Soft Landing Looks More Plausible, but the Fed Isn’t Ready to Call It Done.

•February 16, 2026

0

Why It Matters

A soft landing would validate the Fed’s tightening strategy and reduce recession fears, but lingering inflation and labor‑market uncertainties could force tighter policy longer than expected.

Key Takeaways

- •Core CPI fell to 2.5% YoY in January

- •Unemployment slipped to 4.3% with modest payroll gains

- •Fed's preferred inflation gauge hovers near 3%, above target

- •Job growth narrow, raising labor market fragility concerns

- •Risks include AI-driven cost cuts and sticky services inflation

Pulse Analysis

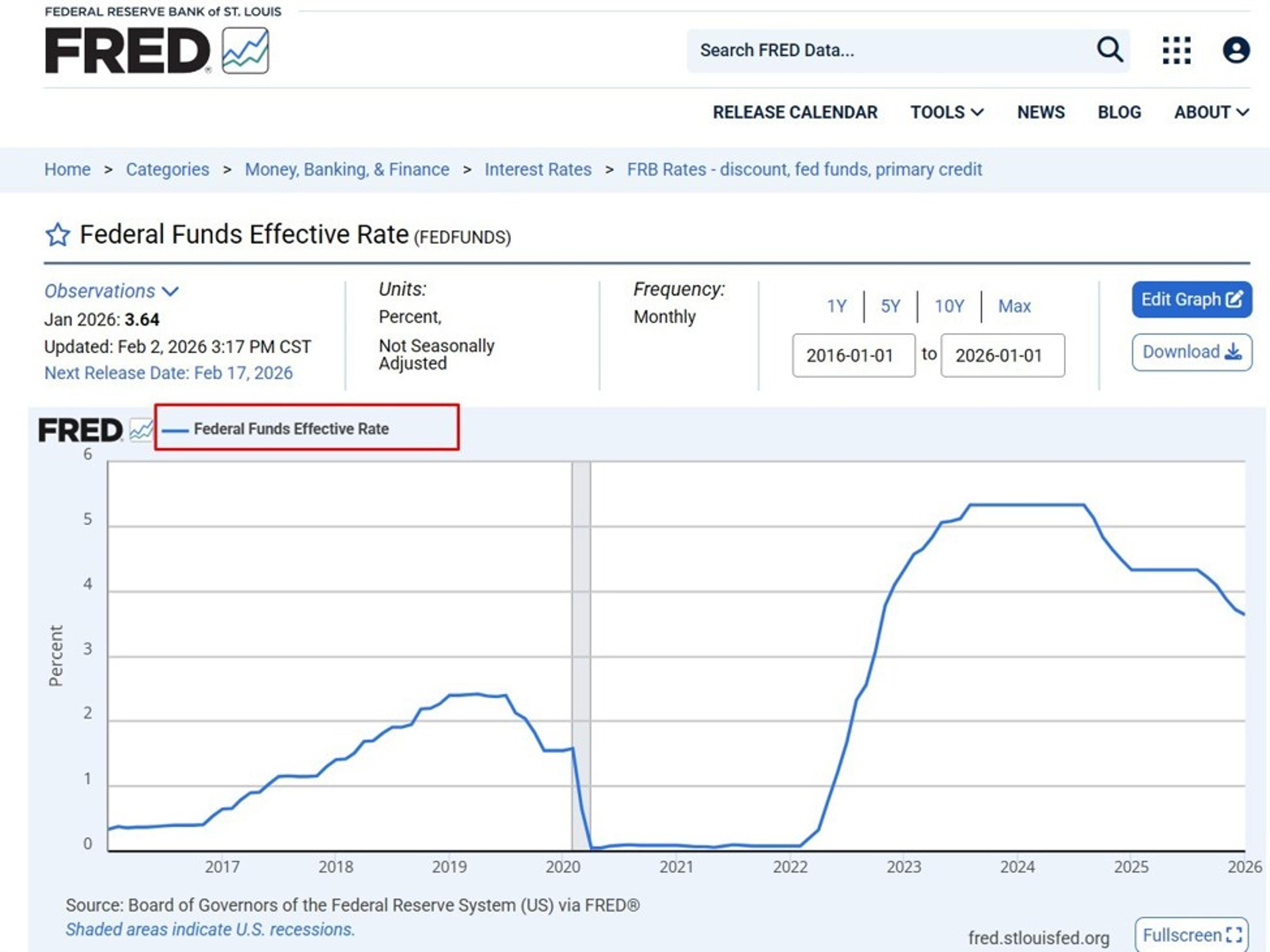

The latest U.S. data package presents the most favorable mix of declining inflation, steady employment, and solid growth since the pre‑pandemic era. Core consumer prices dropping to 2.5% signals that the aggressive rate hikes of the past two years are finally taking hold, yet the Fed’s preferred inflation metric lingering near 3% reminds policymakers that price pressures have not fully receded. This nuanced picture fuels optimism among investors that a soft landing—where growth persists without a recession—is within reach, but it also underscores the delicate balance the central bank must maintain.

Labor‑market dynamics add another layer of complexity. While the headline unemployment rate of 4.3% suggests resilience, payroll additions of roughly 130,000 jobs are modest and heavily weighted toward a narrow set of industries. Such concentration raises concerns that a modest shock—whether from a slowdown in corporate profitability or a rapid AI‑induced restructuring—could quickly translate into broader hiring freezes or layoffs. The Fed, therefore, watches not just the headline numbers but also the depth and breadth of job creation to gauge the economy’s true health.

Looking ahead, the policy horizon remains uncertain. Persistent services inflation and tariff‑related price spikes could keep overall inflation above the 2% target, prompting the Fed to hold rates steady or even consider further tightening. Conversely, a slowdown in consumer spending, potentially triggered by AI‑driven cost‑cutting or a market correction, could accelerate the path to rate cuts. As the Fed’s leadership transition approaches, the next policy cycle will likely hinge on how these competing forces evolve, making the soft‑landing narrative both plausible and precarious.

Soft landing looks more plausible, but the Fed isn’t ready to call it done.

This is via the Wall Street Journal (gated), I've summarised.

Summary:

-

Key US macro “vital signs” are aligned: inflation is easing, jobs are holding up, and growth remains solid.

-

Core CPI slowed to 2.5% y/y in January, while unemployment edged down to 4.3%.

-

The Fed’s preferred inflation gauge is running closer to 3%, keeping officials wary that progress could stall above 2%.

-

Job gains have been modest and narrow, leaving the labour market potentially more fragile than headline prints suggest.

-

Risks run both ways: a consumer slowdown or AI-linked corporate cost-cutting on one side, and resilient demand keeping inflation sticky on the other.

The US economy is showing the clearest combination of falling inflation, steady employment and firm growth seen since before the pandemic, reviving hopes that a “soft landing” may be within reach. Recent data have strengthened the case that inflation can cool back toward the Federal Reserve’s 2% goal without the economy slipping into recession, even as policymakers and forecasters remain cautious about declaring success.

January’s inflation report showed underlying price pressures continuing to moderate. Core consumer prices were up 2.5% from a year earlier, the lowest since 2021. Some of that improvement has been influenced by technical factors, but the reading also suggested less of the early-year reflation pattern that unsettled markets in recent years. On the jobs side, the unemployment rate ticked down to 4.3%, and payrolls rose by around 130,000, pointing to a labour market that is cooling but not cracking.

Still, confidence remains restrained because the Fed’s preferred inflation measure has been running nearer 3% than 2%, and progress has been uneven since mid-2025. Several forecasters expect inflation to prove sticky this year as tariff-related costs filter through supply chains and into retail pricing. That backdrop has shifted the Fed’s concern from a renewed inflation surge to the risk that inflation settles above target.

There are also questions about labour-market durability. Revised data indicate job creation last year was modest by historical standards and concentrated in a narrow set of sectors. The unemployment rate has been stable partly because firms have slowed hiring without moving to widespread layoffs, a balance that could shift quickly if growth or corporate profitability stumbles.

Potential triggers include cost-cutting among companies disrupted by the AI-driven reshuffle of winners and losers, or a sustained market drawdown that dents household wealth and spending. But the bigger near-term inflation risk may be the opposite: consumers staying resilient enough to keep services inflation firm and price pressures lodged above 2%. Under the surface, shelter inflation appears to be cooling, yet non-housing services remain sticky, and tariff-sensitive goods categories have shown signs of re-acceleration.

The economy is closer to a soft landing than many believed possible a few years ago, but the outcome is not locked in. If growth holds up, political pressure for rate cuts could intensify even if the traditional case for easing is weak. With leadership change at the Fed approaching, the next phase may hinge as much on policy choices as on the incoming data.

This article was written by Eamonn Sheridan at investinglive.com.

0

Comments

Want to join the conversation?

Loading comments...