🎯Today's Commodities Pulse

Updated 21m agoWhat's happening: Brazil slaps anti‑dumping duties on Chinese steel imports

Brazil’s foreign trade committee approved five‑year anti‑dumping duties on a range of Chinese steel products, imposing tariffs of $323‑$670 per ton on cold‑rolled coil and $285‑$710 per ton on hot‑dip galvanized coil. In 2025 the country imported 202,000 tons of CRC and 1.42 million tons of HDG from China.

Also developing:

By the numbers: Vale sells control of Thompson nickel complex in $200M injection

News•Feb 16, 2026

China’s Carbon Market Expands Into Heavy Industry As USA Regresses

China’s Ministry of Ecology and Environment has extended mandatory carbon‑reporting to petrochemicals, chemicals, flat glass, copper smelting, papermaking and civil aviation, laying groundwork for future ETS inclusion. The national emissions trading system already covers power, steel, cement and aluminum—about 60‑65% of China’s emissions—making it the world’s largest carbon market by volume. Reporting will begin in 2025‑26, with likely compliance integration by 2027‑30, potentially raising coverage to 70‑80% of national emissions. Meanwhile, the United States has rolled back its federal greenhouse‑gas endangerment finding, contrasting sharply with China’s expansion and the EU’s tightening ETS.

By CleanTechnica

News•Feb 16, 2026

Key Takeaways From Solaire Expo Maroc

The 14th Solaire Expo Maroc in Casablanca highlighted Morocco’s push toward an integrated renewable ecosystem, featuring electric‑vehicle pavilions and a strong Chinese presence in solar equipment. Local distributors reported a dynamic market with rising prices after China ended VAT rebates,...

By pv magazine

News•Feb 16, 2026

EBW Warned of Faltering Gas Demand Heading Into Holiday Weekend

EBW Analytics warned that U.S. natural‑gas demand could weaken heading into the President’s Day weekend, after the front‑month NYMEX contract briefly spiked to $3.316 per MMBtu before retreating. A recent EIA report showed a 249 billion‑cubic‑foot draw, leaving storage 97 bcf below...

By Rigzone – News

News•Feb 16, 2026

French Startup Launches ‘Universal’ Home Energy Management System

French startup PvPilot has launched a fourth‑generation home energy management system (HEMS) that claims universal compatibility with all major solar inverters, batteries and EV chargers. The solution, delivered via a USB‑connected relay device, measures real‑time generation and demand to orchestrate...

By pv magazine

Social•Feb 16, 2026

Investors Bet on Oil Amid Growing Supply Threats

Oil investors bullish on proliferating supply threats Investors are increasingly bullish about the outlook for oil prices as potential risks to production and tanker traffic multiply - including threats of U.S. military action against Iran and stricter sanctions enforcement. Hedge funds and...

By John Kemp

Social•Feb 16, 2026

Metal Volatility Reveals Hidden Market Shifts

Metal Volatility Changed Everything $GLD $SLV $BTCUSD $SPX $QQQ $IGV $XLK Sharp volatility in gold, silver, crypto and equities was easier to spot than most think. And why I study sector rotation, options structure, and investor confidence. https://t.co/PYmLxcJSCJ

By Samantha LaDuc

News•Feb 16, 2026

Refinery Petrochemical Integration, Feedstock Certainty to Define India’s Next Chemical Growth Cycle: Ramya Bharathram, MD, Thirumalai Chemicals

India’s chemical industry faces a structural shift as it seeks to move up the value chain by reducing reliance on imported feedstocks. Ramya Bharathram of Thirumalai Chemicals emphasizes refinery‑petrochemical integration, flexible cracker designs, and transparent, index‑linked pricing as keys to...

By ET EnergyWorld (The Economic Times)

Social•Feb 16, 2026

Bears Dominate Oil Market Narrative After Energy Week

COLUMN: In the oil market, the bears control the narrative — at least for now. (My summary after last week's International Energy Week, the oil trading industry's annual jamboree in London) @Opinion https://t.co/Y3OHEhD4k5

By Javier Blas

Social•Feb 16, 2026

Henry Hub Drops Below $3 on Warm Weather, Shale Supply

GAS MARKET: After a cold blast triggered sild price moves, US gas benchmark Henry Hub has fallen back below $3 per mBtu. Warmer temperatures and the irresistible supply force of the US shale revolution behind the pullback.

By Javier Blas

Blog•Feb 15, 2026

Silver Paper's Problem

The episode examines the severe liquidity crunch in both physical and paper silver, highlighted by a sharp drop in COMEX open interest and widening spreads that deter speculators. It explains how banks and traders are constrained by the high value...

By McleodFinance (Alasdair Macleod)

Social•Feb 16, 2026

California's Gasoline Costs Rise From Bahamas Imports

California has to import US gasoline via Bahamas Refinery closures + no Gulf-to-CA pipelines + the Jones Act = a logistics tax https://t.co/3dGBI24oXI #gasoline #California #energy #refining #JonesAct #shipping #supplychain #oil #inflation #markets

By Art Berman Blog

Social•Feb 15, 2026

U.S. NatGas Spread Widens as Prompt Prices Drop

U.S. natural gas 12-month spread widened $0.10 (10%) on lower prompt price April contract fell $0.13 (4%) from $3.23 to $3.10 week ending February 13 Front-month price decreased $0.18 (5%) from $3.42 to $3.24 #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas #LNG

By Art Berman Blog

News•Feb 14, 2026

China to Continue Dominance of Global Ammonia Supply

China is projected to supply roughly one‑third of the world’s ammonia by 2030, cementing its role as the dominant producer and consumer. Strong agricultural demand for nitrogen‑based fertilizers and a broad industrial base, from steel to plastics, underpin this growth....

By MEED (Middle East)

Social•Feb 15, 2026

Stockpile Buffers Risk, Not Replaces Chinese Supply

A $12B rare earth stockpile is a step in the right direction, but buying from China on the open market isn’t independence; it’s a piggy bank with a very fragile supply chain. Until we build domestic processing, this is a...

By Peter Zeihan

Social•Feb 15, 2026

Egypt's Summer Power Surge Drives Record LNG Demand

Egypt expects electricity demand to increase by 7% this summer. That means strong demand for LNG imports. Egypt's LNG demand reached record high last year. 👇👇

By Anas Alhajji

News•Feb 13, 2026

Taiwan Commits to $69 Billion US Energy Trade Pact

Taiwan's state-owned enterprises have signed a trade agreement with the United States committing to purchase $44 billion in liquefied natural gas and crude oil and $25.2 billion in power‑generation equipment by 2029. The deal, announced on Feb. 12, creates a $69 billion energy trade...

By Energy Intelligence

Social•Feb 15, 2026

Natural Gas Prices Dip, No Rally Expected

The natural gas party is over U.S. natural gas futures price fell $0.18 (5%) from $3.42 to $3.24 week ending February 6 My outlook suggests a modest floor Increase (~$0.25), not a rally forming #energy #NaturalGas #shale #fintwit #oilandgas #Commodities #ONGT #natgas...

By Art Berman Blog

Social•Feb 15, 2026

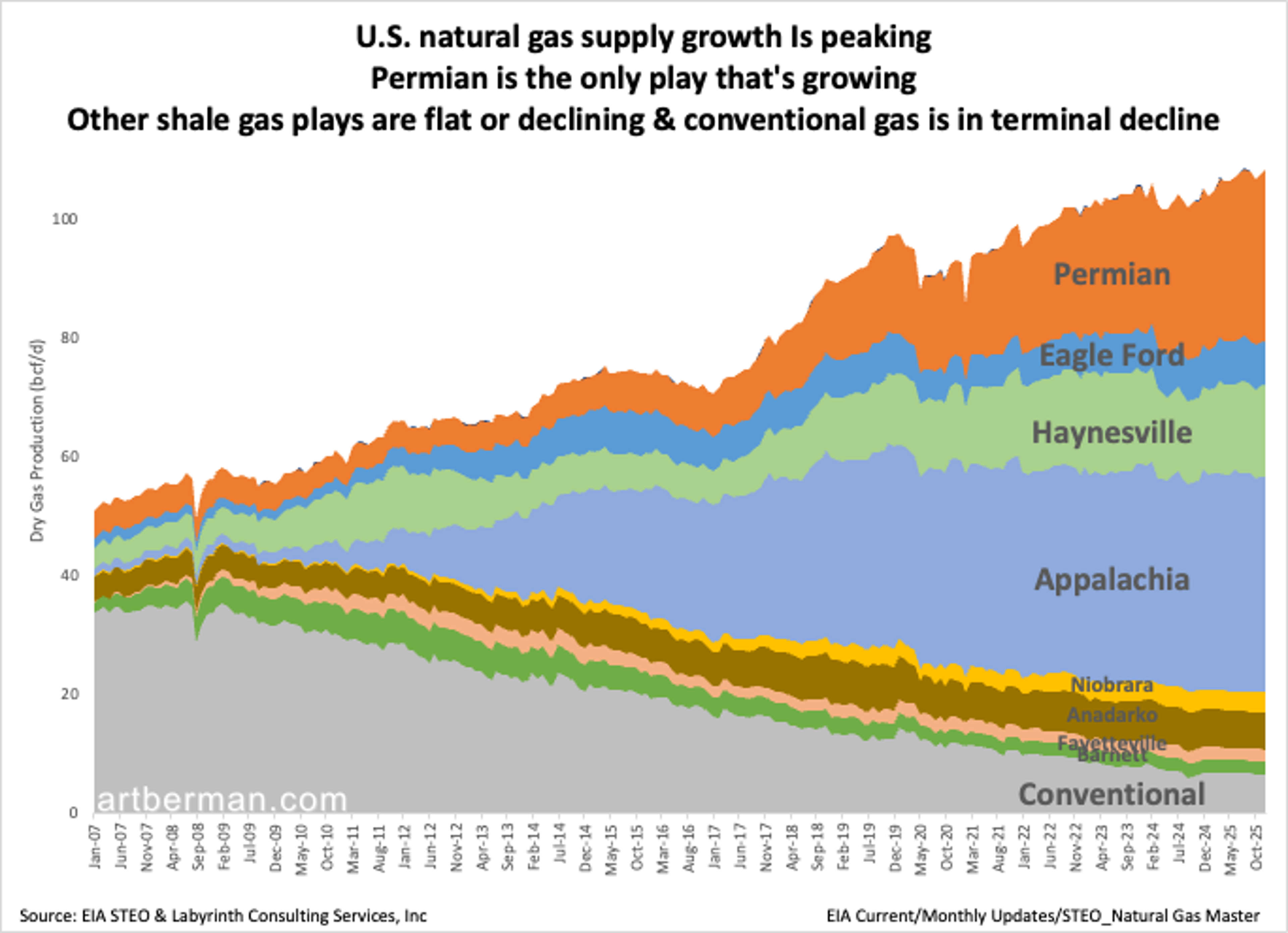

Europe Doubts US LNG Reliability Despite Past Optimism

A decade ago, I wrote an essay @ForeignAffairs about rise of US LNG w subhead "The benign energy superpower." https://t.co/P9r14hfb11 This week @MunSecConf, the Q I got most was whether Europe can trust US LNG to be reliable. And privately, senior...

By Jason Bordoff

News•Feb 13, 2026

Oil Prices Level Out Despite Possible Opec-Plus Supply Growth

Oil prices closed Friday largely unchanged after a session marked by sharp swings between macro‑economic headwinds and geopolitical support. Traders weighed the prospect of OPEC‑plus expanding output against lingering demand concerns. The market’s equilibrium suggests that supply‑side expectations have not...

By Energy Intelligence

Social•Feb 15, 2026

Speculators Turn to Oil for Stability Amid Market Turmoil

Speculative money is leaning back into oil as traders look for stability in a volatile world writes @Ole_S_Hansen Oil is becoming the preferred risk exposure in an otherwise uncertain macro landscape. Relative calm in crude contrasts with violent reversals in precious...

By Art Berman Blog

Social•Feb 15, 2026

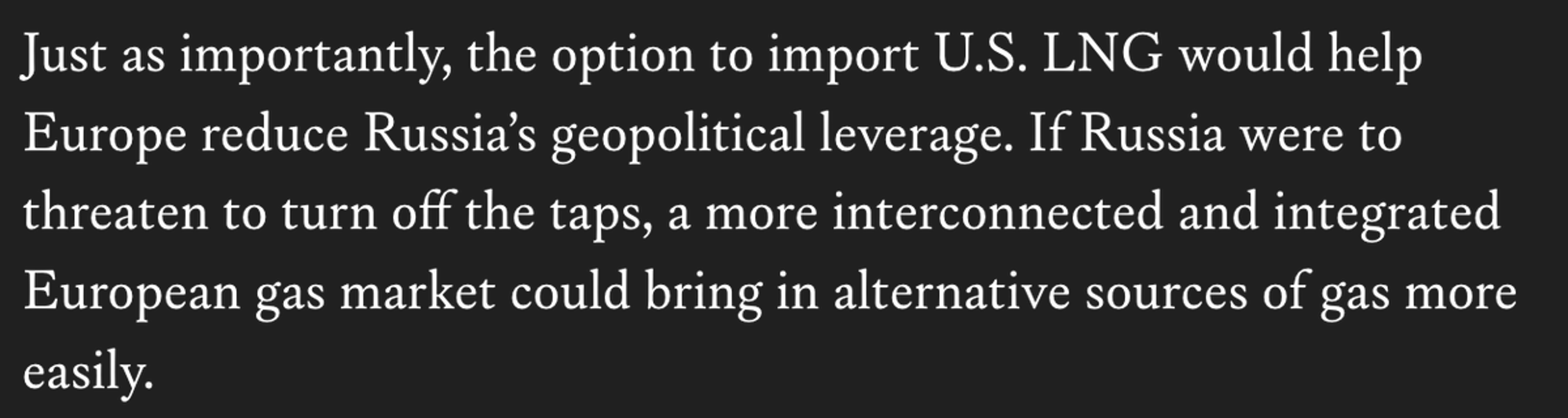

EU's Fossil Imports Hit 58% of Energy Demand.

EU fossil imports met 58% of energy demand in 2023 - near pre-crisis levels - leaving consumers exposed to price shocks. Far above China (24%) & India (37%); only Japan (84%) & S. Korea (80%) rely more on imports. Graph: @ember_energy...

By Jan Rosenow

News•Feb 13, 2026

Are AI Data Centers a Scapegoat for Rising US Energy Costs?

US retail electricity prices have spiked, prompting criticism of new AI data center projects. While AI‑driven facilities consume large amounts of power, they represent a modest slice of total grid demand. The backlash threatens a key source of future natural‑gas...

By Energy Intelligence

Social•Feb 15, 2026

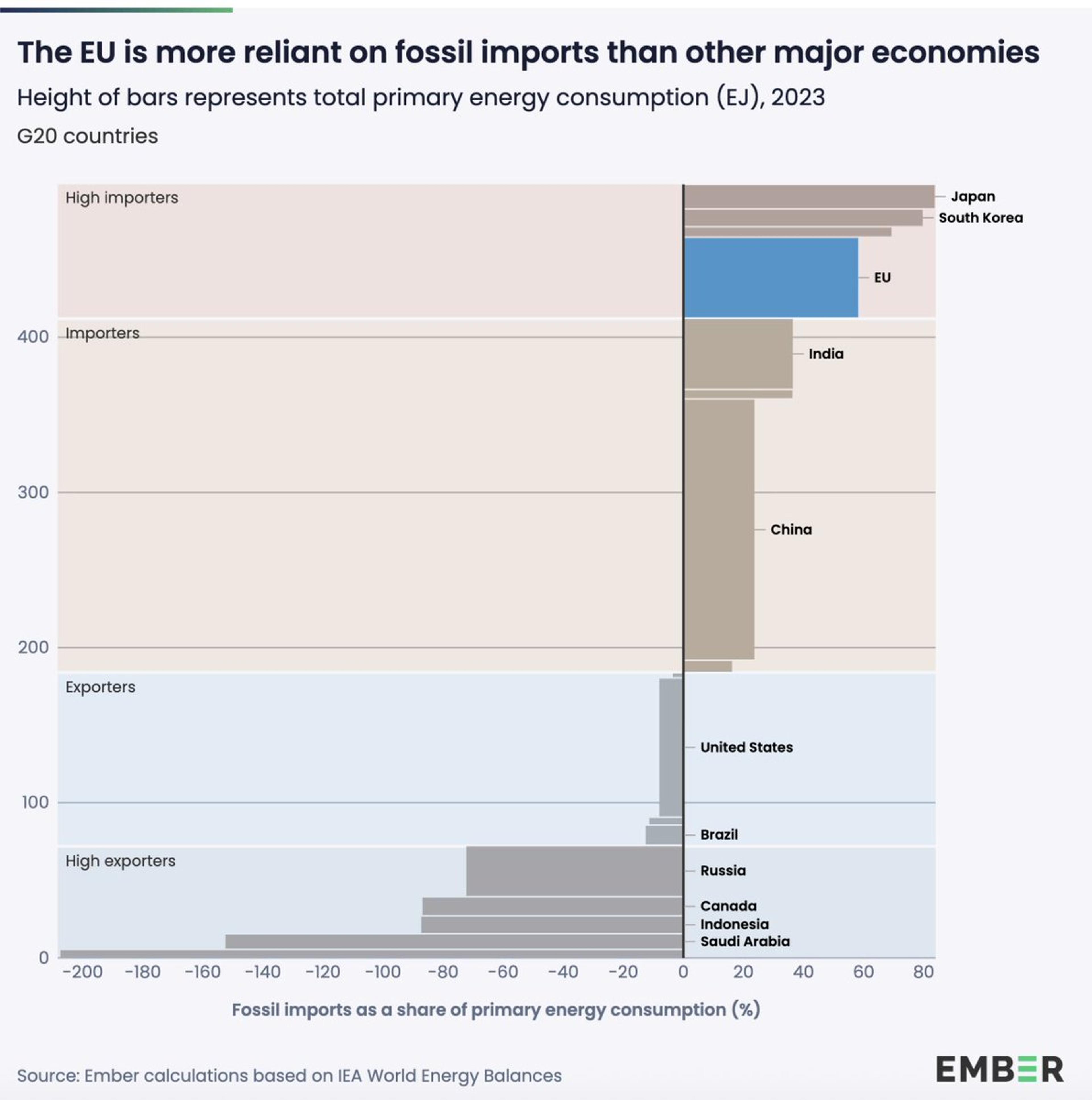

U.S. Gas Exports Set to Hit 20 Bcf/D by 2027

Drain America First U.S. natural gas exports rise toward 20 Bcf/d in 2027 #NaturalGas #EnergySecurity #ShaleGas #Permian #EnergyInfrastructure #SupplyConstraints #USGas https://t.co/rmLKJzpmpS

By Art Berman Blog

Social•Feb 15, 2026

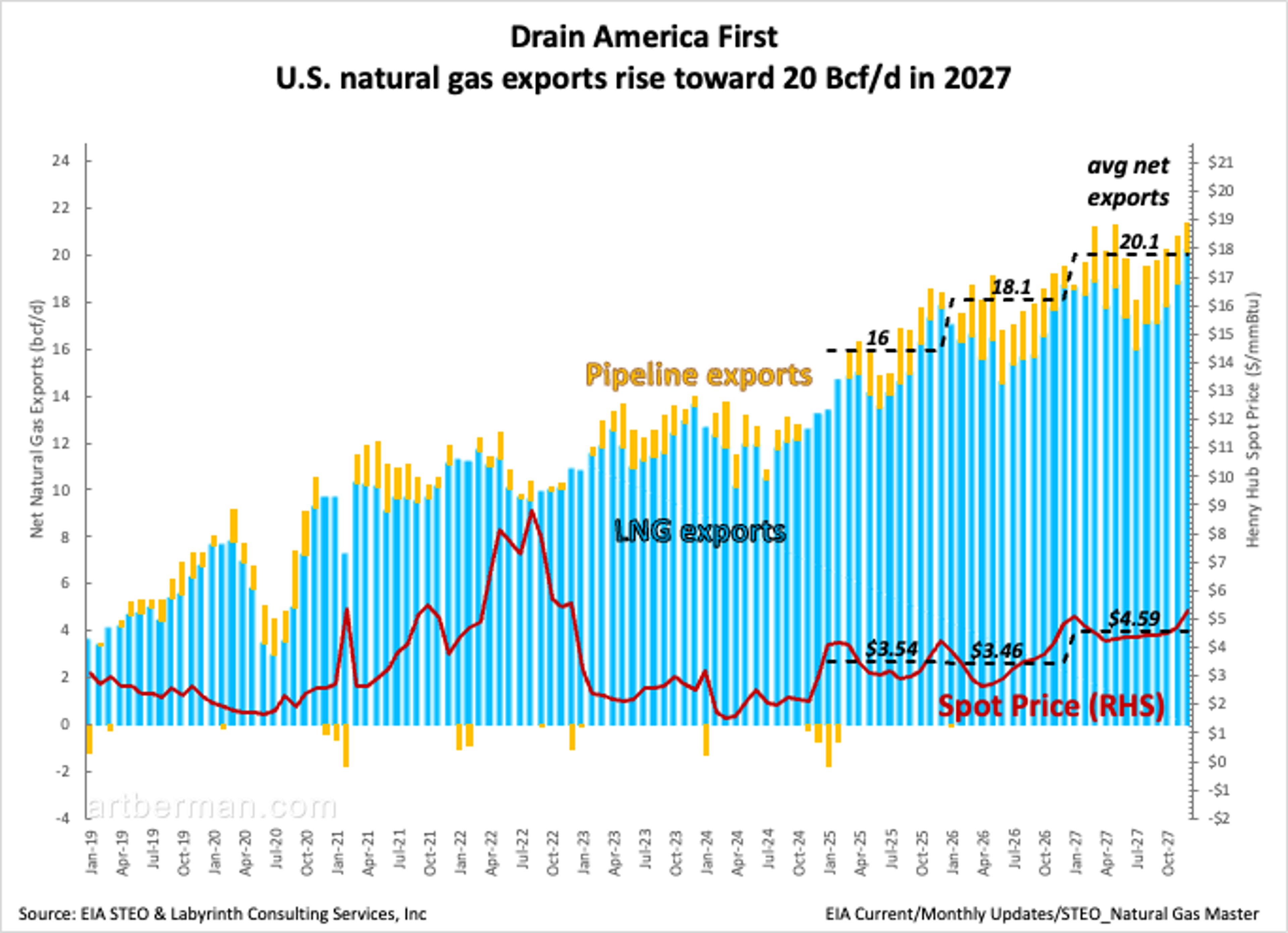

Permian Drives US Gas Growth as Others Stall

U.S. natural gas supply growth Is peaking @yagelski @websterdrake Permian is the only play that's growing Other shale gas plays are flat or declining & conventional gas is in terminal decline #NaturalGas #EnergySecurity #ShaleGas #Permian #EnergyInfrastructure #SupplyConstraints #USGas

By Art Berman Blog

News•Feb 13, 2026

Largest US Gas Producer Expand Ousts CEO, Heads to Houston

Expand Energy, the United States' largest gas producer, announced the removal of CEO Nick Dell'Osso. The leadership change coincided with a plan to relocate the corporate headquarters from Oklahoma City to the Houston metropolitan area. Analysts say the ouster is...

By Energy Intelligence

Social•Feb 15, 2026

US Gas Demand Outpaces Infrastructure, Not Supply

Read your chart @yagelski It shows that the US is awash in natural gas DEMAND not supply Pipelines, storage & power-plant hookups lag demand, as they always do. This is an infrastructure problem, not a resource problem. #NaturalGas #EnergyInfrastructure #LNG #PowerMarkets #GridConstraints...

By Art Berman Blog

Social•Feb 15, 2026

Oil Glut Exists Only in Models, Not Markets

The oil “glut” exists in models, not in physical barrels, writes @MeesEnergy Backwardation holds, volatility stays calm, and the barrels everyone talks about don’t show up in stocks. Models say surplus. The market says otherwise. #OilMarkets #OPECplus #Backwardation #EnergySecurity #SupplyRisk #ChinaOil...

By Art Berman Blog

News•Feb 13, 2026

Delfin LNG Explosion Prompts Lawsuit, Broader Safety Concerns

On February 3, a pipeline explosion at the Delfin LNG export project in the Gulf of Mexico halted construction and triggered a lawsuit alleging negligence by the developers and contractors. The incident adds to a history of delays that have already...

By Energy Intelligence

Social•Feb 14, 2026

RUB Strengthens as Oil Stabilizes, Gold Surges

Macro: MOEX flat as oil steadies and gold spikes; RUB strengthens (USD/RUB 76.65). Key drivers: commodity moves, stable RVI (24.9). Risks: commodity volatility, sanctions. Trade: buy selective energy exporters on RUB resilience. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

Predicting Silver’s Peak and the Next Market

How I Called The Top In Silver & What Comes Next $GLD $SLV $GDX $SIL We also about my yen monetization framework, oil, AI-driven software disruption & timing a historic rotation into large-cap value. https://t.co/0A5l9bLx9C

By Samantha LaDuc

News•Feb 13, 2026

Market View: For Gas Prices, a Tale of Two North Americas

The Northeastern United States is enduring its coldest winter in over three decades, pushing spot gasoline prices to a significant premium. In contrast, Western Canada is enjoying its warmest winter in a century, easing local fuel costs. The divergent weather...

By Energy Intelligence

Social•Feb 14, 2026

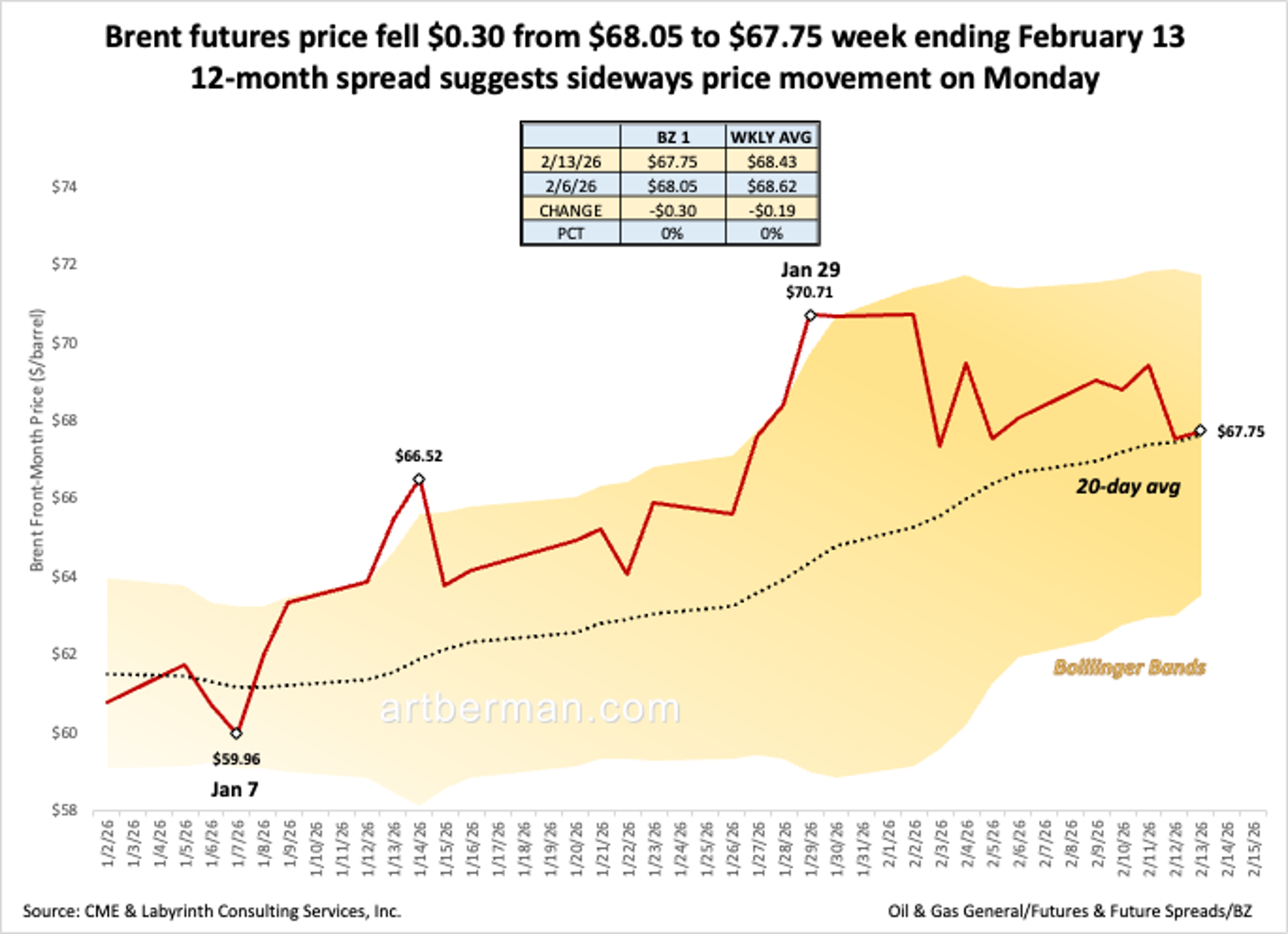

Brent Dips 30 Cents; 12‑month Spread Signals Flat Outlook

Brent futures price fell $0.30 from $68.05 to $67.75 week ending February 13 12-month spread suggests sideways price movement on Monday #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket https://t.co/hYd0O6d84E

By Art Berman Blog

Social•Feb 14, 2026

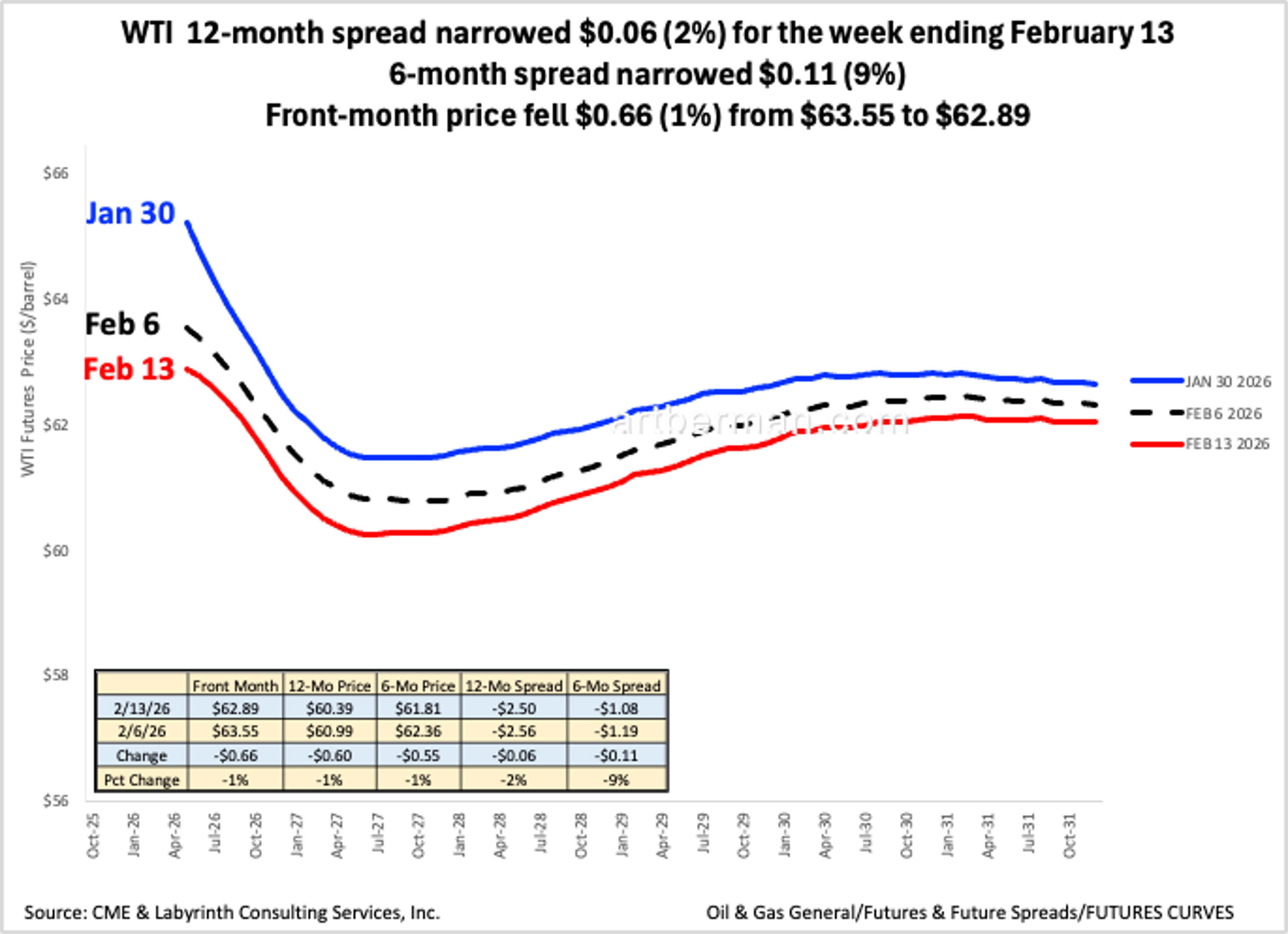

WTI Spreads Tighten as Front-Month Price Slips

Show me the glut WTI 12-month spread narrowed $0.06 (2%) for the week ending February 13 6-month spread narrowed $0.11 (9%) Front-month price fell $0.66 (1%) from $63.55 to $62.89 #energy #OOTT #oilandgas #WTI #CrudeOil #fintwit #OPEC #Commodities #commoditiesmarket https://t.co/1VHaA5PFZN

By Art Berman Blog

News•Feb 13, 2026

Oil Prices, Feb. 13, 2026

Oil prices rose on Feb. 13, 2026 as OPEC+ announced an extension of its production cuts through 2027, supporting a tighter market. U.S. crude inventories dropped by 3.2 million barrels, further tightening supply. Brent crude settled at $84 per barrel,...

By Energy Intelligence

Social•Feb 14, 2026

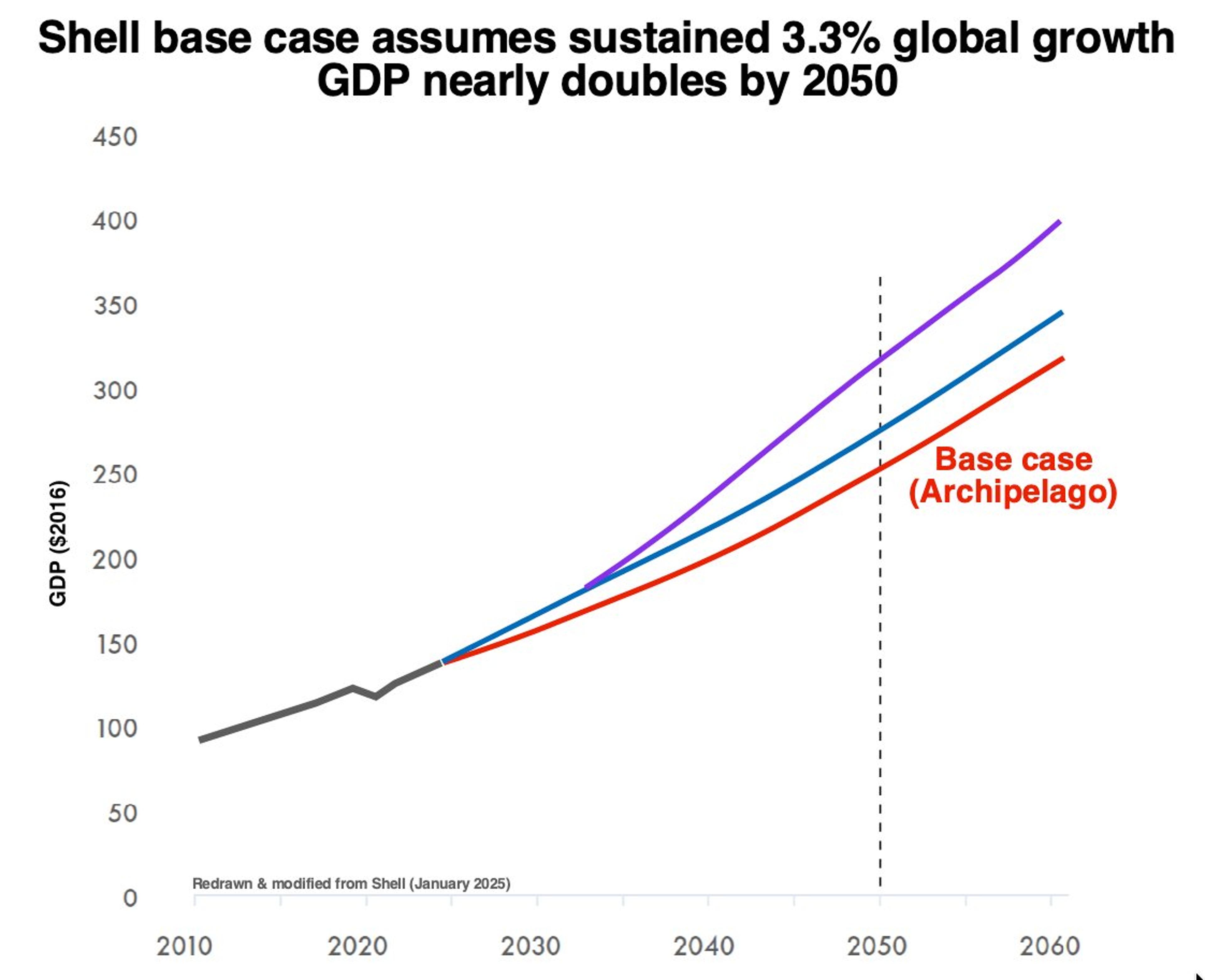

Shell Forecasts Global GDP to Double by 2050

Shell base case assumes sustained 3.3% global growth GDP nearly doubles by 2050 #GlobalGDP #EconomicGrowth #EnergyScenarios #Shell #Macroeconomics #GrowthAssumptions #LongTermForecasts https://t.co/meXF1PuaVe

By Art Berman Blog

Social•Feb 14, 2026

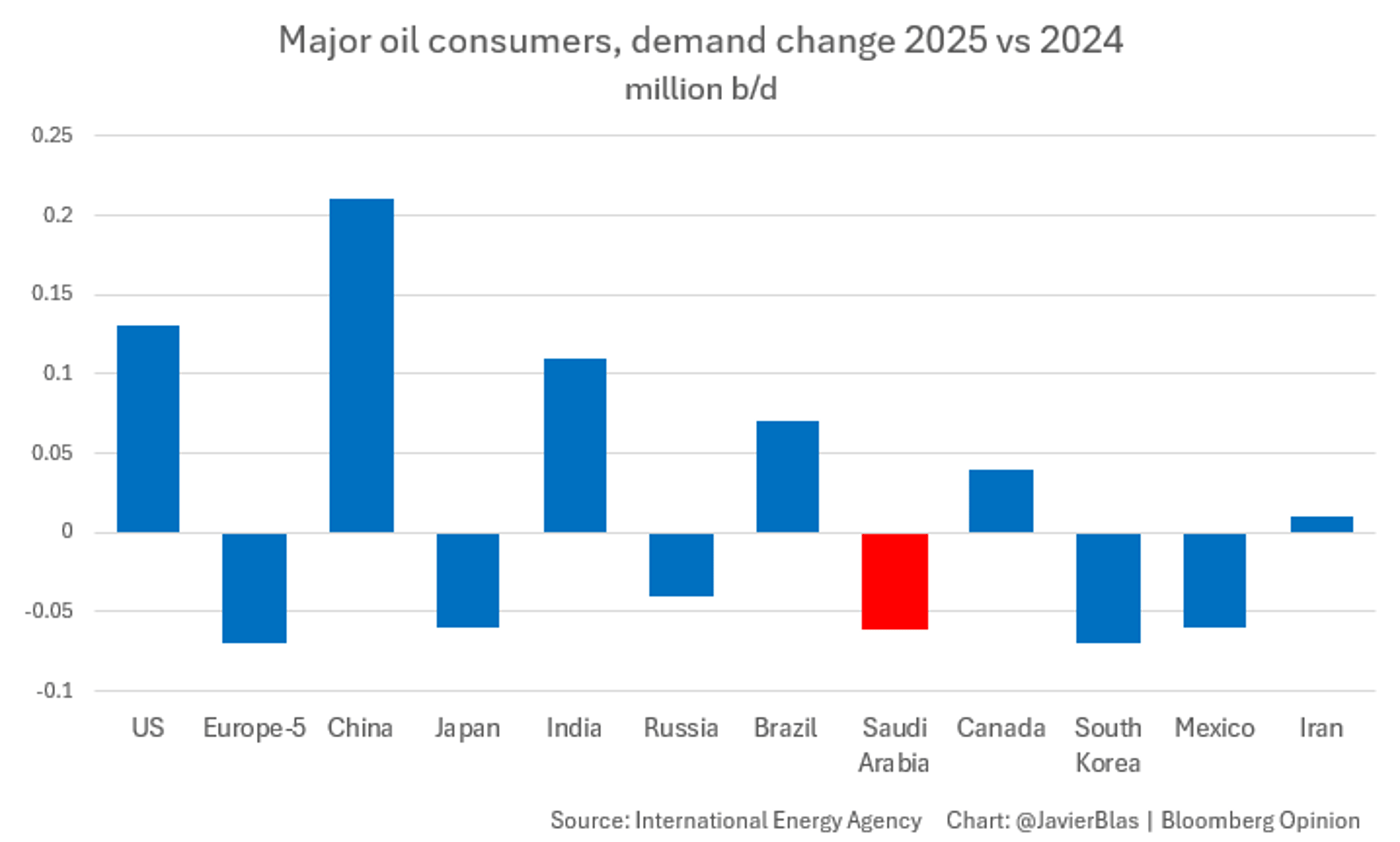

Saudi Arabia’s Oil Demand Plummets as Gas Powers Electricity

CHART OF THE DAY: Among the world's top oil consumers, a curious trend. The 2nd largest consumption drop last year ocurred in Saudi Arabia, where demand fell ~60,000 b/d (only South Korea saw a larger drop). The reason? Gas is...

By Javier Blas

News•Feb 13, 2026

Export Momentum Carries Corn Market Into New Year

U.S. corn prices remain buoyed by robust export demand that persisted into early 2025, according to Compeer Financial economist Megan Roberts. While prices are still below target levels, the export momentum offsets downward pressure. Roberts noted that a nationwide E15...

By Brownfield Ag News

Social•Feb 14, 2026

Pemex's Bond Return Shows State Risk, Not Confidence

Pemex is back in the bond market after six years — and demand was strong. This doesn't signal confidence in Pemex. Buyers are really underwriting the Mexican state. https://t.co/YRGXmzi4aW #Pemex #Mexico #OilMarkets #EnergySecurity #SovereignRisk #DebtMarkets #EmergingMarkets

By Art Berman Blog

Social•Feb 14, 2026

China's Cheap Middle East Oil Squeezes West African Sellers

China is pulling more cheap oil from the Middle East. That leaves W. African oil struggling to find buyers until it gets cheap enough to move again, writes @JuneGoh_Sparta In this tight market, the Middle East has the upper hand. Sorry oil...

By Art Berman Blog

News•Feb 13, 2026

Higher Costs and Lower Prices Driving U.S. Cotton Acreage Decline

U.S. cotton growers are scaling back planting this spring as production costs surge 30% and farmgate prices slump, according to National Cotton Council data. The National Cotton Council’s grower survey shows intended acreage dropping to nine million acres, down from...

By Brownfield Ag News

Social•Feb 14, 2026

OPEC+ Plans April Production Hikes Amid Sanctions

OPEC+ may restart April hikes to catch peak summer and regain share as sanctions bite Russia/Iran. https://t.co/cILwlUi7h2 #OPECplus #Oil #IEA #SaudiArabia #UAE #Iran #Russia

By Art Berman Blog

Social•Feb 14, 2026

Yield Drop Signals Benign CPI, Boosts Gold Prices

The 2-year Treasury yield (blue) fell sharply at 8:30 am today, a sign markets think today's CPI was benign and so the Fed cuts more. Bloomberg's XAU/$ gold price (white) rose around the same time, which is consistent with that...

By Robin Brooks

News•Feb 13, 2026

Closing Grain and Livestock Futures: February 13, 2026

Brownfield Ag News reported mixed grain and livestock futures on February 13, 2026. Corn edged higher to $4.31 per bushel, while soybeans fell to $11.33. Livestock showed divergent moves: feeder cattle rose 42 cents to $366.15, whereas lean hogs slipped 55 cents to $91.27....

By Brownfield Ag News

Social•Feb 13, 2026

No Bullish Catalyst for Oil in 2026, Repeat Likely

🚦From a pure fundamentals perspective, there's simply no bullish driver in sight capable of pushing oil prices into the high $70s—or higher—in 2026. ⚽️Betting your capital on a major war with Iran or any similar geopolitical shock to spike prices isn't...

By Anas Alhajji

Social•Feb 13, 2026

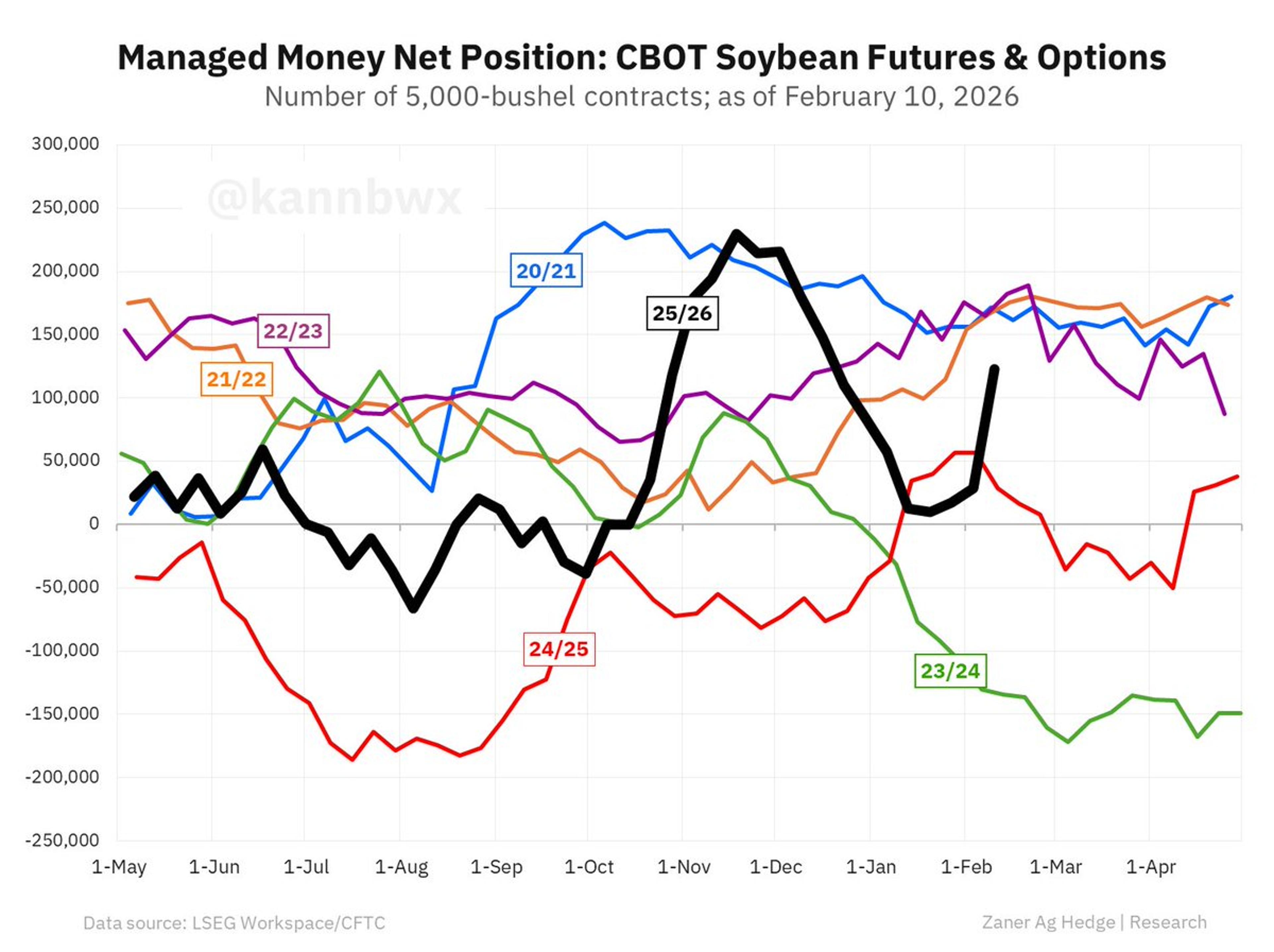

Money Managers Near Record Soybean Futures Buying on US‑China Optimism

📈Money managers staged a near record buying spree in CBOT soybean futures & options in the week ended Feb. 10 on renewed U.S.-China optimism. New net long = 123,148 contracts. Net buying of 94k contracts was the second most for any...

By Karen Braun

News•Feb 13, 2026

USDA Issues $1.89 Billion in Emergency Livestock Relief Program Payments to Farmers

The USDA’s Farm Service Agency has released $1.89 billion in Emergency Livestock Relief Program (ELRP) payments, representing the final disbursements for producers who applied for 2023‑2024 flood and wildfire assistance. Recipients who previously received partial payments will now receive a second...

By Brownfield Ag News

Social•Feb 13, 2026

Kuwait Lags UAE in Oil Capacity, Faces $90.5 Break‑Even

Kuwait's production capacity was ahead of the UAE's in 2010. Now it is 3.2 Mbpd versus 4.85 Mbpd Budget break-even is $90.5 per bbl and oil is 83% of the budget https://t.co/1si82Sc7pF

By Robin Mills

Social•Feb 13, 2026

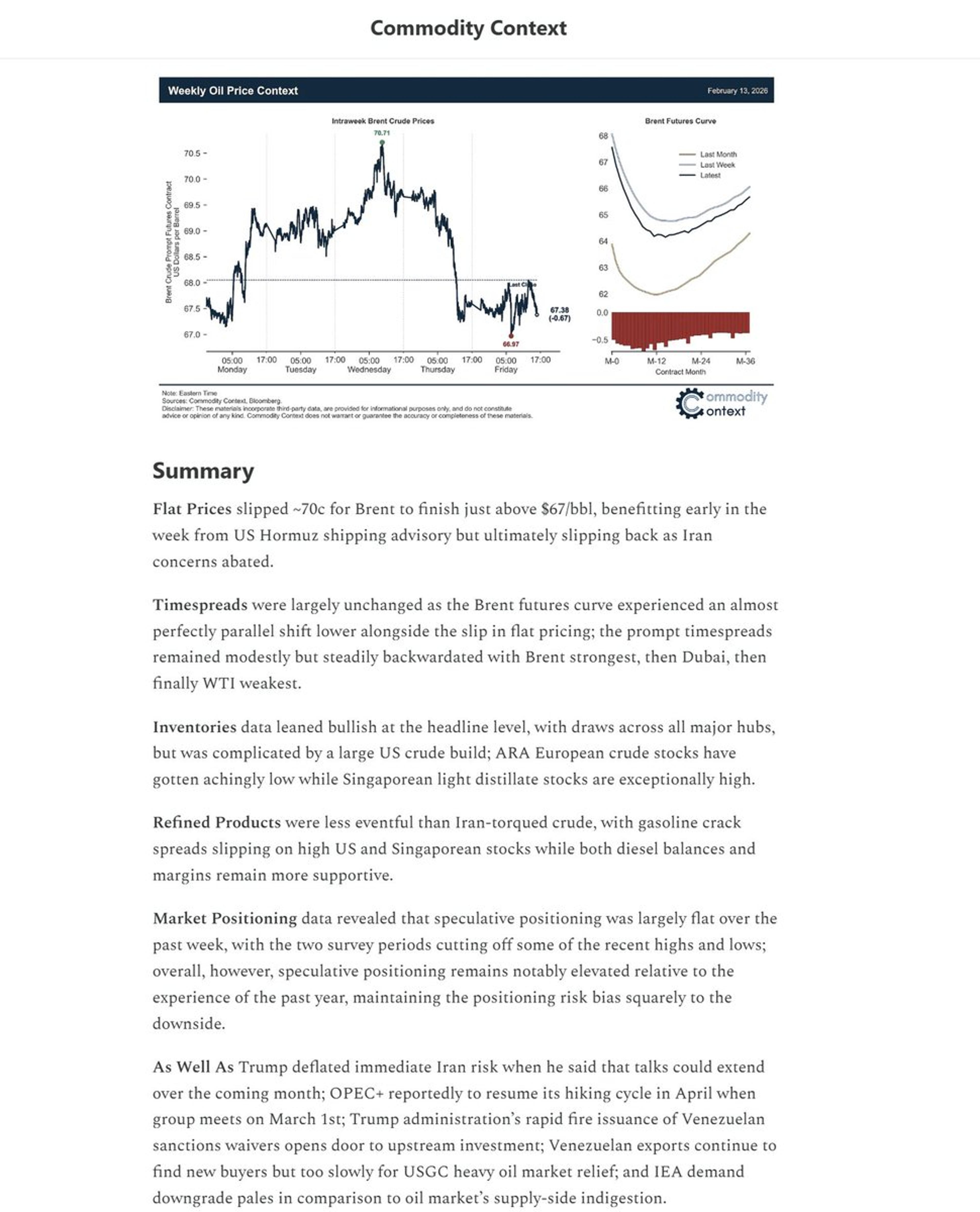

Crude Swings on Hormuz Alert, US‑Iran Talks, Venezuela Relief

🛢️ OIL CONTEXT WEEKLY 🛢️ 📈📉Crude prices rise on Hormuz advisory before falling back on the prospect of longer US-Iran talks, with headlines dotted with a flurry of US sanctions relief on Venezuela’s oil sector. Summary below, link to full report in...

By Rory Johnston

News•Feb 13, 2026

Weather Experts See Drought Relief Potential Under El Niño Shift

U.S. weather forecasters see a shift from La Niña to El Niño by summer, driven by warming central Pacific waters. The transition is expected to bring a wetter spring and an early‑summer rain pulse before a drier late‑season spell. Experts cite analog...

By Brownfield Ag News

News•Feb 13, 2026

US Climate Rollback Set to Raise Gasoline Prices

The EPA’s own analysis shows that eliminating federal greenhouse‑gas standards for cars could lift gasoline prices by up to 29% by 2050, adding roughly 75 cents per gallon in constant dollars. Over the 2026‑2055 horizon, consumers may face a net...

By Argus Media – News & analysis