🎯Today's Commodities Pulse

Updated 21m agoWhat's happening: Brazil slaps anti‑dumping duties on Chinese steel imports

Brazil’s foreign trade committee approved five‑year anti‑dumping duties on a range of Chinese steel products, imposing tariffs of $323‑$670 per ton on cold‑rolled coil and $285‑$710 per ton on hot‑dip galvanized coil. In 2025 the country imported 202,000 tons of CRC and 1.42 million tons of HDG from China.

Also developing:

By the numbers: Vale sells control of Thompson nickel complex in $200M injection

Podcast•Feb 13, 2026•12 min

US Aluminum Market Digests Tariff-Induced Volatility at Platts Symposium

The episode reviews how the U.S. aluminum market is coping with volatility caused by the 50% import tariff introduced in June, examining its impact on industry sentiment and pricing. Experts discuss the shifting demand landscape, noting the slowdown from removed EV incentives and the boost from data center construction, while highlighting dwindling spot inventories. They also outline the broader supply‑demand outlook for 2024, identifying key uncertainties that could affect U.S. aluminum trade.

By Commodities Focus

News•Feb 13, 2026

Lithuania Could Break EU Ranks Over Critical Minerals Deal

Lithuania warned it may negotiate a stand‑alone critical minerals agreement with the United States if the European Union fails to deliver a bloc‑wide pact promptly. The move aims to secure rare‑earths, battery metals and other strategic inputs for its defense...

By OilPrice.com – Main

Social•Feb 13, 2026

Argus Targets Venezuelan Crude for U.S. Gulf Delivery

This is an interesting oil market transparency development. Argus "will assess three grades of Venezuelan crude oil, Merey, Hamaca and Boscan, for delivery to the U.S. Gulf coast, which Argus said is now the most likely destination for Venezuelan cargoes" https://t.co/RaKzvH53Rp

By Rory Johnston

News•Feb 13, 2026

Midday Cash Livestock Markets

Midday cash cattle markets stayed quiet, with Nebraska bids at $238 live and Texas asking $245‑247 live but little action. At Wheeler Livestock Auction, steers under 650 lb rose $5‑16 while larger steers held steady and heifers showed mixed price moves....

By Brownfield Ag News

News•Feb 13, 2026

Cash Dairy Prices End Week Mostly Steady

Cash dairy prices were largely unchanged on Friday, with most commodities holding steady on the Chicago Mercantile Exchange. Butter slipped $0.03 to $1.7050 per pound after Thursday’s gain, while nonfat dry milk edged up $0.0025 to $1.60. Dry whey, 40‑pound...

By Brownfield Ag News

News•Feb 13, 2026

Carbon — In Focus: EU ETS in Political Crosshairs

Political scrutiny of the EU emissions trading system intensified in mid‑February, pushing the front‑year EU ETS contract down almost 6% on Feb 5 and a further 7% after German Chancellor Friedrich Merz’s comments. EU officials denied reports of extending free‑allowance allocations beyond...

By Argus Media – News

News•Feb 13, 2026

Druzhba Flows Halted, More Russian Refineries Under Attack

Slovakia and Hungary have reported a complete halt of Russian crude deliveries through the Druzhba pipeline, marking the latest escalation in the energy conflict between Moscow and Kyiv. Simultaneously, a series of drone attacks this week have damaged several Russian...

By Energy Intelligence

News•Feb 13, 2026

Hecla Nearly Doubles Exploration Budget

Hecla Mining announced it will spend $55 million on exploration and pre‑development in 2026, almost doubling the $27.7 million invested last year. The budget targets its Nevada projects and existing assets in Alaska, Yukon and Idaho, aiming to replace or exceed annual...

By MINING.com – Gold

News•Feb 13, 2026

Aramco Set for Initial Jafurah Condensate Exports

Saudi Aramco will load its first cargoes of Jafurah condensate in March, following the start‑up of the giant Jafurah wet‑gas project late last year. The development converts wet gas into condensate and LPG, adding a new stream to the kingdom’s...

By Energy Intelligence

News•Feb 13, 2026

New England Receives Another LNG Import Cargo as Winter Takes Its Toll

The Excelerate Shenandoah delivered a full LNG cargo from Trinidad’s Atlantic terminal to the Everett import facility in Boston Harbor. The shipment marks the fourth cargo received at Everett this winter, adding to a total of six deliveries last winter and...

By Natural Gas Intelligence (NGI)

Social•Feb 13, 2026

OPEC+ Faces March 1 Decision on Production Hikes

OIL MARKET: The core group of OPEC+ countries need to decide on March 1 whether to re-start production increases after the Jan-Mar pause. Some members in the group see scope for resuming the monthly hikes, although conversations haven't started yet....

By Javier Blas

News•Feb 13, 2026

Silver Price Forecasts: XAG/USD Fails to Find Acceptance Above $79.00

Silver (XAG/USD) slipped to $77.35 on Friday, unable to sustain a breakout above the $79 resistance level. The metal is trapped below the 50‑period SMA at $81, reinforcing a bearish technical bias. A firm US Dollar Index and cautious market...

By FXStreet — News

Social•Feb 13, 2026

Cargill Shuts Milwaukee Plant, 221 Jobs Lost Amid Herd Slump

"Cargill to Close Milwaukee Beef Facility, Cutting 221 Jobs on Herd Decline" https://t.co/R3enSgd7lj "An industry turnaround isn’t expected soon, as there are few signs of a much-anticipated rebuilding of US herds." 😬

By Scott Lincicome

Social•Feb 13, 2026

Trump Admin Eyes Tariff Cuts, Citing Price Hikes, Complexity

BOMBSHELL @FT scoop: Trump admin mulls cutting steel/aluminum tariffs bc these taxes 1) raise US prices; 2) are insanely complicated; 3) had other unintented consequences (incl lobbying). They're admitting, in other words, that gravity exists. Good. https://t.co/o4RkfMWxlF

By Scott Lincicome

News•Feb 13, 2026

European Pulp Prices Climb Amid Ongoing BEK and NBSK Negotiations

European pulp markets are seeing divergent trends as bleached eucalyptus kraft (BEK) prices jumped $120 per tonne for January, while northern bleached softwood kraft (NBSK) only posted modest gains. The BEK surge is driven by supply constraints from Iberian strikes,...

By Fastmarkets – Insights

News•Feb 13, 2026

Senco's Stellar Q3 Topline Growth Driven by Gold Price Rally; Likely to Close FY with ₹8,000 Cr Revenue: MD

Senco Gold & Diamonds reported a 39% same‑store sales surge in Q3, driven primarily by a 65% rally in gold prices over the past year. Despite the topline boost, Q3 volumes slipped 3% YoY and nine‑month volumes fell 10%. EBITDA...

By The Economic Times – Markets

Social•Feb 13, 2026

Oil Returns Green, Signaling Bullish Energy Buying Opportunity

OIL: ticks back into the green and remains Bullish TREND @Hedgeye Yesterday was the 1st day where we could start buying some Energy Exposure on red https://t.co/eURgEMfFpO

By Keith McCullough

News•Feb 13, 2026

Correction to Rationale of Premium Hard Coking Coal, Fob Eastern Australian Ports: Pricing Notice

Fastmarkets corrected the pricing rationale for its Premium Hard Coking Coal (PHCC) index FOB eastern Australian ports on 12 Feb 2026. The index fell $2.43 per wmt that day, reflecting limited market activity and the application of fallback measures. A notable trade...

By Fastmarkets – Insights

News•Feb 13, 2026

Cameroon Clamps Down on Shadow Fleet as Flag Purge Begins

Cameroon’s ship registry, now Africa’s third‑largest, surged 126% in the past year, largely due to Russian‑linked vessels adopting its flag. The fleet’s average age has risen to 32.7 years, prompting safety concerns after several high‑profile incidents. Under pressure from the EU...

By Splash 247

News•Feb 13, 2026

Maran Dry Returns to Newbuilds with Capesize Order at Hengli

Maran Dry, the bulk carrier arm of Angelicoussis Shipping, has placed an order for four new capesize vessels at Hengli Heavy Industry’s Dalian yard, with options that could expand the deal to six ships. This marks the company’s first new‑build...

By Splash 247

News•Feb 13, 2026

Nigeria Marginal Field Dispute Raises Investor Concerns After Dawes Island Court Ruling

A Federal High Court in Nigeria overturned the 2020 revocation of the Dawes Island marginal field licence, reinstating Eurafric Energy Limited’s rights. The ruling challenges the Ministry of Petroleum Resources’ decision not to renew the licence after a decade of...

By World Oil – News

News•Feb 13, 2026

MOL Group Enters Libya Offshore in Joint Venture with Repsol and TPAO

MOL Group has secured a 20% stake in Libya’s O7 offshore block through a joint venture with Repsol and Turkey’s TPAO. The block covers over 10,300 sq km in water deeper than 1,500 m, awarded in Libya’s first licensing round in 17 years....

By World Oil – News

News•Feb 13, 2026

North Sea’s First Methane-Certified ‘Grade A’ Gas Project Launched by ONE-Dyas

ONE‑Dyas has launched the N05‑A development in the Dutch‑German North Sea, becoming the region’s first offshore gas project to earn MiQ Grade A certification for methane emissions. The field, part of the GEMS area, holds up to 50 billion cubic metres of...

By World Oil – News

News•Feb 13, 2026

Partners Advance Vaca Muerta-Linked Argentina LNG Export Development

YPF, Eni and XRG have signed a binding joint development agreement to move the Argentina LNG project forward, leveraging gas from the Vaca Muerta shale play. The plan calls for two floating LNG units delivering a combined 12 million tonnes per year...

By World Oil – News

News•Feb 13, 2026

Patriot Lines up Global Copper-Silver Assets for the AI-Driven Surge

Patriot Resources, an ASX‑listed junior, has assembled a global copper‑silver portfolio aimed at capitalising on the AI‑driven data‑centre boom. The company recently secured the high‑grade Tassa silver‑gold project in Peru for $500,000 and is advancing drilling that has returned multiple...

By The Age – Business

Social•Feb 13, 2026

US NatGas Deficit Hits 2025 High, Prices Plunge

U.S natural gas comparative fell 7 bcf for the week ending February 6 It moved to the greatest deficit since March 2025 Henry Hub spot price decreased $8.78 from $13.79 to $5.01 #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas #LNG https://t.co/tLe3q7z4xZ

By Art Berman Blog

Social•Feb 13, 2026

US Must Secure Mineral Sources, Not Just Funding

You can’t stockpile what you don’t control. The easy part is $12 billion from the Trump Adminstration. The hard part is finding the mines, processing & pricing. Washington needs to build alliances instead of burning them. https://t.co/JfhrJs5VnH #CriticalMinerals #Geopolitics #China #SupplyChains #EnergyTransition #Mining #USPolicy

By Art Berman Blog

News•Feb 13, 2026

CNOOC Targets 40% Offshore Wind Capacity Ramp up in 2026

China National Offshore Oil Corporation (CNOOC) announced a 40% increase in offshore wind capacity for 2026, targeting 3.5 GW of installed power. The expansion, executed with turbine maker Ming Yang Smart Energy, will roll out advanced turbines across southern provinces. Falling costs...

By Splash 247

Social•Feb 13, 2026

EIB's Grid Debt Shift Sparks Skepticism in Europe

The European Investment Bank plans to advance electricity capacity by moving grid debt off bank books & monetizing future revenues I'm not holding my breath. This is Europe, after all. https://t.co/UHQ7GprVvL #PowerGrids #EnergyInfrastructure #Europe #EIB #Electricity #EnergyTransition

By Art Berman Blog

Social•Feb 12, 2026

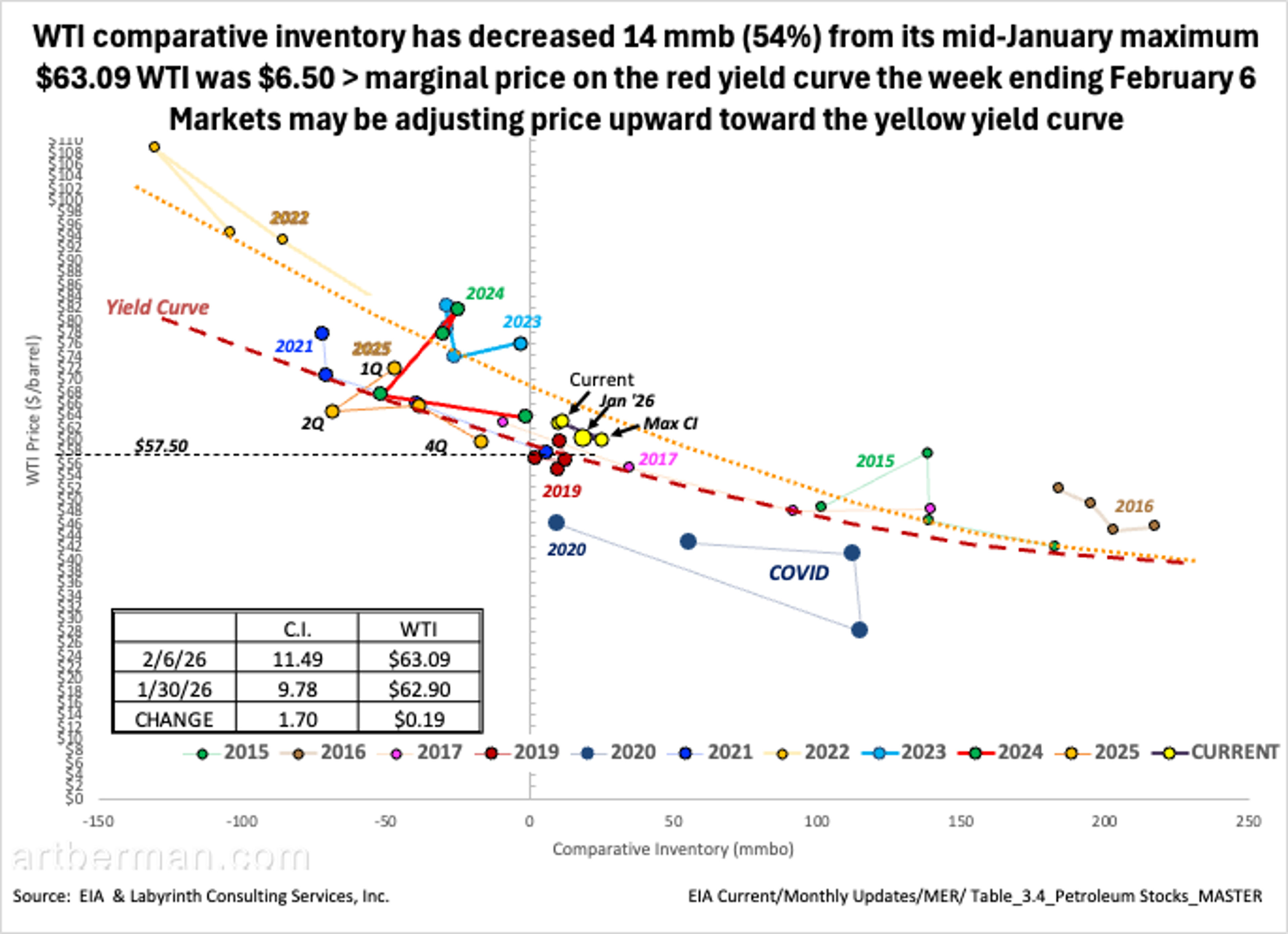

Oil Inventories Rise, Distillate Falls Amid Mixed Market

A mixed week for the oil glut story CI rose but has fallen from its mid-January maximum U.S. comparative inventory rose 1.7 mmb for the week ending February 6 Crude C.I. rose 7.1 mmb, gasoline rose 1.0 mmb but distillate fell 2.4...

By Art Berman Blog

News•Feb 12, 2026

Canadian Farm Milk Price Changes to Reflect Growing Protein Demand

Canadian dairy farmer organizations are overhauling milk pricing to reflect a surge in protein‑rich product demand, with cottage cheese volumes up 32% and yogurt up 7% in 2025. The Western Milk Pool will pay 70% for butterfat, 25% for protein...

By The Western Producer

News•Feb 12, 2026

As U.S. Companies Return to Venezuela's Oilfields — One Canadian Driller Has a Head Start

Canadian oilfield services firm Ensign Energy Services is currently the sole operator of drilling rigs in Venezuela, maintaining two rigs in the Orinoco heavy‑oil region after two decades of continuous presence. A recent Trump administration general licence has opened the...

By Financial Post – Commodities

Social•Feb 12, 2026

SOLS: Cheap US Uranium Conversion Monopoly Amid Global Shortage

Thread(1/2) 🧵 We put our SOLS long thesis above the paywall in our Atoms vs. Bits primer yesterday, so I’m also going to summarize for all you degenerates on X. The story is simple: the uranium trade has resulted in nearly every...

By Citrini7 (pseudonymous)

News•Feb 12, 2026

Nuclear Power Group Alva Energy Launches with $33 Million in Funding

Alva Energy, a Massachusetts‑based nuclear startup, closed a $33 million Series A round led by Playground Global to fund retrofits of existing U.S. reactors. The company will replace steam generators and add a second turbine, boosting each plant’s output by 200‑300 MWe and...

By POWER Magazine

Social•Feb 12, 2026

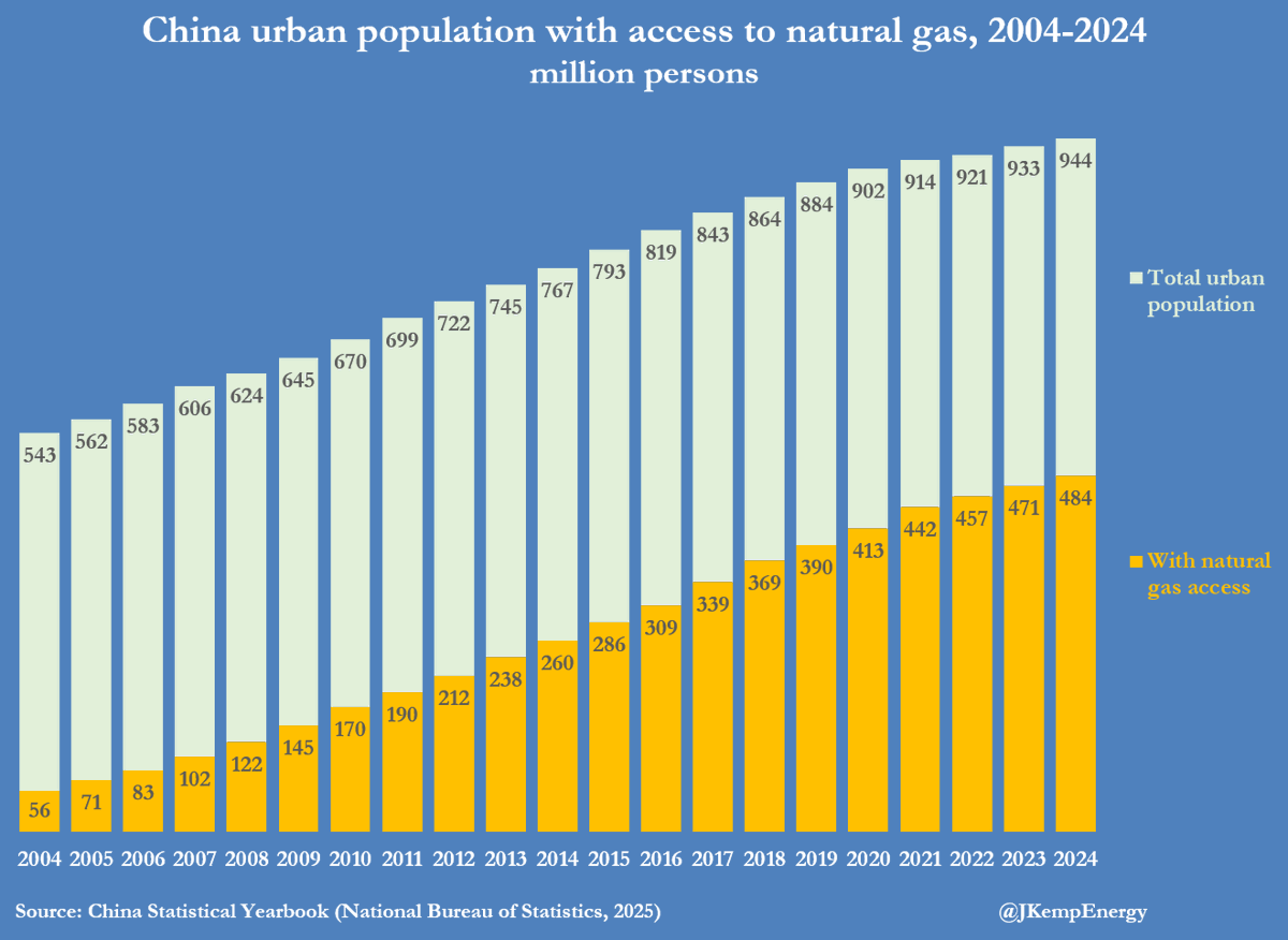

China’s Urban Gas Network Reaches 484 Million Residents

China’s residential gas revolution China has connected more than 300 million people living in urban households to the natural gas network since 2010, according to data published late last year by the National Bureau of Statistics (NBS). The number of urban...

By John Kemp

News•Feb 12, 2026

IEC-Based Technical Specifications Needed for Second-Life PV Module Market

The IEA‑PVPS Task 13 report warns that the second‑life photovoltaic module market remains fragmented due to missing IEC‑based qualification standards, costly manual repairs, and absent policy support. It recommends fast‑tracking IEC specifications, investing in automated testing hubs, and creating financial instruments...

By pv magazine

News•Feb 12, 2026

Spain Hits 50 GW Solar Milestone

Spain’s installed solar capacity hit the 50 GW milestone in early 2026, after adding roughly 8.7 GW in 2025. Solar now represents 33.9% of the country’s total installed power capacity and supplied 18.4% of electricity last year. The expansion was led by...

By pv magazine

News•Feb 12, 2026

The New Rationale of the EU PV Market

Solar photovoltaic installations continued strong growth in 2025, with Europe reaching a record 70 GW and global cumulative installations surpassing 700 GW, led primarily by China’s over‑half share. The market is increasingly bifurcated: mature regions stagnate while emerging economies accelerate, and battery...

By pv magazine

Social•Feb 12, 2026

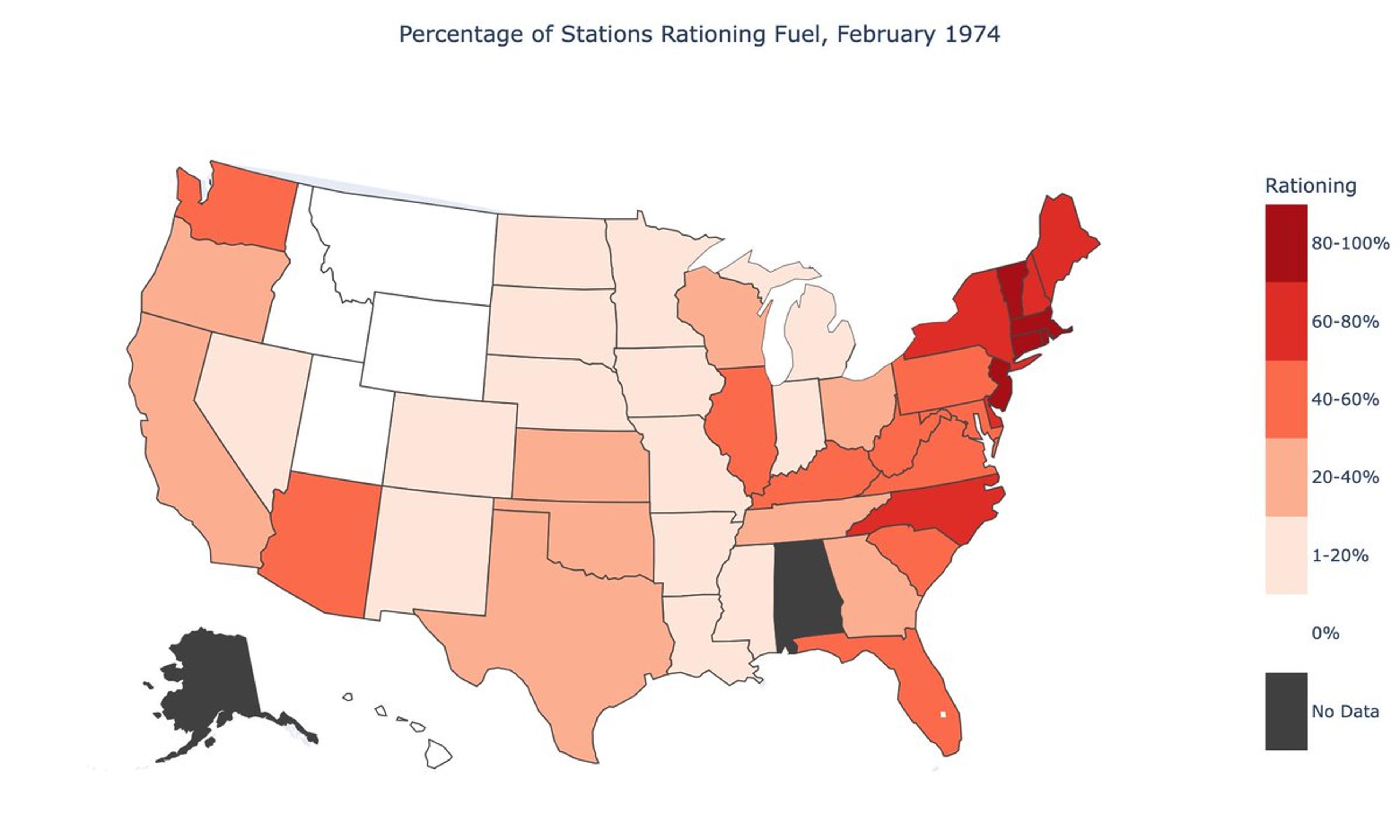

Price Controls Trigger Chaotic, Uneven Resource Allocation

I'm super excited for my new paper with @ATabarrok and Mark Whitmeyer: "Chaos and Misallocation under Price Controls" During the 1973-74 gasoline crisis, the U.S. had about a 9 percent national shortfall. But that was far from evenly spread out. Over...

By Brian Albrecht

Social•Feb 12, 2026

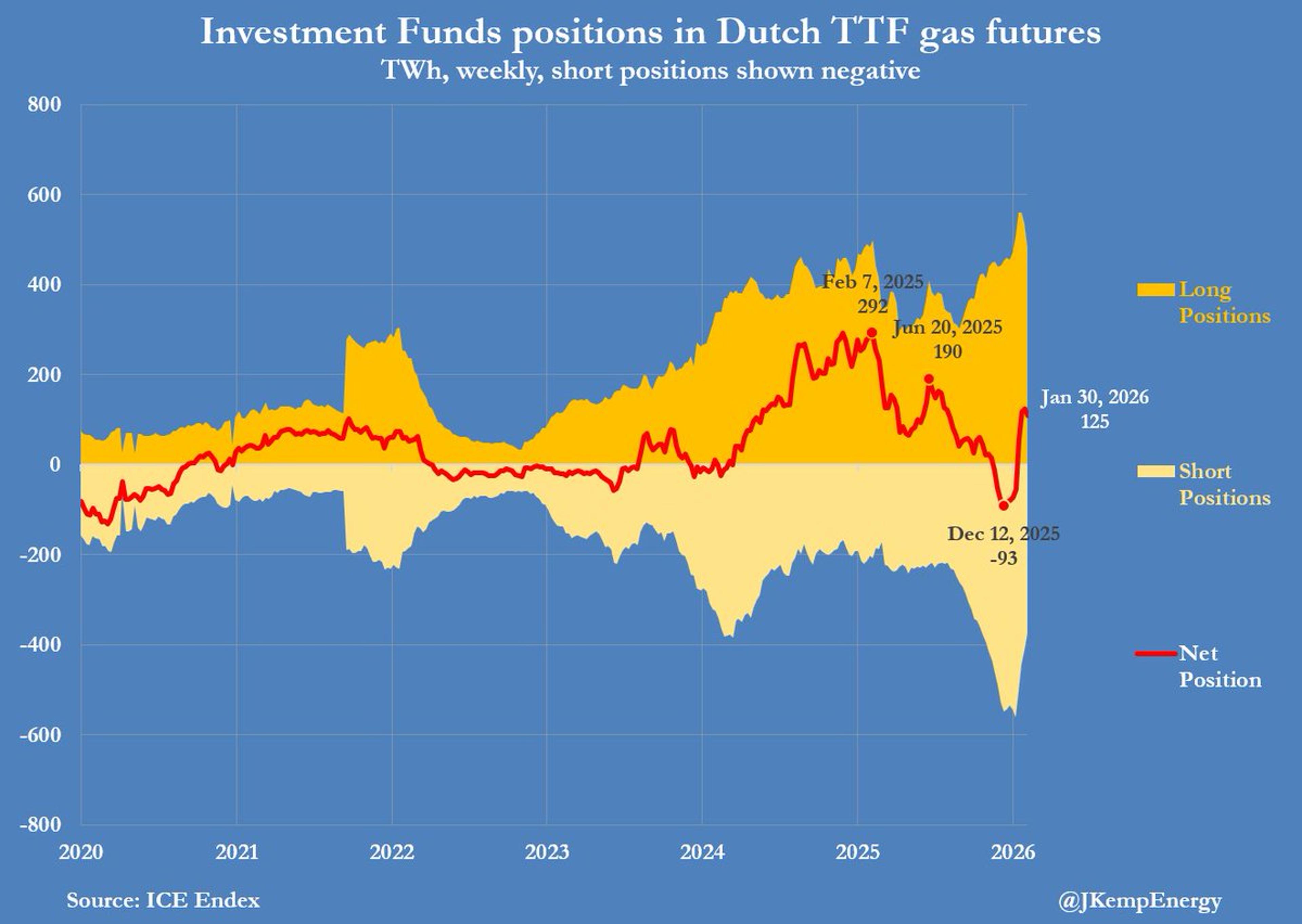

Investors Dump TTF Gas Futures as Prices Slip

INVESTMENT MANAGERS sold futures and options on the Dutch TTF European gas benchmark for the first time in eight weeks as prices retreated despite inventories well below average for the time of year. Funds sold the equivalent of 15 terawatt-hours...

By John Kemp

News•Feb 11, 2026

European Investment Bank Launching Financing Platform for Energy Efficiency

The European Investment Bank is injecting €60 million into Solas Capital’s Sustainable Energy Fund II to launch a new financing platform that will support energy‑efficiency projects for SMEs across the EU. The platform is designed to mobilize nearly €400 million of total capital,...

By POWER Magazine

Social•Feb 12, 2026

WTI Inventories Plunge 54%, Prices Push Toward Yellow Curve

WTI comparative inventory has decreased 14 mmb (54%) from its mid-January maximum $63.09 WTI was $6.50 > marginal price on the red yield curve the week ending February 6 Markets may be adjusting price upward toward the yellow yield curve #energy #OOTT #oilandgas...

By Art Berman Blog

Social•Feb 12, 2026

All Markets Tumble, $3.6T Erased in 90 Minutes

-$3.6T in 90 minutes Gold fell 3.76%, wiping out nearly $1.34T in market cap. Silver dropped 8.5%, losing around $400B in market value. The S&P 500 declined 1%, erasing $620B. Nasdaq slid more than 1.6%, shedding $600B. The crypto...

By Crypto Jack

News•Feb 11, 2026

Govt Urges Refiners to Prioritise US, Venezuelan Crude Amid Evolving Trade Ties: Report

India has urged its state‑owned refiners to give priority to crude from the United States and Venezuela as part of a broader effort to diversify supplies and reduce reliance on Russian oil. The government’s suggestion applies to spot‑market tenders for...

By ET EnergyWorld (The Economic Times)

Social•Feb 12, 2026

Utilities Prefer Rate Hikes over Data‑center‑funded Battery Power

Culture change is hard. Utilities like @DukeEnergy would rather raise rates 15% on their ratepayers because they feel forced to pay “$3k/kW” for gas instead of adding 7,200 MWs of batteries paid for by data centers at existing solar sites...

By Jigar Shah

Social•Feb 11, 2026

Gold Peaks, Yet GameStop‑Style Demand Keeps It Alive

My entire feed says gold has peaked and Bitcoin's turn is coming. Then I sat down with Joshua Lim. He sees signs of a blow off top… BUT also GameStop-esque demand propping up the metal 😅 #gold #markets #liquidations

By Laura Shin

News•Feb 11, 2026

Nickel Price Jumps as Indonesia’s Top Mine Cuts Output

Indonesia ordered the world’s largest nickel mine, PT Weda Bay, to cut its ore quota from 42 million tonnes to 12 million tonnes for 2024, aiming to tighten global supply. The LME nickel price rose 2 percent to $17,835 a tonne, extending a rally of...

By MINING.com

Social•Feb 11, 2026

US Backs Coal Revival as Indonesia Slashes Output

Two major coal developments in the last 24 hours. 1. White House announcing purchases and support to revive the industry 2. Indonesia just ordered the world's largest nickel mine to sharply cut output. They are also looking to cut coal production by...

By Quinn Thompson

Social•Feb 11, 2026

USD Soft, JPY Squeeze Persists, Oil Spikes on Iran Tension

$USD is soft ahead of the delayed jobs report. Japanese markets were closed for a national holiday, but the dramatic short squeeze of $JPY continued. WTI is up ~2% as the US-Iran confrontation seems near a climax. ...

By Marc Chandler

News•Feb 11, 2026

What's Driving Northern Ireland's Falling Fuel Prices?

Petrol prices in Northern Ireland have fallen to 124.2 pence per litre, the lowest level in five years, while diesel holds steady at 131.9 pence. The decline follows a global oil oversupply and easing geopolitical tensions after the 2022 price spike triggered...

By BBC News – Business