleum Technology to Expand Subsurface and Basin Modeling Capabilities

Elemental Energies announced the acquisition of Applied Petroleum Technology AS (APT), a specialist geoscience and petroleum geochemistry firm, to strengthen its global subsurface, geochemistry and reservoir analysis capabilities. The deal adds roughly 10% to Elemental’s workforce, bringing total staff to...

World Oil – News