🎯Today's American Stocks Pulse

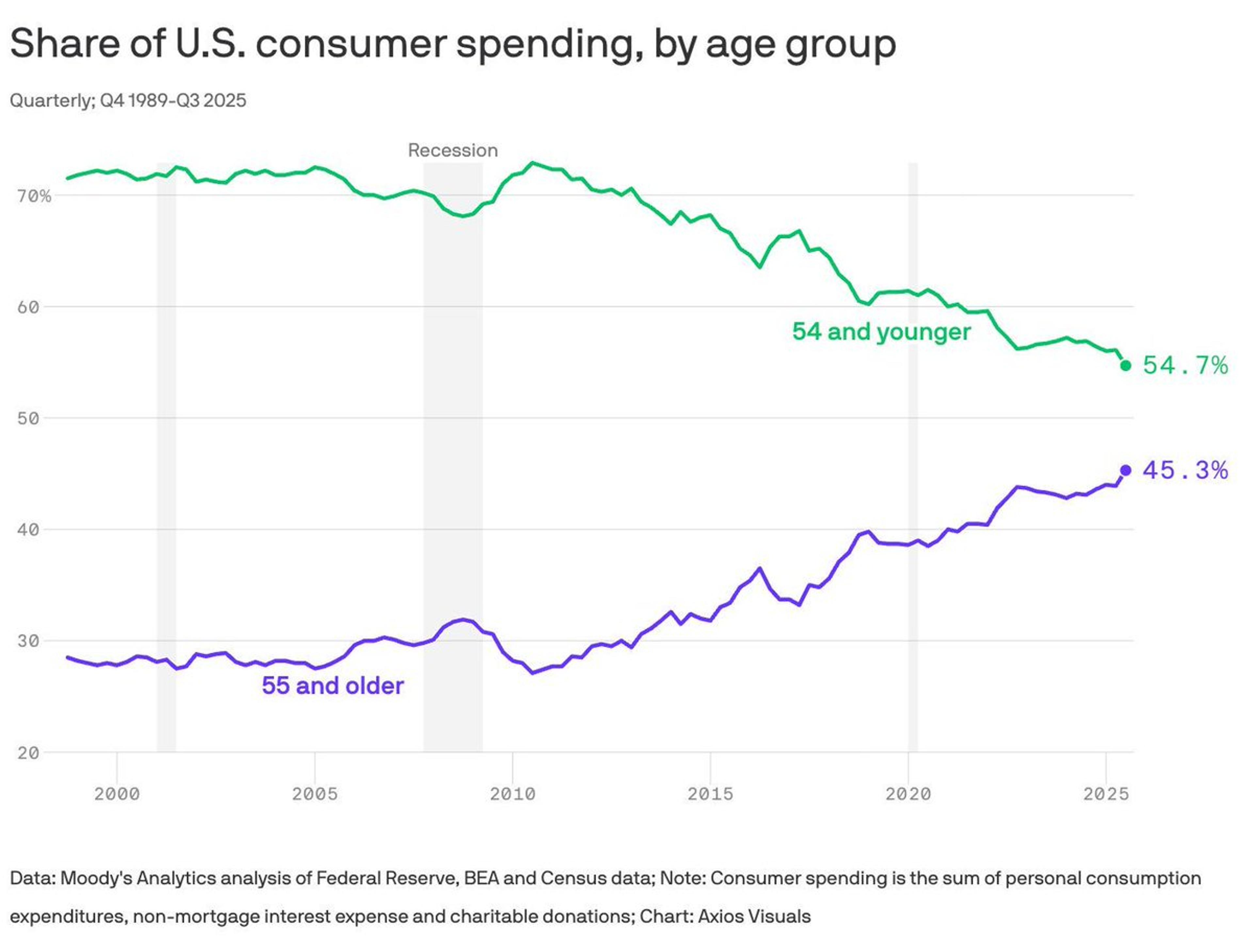

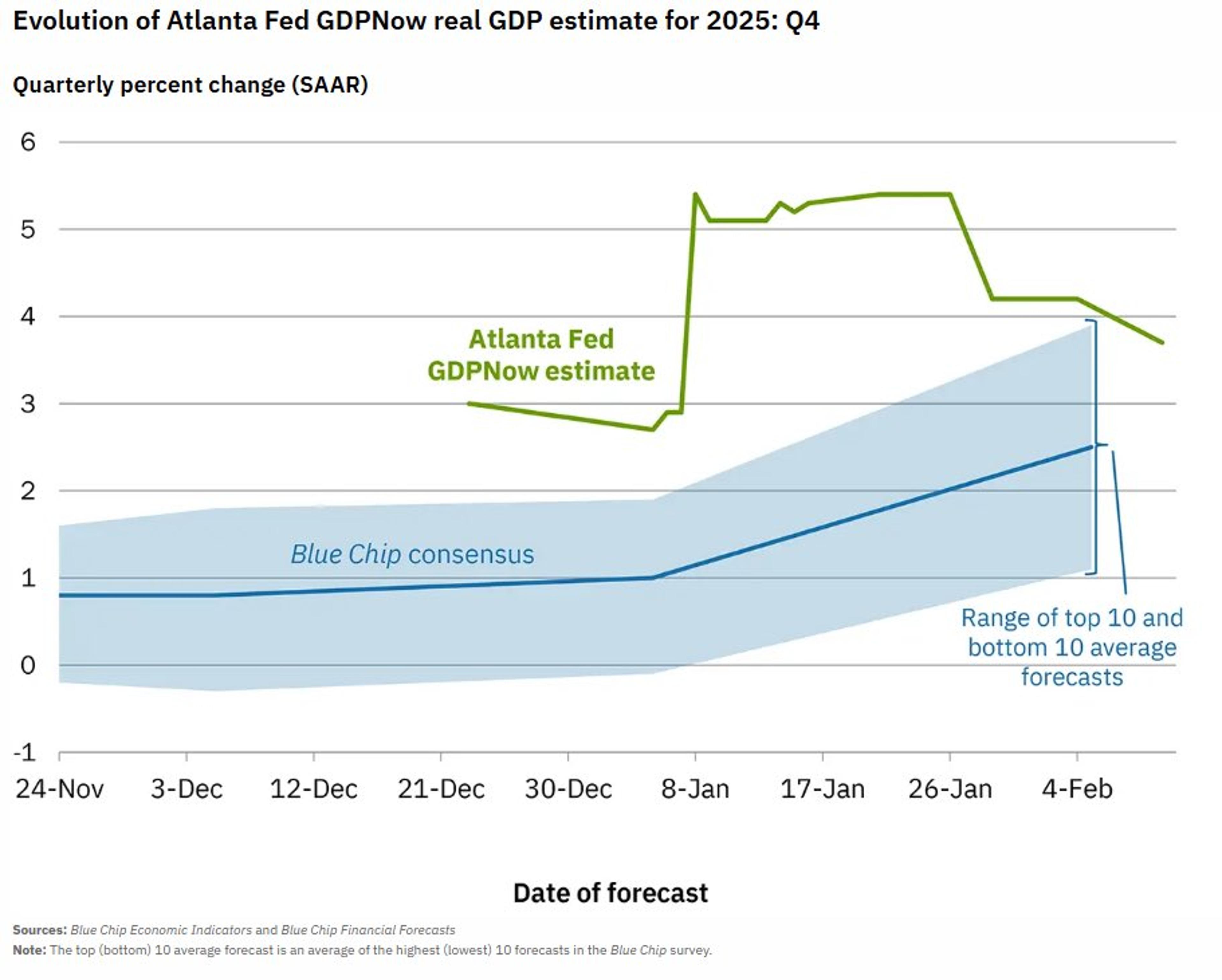

Updated 30m agoWhat's happening: US growth stalls at 1.4% as political gridlock saps momentum

The economy expanded at an annualized 1.4% in Q4 2025, roughly half of analysts' expectations and far below the 4.4% growth recorded the prior quarter. The slowdown marks the weakest expansion since Q1 2024 and coincides with heightened legislative deadlock over fiscal policy and the debt ceiling.

News•Feb 11, 2026

Dow Hits Record as Retail Sales Stall | Closing Bell

The Dow Jones Industrial Average closed at a fresh all‑time high, buoyed by strong earnings from industrial and financial stocks. At the same time, the latest retail sales data showed flat growth, indicating a pause in consumer spending. Despite the consumer‑spending stall, market sentiment remained upbeat, with futures pointing higher across major indices. The rally highlights a divergence between equity performance and short‑term economic indicators.

By Yahoo Finance – Finance News

Social•Feb 13, 2026

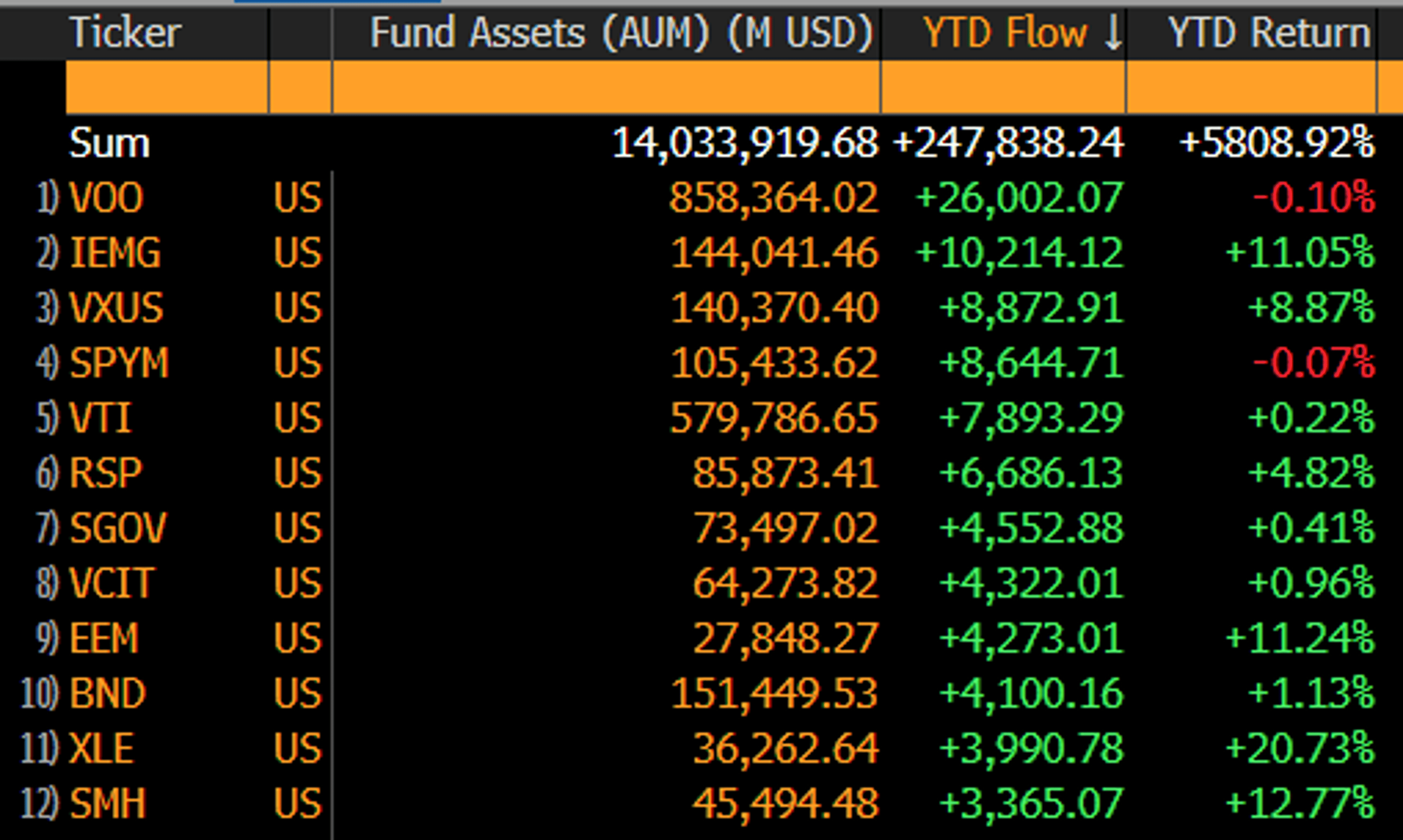

ETFs Rake $250B in 28 Days, EM Overtakes Gold

There's only been 28 trading days this year and ETFs have already pulled in about $250b. More than double any other start to a year. Up until 2020, $250b was what they averaged for a YEAR. That's $9b/day pace, or...

By Eric Balchunas

Social•Feb 13, 2026

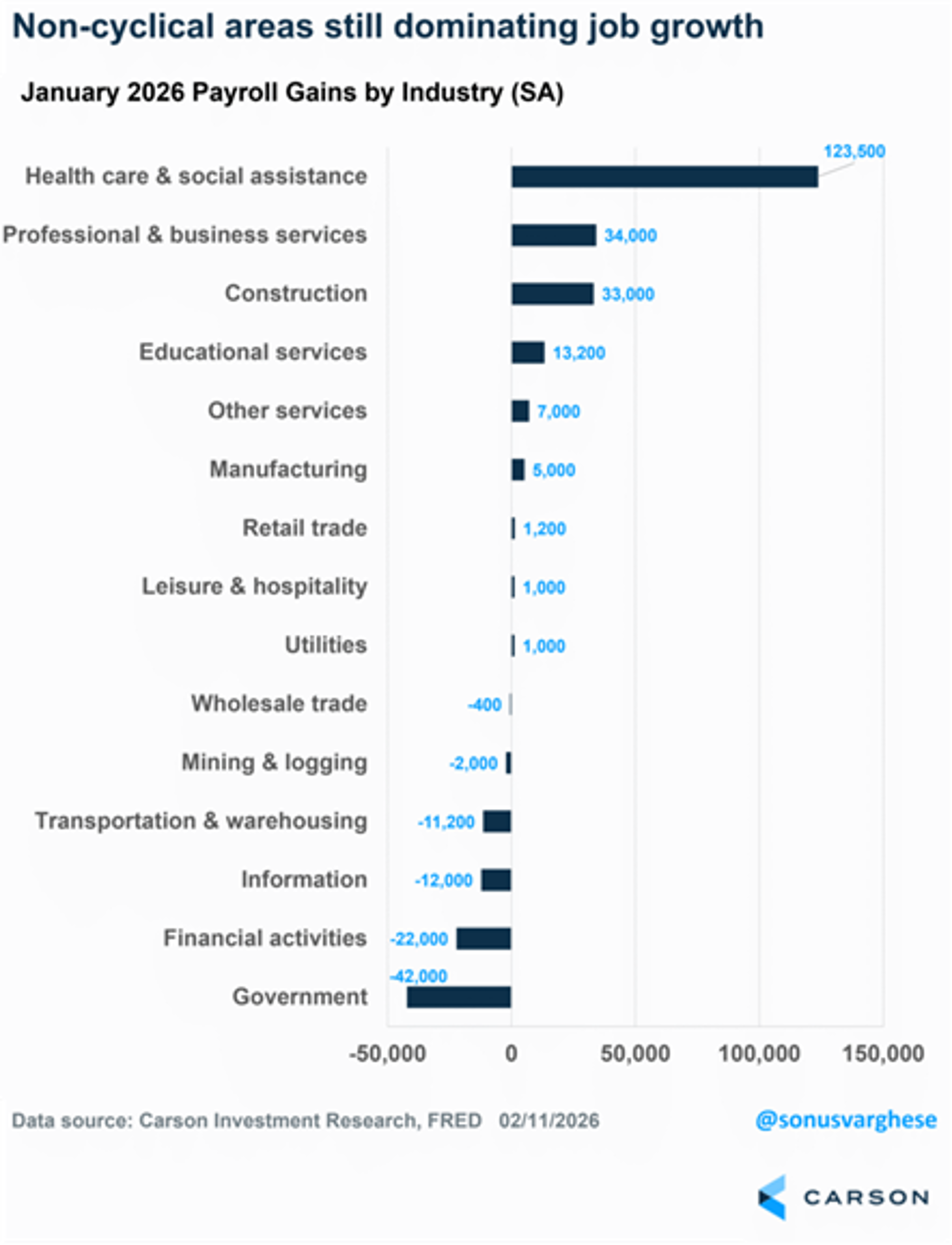

Labor Market Stabilizing: Health Care Leads, Construction Rebounds

Yes, most of the jobs last month (and the previous 18 months) have come from health care/social assistance. But if things were so bad would there be 32k in construction? Or 5k added in manufacturing? The labor market isn't great by...

By Ryan Detrick

Blog•Feb 11, 2026

AI Disrupts Financials. Bad Data Misleads On Economy.

Altruist, a wealth‑management startup, rolled out AI‑driven tax‑planning tools, prompting a sharp sell‑off in legacy financial firms such as Charles Schwab, LPL Financial and Morgan Stanley. The reaction reflects investor anxiety that AI could erode traditional advisory revenue streams. Despite...

By Yardeni QuickTakes

Social•Feb 13, 2026

Gemini Miscalculates Google’s Massive Depreciation Drag

Coming up on @thestreetpro More Tales From Nvidia: The Depreciation "Tail and Spike" Will Be Painful to Mag7 Profits (Issue #178!) * As free cash flow is plummeting... I decided to ask the AI about itself. In this case, I asked Google Gemini about...

By Doug Kass

Social•Feb 13, 2026

Banks' Inflation Forecasts Politicized, Yield Soft Surprises

Another SOFT inflation surrpise... It has become a bit of a theme, and we are increasingly convinced that inflation forecasting has become a "politicized arena" within banks, given how incredibly stubborn they have been in their wrong lean on this.

By Andreas Steno Larsen

Blog•Feb 10, 2026

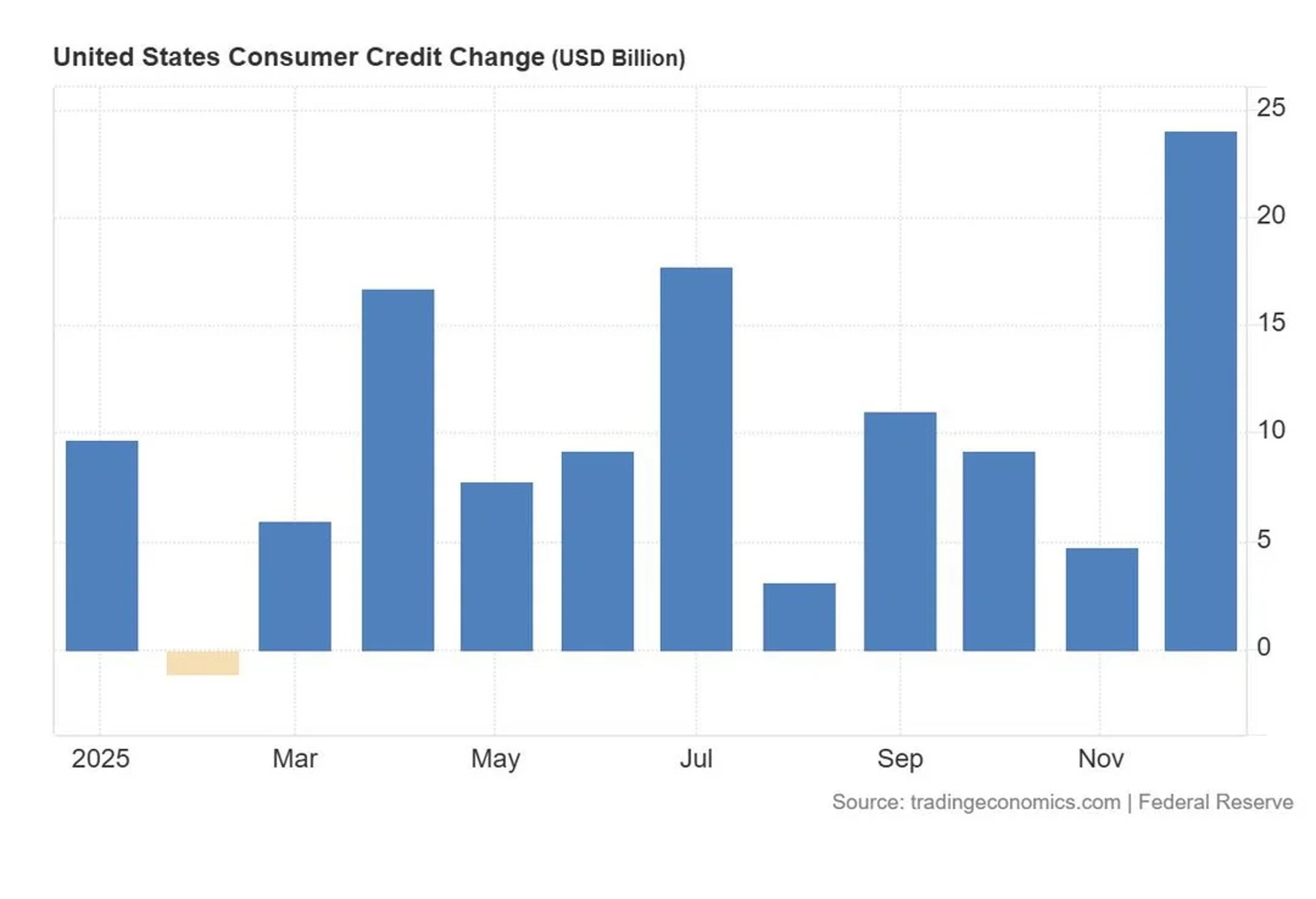

Americans’ Credit Card Balance Hits $1.3 Trillion

The New York Federal Reserve’s latest household‑debt report shows U.S. credit‑card balances climbing to a record $1.3 trillion in the fourth quarter, while the number of open accounts also hit an all‑time high. The surge reflects persistent consumer spending despite elevated...

By Heisenberg Report

Social•Feb 13, 2026

McGough Urges Immediate Buy of GameStop Stock

McGough LIVE on The Call right now saying BUY Gamestop $GME on the open @HedgeyeRetail

By Keith McCullough

Social•Feb 13, 2026

AI‑linked Firms See Growth, yet Stocks Tumble

The market is now punishing even those companies which are beneficiaries of AI. These businesses are accelerating their revenue growth and their management is explicitly stating that AI is a tailwind, yet their stocks are being crushed. Unreal.

By Puru Saxena

Social•Feb 13, 2026

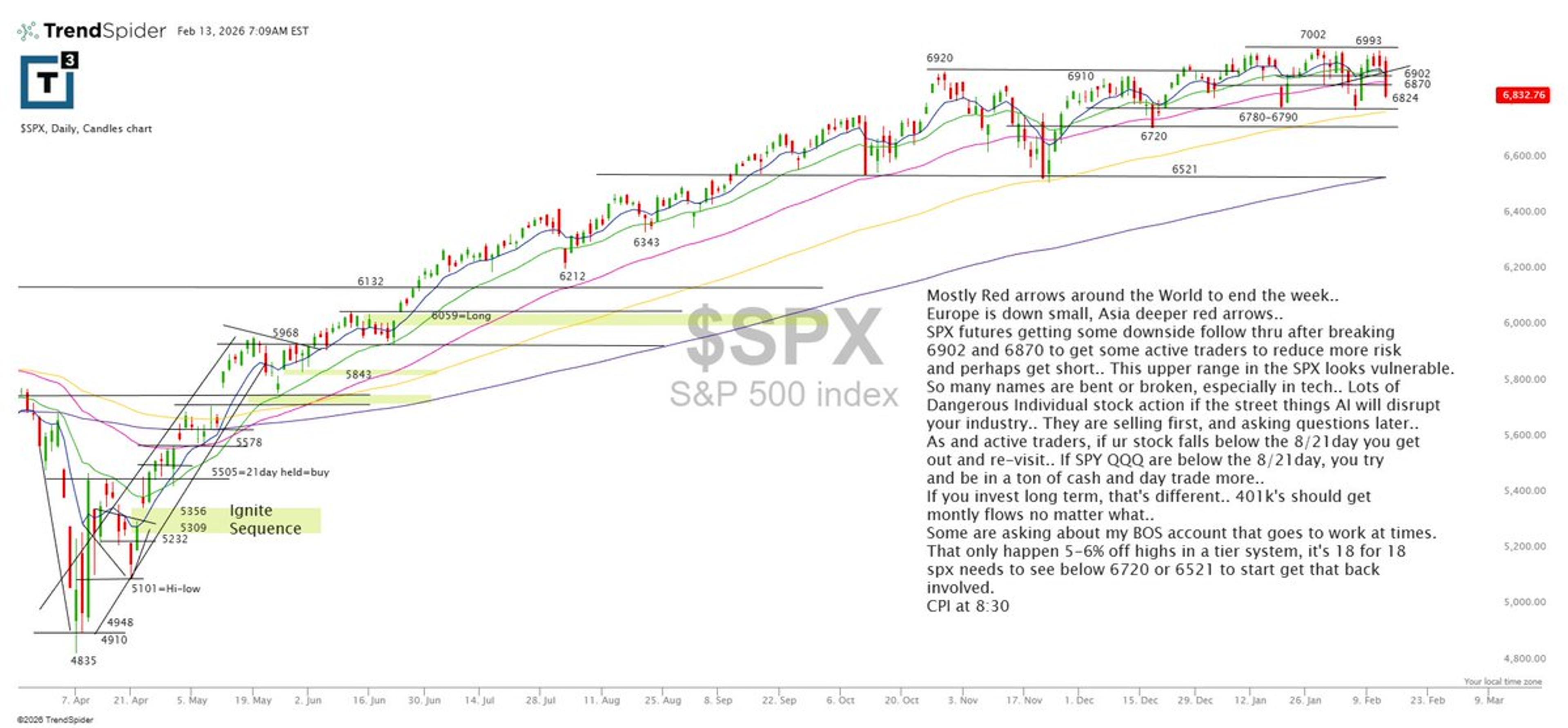

SPX Futures Slip, Risk‑Off Bias Ahead

$SPX futures slipping after losing 6902/6870 as traders cut risk and lean short. Upper range looks vulnerable, especially in tech with lots of names bent or broken. If SPY/QQQ lose the 8/21-day, expect more cash + day trading. CPI at...

By Scott Redler

Social•Feb 13, 2026

CPI Insights on Friday the 13th: Inflation Talk

I will be on @YahooFinance at 8:30 am today to talk about the CPI. Friday the 13th and inflation. (My preview thread below.)

By Claudia Sahm

Social•Feb 13, 2026

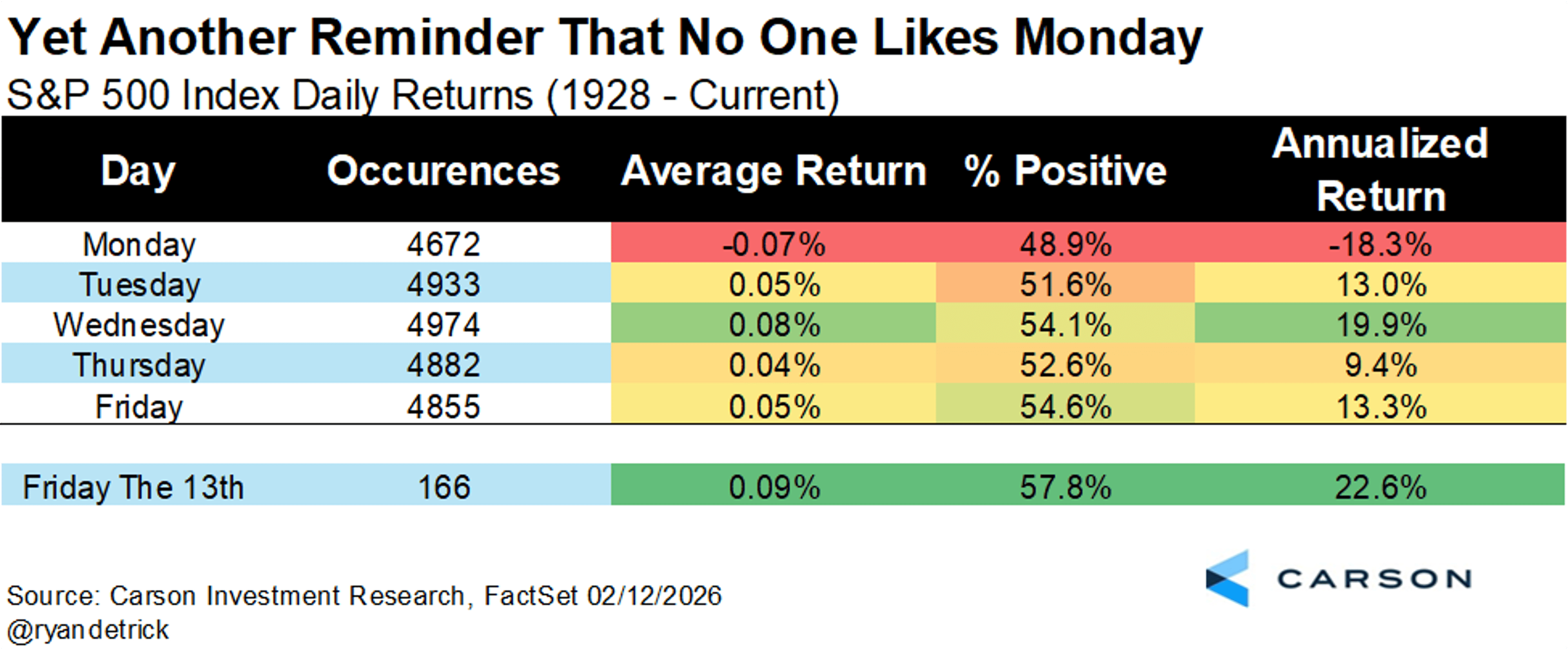

Friday the 13th Rally Masks Monday’s 18% Drop

Stocks are up an annualized 22.6% on Friday the 13th. What really should scare you is a simple case of The Mondays, as stocks are down 18.3% on Monday. #FridayThe13th https://t.co/M74coxbyXF

By Ryan Detrick

Social•Feb 13, 2026

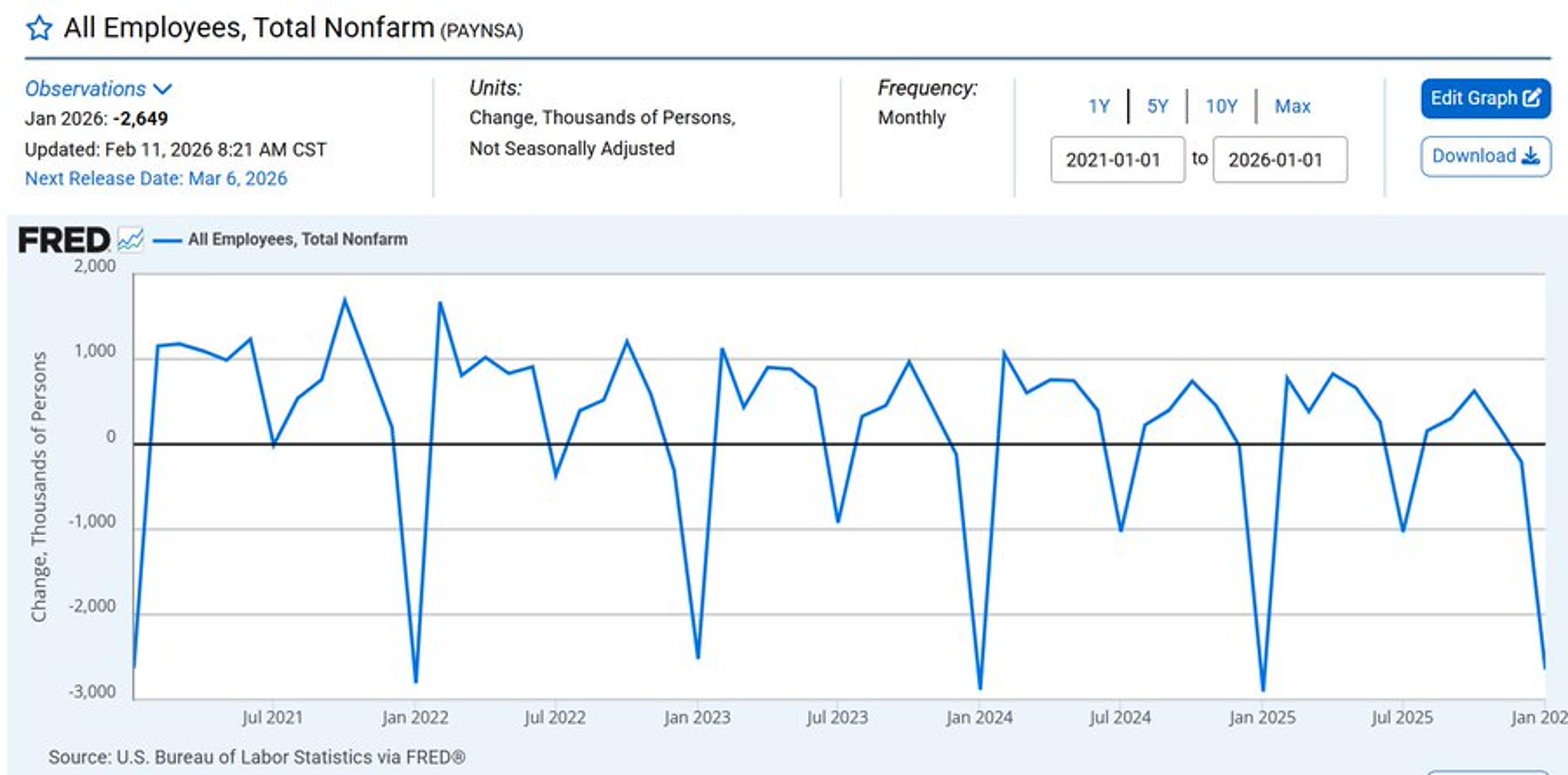

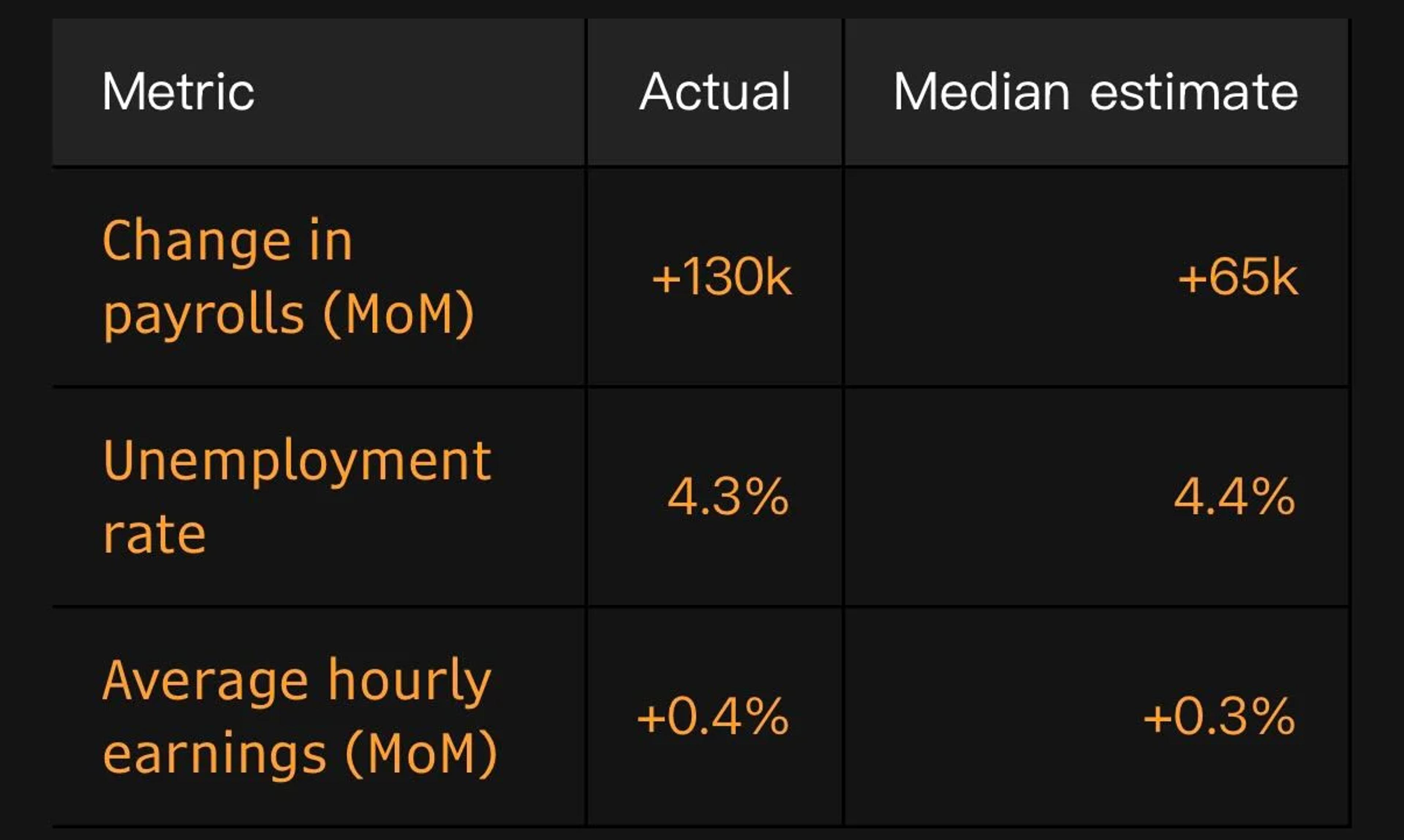

January Job Loss Smaller, Yields 130k Seasonal Gain

Great question. Drop in hiring happens every January. On a non-seasonally adjusted basis (left), we lost 2.6 million jobs in January 2026, but that was a smaller loss than a typical January ... so we got a good print seasonally adjusted...

By Claudia Sahm

Social•Feb 13, 2026

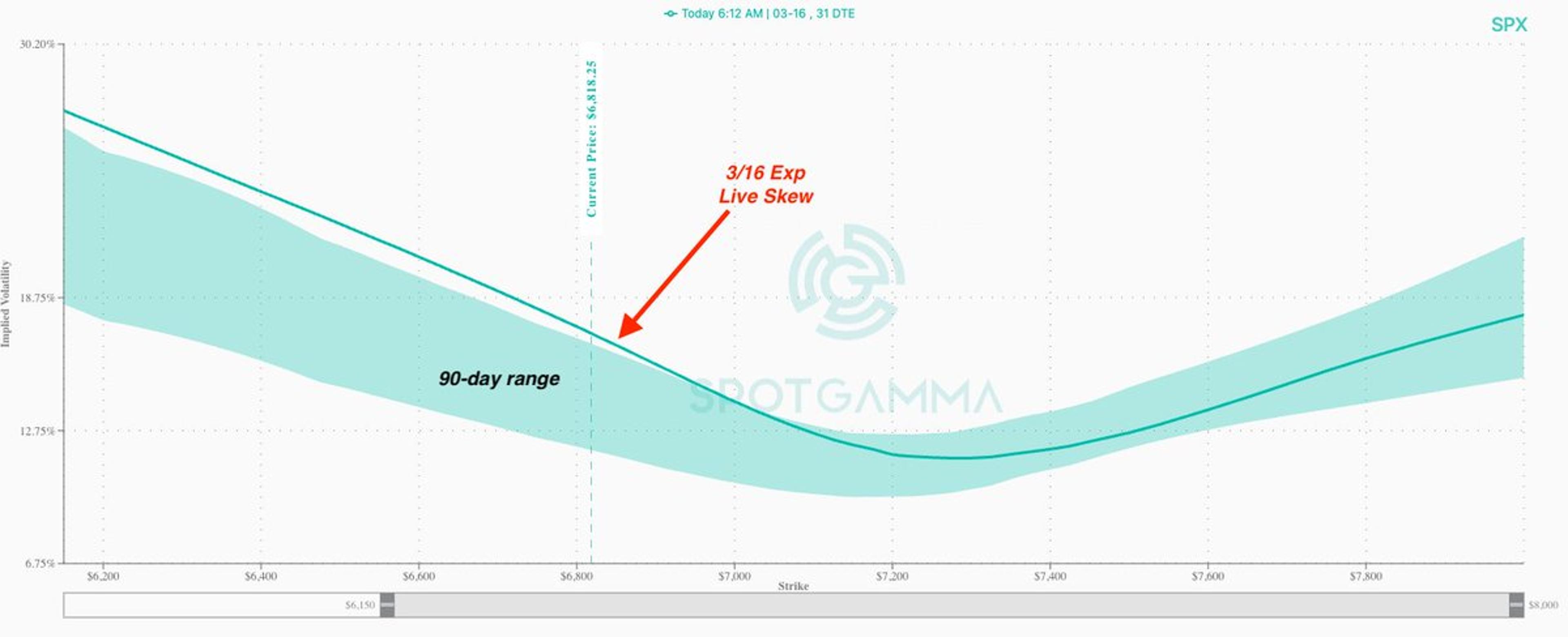

Rising SPX Put Skew May Push VIX to 30

SPX put skew is really starting to warm up here, while ATM IV remains relatively subdued. If SPX 30) https://t.co/p9qsHp8nHk

By Brent Kochuba

Social•Feb 13, 2026

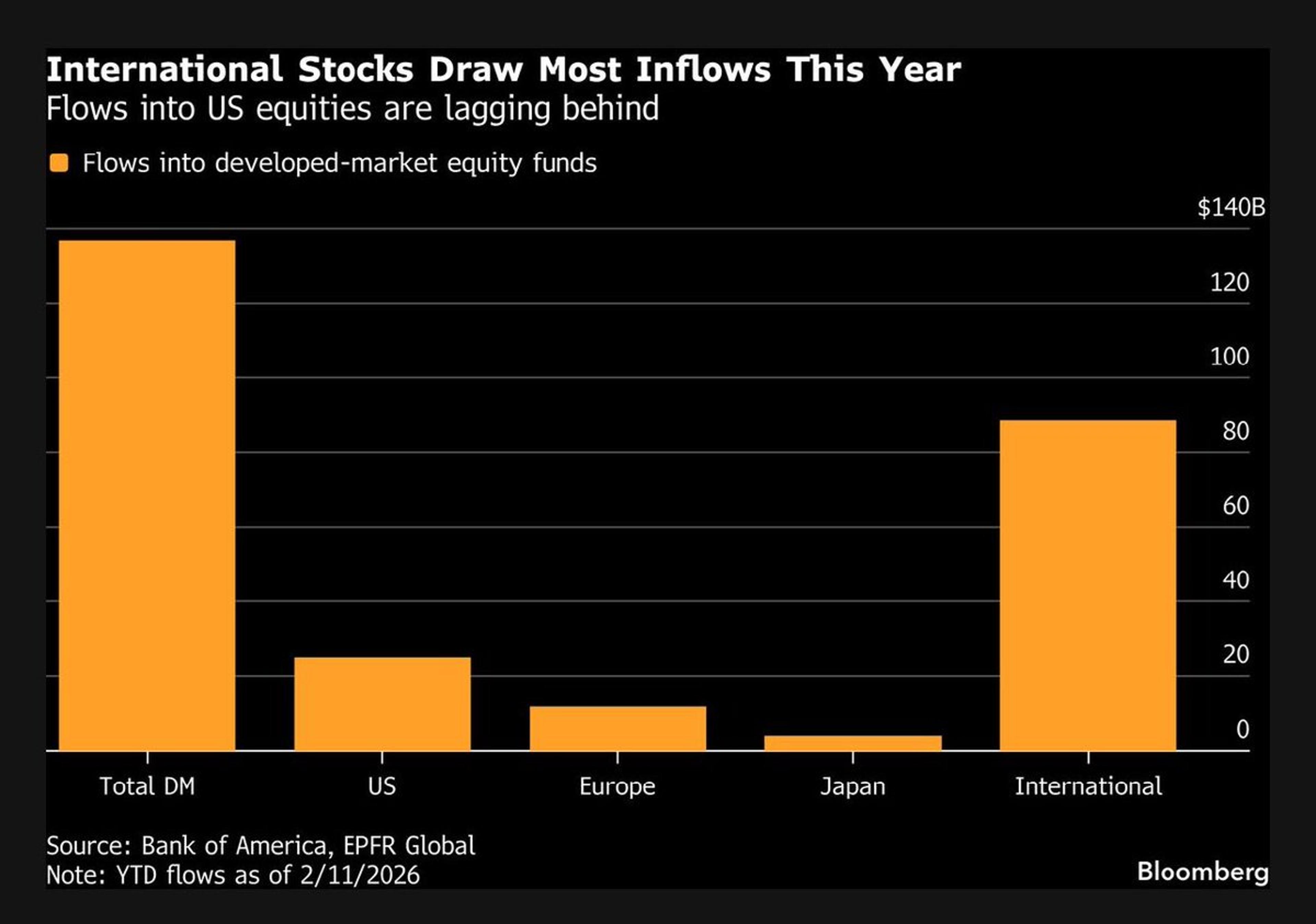

Global Fund Flows Outpace US, Shifting Investment Balance

US exceptionalism is turning into global rebalancing: BofA’s Michael Hartnett. Stock funds in Europe, Japan and other international developed markets have drawn $104 billion this year vs the $25 billion that’s flowed into US funds: BofA citing EPFR Global. https://t.co/ah9arXM6u9...

By Lisa Abramowicz

Social•Feb 13, 2026

Oil Returns Green, Signaling Bullish Energy Buying Opportunity

OIL: ticks back into the green and remains Bullish TREND @Hedgeye Yesterday was the 1st day where we could start buying some Energy Exposure on red https://t.co/eURgEMfFpO

By Keith McCullough

Social•Feb 13, 2026

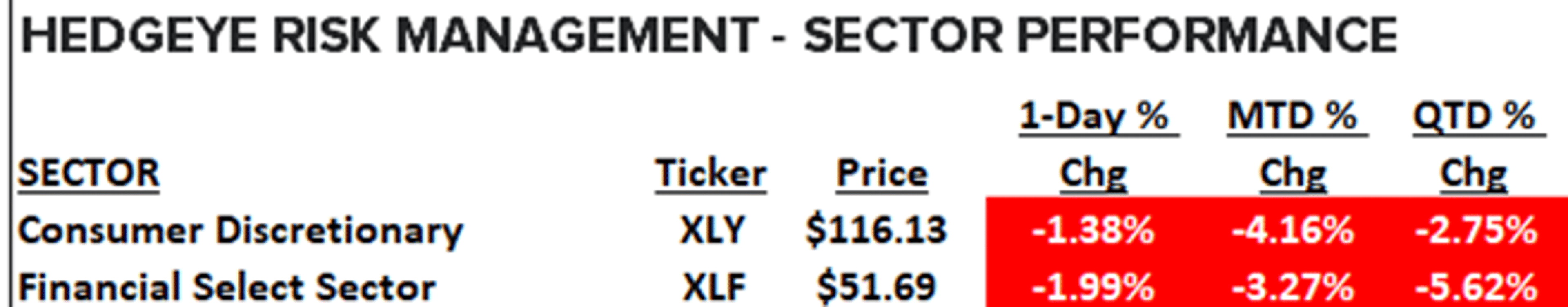

Two of Quad3’s Three Worst US Equity Sectors

SECTORS: as we reminded you, these are 2 of the 3 WORST US Equity Sector Styles in #Quad3 https://t.co/yr2fNhpUZH

By Keith McCullough

Social•Feb 12, 2026

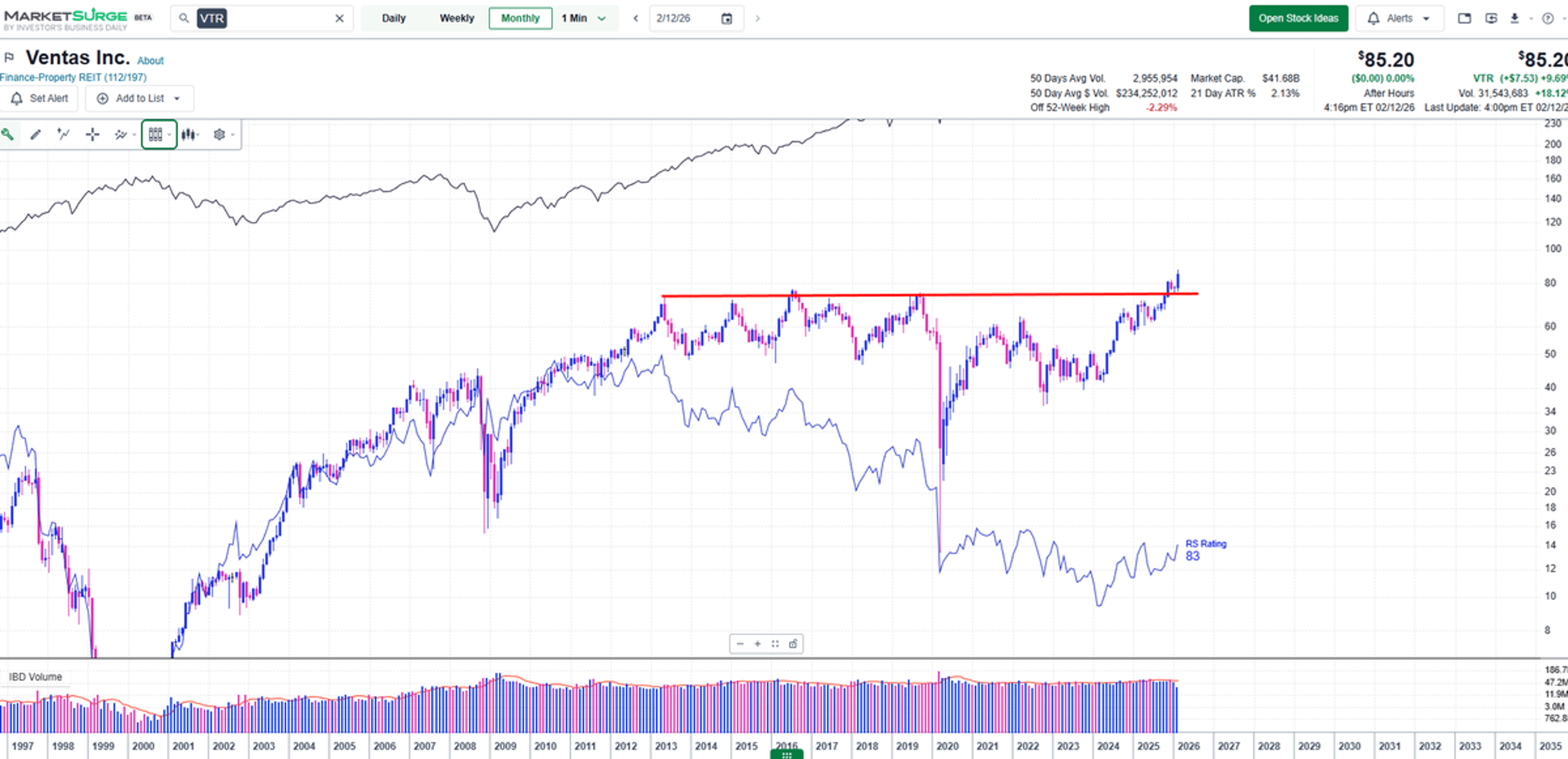

Defensive REITs and Utilities Lead Market Breakouts

Ventas $VTR the Fin Prop REIT, eclipsing highs going back to 2013 as REITS start to kick into gear again with Utilities to join the recent strength seen in Staples, Telco @IBDinvestors @marketsurge Strength in these defensives is more than...

By Mark Newton, CMT

Social•Feb 12, 2026

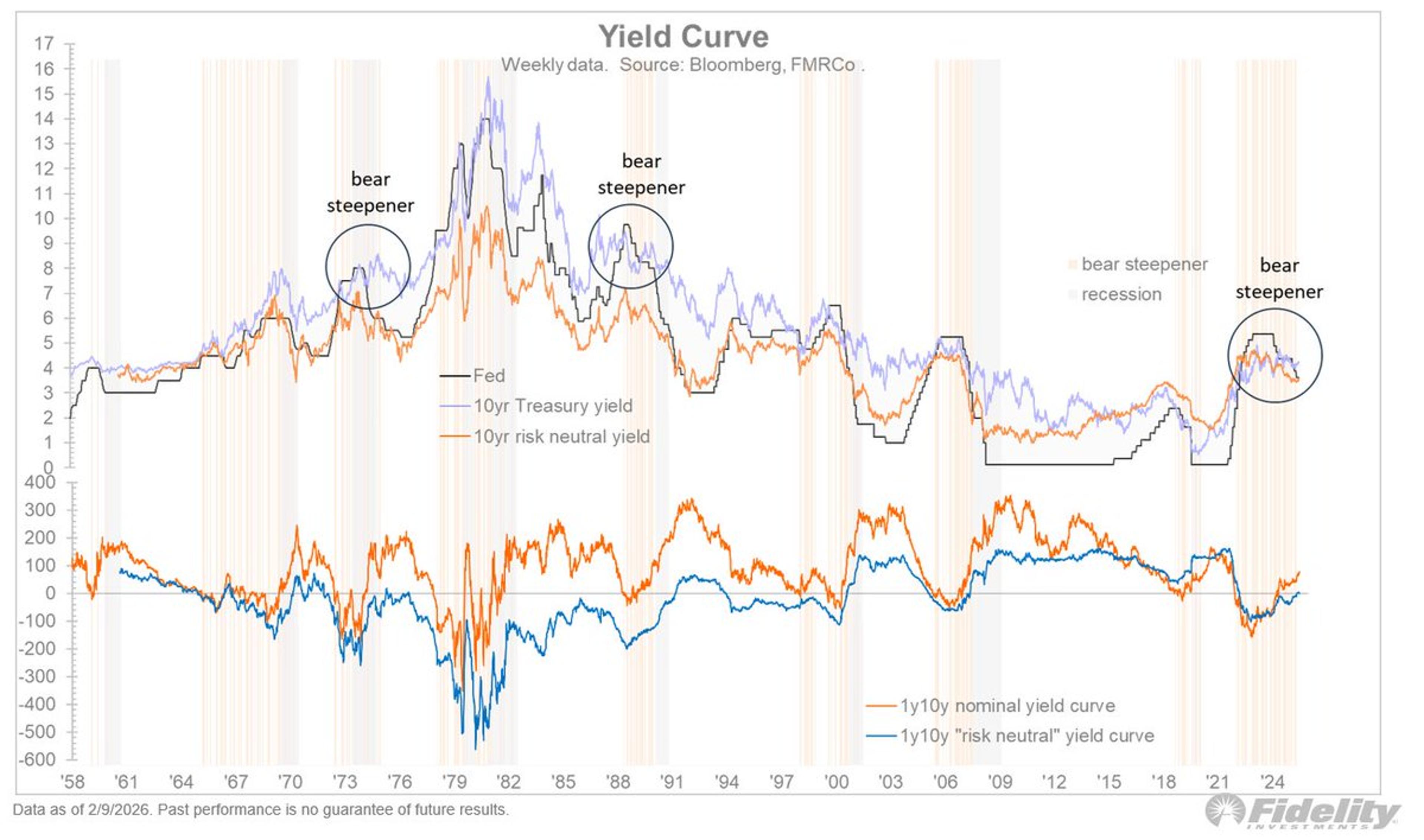

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

Social•Feb 12, 2026

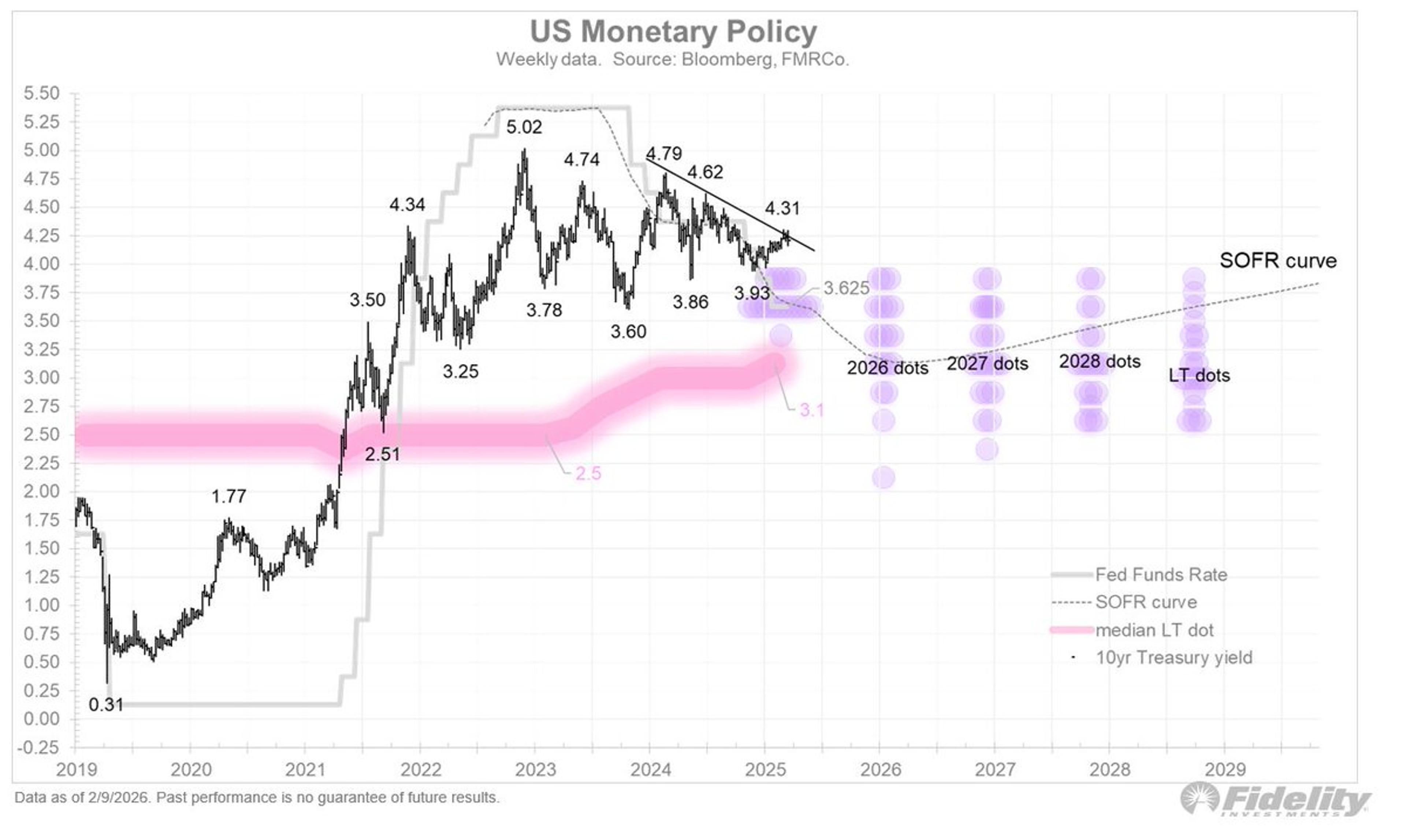

Fed Treasury to Coordinate

Things have been quiet on the rate side, with the 10-year yield trading at around 4 ¼ percent and expectations for a few more rate cuts (down to 3.1%) holding firm. We will likely soon have a lot more coordination between...

By Jurrien Timmer

Social•Feb 12, 2026

Tight Credit Spreads, Fast‑Food Struggles, Tariff Burden Revealed

🆓 Thursday links: tight credit spreads, fast food woes, and who is paying the cost of tariffs. https://t.co/NOuKmm78S8 image: https://t.co/Lhs7cz5vWL https://t.co/nj3y6g7t8i

By Tadas Viskanta

Social•Feb 12, 2026

All Markets Tumble, $3.6T Erased in 90 Minutes

-$3.6T in 90 minutes Gold fell 3.76%, wiping out nearly $1.34T in market cap. Silver dropped 8.5%, losing around $400B in market value. The S&P 500 declined 1%, erasing $620B. Nasdaq slid more than 1.6%, shedding $600B. The crypto...

By Crypto Jack

Social•Feb 11, 2026

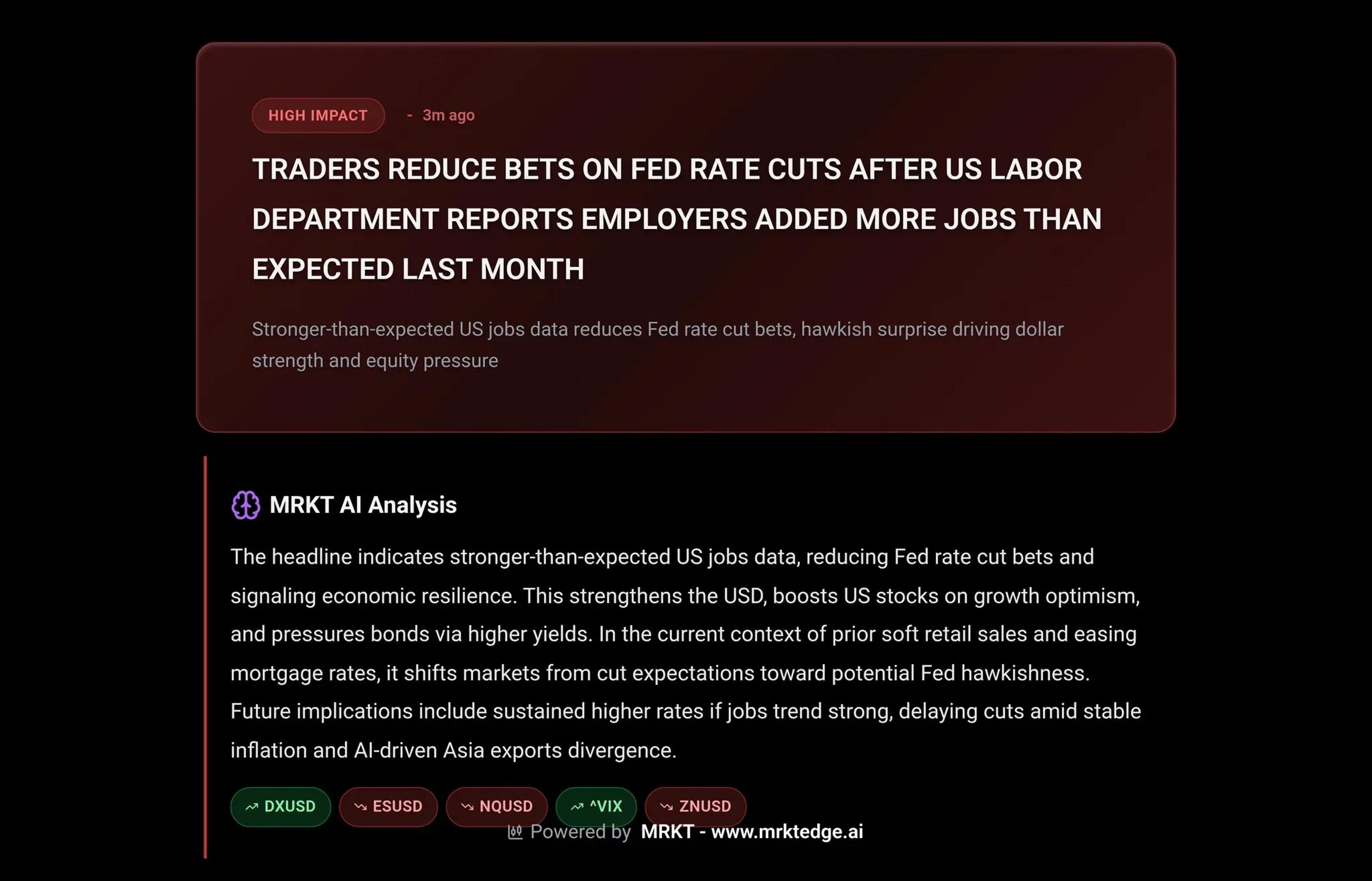

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

Social•Feb 11, 2026

Strong NFP Spurs Fed Pause, Dollar Gains, Market Pullback

NFP BREAKDOWN : Unemployment rate dropped to 4.3% while headline number crushed the expectations. In simple words , this was a much solid NFP all across the board. FED pause will continue. Profit taking in Gold , SPX , NASDAQ on reduced rate cut...

By tradeloq

Social•Feb 11, 2026

Jobs Report Day Shows Record Forecast Divergence

Good morning and welcome to Jobs Report Day in the US. The consensus forecasts are for a monthly employment gain of 65,000, an unemployment rate of 4.4%, and a 3.7% annual increase in average hourly earnings. As we head into this release,...

By Mohamed El‑Erian

Social•Feb 11, 2026

US Hiring Slumps to Recession-Level, Job Market Fragile

⚠️US HIRING IS AT RECESSION LEVELS: US hiring rate sits at just 3.3%, in line with the 2020 Crisis and one of the lowest readings in 13 years. Hiring is even weaker than during the 2001 recession and at levels seen during...

By Global Markets Investor (newsletter author)

Social•Feb 11, 2026

US Consumer Credit Surges $24B, Outpacing Forecasts

Total US consumer credit increased by $24.05 billion in December, far higher than forecasts of an $8.0 billion increase.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 11, 2026

AI Accounts for Just 7% of January Layoffs

🔴AI is NOT the reason for job market LAYOFFS: Artificial Intelligence (AI) was cited in 7,624 of 108,435 layoffs announced in January, representing 7% of all cuts that month. Since 2023, AI has been referenced in just 3% of all job cuts...

By Global Markets Investor (newsletter author)

Social•Feb 11, 2026

Forecasting Trends, NAV Squeeze Mechanics, Active ETF Surge

🆓 Wednesday links: focusing on forecasting, how NAV squeezing works, and the rise of the active ETF. https://t.co/bgzuhBy1Uq image: https://t.co/JRCEGjVQN2 https://t.co/PSs8BSV9vG

By Tadas Viskanta

Social•Feb 11, 2026

Shareholder Rejects Netflix Deal, Backs Paramount Bid

Small Warner Bros. Discovery Shareholder Blasts ‘Flawed, Inferior’ Netflix Offer and Backs Paramount’s Hostile Bid — but Will It Matter? https://t.co/NGSPvAdqOW via @variety

By Todd Spangler

Social•Feb 11, 2026

Markets Await Jobs Data to Gauge Fed Cut Prospects

Will stock markets find enough to like in US jobs data? It’s all about Fed interest rate cut expectations. #Jobs #NFP #StockMarket #Dollar #Fed #Macro #Trading https://t.co/UBCpyuHxhZ

By Ilya Spivak

Social•Feb 11, 2026

AI‑Driven Sell‑Off Sparks Tech Opportunities on Bloomberg TV

Look forward to discussing this AI driven sell-off and the opportunities in tech on @BloombergTV at 9:40 am with @mattmiller1973 and @daniburgz 🔥🍿📺🐂🏆🎯

By Dan Ives

Social•Feb 11, 2026

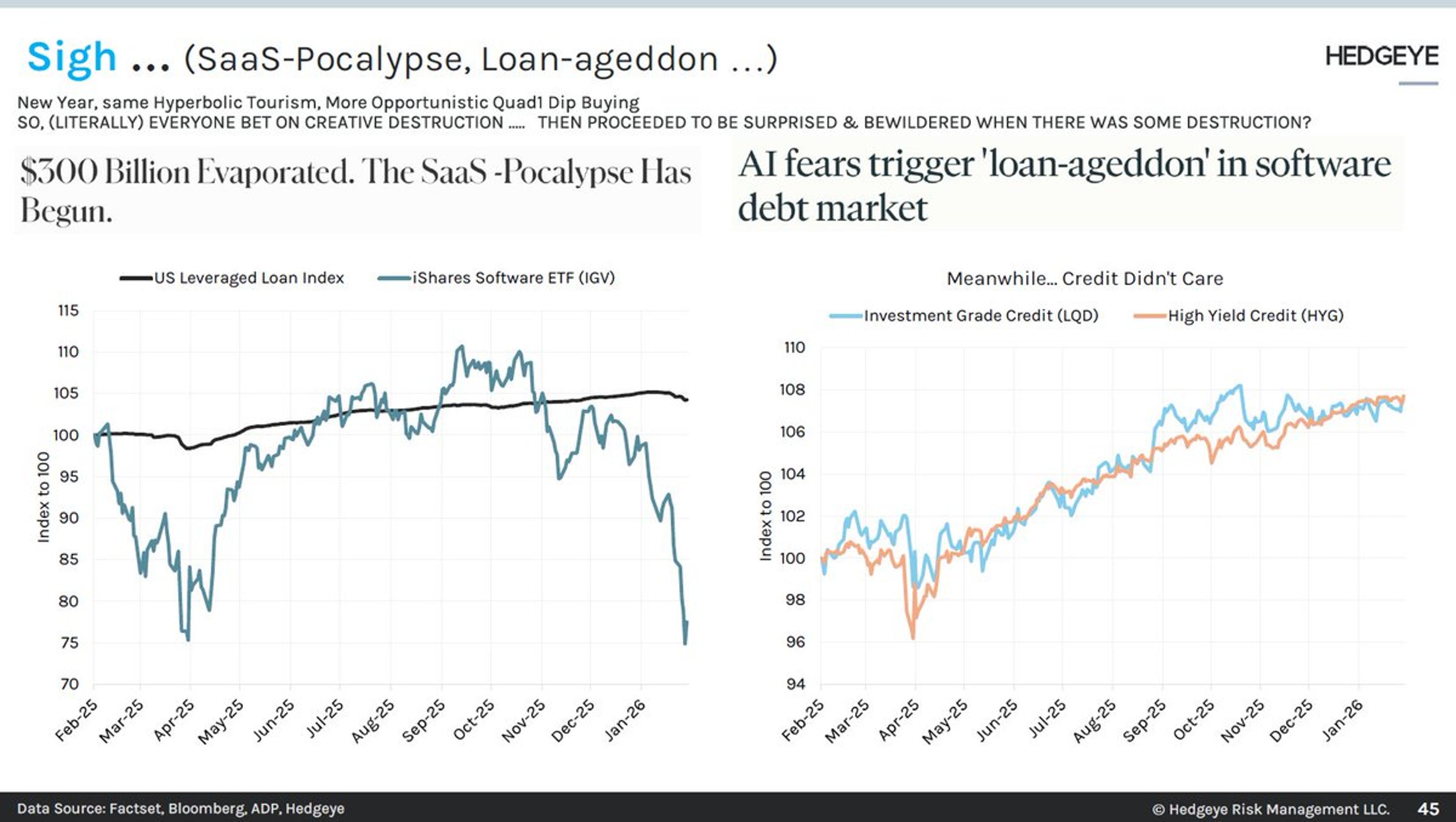

Long Credit, Short Software: Overlooked Hedgeye Macro Theme

Macro Themes Deck (148 slides) @HedgeyeTV 11AM tomorrow Sneak Peak: this slide shows our Long Credit, Short Software Theme that MANY missed https://t.co/sBbXGGtVAr

By Keith McCullough

Social•Feb 10, 2026

Growth Slows, Yields Rise—Short Treasury Duration

Macro: growth softens, yields rise. Key: sticky CPI, Fed tightening, tight labor. Risks: stagflation, policy error. Trade: short US Treasury duration as real yields climb. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 10, 2026

Dow Hits Record High, Markets Eye January CPI

MARKET RECAP 📈 The Dow Jones closed at another record high, now up 4.3% so far in 2026. All eyes on January CPI coming this Friday 👀 What the heck is going on?!? Let’s talk about it 🗣️

By Peter Tuchman (Einstein of Wall Street)

Social•Feb 10, 2026

Financial Stocks Overvalued, Commoditization Signals Short Opportunity

Financial stocks are "overearning" and subject to disruption. Altruist's tool is the tip of the iceberg. Today's share price declines are justified, imho - as pricing of industry product offerings will become more commoditized. This was inevitable. Trading at historic premiums...

By Doug Kass

Social•Feb 10, 2026

Dallas Fed Sees Rates Near Neutral, Warns Stubborn Inflation

Dallas Fed President Lorie Logan sounded more confident about the labor market outlook compared to Sept and Nov. She is also slightly more optimistic about inflation, pointing to recent downtrends in the "trimmed mean" PCE reading. But her bottom line is...

By Nick Timiraos

Social•Feb 10, 2026

Fed Likely Holds Off Policy Changes for Year

Bessent on balance sheet policy in a Warsh Fed: "I wouldn't expect them to do anything quickly. They've moved to an ample [reserves] regime ... that does require a larger balance sheet. So I would think they'll probably sit back,...

By Nick Timiraos

Social•Feb 10, 2026

Markets Defensive as SPX Stalls Below 7000

Markets turned more defensive Tuesday as early strength faded... In today’s CHART THIS: • $SPX stuck below 7000 • Bonds rally on weaker retail sales • $GOOGL below the 50-day • $AVGO trapped between key MAs • Earnings: $KO $MAR $GILD $HOOD CHART THIS -> https://t.co/pHGfUwqPar

By David Keller, CMT

Social•Feb 10, 2026

Underlying Inflation Near 2.5%, Likely to Ease Further

The ECI data out this morning is consistent with the thesis that underlying inflation is around 2.5%. And labor market looseness suggests that is more likely to go down than up. Wages ex volatile incentive pay have been steadily growing at...

By Jason Furman

Social•Feb 10, 2026

Uber Slides to Multi‑month Low, 30% Off Recent High

$UBER one of the show's favorite longs hits a multi month low and is now close to -30% below its recent high. Crickets. @dougkass @KeithMcCullough

By Doug Kass

Social•Feb 10, 2026

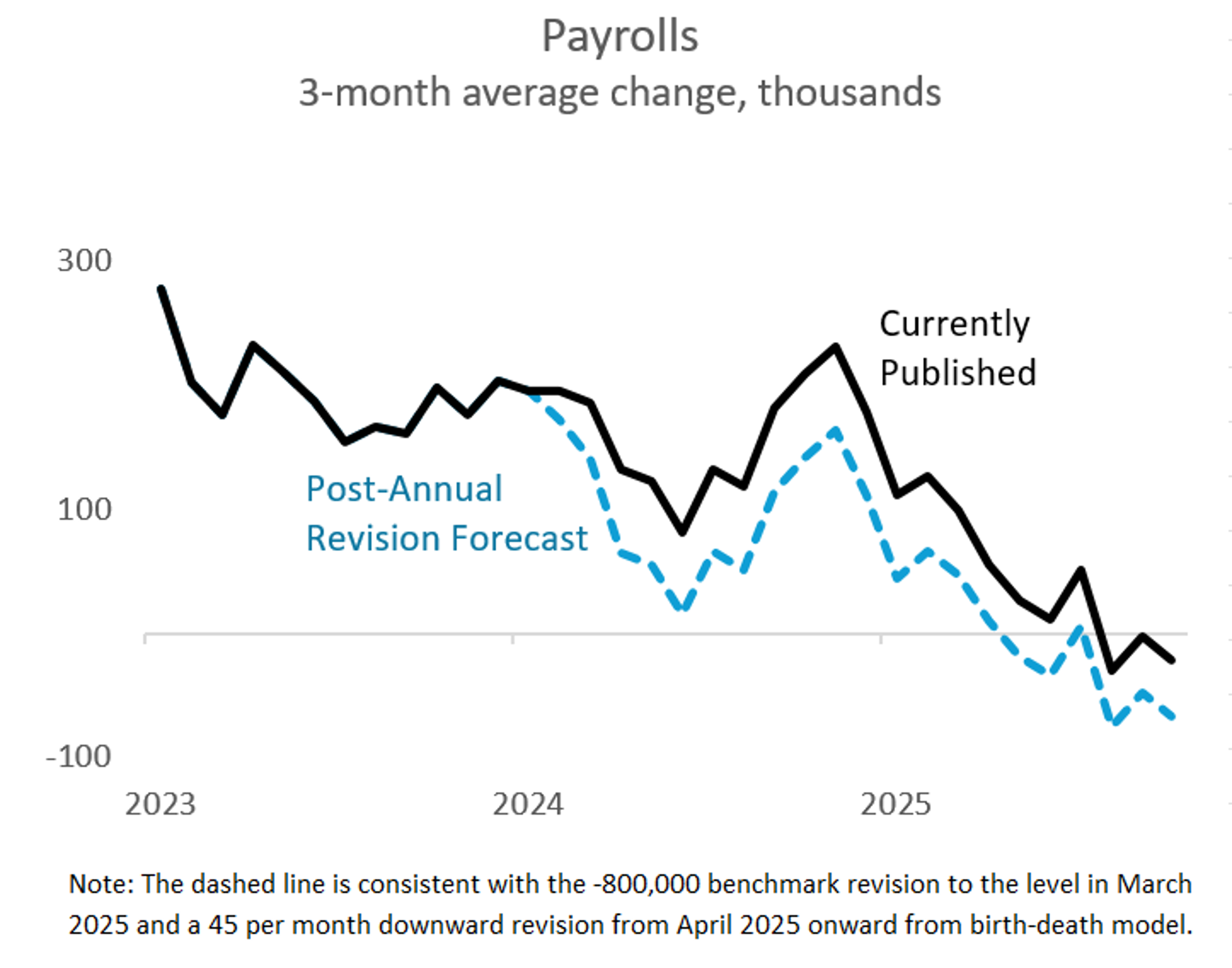

Upcoming Jobs Report May Reveal Weaker Labor Market

The jobs report is due out tomorrow. Along with it, are the annual benchmark revisions. In other words, we may soon learn that the labor market is in worse shape than we thought. https://t.co/b44jhyLPVL

By Eddy Elfenbein

Social•Feb 10, 2026

Seeking Bull Case for Discounted HAL Stock

RPK, last time I asked you about $RIG signaling buy more - what's the bull case on $HAL on sale? @RPKent

By Keith McCullough

Social•Feb 10, 2026

Snap‑back Rallies Off Strong Support Aren’t Reversals

Little Bounces Off Big Support From my live trading room Friday... Snap-back rallies off big support does not a trend-reversal make 🙃 $MSFT $AMZN $QQQ $BTCUSD $SLV https://t.co/OLa6XrVvqJ

By Samantha LaDuc

Social•Feb 10, 2026

Railroads Hit All-Time Highs, AI Disruption Unlikely

No AI disruption worries in railroads, with Union Pacific, CSX, and Norfolk Southern all touching ATHs

By Lawrence Hamtil

Social•Feb 10, 2026

U.S. Stocks Under Pressure as SPX/VEU Hits Near Two‑Year Low

The 'sell America' trade pressure seems to be picking up again. The SPX-VEU (rest of world equity ETF) ratio is the lowest since April 22nd. A little further and it is a two year low. Adding the DXY Dollar Index in for...

By John Kicklighter

Social•Feb 10, 2026

Amazon Steadies; Rally to 200‑day MA Signals Trade

$AMZN is holding steady after the gap frenzy last week. A rally back to the 200-day moving average would make sense for the bulls and the bears, but that feels more like a "trade" to me. The real question...

By David Keller, CMT

Social•Feb 10, 2026

Atlanta Fed GDPNow Now at 3.7% Q4 2025

GDPNow model (a “nowcast,” not a forecast) from @AtlantaFed down to +3.7% q/q annualized for 4Q2025 https://t.co/NKqC4jdaL0

By Liz Ann Sonders

Social•Feb 10, 2026

Committee Claims New Focus, Still Clings to Big Caps

Imagine being on a pretent "investment committee" that has finally figured out being Long Industrials $XLI and isn't Long of the Big $CAT ? lol Reality: they're all still long of the #Bag7 Stocks and widely held Large Cap Financials...

By Keith McCullough

Social•Feb 10, 2026

White House Inflates Payrolls; Revisions Could

WH keeps 'pumping up' payrolls for tomorrow. Here's why. Revisions could wipe out all job growth last year. Zero. zip. nada. https://t.co/RILDizthdl

By Claudia Sahm