News•Feb 20, 2026

Could Medical Care Help Cure China’s Services Trade Deficit?

China’s medical tourism is gaining traction as foreign patients praise rapid, affordable care in megacities like Shanghai and Beijing. While the absolute number of inbound patients remains modest, industry insiders see a growing pipeline driven by visa‑free entry, expanding international departments, and pilot foreign‑owned hospitals. The trend offers a potential lever to narrow China’s sizable services‑trade deficit, which stood at 828.7 billion yuan last year. However, language barriers, limited insurance integration, and low global awareness still constrain scale.

By South China Morning Post — Economy

News•Feb 20, 2026

Rupee Declines 27 Paise to 90.95 Against US Dollar in Early Trade

The Indian rupee slipped to 90.95 per U.S. dollar in early Friday trade, down 27 paise from its previous close. The decline was driven by a firmer dollar, higher Brent crude at $71.77 a barrel, and escalating U.S.-Iran tensions. Domestic...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Global Market | Japan’s Tightening Cycle Could Redraw the Map of Global Market Liquidity

The Bank of Japan has ended its ultra‑easy stance, pushing policy rates to the highest level in decades and pricing in another hike. Higher domestic yields are likely to trigger repatriation of Japanese savings, cutting the flow of low‑cost funding...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Goldman: Gold to Grind Higher to $5,400/Oz by End-2026 on Strong Demand

Goldman Sachs projects gold prices to climb to $5,400 per ounce by the end of 2026, driven primarily by renewed central‑bank buying and modest private‑investor inflows linked to Federal Reserve rate cuts. The forecast assumes a conservative base case with...

By ForexLive — Feed

News•Feb 20, 2026

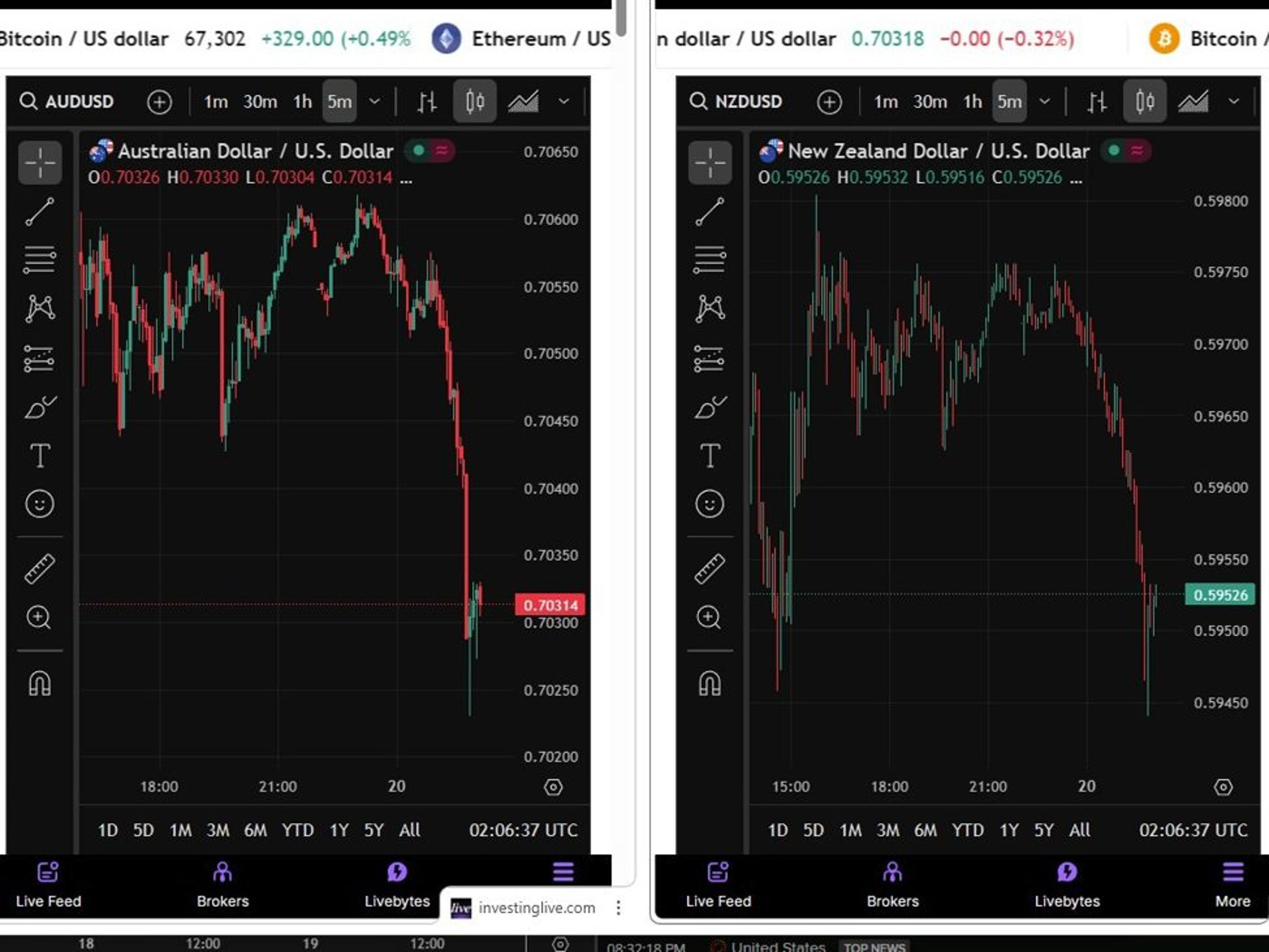

NZD, AUD Fall as RBNZ Says Inflation Returning to Target, No Preset Path

The New Zealand and Australian dollars slipped in Asian trade after the Reserve Bank of New Zealand signaled that inflation is already back within its 2% target band and is expected to stay there for the next year. Governor Adrian Breman emphasized that...

By ForexLive — Feed

News•Feb 20, 2026

USD Gains on Strong US Data Unlikely to Last; Policy Uncertainty, Political Risks to Cap

MUFG’s Derek Halpenny says the U.S. dollar’s recent rally, sparked by stronger‑than‑expected durable‑goods, housing and industrial production data and hawkish Fed minutes, is unlikely to be sustained. While the minutes hinted at a cautious stance on further rate cuts, Halpenny...

By ForexLive — Feed

News•Feb 20, 2026

Shares of Local Oil Explorers Surge on Supply Disruption Fears

Shares of Indian upstream explorers jumped as Brent crude breached $71 per barrel amid renewed US‑Iran tensions and temporary Strait of Hormuz closures. Oil India rose 5.2% and ONGC gained 3.6%, while downstream marketers HPCL and BPCL slipped nearly 5%...

By Economic Times — Markets

News•Feb 20, 2026

IMF Warns Venezuela’s Economy and Humanitarian Situation Is ‘Quite Fragile’

The IMF warned that Venezuela’s economy and humanitarian situation remain “quite fragile,” citing triple‑digit inflation, a sharply depreciating currency and public debt at roughly 180 percent of GDP. The country has seen massive emigration, with about 8 million people leaving since 2014,...

By Al Jazeera – All News (includes Economy)

News•Feb 20, 2026

Japan Inflation Slows to 1.5% in January, Core Measures Ease. What Will the BoJ Think?

Japan’s consumer price index slowed sharply in January, with headline inflation dropping to 1.5% year‑over‑year, the lowest level since March 2022 and below expectations. Core inflation excluding fresh food eased to 2.0% YoY, while the core‑core measure fell to 2.6%,...

By ForexLive — Feed

News•Feb 19, 2026

Philippine Central Bank Cuts Rates in Latest Bid to Support Growth

The Bangko Sentral ng Pilipinas (BSP) lowered its overnight repurchase rate by 25 basis points to 4.25%, marking the ninth cut since August 2024. Inflation remains modest at 2%, comfortably within the 2‑4% target band, while the peso rallied to...

By Nikkei Asia — Economy/Markets

News•Feb 19, 2026

World Briefs | Rwanda Hikes Lending Rate on Higher Inflation

Rwanda’s central bank raised its key lending rate by 50 basis points to 7.25% on Thursday, reacting to a jump in consumer price inflation to 8.9% year‑on‑year in January. The move aims to bring inflation back within the bank’s 2‑8%...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Bank Indonesia Keeps Rates Steady, as Rupiah Weakness Threatens to Delay Easing

Bank Indonesia left its policy rate unchanged at 4.75% as the rupiah continued to weaken amid fiscal‑sustainability concerns and volatile investor sentiment. Moody’s downgraded Indonesia’s credit outlook to negative, reflecting uncertainty over policy direction and transparency. Real‑rate differentials with the...

By ING — THINK Economics

News•Feb 19, 2026

Philippines’ Central Bank Delivers Expected Rate Cut Paired with Uncertain Guidance

The Bangko Sentral ng Pilipinas trimmed its policy rate by 25 basis points to 4.25%, matching market expectations. However, the central bank softened its forward guidance, dropping language that it was nearing the end of easing and emphasizing lingering confidence...

By ING — THINK Economics

News•Feb 18, 2026

Isabel Schnabel: Fiscal Challenges Amid Geopolitical Uncertainty and Ageing Societies

Isabel Schnabel highlighted the euro area’s mounting fiscal pressures, noting that low debt levels often coincide with weak public investment. She examined Germany’s new defence and infrastructure package, showing it can lift GDP but also raise debt ratios under different...

By European Central Bank — Press/Speeches

News•Feb 18, 2026

Dow Jones Industrial Average Gains 200 Points as Fed Minutes Loom and Nvidia Rallies on Meta Deal

The Dow Jones Industrial Average rose about 300 points, or 0.65%, as investors returned to equities ahead of the Federal Reserve’s January minutes. Nvidia surged over 2% after Meta announced an expanded AI‑chip partnership worth tens of billions, reinforcing Nvidia’s...

By FXStreet — News