🎯Today's Commodities Pulse

Updated 2h agoWhat's happening: Brazil slaps anti‑dumping duties on Chinese steel imports

Brazil’s foreign trade committee approved five‑year anti‑dumping duties on a range of Chinese steel products, imposing tariffs of $323‑$670 per ton on cold‑rolled coil and $285‑$710 per ton on hot‑dip galvanized coil. In 2025 the country imported 202,000 tons of CRC and 1.42 million tons of HDG from China.

Also developing:

By the numbers: Vale sells control of Thompson nickel complex in $200M injection

News•Feb 11, 2026

HMM Stays in the Black in Q4

South Korean carrier HMM posted a Q4 2025 net profit of KRW 364 billion, a 59.9% plunge from the prior period, while revenues fell 14.2% to KRW 2.71 trillion. The full‑year results showed a 50.3% profit drop to KRW 1.88 trillion as container freight rates slumped 49% to the U.S. West Coast, 42% to the U.S. East Coast and 49% to Europe. HMM warned that a wave of new‑build deliveries will exacerbate oversupply, prompting it to expand its hub‑and‑spoke network and lean on alliance initiatives.

By Seatrade Maritime

Social•Feb 11, 2026

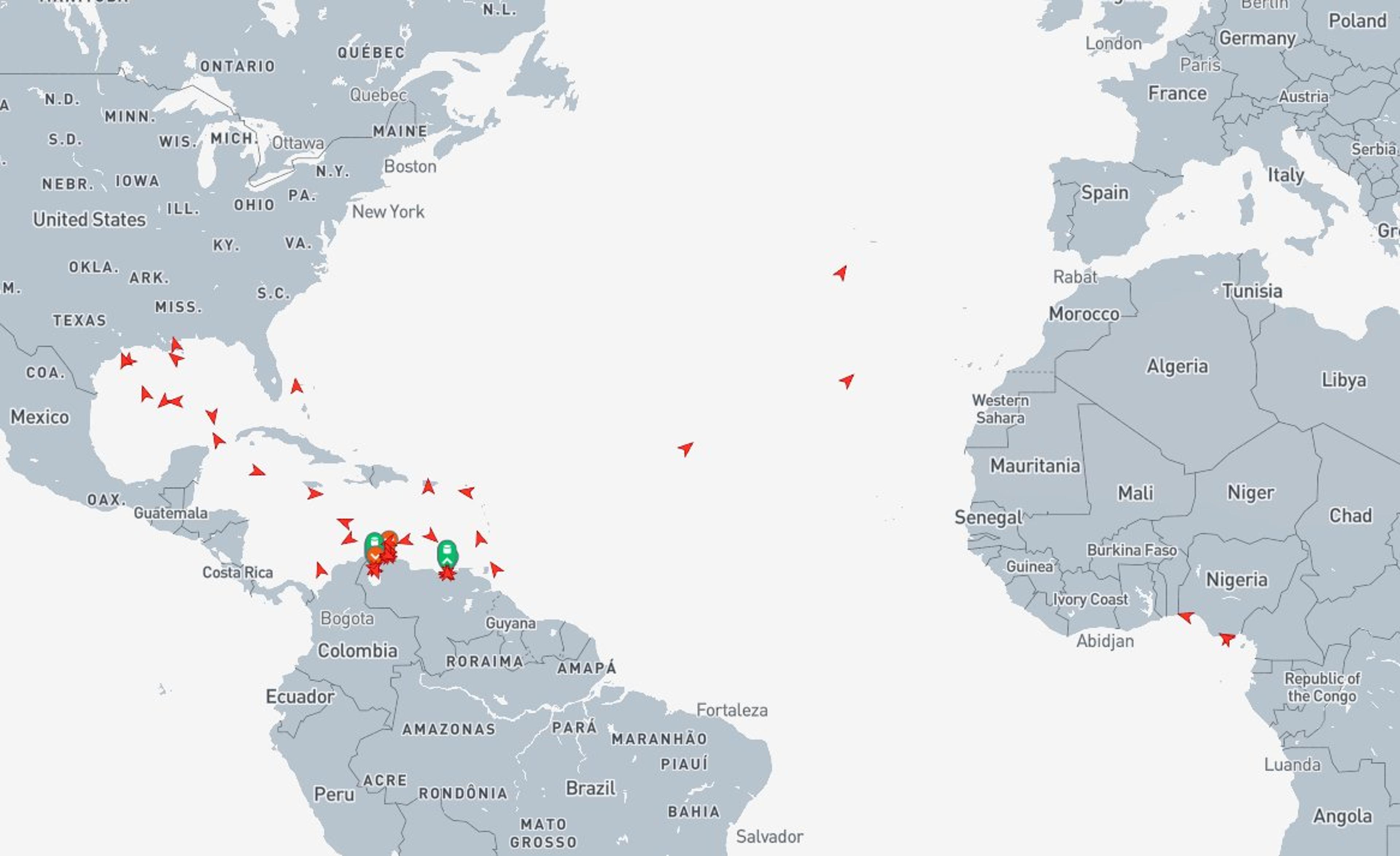

Venezuelan Crude Stuck, Limited Shipments to Europe, India

🇻🇪It seems the trading houses that bought the Venezuelan crude from the Trump administration are having trouble marketing the oil globally. Most of the oil is sent to the US. Here in the map, three tankers are going to Europe...

By Anas Alhajji

Social•Feb 11, 2026

Trump's Choice on Iran Deal Drives Oil Risk Premium

A high-stakes meeting indeed. If Trump yields to Netanyahu's demand to push for a comprehensive deal covering Iran's ballistic missiles programme and support for regional proxies, possible outcomes: -- Drawn-out negotiations under the looming shadow of military action -- Higher chances of a...

By Vandana Hari

News•Feb 11, 2026

China State Gold Miner Zijin Eyes Global Top 3 as Geopolitical Risks Grow

China's state‑owned Zijin Mining Group announced an aggressive push to rank among the world’s top three gold and copper producers, primarily through overseas acquisitions. The strategy emphasizes gold and copper as core minerals for future growth while acknowledging heightened geopolitical...

By Nikkei Asia – Top Stories

Social•Feb 10, 2026

Growth Slows, Yields Rise—Short Treasury Duration

Macro: growth softens, yields rise. Key: sticky CPI, Fed tightening, tight labor. Risks: stagflation, policy error. Trade: short US Treasury duration as real yields climb. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

News•Feb 10, 2026

Uranium Market Gathers Momentum in 2026: Sprott

Uranium spot prices surged above $100 per pound in January 2026, the first breach of that level in two years, signaling renewed market vigor. Sprott Asset Management, a major buyer, added 4 million lb to its fund this year, bringing total holdings...

By MINING.com

Social•Feb 10, 2026

Bitcoin Faces Downside Risk; Gold Remains Strong

Technical analysis made simple with Kevin Wadsworth of Northstar & Bad Charts. We break down his case for more downside risk (bitcoin to bottom in Q3/Q4?) and the Capital Rotation Event: why many assets look bearish while gold holds strong. https://lnkd.in/gfkuCG2A

By Natalie Brunell

News•Feb 10, 2026

US Antimony, Americas Gold to Jointly Build Idaho Plant

United States Antimony and Americas Gold have formed a 51-49 joint venture to construct a hydrometallurgical processing plant in Idaho’s Silver Valley. The facility will treat antimony feed from Americas Gold’s Galena complex and could handle additional sources, aiming to...

By MINING.com

News•Feb 10, 2026

First Quantum Credit Outlook Improves on Cobre Panama Progress

S&P Global Ratings upgraded First Quantum Minerals' credit outlook to positive, citing tangible progress toward restarting the Cobre Panama copper mine. The agency now expects the mine to resume operations in the first half of 2026, with a production ramp‑up later...

By MINING.com

Social•Feb 10, 2026

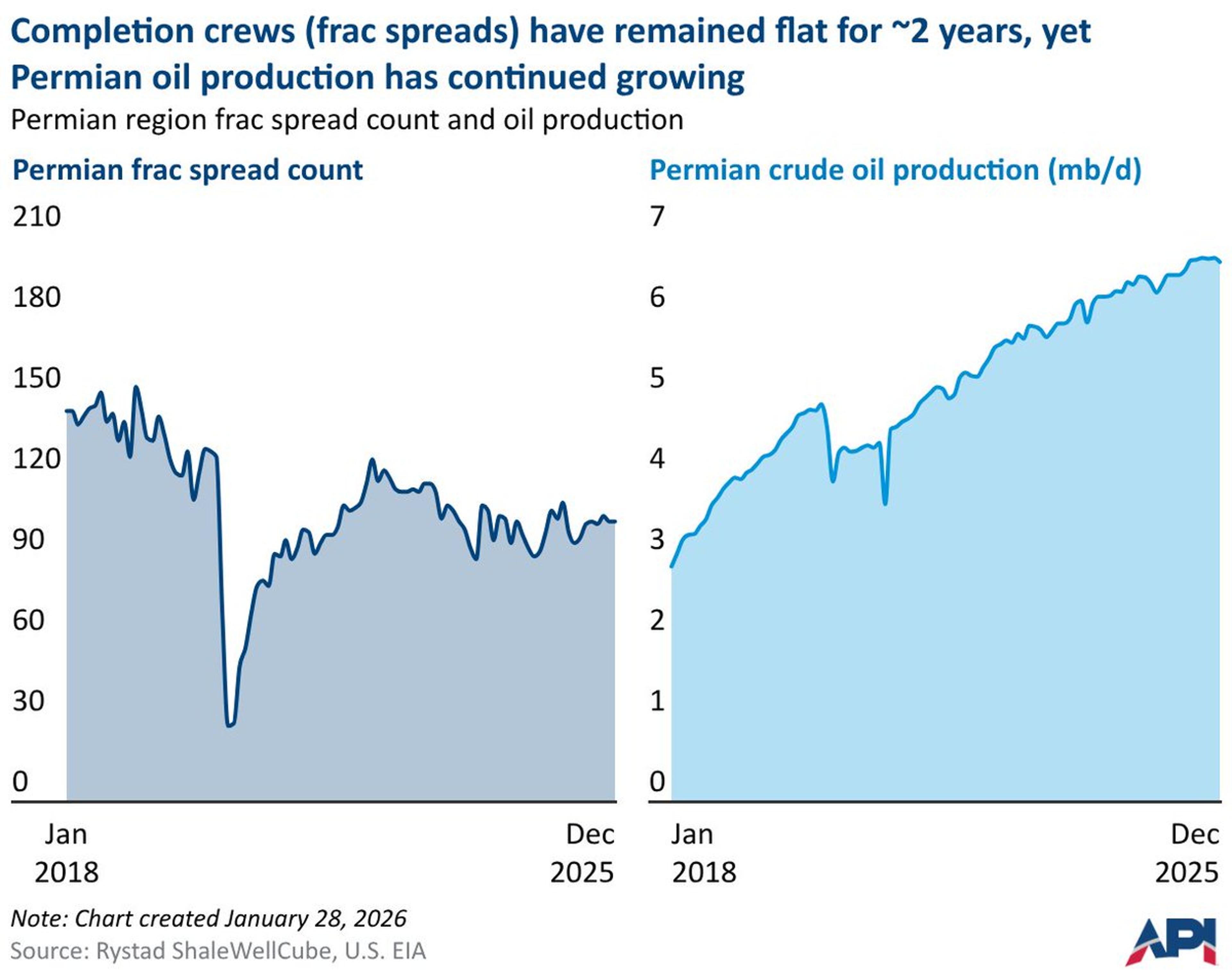

Permian Wells Surge 13% as Crews Work Smarter

The frac spread count measures the number of completion crews actively fracturing a well. In the Permian, the frac spread count averaged ~100 crews in 2025, 3% higher than the 2024 average. Yet operators completed a total of ~6,800 wells,...

By T. Mason Hamilton

News•Feb 10, 2026

Vedanta Aluminium Boosts Billet Production to 830,000 Tonnes per Annum

Vedanta Aluminium has raised its Jharsuguda billet output to 830,000 tonnes per year, adding 250,000 tonnes of new capacity and a 120,000‑tonne Primary Foundry Alloy line. The upgrade uses advanced casting and homogenising technology from Wagstaff and Hertwich, cementing the...

By The Hindu BusinessLine – Markets

Social•Feb 10, 2026

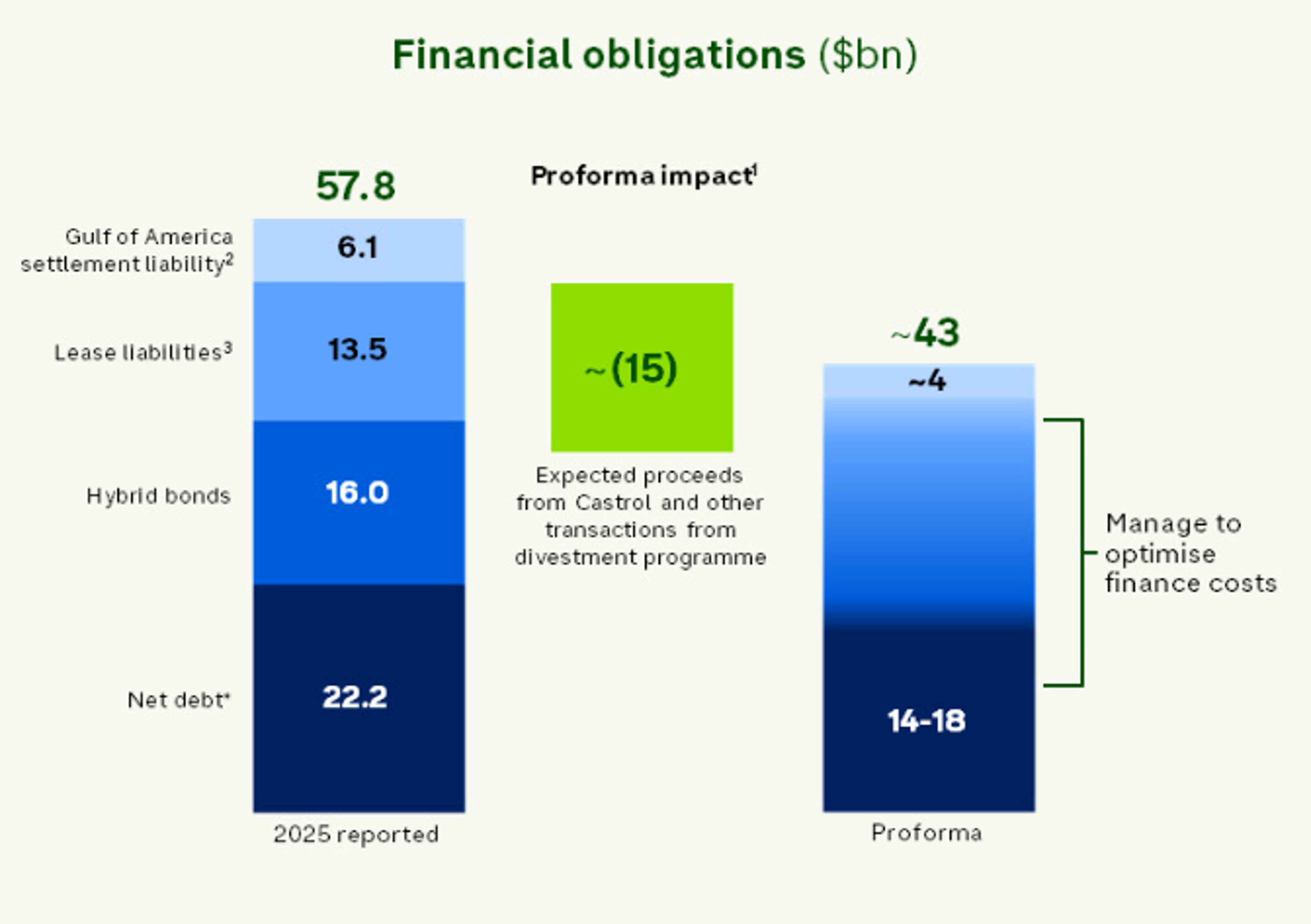

BP Finally Admits Debt Exceeds $50 Billion, Not $22 Billion

Regular readers know we at @Opinion had flagged BP had far more debt than the company's prefered metric (~$22 bn). Look at net debt + hybrids + leases + off-balance sheet items and it's >$50 bn. Now, BP acknowledges the issue...

By Javier Blas

News•Feb 10, 2026

Mining Corridors as Catalysts: Building on the Lobito Model

In December 2025 the United States and the Democratic Republic of Congo signed a strategic partnership that gives Washington preferential access to Congolese mineral deposits. The article argues that the next step is building logistics corridors, using the Lobito Corridor—linking...

By Atlantic Council

News•Feb 10, 2026

Zanaga Iron Lines up $25M in Deal with Red Arc

Zanaga Iron (LON:ZIOC) signed a binding term sheet with Red Arc Minerals for an initial up‑to‑$25 million cash tranche to finance engineering and pre‑production work on its Congolese iron‑ore project. The agreement gives Red Arc a 20% stake in the project’s subsidiary Jumelles,...

By MINING.com

News•Feb 10, 2026

BP Steps up Cost Cutting as Profits Slide

BP reported 2025 earnings of $7.5 bn, a 15% drop from the previous year, as crude prices fell roughly 20%. The oil major lifted its cost‑saving goal to $5.5‑$6.5 bn by the end of 2027, up from a $5 bn ceiling, and halted...

By BBC News – Business

News•Feb 10, 2026

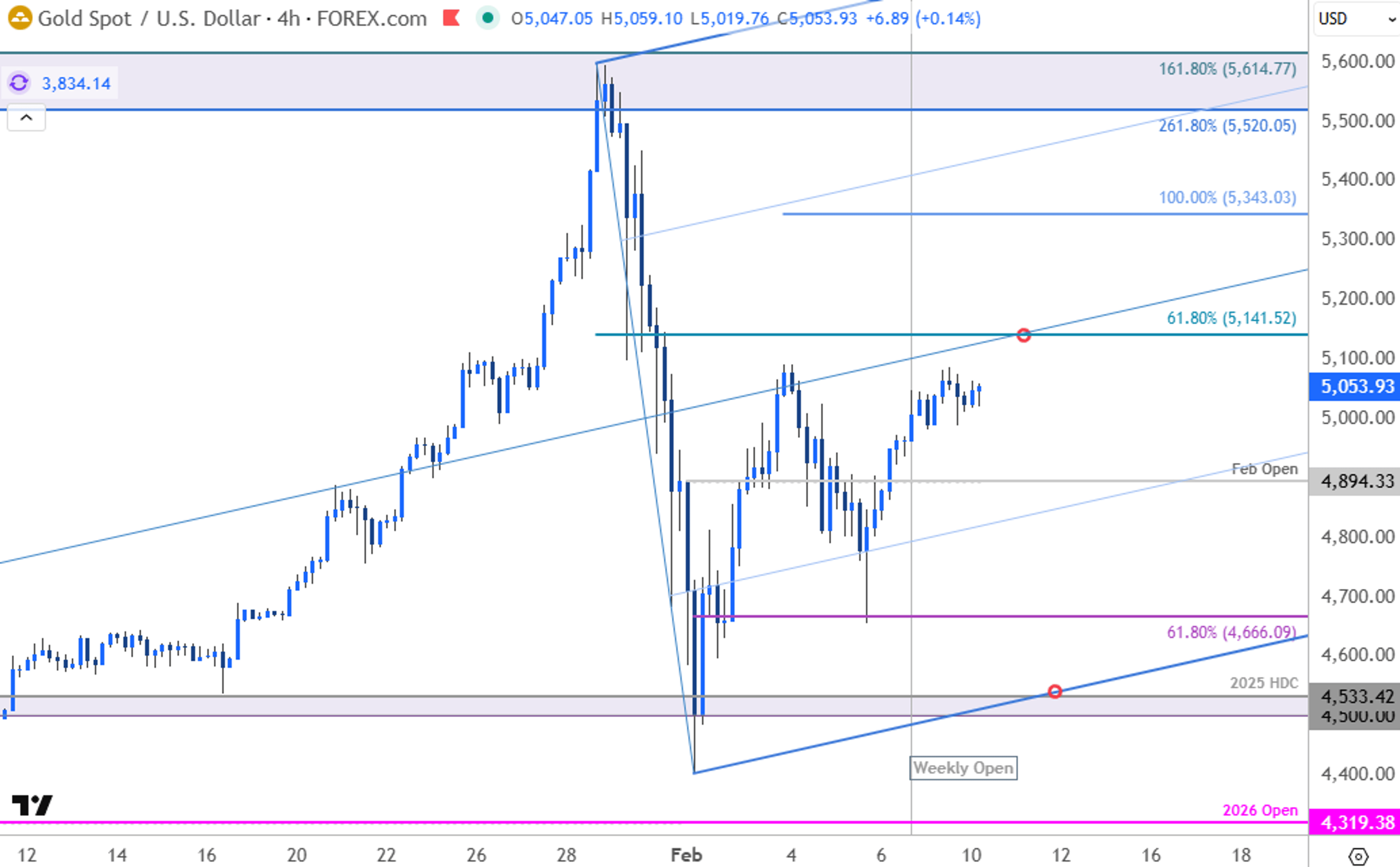

Fresh From the Trading Room: A Little Jittery

The past two weeks saw extreme swings in commodities, with gold tumbling 12% after a record near $5,600, silver down about 30% from its $120 peak, and natural gas plunging 26% on shifting demand forecasts. President Trump’s nomination of former...

By CME Group – OpenMarkets

News•Feb 10, 2026

US to Exempt some Bangladeshi Clothes From Tariffs

The United States announced a new trade pact that lowers its tariff on Bangladeshi apparel from 20% to 19% and grants tariff‑free status to garments made with U.S. cotton and man‑made fibers. In return, Bangladesh will open its market to...

By BBC Business

Social•Feb 10, 2026

India Shuns Urals, China Gets Cheaper Russian Oil

🇮🇳Indian refiners' reluctance to take Russian Urals crude shipments is pushing these discounted cargoes toward buyers like China & others, making them even cheaper in those markets—while the Indian refiners turn to replacement crudes at international prices. An Urals cargo...

By Anas Alhajji

Social•Feb 10, 2026

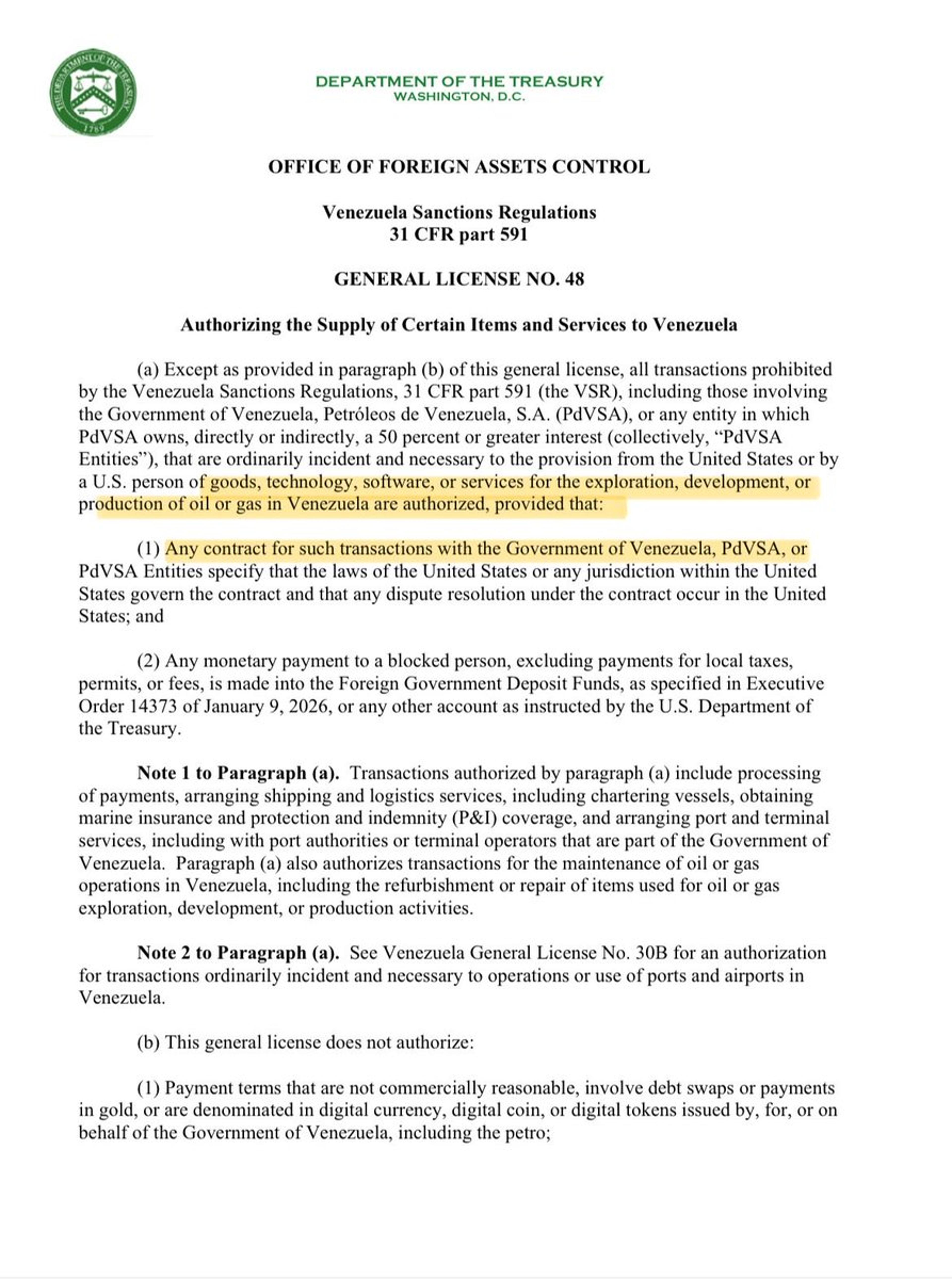

U.S. Grants License to Revive Venezuela's Oil Production

OIL MARKET: Washington issues a new general license to allow oilfield-service companies to work in Venezuela — it’s a crucial step to boost oil output in the Latin American country. https://t.co/ozdDE2MiMZ

By Javier Blas

News•Feb 9, 2026

Former US Officials Warn of Impending 'Widespread Collapse of American Agriculture': 'Our Farmers and Ranchers … Can't Compete with the...

The agricultural sector faces a perfect storm of policy and market pressures, according to a bipartisan letter signed by former heads of the National Corn, Barley, and Soybean Growers associations. The signatories contend that recent tariffs on farm inputs and...

By Yahoo Finance – Finance News

Social•Feb 10, 2026

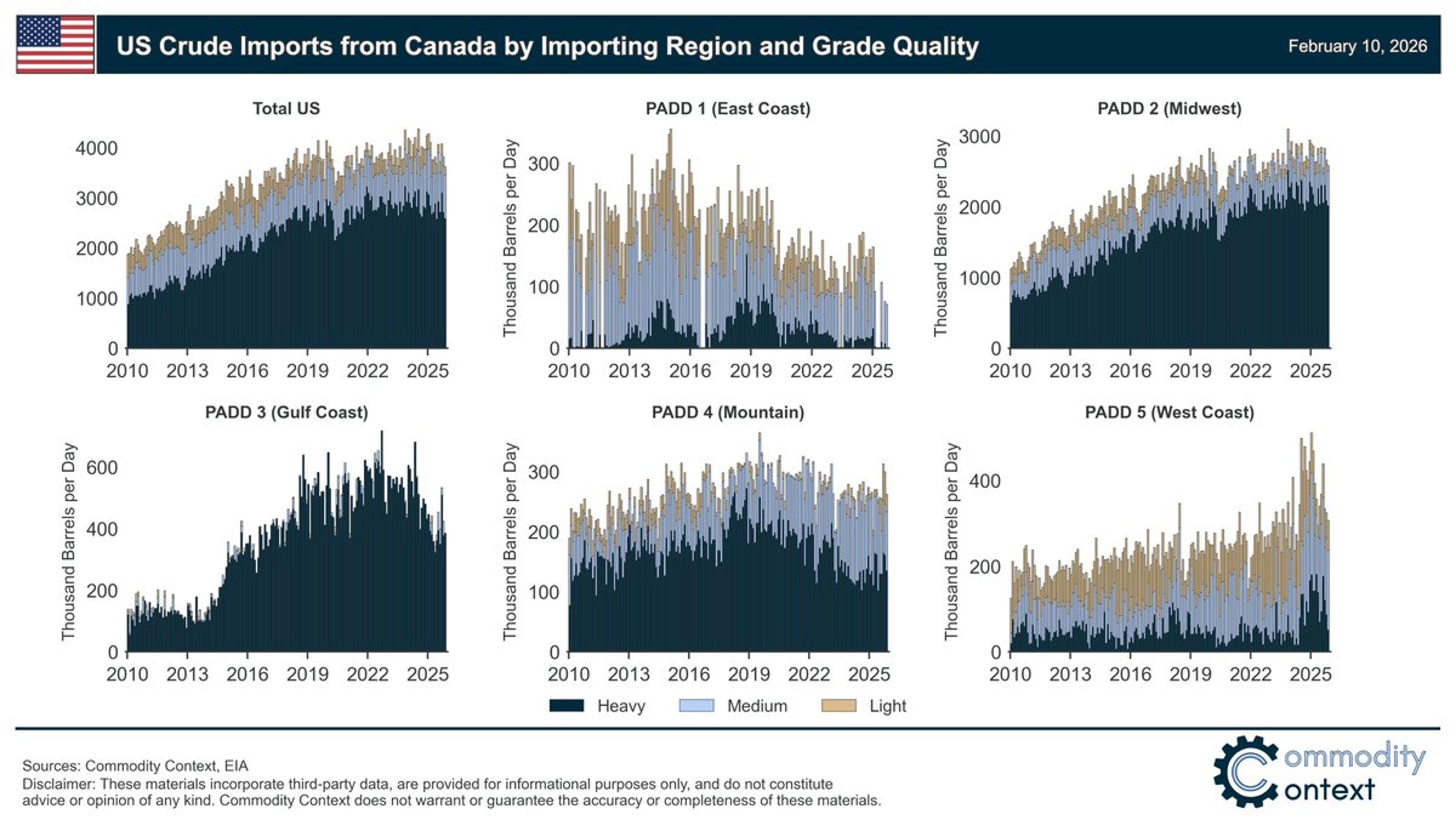

US Canadian Crude Imports Plateau; Midwest Saturated, Gulf Pressure Wanes

🇨🇦🛢️🇺🇸 US Canadian crude imports by importing region and crude grade quality Total US plateauing/rolling over Midwest still key Canadian market, but entirely saturated USGC was the pressure valve, but fell back when TMX opened (first went to West Coast, now increasingly China)...

By Rory Johnston

Social•Feb 10, 2026

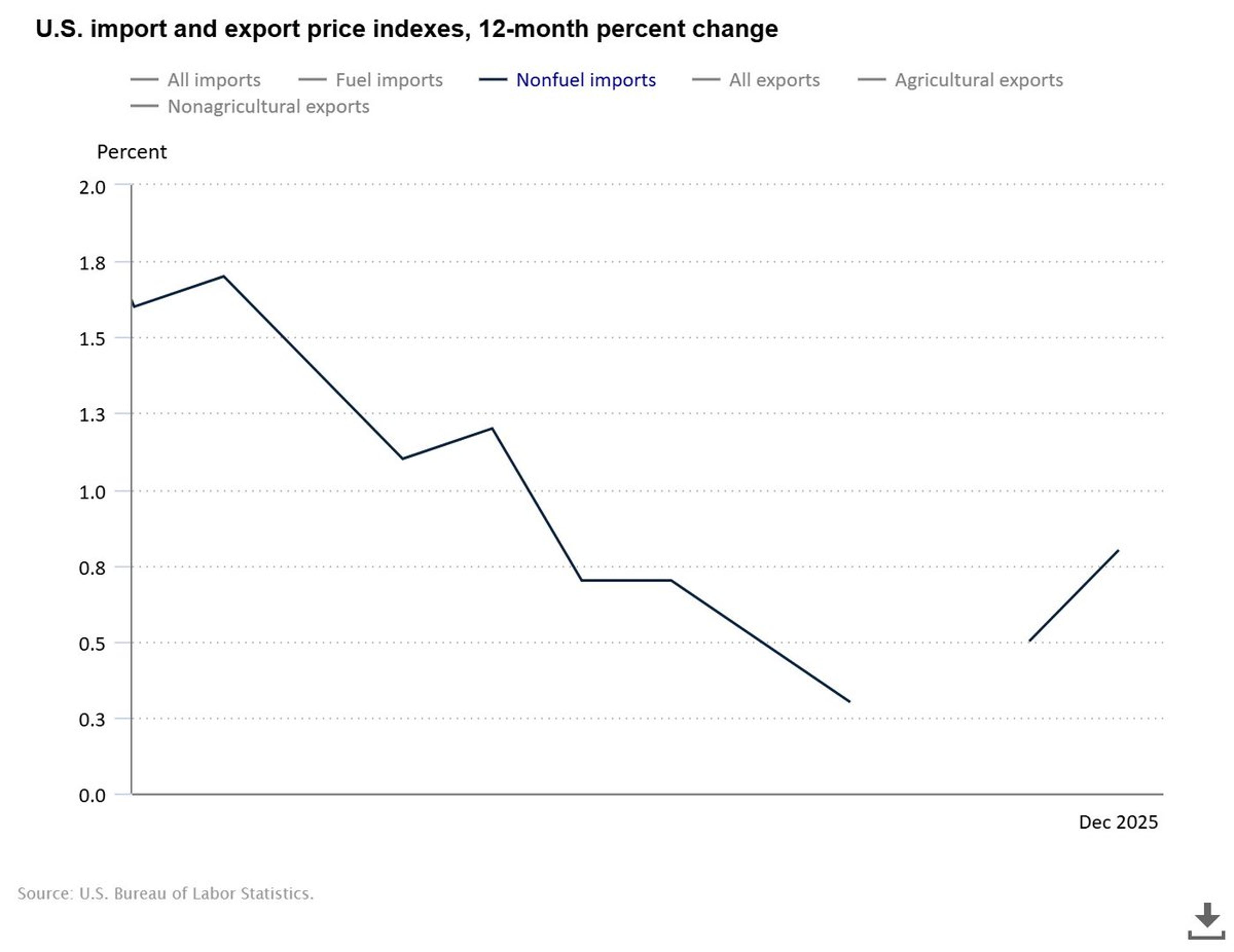

Import Prices Rise Slightly, Showing Tariffs Not Absorbed

Another month of US import price data shows - again - that foreigners aren't broadly eating Trump's tariffs (bc if they were, prices would have collapsed this year - instead they're up slightly) https://t.co/Dwv9hRwxO1 https://t.co/pF66RuUWjN

By Scott Lincicome

News•Feb 9, 2026

Elevra, Mangrove Lithium Ink Offtake MoU for NAL Project in Quebec

Elevra Lithium has signed a non‑binding MOU with Canada’s Mangrove Lithium to off‑take up to 144,000 tonnes of spodumene concentrate per year from the North American Lithium (NAL) project in Quebec. The supply would begin in 2028, scaling to full...

By MINING.com

Social•Feb 10, 2026

Gold Nears Breakout: From Panic to Directional Pause

Gold Price Short-term Outlook: XAU/USD From Panic to Pause- Breakout to Decide Direction https://t.co/e2vca3B4h2 $XAUUSD Daily & 240min Charts https://t.co/BsGu6wpKlh

By Michael Boutros

Social•Feb 10, 2026

Climax Top Signals Bear Market for Precious Metals

OUT NOW - @BergMilton on: - clear sign of "climax top" in gold & silver - why he expects a precious metals bear market - S&P 500, Bitcoin, Software + Korean stocks & more Apple🔊https://t.co/bNqmCOVqMV Spotify📽️https://t.co/mnN6Dn02hi 1/3 https://t.co/U3F0Pxojhy

By Jack Farley

News•Feb 9, 2026

US Military Boards Sanctioned Oil Tanker in Indian Ocean

The U.S. military conducted a right‑of‑visit boarding of the Panama‑flagged tanker Aquila II in the Indian Ocean after tracking it from the Caribbean. The vessel, linked to sanctions on Venezuelan and illicit Russian oil, had been operating with its transponder off,...

By Military Times

Social•Feb 10, 2026

Western Canadian Refineries Thrive, Ontario Slows, East Rebounds

🇨🇦🏭⛽️ Canadian refineries are running strong in the West, have seen operations slip faster than seasonally normal in Ontario, and have had a bouncing start to the year in Quebec & Eastern Canada. https://t.co/CY8K1qOKIh

By Rory Johnston

Social•Feb 10, 2026

US Refineries Pivot From Canadian to Venezuelan Heavy Crude

US refinery heavy crude sourcing from Canada (red) vs Venezuela (pink), compared to refinery capacity (blue) 2010 on the left, 2024 on the right https://t.co/nKOX5T7tGn

By Rory Johnston

News•Feb 9, 2026

TechMet Plans Additional $200M Raise, Has Africa in Sight

TechMet, the US‑backed critical‑minerals investment vehicle, is seeking up to $200 million of new capital to broaden its portfolio after raising $300 million last year, including $180 million from the Qatar Investment Authority. CEO Brian Menell announced the raise at the 2026 Mining...

By MINING.com

Social•Feb 10, 2026

Gulf Coast Refineries Boost Capacity, Replace Imports with Shale Oil

US Gulf Coast refineries (PADD3) have continued to grow distillation capacity while dramatically shrinking imports, displacing imported light and medium crudes with domestic light tight oil from the Shale Patch https://t.co/6EezXrbiQL

By Rory Johnston

Social•Feb 10, 2026

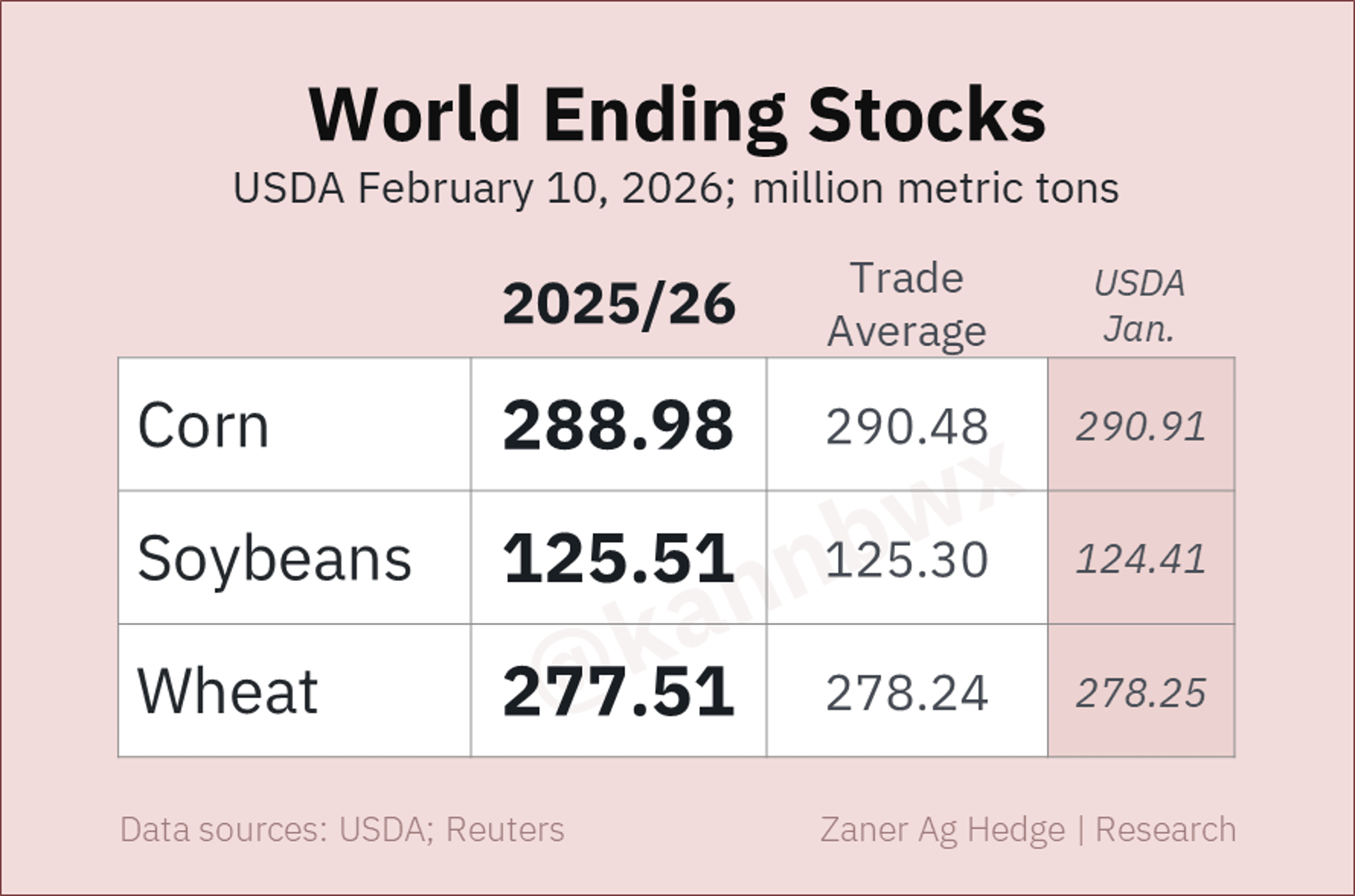

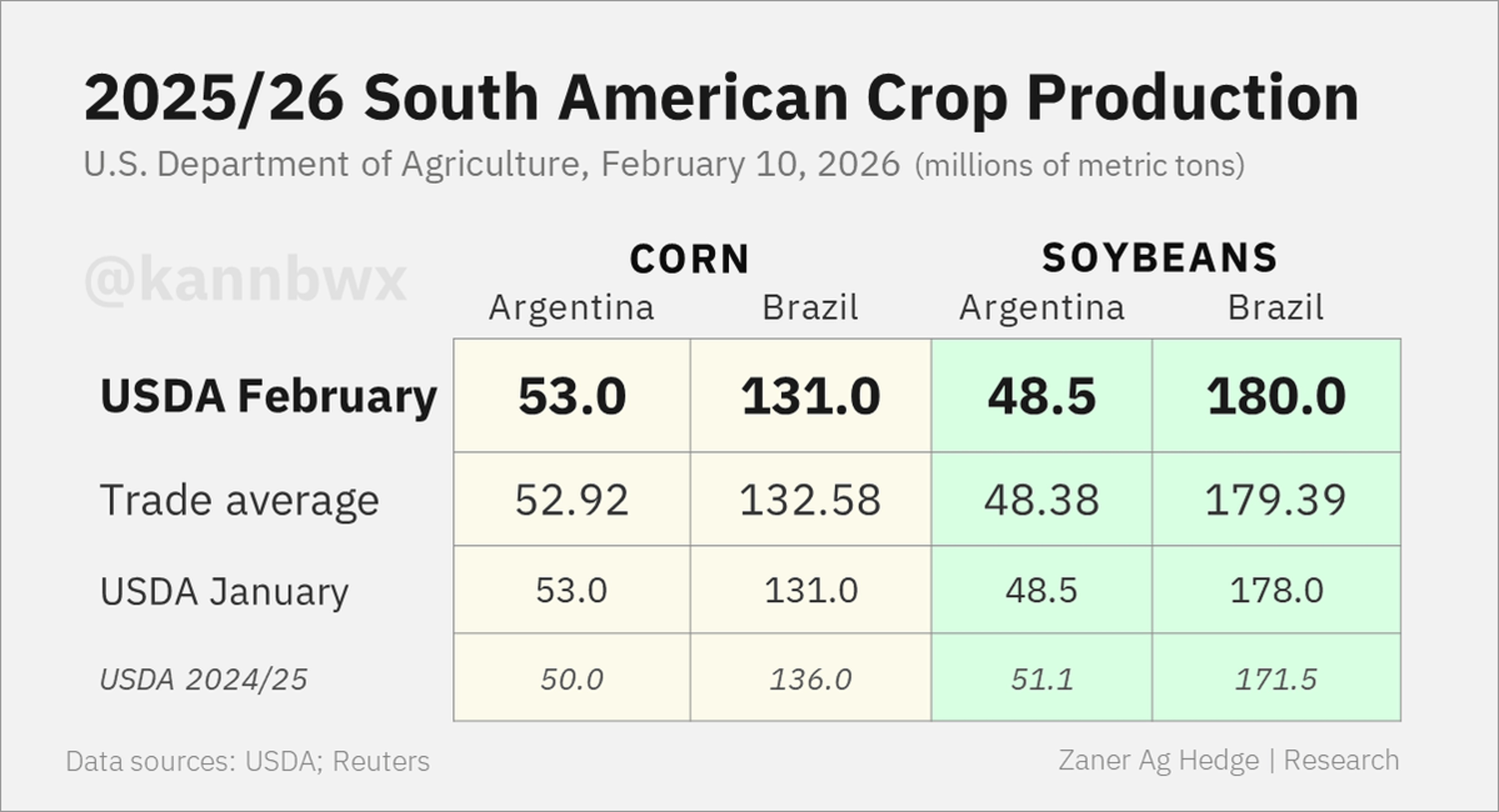

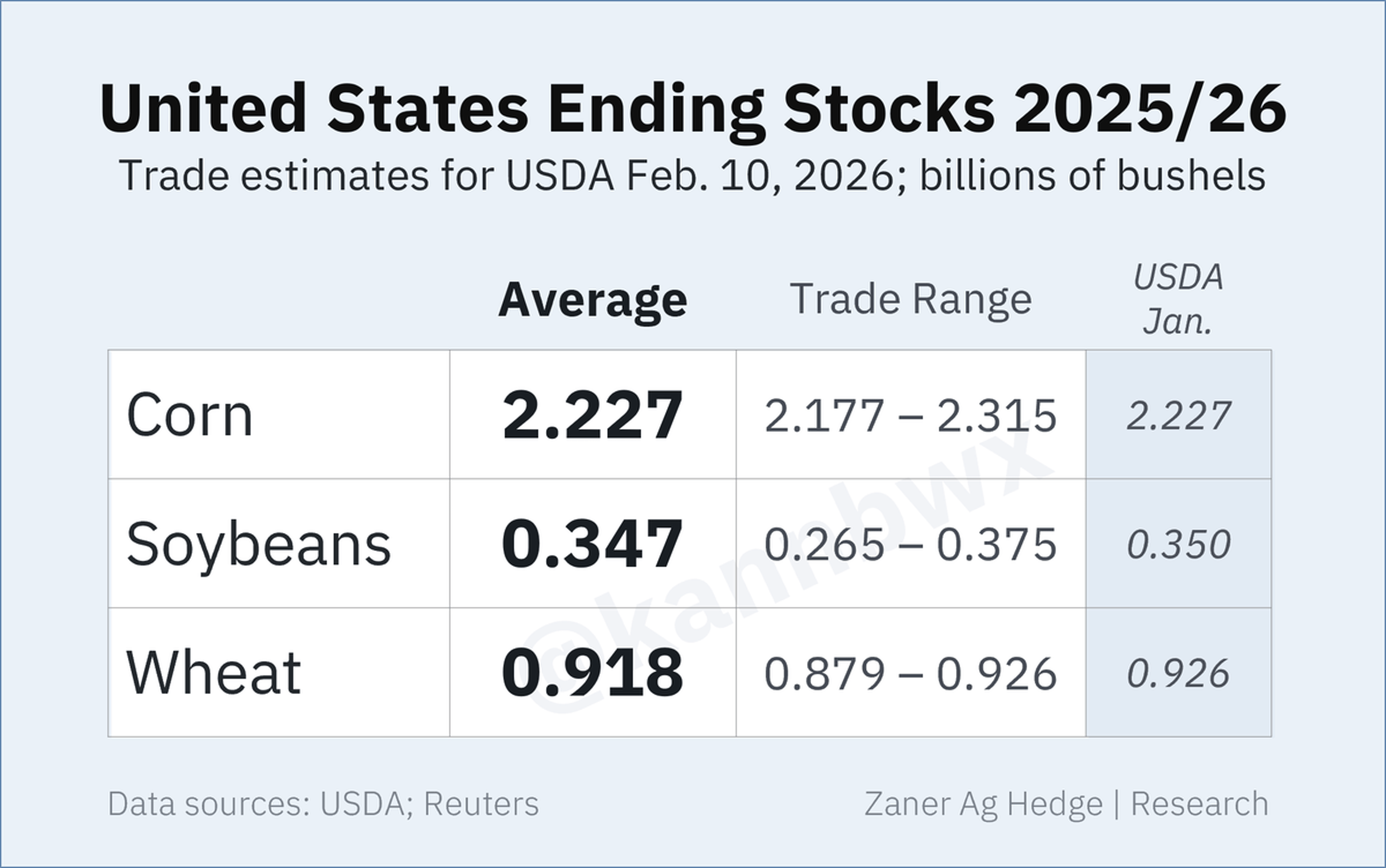

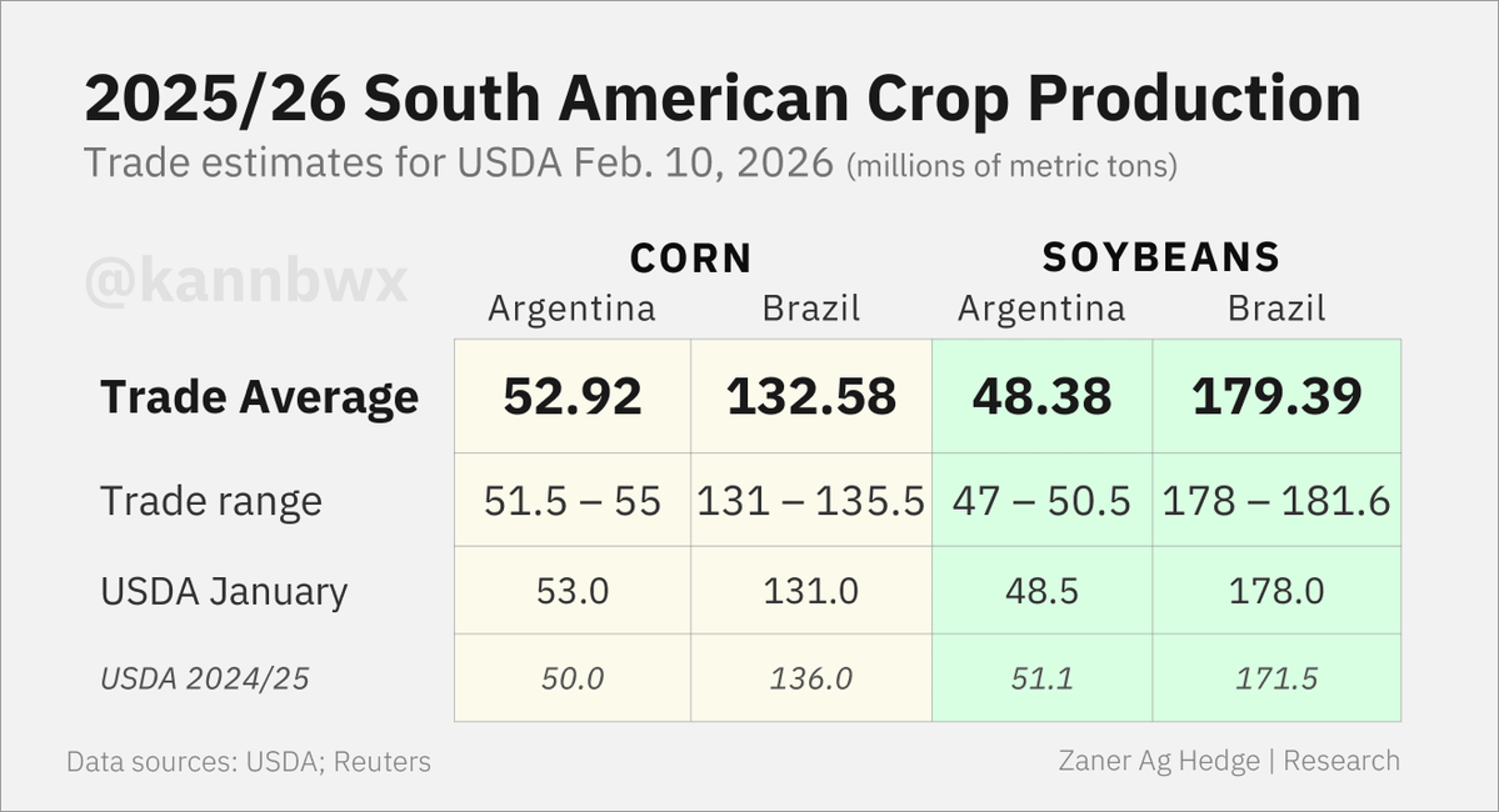

USDA Cuts Global Corn, Wheat Stocks; Soy up on Brazil

USDA's estimates for global corn and wheat ending stocks come in below expectations/last month (ending wheat's run of surging each month as harvests surpassed predictions). Soy stocks are up on a massive 180 mmt Brazilian crop. https://t.co/kM88lO1Zbq

By Karen Braun

Social•Feb 10, 2026

USDA Lifts Brazil 2025/26 Soybean Forecast to 180 Mt

USDA pushes Brazil's 2025/26 soybean harvest to 180 million metric tons. No changes to corn or to Argentina's crops. https://t.co/D2KarYYtVJ

By Karen Braun

Social•Feb 10, 2026

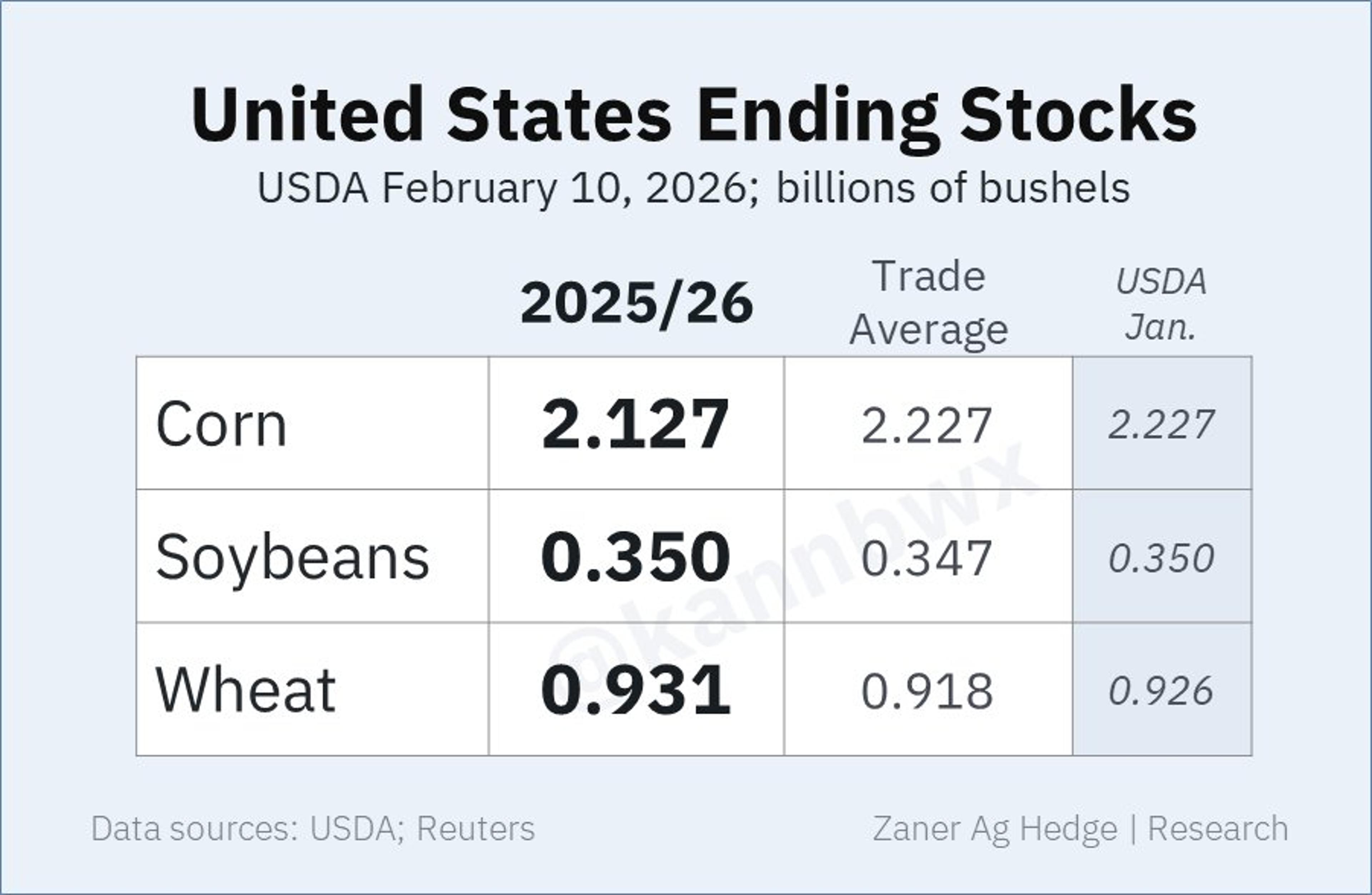

USDA Lifts Corn Export Outlook, Cuts Ending Stocks

U.S. corn ending stocks decrease from last month as USDA bumps exports to 3.3 billion bushels. Minimal/no changes in wheat and beans. https://t.co/FpMZKyhSPO

By Karen Braun

Social•Feb 10, 2026

Gold and Silver Bull Market Persists, Keep Cash Ready

I had a great chat with Peter Spina @goldseek at #VRIC. We covered why this still looks like a real gold/silver bull market, why I keep cash ready, and where early-stage opportunity is hiding. Full interview 👇

By Jeff Clark

Social•Feb 10, 2026

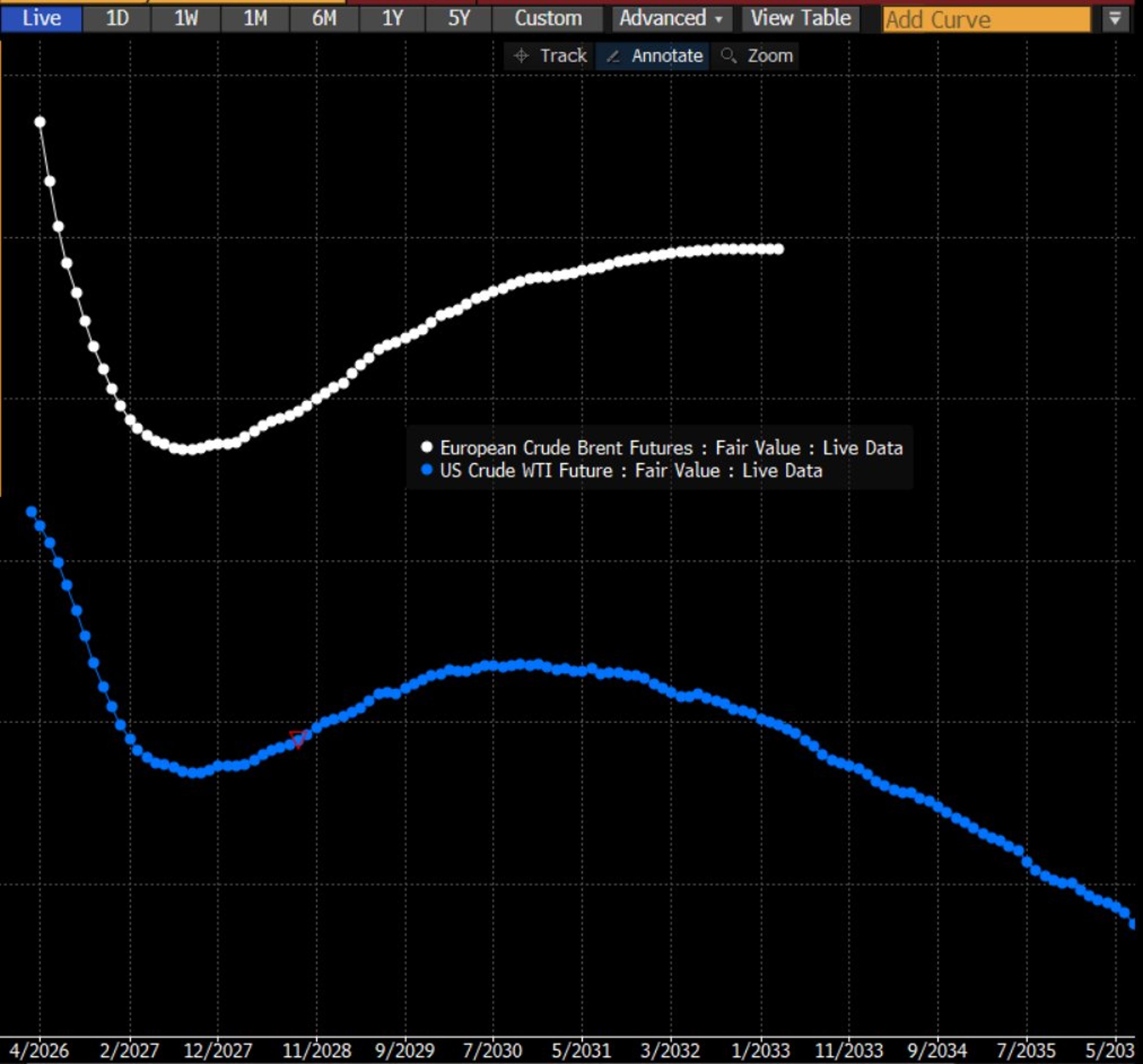

Brent Futures Steepen Backwardation, WTI Weakens

The Brent (white) and WTI (blue) futures curves are telling rhyming but importantly different stories right now Both have a backwardated front, depressed belly into contango past 2027 But Brent curve seeing steepening prompt backwardation (70c/bbl now) while WTI weakening (20c) https://t.co/5ZyF18ZPDO

By Rory Johnston

Social•Feb 10, 2026

Analysts Anticipate Stable US/World Stocks, Brazil Crop Gains

All trade estimates for USDA's supply & demand report due Tuesday at 11 am CT. On average, analysts don't expect major changes to U.S. and world stocks, though Brazil's corn and soybean crops could increase. U.S. demand will also be...

By Karen Braun

Social•Feb 10, 2026

Gold Surges Past $5,000 Amid Debt Monetization Fears

Gold is back above $5,000. The rise in gold is one manifestation of the debasement trade, which is about markets seeking safe havens from debt monetization. Big thanks to @DavidWestin from @BloombergTV for all the right questions and a great...

By Robin Brooks

Social•Feb 10, 2026

BP's Looney and Auchincloss Tenure a Board‑Enabled Disaster

Further thought on BP: Today proves, if ever there was a need of further proof, what a disaster the tenure of Bernard Looney and Murray Auchincloss were for the UK oil major. (...all permited / encouraged by a weak board...)

By Javier Blas

Social•Feb 10, 2026

BP Halts $750M Quarterly Buyback Over Mounting Debt

In view of BP's announcement this morning it's cancelling its $750-million-a-quarter share buyback, let me re-publish yesterday's @Opinion note arguing the British oil major couldn't afford it anymore. It comes down to debt -- lots of debt. https://t.co/23vNRD4Nsw

By Javier Blas

Social•Feb 10, 2026

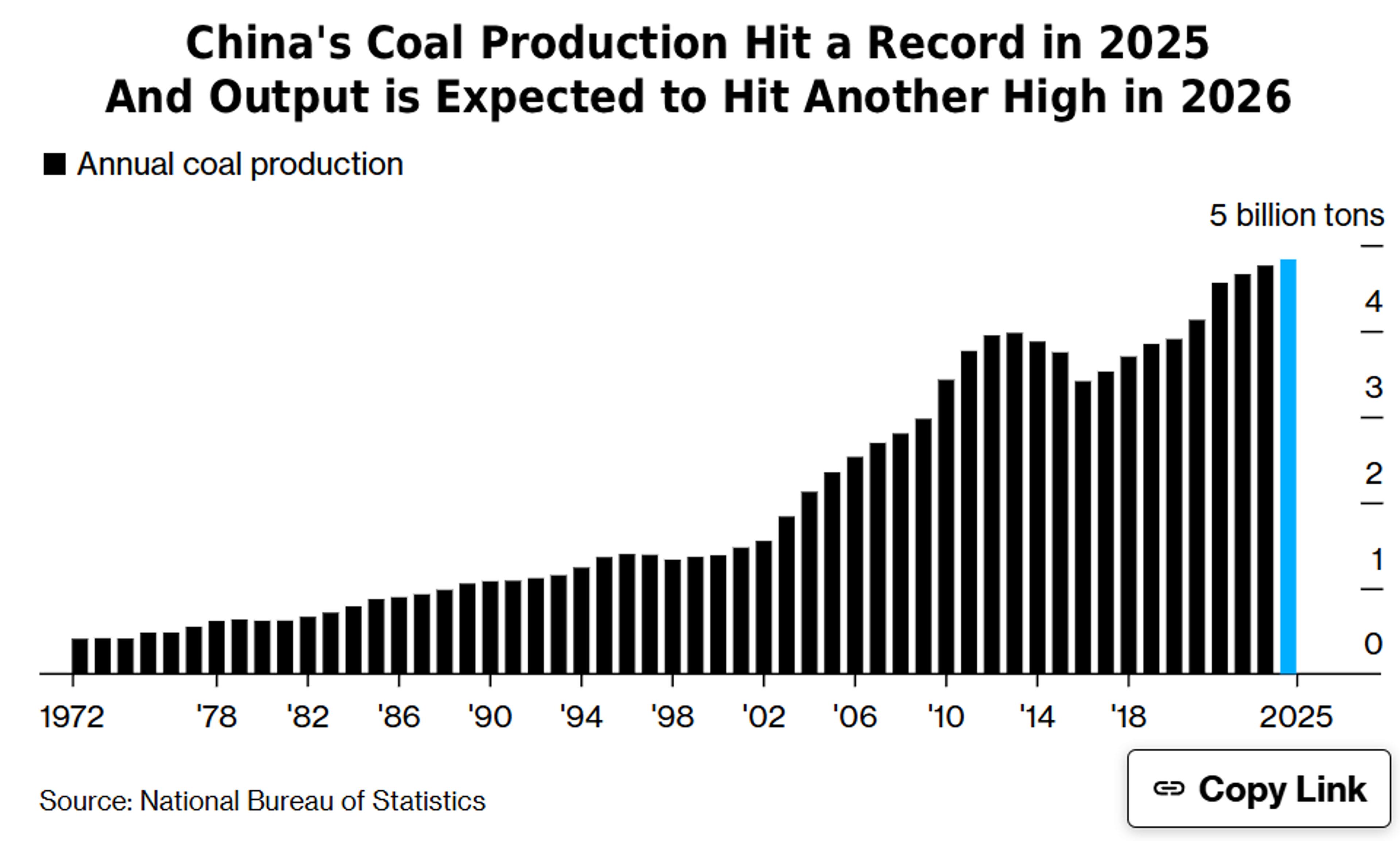

China May Smash Coal Output Record if Imports Fall

Will China's coal production hit another record this year? 🇨🇳🪨 China’s main coal industry body warns that imports may fall if Indonesia moves to restrict shipments They see production hitting a record 4.86 billion tons in 2026, but could go higher if...

By Stephen Stapczynski

Social•Feb 10, 2026

Russian Tankers Route to Singapore Despite Sanctions, China Shift

Russian oil tankers list Singapore as destination amid sanctions and shift to China, LSEG data shows https://t.co/1md44bH813

By Guy Faulconbridge

Social•Feb 10, 2026

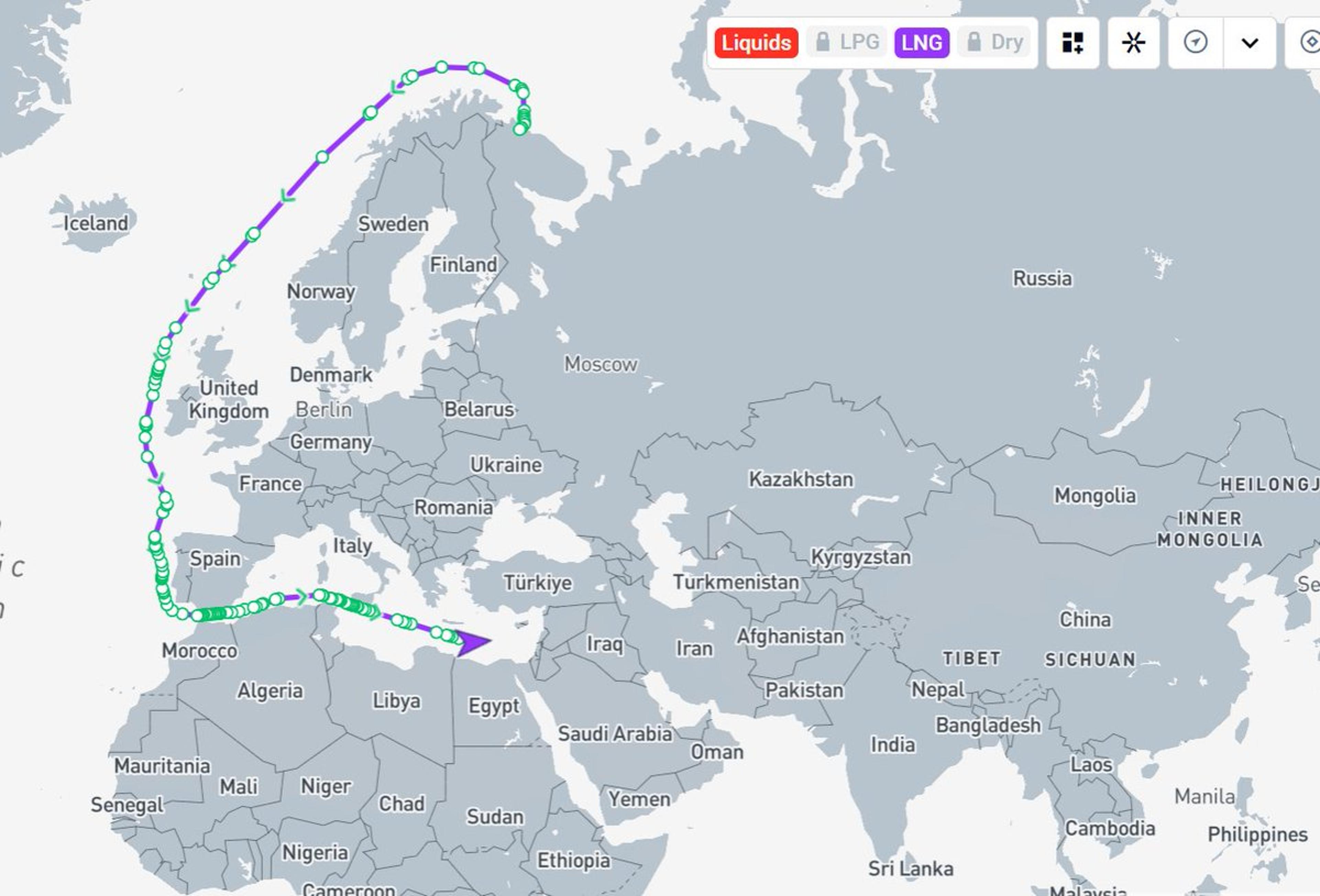

Seventh Sanctioned Russian LNG Tanker Navigates Red Sea

⛄️⛄️⛄️Sanctions? What sanctions? Where are you going, Zarya? This is going to be the 7th LNG carrier passing the Red Sea carrying Russian LNG. This is a sanctioned tanker carrying LNG from the sanctioned Arctic LNG 2. Map from @Kpler

By Anas Alhajji

Social•Feb 9, 2026

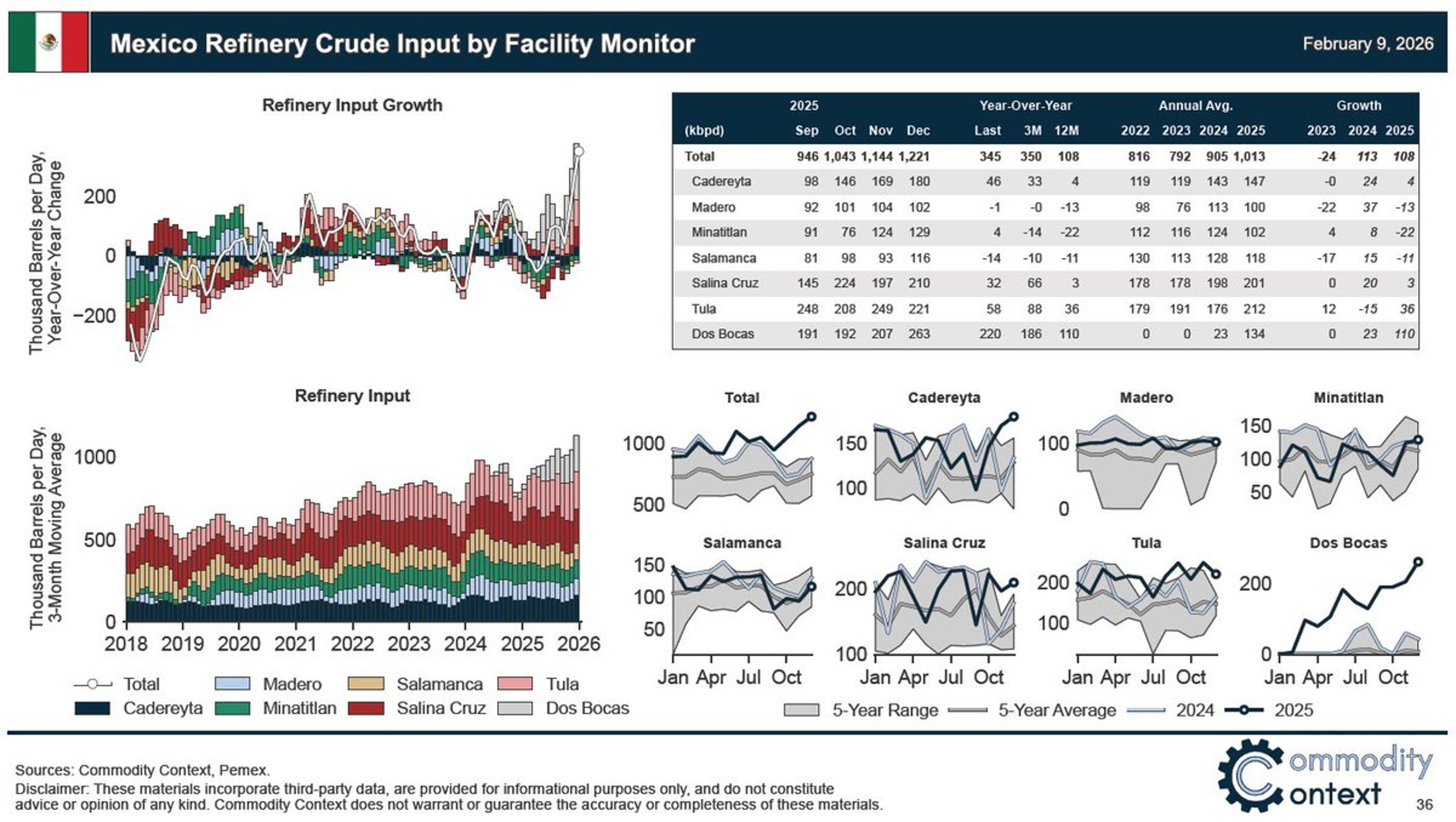

Mexico’s Refineries Hit Highest Crude Processing Since 2014

🇲🇽🏭 Mexican refineries are processing more crude right now than any time since 2014. Thanks most obviously to the start-up of the Dos Bocas refinery, but helped along by high utilization across other large facilities. https://t.co/wEpnmiM8He

By Rory Johnston

Social•Feb 9, 2026

Gold Surges Past $5,000 Amid Reckless Fiscal Policy

Gold is back above $5,000. The rally in precious metals is reckless and crazy, but so is global fiscal policy. At some point over the past 20 years, policy makers who believe in keeping public debt stable stopped existing. Makes...

By Robin Brooks

Social•Feb 9, 2026

Brazil's Corn, Soybean Harvests Expected to Rise; Argentina Steady

🇧🇷Analysts are expecting upside to Brazil's corn and soybean harvests in USDA's report on Tuesday. 🇦🇷Argentina's crops, on average, are not predicted to move much from the January forecast. https://t.co/D3Jg3BAIYv

By Karen Braun

Social•Feb 9, 2026

Canadian Oil Output Hits Record, Boosting Continental Production

📊 Fresh N. American Oil Data 📊 Continental petroleum output hits fresh high-water mark with Canadian supply reaching all-time highs amidst a bounceback in oilsands activity, offsetting flat-ish production in the US and Mexico Check out the Full report: https://t.co/7Xk7El7r1l

By Rory Johnston

Social•Feb 9, 2026

Wheat Export Inspections Outpace USDA Target by 61 M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 61 million bushels, up from 56 million bushels the previous week. #oatt

By Arlan Suderman

Social•Feb 9, 2026

LNG Tightens Longer as Qatar, US Delays Stall Supply

Global LNG market is at risk of being tighter for longer 🚢 ⚠️ 🇶🇦 Qatar is pushing back start of its massive expansion to end 2026 🇺🇸 Golden Pass plant in the US delayed to at least March Supply chain bottlenecks threaten...

By Stephen Stapczynski

Social•Feb 9, 2026

US Corn, Wheat Inspections Beat Forecasts; Beans Headed to China

🇺🇸U.S. corn & wheat export inspections exceeded all trade estimates last week. Two-thirds of the week's inspected bean cargoes were destined for China, predominantly out of the Gulf. https://t.co/e3b34Q6I3g

By Karen Braun

Social•Feb 9, 2026

Corn and Soybean Export Inspections Top Weekly Totals

Export inspections for the week ending Feb. 5 (mln bu) #corn 51.5, grain sorghum 4.9, #soybeans 41.7, #wheat 21.3 #oatt

By Arlan Suderman