🎯Today's Commodities Pulse

Updated 2h agoWhat's happening: Brazil slaps anti‑dumping duties on Chinese steel imports

Brazil’s foreign trade committee approved five‑year anti‑dumping duties on a range of Chinese steel products, imposing tariffs of $323‑$670 per ton on cold‑rolled coil and $285‑$710 per ton on hot‑dip galvanized coil. In 2025 the country imported 202,000 tons of CRC and 1.42 million tons of HDG from China.

Also developing:

By the numbers: Vale sells control of Thompson nickel complex in $200M injection

News•Feb 9, 2026

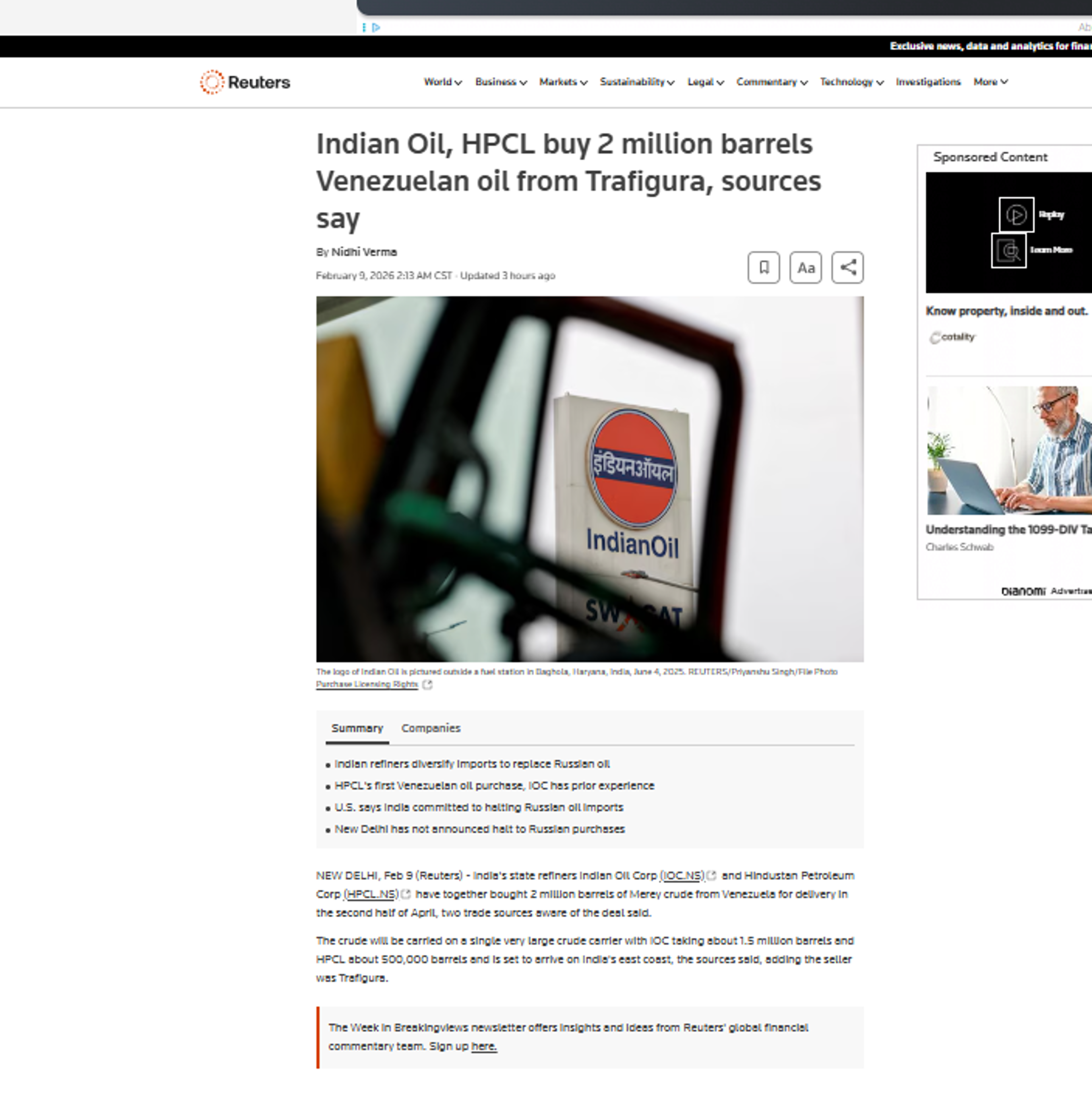

Russian Oil Sector Under Siege as EU Ramps up Pressure and India Winds Down Imports

The European Union announced plans to replace its $44.10‑per‑barrel Russian oil price cap with a comprehensive ban on maritime services for Russian crude, pending member‑state approval. The ban would block hull, machinery, and insurance services, pushing Russia toward the uninsured shadow fleet and raising pollution‑risk concerns. Simultaneously, a new US‑India trade agreement will require India to halt Russian oil imports in exchange for reduced US tariffs, redirecting its demand to the Middle East, the United States and Venezuela. The combined moves threaten Russian export volumes while reshaping global tanker utilization.

By Seatrade Maritime

Social•Feb 9, 2026

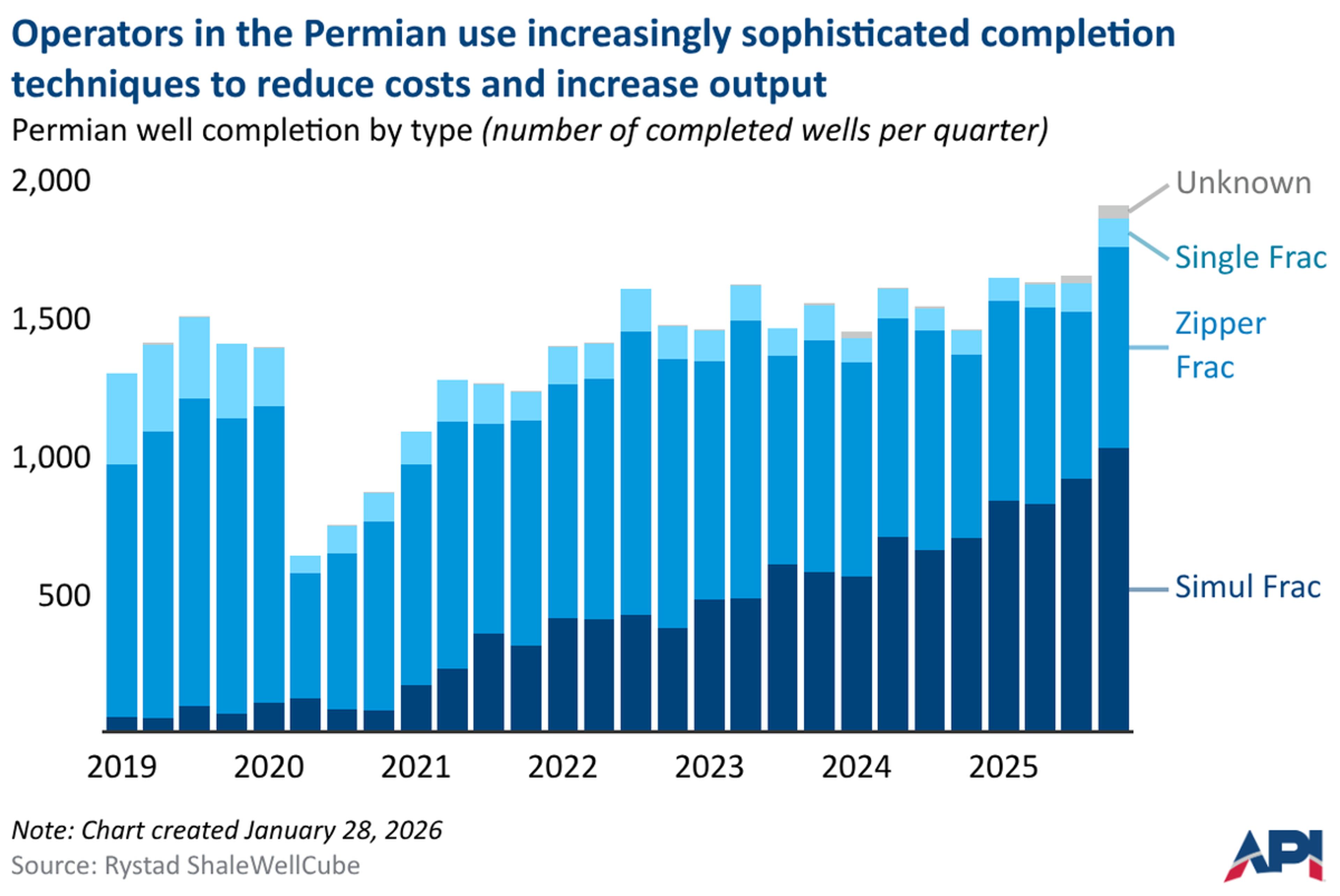

Permian Operators Complete 3,600 Wells via Simul Frac

U.S. operators in the Permian region of Texas and New Mexico completed ~3,600 wells in 2025 using simultaneous hydraulic fracturing (simul frac), a technique that minimizes completion crew time on well pad sites by completing two wells simultaneously. https://t.co/FxdE8jlBs7 Well completion occurs...

By T. Mason Hamilton

News•Feb 9, 2026

Taiwan to Freeze Fuel Prices over Lunar New Year, Gas Rates Through February

Taiwan's Executive Yuan announced a temporary freeze on gasoline and diesel prices from Feb 16‑23 and will keep natural gas and LPG rates unchanged through the end of February to smooth consumer costs during the Lunar New Year. The decision follows...

By Focus Taiwan (CNA) – English News

Social•Feb 9, 2026

Trump Tariff Keeps India From Returning to Venezuelan Oil

🔴 Here is something to think about: 🇮🇳 If President Trump had not imposed the additional 25% tariff on India for importing Russian oil—and with Venezuelan crude now becoming available—would Indian refineries resume buying Venezuelan oil, as they did in the...

By Anas Alhajji

News•Feb 9, 2026

US Backs Altona’s Mozambique Rare Earths Project

Altona Rare Earths announced that the U.S. Trade & Development Agency will support its Monte Muambe project in Mozambique, prompting a 76% surge in the company's London‑listed shares. The backing aims to map technical and financial routes for extracting rare‑earth...

By MINING.com

Blog•Feb 9, 2026

Interview with Triangle Investor

In this episode, economist Alasdair Macleod outlines a 2026 outlook where a tightening silver market, driven by massive physical shortages and surging demand from China and India, is creating a sharp premium between Shanghai and Western markets. He warns that...

By McleodFinance (Alasdair Macleod)

Social•Feb 9, 2026

Illegal Iran-India Fuel Smuggling Fuels Refineries, Not Politics

This has nothing to do with Trump's phone call. These are very small shipments of smuggled petroleum products (not crude) that are illegal in both Iran and India. (One of the ships was empty.) These are usually managed by gangs,...

By Anas Alhajji

Social•Feb 9, 2026

Wheat Export Inspections Outpace USDA Target by 61 M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 61 million bushels, up from 56 million bushels the previous week. #oatt

By Arlan Suderman

News•Feb 8, 2026

Why China’s Aluminum Industry May Have Reached Peak CO2

China's primary aluminum sector, producing about 44 million tons annually, has seen its CO₂ emissions likely peak in 2024. The peak stems from a massive geographic shift moving roughly 13 million tons of output from coal‑heavy provinces to hydro‑rich regions such as...

By CleanTechnica

Social•Feb 9, 2026

LNG Tightens Longer as Qatar, US Delays Stall Supply

Global LNG market is at risk of being tighter for longer 🚢 ⚠️ 🇶🇦 Qatar is pushing back start of its massive expansion to end 2026 🇺🇸 Golden Pass plant in the US delayed to at least March Supply chain bottlenecks threaten...

By Stephen Stapczynski

Social•Feb 9, 2026

US Corn, Wheat Inspections Beat Forecasts; Beans Headed to China

🇺🇸U.S. corn & wheat export inspections exceeded all trade estimates last week. Two-thirds of the week's inspected bean cargoes were destined for China, predominantly out of the Gulf. https://t.co/e3b34Q6I3g

By Karen Braun

Blog•Feb 8, 2026

I Talk Silver with Danny of CapitalCosm

In this episode Alasdair Macleod talks with Danny from CapitalCosm about the current state and outlook for silver as an investment. They explore silver's price dynamics, its relationship to gold, and the macroeconomic factors—like inflation, monetary policy, and industrial demand—shaping...

By McleodFinance (Alasdair Macleod)

Social•Feb 9, 2026

Corn and Soybean Export Inspections Top Weekly Totals

Export inspections for the week ending Feb. 5 (mln bu) #corn 51.5, grain sorghum 4.9, #soybeans 41.7, #wheat 21.3 #oatt

By Arlan Suderman

Social•Feb 9, 2026

Cuba's Fuel Shortage Forces Airport Closures and Hotel Shutdowns

Cuba is running out of oil. The island warned airlines that they wouldn't be able to re-fuel at its 9 major airports from Tuesday for at least one month. The Communist government has closed international hotels to save fuel, too. In...

By Javier Blas

Blog•Feb 8, 2026

Silver Post-Smash Outlook

Alasdair Macleod analyzes the aftermath of a recent sharp drop in silver derivatives, noting that hedge fund long positions are near a 20‑year low while physical liquidity in COMEX and London vaults is extremely thin. He warns that a massive...

By McleodFinance (Alasdair Macleod)

Social•Feb 9, 2026

USDA Confirms 264

USDA confirms the sale of 264,000 tons of U.S. soybeans for delivery to China in 2025/26.

By Karen Braun

Social•Feb 9, 2026

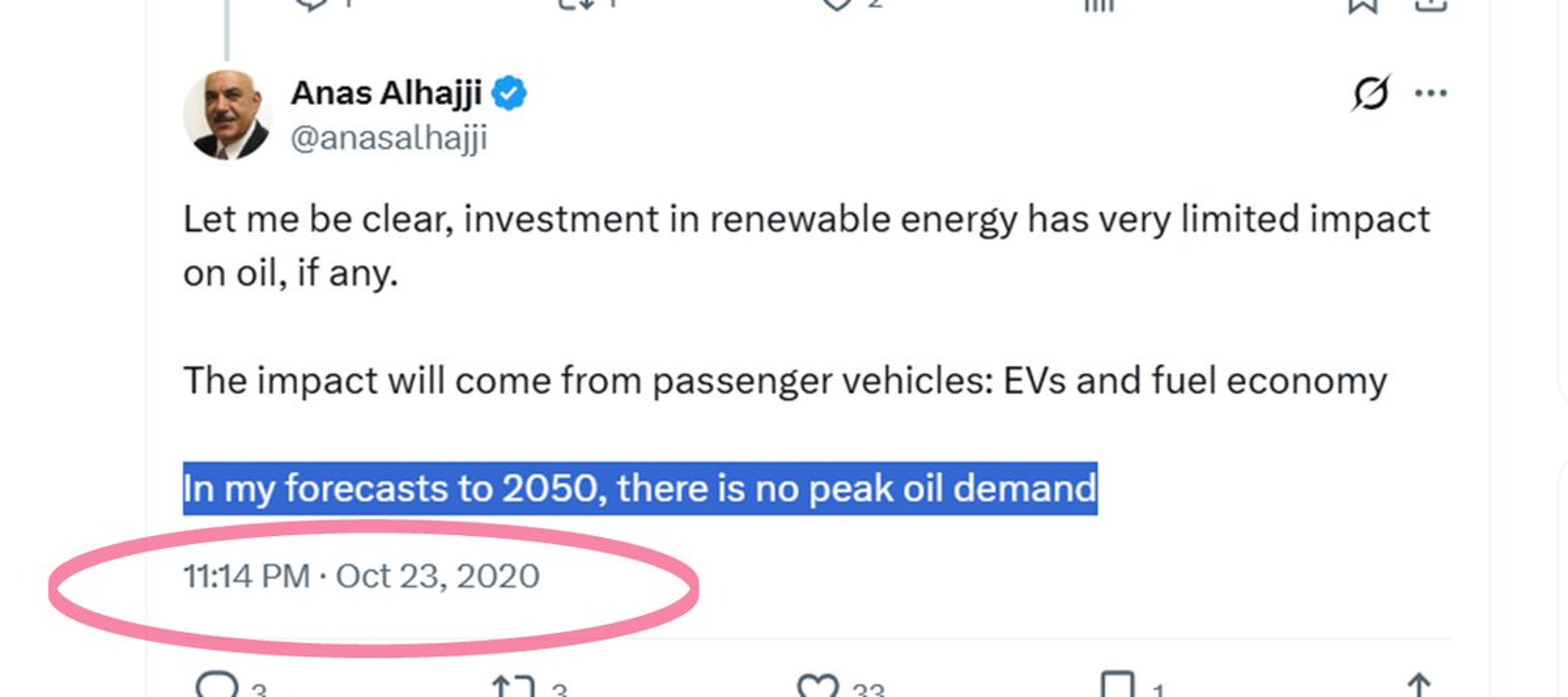

2020 Model Predicted No Oil Peak; Experts Now Retreat

🚨Today's news vs my prediction 5 years ago: 👔My model to 2050 showed no peak in oil demand. That was in 2020. 🪶Many have retreated from their "peak demand" predictions. The latest is from Vitol: 🐼Vitol Pushes...

By Anas Alhajji

News•Feb 6, 2026

Saudi Graphite Plant Is ‘Wake-Up Call’ for Quebec, France: CEO

Northern Graphite has partnered with Saudi Arabia's Al Obeikan Group to build a $200 million battery‑grade graphite plant in Yanbu, slated for production in 2028. The venture will source concentrate from the revived Okanjande mine in Namibia and gives Northern a...

By MINING.com

Social•Feb 9, 2026

BP Should Halt $750M Buybacks for New CEO

COLUMN: Britrish oil giant BP should suspend its $750 million quarterly share buybacks to give incoming CEO Meg O'Neill (who arrives in April) extra financial breathing room. @Opinion $BP https://t.co/23vNRD4Nsw

By Javier Blas

Social•Feb 9, 2026

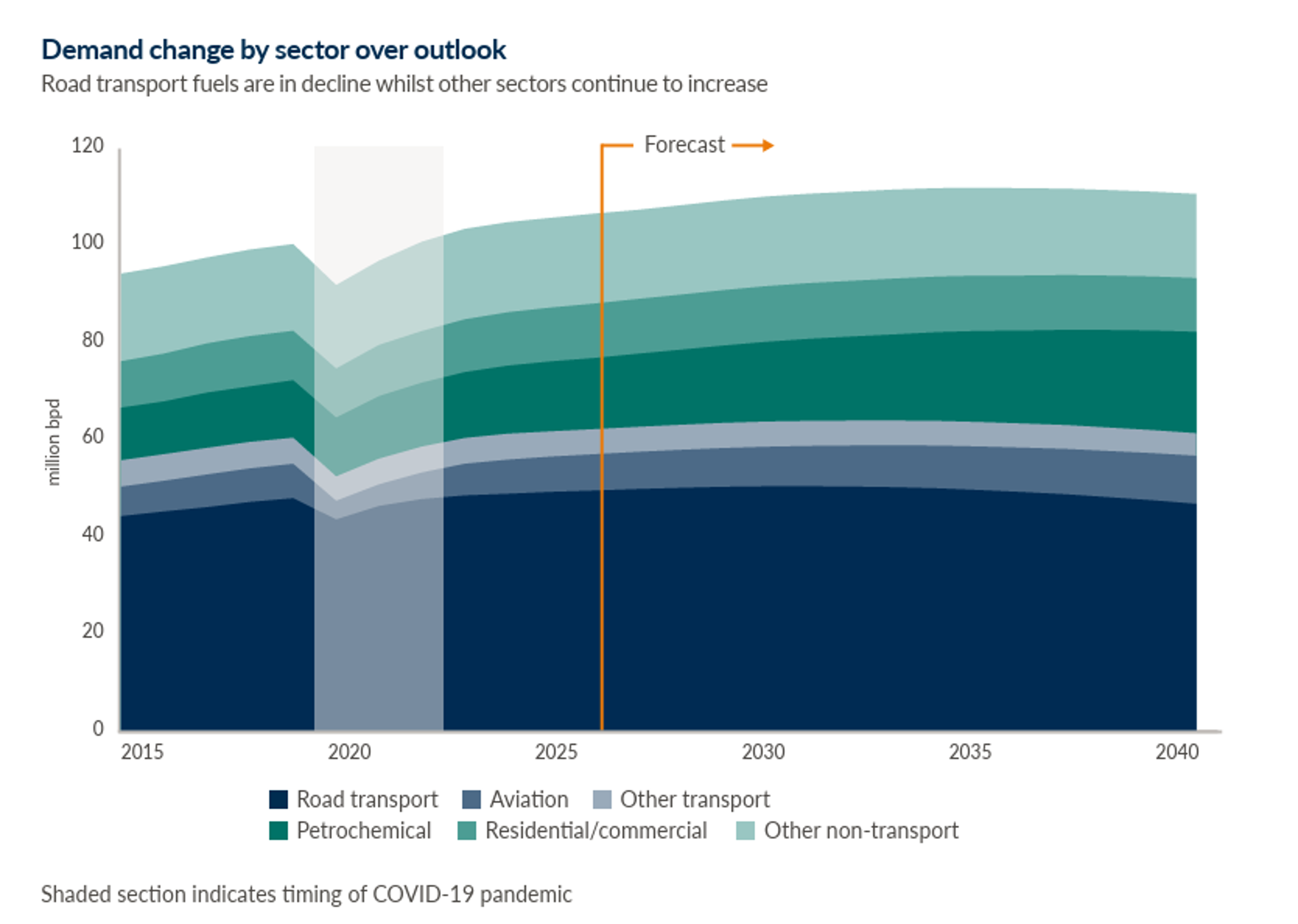

Vitol Pushes Global Oil Demand Peak to Mid‑2030s

CHART OF THE DAY: Vitol, the world's largest independent oil trader, shifts its view on global peak oil demand: higher and later. Now, Vitol sees a peak by the "mid" 2030s (previously it anticipated "early" 2030s). Peak demand seen at ~112m...

By Javier Blas

News•Feb 6, 2026

US Mineral Supply Chains Remain Exposed to China Chokehold: USGS Report

The U.S. Geological Survey’s 2026 mineral commodities summary shows the United States now imports 100% of 16 of the 90 non‑fuel minerals it tracks, up from 15 a year earlier, and relies on foreign sources for more than half of...

By MINING.com

Social•Feb 7, 2026

Russia's Gold Reserves Top $400 Billion for First Time

🚨 Russia’s gold reserves have officially crossed the $400 billion mark for the first time ever. The milestone reflects years of aggressive gold accumulation, accelerated by rising prices and a strategic shift away from reliance on foreign currencies. Follow for more macro...

By cryptosauce_

News•Feb 6, 2026

Heliostar Pours First Gold From San Agustin Mine

Heliostar Metals announced the first gold pour from its newly restarted San Agustin mine in Durango, marking its second operating asset after La Colorada. The open‑pit mine is projected to deliver roughly 45,000 ounces of gold from existing reserves, prompting...

By MINING.com

News•Feb 6, 2026

DPM Adds 20% More Gold-Silver to Extend Bulgaria Mine

DPM Metals announced a 20% increase in measured and indicated resources at its Chelopech gold‑copper mine, boosting total reserves to 1.6 million ounces of gold and 6.23 million ounces of silver. The update extends the mine’s projected life to ten years, up...

By MINING.com

News•Feb 6, 2026

January 2026 Metals Options Report

Gold options opened 2026 with record‑high activity, posting a month‑to‑date average daily volume of 73 K contracts for monthly tenors and 30 K for weekly. Spot gold surged past $5,000 per ounce, driven by a weaker dollar and heightened geopolitical tension, while...

By CME Group – OpenMarkets

Blog•Feb 4, 2026

US Weekly Oil Data

The episode breaks down the latest U.S. weekly oil production and inventory figures, highlighting recent shifts in crude output, refinery utilization, and stockpile levels. It explains how these data points are influencing price movements and market sentiment, especially in the...

By Anas Alhajji (Energy Outlook Advisors)

Blog•Feb 4, 2026

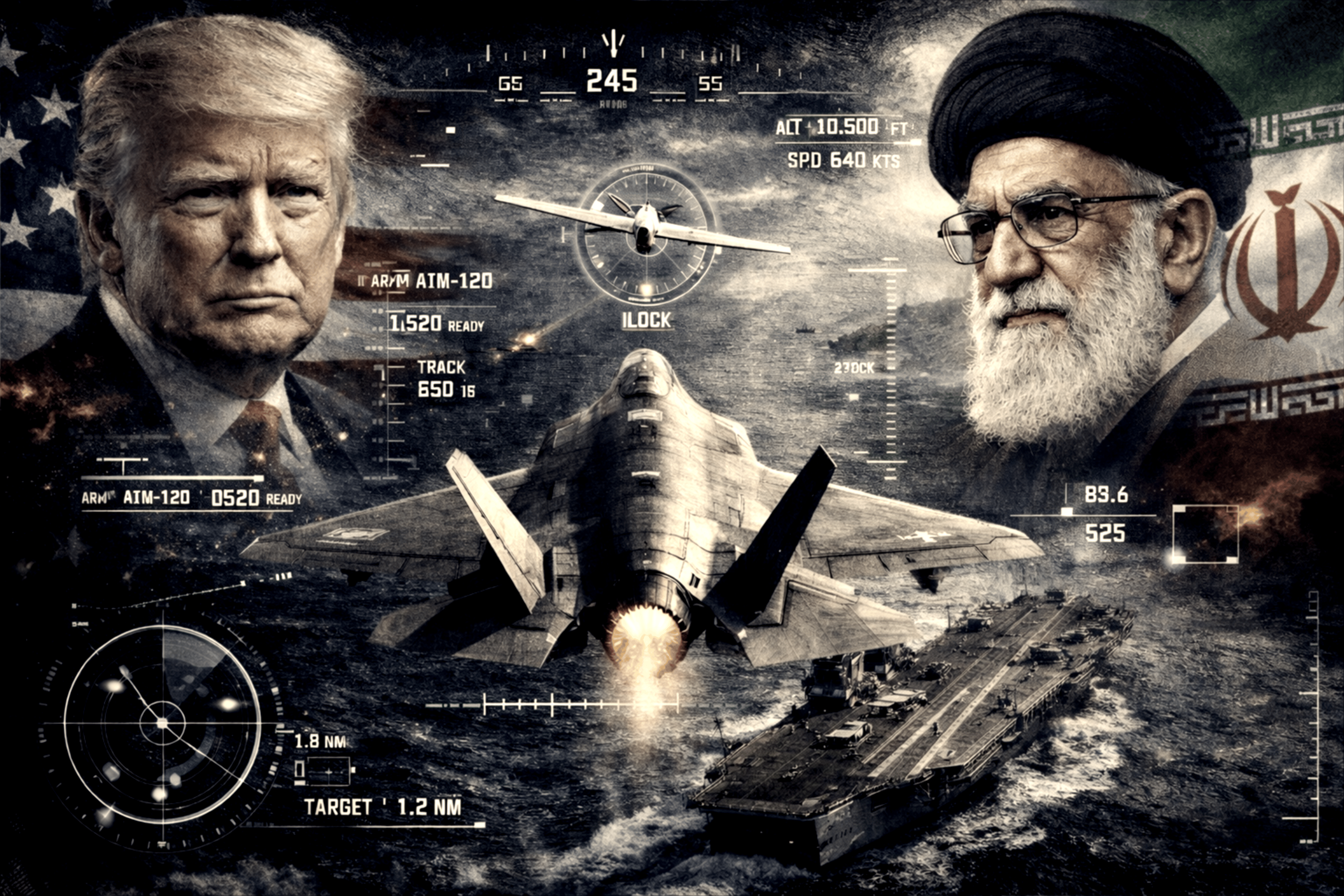

Hormuz on the Brink?

U.S. forces escalated the standoff with Iran after an F‑35 shot down an Iranian drone that approached a carrier in the Arabian Sea. Both sides have scheduled high‑level talks in Istanbul, raising hopes for a diplomatic de‑escalation. The dispute centers...

By Energy Flux

Blog•Feb 4, 2026

Watch Out for Japan’s Election on Sunday

The episode analyzes the recent collapse in gold and silver prices, attributing it to extremely low speculative open interest on COMEX and a lack of buyers, which created a price vacuum. It notes that the market has now stabilized as...

By McleodFinance (Alasdair Macleod)

News•Feb 4, 2026

LG Energy Solution Targets 90GWh of Battery Orders in US Energy Storage Market in 2026

LG Energy Solution announced a target of 90 GWh of new battery‑energy‑storage‑system (BESS) orders in the United States for 2026, raising its ESS cell output to over 60 GWh while keeping total global capacity at roughly 300 GWh. The company plans to slash...

By Energy Storage News

Blog•Feb 4, 2026

Interview with Jasmine of Money Magpie

In this episode, Alasdair Macleod discusses the potential collapse of the fiat currency system, drawing parallels to the Weimar Republic's hyperinflation and the subsequent surge in gold prices. He argues that fiat money depends on confidence and credit, but governments...

By McleodFinance (Alasdair Macleod)

News•Feb 2, 2026

Pro Farmer Podcast | What's Next for the Dollar?

In the February 2 2026 episode of the Pro Farmer Podcast, host Davis Michaelsen and guest Bill Watts dissect the recent turbulence in the U.S. dollar and its ripple effects on precious‑metal markets. They attribute the dollar’s swings to shifting Federal Reserve...

By Pro Farmer

Podcast•Feb 2, 2026•15 min

Money and Me: When Gold Breaks, AI Bites Back, and Japan Shakes the World

In this episode, host Michelle Martin and guest Simon Ree, founder of Tao of Trading, dissect a volatile market landscape where gold and silver have sharply retreated after a steep rally, and Microsoft’s stock fell despite strong earnings, raising concerns...

By Your Money with Michelle Martin (MONEY FM 89.3)

Blog•Feb 1, 2026

Interview with Jesse Day of Commodity Culture

In this episode, host Alasdair Macleod and guest Jesse Day of Commodity Culture explore the theory that China is amassing silver to eventually back the yuan with a silver standard, a move that could accelerate the dollar’s decline. They discuss...

By McleodFinance (Alasdair Macleod)

Blog•Feb 1, 2026

No Glut in Sight: Why Oil Bears Remain Mistaken—Despite OPEC+ V8 Easing the Taps in April

The episode explains that recent oil price gains are driven primarily by sharp production cuts in the United States and Mexico caused by an unusually harsh winter, rather than by OPEC+ policy changes. Geopolitical tension, including rumors of a possible...

By Anas Alhajji (Energy Outlook Advisors)

Social•Jan 31, 2026

Silver Suffers Steepest One‑day Drop Since 1921

January 30, 2026 . . . . Worst one day % drop in silver prices since 1921.

By Errol Anderson

Blog•Jan 29, 2026

Inventories Before and During the Storm: A Reliable Predictor of… Nothing

The episode examines U.S. oil inventory data, highlighting that the Strategic Petroleum Reserve (SPR) has accumulated more barrels since early 2025 than the increase in domestic crude production. This discrepancy undermines claims of a true global oil surplus, as much...

By Anas Alhajji (Energy Outlook Advisors)

News•Jan 26, 2026

Pro Farmer Podcast | A Winter Wonderland

On the January 26, 2026 episode of the Pro Farmer Podcast, hosts Davis and Hillari examined how unusually frigid temperatures could jeopardize the upcoming winter wheat crop. They highlighted potential germination delays, reduced tiller development, and heightened disease pressure. Editor Bill Watts...

By Pro Farmer

Blog•Jan 26, 2026

Iraq’s January Oil Exports Surge: A Short Explanation.

The episode examines recent Kpler data showing Iraq’s seaborne crude oil exports jumping to an average of 3.457 million barrels per day in January, a rise of roughly 208 kb/d from December. It notes that pipeline shipments to Turkey have stayed steady...

By Anas Alhajji (Energy Outlook Advisors)

Blog•Jan 22, 2026

Gasoline Inventories Rise to Highest Level Since 2020

The episode examines the recent surge in U.S. gasoline inventories, which have climbed to their highest level since 2020, and explores the factors driving this buildup, including weaker demand, refinery outages, and seasonal storage patterns. Analysts discuss how the inventory...

By Anas Alhajji (Energy Outlook Advisors)

Blog•Jan 20, 2026

Assisted Thinking

The episode “Assisted Thinking” dissects the stark contrast between China’s massive reliance on coal—accounting for 58% of its primary energy in 2024—and the Western media narrative that paints Beijing as a climate leader. By examining data from the Statistical Review...

By Doomberg

Blog•Jan 20, 2026

Annual Review of EU’s Gas Market in 2025 and the Outlook for 2026

The episode reviews the EU gas market in 2025, noting a modest 1.2% demand rebound after two years of decline and a sharp increase in LNG imports that offset a 15 bcm loss of Russian pipeline gas following the end of...

By Anas Alhajji (Energy Outlook Advisors)

Blog•Jan 19, 2026

Are the Attacks on Kazakhstan’s Petroleum Sector Potentially Linked to Retaliation Against Trump’s Venezuela Strategy?

In this episode, A.F. Alhajji examines a sudden decline in OPEC+ oil output, focusing on recent attacks on Kazakhstan’s petroleum infrastructure and their possible connection to U.S. policy toward Venezuela under former President Trump. He argues that the disruptions may...

By Anas Alhajji (Energy Outlook Advisors)

Podcast•Jan 18, 2026•8 min

Monday: Silver Slides as Iran Tensions Ease

In this brief episode, ANZ’s research analysts discuss the recent decline in silver prices, attributing the slide to easing geopolitical tensions with Iran. They note that reduced risk premiums are dampening demand for safe‑haven assets, while broader market dynamics and...

By 5 in 5 with ANZ

Blog•Jan 17, 2026

Weekly Indicators for January 12 - 16 at Seeking Alpha

Seeking Alpha’s weekly indicators for Jan 12‑16 highlight a normalizing yield curve and mortgage rates at three‑year lows, which are reviving the housing market. At the same time, gasoline prices have slipped to their lowest level in almost five years, creating...

By The Bonddad Blog

Blog•Jan 16, 2026

Counterparty Risk in Silver Exposed

The episode examines the recent price dynamics of precious metals, noting gold's steady rise to $4,606 and silver's rapid surge to $90.75, driven by heightened open interest on the COMEX. It highlights the emerging counterparty risk in the silver market,...

By McleodFinance (Alasdair Macleod)

Podcast•Jan 15, 2026•9 min

Friday: Oil Down 4.9% as Iran Tensions Ease

In this brief episode, ANZ Research analysts discuss the recent 4.9% drop in oil prices, attributing the decline primarily to easing geopolitical tensions with Iran. They explain how reduced risk of supply disruptions has softened market sentiment and led to...

By 5 in 5 with ANZ

Blog•Jan 15, 2026

The Gasoline Build Paradox: Weather and Shale Vs. Economic Growth?

The episode explores the paradox of rising gasoline consumption despite advances in shale production and the influence of weather patterns on fuel demand. It examines how economic growth, seasonal temperature shifts, and the resilience of the oil market interact to...

By Anas Alhajji (Energy Outlook Advisors)

News•Jan 14, 2026

Heat Pumps That Pay: How Industrial Process Heat Is Becoming a Cost-Saving Asset

Industrial heat, the world’s largest energy end‑use, is now a balance‑sheet issue as manufacturers grapple with volatile fuel prices and rising carbon costs. A new generation of high‑temperature heat pumps can deliver up to ~200 °C, turning waste heat and low‑grade...

By CFI.co (Capital Finance International)

Blog•Jan 14, 2026

Kazakhstan, Venezuela, and Iran: Key Wildcards Driving Oil Price Volatility

The episode examines three emerging wildcards that could destabilize oil markets: a sharp decline in Kazakhstan’s crude exports due to Ukrainian drone attacks and weather‑related production cuts, political and operational uncertainties in Venezuela, and renewed sanctions and geopolitical tension surrounding...

By Anas Alhajji (Energy Outlook Advisors)

Podcast•Jan 12, 2026•7 min

Powell’s Fed Up

The episode reviews Jerome Powell’s remarks that a potential criminal indictment against him must be viewed against the backdrop of broader political pressures from the administration. It also analyzes December’s U.S. jobs data, which showed a slowdown in hiring while...

By Reuters Morning Bid