Turkey’s Current Account Deficit Remains on a Widening Track

•February 13, 2026

0

Why It Matters

The widening deficit heightens external financing pressure and could strain the lira, prompting tighter monetary or policy responses. Persistent capital‑account weakness limits Turkey’s ability to buffer shocks from global trade and geopolitical volatility.

Key Takeaways

- •December deficit $7.3bn, exceeds $5.3bn forecast

- •12‑month deficit hits $25.2bn, 1.8% GDP

- •Trade gap deepened to $‑7.4bn, primary income worsened

- •Capital inflows $2.1bn; reserves down $4.1bn

- •Resident outflows $7bn vs non‑resident inflows $9bn

Pulse Analysis

Turkey’s current‑account trajectory underscores a structural shift in its external balance. While the energy‑price shock that once inflated the deficit has eased, a resurgence in the trade gap—driven by weaker export performance and higher import demand—has taken centre stage. Primary‑income outflows, reflecting higher interest payments on foreign debt, compound the pressure, even as lower energy and gold deficits provide a modest cushion. This mix signals that the country’s external vulnerability now hinges more on competitiveness and domestic demand than on commodity price swings.

On the financing front, the capital account tells a story of uneven flows. Net inflows of $2.1 bn in December barely offset resident outflows of $7 bn, which stem from outward FDI, portfolio sales, and expanding trade‑credit lines. Non‑resident investors supplied $9 bn, largely through debt‑related channels, keeping the capital account in positive territory but not enough to replenish the $22 bn reserve drawdown recorded this year. Elevated long‑term debt rollover ratios—377 % for corporations and 113 % for banks—highlight a reliance on refinancing, raising concerns about balance‑sheet resilience if global funding conditions tighten.

Looking ahead, Turkey faces a delicate balancing act. Modest widening of the current account is likely as global trade tensions and regional geopolitics persist, while domestic consumption pressures could further erode the trade surplus. With capital inflows expected to stay muted, policymakers may need to lean on monetary tightening or fiscal adjustments to safeguard the lira and preserve confidence. Monitoring reserve levels, debt‑service capacity, and the evolution of primary‑income balances will be crucial for investors assessing Turkey’s external risk profile.

Turkey’s current account deficit remains on a widening track

December's current account deficit in Turkey turned out significantly wider than expected, maintaining a gradual increase on a 12‑month rolling basis. Meanwhile, the capital account has remained weak, leading to reserve depletion.

Turkey's current account posted a deficit of US $7.3 bn, higher than the market forecast (US $5.3 bn) and our call (US $5.5 bn). As a result, the 12‑month rolling current account deficit maintained the uptrend and reached US $25.2 bn, or approximately 1.8 % of GDP, from US $22.7 bn a month ago.

A closer look at the monthly figures shows that the deficit widened by roughly US $2.5 bn compared to the same month of 2024, primarily due to a higher trade gap, which deteriorated from US $‑6.2 bn to US $‑7.4 bn. In addition to the turn of the core trade surplus in 2024 to a deficit – weighing on foreign trade and, in turn, the current account – this deterioration in the monthly current account was also driven by a worsening balance in primary income. However, lower energy and gold deficits limited the deterioration in the current account balance.

Breakdown of the current account

Monthly, US$bn

Source: CBT, ING

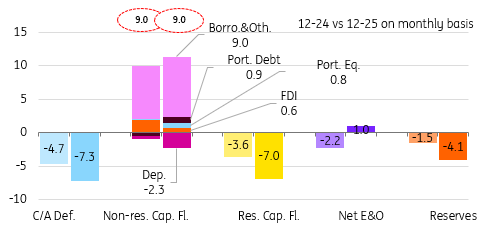

On the capital account side, inflows remained weak in December at US $2.1 bn. With net inflows from errors and omissions of US $1.0 bn, and considering the current account deficit, official reserves contracted by US $4.1 bn.

Further analysis reveals that resident activities generated an outflow of US $7.0 bn, mainly due to several factors, including outward FDI, portfolio investments, extending trade credits and increasing deposits abroad. On the flip side, non‑resident activity led to inflows totalling US $9.0 bn, primarily from debt‑related channels.

Accordingly, despite a US $2.3 bn fall in foreign deposits in local banks, a US $6.0 bn net borrowing trade credit at US $2.7 bn and portfolio inflows amounting to US $1.8 bn turned out to be the major contributors to a positive capital account. In the breakdown, banks’ borrowing stood at US $1.3 bn, while corporate borrowing was strong at US $4.3 bn, with a large share in the long‑term. Consequently, long‑term debt rollover ratios stood at 377 % for corporations and 113 % for banks, compared to 202 % and 184 %, respectively, on a 12‑month rolling basis.

Breakdown of financing

Monthly, US$bn

Source: CBT, ING

In 2025, resident outflows rose to US $44.2 bn from US $35.4 bn a year ago. Foreign inflows, on the other hand, recorded an increase, coming in at US $64.2 bn compared to US $57.8 bn in 2024. As a result, the capital account has remained in positive territory with US $19.8 bn, compared to US $22.3 bn.

In addition, outflows via net errors and omissions remained elevated, totalling US $‑16.6 bn vs US $‑11.3 bn in 2024. Taken together with the widening current account deficit, which grew from US $‑10.4 bn to US $‑25.2 bn, official reserves were depleted by US $22.0 bn versus a slight US $0.6 bn increase recorded a year earlier.

Overall, the current account surplus in December exceeded expectations and maintained a widening trend, while the capital account has remained weak, which has been the case since July. Preliminary customs data from the Ministry of Trade suggest continuing deterioration in the January current account, as the foreign trade deficit appears to be widened by US $0.8 bn in comparison to last year.

In the months ahead, the trajectory of the current account balance is expected to be influenced by a mix of external risks – such as global trade developments and geopolitical tensions – alongside domestic demand conditions. We expect a modest widening this year, while capital inflows will likely remain sluggish amid significant outflows via net errors and omissions.

0

Comments

Want to join the conversation?

Loading comments...