🎯Today's Commodities Pulse

Updated 1h agoWhat's happening: Brazil imposes anti‑dumping duties on Chinese steel

Brazil's foreign trade committee approved five‑year anti‑dumping duties on a range of Chinese steel products, with tariffs from $323 to $670 per ton for cold‑rolled coil and $285 to $710 per ton for hot‑dip galvanized coil. In 2025 the country is set to import 202,000 tons of CRC and 1.42 million tons of HDG from China.

Also developing:

- •Goldman forecasts gold to hit $5,400/oz by end‑2026 on strong demand

- •Nymex natural gas futures dip below $3 per MMBtu

- •Indonesia secures 19% tariff deal with US, palm oil exempt

- •Anglo American posts $3.7B loss after De Beers writedown

News•Feb 17, 2026

Dairy Margin Coverage Signup Slow in the Dairy State

Most Wisconsin dairy producers have yet to enroll in the USDA’s Dairy Margin Coverage (DMC) program, with only 1,616 of the state’s 5,116 licensed farms—31.5%—signed up as of Feb 17. The enrollment deadline is Feb 26, prompting FSA officials and risk‑management advisors to urge rapid participation. USDA recently expanded tier‑one coverage to up to six million pounds of milk and introduced a 25% premium discount for producers who lock in six years of coverage. The program is positioned as a critical safety net against volatile milk and feed prices.

By Brownfield Ag News

Social•Feb 17, 2026

Sanctions Spawn Shadow Fleet, Aging Tankers Scrapped in India

US sanctions squeezed Russian and Venezuelan oil shipping out of mainstream markets. A shadow fleet emerged. Now aging dark fleet tankers are arriving at Indian scrapyards at a record pace. SANCTIONS = WORKAROUNDS = UNINTENDED CONSEQUENCES. https://t.co/GddyWzZwZd

By Steve Hanke

Social•Feb 17, 2026

Wheat Export Inspections Outpace USDA Target by 59M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 59 million bushels, versus 61 million the previous week. #oatt

By Arlan Suderman

News•Feb 17, 2026

Iciest Baltic in 15 Years Threatens to Cut Russian Exports

Russia’s Baltic Sea ports are encased in the thickest ice in 15 years, forcing non‑ice‑class vessels to wait for ice‑breaker escorts. The ice surge has already cut oil exports from Primorsk by roughly one‑third, and waiting times for convoys have...

By gCaptain

News•Feb 17, 2026

France Releases Oil Tanker GRINCH After ‘Several Million Euro’ Penalty for Sanctions Evasion

French authorities released the oil tanker GRINCH after its owner paid a multi‑million‑euro penalty for sanctions evasion. The vessel, seized in the Alboran Sea in January, was suspected of operating under a false Comoros flag as part of Russia’s shadow...

By gCaptain

Social•Feb 17, 2026

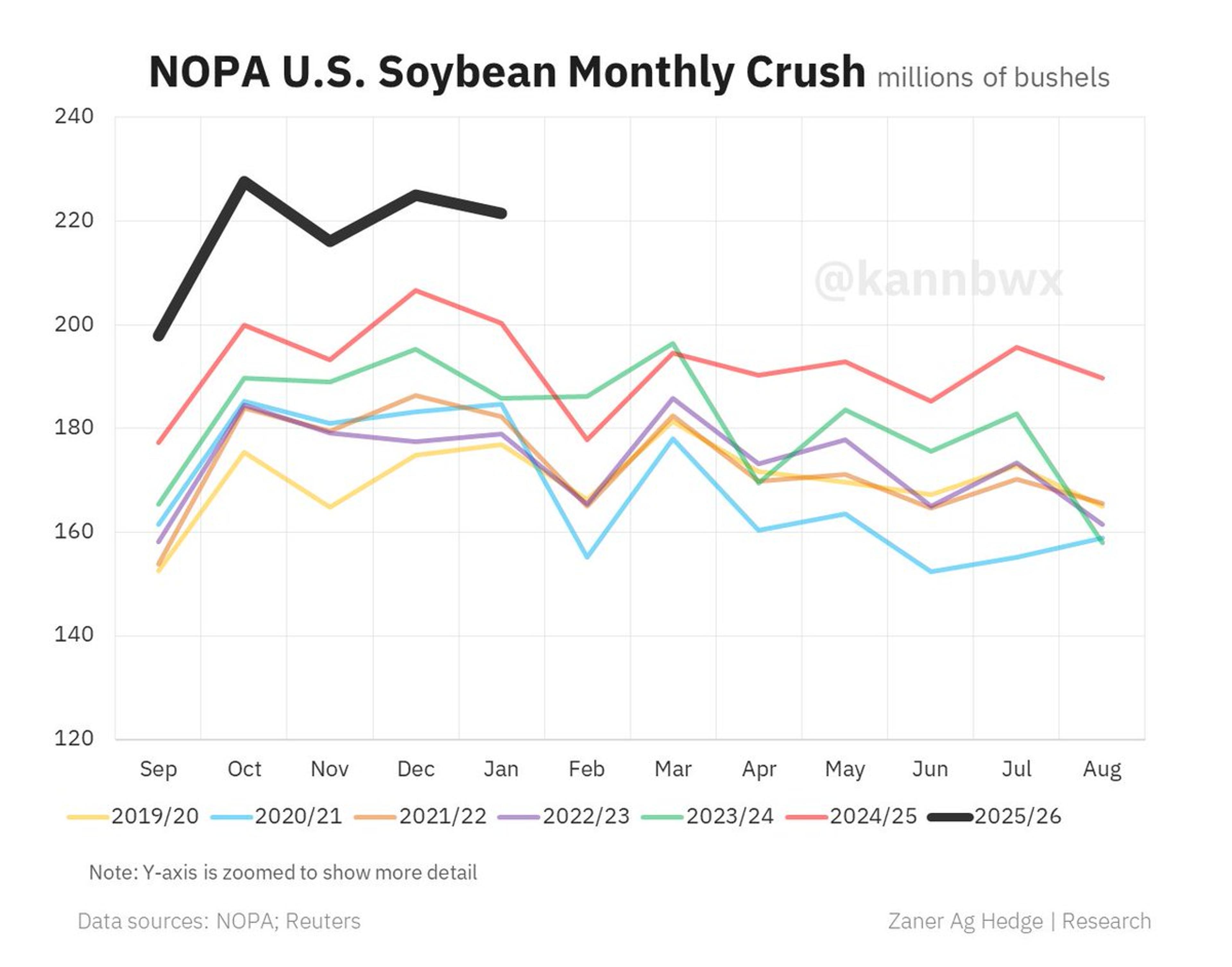

US Jan Soy Crush Beats Forecast, Stocks Surge 49%

🇺🇸NOPA U.S. crush, Jan. 2026: ▪️221.564 mln bu of soybeans ▪️Above avg trade guess of 218.52 mln ▪️+10.6% YOY; down 1.5% from Dec. 2025 ▪️Soyoil stocks 1.9 bln lbs ▪️Above all trade guesses (avg was 1.71 bln) ▪️+49% YOY; highest since April 2023 https://t.co/UItFPJlkd8

By Karen Braun

Social•Feb 17, 2026

Guyana Gains as Venezuela's Maduro Falls, Boosting Investment

Guyana is the biggest winner from Maduro's ouster in Venezuela. "It removes the biggest barrier for foreign investment," said CSIS's Henry Ziemer Lower risk premium, faster development, higher upside. https://t.co/1Tpj1OK8dp #oil #Guyana #Exxon #geopolitics #energy

By Art Berman Blog

News•Feb 17, 2026

Q1 2026 Metals Update

Metals futures and options surged in early 2026, hitting a record single‑day volume of 4.2 million contracts on January 30, driven by rising gold and silver prices and a 100 % jump in battery‑metal activity. The launch of a 100‑Ounce Silver futures contract...

By CME Group – OpenMarkets

Social•Feb 17, 2026

Guyana and Exxon Profit From Venezuela's Turmoil

Been saying this for a while: Guyana (and by extension Exxon) was a big collateral winner of Venezuela developments. https://t.co/QzfRIJKK1F

By Rory Johnston

Social•Feb 17, 2026

U.S. Corn Inspections Surpass Expectations, Soy Exports to China Strong

🇺🇸Last week's U.S. corn inspections easily beat all trade expectations (though they weren't a weekly record). FYI the previous week's corn volume was hiked significantly. Soy inspections were near the top end of estimates - 57% of the beans were...

By Karen Braun

News•Feb 17, 2026

French Urea Imports Surge in 2H 2025

France’s urea imports surged to 1.15 million tonnes in the July‑December 2025 period, up from 842,000 tonnes a year earlier, as buyers rushed to stock ahead of the EU’s Carbon Border Adjustment Mechanism (CBAM). December shipments more than doubled the three‑year monthly...

By Argus Media – News & analysis

Social•Feb 17, 2026

Corn Leads Weekly Export Inspections, Soybeans Follow

Export inspections for the week ending Feb. 12 (mln bu): #corn 58.8, grain sorghum 9.5, #soybeans 44.2, #wheat 13.8 #oatt

By Arlan Suderman

News•Feb 17, 2026

East Coast LNG Export Ambitions Fade Further as Another Project Stalls

The Penn LNG export terminal in eastern Pennsylvania appears increasingly unlikely after the project's developer dissolved its corporate entity, halting any progress. Despite earlier claims that the project was still advancing, no permits, financing, or construction milestones have materialized. The...

By Natural Gas Intelligence (NGI)

Social•Feb 17, 2026

US‑Iran Oil Talks Conclude Second Round, Third Round Pending

OIL MARKET: The 2nd round of US-Iran talks has concluded, and Iranian media says there would be a 3rd round of negotiations in the “near future” after both sides consult with their respective governments.

By Javier Blas

News•Feb 17, 2026

Antofagasta Profit Rockets 52% as Record Copper Prices Offset Weaker Output

Chilean miner Antofagasta reported a 52% surge in 2025 core profit to $5.2 bn, driven by record copper prices that rose over 40% last year. Despite slightly lower output, the company lifted capital spending to $3.7 bn, mainly for the Centinela concentrator...

By BusinessLIVE (South Africa) – RSS hub

Social•Feb 17, 2026

Iran and Russia Clash over China Oil Supply Rivalry

The oil ministers of Iran and Russia met today. Contrary to popular belief, Moscow and Tehran are now bitter rivals in the oil market as the size of the black market for crude shrinks. Both compete to supply China. (My earlier @Opinion...

By Javier Blas

News•Feb 17, 2026

Buccaneer Reports Production Gains From East Texas Oil Recovery Pilot

Buccaneer Energy completed an organic oil recovery (OOR) pilot at its Pine Mills field in East Texas, treating one water injector and two producing wells. Post‑treatment production in the pilot zone rose from roughly 15 barrels per day to about 30...

By World Oil – News

News•Feb 17, 2026

Gold, Silver Prices Crash up to 4%: What Is Driving This Selloff? Should You Buy?

Gold and silver prices plunged up to 4% amid a rallying U.S. dollar and heightened profit‑taking. The sell‑off follows recent geopolitical tensions that initially lifted safe‑haven demand but have now softened. Technically, gold is trading around its 20‑day exponential moving...

By Mint (LiveMint) – Markets

News•Feb 17, 2026

Report Labels Unbundling of Eskom as ‘Most Important Economic Reform Since 1994'

A South African Energy Traders Association (SAETA) report declares the unbundling of Eskom Holdings the most consequential economic reform since the end of apartheid in 1994. The study, titled “Policy to power: 10 actions to deliver green, accessible and secure electricity,”...

By Mining Weekly

Blog•Feb 17, 2026

Industry Needs $90/Bbl.

The episode explains that the oil industry needs oil prices around $90 per barrel to achieve a 10% return on capital, the threshold where oil stocks typically outperform the S&P 500. It highlights that current reinvestment rates are just above...

By The Crude Chronicles

News•Feb 17, 2026

EIA Still Sees USA Oil Output Falling Next Year

The U.S. Energy Information Administration’s February short‑term energy outlook projects total U.S. crude oil production, including lease condensate, to fall from an average of 13.60 million barrels per day in 2026 to 13.32 million barrels per day in 2027. The decline is...

By Rigzone – News

Blog•Feb 17, 2026

Wheat at the Ceiling: Is This Rebound Real?

The episode examines the recent rebound in wheat prices, noting a 3.6% weekly gain that places futures just below the long‑term technical ceiling. While global production remains near record levels—841.8 million tonnes—with strong output from Russia, Argentina, and the EU, U.S....

By CropGPT Soft Commodity Pricing

News•Feb 17, 2026

Ongoing War Stifles Ukraine’s Grain Exports

Ukraine’s grain exports have slumped dramatically as Russian shelling intensifies attacks on Black Sea ports and energy infrastructure, cutting monthly shipments from 3.6 Mt to 2.5 Mt. Year‑to‑date volumes are 28.5% lower and export value down 18%, eroding billions of foreign‑currency earnings...

By Grain Central

News•Feb 17, 2026

Almi Marine Back in Newbuild Arena with Ultramax Pair

Greek dry‑bulk carrier Almi Marine has re‑entered the new‑building market after a four‑year hiatus, signing a contract for two next‑generation 64,000 dwt ultramax vessels with Nantong Cosco KHI Ship Engineering (NACKS). The ships, slated for delivery in the second quarter of...

By Splash 247

News•Feb 17, 2026

Indian Veg Oil Buyers Await Clarity on US Trade Deal

Indian vegetable‑oil importers are waiting for concrete details on the pending U.S.–India trade pact that could lower tariffs on U.S. soybean oil. The framework hints at a 0‑15% duty cut and a tariff‑rate quota of roughly 200,000‑250,000 tonnes, but exact...

By Fastmarkets – Insights

News•Feb 17, 2026

NKT Signs €6bn Copper Supply Deal

NKT has inked a €6 billion long‑term agreement with Polish miner KGHM to secure copper supplies through 2036, extending their existing partnership by nine years. The contract covers copper needed for NKT’s power‑cable production as it scales up to meet rising...

By reNEWS

News•Feb 17, 2026

Australian Vanadium, Sumitomo Electric Partner for Bid in Western Australia’s 500MWh Flow Battery Procurement

Australian Vanadium Limited has formed an exclusive partnership with Japan’s Sumitomo Electric to compete for Western Australia’s AU$150 million, 500 MWh Kalgoorlie vanadium flow‑battery project. The deal makes Sumitomo the sole provider of its flow‑battery technology, engineering services and technical support for...

By Energy Storage News

News•Feb 17, 2026

Copper Becomes BHP's Biggest Earner as Profits Soar

BHP reported that copper now accounts for the majority of its earnings for the first time, propelling a sharp rise in six‑month profit and revenue. The miner’s shift away from iron ore, which is suffering from weaker Chinese demand, has...

By Nikkei Asia – Economy

Social•Feb 17, 2026

Copper Price Surge Fuels BHP's Profit Growth

Who could have seen this coming? Higher copper prices are BHP's main profit driver. https://t.co/ifvnq0Y31l #BHP #copper #mining #commodities #energytransition #AI #electrification #China #ironore #markets

By Art Berman Blog

Social•Feb 17, 2026

Sinokor's 120‑tanker Dominance Spikes Freight, Rattles Oil Markets

South Korean Sinokor now controls 120 oil tankers When one buyer controls the tradable fleet, charterers panic-book, freight spikes, and shocks bleeds into physical oil prices and spreads. https://t.co/Z2GsMyfbtl #oil #tankers #VLCC #shipping #freight #supplychain #sanctions #geopolitics #markets #energy

By Art Berman Blog

News•Feb 16, 2026

BHP Profit Climbs as Copper Offsets China Drag on Iron Ore

BHP Group posted a 22% rise in underlying attributable profit to $6.2 billion for the six months ended December, propelled by a sharp rally in copper prices. At the same time, demand weakness in China dampened iron‑ore and steelmaking‑coal sales. The...

By Bloomberg – Markets

Social•Feb 16, 2026

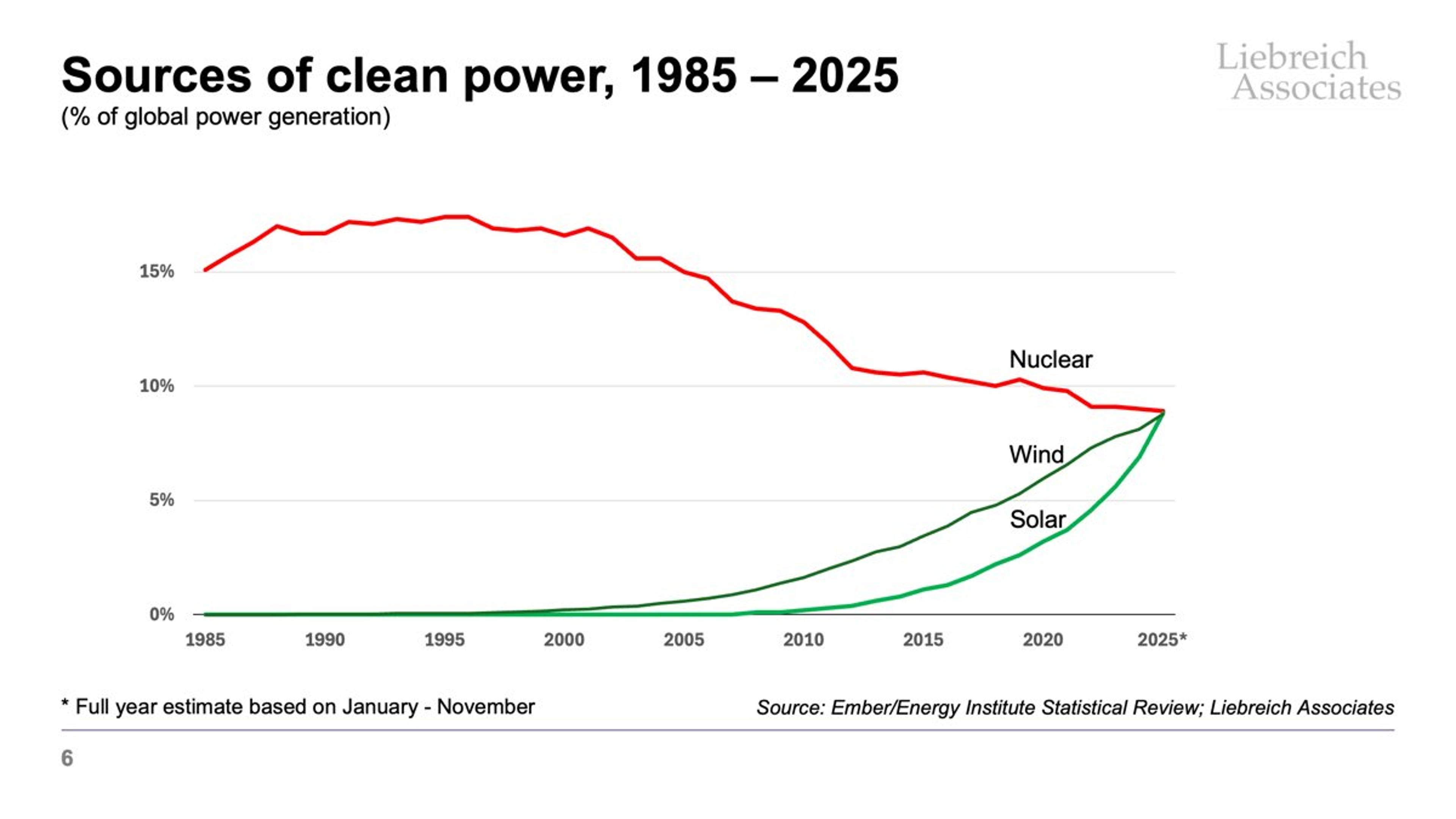

Solar Overtakes Nuclear; Nuclear Drops to Third by 2026

I've been cranking numbers. Full year 2025, it looks like nuclear power just about kept its nose ahead of wind and solar. But in H2 2025, while wind didn't quite overtake nuclear, solar did. In 2026 nuclear will drop to...

By Michael Liebreich

News•Feb 16, 2026

CHART: EV Battery Metals Index Jumps to 27-Month High

The EV battery metals index surged to a 27‑month high as December’s raw‑material spend topped $2 billion, the first such level since August 2023. Global passenger EV sales likely passed 30 million units in 2025, driving a 25% increase in deployed battery...

By MINING.com – Gold

News•Feb 16, 2026

Balances: Supply Surplus Narrows After First Quarter

Supply and demand balances show a 3.1 million‑barrel‑per‑day surplus in the first quarter of 2026, the largest for the year and unchanged from the previous month. Asian storage facilities have largely absorbed the excess crude, preventing immediate price spikes. Nevertheless, continued...

By Energy Intelligence

News•Feb 16, 2026

Congo Launches Phase 2 LNG Exports From Nguya FLNG Facility

The Republic of Congo has begun Phase 2 LNG exports from the new Nguya FLNG facility, boosting total project capacity to roughly 3 million metric tons per year. Operated by Eni, the unit was commissioned ahead of schedule and shipped its first...

By World Oil – News

News•Feb 16, 2026

Canada Backs Carbon Capture Buildout to Secure Oil Sands Future, Energy Minister Says

Canada’s energy minister announced a C$16.5 billion Pathways Alliance carbon‑capture buildout in Alberta’s oil sands, linking the project to a new pipeline deal and a higher industrial carbon price. Six of the country’s largest oil‑sands producers will capture and store CO₂...

By World Oil – News

News•Feb 16, 2026

Wartsila Building Energy Storage in Support of Belgian Grid

Wärtsilä has been chosen by Gramme Storage 1 to build a 50‑MW/100‑MWh battery energy storage system in central‑eastern Belgium, with construction underway and commissioning expected by mid‑2027. The project will participate in Belgium’s Capacity Remuneration Mechanism, delivering frequency and voltage support...

By POWER Magazine

Social•Feb 16, 2026

Trump's Presidency Keeps Oil Prices Higher, OPEC+ Cuts Production

The best—only?—argument that Trump is bearish for oil prices is that OPEC+ wouldn't have hiked crude production as aggressively last year in a world in which Harris was sitting in the White House.

By Rory Johnston

News•Feb 16, 2026

Oil Prices Edge Higher Ahead of US–Iran Nuclear Talks

Oil prices nudged higher on Monday as traders priced in the upcoming US‑Iran nuclear talks, which aim to ease regional tensions. The market also factored in OPEC‑plus’s plan to increase output later in the year, tempering the risk‑off sentiment. Brent...

By Energy Intelligence

News•Feb 16, 2026

M&P Sees Silver Lining in Venezuela

Maurel & Prom (M&P) is lobbying Venezuelan authorities to regain access to its Urdaneta Oeste oil field after being omitted from the government’s initial roster of approved foreign operators. The Paris‑listed firm argues that the field, capable of delivering several thousand...

By Energy Intelligence

News•Feb 16, 2026

TotalEnergies, Oman Eye Marsa LNG Expansion

TotalEnergies and Oman’s state‑run OQ Exploration and Production are evaluating a second liquefaction train for the Marsa LNG project, which is currently under construction. The additional train would significantly raise the plant’s export capacity, positioning the facility as a major...

By Energy Intelligence

News•Feb 16, 2026

Egypt’s NCIC Issues Fertilizer Sales Tender: Correction

Egyptian fertilizer producer NCIC announced a new tender for March‑loading shipments, closing on 19 February. The offer includes 1,000 t water‑soluble SOP, 20,000 t CAN26 (grade corrected), 20,000 t granular urea, 25,000 t TSP and 20,000 t DAP. Prices reference previous tender sales, with urea spot...

By Argus Media – News & analysis

News•Feb 16, 2026

Dangote Drives Nigeria’s Domestic Fuel Supply Above 57% as Imports Retreat

Nigeria’s Dangote Refinery reached full 650,000 bpd capacity in January 2026, processing a record 40.1 million litres of crude per day and supplying 57 % of the nation’s fuel. Domestic output now provides 62 % of premium motor spirit, overtaking imports for the first...

By OilPrice.com – Main

News•Feb 16, 2026

AOM Biodiesel Deals Hit 2-Year High in January

European biodiesel trading on Argus Open Markets surged to its strongest January level in two years, driven by the EU’s revised Renewable Energy Directive (RED III) and Germany’s new rule eliminating carry‑over of surplus GHG certificates. The stricter mandates, which require...

By Argus Media – News & analysis

News•Feb 16, 2026

Why Chevron Is Betting Big on Venezuela’s Heavy Crude

Chevron is aggressively expanding its Venezuelan heavy‑crude production to feed its complex Gulf Coast refineries, which are optimized for dense, sulfur‑rich oil. Global supplies of such crude have tightened as Mexican exports fall, Russian barrels are sanctioned, and Canadian logistics...

By OilPrice.com – Main

News•Feb 16, 2026

Niger Stockpiled 1,000t of Yellowcake at Military Base: FT

Niger's military government moved roughly 1,000 tonnes of uranium concentrate, known as yellowcake, to Air Base 101 near Niamey after seizing the Orano‑run mine. The stockpile remains unsold, with potential buyers from Russia, China, the United States and the UAE...

By MINING.com – Gold

News•Feb 16, 2026

Silver-Saving Efforts Ramping up in Solar Industry, Says Heraeus

Rising silver prices, now 187 % above early‑2025 levels, are pressuring solar manufacturers as silver paste can account for up to 30 % of cell costs. Heraeus forecasts a decline in photovoltaic silver demand despite stable global installations, citing ongoing substitution efforts....

By pv magazine

Social•Feb 16, 2026

Metal Volatility Reveals Hidden Market Shifts

Metal Volatility Changed Everything $GLD $SLV $BTCUSD $SPX $QQQ $IGV $XLK Sharp volatility in gold, silver, crypto and equities was easier to spot than most think. And why I study sector rotation, options structure, and investor confidence. https://t.co/PYmLxcJSCJ

By Samantha LaDuc

News•Feb 16, 2026

China’s Carbon Market Expands Into Heavy Industry As USA Regresses

China’s Ministry of Ecology and Environment has extended mandatory carbon‑reporting to petrochemicals, chemicals, flat glass, copper smelting, papermaking and civil aviation, laying groundwork for future ETS inclusion. The national emissions trading system already covers power, steel, cement and aluminum—about 60‑65%...

By CleanTechnica

News•Feb 16, 2026

Key Takeaways From Solaire Expo Maroc

The 14th Solaire Expo Maroc in Casablanca highlighted Morocco’s push toward an integrated renewable ecosystem, featuring electric‑vehicle pavilions and a strong Chinese presence in solar equipment. Local distributors reported a dynamic market with rising prices after China ended VAT rebates,...

By pv magazine