🎯Today's American Stocks Pulse

Updated 1h agoWhat's happening: Legislative gridlock drags US Q4 growth to 1.4% annualized

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and a sharp deceleration from the 4.4% growth recorded in the prior quarter. The slowdown marks the slowest expansion since Q1 2024 and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

Video•Feb 20, 2026

WMT Downgrade, DECK Upgrade, TXRH Double Miss in Earnings

Texas Roadhouse (TXRH) gained Friday morning despite posting a double miss in earnings. HSBC downgraded Walmart (WMT) to hold from buy over growth concerns. Deckers (DECK) stepped up thanks to an upgrade from Argus. Diane King Hall talks about the analyst and earnings movers to watch on the last day of the trading week. ======== Schwab Network ======== Empowering every investor and trader, every market day. Subscribe to the Market Minute newsletter - https://schwabnetwork.com/subscribe Download the iOS app - https://apps.apple.com/us/app/schwab-network/id1460719185 Download the Amazon Fire Tv App - https://www.amazon.com/TD-Ameritrade-Network/dp/B07KRD76C7 Watch on Sling - https://watch.sling.com/1/asset/191928615bd8d47686f94682aefaa007/watch Watch on Vizio - https://www.vizio.com/en/watchfreeplus-explore Watch on DistroTV - https://www.distro.tv/live/schwab-network/ Follow us on X – https://twitter.com/schwabnetwork Follow us on Facebook – https://www.facebook.com/schwabnetwork Follow us on LinkedIn - https://www.linkedin.com/company/schwab-network/ About Schwab Network - https://schwabnetwork.com/about #walmart #deckers #texasroadhouse #economy #finance #investing #marketnews #stock #stockmarket #trading #live #schwabnetwork #wmt #deck #txrh #earnings #guidance #retail #ecommerce #shoes #ugg #hoka #restaurant #chart

By Schwab Network (ex‑TD Ameritrade Network)

Social•Feb 20, 2026

Equity Risk Discount Signals Overvalued Market Amid Turmoil

An equity risk premium which has recently turned into an equity risk discount. (Historically, an awful launnching pad for future returns) Policy turmoil, slowing domestic economic growth, sticky inflation, circular financing deals in AI (holding up the econ data) and traditional...

By Doug Kass

Social•Feb 20, 2026

Accounting Rules Reveal Shutdown’s Massive Real GDP Loss

A fun(?) 🧵 on how nerdy government accounting rules had a big impact on Q4 GDP. And how they reflect how wasteful the 43-day government shutdown was. TL;DR: Small reduction in nominal federal spending in Q4. But a big decline in...

By Jason Furman

Video•Feb 20, 2026

Today on Taking Stock | Markets Slide With Earnings and Oil in Focus

By NYSE Official

Social•Feb 20, 2026

Gold Rises With Stocks, Breaking Inverse Trend

🚨 GOLD DEEP DIVE | FEB 20, 2026 🚨 Gold: $5,048/oz (+1.25% today | +71.82% YoY) Silver: $81.94 (+151% YoY) GDX Miners ETF: $104.23 (+21% YTD) The most telling signal: gold is surging today while stocks ALSO rally on the Supreme Court tariff ruling....

By dailyanalysts

Social•Feb 20, 2026

S&P Reverses Gains, Slides Downward After Recent Surge

S and P now down on the day (reversing 45 handles in last few minutes) From an hour ago... on @thestreetpro Dougie Kass Ludacris Day? @dougkass

By Doug Kass

Video•Feb 20, 2026

Stocks Slide as Oil Jumps on Rising US-Iran Tensions | The Close 2/19/2026

The Close highlighted a sharp equity sell‑off on Feb 19, 2026 as Brent crude surged to its highest level since July amid escalating U.S.–Iran tensions. The S&P 500 slipped about 0.6% and the Nasdaq 100 fell roughly 0.7%, while the VIX nudged back...

By Bloomberg Television

Social•Feb 20, 2026

High Valuations Test Market Resilience in 2026

Markets flat near the highs + valuations near the upper end of history. Tom Martin of Globalt breaks down what that actually means—and what could sustain (or break) it in 2026! Our latest episode of the Market Misbehavior podcast: https://t.co/nA9bmU87rf...

By David Keller, CMT

Social•Feb 20, 2026

Ex‑US Value Soars, Advisors Still Underweight Benchmark

Value ex-US ripping again this year, spreading to US value too. Not a lot of discussion about it in my world yet. Every advisor we speak to still way underallocated relative to benchmark...

By Meb Faber

Blog•Feb 20, 2026

Inflation’s Back In America. Not That It Ever Left

The Federal Reserve’s January FOMC minutes confirm that inflation remains entrenched in the United States, contrary to earlier optimism. Core consumer‑price index rose 0.3% month‑over‑month, keeping annual inflation above the Fed’s 2% target. The minutes show policymakers acknowledging persistent price...

By Heisenberg Report

Social•Feb 20, 2026

AI Connectivity Group Ends Week on Fire

TTMI, GLW, COHR, LITE, CIEN, FN AI connectivity group stays super hot to close the week

By Joe Kunkle

Social•Feb 20, 2026

Amazon Clears $207, Targets $210+ After $197 Pivot

$amzn nice week. RDR Tuesday around $197 pivot. Cleared $207 and now it’s $210+ to manage.

By Scott Redler

Blog•Feb 20, 2026

Government Dysfunction Torpedoes US Economic Growth

The U.S. economy grew at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations. This marks a sharp deceleration from the 4.4% surge recorded in the preceding quarter and is the slowest expansion since...

By Heisenberg Report

Social•Feb 20, 2026

GE Call Spreads Double, Extra Time Boosts Returns

$GE Feb 330/350 call spreads from earnings snapshots now near $13 from $7, often pays to give extra time when playing a high quality name

By Joe Kunkle

Social•Feb 20, 2026

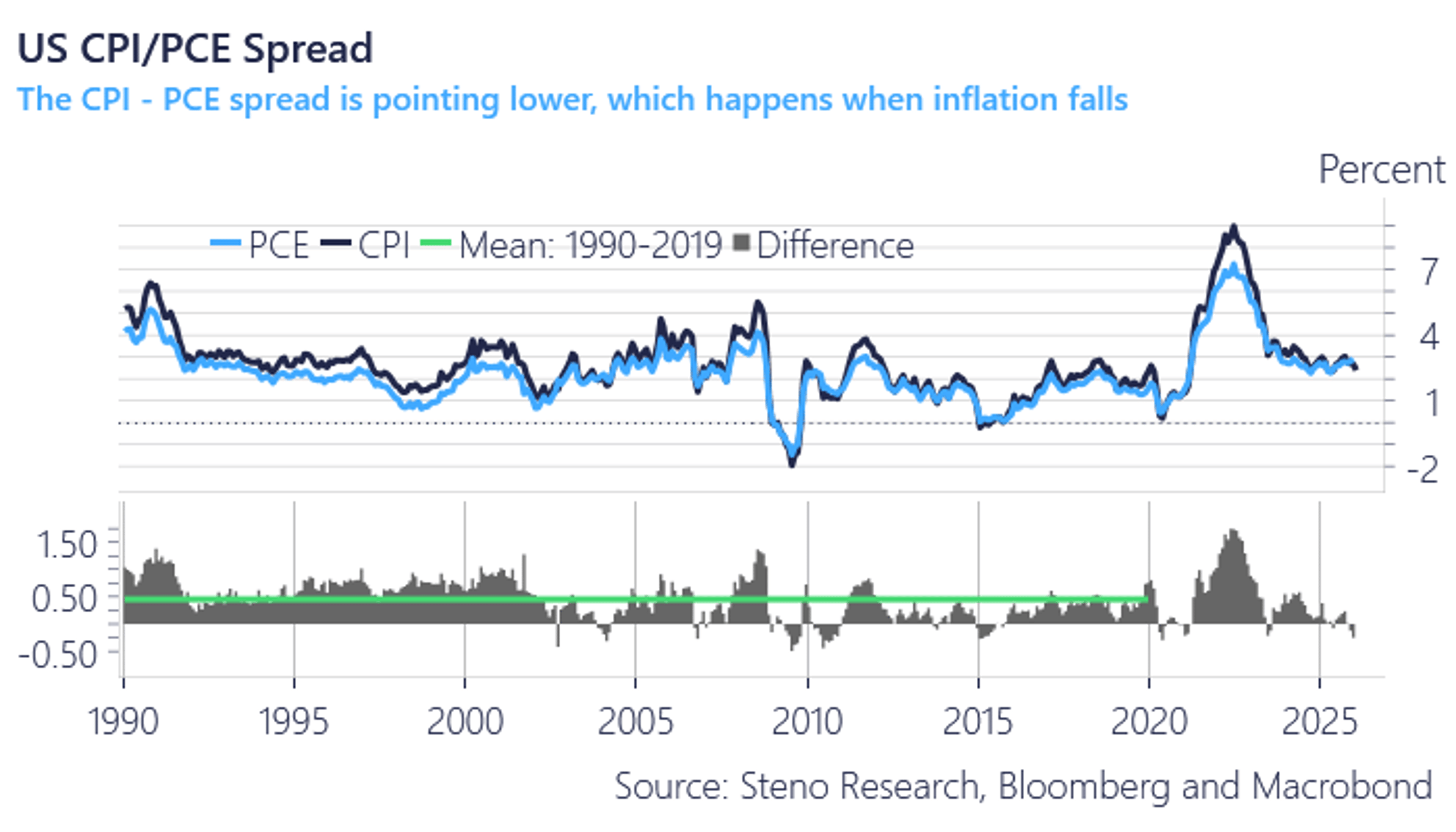

Falling CPI‑PCE Spread Signals Declining Inflation, Defying Q4 GDP

When the CPI-PCE spread heads lower (the spread is cyclical), it is because inflation is going lower. CPI is what matters.. End of discussion The economy is currently doing the opposite of that Q4 GDP report https://t.co/xBUcAxE1EP

By Andreas Steno Larsen

Video•Feb 19, 2026

Thursday's Final Takeaways: Trade Deficit Narrows & Tech Rotation Continues

Beyond today's stock movers, Marley Kayden and Sam Vadas turn to the broader market perspective by discussing the narrowing trade deficit and the continuing rotation out of tech. ======== Schwab Network ======== Empowering every investor and trader, every market day. Subscribe...

By Schwab Network

Social•Feb 20, 2026

First‑Round Knockout: YTD Dominance Over Competitors

CHART OF THE DAY: This Is A First Round Knockout, YTD We Are Crushing The Competition https://t.co/ohQwlRHqY4 via @hedgeye

By Keith McCullough

Social•Feb 20, 2026

Core PCE Near Target; Fed Cuts Still Unlikely

Q4/Q4 core PCE inflation was 2.9% last year (vs. 3.0% in 2024). Trump's statement on the GDP report includes a parenthetical jab at the Fed chair, but there's not much of anything in this report that tells the Fed it...

By Nick Timiraos

Video•Feb 19, 2026

US Runs Annual Trade Deficit Up to $901 Billion, One of Biggest Since 1960

U.S. trade data released this week showed the annual deficit expanding to $901 billion, the widest gap since the early 1960s. After a brief narrowing in the first half of last year, imports surged in the second half, pushing the balance...

By Bloomberg Television

Social•Feb 20, 2026

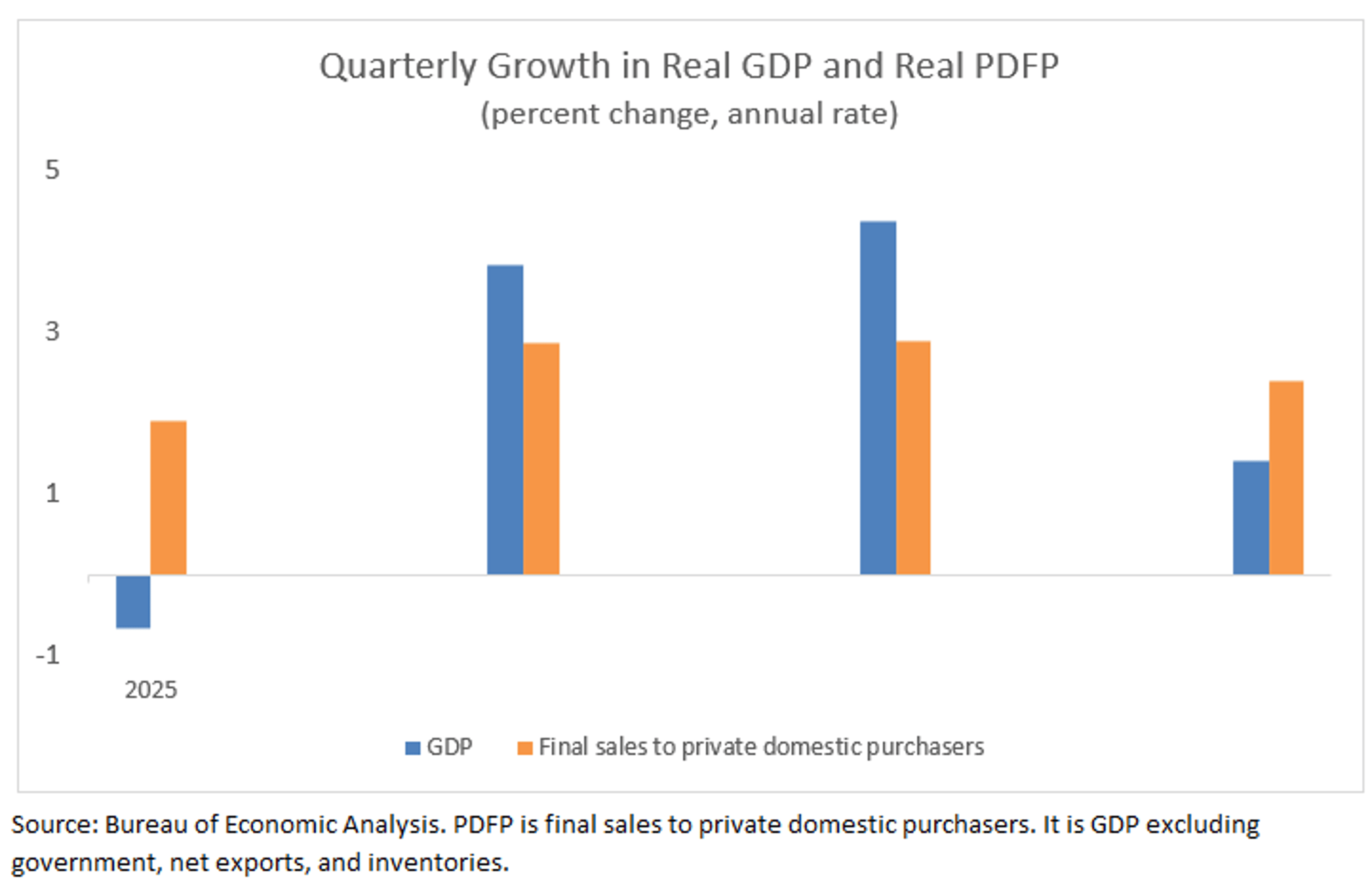

2025 GDP Volatile, PDFP Shows Steady Growth

Did 2025 feel like a wild ride? GDP feels your pain. The quarterly swings were big and short-lived. PDFP, which focuses on consumption and private fixed investment, showed more even, solid gains. https://t.co/LlVwQ7yna5

By Claudia Sahm

Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices...

By Bloomberg Television

Video•Feb 19, 2026

Stocks Slide as Oil Spikes on US–Iran Tension | Closing Bell

The closing bell showed U.S. equities slipping as oil prices spiked on renewed U.S.–Iran tensions. The S&P 500 and Nasdaq each fell roughly 0.3%, while the Russell 2000 managed a modest gain, underscoring the market’s mixed reaction to geopolitical risk. Energy‑related concerns lifted...

By Bloomberg Television

Video•Feb 19, 2026

Figma Gains on Strong Growth Outlook that Eases AI Fears

Figma’s latest earnings call highlighted a bullish growth outlook that directly counters lingering industry anxieties about artificial‑intelligence disruptions. The company emphasized that as AI improves, its own product suite becomes more powerful, positioning the design platform to benefit rather than...

By Bloomberg Television

Video•Feb 19, 2026

Charting DE After Earnings Send Shares to All-Time High

Agriculture companies have taken a much bigger investor focus to start 2026, and no company may have muscled more gains than Deere & Co. (DE). Shares of the company have climbed more than 40% in the last few weeks, helped...

By Schwab Network

Video•Feb 19, 2026

Amazon Dethrones Walmart

The video highlights that Amazon finally eclipsed Walmart in total sales for 2025, reporting $717 billion versus Walmart’s $713.2 billion, cementing a shift from the traditional Walmart‑Target rivalry to a direct Amazon‑Walmart showdown. Analysts note Walmart’s strategic pivot toward technology: a $40 billion free‑cash‑flow...

By Yahoo Finance