🎯Today's Commodities Pulse

Updated 1h agoWhat's happening: Brazil imposes anti‑dumping duties on Chinese steel

Brazil's foreign trade committee approved five‑year anti‑dumping duties on a range of Chinese steel products, with tariffs from $323 to $670 per ton for cold‑rolled coil and $285 to $710 per ton for hot‑dip galvanized coil. In 2025 the country is set to import 202,000 tons of CRC and 1.42 million tons of HDG from China.

Also developing:

- •Goldman forecasts gold to hit $5,400/oz by end‑2026 on strong demand

- •Nymex natural gas futures dip below $3 per MMBtu

- •Indonesia secures 19% tariff deal with US, palm oil exempt

- •Anglo American posts $3.7B loss after De Beers writedown

News•Feb 19, 2026

Spot Cash Electricity Prices, Feb. 19, 2026

On February 19, 2026, the U.S. spot cash electricity market posted a 3.2% increase in average price, reaching $58.4 per megawatt‑hour. The rise reflected higher natural‑gas forward curves and a dip in wind generation across the Midwest. Day‑ahead trading volumes also expanded, indicating heightened hedging activity among utilities. Analysts attribute the movement to a combination of weather‑driven demand spikes and constrained supply.

By Energy Intelligence

News•Feb 19, 2026

Ausenco to Lead Feasibility Study at Ikkari Project

Rupert Resources has engaged Auscenco Engineering to head the feasibility study for the Ikkari gold project in northern Finland, a multi‑million‑ounce development slated for completion by mid‑2027. The study builds on recent optimisation work that delivered over 95% gold recoveries...

By Engineering & Mining Journal (E&MJ)

News•Feb 19, 2026

Kazakhstan Thermal Coal Production Falls in Jan

Kazakhstan’s thermal coal production slipped 1.7% YoY to 9.92 million tonnes in January, while total coal output fell 0.7% to 10.31 million tonnes. Despite the dip, the government is rolling out a national project to add about 7.6 GW of coal‑fired capacity by...

By Argus Media – News & analysis

News•Feb 19, 2026

Spanish Spot to Deliver Well Below Feb Expectations

The Spanish electricity spot index plunged to an average €12.66/MWh for 1‑20 February, far below the €50.55/MWh forward contract and last year’s €116.88/MWh level. Wind generation surged 123% year‑on‑year to 11.2 GW, while gas‑fired output fell 25% to 3.6 GW, driving the price...

By Argus Media – News & analysis

News•Feb 19, 2026

CoBank Projects 6% Jump in U.S. Soybean Acres for 2026

CoBank forecasts U.S. soybean planting to reach 86 million acres in 2026, a rise of nearly six percent over the previous year. The projection reflects tighter profit margins and high production costs that are forcing growers to prioritize higher‑return crops. Corn...

By Brownfield Ag News

News•Feb 19, 2026

Brazos Starts Up New Gas Processing Plant in Midland Basin

Brazos Midstream commissioned its largest cryogenic plant, Sundance II, adding 300 MMcfd of processing capacity in the Midland Basin and joining the 200 MMcfd Sundance I that began operations in 2024. The company also broke ground on Cassidy I, another 300 MMcfd cryogenic facility in Glasscock...

By Rigzone – News

News•Feb 19, 2026

Orsted’s Hornsea Chief Describes 'Juggling Act' After Monopile Deal Collapse

Orsted’s Hornsea 3 chief announced the collapse of a major monopile contract, forcing the 2.9 GW offshore wind project to pause its foundation procurement. The decision highlights the difficulty of securing large‑scale steel structures for the UK’s expanding offshore wind fleet....

By Recharge News

News•Feb 19, 2026

USA Says VEN Oil Output Can Climb 30-40 Pct This Year

The Trump administration has issued new licenses permitting several Western oil companies to operate in Venezuela, potentially boosting the country's output by 30‑40 percent—roughly 300,000 to 400,000 barrels per day—this year. Energy Secretary Chris Wright said the increase would represent...

By Rigzone – News

News•Feb 19, 2026

Equinor Halts Dutch CCS-H2 Plans, Belgian Site Still On

Equinor has scrapped its Dutch H2M Eemshaven CCS‑hydrogen project, citing policy uncertainty and insufficient funding, while the Belgian H2BE plant remains on schedule. Both plants were designed to produce 210,000 t/yr of low‑carbon hydrogen using autothermal reforming and each received roughly €160 million...

By Argus Media – News & analysis

News•Feb 19, 2026

EIA Lowers USA Gasoline Price Forecasts

The U.S. Energy Information Administration trimmed its gasoline price outlook, now projecting an average of $2.91 per gallon in 2026 and $2.93 in 2027, down slightly from the January forecast of $2.92 and $2.95. The agency’s short‑term energy outlook still...

By Rigzone – News

News•Feb 19, 2026

Martin Midstream Partners' Annual Loss Deepens

Martin Midstream Partners reported a $14.7 million net loss for 2025, widening from a $5.2 million loss in 2024. The loss was driven primarily by $57.8 million in interest expense and higher SG&A costs, while adjusted EBITDA fell to $99 million for the year....

By Rigzone – News

News•Feb 19, 2026

South Africa’s Kropz Raises Phosrock Output, Grade

South African phosphate rock producer Kropz has lifted monthly output to roughly 40,000 tonnes, a 33% increase over last year. The company now ships rock averaging 30% P₂O₅, but recently exported a 31.1% P₂O₅ cargo to South Korea, its highest‑grade...

By Argus Media – News & analysis

News•Feb 19, 2026

Saudi Maaden Sells DAP to Latam

Saudi Maaden announced the sale of 45,000‑50,000 tonnes of diammonium phosphate (DAP) at $715‑720 per tonne FOB, with loading slated for early March. The cargo is destined for Latin America, with Argentina emerging as the most probable off‑take market. Net...

By Argus Media – News & analysis

News•Feb 19, 2026

Kimmeridge-Mubadala JV to Acquire SM Galvan Ranch in Texas

Mubadala and Kimmeridge’s joint venture Caturus will buy SM Energy’s Galvan Ranch for $950 million, adding 250 MMcfed production from 260 wells. Post‑deal, pro‑forma net output rises to about 950 MMcfed. The acquisition gives Caturus over 275,000 net acres across the Gulf Coast...

By Rigzone – News

News•Feb 19, 2026

Turkey Launches Ramadan Food Price Crackdown as Inflation Anger Intensifies

Turkey’s government has banned chicken exports and launched a nationwide crackdown on "exorbitant" food prices as Ramadan begins. Trade inspectors are sweeping markets for hoarding and misleading practices, with fines up to TL 1.8 million for violations. Food inflation is running at...

By Financial Times – Commodities

News•Feb 19, 2026

GrainCorp Confident of Global Grain Market Rebalance

GrainCorp CEO Robert Spurway told shareholders that global wheat oversupply of 18 million tonnes is driving low prices and tighter margins for grain handlers. Growers are holding back grain, reducing market availability, but the company expects inventories to rebalance eventually, though...

By Grain Central

News•Feb 19, 2026

GRDC Update: Pulses a ‘Slow Burn’ as WA Seeks Wider Rotation

At the GRDC’s 2026 Perth Update, a pulse panel highlighted the modest share of pulses in Western Australia’s record 27 million‑tonne harvest—just 1 % compared with 4.4 Mt of canola. Researchers and growers argued that improved soil liming, longer‑term rotation planning, and newer...

By Grain Central

Social•Feb 19, 2026

U.S. Refiners Accuse Trump‑linked Scheme in Venezuelan Oil

U.S. refiners want to cut out traders & Chevron from Venezuelan crude purchases. They see the Trump setup as a RIP OFF Barrels now must move thru an elite club of approved middle men. Want to bet there's a grift component flowing to...

By Art Berman Blog

Social•Feb 19, 2026

Copper Prices Jump 44% Year‑Over‑Year

Copper prices have surged to an average of $13,012/mt in January 2026 from $8,991/mt a year ago. That's a WHOPPING 44% INCREASE. BUY COPPER, WEAR DIAMONDS. https://t.co/FIhvIikhjQ

By Steve Hanke

News•Feb 18, 2026

Golden Pass LNG Activity Normalizes; Permian Lateral Cleared to Proceed

Golden Pass LNG’s gas nominations have settled back to average levels after a brief surge, now hovering around 1.5% of the terminal’s capacity. The project received approval to construct a 1.1‑mile, 42‑inch lateral linking the facility to the Permian Basin,...

By Natural Gas Intelligence (NGI)

Social•Feb 19, 2026

US Strike Risk Adds Premium to Oil Market

Expectations of a possible US strike on Iran—currently oscillating between wait-and-see and watchful anticipation—have introduced a risk premium into an otherwise well-supplied oil market. My talk w/ @KellyCNBC @CNBCTheExchange https://t.co/XwyD5XmiRg

By Daniel Yergin

Social•Feb 19, 2026

EU Gas Storage at 32%—Second Lowest Since 2011

EU GAS STORAGE facilities are now less than one-third full, with more than a month of the winter heating season probably still ahead. Storage facilities were on average 32.5% full on February 17, the second lowest seasonal fill in records...

By John Kemp

News•Feb 18, 2026

Luxembourg Launches New Tender for C&I Solar

Luxembourg’s Ministry of the Economy has opened a €3 million tender to fund commercial and industrial solar projects between 30 kW and 200 kW. Applications are accepted until April 17 and are split into three lots covering rooftop, façade and car‑port installations. Projects that...

By pv magazine

Social•Feb 19, 2026

US Iran Strike Would Spark Prolonged, Global Fallout

If the US strikes Iran, it won’t be a weekend event, writes @TheMichaelEvery Retaliation risks include terror cells in Europe The broader Middle East is flammable Energy markets are rightly pricing tail risk—but the real question is duration, not ignition #OilMarkets #Iran #Geopolitics...

By Art Berman Blog

Social•Feb 19, 2026

China Buys US LNG, Redirects It to Europe

China hasn’t stopped buying U.S. LNG It’s just not burning it at home. Long-term contracts still bind the two systems Flexible LNG markets let China arbitrage politics by diverting cargoes to Europe. Does anyone on Team Trump know this? https://t.co/CacMbcaSMk #LNG #China #EnergyMarkets #Geopolitics #TradeWar #NaturalGas

By Art Berman Blog

Blog•Feb 18, 2026

Gold & Silver Rebound After Latest Selloff, While Warsh's 'Treasury Accord' Looms...

Gold and silver prices bounced back after a recent sell‑off, with gold futures climbing $121 to $5,026 and silver futures up $4.50 to $78.04, while the Shanghai silver market remains closed for a holiday. The episode notes regional price differences,...

By Arcadia Economics’ Gold & Silver Daily

Social•Feb 19, 2026

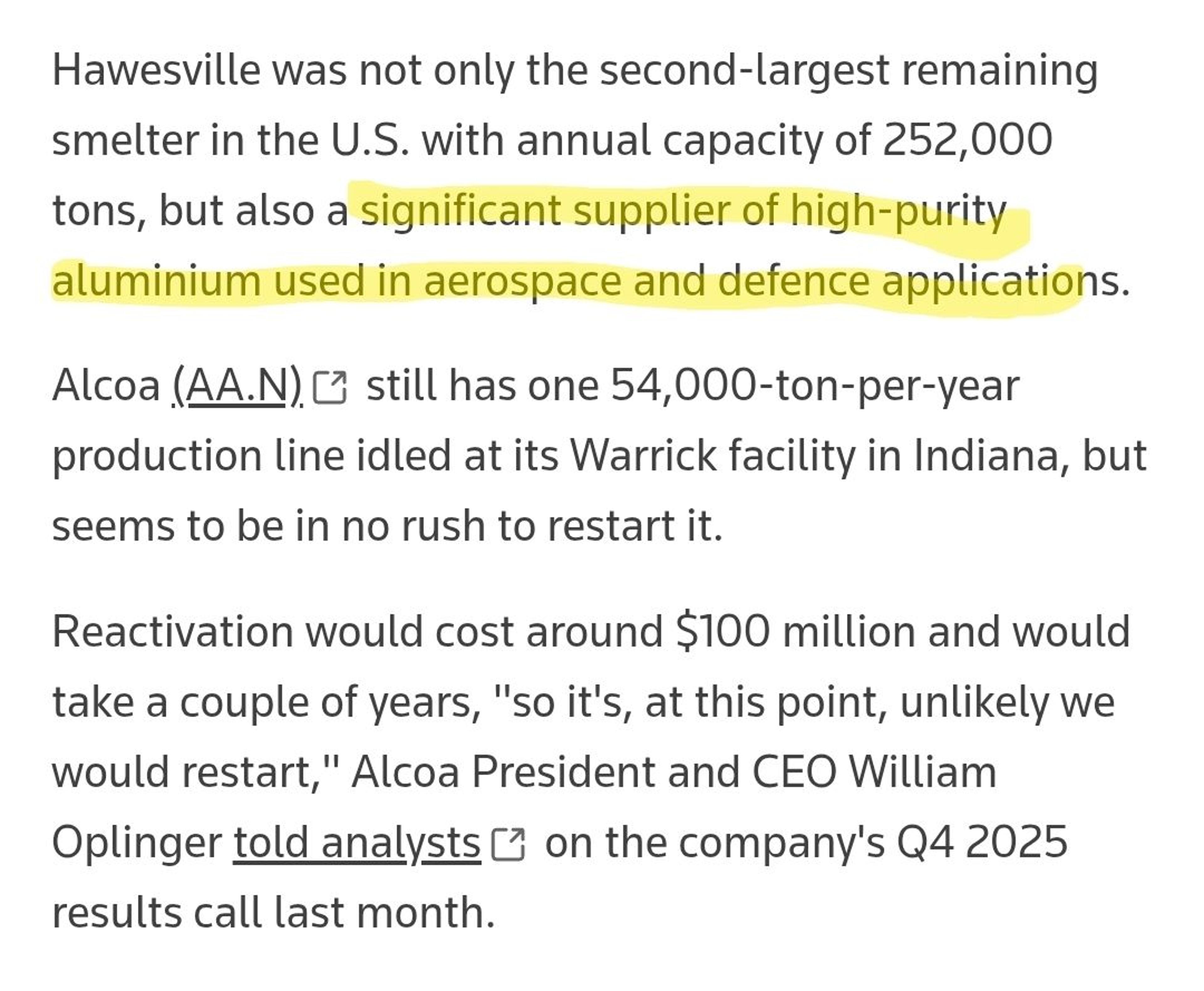

Power Costs, Not Tariffs, Decide Aluminum Smelter Survival

Trump tariffs couldn’t save a major U.S. aluminum smelter Smelting lives or dies on cheap, reliable power AI and data centers now outcompete metalmaking for electricity. Tariffs are the minor leagues. Energy is the big show. https://t.co/z7ZanDwxd5 #Aluminum #EnergyPolicy #Manufacturing #AI #Trade #PowerMarkets

By Art Berman Blog

Social•Feb 19, 2026

Geopolitical Fears Add Incremental Risk Premium to Oil

Oil rallied on fear Iran headlines + Israel alerts = instant risk premium in a tight market But geopolitics don't matter. Except they do in small continuous increments that convert to a steady aggregate premium. https://t.co/6vQGj7YEmu #OilMarkets #Geopolitics #Iran #EnergySecurity #crudeoil

By Art Berman Blog

News•Feb 18, 2026

CleanChoice Energy Triples Capacity with Solar Acquisitions in North Carolina

CleanChoice Energy announced the acquisition of two utility‑scale solar projects in North Carolina—Sumac (103.92 MW) and Sweetleaf (118.3 MW)—adding 222.2 MW of capacity and tripling its portfolio. Construction is slated to start early 2027 with grid interconnection to the PJM market expected in...

By POWER Magazine

Social•Feb 19, 2026

Midweek Market Snapshot Across Crypto, Commodities, and Equities

Market Update with Landy: The Wednesday Check-In 02/18/2026 $BTC $GOLD $SILVER $OIL $NG $DJI $NDX $SPY Brought to you by @davidgokhshtein @gokhshtein and hosted by @CryptoLandy. https://t.co/wB4GTwTt32

By David Gokhshtein

Social•Feb 19, 2026

Libya Redirects Oil Payments From Russia to Western Traders

Libya is cutting Russia out of its oil trade Fuel imports are shifting away from Russia toward large Western traders Sanctions didn’t “punish” Libya into changing behavior. They reshaped who gets paid. https://t.co/pmKRlqgEK1 #OilMarkets #Libya #EnergyGeopolitics #Sanctions #OPEC #crudeoil

By Art Berman Blog

News•Feb 18, 2026

Mining Stocks Dominate TSXV’s Top Performers List

Metals and mining dominated the TSX Venture Exchange’s 2025 top‑performer list, with 48 of the 51 entries coming from the sector. Junior miners posted an average share‑price gain of 443% and a combined market capitalisation of $19.9 billion. Record liquidity supported...

By MINING.com

Social•Feb 18, 2026

Global Growth Slows, Rates Sticky; Shorten Treasury Duration

Macro: global growth slows; rates remain sticky. Key factors: US CPI, China demand, energy. Risks: policy missteps, inflation shocks. Trade: shorten duration in US Treasuries. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

News•Feb 18, 2026

South African Govt ‘Very Supportive, Great to Work with’, Glencore Highlights

Glencore reported 2025 earnings of $13.5 billion, driven by strong copper and zinc markets. CEO Gary Nagle praised the South African government as "very supportive" and "great to work with," extending beyond ferrochrome negotiations. The mining giant highlighted that the collaborative...

By Mining Weekly

News•Feb 18, 2026

Ground View: How Industry Leaders Are Shaping Pakistan’s Mining Future

The Pakistan Mineral Investment Forum (PMIF) will gather industry leaders in Islamabad to spotlight the country’s world‑class copper, gold, and critical mineral deposits, most notably the revived Reko Diq project. While the geology is undisputed, the article argues that mining...

By MINING.com

News•Feb 18, 2026

AD Ports Joins Cameroon’s Douala New Dry Bulk Terminal Concession

UAE‑based AD Ports Group has entered a 30‑year concession with Africa Ports Development to design, build and operate a new dry‑bulk terminal at Cameroon’s Port of Douala. The partnership gives AD Ports an effective 51% economic stake and commits roughly...

By Seatrade Maritime

News•Feb 18, 2026

Energy Transition Underpins Dry Bulk Sector

Electric‑vehicle sales have surged nearly 700% this decade, driving a rapid rise in spodumene shipments from Australia to China and doubling bulk volumes since 2023. Panamax vessels now carry almost half of the 7 million tonnes of dry bulk moved last...

By Seatrade Maritime

News•Feb 18, 2026

Glencore Doubles Down on Copper, Keeps M&A in Play

Glencore has secured a land‑access agreement with Gecamines that extends the Kamoto Copper Company’s mine life into the mid‑2040s and unlocks additional ore zones, enabling the asset to target 300,000 tonnes of copper annually. The deal is a cornerstone of...

By MINING.com

Social•Feb 18, 2026

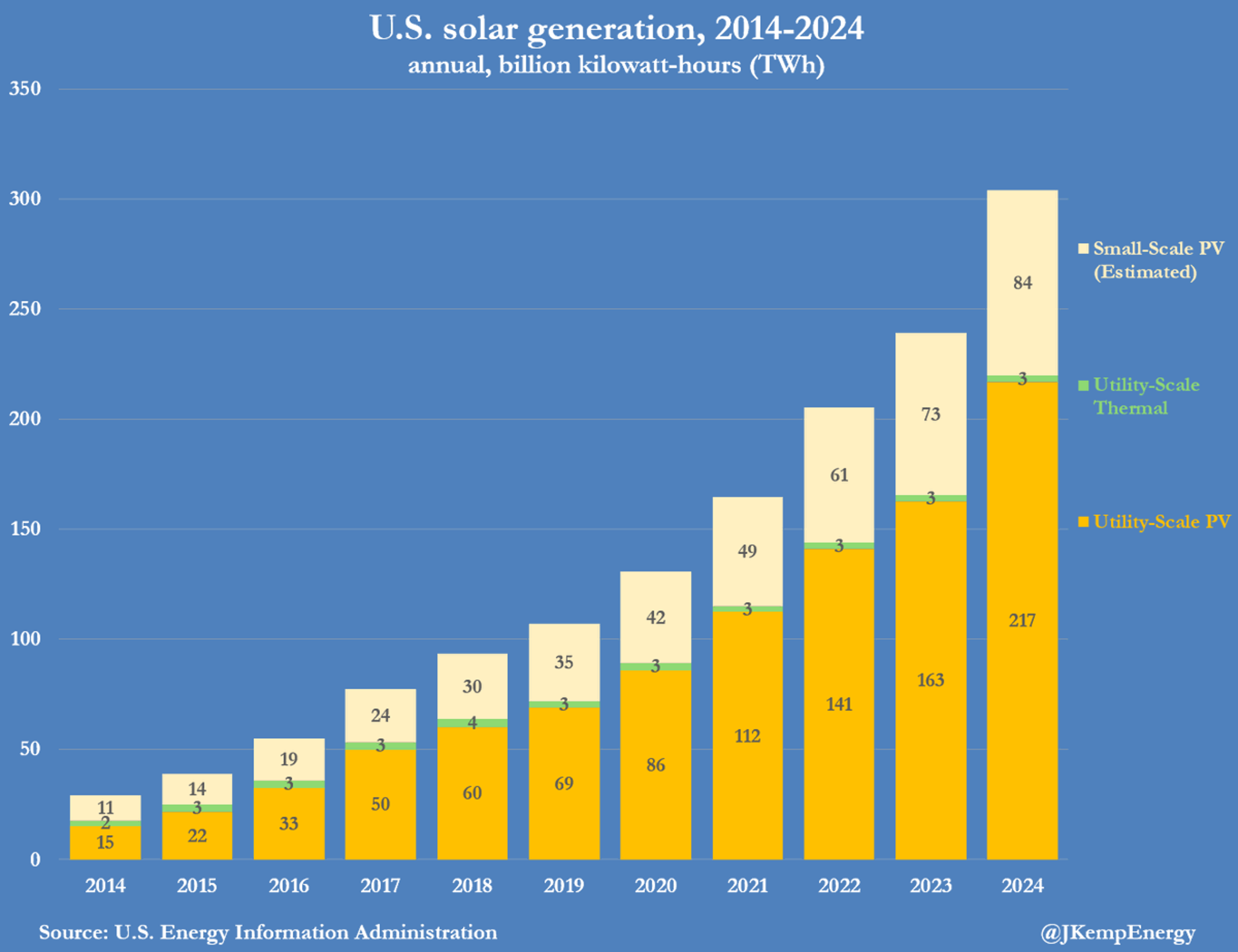

U.S. Solar Power Hits Record 304 TWh, Ten‑Fold Growth

U.S. SOLAR GENERATION increased to a record 304 billion kilowatt-hours (kWh) or 304 terawatt-hours (TWh) in 2024. Solar generation had increased ten-fold over the previous ten years from 29 billion kWh in 2014. Data prepared by the U.S. Energy Information...

By John Kemp

Social•Feb 18, 2026

Tariffs Inflate Prices and Act Like Hidden Corporate Tax

A) Many studies have examined whether tariffs have been passed through to consumer prices, and they've found significant retail price increases B) Tariff burdens absorbed by US companies are an inefficient corporate tax, paid by Americans via lower wages or share...

By Scott Lincicome

Podcast•Feb 18, 2026•43 min

The New European Sovereignty Stack: Energy, Minerals, Compute

The episode examines Europe’s modern sovereignty as an industrial and supply‑chain challenge, focusing on semiconductors, rare‑earth minerals, and energy infrastructure. Guests highlight Europe’s heavy reliance on imports, a thin venture‑capital ecosystem, and the need for coordinated capital to close the...

By The European VC (EUVC)

Social•Feb 18, 2026

Tariffs Fail: US Down to Five Aluminum Smelters

"U.S. import tariffs haven't been enough to stop the United States losing another aluminium smelter, leaving the country with just five primary metal production plants." 😲 https://t.co/T5U4nxglb0 https://t.co/EOQY3OwzE6

By Scott Lincicome

Social•Feb 18, 2026

IEA Shifts Priorities to Security, Clean Energy, Affordability

IEA executive director Fatih Birol proposes focusing the agency's work in three areas during the next few years: 1) energy security -- "first and foremost" mission 2) new energy uptake (wind, solar, geothermal, nuclear) 3) afordability of energy "IEA 3.0" may well be...

By Javier Blas

News•Feb 18, 2026

Bumi Resources Minerals Says Palu Operations Unaffected by Site Closure

Bumi Resources Minerals (BRM) confirmed that the government‑ordered closure of a contested gold mine in its Palu concession will not disrupt its core operations because the site was never active. The enforcement action targeted an area where illegal miners had...

By The Jakarta Post – Business (site)

News•Feb 18, 2026

Vietnam Tackles Gold Fever with Black Market Crackdown

Vietnam has introduced fines of up to $12,000 to deter illicit gold trading, marking a decisive shift after ending a 13‑year state monopoly on gold production and sales. The new penalties target black‑market dealers and unlicensed jewelers, aiming to bring...

By Nikkei Asia – Economy

Social•Feb 18, 2026

Japan Commits $36B to U.S. Energy, Led by SoftBank

Japan plans to invest $36 billion in US oil, gas and critical mineral projects 🇯🇵 🤝 🇺🇸 The most significant piece is a 9.2GW gas-fired power plant in Ohio. The investment will be led by SoftBank https://t.co/5io8koo0jd

By Stephen Stapczynski

News•Feb 17, 2026

China's Solar Industry Braces for Disruption

China’s photovoltaic manufacturing capacity has surged past 1,100 GW annually, roughly twice the world’s current demand of 580 GW. The glut has driven panel prices down and intensified competition among predominantly private firms. Overcapacity is now triggering a wave of bankruptcies and...

By Energy Intelligence

News•Feb 17, 2026

Majors' 'Cash Cow' Model Starts to Show Limits

Western oil majors continue to benefit from Brent prices above $60 per barrel, yet a deep‑seated surplus is dampening market optimism. Preliminary 2025 results show that the capital spending commitments made during the 2021‑22 post‑COVID recovery are already under strain,...

By Energy Intelligence

News•Feb 17, 2026

Gas and LNG Markets, Feb. 17, 2026

The Energy Intelligence roundup shows European LNG prices falling to two‑month lows as a global supply surge pressures the market. Analysts argue that low‑cost contracts and expanded regasification capacity are crucial for price‑sensitive emerging economies to absorb the influx. At...

By Energy Intelligence

News•Feb 17, 2026

Non-Opec-Plus: Flows Poised to Change as Output Grows

In 2026 non‑OPEC‑plus producers are expanding output, prompting a fresh reshuffle of global crude flows. The United States is set to import more Venezuelan oil, freeing domestic barrels for export. India, under pressure to curb Russian supplies, is turning to...

By Energy Intelligence