GLOBAL ECONOMY PULSE

Friday, February 20, 2026

Market Intelligence for Global Economy Professionals

🎯 Today's Global Economy PulseUpdated 1h ago

What's happening: US inflation remains entrenched despite Fed optimism

Federal Reserve January FOMC minutes confirm that price pressures persist in the United States. The core consumer‑price index rose 0.3% month‑over‑month, keeping annual inflation above the Fed’s 2% target, and policymakers see limited room for further easing.

🚀 Top Global Economy Headlines

Brazil Imposes Anti-Dumping Duties on Chinese Steel

China accounted for 64% of rolled steel imports in 2025.

Just Auto

US-India Trade Marathon Eyes April Finish Line

India and the United States are set to operationalise an interim trade agreement in April, Union Commerce Minister Piyush Goyal said on Friday. Negotiators from both countries will meet in the US from February 23 for three days to finalise the legal text.

The Economic Times (India) – Economy

Economic Factors and Themes to Be Mindful Of

The medium term is expected to be shaped by diverging central bank policies rising geopolitical risks and shifting capital flows Trinh Ha market analyst at Exness Investment Bank discussed with VIR s Nha Phuong Vietnam s growth outlook policy priorities and key investment themes

Vietnam Investment Review (VIR)

Southeast Asia Braces for 'Increasing Divergence' After Mixed 2025 Growth

Nikkei Asia – Economy

India Sets ₹25,000 Crore Export Engine in Motion as Goyal Launches Plan

India is stepping onto the global trade stage with a robust Export Promotion Mission aimed at revolutionising its outbound trade. This initiative seeks to ease the path for smaller companies, making exporting more straightforward and accessible. With a sharp focus on adapting to shifting global trade trends, this six-year program will equip Indian enterprises to thrive in diverse markets.

The Economic Times (India) – Economy

💬 Top Global Economy Social Posts

Thread by @Global_markets_investor

🚨US market concentration BUBBLE in one chart: The top 10 US stocks make up a record 40% of the S&P 500 market value. At the same time, the weight of the largest stock in the S&P 500 relative to the 75th percentile stock is ~770x, an all-time high.👇 https://globalmarketsinvestor.beehiiv.com/p/the-us-stock-market-has-peaked

by Global Markets Investor (newsletter author)•

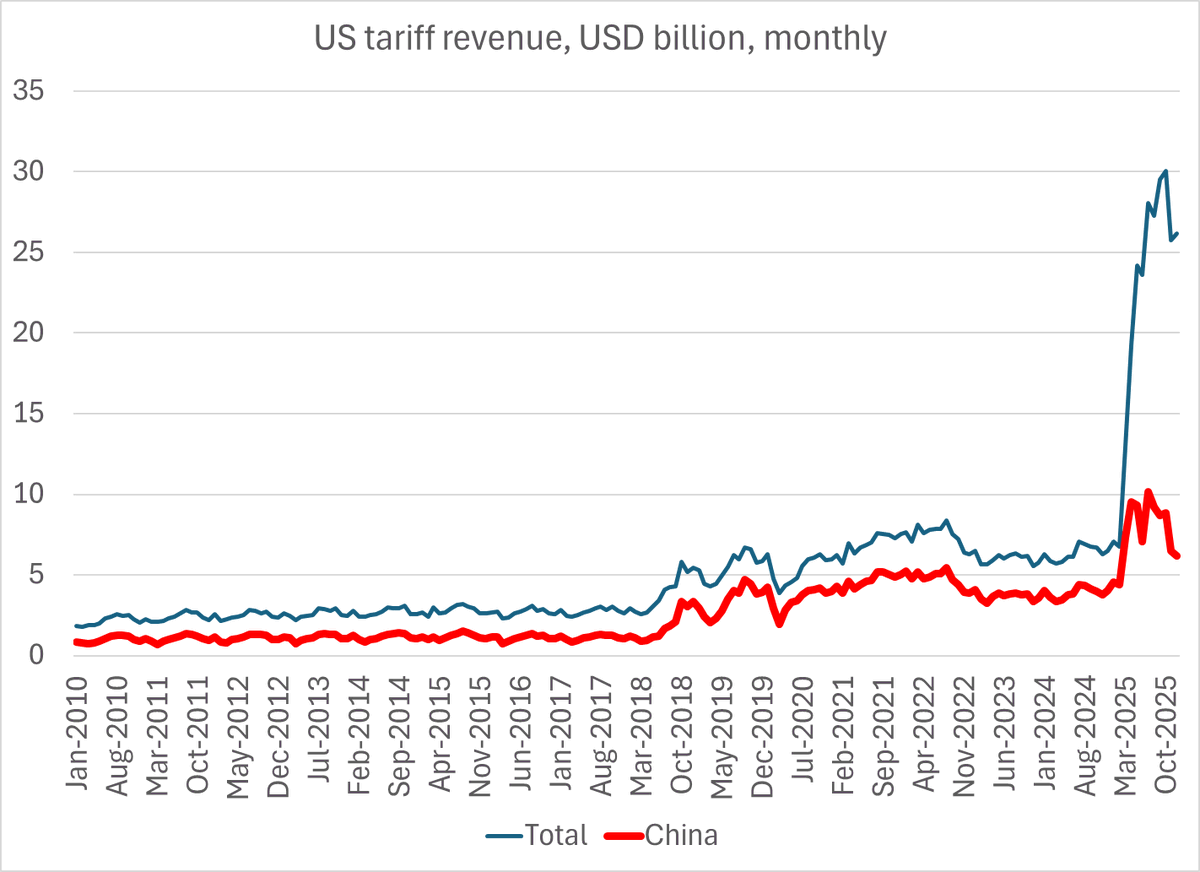

Tweet by @Brad_Setser

The impact of the "Busan" deal is now in the trade data -- the US clearly gave up a bit of tariff revenue (lowering the tariff on China) for a bit of supply chain peace, and the prospect of renewed 'bean exports 1/2 https://t.co/I6hpxMruNO

by Brad Setser•

Where's The Evidence That AI Increases Productivity?

IT productivity researcher Erik Brynjolfsson writes in the Financial Times that he's finally found evidence AI is impacting America's economy. This week America's Bureau of Labor Statistics showed a 403,000 drop in 2025's payroll growth — while real GDP "remained robust, including a 3.7% growth rate in the fourth quarter." This decoupling — maintaining high output with significantly lower labour input — is the hallmark of productivity growth. My own updated analysis suggests a US productivity increase of roughly 2.7% for 2025. This is a near doubling from the sluggish 1.4% annual average that characterised the past decade... The updated 2025 US data suggests we are now transitioning out of this investment phase into a harvest phase where those earlier efforts begin to manifest as measurable output. Micro-level evidence further supports this structural shift. In our work on the employment effects of AI last year, Bharat Chandar, Ruyu Chen and I identified a cooling in entry-level hiring within AI-exposed sectors, where recruitment for junior roles declined by roughly 16% while those who used AI to augment skills saw growing employment. This suggests companies are beginning to use AI for some codified, entry-level tasks. Or, AI "isn't really stealing jobs yet," according to employment policy analyst Will Raderman (from the American think tank called the Niskanen Center). He argues in Barron's that "there is no clear link yet between higher AI use and worse outcomes for young workers." Recent graduates' unemployment rates have been drifting in the wrong direction since the 2010s, long before generative AI models hit the market. And many occupations with moderate to high exposure to AI disruptions are actually faring better over the past few years. According to recent data for young workers, there has been employment growth in roles typically filled by those with college degrees related to computer systems, accounting and auditing, and market research. AI-intensive sectors like finance and insurance have also seen rising employment of new graduates in recent years. Since ChatGPT's release, sectors in which more than 10% of firms report using AI and sectors in which fewer than 10% reporting using AI are hiring relatively the same number of recent grads. Even Brynjolfsson's article in the Financial Times concedes that "While the trends are suggestive, a degree of caution is warranted. Productivity metrics are famously volatile, and it will take several more periods of sustained growth to confirm a new long-term trend." And he's not the only one wanting evidence for AI's impact. The same weekend Fortune wrote that growth from AI "has yet to manifest itself clearly in macro data, according to Apollo Chief Economist Torsten Slok." Data on employment, productivity and inflation are still not showing signs of the new technology. Profit margins and earnings forecasts for S&P 500 companies outside of the "Magnificent 7" also lack evidence of AI at work... "After three years with ChatGPT and still no signs of AI in the incoming data, it looks like AI will likely be labor enhancing in some sectors rather than labor replacing in all sectors," Slok said. [](http://twitter.com/home?status=Where's+The+Evidence+That+AI+Increases+Productivity%3F%3A+https%3A%2F%2Fit.slashdot.org%2Fstory%2F26%2F02%2F16%2F0316228%2F%3Futm_source%3Dtwitter%26utm_medium%3Dtwitter) [](http://www.facebook.com/sharer.php?u=https%3A%2F%2Fit.slashdot.org%2Fstory%2F26%2F02%2F16%2F0316228%2Fwheres-the-evidence-that-ai-increases-productivity%3Futm_source%3Dslashdot%26utm_medium%3Dfacebook) [Read more of this story](https://it.slashdot.org/story/26/02/16/0316228/wheres-the-evidence-that-ai-increases-productivity?utm_source=rss1.0moreanon&utm_medium=feed) at Slashdot.

by Slashdot•