🎯Today's American Stocks Pulse

Updated 1h agoWhat's happening: Booking Holdings launches 25‑for‑1 stock split as earnings surge

Booking Holdings announced a 25‑for‑1 forward stock split, converting each share into 25 shares, effective April 6 2026. The move follows a Q4 report showing $6.3 billion revenue, 38% EPS growth, and a dividend increase to $10.50 per share.

News•Feb 16, 2026

The Quiet Architect of Trump’s Global Trade War

Jamieson Greer, a low‑key lawyer turned U.S. Trade Representative, has become the chief architect of President Trump’s renewed global trade war. Since his appointment in early 2025, Greer has designed aggressive tariff structures and led negotiations with major trading partners, including China, the EU, and Colombia. His legal expertise underpins the administration’s push to raise tariffs to historic levels and reshape supply chains. Greer’s behind‑the‑scenes influence is reshaping how trillions of dollars in goods move worldwide.

By The New York Times – Business

Social•Feb 16, 2026

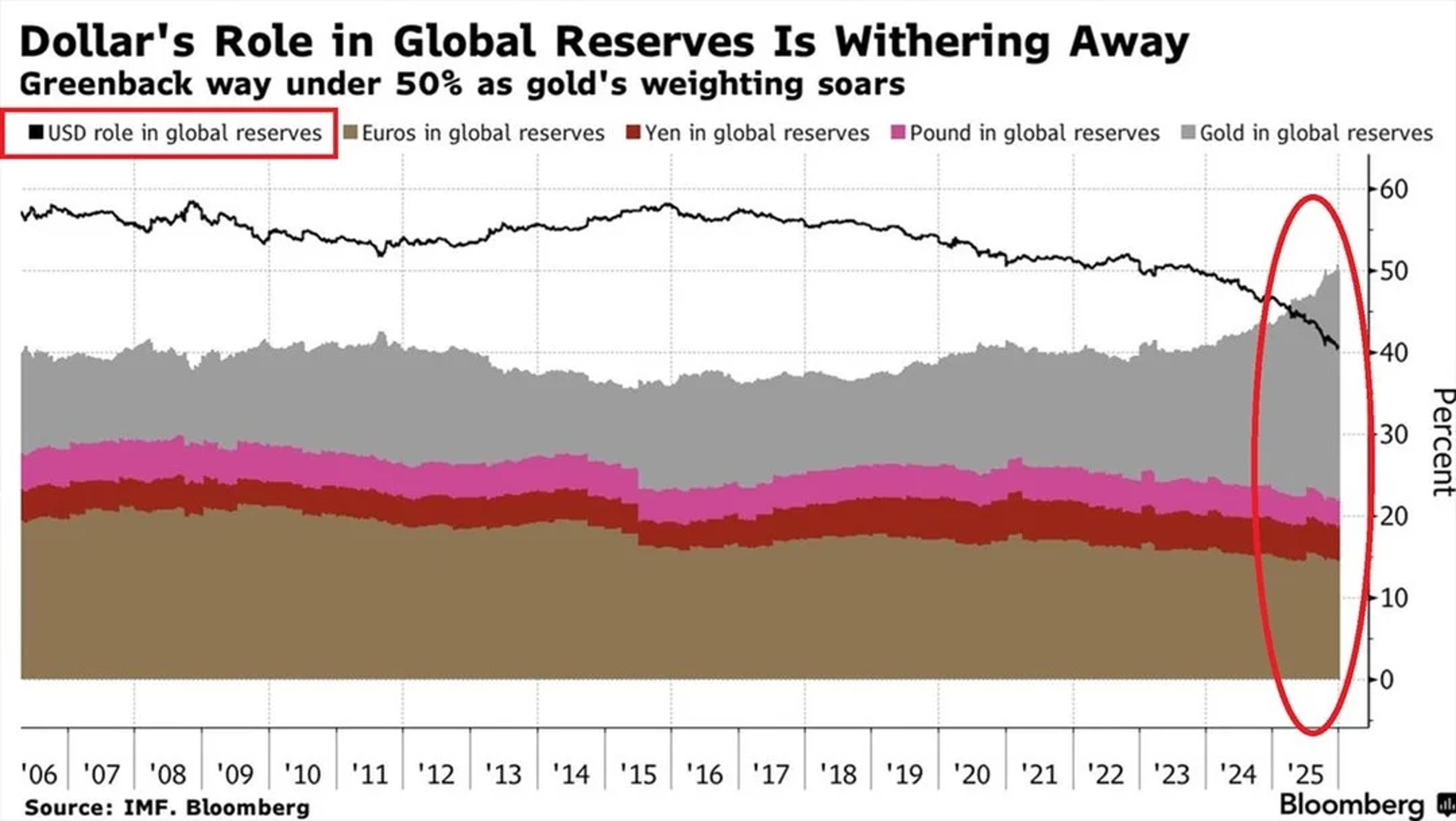

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

News•Feb 16, 2026

How a Trump Tax Break Rescued Horse Racing

Owners poured nearly $1.5 billion into racehorses last year, a 21 percent jump from 2024, while the Keeneland September Yearling Sale set a record $531.5 million in sales, up 24 percent. A Trump‑era bonus depreciation provision now lets owners immediately deduct the full purchase...

By The New York Times – Business

Blog•Feb 16, 2026

☕ Did We Just Miss the Turn in Dutch Bros?

In this episode, Edward Corona examines Dutch Bros (BROS), a drive‑thru coffee chain that just reported one of its strongest quarters, asking whether the stock is showing an early momentum shift that could signal a broader market turn. He breaks...

By The Options Oracle (Closing Bell Recap & Premarket)

Social•Feb 16, 2026

US Growth Decouples From Jobs, Entering Uncharted Territory

Via the Financial Times: My thoughts on why US "jobless growth" may have entered uncharted territory. The decoupling of US growth from employment looks more persistent—and consequential—than the three previous episodes we've seen over the last 40 years: https://www.ft.com/content/298a38bb-4cc1-44f3-bd62-6aff25d58b94 #economy #jobs #employment #unemployment #growth...

By Mohamed El‑Erian

Social•Feb 16, 2026

Institutional Cash at Historic Low Triggers Global Sell Signal

🚨Global equities 'SELL SIGNAL' was triggered for the 7th month STRAIGHT: Institutional investors' cash as a share of assets fell to 3.2% in January, the lowest EVER. Cash allocations at or below 4% indicate a SELL SIGNAL for world stocks.👇 https://globalmarketsinvestor.beehiiv.com/p/us-stocks-ended-the-week-mixed-after-a-powerful-rebound-on-friday-weekly-market-recap-trading-week-0

By Global Markets Investor (newsletter author)

News•Feb 14, 2026

FFSM: Sensible SMID Strategy, Competitive Returns, Worth Shotlisting

Fidelity Fundamental Small‑Mid Cap ETF (FFSM) is an actively managed, non‑transparent fund that combines quantitative screening with fundamental research. Since its 2024 strategy shift, FFSM has outperformed the S&P 500 and several SMID peers such as IJH and SMMD, driven by...

By Seeking Alpha – ETFs & Funds

Social•Feb 16, 2026

Weekly S&P 500 Chart Review Highlights Key Trends

ICYMI: Weekly S&P500 #ChartStorm blog post https://t.co/B5a4uBC2Q4 Thanks + follow reco to chart sources @MarketCharts @topdowncharts @dailychartbook @MauiBoyMacro @KobeissiLetter @StealthQE4 @HayekAndKeynes

By Callum Thomas

Social•Feb 16, 2026

Sector Rotation Ends; Brace for Upcoming Volatility

Given I timed the sector rotation with precision in Nov & said it would likely run until Feb, and we are here, I'm gonna share what else I also told clients: IN LIEU OF SECTOR ROTATION, THERE WILL BE VOLATILITY™️😉

By Samantha LaDuc

Social•Feb 16, 2026

Warsh May Threaten Fed Stability Despite Doubtful Capability

Good piece. Warsh would be a fundamental break from the Bernanke, Yellen, and Powell Feds if he carried out his views. Do I think he’s capable of pulling that off? Not really. Do I think he might try to and...

By Claudia Sahm

Social•Feb 16, 2026

Metal Volatility Reveals Hidden Market Shifts

Metal Volatility Changed Everything $GLD $SLV $BTCUSD $SPX $QQQ $IGV $XLK Sharp volatility in gold, silver, crypto and equities was easier to spot than most think. And why I study sector rotation, options structure, and investor confidence. https://t.co/PYmLxcJSCJ

By Samantha LaDuc

Social•Feb 16, 2026

Chamath's SPACs Crash: All Lose Over 90%

Meanwhile Chamath Palihapitiya’s SPAC track record - Chamath became the face of the SPAC boom through his Social Capital Hedosophia deals. Their performance since? • $SPCE: −95% • $OPEN: −98% • $CLOV: −90% • $SOFI: −45% • $AKLI: −95% •...

By Doug Kass

Social•Feb 16, 2026

Flat Index Hides Underlying Market Turbulence

Flat Index Masks Hidden Chaos A guest contribution post by our partners at SpotGamma https://t.co/XlP50y4c9B

By Samantha LaDuc

Social•Feb 16, 2026

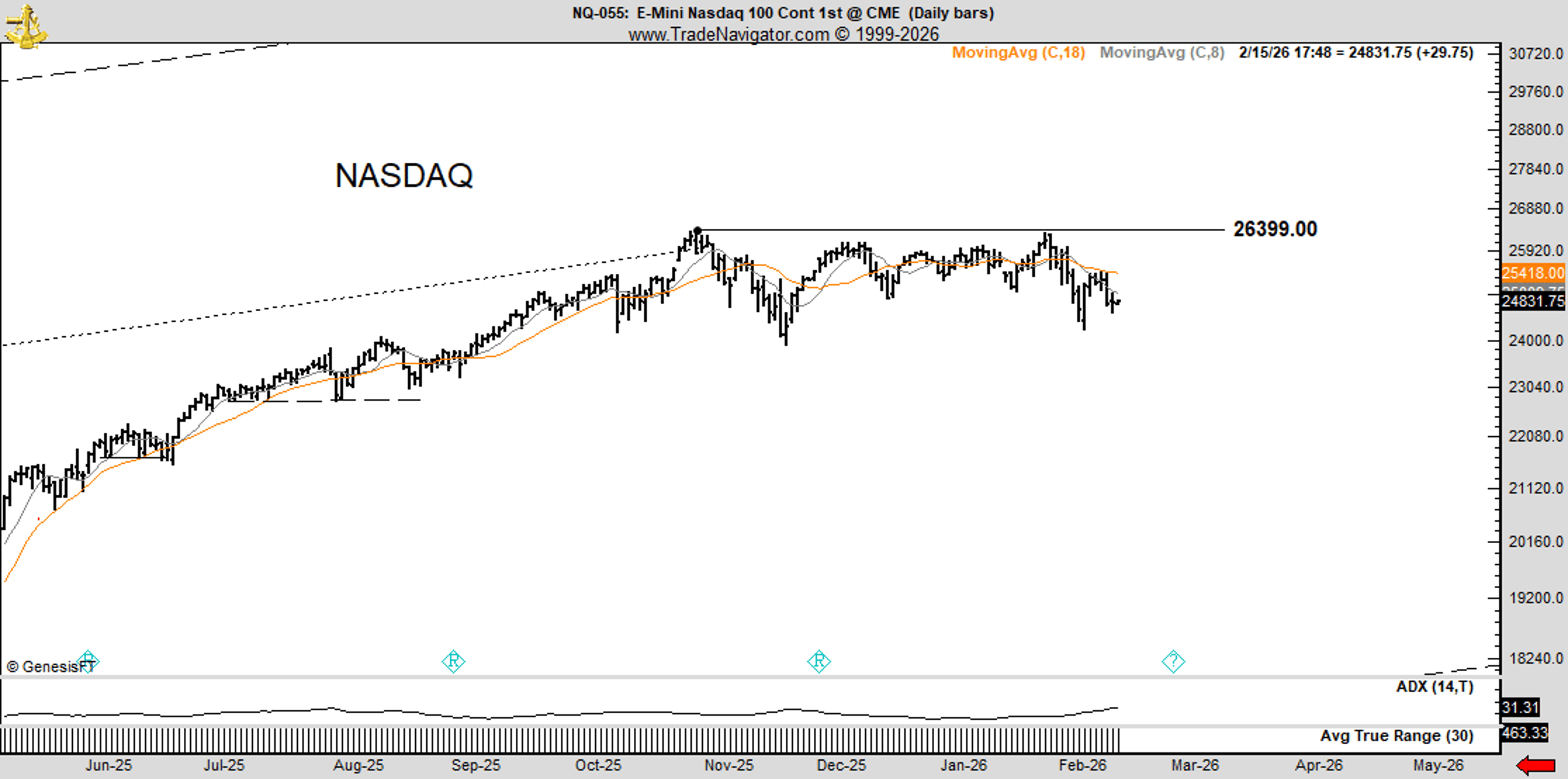

NQ Needs 26,800 Consolidation to Avoid Wyckoff Distribution

Unless and until NQ can consolidate above 26,800 there is a distinct possibility (50% Bayesian view) that this chart displays classic Wyckoff distribution For me the jury is still undecided @NQ_F $QQQ https://t.co/NdTFclpl7U

By Peter Brandt

Social•Feb 15, 2026

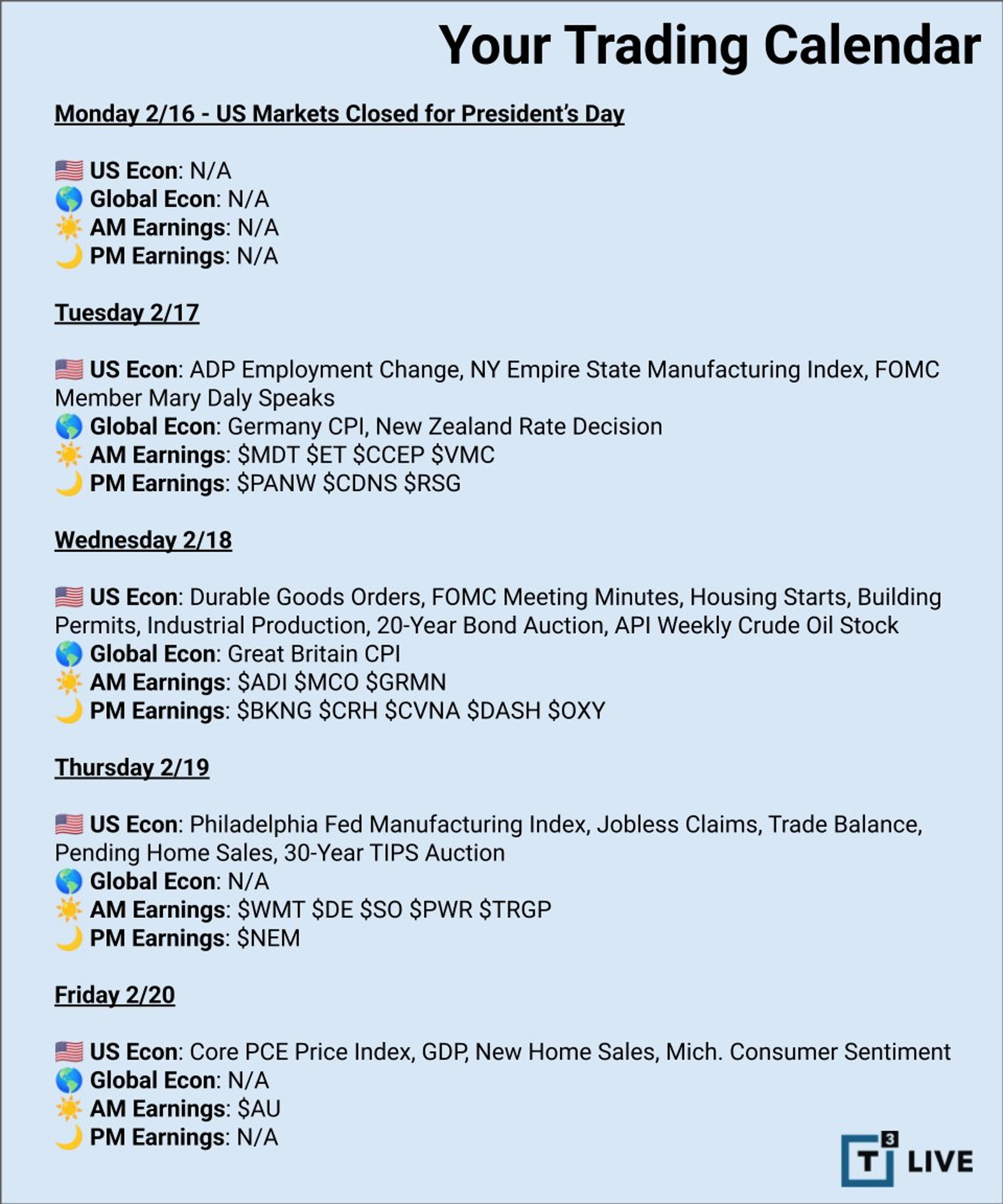

FOMC Minutes May Spark Q1 Market Shift

dailyanalysts 🚨 WEEK AHEAD ALERT: Feb 16-21 🚨 Three catalysts could define your portfolio's Q1. Markets closed Monday for Presidents' Day, but Tuesday through Friday is packed with market-moving data. S&P 500 is flat YTD. Nasdaq down 3%. Consumer confidence at DECADE LOWS. Here's...

By dailyanalysts

Social•Feb 15, 2026

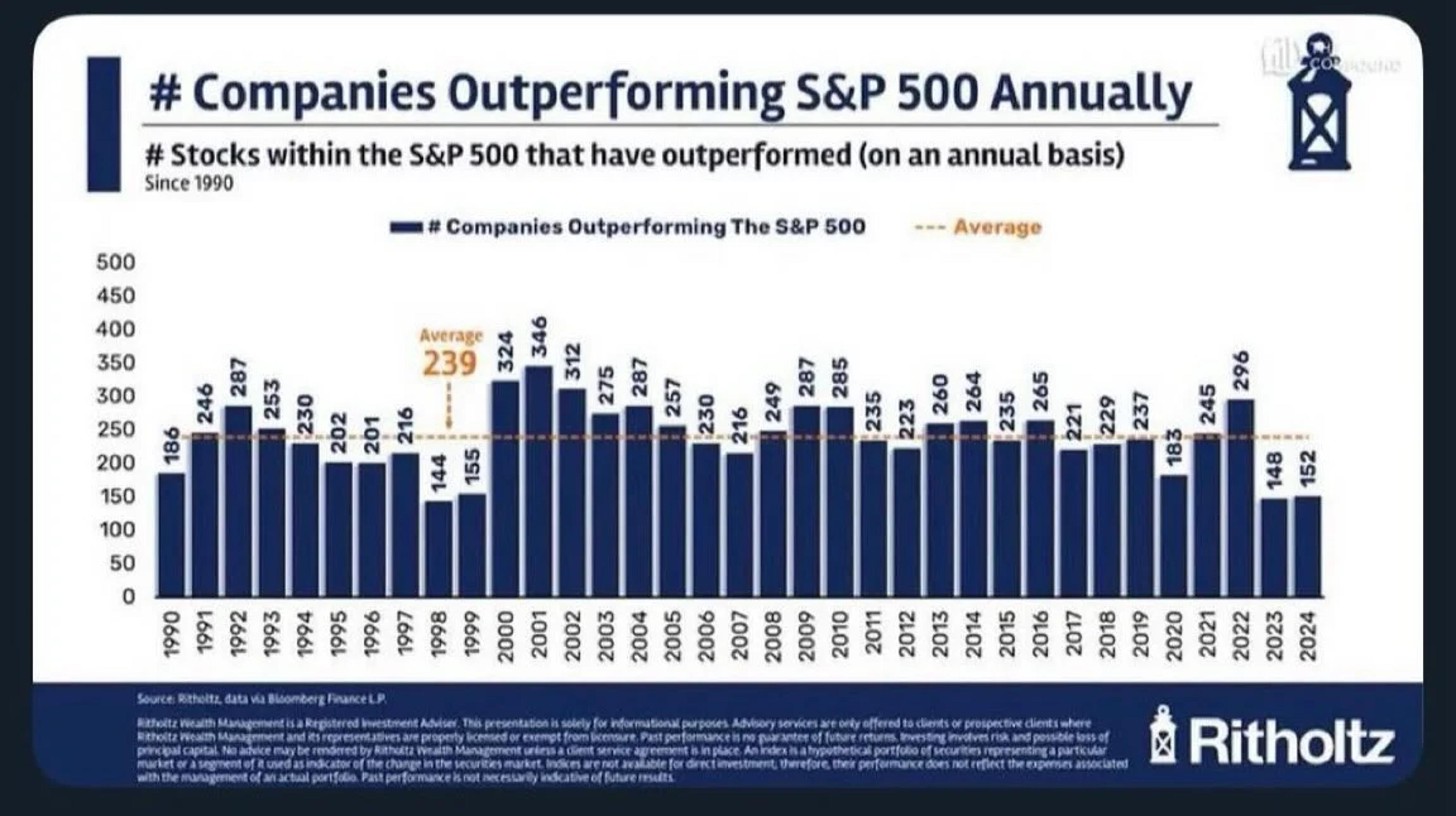

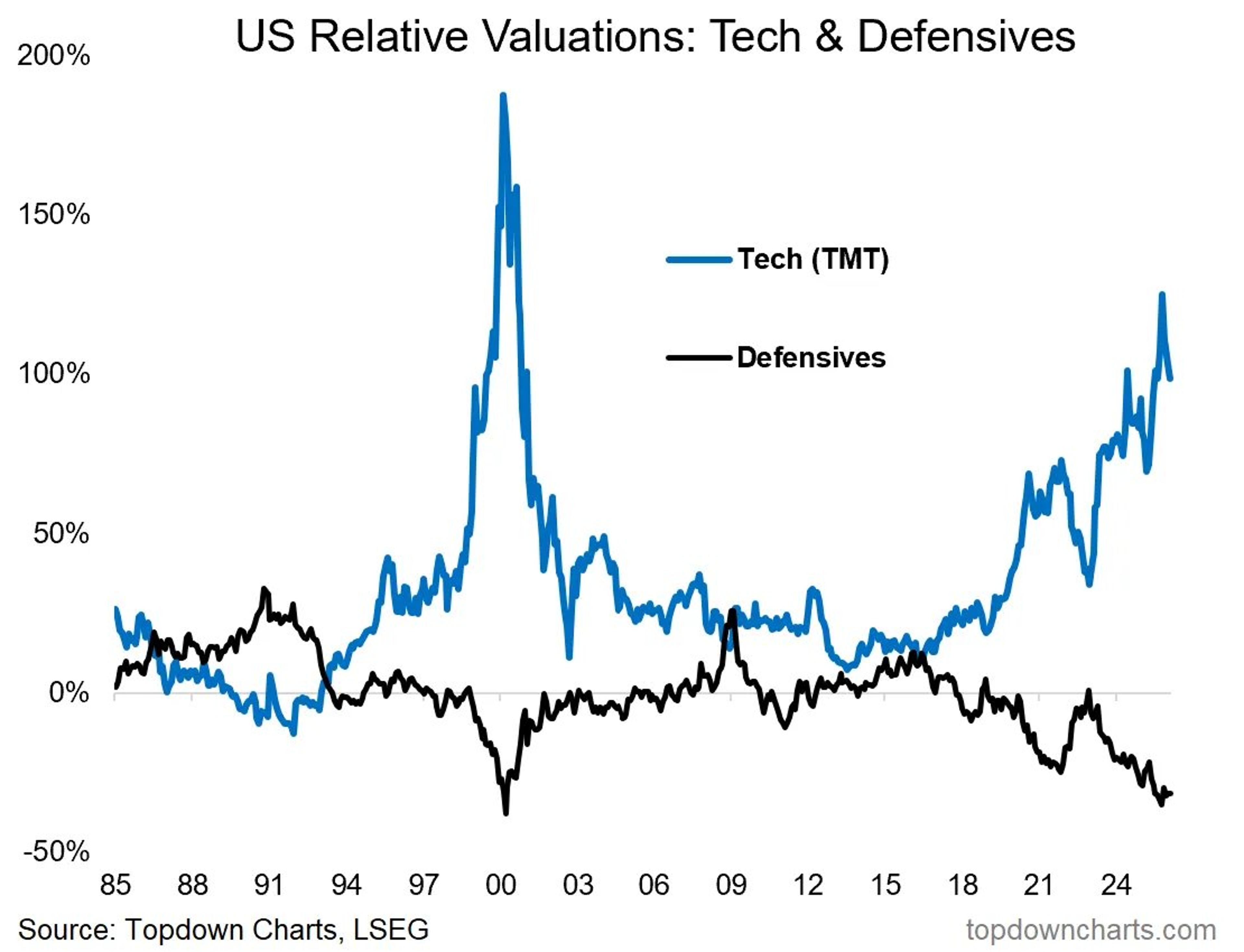

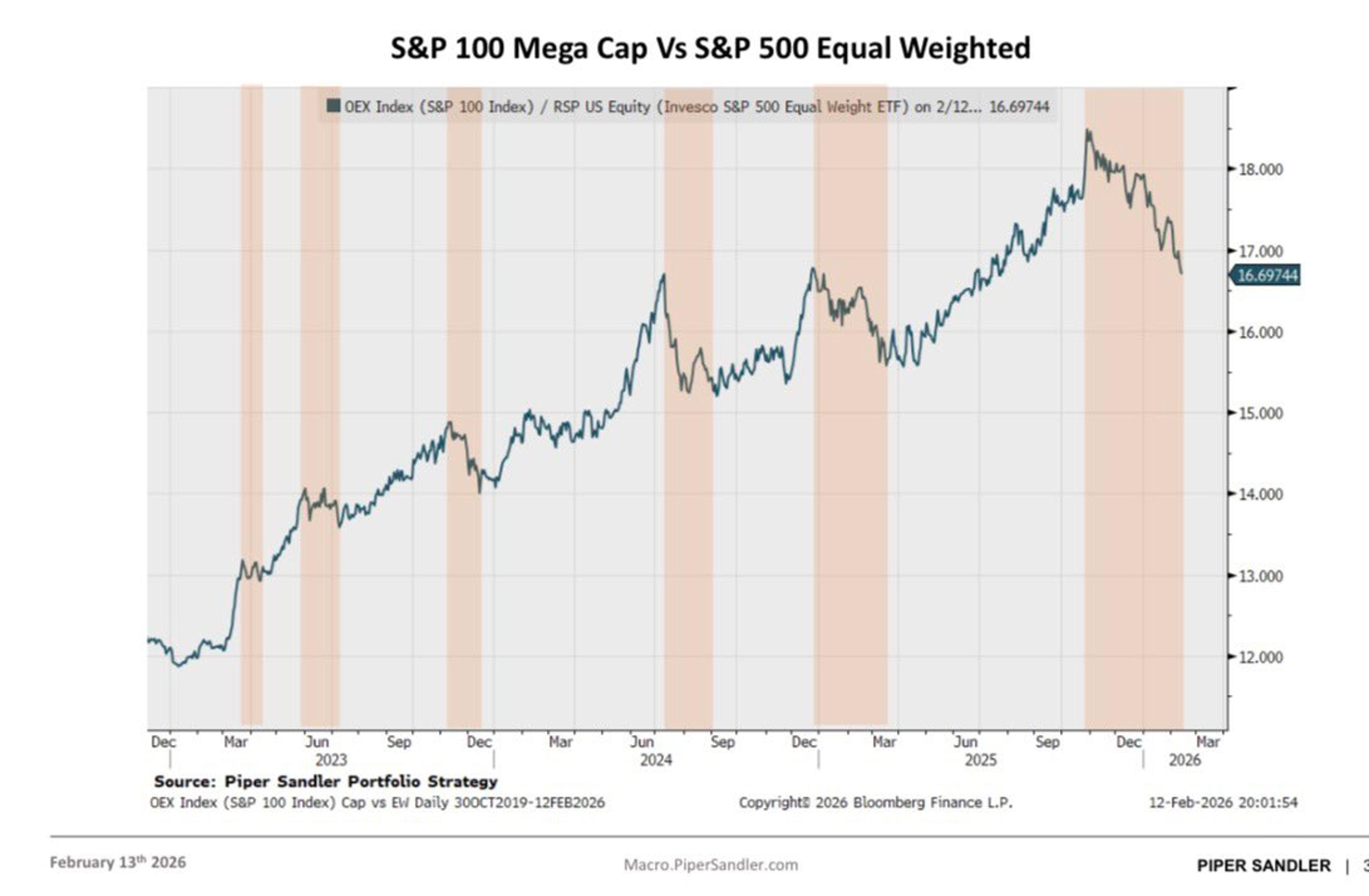

Tech Pullback Could Let Most S&P 500 Outperform

We have the potential to see a large portion of S&P 500 companies out perform in 2026. With the top 10 stocks making up around 40% of the index, even a slight pullback in tech would make this quite easy.

By Dividendology

Social•Feb 15, 2026

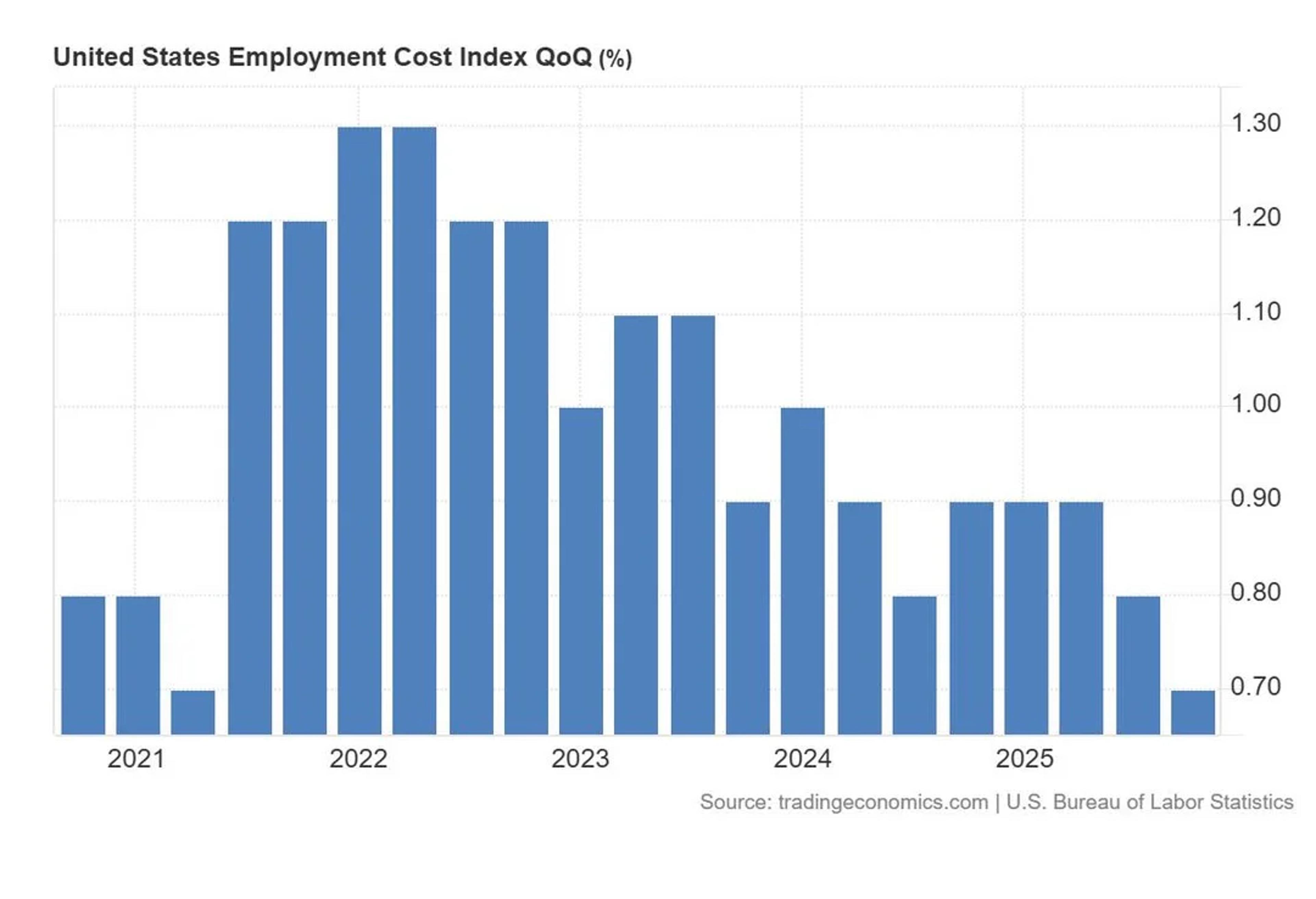

US Employment Costs Rise 0.7%, Lowest Since 2021

US employment costs rose 0.7% in the fourth quarter of 2025, just under forecasts of 0.8%, and the lowest level since Q2 2021.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 15, 2026

Tech Pressure Rises, Defensives Gain Amid Market Crossroads

Learnings and conclusions from this week’s charts: 1. Tech stocks (particularly software) remain under pressure. 2. Investor exposure to tech is at historically elevated levels. 3. Surging tech capex is coming at the cost of buybacks. 4. Private equity stocks are also coming under...

By Callum Thomas

Social•Feb 15, 2026

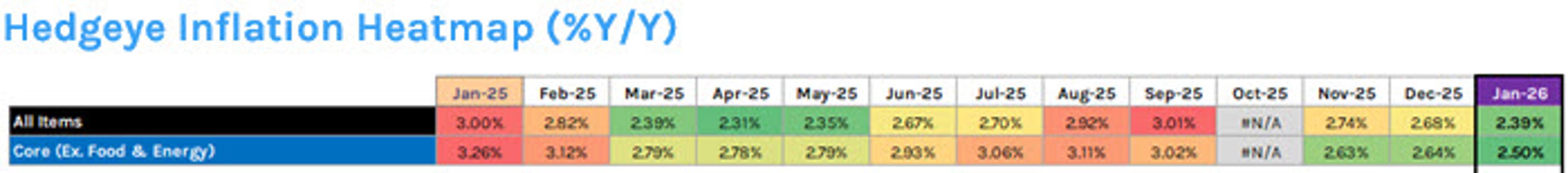

Hedgeye Nowcast Predicts Slowing Inflation, Yields Drop, Gold Rises

Hedgeye's Models vs. The Fed Reminder on the Hedgeye Nowcast for SLOWING US Inflation (which drove Bond Yields lower and Gold higher late this wk) Our monthly inflation nowcast is a weekly publication which augments our existing quarterly nowcast by offering a...

By Keith McCullough

Social•Feb 15, 2026

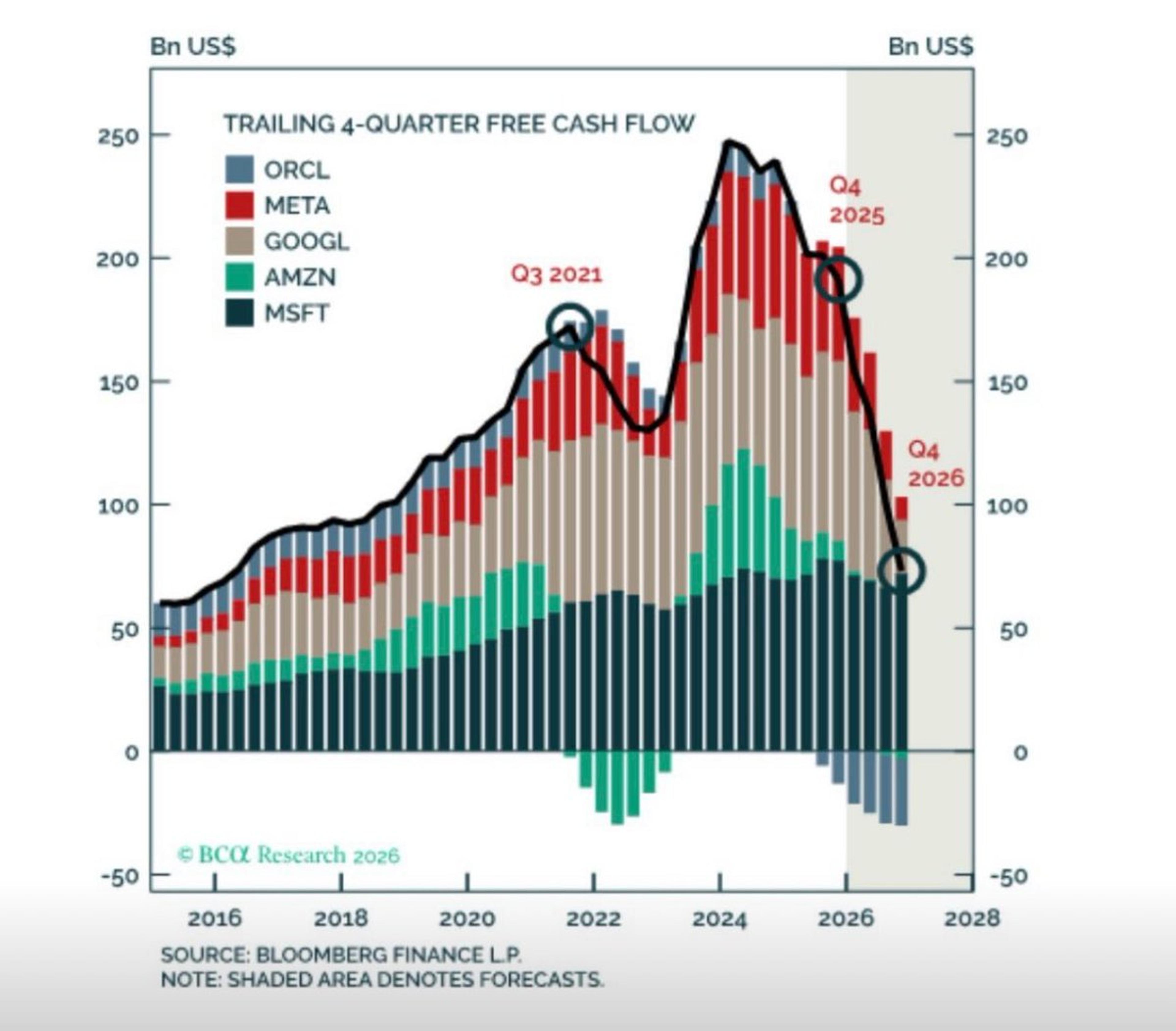

Strategists Misread CapEx, Overhype Free Cash Flow

I love how boomer strategists present the chart on free cash flows from the Mag 7 as rocket science. We learned on the first days at university that CapEx means less FCF in that year. Do these guys understand anything whatsoever...

By Andreas Steno Larsen

Social•Feb 15, 2026

S&P's Calm Mask Hiding Rising Dispersion and Volatility

The S&P 500 may appear calm on the surface, yet index-stock dispersion has increased dramatically and SPX has now slipped below the critical 6,900 level. With put skew rising and VIX expiration ahead, volatility risk is building. Read our latest...

By Brent Kochuba

Social•Feb 15, 2026

Semis Surge While Tech Splits Into Winners, Losers

If all you knew was that semis were up double digits, you'd never expect tech to be this weak. It is like tech is being split into two groups, the stuff that goes up and the stuff that goes down.

By Ryan Detrick

Social•Feb 15, 2026

Upcoming Week Packed with GDP, PCE, FOMC Insights

Get my newsletter Tuesday morning: https://t.co/dSU3TT2kZX Busy week coming with GDP, Core PCE, FOMC Minutes $PANW $ADI $WMT $DE https://t.co/7mNeUbi7R9

By Scott Redler

Social•Feb 15, 2026

Young Investors' Account Transfers Triple in a Decade

The share of people 25 to 39 years old making annual transfers to investment accounts more than **tripled** between 2013 and 2023 to 14.4 percent, outpacing increases for those 40 and over -- JPMorgan Chase Institute https://t.co/gcJCu02dAu @WSJmarkets

By Gunjan Banerji

Social•Feb 15, 2026

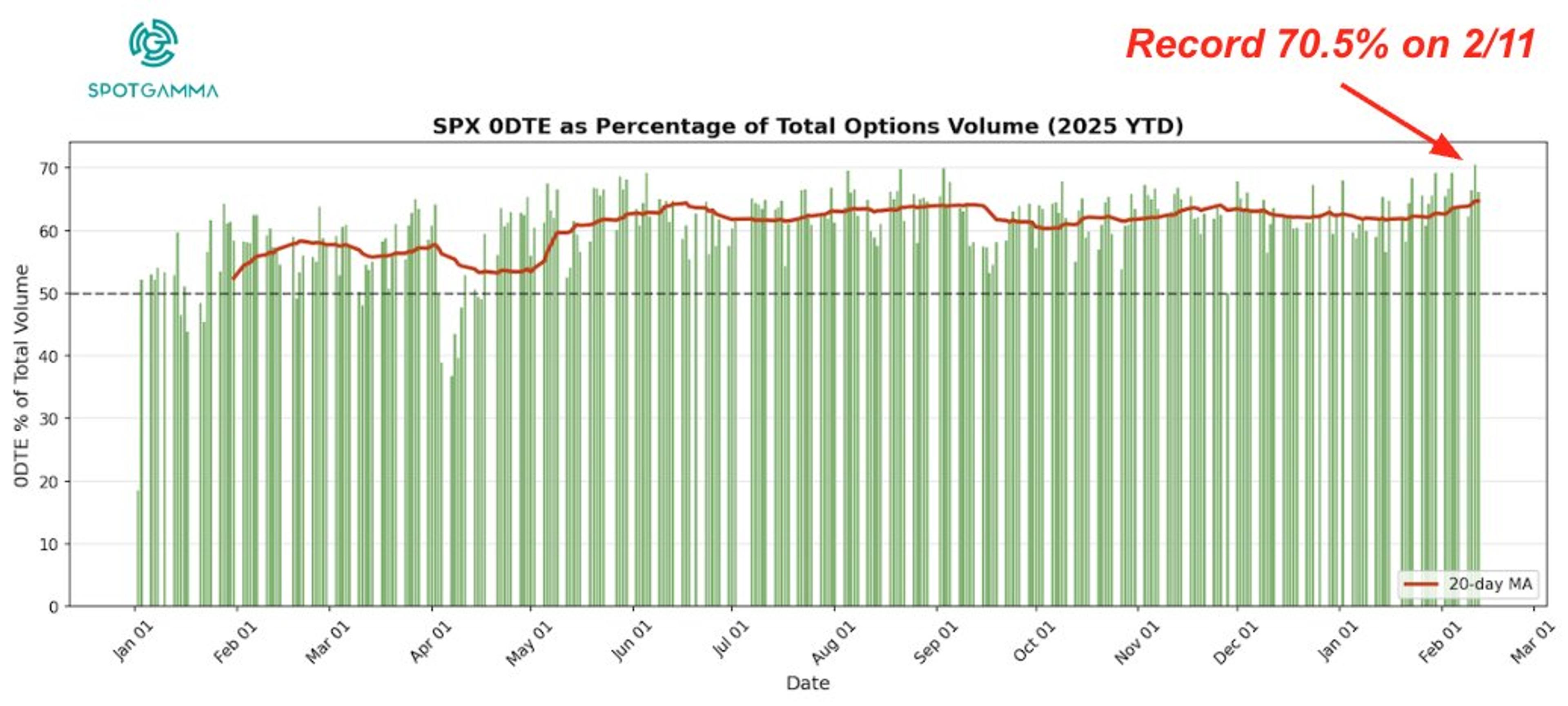

0DTE Options Dominate SPX Volume at 70.5% Record

SPX 0DTE set a record at 70.5% percent of total SPX volume on 2/11. https://t.co/Mt3ulp1iSt

By Brent Kochuba

Social•Feb 15, 2026

U.S. Economy Near Soft Landing Amid Multiple Risks

This isn’t a victory lap, and it isn’t a doom story. The U.S. economy is closer to a soft landing than it’s been in some time, and there are real risks that could undo it from multiple directions. I try...

By Nick Timiraos

Social•Feb 14, 2026

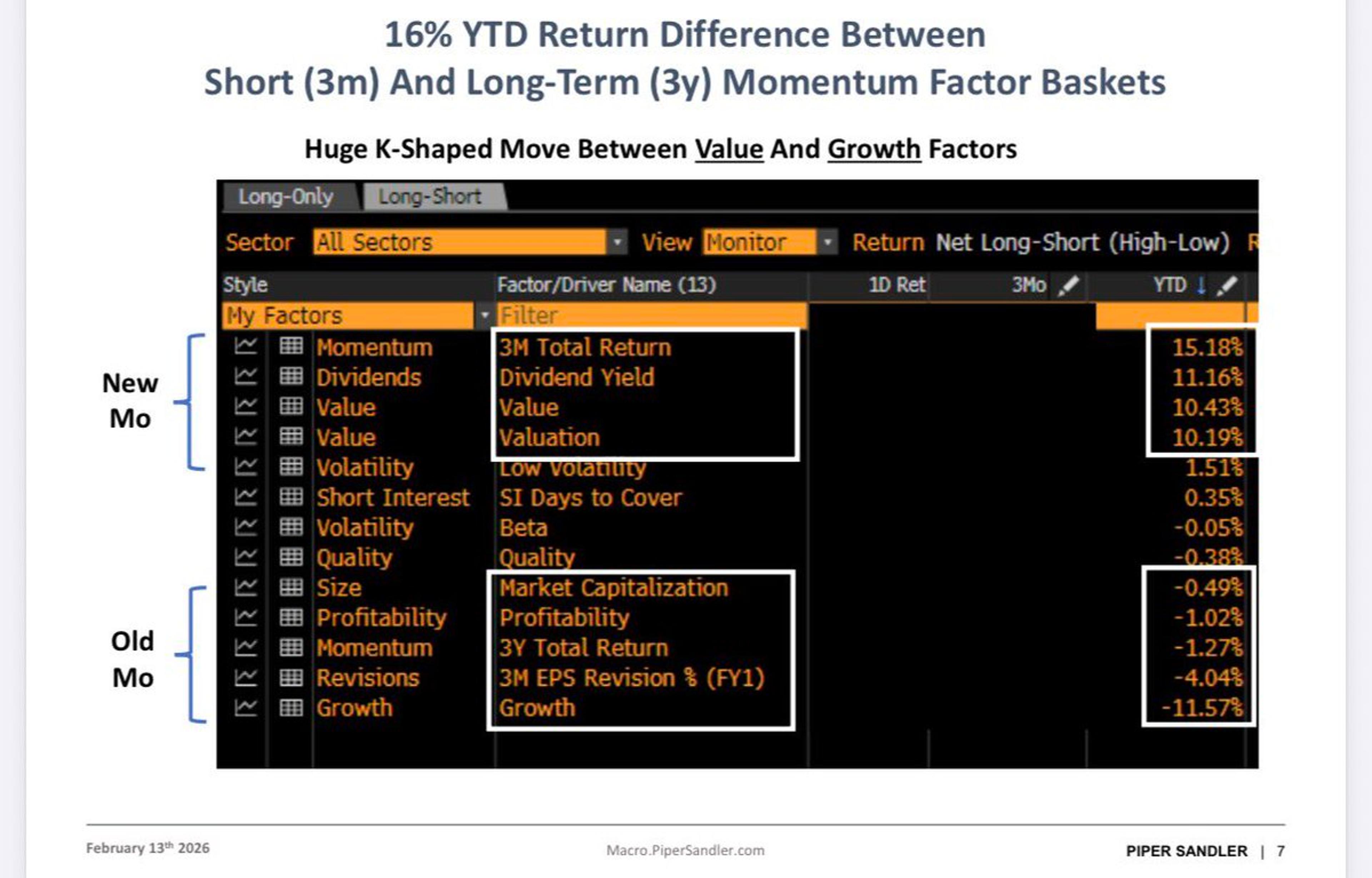

Value Tilt Gains as Momentum Spread Widens 16%

Classic monotonic pattern. When you see this pattern you know with a higher degree of certainty that it is one of THE drivers of how investors are positioning their portfolios. We’ve been recommending a value tilt since last fall, as...

By Michael Kantro

Social•Feb 14, 2026

Energy Leads US Sector Gains; Financials Fall

🇺🇸 US Sector Performance in 2026 📈 $XLE Energy up 22% $XLB Basic Materials up 18% $XLP Consumer Defensive up 16% $XLI industrials up 12.8% $XLU Utilities up 9% $XLRE Real Estate up 8% $XLV Healthcare up 2% $XLY Consumer Retail -2% $XLK Technology -2.5% $XLF Financials -5%

By Peter Sin Guili

Social•Feb 14, 2026

Predicting Silver’s Peak and the Next Market

How I Called The Top In Silver & What Comes Next $GLD $SLV $GDX $SIL We also about my yen monetization framework, oil, AI-driven software disruption & timing a historic rotation into large-cap value. https://t.co/0A5l9bLx9C

By Samantha LaDuc

Social•Feb 14, 2026

USD Poised to Rise if Congress Regains Tariff Control

Wouldn’t that be something: $NVDA earnings 25th with SCOTUS decision on tariffs anytime after 20th… #IEEPA USD bullish in the short term if they hand back tariff control to Congress 🎰 $VIX

By Samantha LaDuc

Social•Feb 14, 2026

Stocks Are only Cheap During Economic or Business Crises

There are really only two times when stocks become "cheap": collectively, - usually when the health of the economy is in question, - and, more narrowly, when the viability of a business or its industry is in question. You...

By Lawrence Hamtil

Social•Feb 14, 2026

Debate: Should S&P Reclassify HOOD to Gaming?

Should S&P move $HOOD from Financial Services to Gaming? Put it in an entirely different GICS category? @RealJimChanos

By Barry Ritholtz

Social•Feb 14, 2026

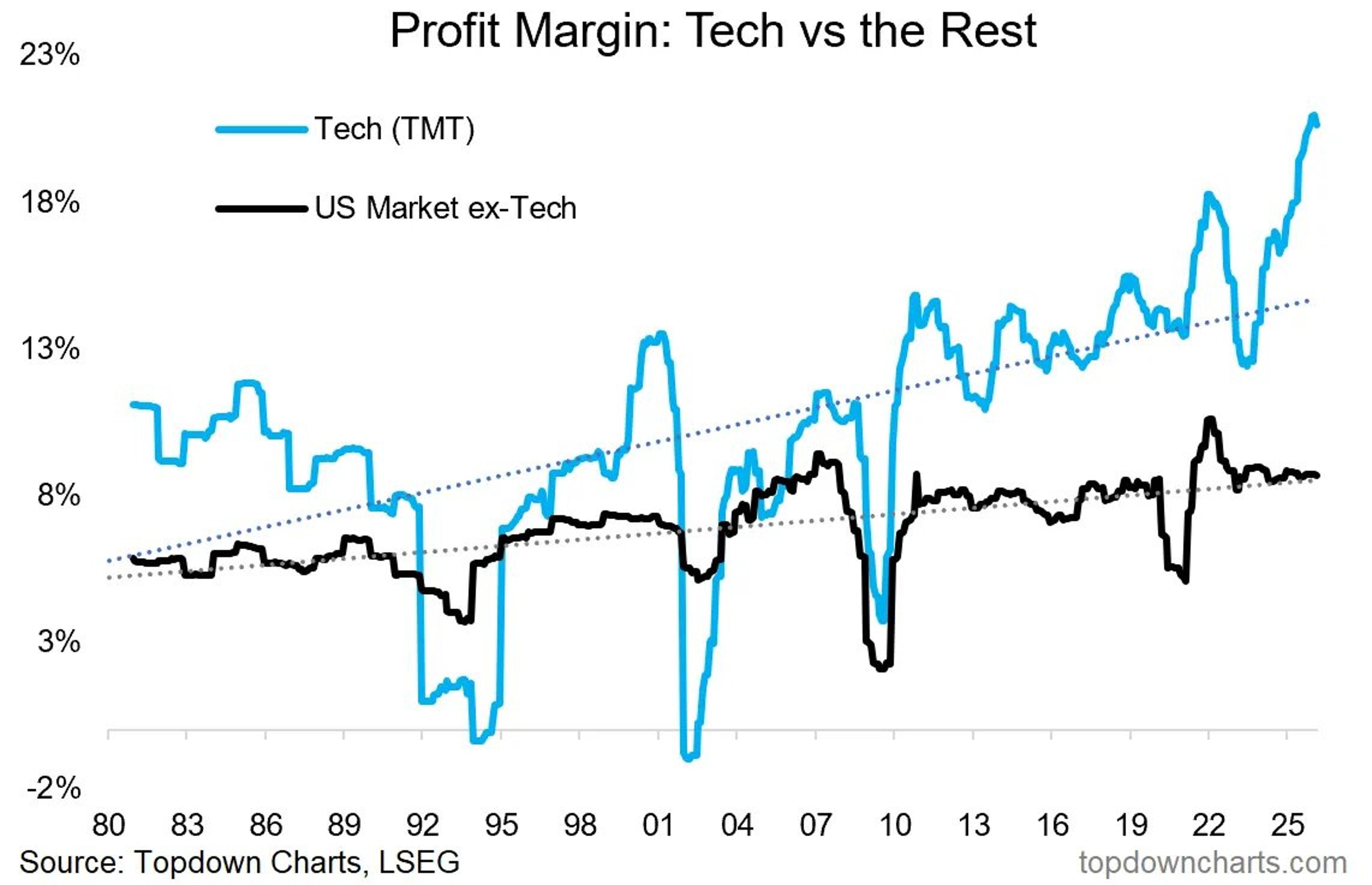

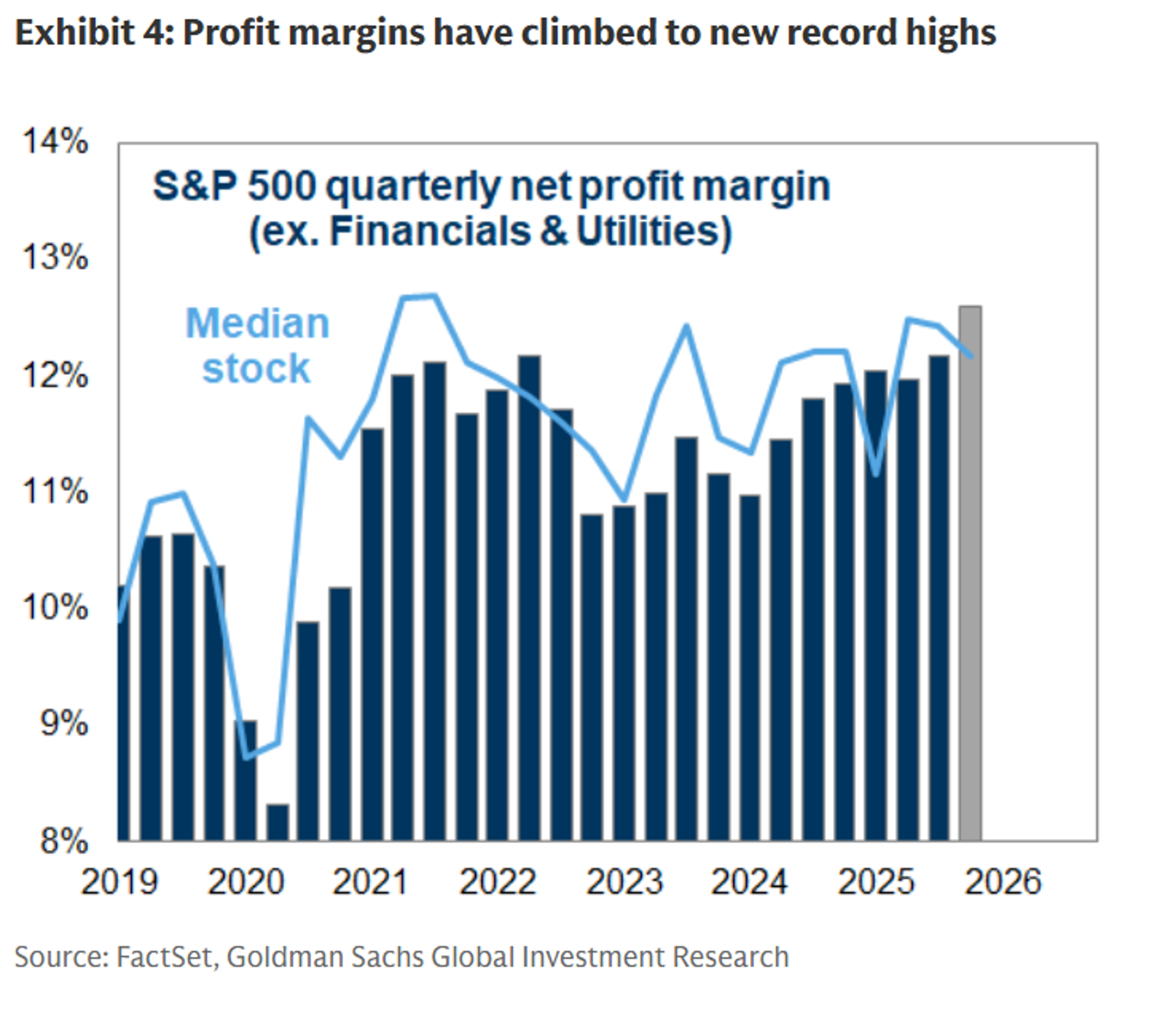

Tech Stocks' Valuations Soar, Yet Margins Remain Stretched

Biggest strength for Tech Stocks. and their biggest weakness? (stretched valuations are underpinned by stretched profit margins) https://t.co/JyYGvhtRlC

By Callum Thomas

Social•Feb 14, 2026

Disinflation Relief Meets Market Disruption Fear

CPI cools to 2.4%. Yields fall 18bps. S&P 500 posts its worst week since November. If inflation is easing… why aren’t stocks cheering? The market isn’t repricing rates. It’s repricing disruption. Disinflation Relief, Disruption Fear 👇 https://t.co/JM3yRs0tFM

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

Services Inflation Sticks While Housing Disinflation Persists

Closing out the week with @GregDaco and @ElizRosner talking about inflation: "On the latest episode of The Inflation Brief from ECON-versations with NABE, hosts Greg Daco and Laura Rosner-Warburton are joined by special guest Claudia Sahm to break down the...

By Claudia Sahm

Social•Feb 13, 2026

Capital Shifts to Value: Cash Flow Beats Future Promises

Leadership didn’t vanish; it rotated. Capital moved from high-growth tech into value, dividends, and economically sensitive sectors. When rates stay higher and scrutiny rises, cash flow today beats promises tomorrow. Style matters again.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

Old Leaders Fade; Adapt Fast to New Trading Landscape

The leaders of last year are no longer the favorites. The trading landscape is changing, and you have to adapt quickly to keep an edge.

By Hyperstocks

Social•Feb 13, 2026

Defensive Sectors Lead as Market Turns Bearish

Defensive rotation continues. Utilities and real estate led again, $VIX closed above 20, and my short-term trend model flipped bearish. I also answered questions on holding through earnings ($MAR), #Bitcoin correlation, and what makes a trader great. Watch here: https://t.co/dJtLYZYHoz

By David Keller, CMT

Social•Feb 13, 2026

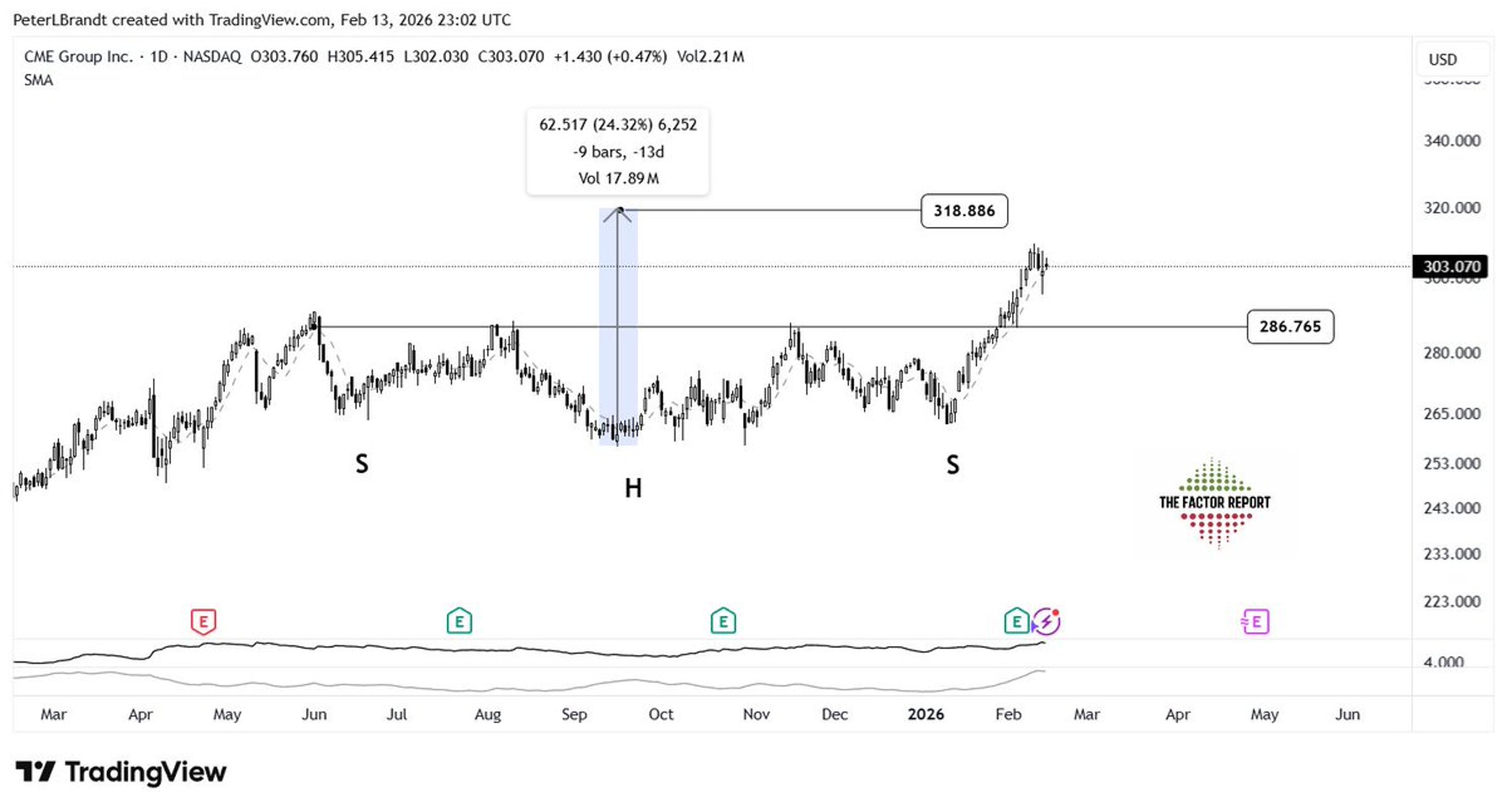

Inverted Head‑Shoulders Pattern Shows 61% Success Rate

This classical pattern is called a continuation inverted head and shoulders. This is one of the most reliable patterns with a success rate of 61%, of which 43% travel to the target with minimum interruption. $CME @TechCharts #probabilities matter in...

By Peter Brandt

Social•Feb 13, 2026

Biggest Stocks Push S&P 500 Margin to Record 12.6%

"The exceptional profitability of the largest stocks boosted the aggregate S&P 500 profit margin to a new record high of 12.6% in 4Q" - Goldman https://t.co/5fnYCaoDhm

By Gunjan Banerji

Social•Feb 13, 2026

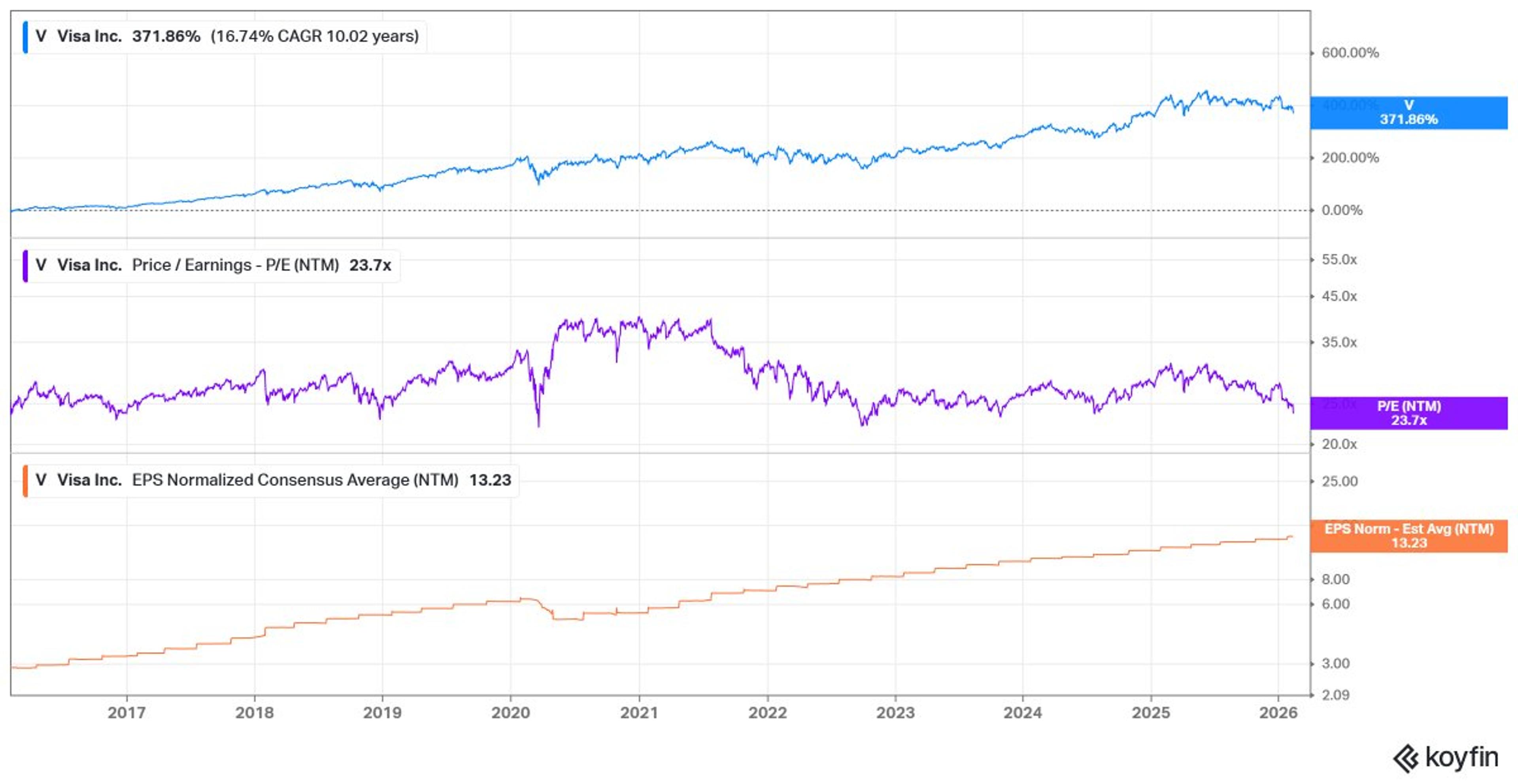

Visa's TSR Mirrors Earnings Growth, P/E Stays Flat

Visa total return the last decade or so basically all earnings growth; P/E unchanged while change in EPS estimates roughly equal TSR https://t.co/wYh3Mkz7Aq

By Lawrence Hamtil

Social•Feb 13, 2026

Ford Faces $900M Tariff Blow, Highlighting US Corporate Pain

Ford just disclosed an additional $900M tariff hit in its Q4 results. TARIFFS = BAD NEWS FOR AMERICAN CORPORATIONS. https://t.co/kau61WOizz

By Steve Hanke

Social•Feb 13, 2026

Broadening Value and Cyclical Rotation Driven by Fundamentals

We now have the longest and strongest breadth rotation in recent years. Notably, it’s the only rotation that has been propelled by broader macro and micro fundamentals rather than lower rates. We first recommended a broadening trade of value and...

By Michael Kantro

Social•Feb 13, 2026

SPY Likely Drops Below $670 Before Hitting $690

Some ask. What do I think next week. The next ten $spy points. I’d say below $670 before above $690

By Scott Redler

Social•Feb 13, 2026

Steel Stock SLX Surges: Rare Early Buying Opportunity

Helpful context. Your competitors completely missed this epic Cyclical ramp in the Steel Stocks $SLX and today's one of our 1st Buying Opportunities in a while

By Keith McCullough

Social•Feb 13, 2026

Signal Strength Recommends Holding Nucor Stock

Sam @SamofAmerica , Signal Strength says to stay with Nucor $NUE here. What say you?

By Keith McCullough

Social•Feb 13, 2026

DWSH Slides 1.3% as Borrowing Costs

Drosey Wrong $DWSH down another -1.3% and they're trying to jack up the borrow, sad

By Keith McCullough

Social•Feb 13, 2026

Professional Energy Bet After Yesterday’s Red Close

If you were buying more Energy Exposure via $XOP $OIH into a red close 24 hours ago, professionally done

By Keith McCullough

Social•Feb 13, 2026

Market Rally Likely False Amid Risk‑off Sentiment

I believe this is a false rally. Look at Utilities. That's defensive positioning. Same with long duration Treasuries. We remain in a risk-off condition for now.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

SaaS Still Thriving: Mispriced Narrative, Not Collapse

“Software is dead.” That’s the narrative. Revenue isn’t collapsing. Balance sheets aren’t broken. The Fed isn’t tightening. AI disruption… or mispricing? The setup in large-cap SaaS may be asymmetric. Read: https://t.co/dhUDCqMzbs

By Michael A. Gayed, CFA (Lead-Lag Report)