🎯Today's American Stocks Pulse

Updated 7m agoWhat's happening: Booking Holdings launches 25‑for‑1 stock split as earnings surge

Booking Holdings announced a 25‑for‑1 forward stock split, converting each share into 25 shares, effective April 6 2026. The move follows a Q4 report showing $6.3 billion revenue, 38% EPS growth, and a dividend increase to $10.50 per share.

News•Feb 18, 2026

Dow Jones Industrial Average Gains 200 Points as Fed Minutes Loom and Nvidia Rallies on Meta Deal

The Dow Jones Industrial Average rose about 300 points, or 0.65%, as investors returned to equities ahead of the Federal Reserve’s January minutes. Nvidia surged over 2% after Meta announced an expanded AI‑chip partnership worth tens of billions, reinforcing Nvidia’s lead in data‑center hardware. Meanwhile, Palo Alto Networks’ shares plunged roughly 10% following a fiscal‑Q3 guidance miss, while Garmin and Wingstop delivered strong earnings beats that lifted their stocks. Gold reclaimed the $5,000 per ounce level as safe‑haven demand persisted amid mixed macro data.

By FXStreet — News

Social•Feb 18, 2026

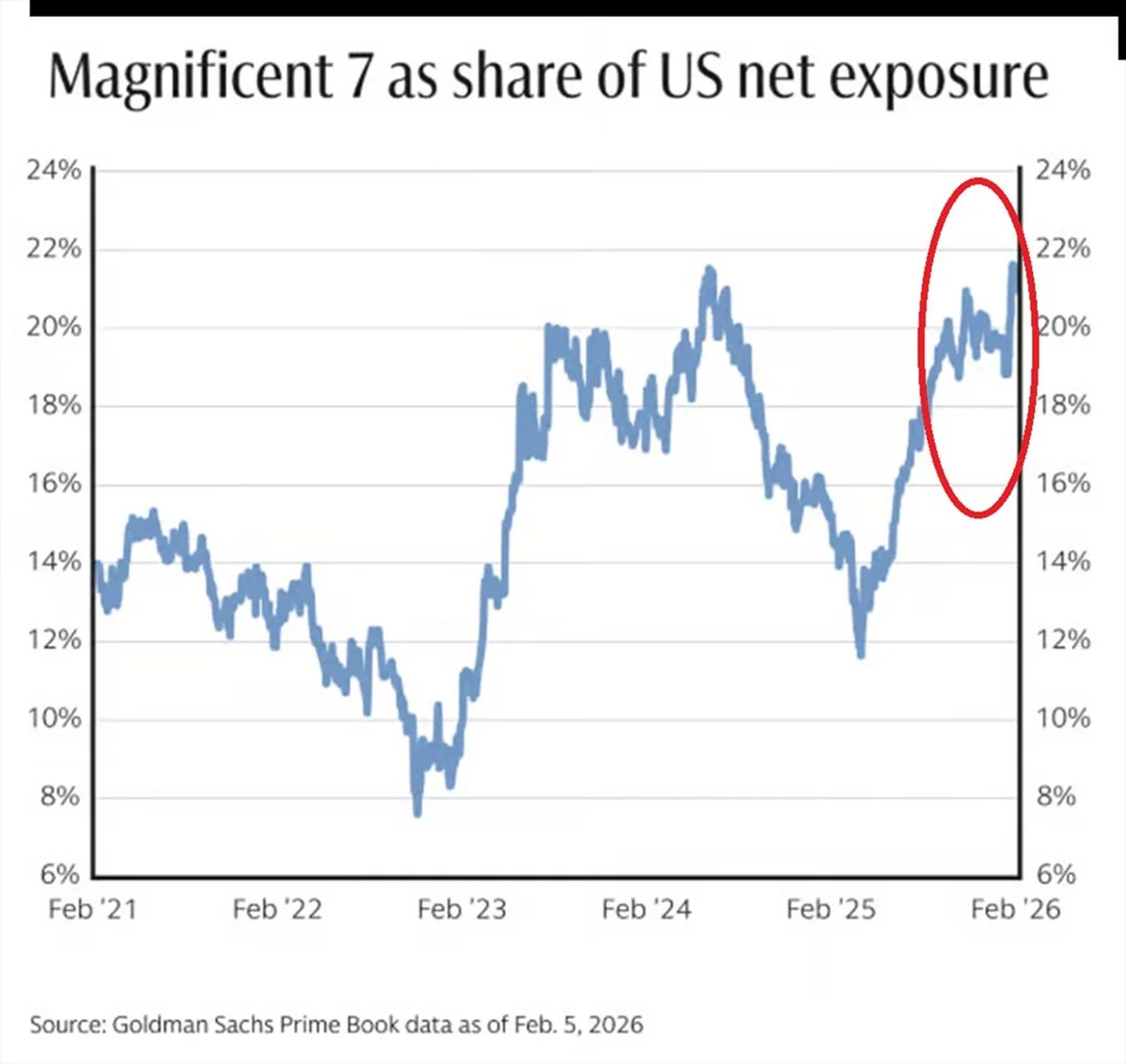

Record Hedge Fund Bet on Magnificent 7 Risks Collapse

⚠️Almost everybody is piling into the SAME TRADE: Hedge fund net allocation to Magnificent 7 stocks is up to a RECORD 22%. This is more than DOUBLE the level seen in 2022. At the same time, these stocks remain among the most popular...

By Global Markets Investor (newsletter author)

Social•Feb 18, 2026

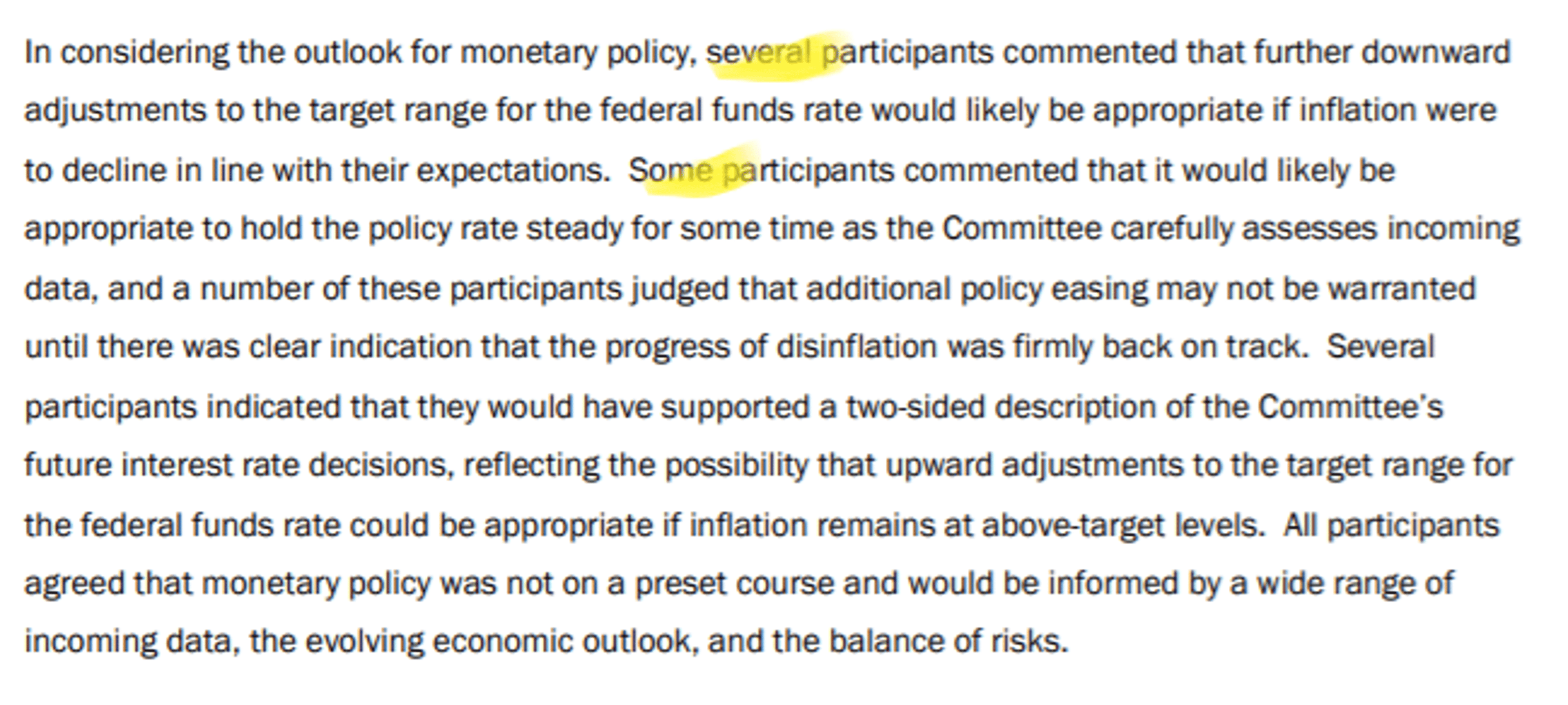

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos

News•Feb 18, 2026

US Stocks: Trump Adviser Hassett Suggests New York Fed Researchers Be Punished for Tariffs Argument

Kevin Hassett, former Trump economic adviser, blasted a New York Fed research paper that argued tariffs mainly hurt American consumers, calling it "shoddy scholarship" and the worst paper in Fed history. He urged that the authors be disciplined for their...

By The Economic Times – Markets

Social•Feb 18, 2026

Micron Poised for Record Highs Amid Memory Shortage

Can Micron do it again? $MU heading back towards record territory as memory shortages continue.

By Hyperstocks

Social•Feb 18, 2026

S&P Adds $500B, Gold Climbs; PCE Inflation Watch

WHAT A DAY, the S&P 500 has gained around $500 BILLION in market cap, up 0.8%. The index is now up 0.3% YTD 📈 Gold is also trading higher, back above $5,000/oz, as global tensions start to escalate 😳 Mark your calendars...

By Peter Tuchman (Einstein of Wall Street)

Blog•Feb 18, 2026

Dispersion Trade ‘Cash-In’ Risks Index Vol Spike

A historic surge in dispersion across large‑cap U.S. equities has pushed the one‑month change in average S&P 500 constituent values to unprecedented levels. The spike stems from a confluence of early‑year sector rotation, the AI disruption theme, and divergent earnings outcomes....

By Heisenberg Report

Social•Feb 18, 2026

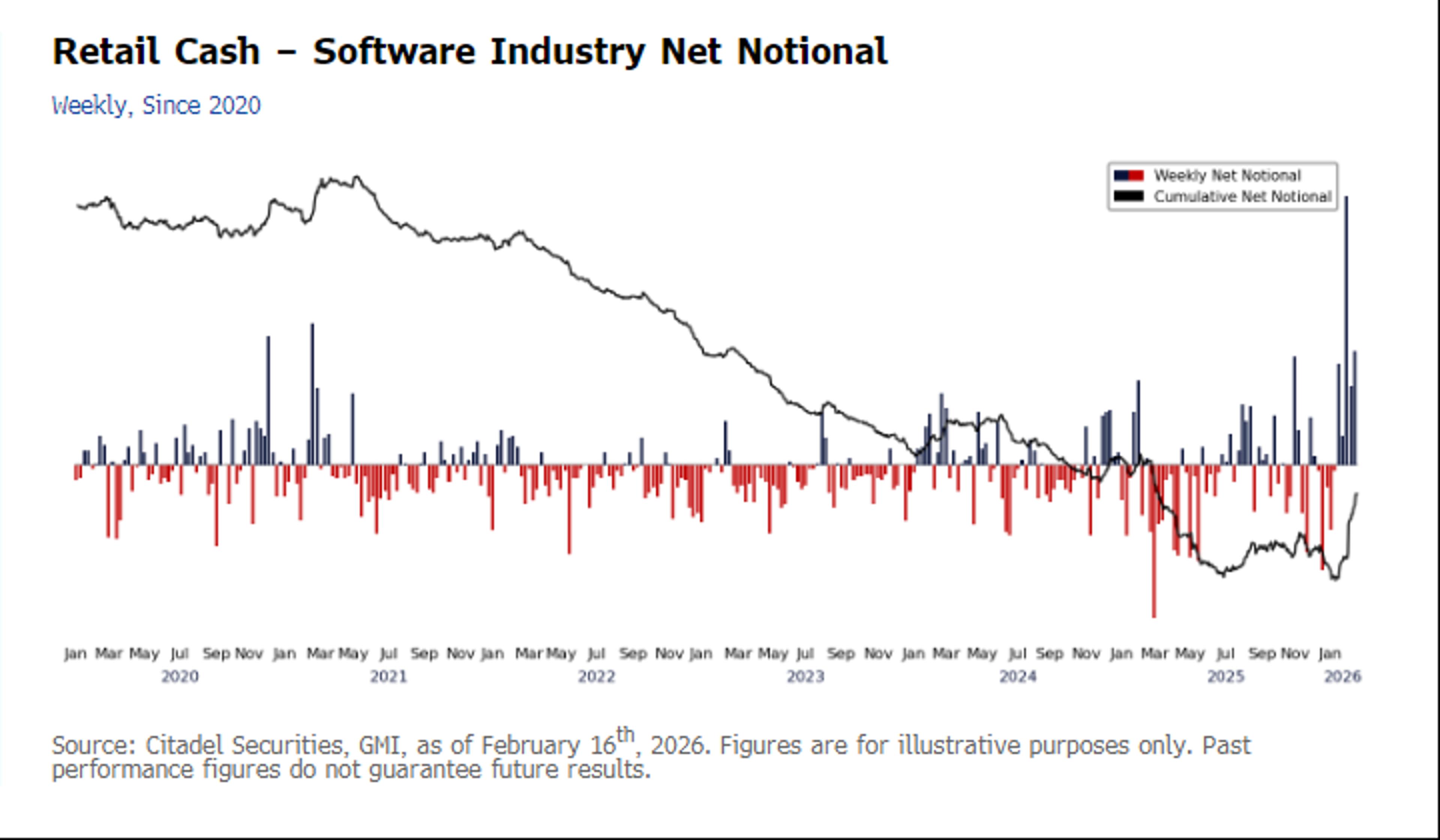

Retail Traders Set Record Demand on Citadel Platform

Citadel on flows, via Bbrg: Retail traders spent a record amount snapping up software shares on Citadel Securities’ platform, according to Scott Rubner, head of equity and equity derivatives strategy at the firm, which began tracking the data in 2017: “Net notional...

By MacroCharts

Social•Feb 18, 2026

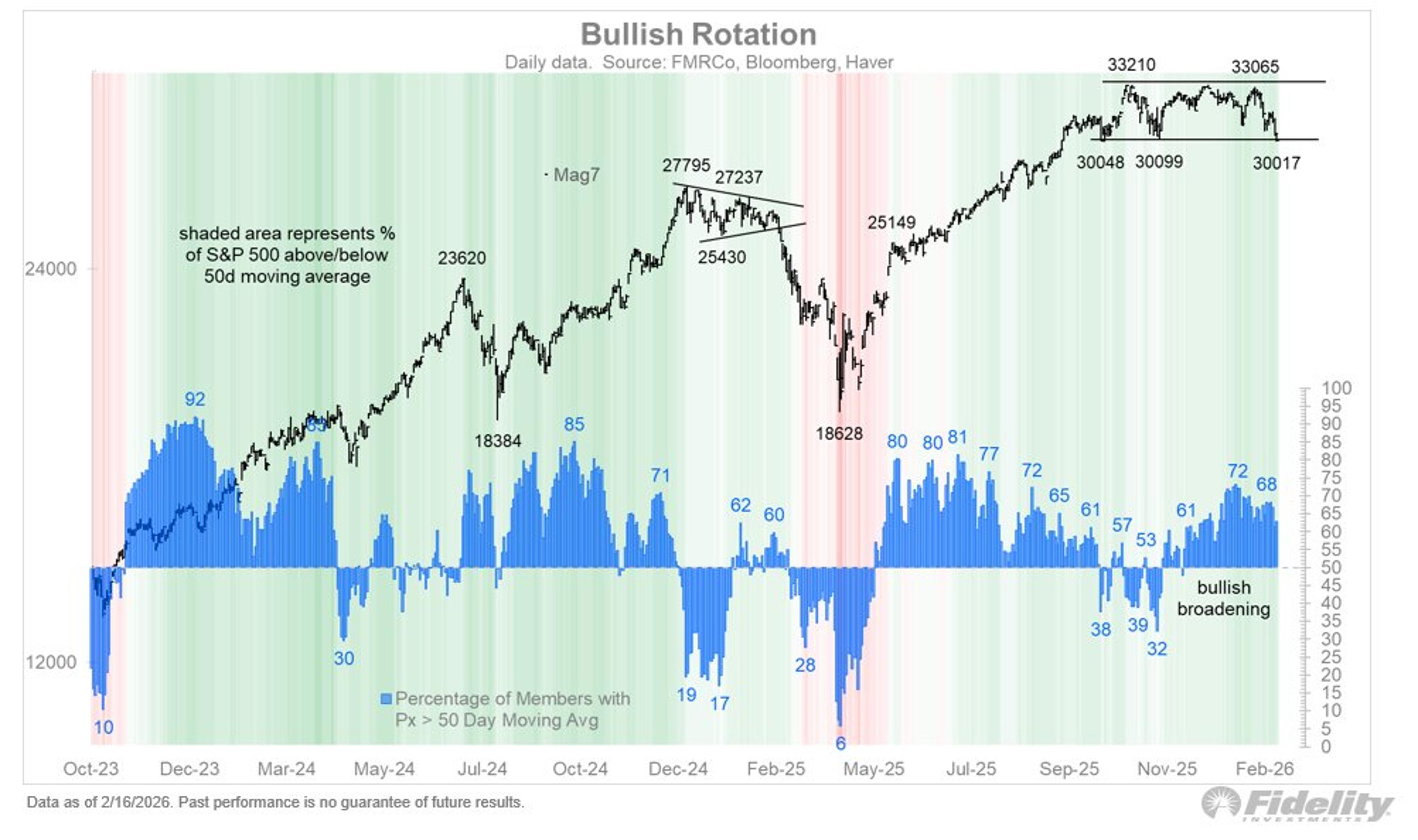

M7 Tech Stocks Test Low, Threatening Repeat Correction

However, as the AI narrative continues to unfold, from euphoria a few months ago to handwringing now (over the commodification of the SaaS stocks and the unknown ROI of hyperscaler capex), the Might Mag 7 is showing some strains. The...

By Jurrien Timmer

News•Feb 18, 2026

BIBL: Biblical Values-Focused Strategy Outperforming In 2026 Has Disadvantages, A Hold

The Inspire 100 ETF (BIBL) offers exposure to 100 U.S. large‑cap companies screened for biblical alignment. In 2026 the fund outperformed the S&P 500 benchmark IVV, largely because of a heavier tilt toward cyclical sectors and zero allocation to communications. Over the...

By Seeking Alpha – ETFs & Funds

Social•Feb 18, 2026

Global Indices Inch Higher as India VIX Plunges

Global Market Update: Gift Nifty +50.50 (0.20%) 25,760.50 DowJones +32.26 (+0.07%) 49,533.19 Nasdaq +31.71 (+0.14%) 22,578.38 India Vix -0.6600 (-4.95%) 12.6700 S&P 500 +7.05 (+0.10%) 6,843.22

By stock_n_trade

Social•Feb 18, 2026

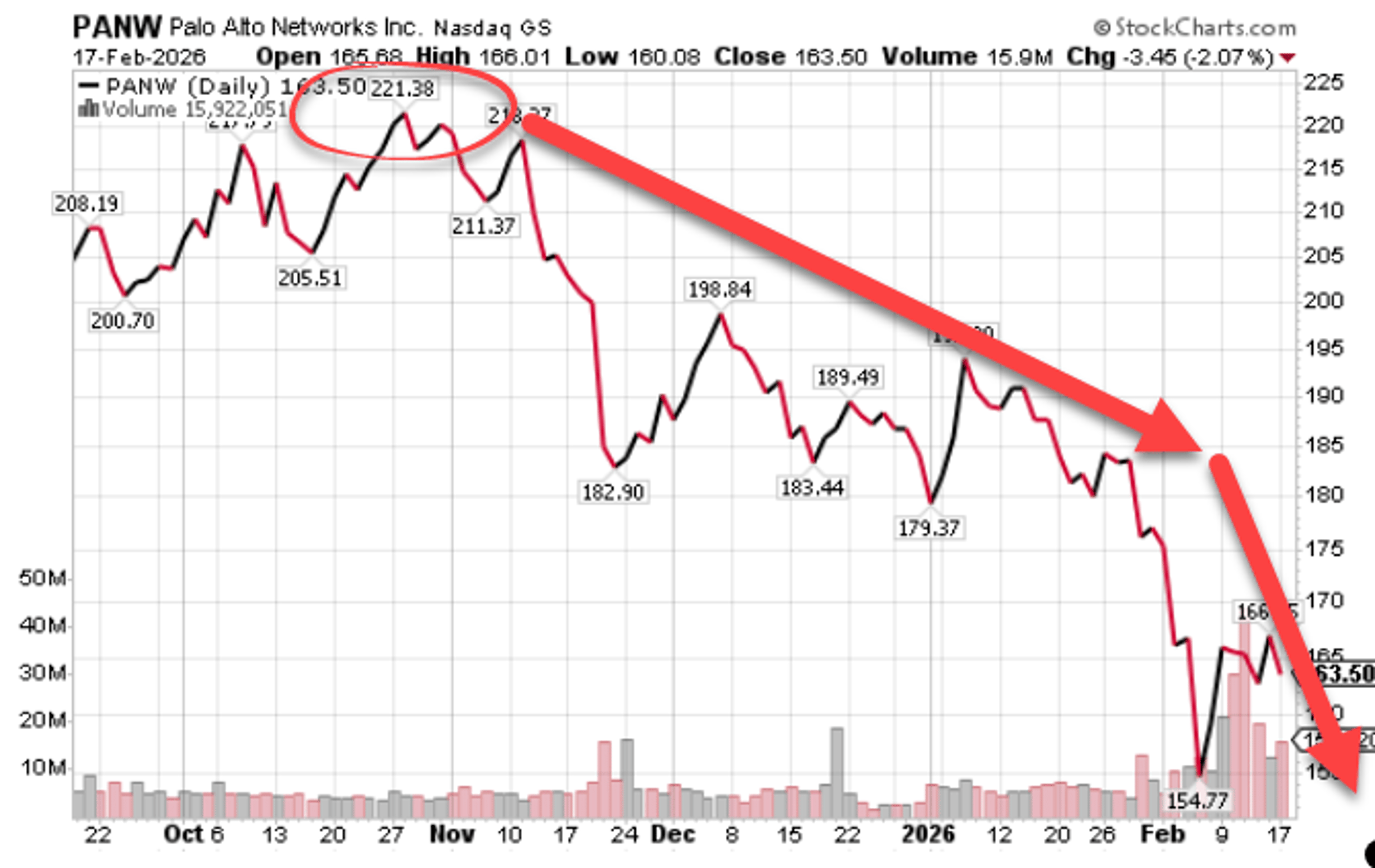

Media's Shallow Analysis Misleads Retail Investors

No, Kip, not pumping and dumping $PANW. Just no or limited investment process, opinions full of hubris, memorized sound bytes, no company spreadsheets/models, no timestamps - which "works" when the tide is coming in but not when the tide is going...

By Doug Kass

News•Feb 17, 2026

Trump Crackdown Drives 80% Plunge in Immigrant Employment, Reshaping Labor Market, Goldman Says

Goldman Sachs reports an 80% plunge in net immigration to the United States, falling from roughly one million annually in the 2010s to an estimated 200,000 arrivals in 2026. The decline is attributed to heightened deportations, a visa processing pause...

By Fortune – Markets

Social•Feb 18, 2026

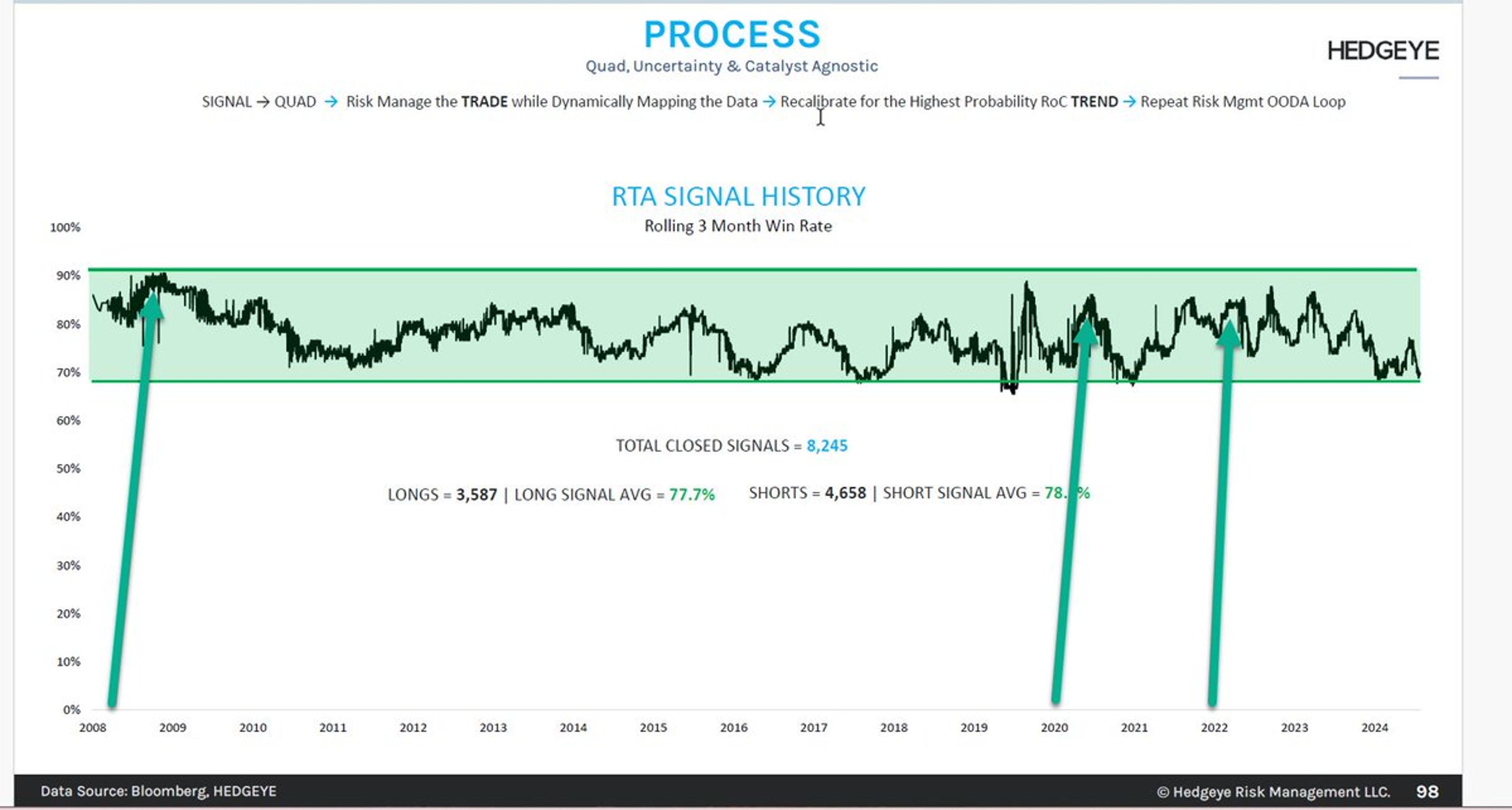

Four Real-Time Alerts Launched, All Timestamped Since

4 new Real-Time Alerts (2 Longs, 2 Shorts) fired off today Every. Single. One. #timestamped since 2008 https://t.co/alAFTYikLd

By Keith McCullough

Social•Feb 18, 2026

Mania Depression: Elites Stagnate, Borrowers Slip Further

FWIW - The sentiment data suggests its not a "boomcession" we're experiencing but a "maniapression." Those at the top can't put enough into the markets, while those at the bottom fall further and further behind on their loans.

By Peter Atwater

News•Feb 17, 2026

Stocks Make More Big Up and Down Moves: Stock Market Today

U.S. equity indexes posted modest gains as AI‑related uncertainty lifted volatility, with the VIX climbing to 22.96 before settling near 20. The utility sector saw DTE Energy’s earnings beat forecasts, propelled by a new 1.4 GW power contract for an AI‑driven...

By Kiplinger All

Social•Feb 18, 2026

Herbalife Stands Strong, Remains AI‑Proof Since November

Herbalife $HLF apparently is AI-proof Nice move since 11/20 when they came hard for calls and it continues https://t.co/G7vt2JRhuJ

By Joe Kunkle

Social•Feb 18, 2026

Markets May Slip as Fed Delays Rate Cuts

Will stock markets tip over amid worries about the Fed dragging its feet on rate cuts? FOMC meeting minutes are in focus. #stockmarkets #fed #fomc #dollar #macro #trading https://t.co/yYSQfOx27L

By Ilya Spivak

News•Feb 17, 2026

Down 72%, Should You Buy the Dip on Rigetti Computing?

Rigetti Computing’s stock plunged 72% from its October peak, settling near $15 after a 270% rally earlier this year. The quantum‑computing firm posted Q3 revenue of $1.9 million, down from $2.4 million, and a net loss that widened to $201 million versus $15 million...

By Yahoo Finance – News Index

Social•Feb 18, 2026

PANW Chase at $221 Requires 47% Rally to Breakeven

If you "loved the chart" and chased $PANW at $221, you now only have to be up +47% (from here) to get back to breakeven #bags https://t.co/UStQewrZkp

By Keith McCullough

Social•Feb 18, 2026

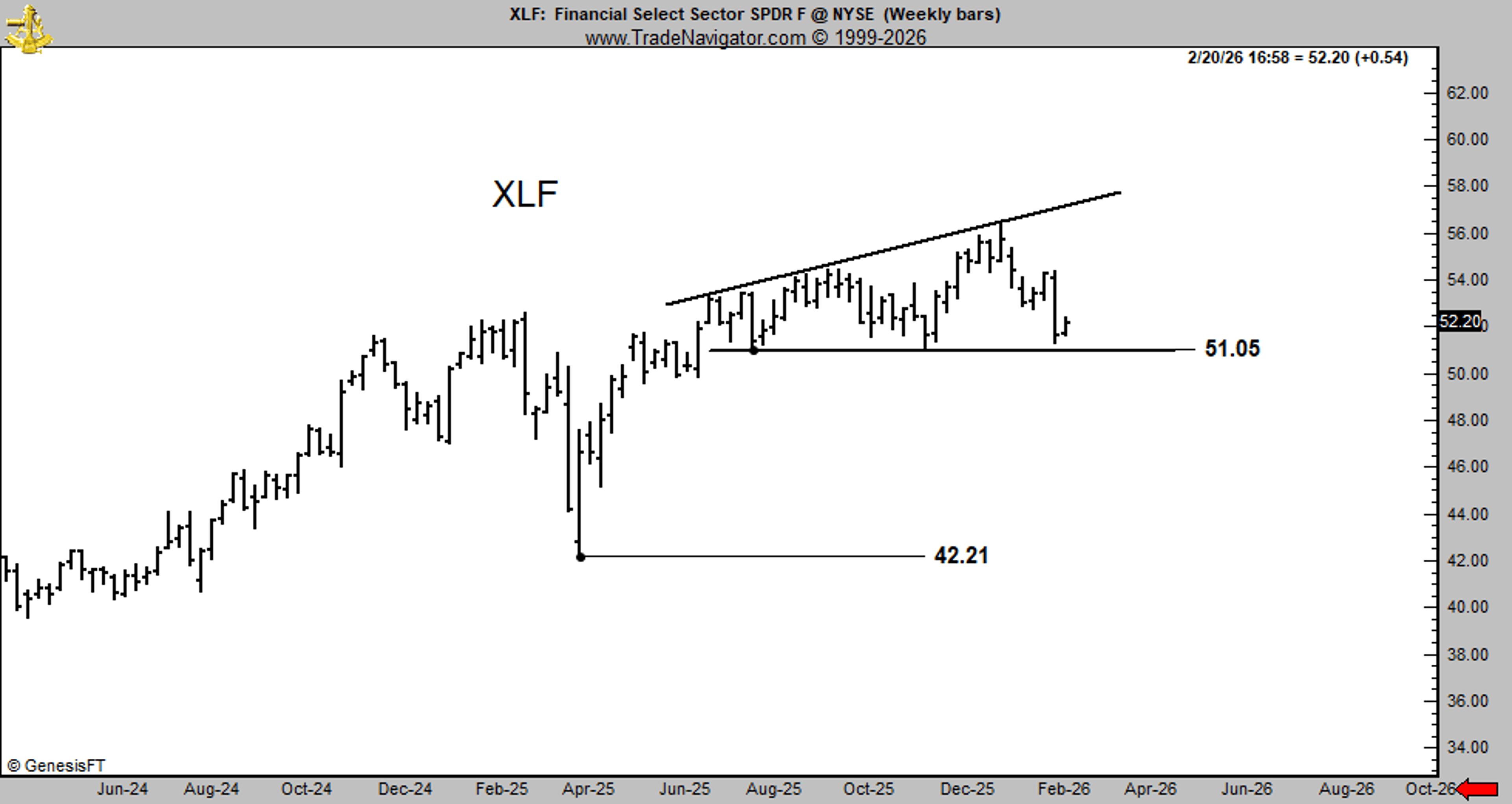

Right‑angled Broadening Pattern Signals Bearish Outlook

The rules of classical charting principles have been lost to the younger generations. This is a right angled broadening pattern. According to E&M, 5th edition, page 149, the pattern has bearish implications regardless of which boundary is horizontal $XLF Don't shoot the...

By Peter Brandt

News•Feb 17, 2026

Roku Shares Climb. Is It Too Late to Buy the Stock?

Roku reported a robust Q4, with revenue rising 16% to $1.39 billion and EPS flipping to a profit of $0.53, beating expectations. Platform revenue surged 18% to $1.22 billion, driven by video ads and premium subscriptions, while device revenue barely grew. Adjusted...

By Yahoo Finance – News Index

News•Feb 17, 2026

Tripadvisor Engages with Starboard as Activist Seeks Board Control, Sale

Tripadvisor disclosed multiple discussions with activist investor Starboard Value, which owns about 9 % of the company and is seeking board control and a possible sale. Starboard criticizes a 50 % share decline since CEO Matt Goldberg’s 2022 appointment, slow adoption of...

By Yahoo Finance – News Index

Social•Feb 17, 2026

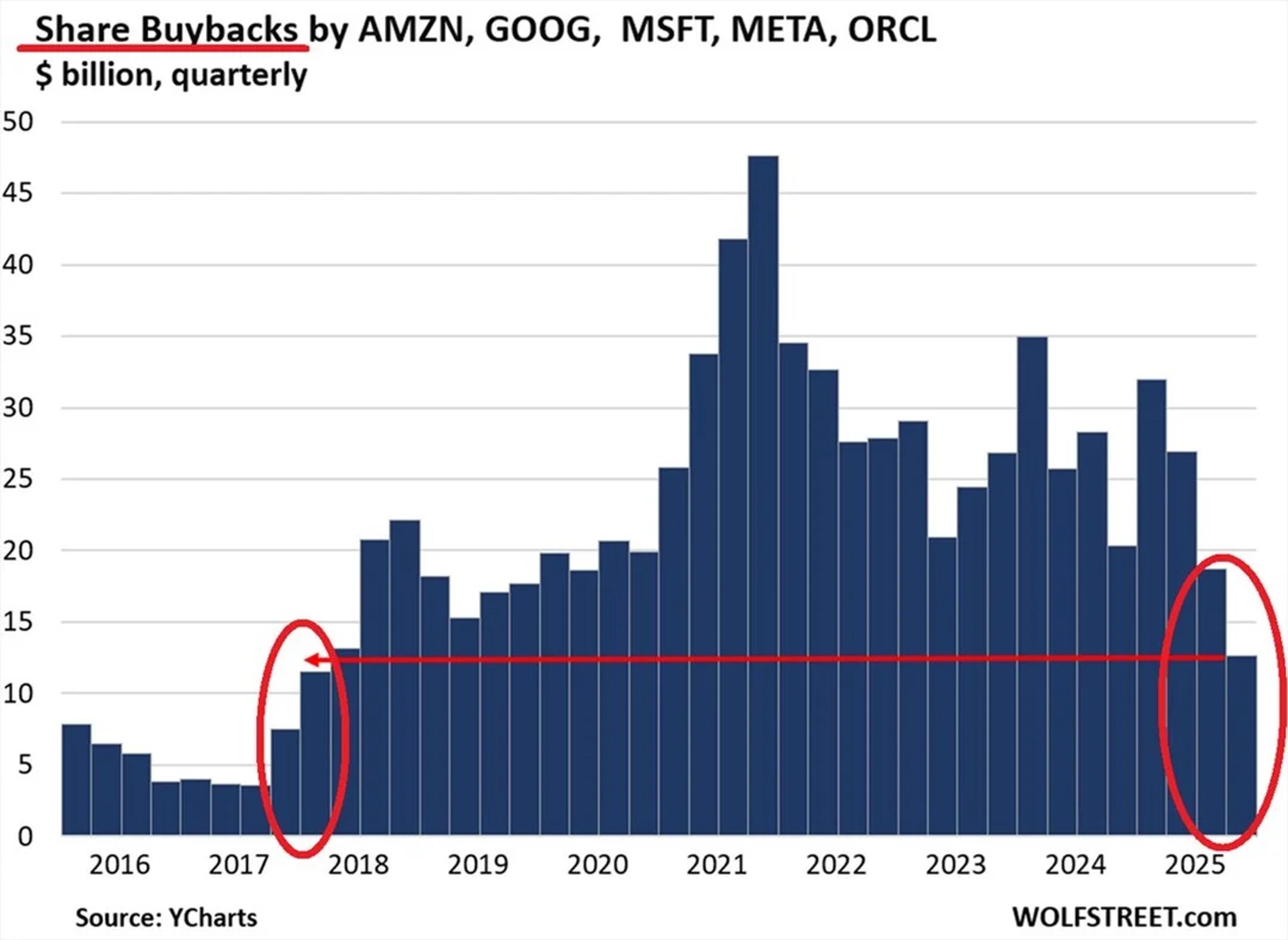

Big Tech Cuts Buybacks, Shifts to AI Spending

‼️The largest US stock buyer since 2009 is STEPPING BACK: Combined buybacks by Amazon, Alphabet, Microsoft, Meta, and Oracle fell to $12.6 billion in Q4 2025, the lowest in 7 YEARS. This marks the 3rd quarterly decline, a -70% DROP from the...

By Global Markets Investor (newsletter author)

Social•Feb 17, 2026

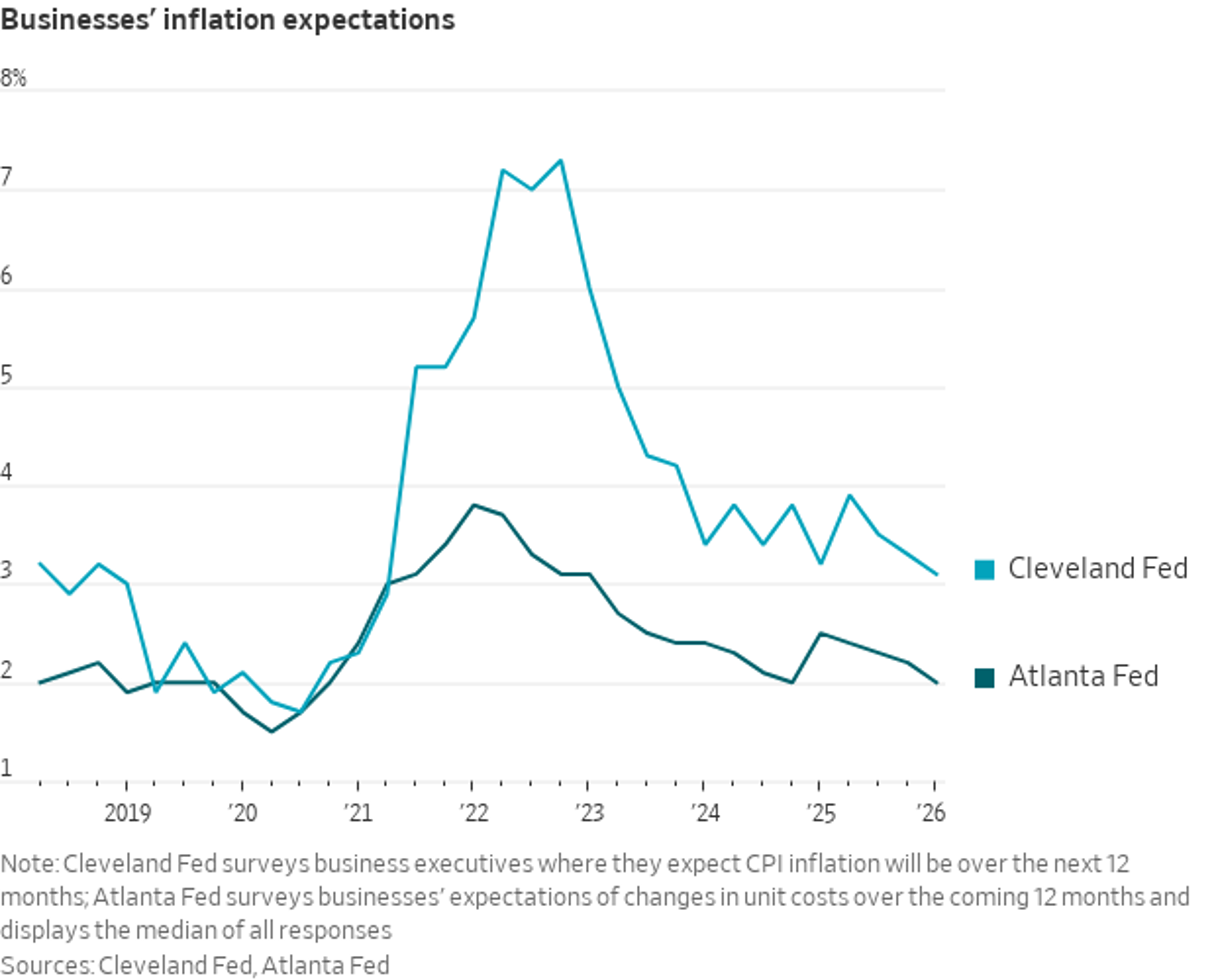

Business Inflation Expectations Return to Pre‑Pandemic Levels

Two different measures of business inflation expectations have essentially returned to pre-pandemic levels. The Atlanta Fed survey (dark line), which asks businesses how much they expect their own unit costs to change, is back at 2%—right where it was in 2019....

By Nick Timiraos

News•Feb 17, 2026

Cloud Startup Render Raises Funding at $1.5 Billion Valuation as AI-Built Apps Boom

Render announced a $100 million financing round that lifts its valuation to $1.5 billion, reflecting the surge in AI‑generated applications. The San‑Francisco startup reports revenue growth exceeding 100 percent and a developer community of more than 4.5 million users. It runs on AWS and...

By CNBC – Markets

Social•Feb 17, 2026

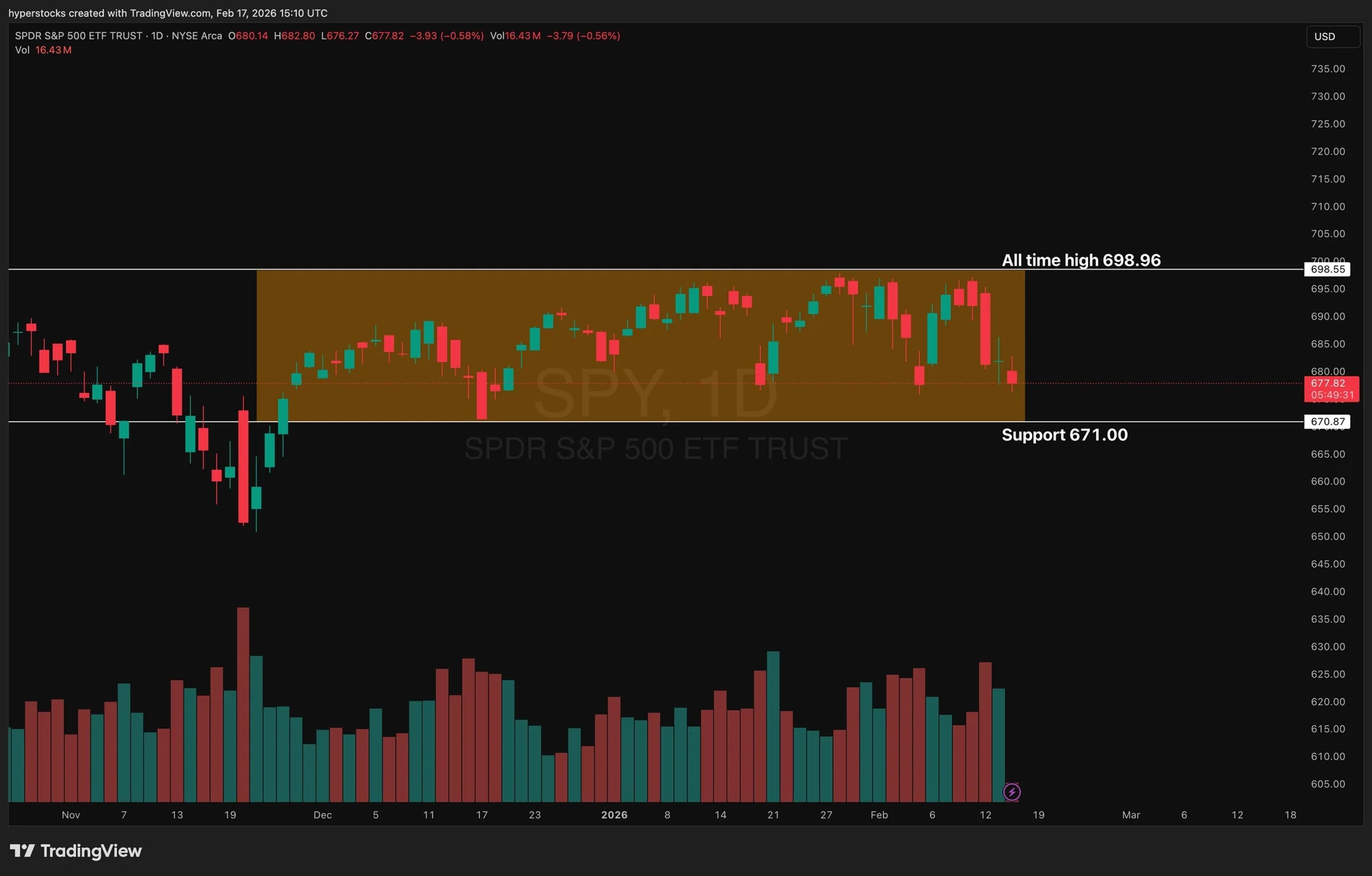

SPY Poised to Break November Range Amid Key Data

Is it finally the week $SPY breaks this range? Stuck here since November. Reports scheduled this week: - U.S. Trade Deficit Report (Thu) - GDP (Fri) - Inflation Report (Fri) - Consumer Sentiment (Fri)

By Hyperstocks

Social•Feb 17, 2026

Watch MU’s $386 Support to Gauge Memory Group Strength

📺 IS THE MEMORY GROUP STILL “SPECIAL”? $MU, $SNDK, and $WDC were some of the strongest names in the market recently. The key question is whether this group can maintain its leadership while broader tech faces downside pressure. $MU trade framework: – If $MU...

By Scott Redler

News•Feb 17, 2026

FDIS: Consumer Discretionary Dashboard For February

The February Consumer Discretionary Dashboard shows the sector’s services segment trading about 14% below its 11‑year average, while autos and components remain the most overpriced subsector. Fidelity’s FDIS ETF and SPDR’s XLY deliver comparable long‑term Sharpe ratios, but FDIS offers...

By Seeking Alpha – ETFs & Funds

Social•Feb 17, 2026

Market Awaiting Decisive Breakout: Support or Resistance?

📺 THIS MARKET NEEDS RESOLUTION The market is stuck in a range. Breakouts fail, breakdowns bounce, and both longs and shorts get frustrated. We need a decisive move that breaks the range and sticks. That could mean: 🔻 A clean break below support $QQQ...

By Scott Redler

Social•Feb 17, 2026

Foreign Investment Steady, US Stocks Slightly Lagging

Balanced take from Bob. While the headline may be different than my "get out" thesis. The meat says the same. Flows suggest marginally weaker dollar and relative underperformance of U.S. stocks vs ROW. Don't panic out...

By Andy Constan

News•Feb 16, 2026

Oracle Surges 12% While Apple, Amazon Tumble in Choppy Tech Week

Oracle surged 12% after unveiling a multi‑billion AI cloud infrastructure plan, bucking a week where all Magnificent 7 stocks fell year‑to‑date. Microsoft and Amazon slipped into bear‑market territory despite solid earnings, while Apple dropped nearly 8% on memory‑price margin worries. Nvidia...

By Yahoo Finance – Top Financial News

Social•Feb 17, 2026

Dollar Up Shows Unchanged Signal Amid Correlation Risk

If there was something else to "dig into", I would have. Dollar Up has its implied Correlation Risk today. I'll do what the signal does. It didn't change.

By Keith McCullough

Social•Feb 17, 2026

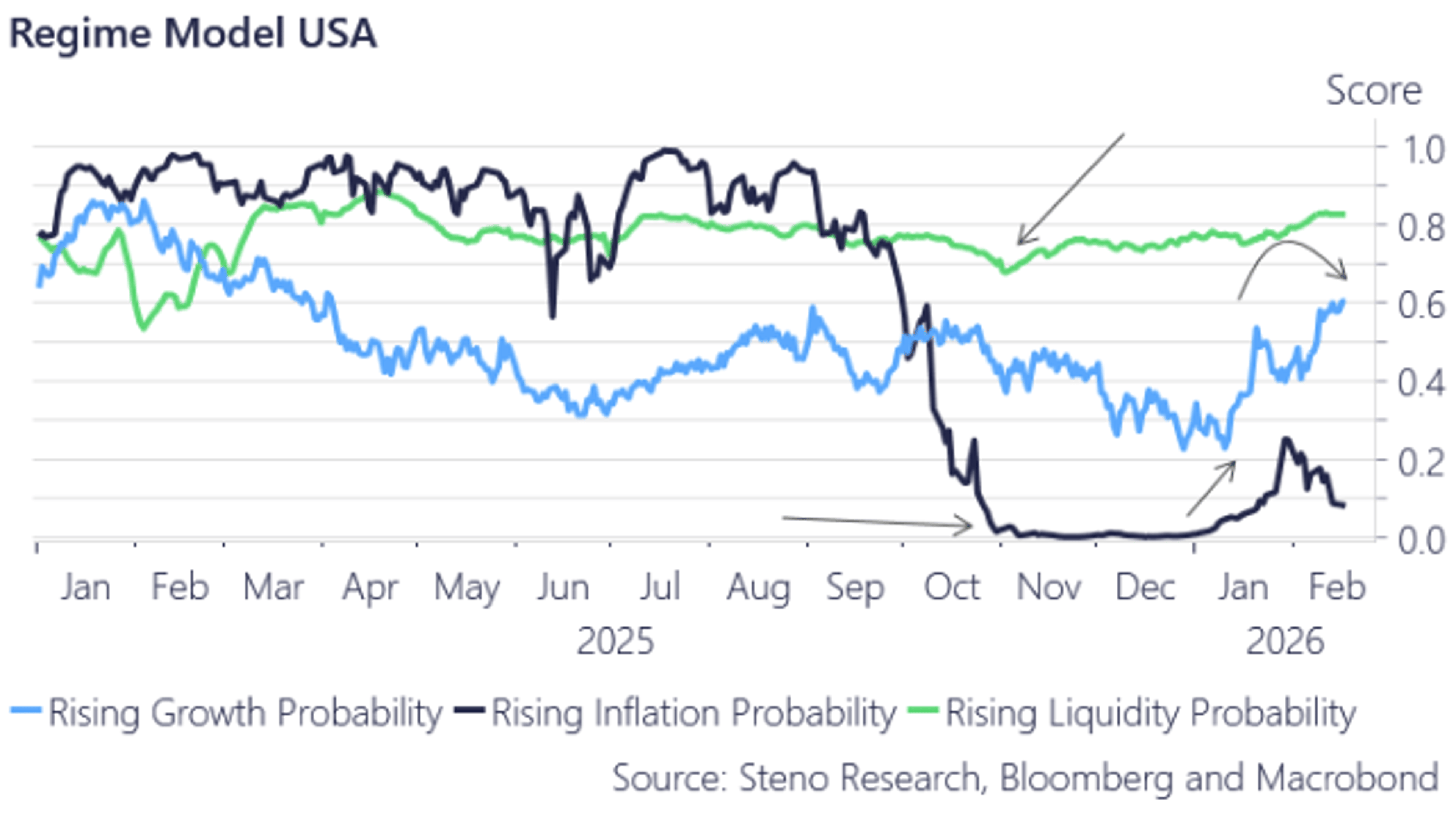

Nowcast IQ Predicts US Growth Despite Market Pessimism

A few of our weekly inputs have come in for US growth. We continue to rebound hard cyclically. EURUSD down, US assets (soon) up, and ISM PMI towards 60 by summer. Our Nowcast IQ is telling a VERY contrarian story to...

By Andreas Steno Larsen

Social•Feb 17, 2026

Retail Favorites, IPO Timing, and Base Rates Explained

🔬 Research links: the stocks retail investors favor, the impact of IPO timing, and why base rates matter so much. https://t.co/cjmTGAY0wz chart: https://t.co/rvyduDs39u https://t.co/EKv26rorKm

By Tadas Viskanta

Social•Feb 17, 2026

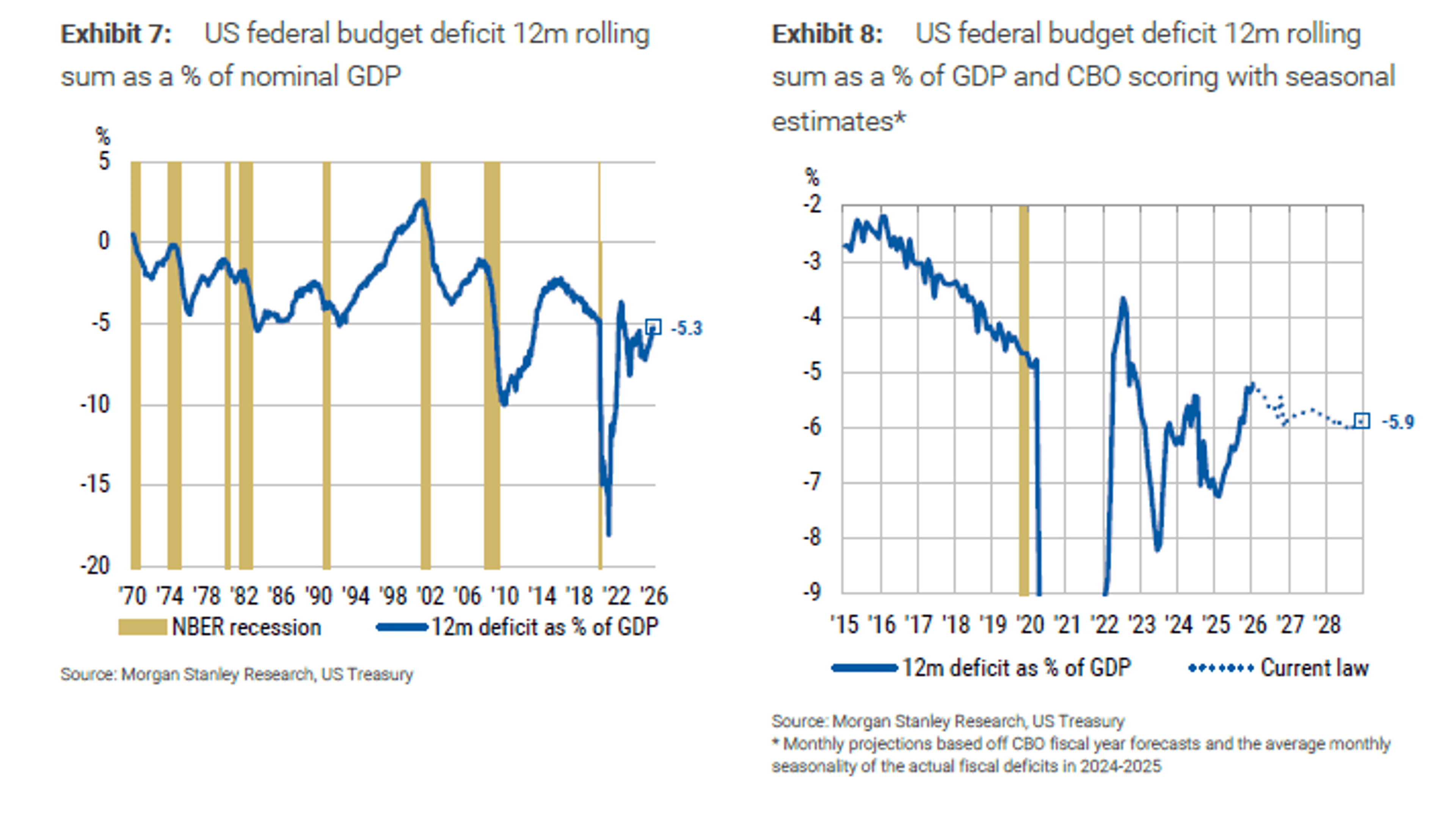

New Projections Quiet Bond Vigilantes, Ease Debt Fears

New US deficit and growth projections ""suggest a quiet period ahead for bond vigilantes and others who hand-wring over the unsustainable nature of the US debt and the inevitable market revolt – the Godot for which they have waited impatiently...

By Lisa Abramowicz

Social•Feb 17, 2026

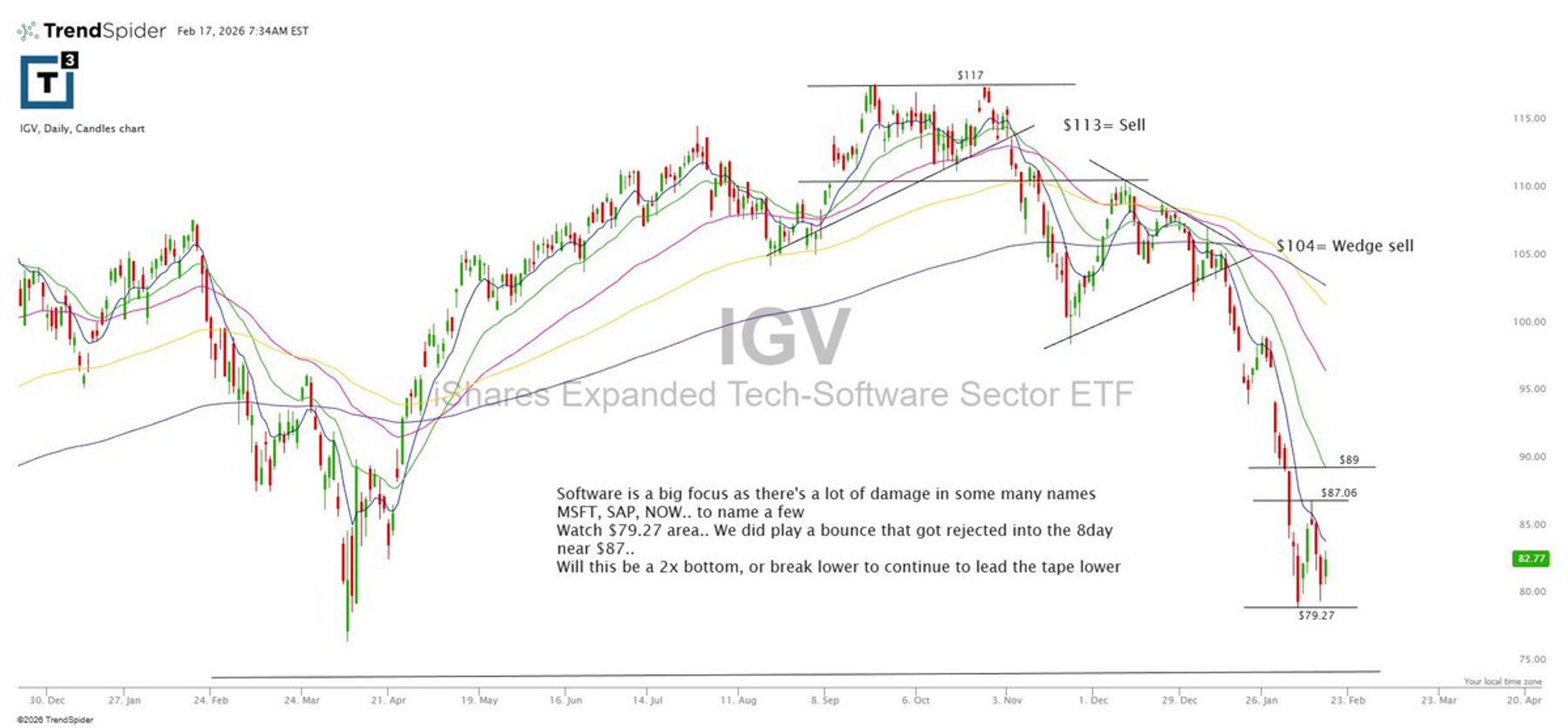

IGV Bottom? Watch

Did we get a 2X bottom in $IGV or does it take another leg lower. $orcl worth a look if software tries to hold last weeks low https://t.co/bmeM49XP1F

By Scott Redler

Social•Feb 17, 2026

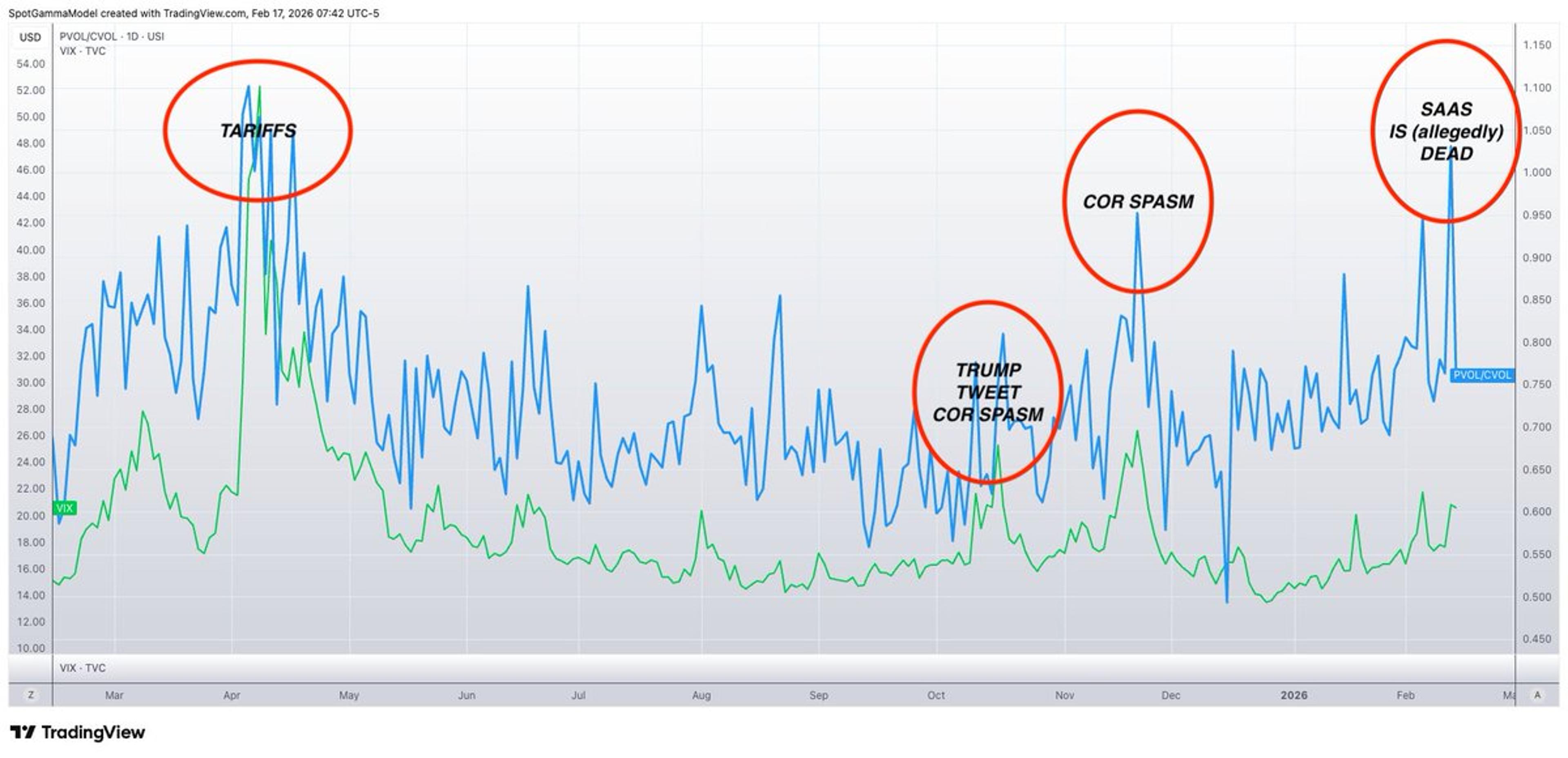

VIX Lags Behind Single‑Stock PC Ratio Indicator

In the spirit of committing chart crimes, here is the single stock PC ratio vs the VIX (green). VIX, a proxy for SPX IV, is clearly lagging. Likely unrelated is that VIX exp is tomorrow... https://t.co/ygiUeMv38z

By Brent Kochuba

Social•Feb 17, 2026

SPX Below 50‑Day MA, Support at 6780‑6790

$SPX is now below the 8/21/50day. The longer we sit under 6880ish the higher the odds we see lower prices. A reclaim back above there keeps this range action intact, while 6780–6790 remains the key major support zone. https://t.co/Zmq5a33GXE

By Scott Redler

Social•Feb 17, 2026

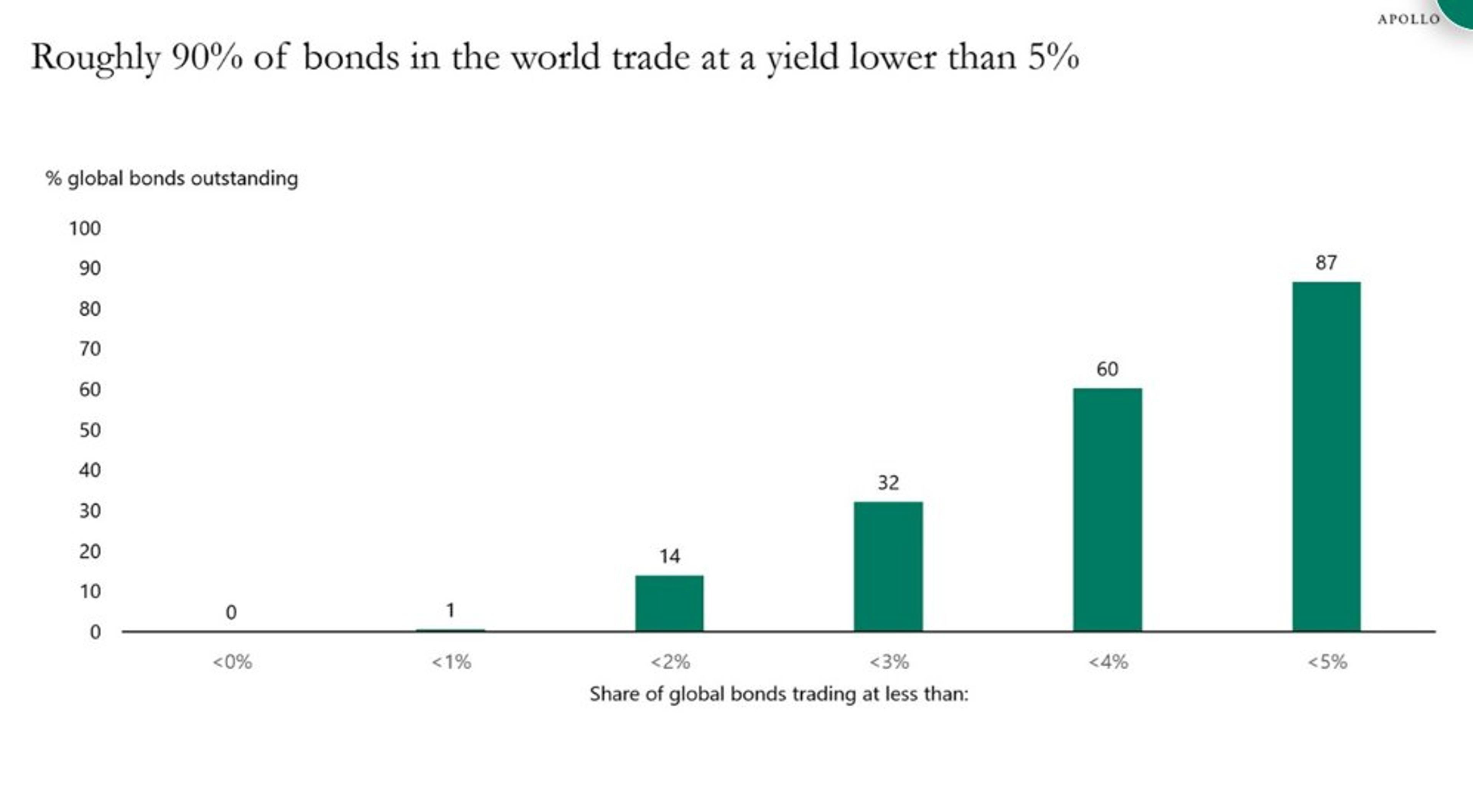

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

Social•Feb 17, 2026

Institutional Sentiment Swings Rapidly Amid AI Disruption Fears

This week’s episode explores a dramatic shift in sentiment that unfolded in just a few days. Emily and Michael are joined by Jay Glickson (Macro Sales) to discuss what institutional investors are saying, how AI disruption fears are shaping their...

By Michael Kantro

Social•Feb 17, 2026

Nvidia

"AI Revolution" - Nvidia unchanged since July, off 3% in 2026. Street Research $NVDA at $181 Buys 92.8% ...

By Lawrence McDonald

Social•Feb 16, 2026

AI Accelerates Market Signal Turnover and Degradation

One thing I feel strongly about regarding AI is that, when it comes to trading, we are going to witness a streamlined cycle of signal degradation. Classical signals will become crowded very quickly. The market will rotate through those cycles faster...

By Kris Sidial

Social•Feb 16, 2026

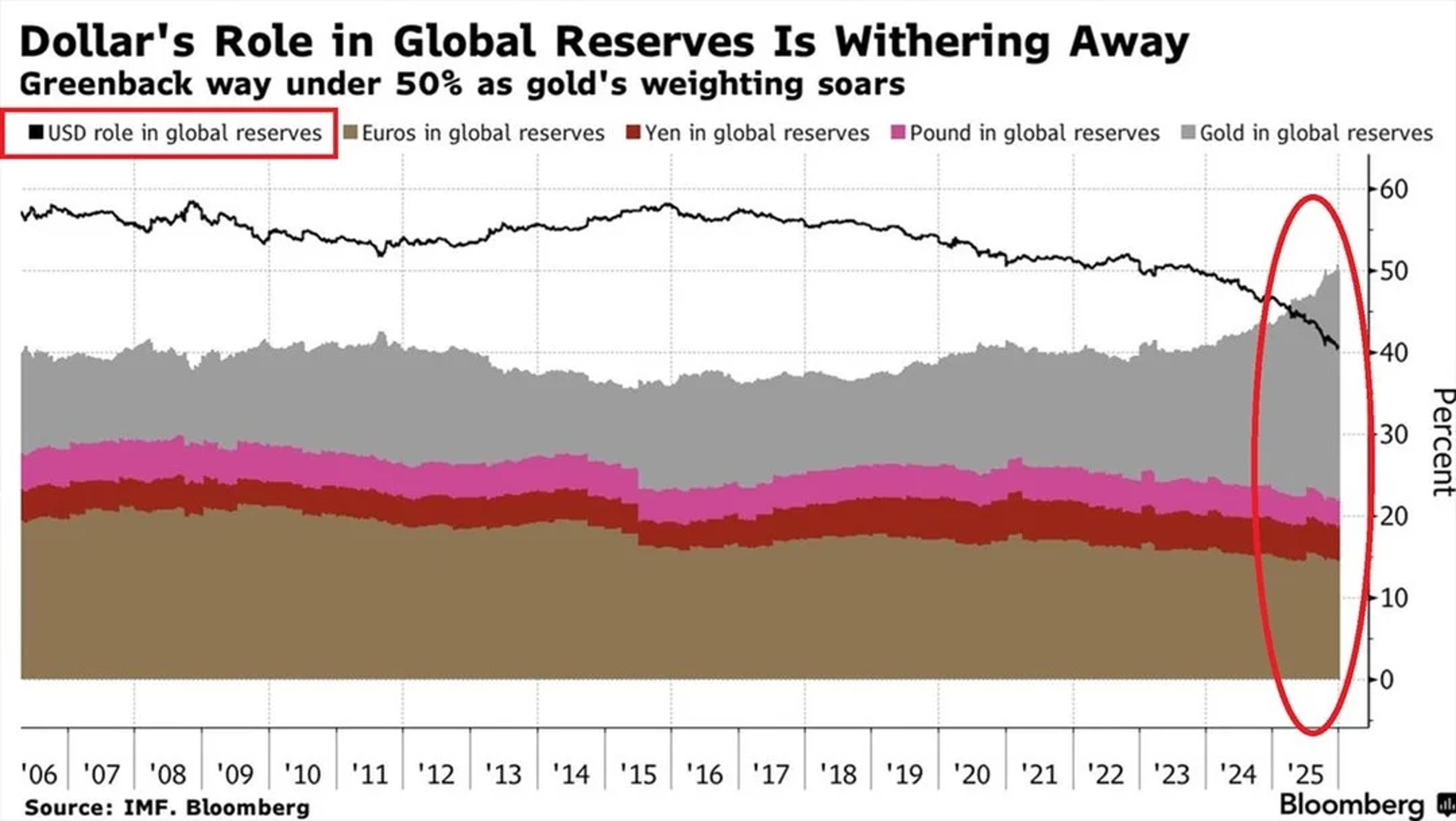

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

Low‑end Apple Releases Spark Brief Sales Bump

Agree with Mark. March 4 will likely be highlighted by a low-end MacBook and maybe a new lower-priced iPhone 17e (the 16e came out a year ago). Siri won't be addressed. My take: The low-end products have historically led to a...

By Gene Munster

Social•Feb 16, 2026

2025 Profitability Snapshot: Sector Returns & Excess Gains

In my sixth data update, I look at business profitability in 2025, across sectors, industries and regions, scaled to revenues (profit margins) and to invested capital (accounting returns). I use the latter to compute and compare excess returns. https://t.co/L3PDmph4VA

By Aswath Damodaran

Social•Feb 16, 2026

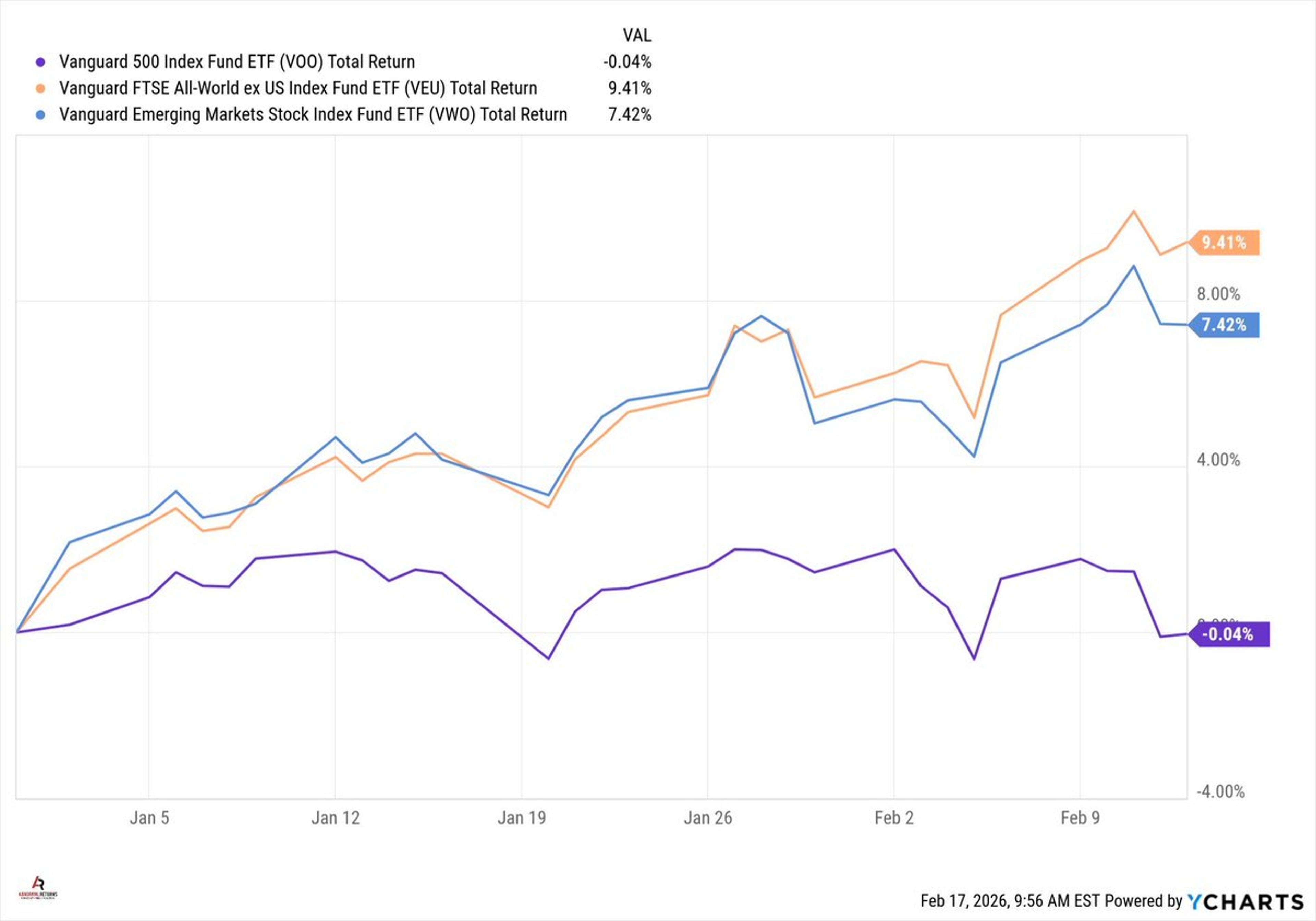

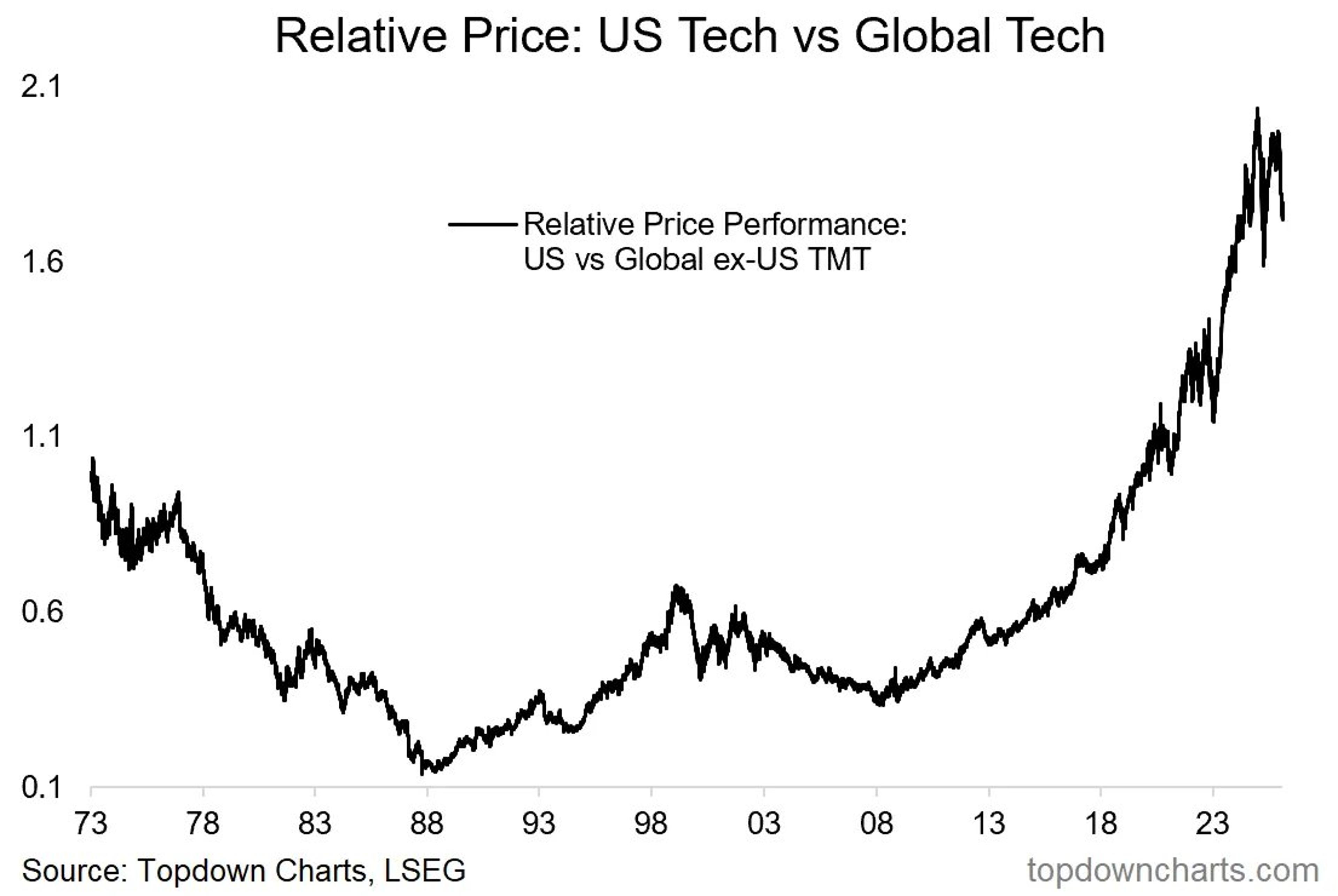

US Tech Dominance Fades as Global Rotation Shifts

This chart captures the 2 most important themes in the Stockmarket right now. 1. Global vs US rotation 2. Top in tech stocks For the past 17-years US Tech stocks have dominated global markets, but that is starting to change... https://t.co/6DhUXusR6C

By Callum Thomas

Social•Feb 16, 2026

Investors Shift From S&P 500 to Alternatives, Gains Accelerate

Rotation away from S&P500 (flat on the year) into other assets like foreign stocks, US value, etc up 10-15% seems to be accelerating...

By Meb Faber

Social•Feb 16, 2026

Weekly S&P 500 Chart Review Highlights Key Trends

ICYMI: Weekly S&P500 #ChartStorm blog post https://t.co/B5a4uBC2Q4 Thanks + follow reco to chart sources @MarketCharts @topdowncharts @dailychartbook @MauiBoyMacro @KobeissiLetter @StealthQE4 @HayekAndKeynes

By Callum Thomas

Social•Feb 16, 2026

Sector Rotation Ends; Brace for Upcoming Volatility

Given I timed the sector rotation with precision in Nov & said it would likely run until Feb, and we are here, I'm gonna share what else I also told clients: IN LIEU OF SECTOR ROTATION, THERE WILL BE VOLATILITY™️😉

By Samantha LaDuc