🎯Today's Finance Pulse

Updated 1h agoWhat's happening: ESMA fines REGIS‑TR €1.374 million for EMIR and SFTR breaches

The European Securities and Markets Authority imposed a €1.374 million penalty on trade repository REGIS‑TR after finding seven breaches of the European Market Infrastructure Regulation and the Securities Financing Transactions Regulation. The sanction represents the first enforcement action involving SFTR violations and is the highest fine ever levied on a trade repository.

Also developing:

By the numbers: Novartis sells 70.68% stake in Novartis India for ₹1,446 crore

Deals•Feb 20, 2026

AlayaCare Secures $50M Growth Capital Facility From CIBC Innovation Banking

AlayaCare Inc., a Montreal‑based provider of home and community care software, secured a $50 million growth‑capital facility from CIBC Innovation Banking. The funding will fuel the company's expansion and support strategic mergers and acquisitions. The partnership builds on a relationship dating back to 2014.

FinSMEs

Social•Feb 20, 2026

Accounting Rules Reveal Shutdown’s Massive Real GDP Loss

A fun(?) 🧵 on how nerdy government accounting rules had a big impact on Q4 GDP. And how they reflect how wasteful the 43-day government shutdown was. TL;DR: Small reduction in nominal federal spending in Q4. But a big decline in...

By Jason Furman

Social•Feb 20, 2026

Cooling Volatility Triggers Machine Re‑Leverage, Expect Upward Grind

Volatility is cooling. 30D realized volatility (yellow line) just rolled over and is now below 90D (blue line). When short-term vol drops, the machines re-lever. Vol control funds start buying. Right now, the signal says grind higher until proven otherwise.

By Kurt S. Altrichter

Deals•Feb 20, 2026

Slide Insurance Company Secures $320M Cat Bond Issuance in Purple Re 2026-1

Slide Insurance Company has priced its new Purple Re Ltd. (Series 2026-1) catastrophe bond, upsizing the issuance to $320 million of fully-collateralized reinsurance. The Bermuda‑based special purpose insurer Purple Re Ltd. will issue the notes at a 6.5% risk interest spread,...

Artemis (ILS/cat bonds)

Deals•Feb 20, 2026

Lloyds Banking Group Extends £200M Revolving Credit Facility to Sovereign Network Group

Lloyds Banking Group has provided a £200 million revolving credit facility to Sovereign Network Group (SNG), a UK housing association formed in 2023. The facility aims to accelerate construction of new social homes and fund energy‑efficient upgrades, building on a prior...

Crowdfund Insider

Deals•Feb 20, 2026

Euler Motors to Raise $25M in Debt Financing Led by BlackSoil Capital

Delhi-based electric-vehicle startup Euler Motors announced a planned debt raise of up to Rs 220 crore ($25 million) in one or more tranches. The first tranche of Rs 105 crore ($11.6 million) will be led by BlackSoil Capital with participation from Trifecta Venture. Proceeds will fund...

Entrackr

Deals•Feb 20, 2026

Queensland Government Invests $15M in Austral Resources Australia to Revive Rocklands Copper Plant

The Queensland government announced a $15 million investment in Austral Resources Australia to refurbish the Rocklands sulphide processing plant, targeting a restart of copper production by 2027. The funding will support the plant's refurbishment and the company's copper vision.

Mining Magazine

Deals•Feb 20, 2026

Phoenix Tailings Secures $40.2M in Series B-3 Funding Led by Olive Tree Capital

Phoenix Tailings, a rare‑earth metals producer, raised $40.2 million in a Series B‑3 amplification round. The financing included $30.2 million of equity led by Olive Tree Capital and $10 million of venture debt from Nomura, with strategic partners Traxys, Eni Next and Geodesic Alliance Fund...

FinSMEs

Deals•Feb 20, 2026

Allstate Raises $1.2bn Target for Sanders Re III & IV Catastrophe Bonds

Allstate announced it has increased its target for the dual Sanders Re III and Sanders Re IV catastrophe bond issuances to $1.2 billion, seeking $600 million of reinsurance limit per series. The bonds, issued by Sanders Re III Ltd. and Sanders Re...

Artemis (ILS/cat bonds)

Video•Feb 20, 2026

WMT Downgrade, DECK Upgrade, TXRH Double Miss in Earnings

Texas Roadhouse (TXRH) gained Friday morning despite posting a double miss in earnings. HSBC downgraded Walmart (WMT) to hold from buy over growth concerns. Deckers (DECK) stepped up thanks to an upgrade from Argus. Diane King Hall talks about the...

By Schwab Network (ex‑TD Ameritrade Network)

News•Feb 20, 2026

Earnings Season Made It Clear: Digitize Supply Chains or Fall Behind

Earnings season revealed that digitizing supply chains has shifted from a cost‑saving exercise to a strategic imperative. Executives at FedEx, Caterpillar, Dollar General and others highlighted upstream capex on supplier integration, AI‑enabled orchestration and real‑time visibility as growth enablers. The...

By PYMNTS

News•Feb 20, 2026

RWA Issuers Prioritize Capital Formation over Liquidity, According to Brickken Survey

A Brickken Q4 2025 survey shows most real‑world‑asset issuers use tokenization primarily to raise capital rather than to secure secondary‑market liquidity. 53.8% cite capital formation as the main driver, while only 15.4% prioritize liquidity, and 69.2% of respondents are already live...

By CoinDesk

News•Feb 20, 2026

Worldline Scales One Commerce Across Europe to Support Cross-Border Sales

Worldline is rolling out its One Commerce omnichannel retail platform beyond the United Kingdom, showcasing it at the EuroShop trade fair in Germany from Feb. 22‑26. The solution lets merchants manage in‑store and online payments, integrate new payment methods, and...

By PYMNTS

News•Feb 20, 2026

Upcoming Changes to the Euribor Panel

The European Securities and Markets Authority (ESMA) announced that Barclays Bank PLC will withdraw from the Euribor panel, with its final contribution date set for 27 February 2026. ESMA and the Euribor College of Supervisors assessed the impact and concluded...

By ESMA – Press

News•Feb 20, 2026

ESMA Publishes List of Supplementary Deferrals for Sovereign Bonds

The European Securities and Markets Authority (ESMA) and most EU national competent authorities have released a list of supplementary deferrals that extend the MiFIR transparency regime for sovereign bonds. The new rule permits the omission of volume publication for medium‑size...

By ESMA – Press

News•Feb 20, 2026

ESMA Sanctions Regis-TR for Serious Breaches of Organisational Obligations

The European Securities and Markets Authority (ESMA) has imposed a €1.374 million fine on trade repository REGIS‑TR for seven breaches of the European Market Infrastructure Regulation (EMIR) and the Securities Financing Transactions Regulation (SFTR). This marks the first enforcement action involving...

By ESMA – Press

News•Feb 20, 2026

ESMA Publishes a Supervisory Briefing on the AAR Representativeness Obligation

The European Securities and Markets Authority (ESMA) has released a supervisory briefing outlining how counterparties must meet the active‑account requirement (AAR) representativeness obligation. The document details the identification of relevant derivative sub‑categories, reporting procedures, and provides a compliance example. ESMA...

By ESMA – Press

News•Feb 20, 2026

ESMA Publishes Statement Supporting the Smooth Implementation of the Listing Act – Simplifying Prospectus Compliance for Issuers

The European Securities and Markets Authority (ESMA) issued a statement to facilitate the rollout of the EU Listing Act, offering practical guidance on the revised prospectus framework. It confirms that registration documents approved or filed up to 4 June 2026 remain valid...

By ESMA – Press

News•Feb 20, 2026

ESMA Seeks Input to Streamline and Simplify Its Market Abuse Guidelines

ESMA has opened a consultation to amend its Market Abuse Regulation (MAR) guidelines on delayed disclosure of inside information, aligning them with the EU Listing Act. From June 2026 issuers will no longer need to disclose immediately information tied to...

By ESMA – Press

News•Feb 20, 2026

Tribunal Upholds Bans and Fines for Reckless Adviser and Fund Manager

The Upper Tribunal upheld the FCA's bans on Stephen Joseph Burdett and James Paul Goodchild, senior advisers at Synergy Wealth and Westbury Private Clients, for recklessly exposing pension holders to unsuitable, high‑risk investments. The pair were fined £265,071 and £47,600...

By UK FCA – News

News•Feb 20, 2026

Statement on Notifications Relating to Admissions to Trading and Recent Changes to the UK Listing Rules

On 19 January 2026 the UK’s Public Offers and Admissions to Trading Regulations (POATRs) came into force, requiring issuers to notify a Regulatory Information Service (RIS) within 60 days of any admission to trading. Overlapping provisions in the UK Listing Rules (UKLR) have...

By UK FCA – News

News•Feb 20, 2026

JSW Infra to Issue Shares to Meet Minimum Public Stake Norm

JSW Infrastructure approved an equity raise of up to 25 crore shares, valued at roughly ₹6,325 crore, to satisfy SEBI’s requirement of a 25% public shareholding within three years of its October 2023 listing. The proceeds will back a ₹39,000 crore capital‑expenditure programme that...

By The Hindu BusinessLine – Markets

News•Feb 20, 2026

Jim Cramer's Top 10 Things to Watch in the Stock Market Friday

Jim Cramer highlighted ten market catalysts for Friday, Feb 20, ranging from macro data to individual stocks. Weak Q4 GDP growth at 1.4% pushed futures lower, while Texas Roadhouse rallied over 3% on a strong Q1 outlook. GE Aerospace received a...

By CNBC – US Top News & Analysis

Deals•Feb 20, 2026

Omnitech Engineering to Float Rs 583 Cr IPO on Feb 25

Omnitech Engineering announced an IPO to raise Rs 583 crore, with a price band of Rs 216‑227 per share. The offering includes a fresh issue of Rs 418 crore and an offer‑for‑sale of Rs 165 crore, open to the public from Feb 25 to Feb 27, with anchor bidding...

The Economic Times (India) – RSS hub

Deals•Feb 20, 2026

C3ntro Telecom Secures Syndicated DFI Financing From PROPARCO and DEG for Project TIKVA

C3ntro Telecom announced it has secured syndicated development finance institution (DFI) financing from PROPARCO and DEG (KfW Group) to fund its 2,700‑km cross‑border fiber network project, TIKVA. The financing terms were not disclosed, and the deal was announced on February...

Business Wire — Executive Appointments

Deals•Feb 20, 2026

Novartis to Sell 70.68% Stake in Novartis India to Consortium for ₹1,446 Crore

Novartis AG announced the sale of its 70.68% stake in Novartis India Ltd. to a consortium of WaveRise Investments, ChrysCapital Fund X and Two Infinity Partners for ₹1,446 crore. The share purchase agreement was signed on 19 February 2026, concluding...

The Hindu BusinessLine — Economy/Markets

Deals•Feb 20, 2026

Arif Habib Consortium to Acquire Full Control of Pakistan International Airlines

Arif Habib consortium announced plans to acquire full control of Pakistan International Airlines (PIA), taking the airline private. The terms of the transaction were not disclosed.

ch-aviation News

Deals•Feb 20, 2026

Manilam Industries Announces IPO with Price Band and Subscription Details

Manilam Industries has filed for an initial public offering, releasing details on the global minimum price (GMP), price band, and subscription process. The IPO is slated for the near term, and investors can review the offering particulars on the stock...

The Economic Times (India) – RSS hub

Deals•Feb 20, 2026

Eurazeo Completes Exit of Minority Stake in Ex Nihilo to L Catterton

Eurazeo has completed the sale of its minority stake in the Paris‑based luxury fragrance house Ex Nihilo to private equity firm L Catterton. The transaction, announced on February 20, 2026, marks Eurazeo’s exit from the brand. Deal value was not...

PE Hub

Deals•Feb 20, 2026

Blue Owl Capital Provides Debt Financing for CoreWeave Data Center

Blue Owl Capital arranged a debt financing package for CoreWeave to fund its new data center, announced on Feb. 20, 2026. The loan terms were not disclosed, and the financing was structured without selling the debt to external lenders. The...

Business Insider — RSS (site-wide)

Deals•Feb 20, 2026

Stone Point Capital Invests in UK Wealth Management Advisor Amber River

Stone Point Capital has invested in Amber River, an independent wealth management advice firm based in the UK. The terms of the investment, including the amount and round type, were not disclosed.

PE Hub

Video•Feb 19, 2026

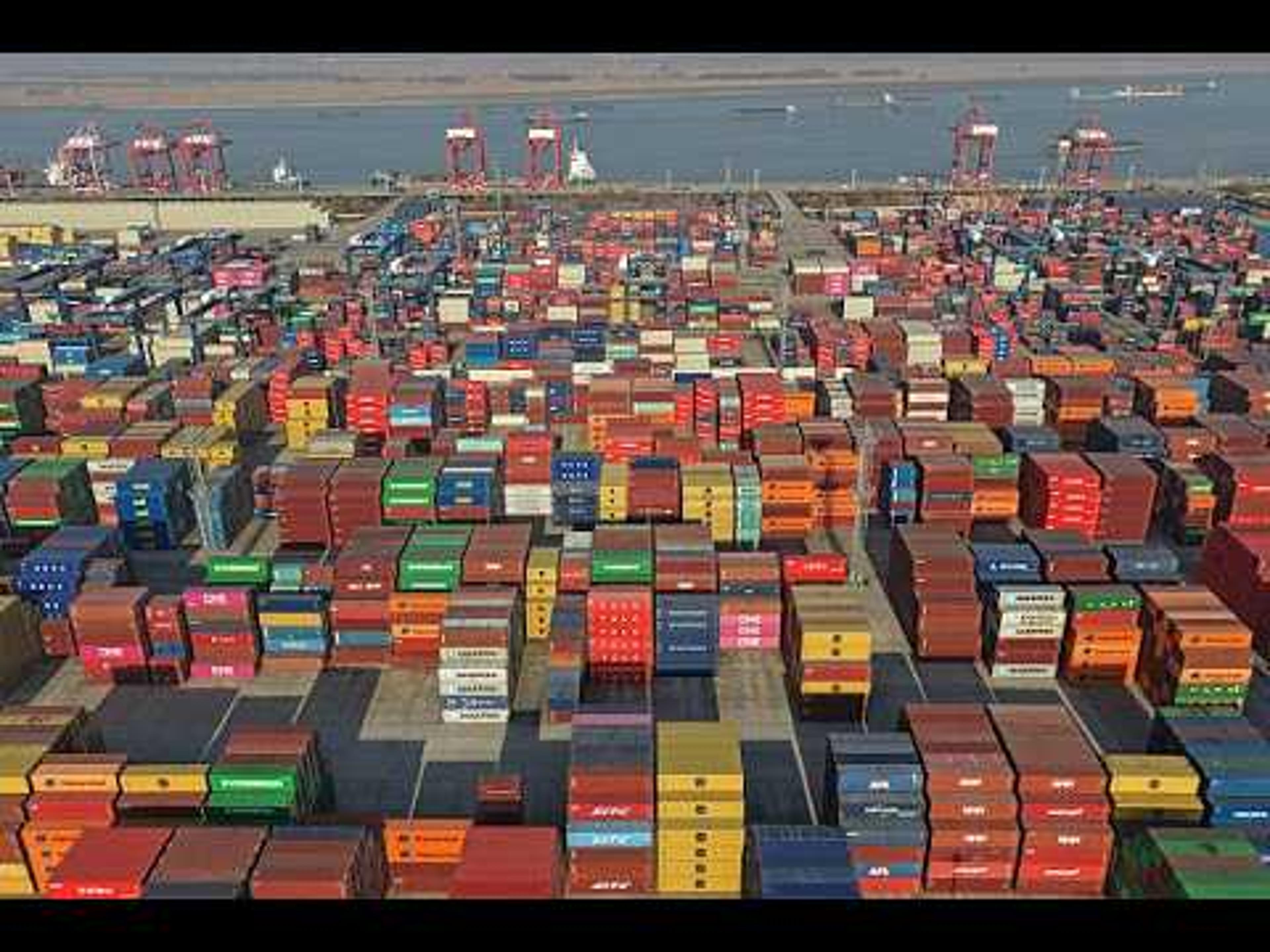

US Runs Annual Trade Deficit Up to $901 Billion, One of Biggest Since 1960

U.S. trade data released this week showed the annual deficit expanding to $901 billion, the widest gap since the early 1960s. After a brief narrowing in the first half of last year, imports surged in the second half, pushing the balance...

By Bloomberg Television

Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices...

By Bloomberg Television

Video•Feb 19, 2026

Stocks Slide as Oil Spikes on US–Iran Tension | Closing Bell

The closing bell showed U.S. equities slipping as oil prices spiked on renewed U.S.–Iran tensions. The S&P 500 and Nasdaq each fell roughly 0.3%, while the Russell 2000 managed a modest gain, underscoring the market’s mixed reaction to geopolitical risk. Energy‑related concerns lifted...

By Bloomberg Television

Video•Feb 19, 2026

Figma Gains on Strong Growth Outlook that Eases AI Fears

Figma’s latest earnings call highlighted a bullish growth outlook that directly counters lingering industry anxieties about artificial‑intelligence disruptions. The company emphasized that as AI improves, its own product suite becomes more powerful, positioning the design platform to benefit rather than...

By Bloomberg Television

Video•Feb 19, 2026

Amazon Dethrones Walmart

The video highlights that Amazon finally eclipsed Walmart in total sales for 2025, reporting $717 billion versus Walmart’s $713.2 billion, cementing a shift from the traditional Walmart‑Target rivalry to a direct Amazon‑Walmart showdown. Analysts note Walmart’s strategic pivot toward technology: a $40 billion free‑cash‑flow...

By Yahoo Finance

Video•Feb 19, 2026

The Capitalism No One Sees | Jason Hsu on What Investors Miss About China

In this episode of Excess Returns, Jason Hsu returns for a wide-ranging conversation on China’s economy, the global AI race, emerging markets, factor investing, and what the next phase of globalization could mean for U.S. investors. We explore how China’s...

By Excess Returns

Video•Feb 19, 2026

Bloomberg Surveillance 2/19/2026

Jonathan Ferro, Lisa Abramowicz and Annmarie Hordern speak daily with leaders and decision makers from Wall Street to Washington and beyond. No other program better positions investors and executives for the trading day. Chapters: 00:00:00 - Bloomberg Surveillance starts 00:03:45 - Max Kettner,...

By Bloomberg Markets and Finance

Video•Feb 19, 2026

'The Markets Are Fine but the Gyrations Under the Hood Have Become a Bit Unnerving': Basinger

The interview with Craig Bassinger, Chief Market Strategist at Purpose Investments, centered on how AI‑driven hype is unsettling equity markets despite the S&P 500 hovering near all‑time highs. Bassinger warned that headlines suggesting AI will upend industries—from wealth services to trucking—have sparked...

By BNN Bloomberg

Video•Feb 19, 2026

Seeking Resilient Income and Capital Growth with Dunedin Income Growth Investment Trust

Jeremy Naylor is joined by Fund Manager Ben Ritchie to discuss Dunedin Income Growth’s differentiated approach to growing a stable income. The Aberdeen managed Dunedin Income Growth Investment Trust has grown or maintained its dividend for over 40 years and currently...

By UK Investor Magazine