News•Feb 18, 2026

Five US Policy Shifts Could Reshape Financial Markets

The Trump administration is advancing five domestic policy initiatives that touch credit, housing, monetary policy, corporate governance, and digital‑asset regulation. Proposed credit reforms would tighten loan underwriting, while housing changes could modify the mortgage interest deduction. Monetary officials hint at faster rate hikes and a governance push aims to boost board independence. Finally, a clear digital‑asset framework seeks to legitimize crypto markets and attract fintech investment.

By Project Syndicate — Economics

News•Feb 18, 2026

The 'Ex-America' Trade Is Off to a Roaring Start in 2026

Global equities have surged ahead of the U.S. market in 2026, with the MSCI EAFE up roughly 8% and the MSCI ACWI ex‑U.S. gaining about 8.5% year‑to‑date, while the S&P 500 is down 0.5%. Goldman Sachs notes this is the widest...

By Quartz — Economy/Markets (site-wide feed)

News•Feb 18, 2026

Europe Is Squandering Its Leverage Over China

Europe is losing bargaining power with China as the continent’s growth stalls while Beijing posts a record trade surplus. German Chancellor Friedrich Merz’s upcoming China visit underscores the urgency, with Germany’s 2025 GDP expanding only 0.2% versus a $1.19 trillion Chinese surplus....

By Project Syndicate — Economics

News•Feb 18, 2026

Rupee Rises 5 Paise to Close at 90.67 Against US Dollar

The Indian rupee edged higher, closing at a provisional 90.67 per U.S. dollar, up five paise on the day. The modest gain was driven by fresh foreign fund inflows and a buoyant domestic equity market, which saw the Sensex climb...

By The Hindu BusinessLine – Markets

News•Feb 18, 2026

Westpac: China Must Shift to Proactive Policy in 2026 to Sustain Growth

China met its official 5.0% GDP target in 2025, largely on the back of robust export growth to Asia, Europe and Latin America. Manufacturing investment, particularly in electric vehicles and electronics, remained resilient, while overall fixed‑asset investment fell 3.8% and...

By ForexLive — Feed

News•Feb 18, 2026

Chinese and Indian Tourists to Boost Europe’s Travel Market Amid US Slowdown

The European Travel Commission forecasts a 6.2% rise in international arrivals to Europe this year, driven largely by a surge in Chinese and Indian tourists. Chinese visitor numbers are expected to jump 28% and Indian arrivals 9% compared with 2025,...

By South China Morning Post — Economy

News•Feb 18, 2026

RBNZ Leave Cash Rate on Hold, as Expected

The Reserve Bank of New Zealand kept its official cash rate unchanged at 2.25%, matching market expectations. While inflation stays above the 2% target, slower wage growth and softened demand reduce immediate pressure for further hikes. The RBNZ modestly raised...

By ForexLive — Feed

News•Feb 18, 2026

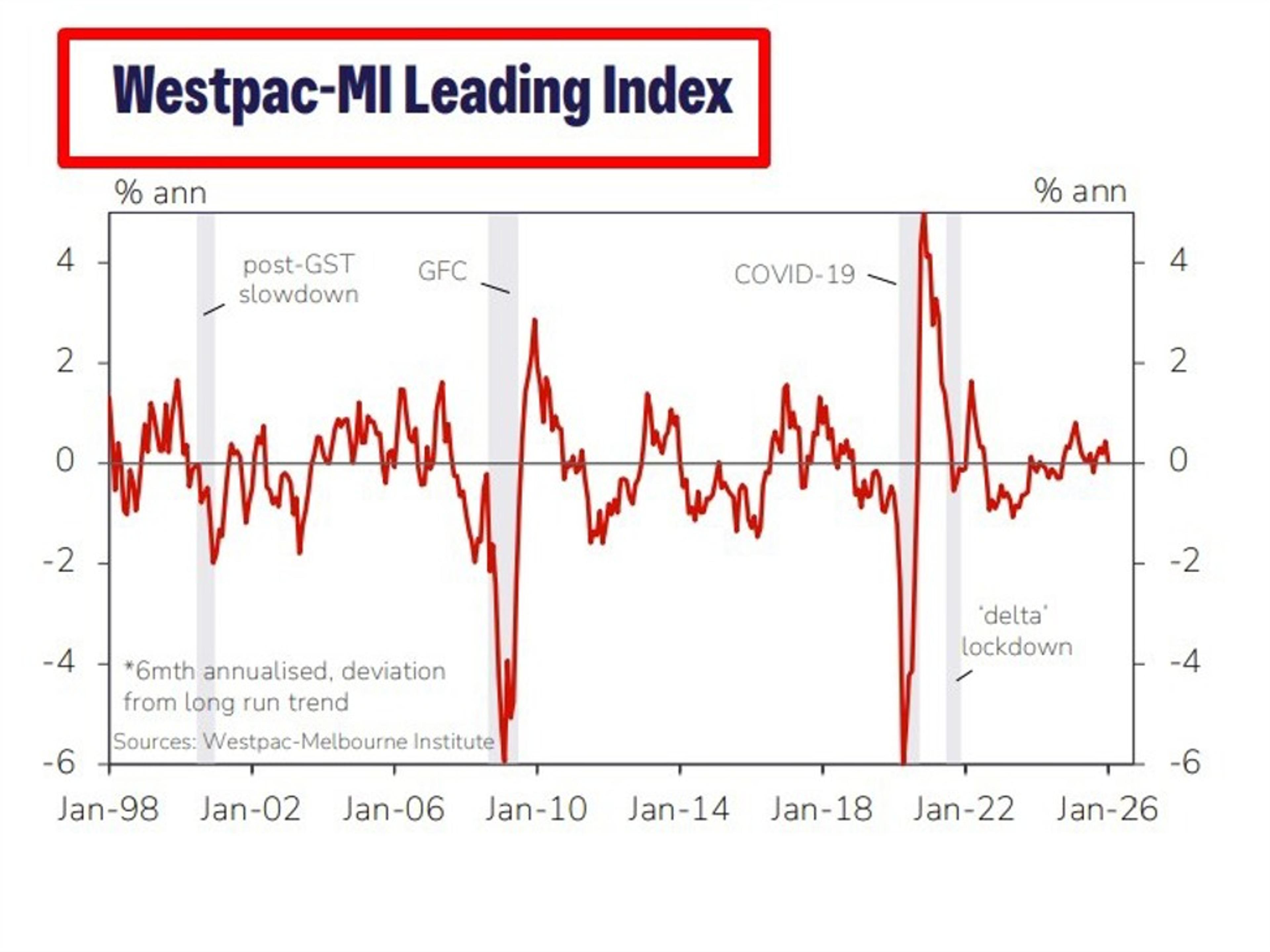

Westpac Leading Index Slows to Near-Flat, Signals Cooling Growth Momentum

Westpac’s Melbourne‑Institute Leading Index barely moved in January, posting a six‑month annualised gain of just +0.02% versus +0.44% in December. The slowdown reflects weakening consumer sentiment and a dip in dwelling approvals, while modest commodity price gains provided limited support....

By ForexLive — Feed

News•Feb 18, 2026

EU Capital Markets Reform Should Focus on Innovation Investment

The Bocconi Institute proposes six pragmatic reforms to close Europe’s “scale‑up gap” and boost venture‑capital financing for innovative firms. Using Dealroom data on 64,500 EU start‑ups, the report shows that VC investment in scale‑ups is under 10% of U.S. levels...

By CEPR — VoxEU

News•Feb 17, 2026

Exclusive: Tiago Da Costa Cardoso Returns to INFINOX as Commercial Director

Tiago da Costa Cardoso has rejoined INFINOX as Commercial Director, returning to the Dubai‑based broker after a stint at Exinity, HFM and XTB. His appointment follows INFINOX’s recent receipt of a UAE Capital Market Authority license, positioning the firm for...

By FX News Group — Feed

News•Feb 17, 2026

Breaking News: Canadian CPI Eases From 3-Month High, USD/CAD Extends Gain...

Canada’s annual CPI slipped to 2.3% in January 2026, easing from a three‑month peak of 2.4% and landing just below market forecasts. The trimmed‑mean core rate fell to 2.4%, the lowest level since April 2021, indicating waning underlying price pressure....

By Myfxbook — Latest Forex News

News•Feb 17, 2026

GBP/JPY Price Forecast: Short-Term Trend Turns Negative Below 210.00 Handle

GBP/JPY slipped below the 210.00 psychological level, trading around 207.28 and marking a near two‑month low. The decline follows weaker UK labour‑market data that has pushed market consensus toward two Bank of England rate cuts this year, with the first...

By FXStreet — News

News•Feb 17, 2026

Conflicting Policies, Confused Investors, and the Weak Dollar

The United States continues to dominate global growth, driven by an AI-fueled expansion, yet its flagship currency is unusually weak. Markets are now pricing U.S. policy uncertainty on par with economies that lack a reserve currency. Conflicting fiscal and monetary...

By Project Syndicate — Economics

News•Feb 17, 2026

USD/JPY Is Looking for Direction Around 153.00 with Key US Data in Focus

USD/JPY is hovering around the 153.00 level as traders await key US data. The pair was rejected at the 153.70 resistance, found support near 152.70, and settled back near 153.00. Weak Japanese Q4 GDP, which fell short of forecasts, kept...

By FXStreet — News

News•Feb 17, 2026

Philip R Lane: Bulgaria and the Euro

Philip R. Lane praised Bulgaria’s smooth euro cash changeover, noting that euros now represent 70 percent of cash in circulation as the dual‑lev/euro period ends on 31 January 2026. The speech highlighted Bulgaria’s new seat at the ECB Governing Council, giving the country a...

By BIS — Press Releases

News•Feb 17, 2026

Christine Lagarde: Preparing for Geoeconomic Fragmentation

European Central Bank President Christine Lagarde warned that deepening supply‑chain interdependence now poses a security risk, prompting Europe to shift toward strategic autonomy. She outlined three policy levers—diversification, indispensability and independence—to reduce reliance on distant suppliers, especially in electronics, chemicals...

By BIS — Press Releases

News•Feb 17, 2026

Stablecoins Gain Ground for Paychecks and Daily Spending: BVNK Report

A BVNK‑commissioned YouGov survey of 4,658 crypto‑savvy adults across 15 countries shows that 39% receive income in stablecoins and 27% use them for everyday payments, attracted by lower fees and faster cross‑border transfers. Respondents hold an average of $200 in...

By Cointelegraph

News•Feb 17, 2026

BofA Survey Flags Dollar Bearish Bets at over a Decade High. Here's What It Means for Bitcoin

Bank of America’s February survey shows investor exposure to the U.S. dollar is at its most bearish since early 2012, marking a record underweight stance. Historically, a weaker dollar has acted as a bullish tailwind for bitcoin, but since early...

By CoinDesk

News•Feb 17, 2026

US Dollar Positioning Hits Record Underweight in Bank of America Survey

Bank of America’s FX sentiment survey shows net US dollar exposure at a record underweight, the most negative level since the survey began in January 2012. Short positions have surged to extreme levels, surpassing the lows recorded in April 2023....

By ForexLive — Feed

News•Feb 17, 2026

BOJ Likely to Raise Rates 25bp April, Former Board Member Says. Gradual Move Toward 1.25%

Former Bank of Japan board member Seiji Adachi says the central bank is most likely to raise rates in April rather than March, waiting for clearer wage and inflation data. The BOJ’s December hike to 0.75% marked the first move...

By ForexLive — Feed

News•Feb 16, 2026

ICYMI: China to Remove Tariffs on Imports From 53 African Nations From May 1

China will eliminate tariffs on imports from 53 African nations starting May 1, 2026, expanding the preferential regime beyond the continent’s least‑developed economies. The zero‑tariff policy applies to every African country that maintains diplomatic ties with Beijing and is paired with a...

By ForexLive — Feed

News•Feb 16, 2026

FX Option Expiries for 17 February 10am New York Cut

Investors received the FX option expiry list for 17 February 10 am New York cut, detailing strike levels and notional amounts across major pairs. EUR/USD options total roughly €2.6 billion at strikes 1.1900, 1.2000 and 1.2025. USD/JPY carries about $2.86 billion at 156.00 and 151.00,...

By ForexLive — Feed

News•Feb 16, 2026

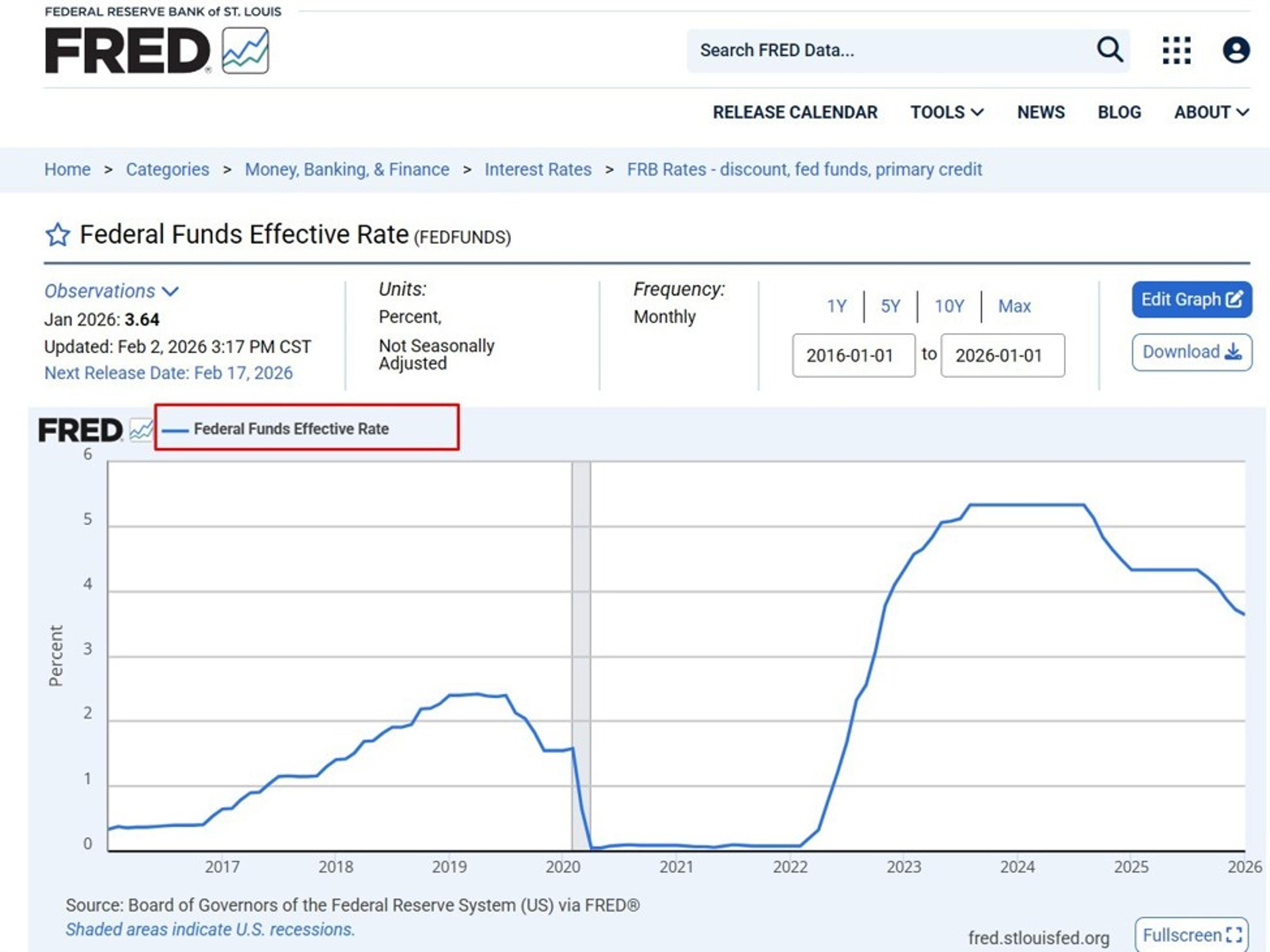

Soft Landing Looks More Plausible, but the Fed Isn’t Ready to Call It Done.

U.S. macro data are aligning for a potential soft landing, with core CPI easing to 2.5% year‑over‑year and unemployment slipping to 4.3% in January. While inflation is moving toward the Federal Reserve’s 2% goal, the Fed’s preferred gauge remains near...

By ForexLive — Feed

News•Feb 16, 2026

Germany‘s Central Bank President Touts Stablecoin and CBDC Benefits for EU

Bundesbank president Joachim Nagel endorsed the creation of a euro‑pegged retail CBDC and euro‑denominated stablecoins, arguing they would strengthen Europe’s payment independence. He highlighted that a wholesale CBDC would allow programmable payments in central‑bank money. Nagel warned that a surge...

By Cointelegraph

News•Feb 16, 2026

AUD/USD Flat Amid US Dollar Strength, RBA Minutes Eyed

The Australian dollar held near 0.7072 against the U.S. dollar on Monday as a firmer greenback limited upside. The pair slipped from three‑year highs of 0.7147 after U.S. CPI showed inflation easing to 2.4% and unemployment edging down to 4.3%,...

By FXStreet — News

News•Feb 16, 2026

Plus500 CEO, CFO, CMO to Sell 1.5M Shares

Plus500’s chief executive, chief financial officer and chief marketing officer announced the sale of 1,500,000 ordinary shares, representing roughly 2.14% of the company’s issued capital. The transaction will be executed on the secondary market through Goldman Sachs International, with Panmure...

By FX News Group — Feed

News•Feb 16, 2026

RBI Issues Draft Norms for Reporting on Forex Derivative Transactions Involving Rupee

The Reserve Bank of India released draft norms requiring Authorised Dealer Category‑I banks to report all rupee‑denominated foreign‑exchange derivative transactions undertaken by their related parties worldwide. This follows earlier steps that mandated primary dealers and banks to disclose rupee interest‑rate...

By The Economic Times – Markets

News•Feb 16, 2026

India’s Game-Changing Digital Money Model

India’s Unified Payments Interface (UPI) has become the world’s largest real‑time payments network, handling billions of free transactions daily. Built on a public, open‑source infrastructure managed by the National Payments Corporation of India, UPI lets banks, fintechs and merchants interoperate...

By Project Syndicate — Economics

News•Feb 13, 2026

US Supreme Court Says Next Friday Will Be a Decision Day

The U.S. Supreme Court announced three decision days—Feb. 20, 24, and 25—when it will issue opinions, though it has not disclosed which cases will be decided. Lawmakers in the House have voted against new tariffs and the Senate is expected...

By ForexLive — Feed

News•Feb 13, 2026

Fed's Goolsbee Sees Encouraging and Concerning Parts of the CPI Report

Chicago Fed President Austan Goolsbee highlighted a mixed CPI report, noting a modest 0.2% month‑over‑month rise in headline inflation and a steady 2.5% year‑over‑year rate. While core inflation matched expectations, services inflation remains elevated, keeping overall inflation around 3% and...

By ForexLive — Feed

News•Feb 13, 2026

Stable Money Leads Gold & Silver ETF Surge on ONDC as Investors Turn to Safe, Regulated Products

Stable Money reported record transaction volumes in gold and silver ETFs as Indian investors gravitate toward SEBI‑regulated products amid near‑record precious‑metal prices. The platform now handles over 95% of mutual‑fund trades on the Open Network for Digital Commerce (ONDC), reflecting...

By Business Standard — Economy/Markets

News•Feb 13, 2026

THINK Ahead: Green Shoots or Just Weeds? What This Week’s Data Signals

Economists spot early signs of recovery in the US labor market, with private payrolls accelerating, yet underlying job quality remains thin. The Federal Reserve is expected to deliver two 25‑basis‑point cuts, likely in June and September, as inflation stays modest....

By ING — THINK Economics

News•Feb 13, 2026

US Inflation Details Offer Room for Deeper Fed Rate Cuts

U.S. consumer price inflation in January eased to 0.2% month‑on‑month, with core CPI matching expectations at 0.3% and both headline and core year‑on‑year rates falling to four‑year lows of 2.4% and 2.5%. Goods prices excluding food and energy were flat,...

By ING — THINK Economics

News•Feb 13, 2026

EUR/GBP Bounces From Daily Lows as Eurozone GDP Supports the Euro

Eurozone preliminary GDP showed a 0.3 % QoQ rise in Q4 2025, matching expectations and nudging annual growth to 1.4 %. The United Kingdom posted a weaker 0.1 % QoQ increase, missing forecasts and pulling annual growth to 1 %. The data lifted the...

By FXStreet — News

News•Feb 13, 2026

US CPI Data Expected to Show a Mild Decline in Inflation in January

U.S. consumer price index data for January showed annual inflation easing to 2.4% from 2.7% in December, missing the 2.5% market forecast. Monthly CPI rose 0.2% and core CPI remained at 2.5% year‑over‑year, matching expectations. The softer headline number nudged...

By FXStreet — News

News•Feb 13, 2026

Silver Price Forecasts: XAG/USD Fails to Find Acceptance Above $79.00

Silver (XAG/USD) slipped to $77.35 on Friday, unable to sustain a breakout above the $79 resistance level. The metal is trapped below the 50‑period SMA at $81, reinforcing a bearish technical bias. A firm US Dollar Index and cautious market...

By FXStreet — News

News•Feb 13, 2026

USD/CAD: Sideways Range with Tariff Risks – Rabobank

Rabobank analysts Molly Schwartz and Christian Lawrence project the USD/CAD pair to remain largely sideways throughout 2026, confined to a 1.36‑1.41 band. The outlook is driven by persistent US‑Canada trade tensions, a looming USMCA review, and a weakening U.S. dollar...

By FXStreet — News

News•Feb 13, 2026

Polish Disinflation Continues Despite Upside Surprise in January CPI

Poland’s January flash CPI showed headline inflation at 2.2% YoY, modestly above the 1.9% consensus but still under the NBP’s 2.5% ± 1‑point target. The decline was driven by a 7.1% drop in gasoline prices, while food prices held steady at 2.4%...

By ING — THINK Economics

News•Feb 13, 2026

US Dollar Credit Supply: Primary Market Shows Strong Start to 2026

US dollar primary market began 2026 with robust corporate issuance, totaling $56 bn in January, driven largely by technology, media and telecom (TMT) firms contributing $24 bn. Banks led the financial sector, printing $134 bn of senior non‑preferred bonds, a $20 bn year‑to‑date increase...

By ING — THINK Economics

News•Feb 13, 2026

Rupee Closes Nearly Flat, Modest Depreciation Bias Lingers

India’s rupee ended Friday essentially unchanged, closing at 90.6350 per dollar, a slight dip from the prior session. The currency faced pressure from weak domestic equities, elevated interbank dollar demand, and maturing non‑deliverable forward contracts, while the Reserve Bank of...

By The Economic Times – Markets

News•Feb 13, 2026

We’re Trimming Our 2026 Romania Growth Forecast After a Bumpy End to 2025

Romania’s economy entered recession in early 2024 and posted a 1.9% quarterly contraction in Q4 2025, the steepest drop since 2012. Revised data also turned Q1 2025 growth negative, prompting analysts to slash the 2026 GDP outlook from 1.4% to 0.6%. The...

By ING — THINK Economics

News•Feb 13, 2026

Poland’s Economy Expanded by 4%YoY in the Final Quarter of 2025

Poland’s economy posted a 4.0% year‑on‑year increase in the fourth quarter of 2025, outpacing the 3.8% growth recorded in Q3. Quarterly expansion accelerated to 1.0% from 0.9% in the prior period, driven primarily by a surge in private consumption that...

By ING — THINK Economics

News•Feb 13, 2026

Turkey’s Current Account Deficit Remains on a Widening Track

Turkey posted a December current‑account deficit of $7.3 bn, well above the $5.3 bn forecast, pushing the 12‑month rolling deficit to $25.2 bn (about 1.8 % of GDP). The gap widened mainly because the trade balance slipped to a $‑7.4 bn deficit and primary‑income balances...

By ING — THINK Economics

News•Feb 13, 2026

Dollar Rises Against Dong on Black Market

The Vietnamese dollar rose 0.5% on the black market to VND 26,547 per U.S. dollar, while the official Vietcombank rate stayed at VND 26,160. The State Bank of Vietnam trimmed its reference rate marginally to VND 25,049. Globally, the greenback is set for...

By VNExpress – Companies (subset)

News•Feb 13, 2026

Rates Spark: Dutch Pension Funds May Prepare Early for 2027 Transitions

Almost €1 trillion of Dutch pension assets are slated to transition by 2027, but early hedge rebalancing has already begun. Smaller funds moved interest‑rate hedges in December 2025, while larger players like PMT and PFZW are timing their flows for the first...

By ING — THINK Economics

News•Feb 13, 2026

Asia Week Ahead: Key Growth Data From Japan

Japan is set to publish key macro data next week, including Q4 2025 GDP, export figures, and inflation. Analysts forecast a modest 0.3% quarter‑on‑quarter GDP rebound after a 0.6% contraction, driven by recovering construction and strong semiconductor exports. Inflation is expected...

By ING — THINK Economics

News•Feb 13, 2026

Appointment to the Monetary Policy Board

The Reserve Bank of Australia announced that Professor Bruce Preston has been appointed to the Monetary Policy Board, effective immediately. Preston brings a distinguished academic record and extensive experience in public‑policy economics. Governor Michele Bullock also thanked outgoing board member...

By Reserve Bank of Australia — Media Releases

News•Feb 12, 2026

Release: Market Participants Survey

On November 9 2026 the Bank of Canada published its quarterly Market Participants Survey, a systematic outreach to a broad cross‑section of financial‑market actors. The survey solicits expectations on key macro‑economic indicators such as inflation, growth, and exchange rates, as well as...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada’s Governing Council released a detailed summary of its monetary‑policy deliberations for the decision announced two weeks ago. The Council kept the policy interest rate steady at 4.75%, citing modest progress toward its 2% inflation target. Officials...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Interest Rate Announcement

On December 9, 2026 the Bank of Canada will release its next overnight rate target, one of eight scheduled policy announcements each year. The press release will outline the economic factors shaping the decision, including inflation trends, labour market conditions, and global...

By Bank of Canada — RSS (site hub)