INVESTMENT BANKING PULSE

Friday, February 20, 2026

Market Intelligence for Investment Banking Professionals

🎯 Today's Investment Banking PulseUpdated Just now

What's happening: JSW Infrastructure launches ₹6,325 crore equity raise to meet SEBI public‑shareholding mandate

The company approved an issue of up to 25 crore shares, valued at about ₹6,325 crore, to satisfy SEBI’s 25% public‑shareholding rule within three years of its Oct 2023 listing. Proceeds will fund a ₹39,000 crore capex plan to expand port capacity to 400 MTPA by FY 2030 across India and Oman.

Also developing:

By the numbers: Allstate raises $1.2B in catastrophe bonds

🚀 Top Investment Banking Headlines

Omnitech Engineering to Float Rs 583 Cr IPO on Feb 25

Omnitech Engineering has announced its upcoming IPO, aiming to raise Rs 583 crore with a price band of Rs 216-227 per share. The precision component manufacturer's share sale opens February 25, with funds earmarked for debt repayment and expansion. The company, serving global energy and industrial clients, is set to list on March 5.

The Economic Times (India) – RSS hub

M&A Trends: Outlook for Healthcare, Tech, Banking, & More

Uncover the M&A trends driving strategic growth, from AI in due diligence to rising cross-border mergers and a focus on data privacy.

DealRoom – Blog

New SPAC: NewHold Investment Corp. IV (NHIVU) Files for $175M IPO

To access this post, you must purchase 1 - User: Monthly Plan. Nicholas Alan Clayton

SPACInsider

TIP Solar Raises $179.7 Million in ABS From Residential Solar, PPA Leases

Interest payments on the class B notes might be deferred to allow the interest and principal on the class A notes if a sequential interest amortization period is in effect.

Asset Securitization Report

Ebay to Acquire Depop Resale Fashion Marketplace for $1.2 Billion

Ebay will purchase the Depop consumer-to-consumer (C2C) fashion marketplace from Etsy for $1.2 billion in cash, subject to purchase price adjustments. The transaction, which has been unanimously approved by the boards of both Ebay and Etsy, is expected to close in Q2 2026, and Depop will retain its name, brand, platform and culture following the […]

Retail TouchPoints

💰 Investment Banking Fundraising

Vale Base Metals Partners with Exiro, Orion and Canada Growth Fund to Form Exiro Nickel Company with $200M Investment

Vale Base Metals announced a partnership with Exiro Minerals Corp, Orion Resource Partners LP and Canada Growth Fund Inc to create a new joint venture, Exiro Nickel Company, to invest up to $200 million in the Thompson Mine Complex in Manitoba. The consortium will own 81.1% of the new company, with Vale holding the remaining 18.9%, and the transaction is expected to close by the end of 2026.

CorporateExiro Minerals

Lee County Port Authority Announces $681.3M Bond Issuance for Southwest Florida International Airport Concourse E

Lee County Port Authority announced a $681.3 million bond issuance to fund the construction of Concourse E at Southwest Florida International Airport. The offering includes $464.1 million of AMT‑eligible Series 2026A‑1 bonds, $169.8 million of Series 2026A‑2 bonds, and $47.3 million of Series 2026B tax‑exempt bonds. BofA Securities will act as lead underwriter with J.P. Morgan and Raymond James as co‑underwriters.

Debt FinancingLee County Port Authority

SageSure and SureChoice Underwriters Reciprocal Exchange Close Record-Breaking $670M Cat Bond

SageSure, a managing general underwriter, and SureChoice Underwriters Reciprocal Exchange (SURE) have closed the Gateway Re Ltd. Series 2026-1 catastrophe bond with an original principal amount of $670 million, the largest issuance for SageSure to date. Structured and bookrun by Swiss Re Capital Markets Corporation, the bond expands coverage to earthquakes, severe thunderstorms, winter storms, and wildfires, positioning SageSure as the third largest cat‑bond sponsor globally.

Debt FinancingSageSure

💬 Top Investment Banking Social Posts

Thread by @Si14ag

Macro: HSBC trims ~10% of US DCM in broader $1.8bn cost overhaul and pivot to Asia/Middle East. Key factors: management cuts, M&A/ECM pullback. Risk: execution/credit cycles. Trade: favor Asian bank equities. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

by Viktor Kopylov, PhD, CFA•

Blue Owl Plunges After Halting Redemptions At Private Credit Retail Fund

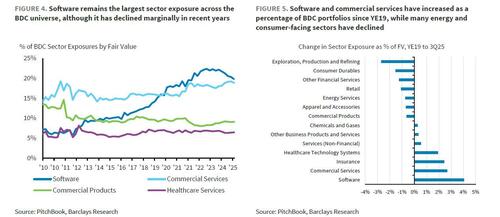

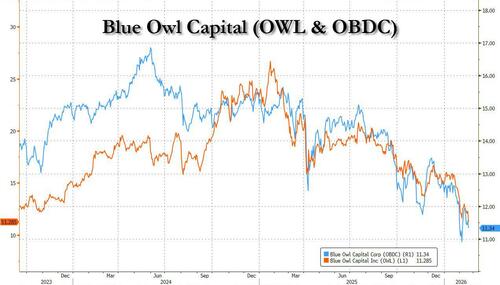

Blue Owl Plunges After Halting Redemptions At Private Credit Retail Fund Things are getting from bad to worse for Private Credit giant Blue Owl Capital. The last time we looked at the firm's precarious liquidity situation about a month ago, we found that the Blue Owl BDC would allow for 17% redemptions as investors, burned by both the tumbling stock price and the company's massive exposure to ticking private credit time bombs, were storming for the exit. > Blue Owl BDC Allows for 17% Redemptions as Investors Storm Exit: BBG > > — zerohedge (@zerohedge) [January 7, 2026](https://twitter.com/zerohedge/status/2008951795507241261?ref_src=twsrc%5Etfw) One month later, it has gotten far worse. On Wednesday, Blue Owl Capital said it will **fully restrict withdrawals from one of its retail-focused private credit funds,** reversing a previous plan to resume redemptions this quarter as furious investors, fearing many more cockroaches are about to emerge, demanded their money in droves. The New York private credit firm said that **investors in Blue Owl Capital Corp II, known as** ***OBDC II,*** **will no longer be able to redeem shares on a quarterly basis**. Instead, the gated fund will return capital through periodic distributions funded by loan repayments, asset sales or other transactions. The firm **said it sold about $1.4 billion in direct-lending investments across three funds to provide investors with promised liquidity:** Blue Owl Capital Corp II, Blue Owl Capital Corporation, and Blue Owl Technology Income Corp. The buyers included North American public pension funds and insurance companies (and, potentially, *related parties* which would be a huge negative if confirmed). According to Bloomberg, the decision to gate capital highlights the risks confronting retail investors entering the fast-growing private credit market. Though investors are generally allowed to redeem a portion of their capital each quarter, payouts can be curtailed if withdrawal requests exceed set limits. The news also rekindled fears in an industry that has attracted increasing scrutiny in recent months over valuations in the market and the quality of lending to firms with heavy debt loads and often little track record. OBDC II drew scrutiny in recent months after Blue Owl proposed merging it with a publicly traded vehicle — a transaction that prior disclosures indicated could have **resulted in losses of roughly 20% for some investors**. The company promptly reversed the decision following investor outcry, but that did not change anything in the underlying business and redemption requests had already exceeded the standard 5% quarterly cap. Blue Owl co-founder Craig Packer defended the decision to sell the loans, saying that the sale at 99.7% of par value was “*a strong statement.”* *“There’s skepticism about marks. There’s skepticism about valuation. We’ve always been saying we feel really good about the quality of our portfolio and the quality of our marks, but just saying it in some ways doesn’t seem to have done enough. So we’re putting our money where our mouth is,”* Packer said on a conference call Thursday morning. He added that the **fund could return half of investors’ capital by the end of this year**. He said that the fund was always going to come up with a strategic transaction to return money to investors at this point. “We will look for repayments, earnings and also potential additional asset sales to continue to return that capital,” Packer said. *“OBDC II has been exploring options to either create a liquidity event for investors or wind down the legacy vehicle and ultimately return capital to shareholders. We believe this is an important step forward for the fund as it creates an efficient process around returning capital to these investors,”* wrote a Citizens Financial Group analyst, adding that selling loans at par was a “win-win.” Blue Owl initially looked to sell loans at OBDC II and then widened to other vehicles following demand from institutional buyers, the firm said. **OBDC II sold about $600 million - roughly 34% of its portfolio - and will use the proceeds to repay a credit facility from Goldman Sachs, and make a special cash distribution that will total about 30% of the fund’s net asset value.** It has been a very bad year for private credit funds in general and Blue Owl in particular which has been flooded with redemption requests in the past year: funds that let investors redeem periodically can face pressure when too many people want their money back at once. Managers often keep some more easily sold assets to meet withdrawals. Selling directly originated loans, which typically don’t trade often, is less common. In the most recent quarter, redemption requests exceeded 5% at both of Blue Owl’s non-traded business development companies. **Its tech-focused vehicle, OTIC, saw redemption requests jump to about 15% of net asset value, Blue Owl said.** As we reported earlier this month, the latest pressure point for Private Credit funds are their investment in Software/SaaS stocks, with fears spiking after a Barclays report [revealed huge exposure to the collapsing software sector](https://www.zerohedge.com/markets/private-credit-stocks-crash-after-shock-report-reveals-huge-exposure-collapsing-software). [](https://cms.zerohedge.com/s3/files/inline-images/software%20exposure%20private%20credit_2.jpg?itok=dPFK_S4Z) [](https://cms.zerohedge.com/s3/files/inline-images/software%20exposure%20private%20credit_2.jpg?itok=dPFK_S4Z) [](https://cms.zerohedge.com/s3/files/inline-images/software%20exposure%20private%20credit_2.jpg?itok=dPFK_S4Z)[*Source*](https://www.zerohedge.com/markets/private-credit-stocks-crash-after-shock-report-reveals-huge-exposure-collapsing-software) Blue Owl’s largest publicly traded BDC, OBDC, sold about $400 million of loans across 74 portfolio companies at around par, with an average position size of about $5 million. Blue Owl Technology Income Corp. sold roughly $400 million of loans and used the proceeds to pay down debt. ***“What began as a targeted transaction to provide liquidity to OBDC II shareholders attracted significant interest from sophisticated institutional investors, allowing us to opportunistically extend the sale to OBDC,”*** Craig Packer, a co-founder of Blue Owl, said in a press release. The firm said the transactions improved balance-sheet flexibility, modestly increased diversification and created more room to deploy capital. Commenting on the latest news ouf of Blue Owl., Goldman's alt-financials specialist Christian DeGrasse laid out a bullish and bearish take *(below we [excerpt from his full note](https://marketdesk.ai/library/browse/Rkhy1WApVPh) available to [pro subs](https://www.zerohedge.com/signup/professional-membership-year))* * **Bullish feedback:** * 1) Positive for the BDCs to be selling loans at/near PAR and combo of delever / buy back stock (OBDC bought back stock at ~86% of book from Nov – Dec), * 2) this is a positive ‘proof of concept’ that the marks are in a good place (particularly software, the largest industry in the sale), yes FPAUM getting impacted but with where valuations are, what matters is durability/quality/question of underwriting rather than small movement in mgmt fees * **Bearish feedback:** * 1) This impacts OWL’s FPAUM and thus there base mgmt. fee & Part 1 fees (the $1.4bn loan sale est impact firmwide rev by ~1% .. though more OBDC II runoff in future could continue to weigh slightly), * 2) Views that this is cherry picking the best loans, * 3) we don’t know the duration on these loans – credit spreads have mostly tightened over the past few years, shouldn’t these loans be sold at above-par?, * 4) this could indicate higher redemptions on the come (the big non-traded BDC OCIC is not participating in the loan sale so not a read through there … but maybe on OTIC?) * 5) some are wondering whether OWL’s own affiliates participated (I’m not seeing any facts around this FWIW, just sharing feedback) * 6) this morning we’re getting a lot more inbounds from the macro community about gating redemptions OBDC II (they are saying they’ll return capital through distributions funded by loan repayments, asset sales or other transactions) Mohamed El-Erian also chimed in, asking if the news was a “canary in a coalmine moment” for private credit. > Is this a “canary-in-the-coalmine” moment, similar to August 2007? > This question will be on the mind of some investors and policymakers this morning as they assess the news that, quoting the FT, the “private credit group Blue Owl will permanently restrict investors from… [pic.twitter.com/DhvLlIAy5S](https://t.co/DhvLlIAy5S) > > — Mohamed A. El-Erian (@elerianm) [February 19, 2026](https://twitter.com/elerianm/status/2024432428052365443?ref_src=twsrc%5Etfw) A much less nuanced - and much more bearish take - this morning from George Noble: > Remember this scene in The Big Short? > > Jamie Shipley and Charlie Geller have bet everything against the housing market. > > They've been bleeding for months, wondering if they're wrong. > > Then they flip on CNN and see it: New Century Financial - the second-largest subprime lender… [https://t.co/AoEdZXp77x](https://t.co/AoEdZXp77x) [pic.twitter.com/vTMmNySCpw](https://t.co/vTMmNySCpw) > > — George Noble (@gnoble79) [February 19, 2026](https://twitter.com/gnoble79/status/2024500135237931077?ref_src=twsrc%5Etfw) The stock of Blue Owl Capital (OWL) tumbled to a fresh two year low this morning, while the publicly-traded BDC (OBDC) also plunged as much as 9.4% on Thursday, approaching the more than two-year low that they reached earlier in the month amid mounting worries over the firm’s exposure to software businesses vulnerable to disruption from AI. [](https://cms.zerohedge.com/s3/files/inline-images/blue%20owl%20stock%20dump.jpg?itok=H9dzpryH) *More in the [Goldman note](https://marketdesk.ai/library/browse/Rkhy1WApVPh) available to [pro subs](https://www.zerohedge.com/signup/professional-membership-year).* [Tyler Durden](https://cms.zerohedge.com/users/tyler-durden "View user profile.") Thu, 02/19/2026 - 10:50

by ZeroHedge – Markets•