CURRENCIES PULSE

Friday, February 20, 2026

Market Intelligence for Currencies Professionals

🎯 Today's Currencies PulseUpdated 3m ago

What's happening: Rupee slides to 90.95 per dollar as dollar strength and oil prices rise

The Indian rupee fell to 90.95 against the U.S. dollar in early Friday trade, down 27 paise from its previous close. The move was prompted by a firmer dollar, Brent crude climbing to $71.77 a barrel, and heightened U.S.-Iran tensions. Domestic equities also weakened, with the Sensex shedding 150 points.

🚀 Top Currencies Headlines

Rupee Closes Nearly Flat, Modest Depreciation Bias Lingers

The Indian rupee was little changed on Friday as pressure from weak local stocks and elevated interbank dollar demand met likely central bank intervention to defend the currency, traders said.

The Economic Times – Markets

Press Release: Millions in Losses Drive Return to FX Protection in 2026

17th February 2026 – A new report from advanced FX and cash management solutions provider, MillTech, has revealed that UK corporates lost an average of £6.71m in 2025 due to unhedged FX exposure, while US firms lost $9.85m, driving a renewed focus on currency protection in 2026. The post Press release: Millions in losses drive return to FX protection in 2026 first appeared on Treasury Today.

Treasury Today

Chhangani Cited in Bloomberg on the Dollar’s Waning Influence Relative to E-CNY

Read the full article here The post Chhangani cited in Bloomberg on the Dollar’s Waning Influence Relative to e-CNY appeared first on Atlantic Council.

Atlantic Council – All Content

USD Gains on Strong US Data Unlikely to Last; Policy Uncertainty, Political Risks to Cap

MUFG says recent dollar gains driven by stronger U.S. data and cautious Fed minutes are unlikely to last. Political uncertainty and concerns about Fed independence under President Trump may keep investor sentiment toward the greenback fragile. Summary: MUFG’s Derek Halpenny says recent U.S. dollar strength is unlikely to be sustained. Durable goods, housing and industrial production data all beat expectations. Fed minutes showed caution over further rate cuts, supporting the greenback. Halpenny argues dollar sentiment remains fragile under President Trump. Policy unpredictability and rhetoric around Fed independence weigh on outlook. National Economic Council Director Kevin Hassett criticised New York Fed tariff analysis. Halpenny sees such criticism as an example of potential White House interference risk The U.S. dollar’s rebound following stronger-than-expected economic data and hawkish-leaning Federal Reserve minutes is unlikely to prove durable, according to MUFG Bank’s Derek Halpenny. The greenback firmed after a run of upside surprises in key activity indicators. Data on durable goods orders, housing activity and industrial production all exceeded expectations, reinforcing the view that U.S. growth momentum remains resilient. In addition, minutes from the latest meeting of the Federal Reserve highlighted caution among policymakers over delivering further interest rate cuts, suggesting a more patient approach to easing. While that combination typically supports the dollar through higher yield expectations and growth outperformance, Halpenny argues the broader backdrop leaves the currency vulnerable. He contends that investor sentiment toward the dollar is likely to remain fragile as long as Donald Trump remains in office, citing policy unpredictability and recurring tensions around central bank independence. In his view, political noise risks overshadowing near-term data strength. Halpenny pointed specifically to comments from National Economic Council Director Kevin Hassett, who criticised analysis from the New York Fed regarding tariffs. The episode, he suggested, serves as an example of how the White House could challenge or pressure institutional independence, a factor that can weigh on foreign investor confidence. Markets remain sensitive to any perceived erosion of Fed autonomy, particularly at a time when monetary policy credibility plays a central role in anchoring inflation expectations and sustaining capital inflows. In that context, MUFG argues that while cyclical data surprises may generate episodic dollar strength, structural and political risks could cap upside and contribute to ongoing volatility. Because its Friday, here's a Dolla This article was written by Eamonn Sheridan at investinglive.com.

ForexLive — Feed

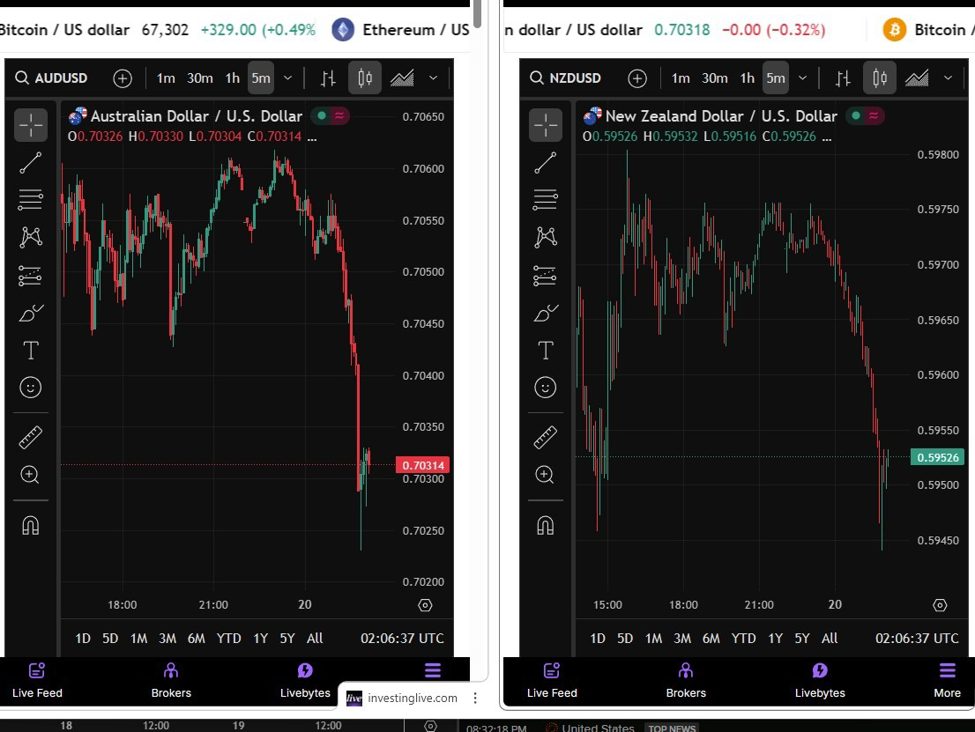

NZD, AUD Fall as RBNZ Says Inflation Returning to Target, No Preset Path

RBNZ signals steady hand on rates, nudging NZD lower and dragging AUD with it. Summary: NZD and AUD both fall, with Kiwi leading declines during Asian trade. RBNZ Governor Breman says inflation likely already back inside target band in Q1. RBNZ confident inflation will return to the 2% midpoint within 12 months. Policy is not on a pre-set course, decisions remain data dependent. Chief Economist Paul Conway says the RBNZ “won’t be trigger happy” with rate hikes. Tone reads steady-to-dovish at the margin despite confidence on inflation trajectory The New Zealand and Australian dollars weakened in Asian trade following remarks from Reserve Bank of New Zealand officials that, while broadly constructive on inflation, signalled no urgency to tighten policy further. RBNZ Governor Breman said the path back to 2% inflation “has been bumpy,” but added that inflation is expected to already be back within the target range in the first quarter of this year. She reiterated confidence that inflation will return to the 2% midpoint within the next 12 months. Crucially for markets, Breman emphasised that being forward-focused does not imply policy is on a pre-set course. The central bank will adjust plans as new information arrives, maintaining flexibility in response to evolving data. RBNZ Chief Economist Paul Conway reinforced that message, stating the Bank “won’t be trigger happy” with rate hikes, a line that appeared to weigh on the Kiwi at the margin. The tone suggests the RBNZ sees inflation progress as broadly on track, reducing the need for aggressive follow-up tightening unless data surprise to the upside. That combination, confidence in disinflation alongside a cautious tightening stance, can dampen short-term rate expectations and pressure the currency. The Australian dollar moved lower alongside the Kiwi, reflecting regional FX correlation and broader risk sentiment rather than any direct domestic catalyst.The Reserve Bank of Australia recently delivered its first rate hike in roughly two years and markets continue to price the risk of further increases. Be sure to be following us, we had Breman's comments hours ago. This article was written by Eamonn Sheridan at investinglive.com.

ForexLive — Feed

💬 Top Currencies Social Posts

Tweet by @Brad_Setser

Just how undervalued is the Chinese yuan -- the IMF (via the Economist) just revised its estimate up to 19% (plus or minus 4%) 1/many https://t.co/IJ4Z1SmGIq

by Brad Setser•