🎯Today's American Stocks Pulse

Updated 3h agoWhat's happening: Booking Holdings launches 25‑for‑1 stock split as earnings surge

Booking Holdings announced a 25‑for‑1 forward stock split, converting each share into 25 shares, effective April 6 2026. The move follows a Q4 report showing $6.3 billion revenue, 38% EPS growth, and a dividend increase to $10.50 per share.

Blog•Feb 10, 2026

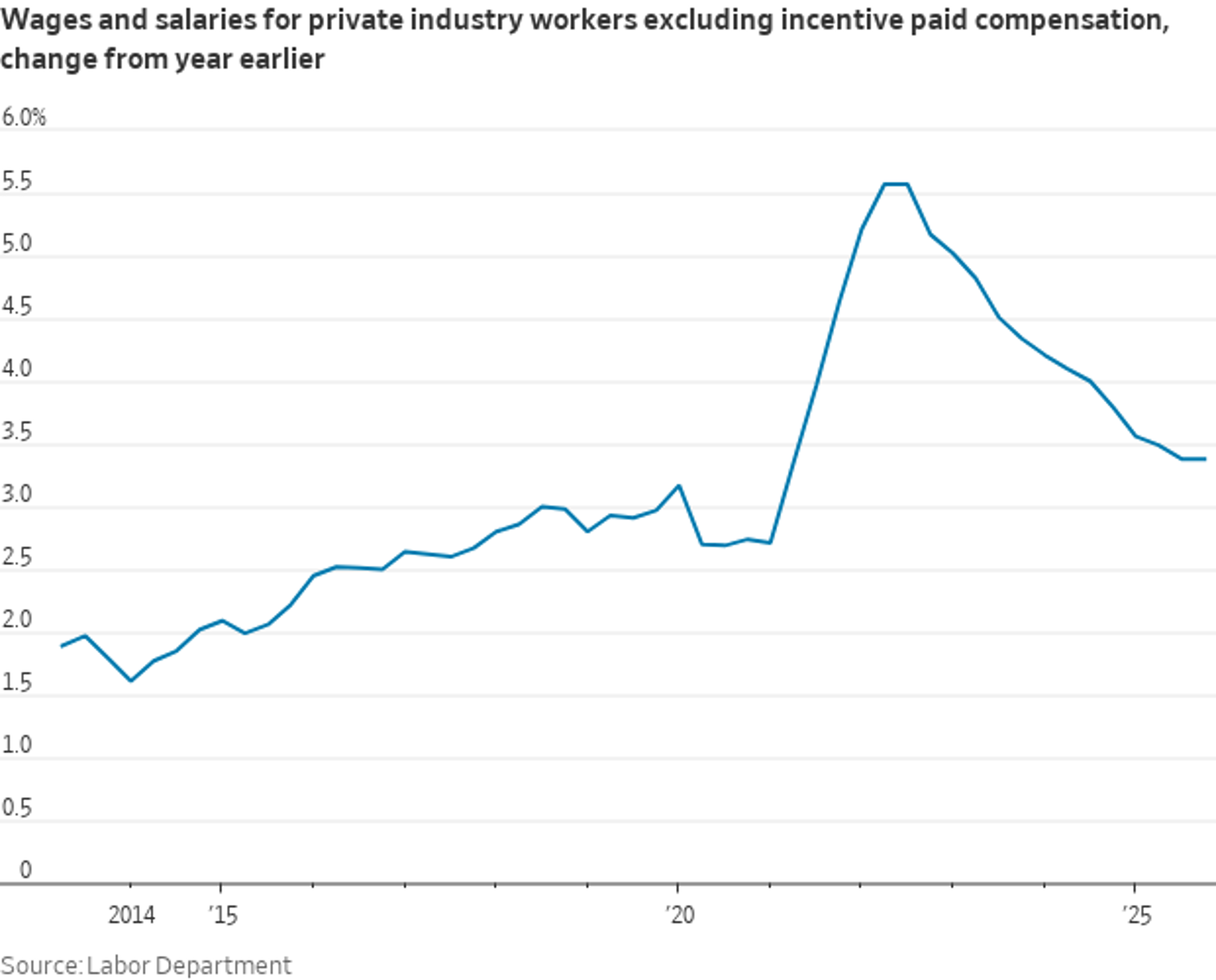

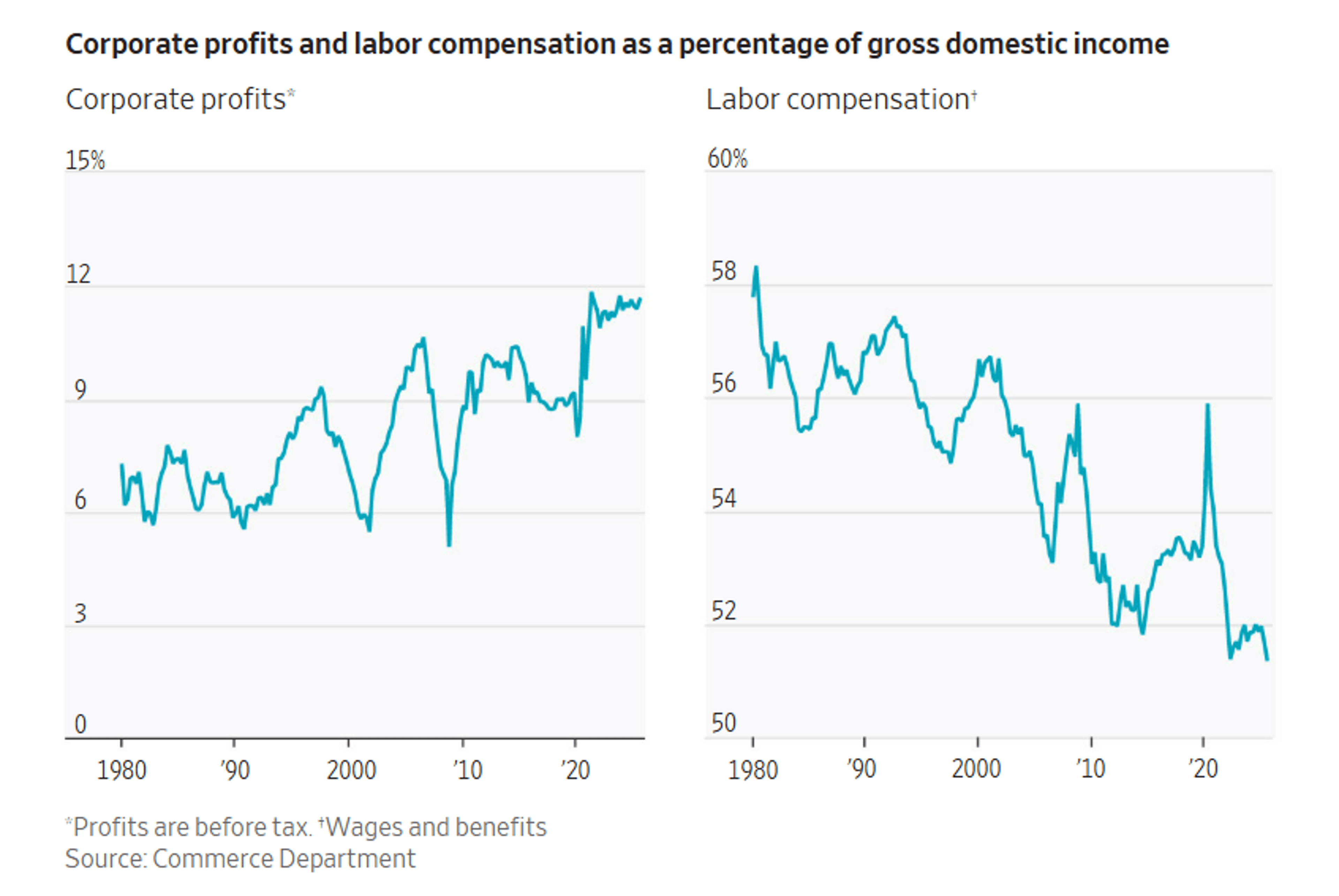

US Employment Costs Are Still Falling

The U.S. Bureau of Labor Statistics reported that the Employment Cost Index (ECI) fell for the second straight quarter, marking the slowest annual wage growth in more than four years. In Q4, total compensation rose just 2.8% year‑over‑year, down from 3.2% in the prior quarter. The slowdown was broad‑based, affecting both private‑sector wages and benefits. The data suggest that labor‑cost pressures, a key driver of inflation, are easing faster than many economists expected.

By Heisenberg Report

Blog•Feb 10, 2026

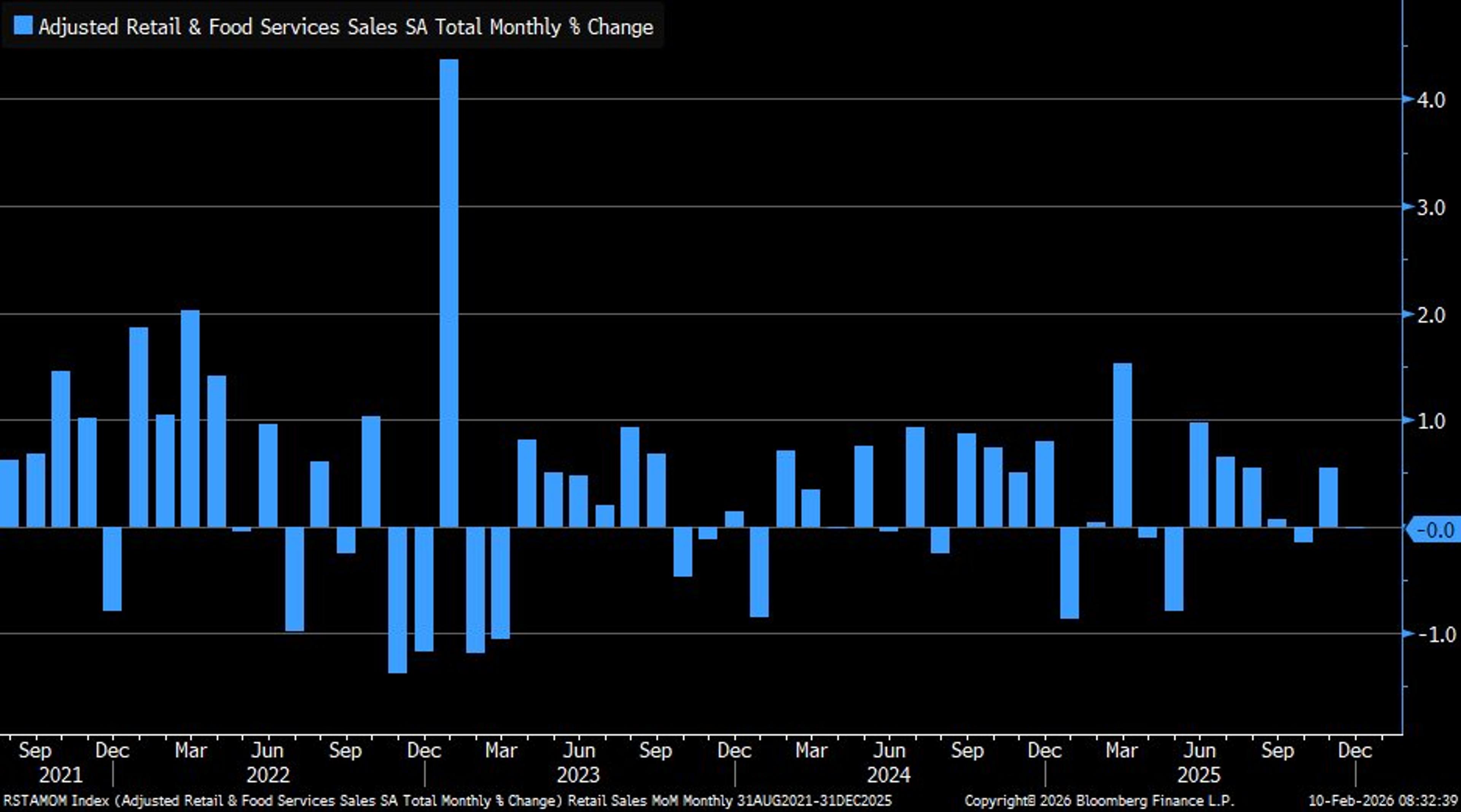

American Consumers Slam On The Brakes

The U.S. Commerce Department reported that January 2026 consumer spending stalled, with retail sales slipping amid unusually cold weather. Month‑over‑month retail sales fell 1.2%, while personal consumption expenditures dropped 0.8% year‑over‑year. Analysts say the weather‑induced headwind temporarily depressed demand, but...

By Heisenberg Report

Social•Feb 10, 2026

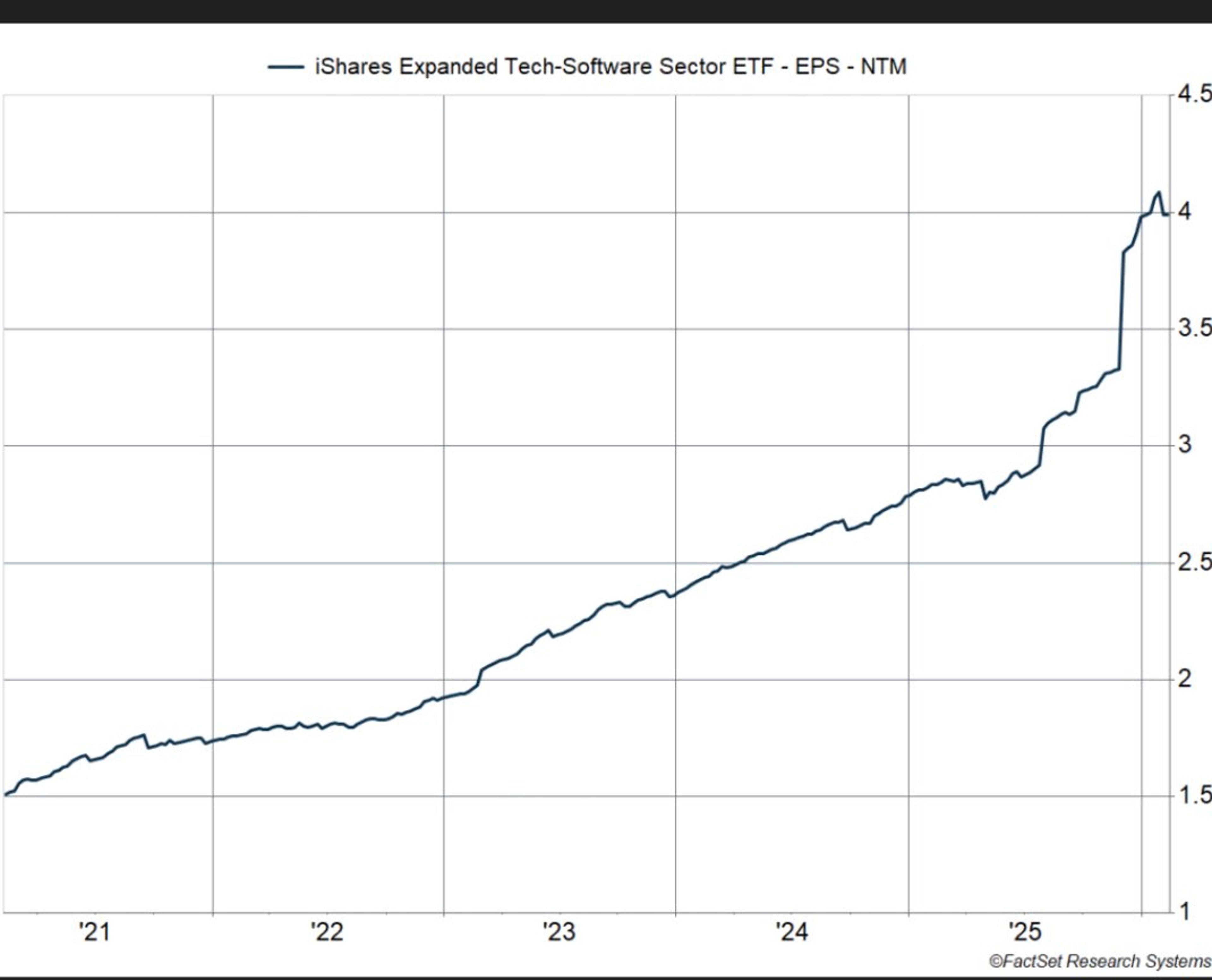

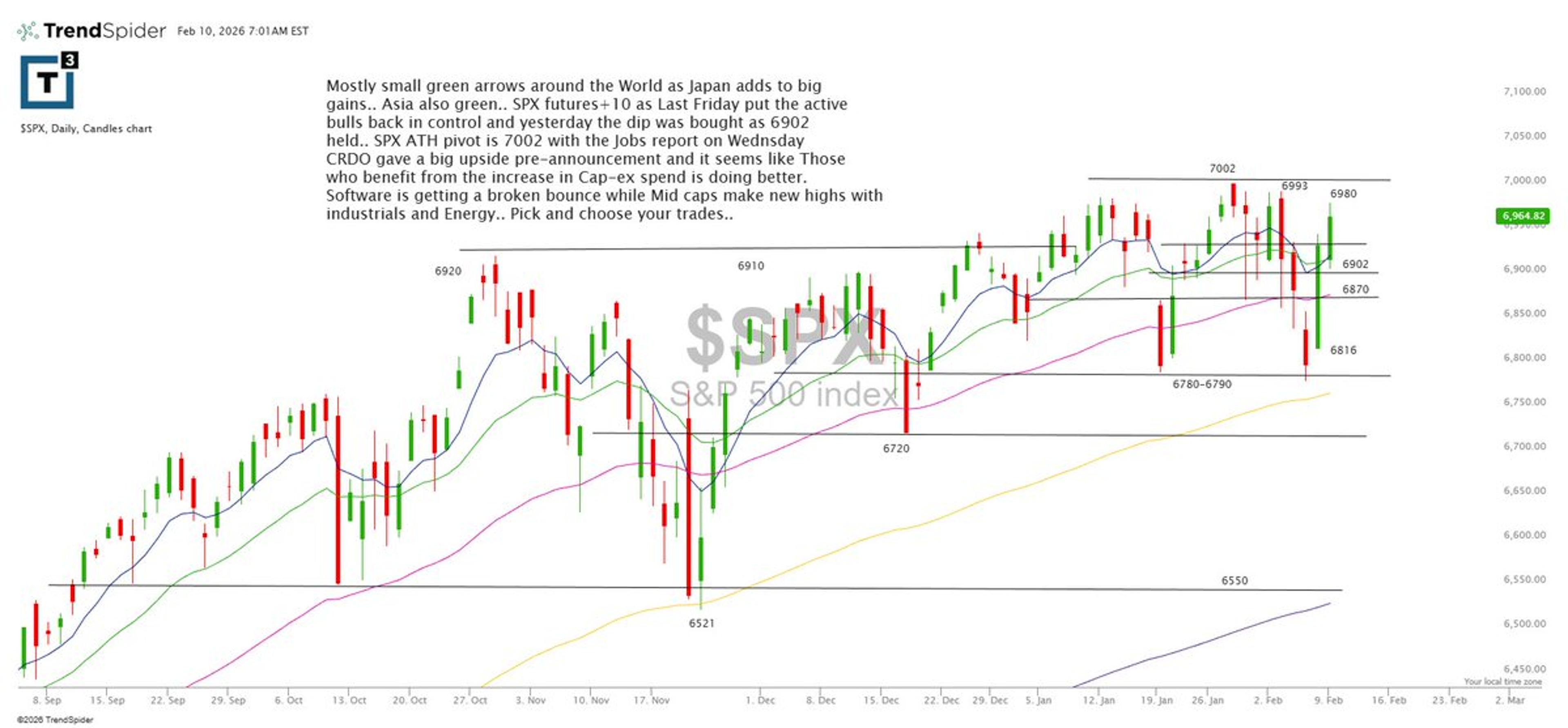

Software Sector Oversold Bounce, Not Sustainable Trend Reversal

📺 SOFTWARE SECTOR: TACTICAL OVERSOLD BOUNCE, NOT A TREND REVERSAL Software $IGV is seeing a short-term oversold bounce, not a trend reversal. The sector remains broken after losing key moving averages, so upside is likely limited near short-term resistance like the 8-day....

By Scott Redler

Podcast•Feb 10, 2026•0 min

Morning Market Brief

Lawrence Fuller reviews the market rebound after last week's sell‑off, noting that while volatility has eased and precious metals and crypto have steadied, technology stocks remain overvalued and lack true bargains. He highlights upcoming economic data—strong Redbook retail sales, a...

By The Market Strategist

Social•Feb 10, 2026

Bulls Hold SPY Above 680, Eye 7,000 Target

📺 BULLS TOOK CONTROL: HERE’S THE LEVEL THAT MATTERS Active bulls regained control after $SPY held the $687 level and followed through on Friday’s strength. Small caps $IWM and mid caps $MDY continue to lead, while $QQQ works back into key...

By Scott Redler

Social•Feb 10, 2026

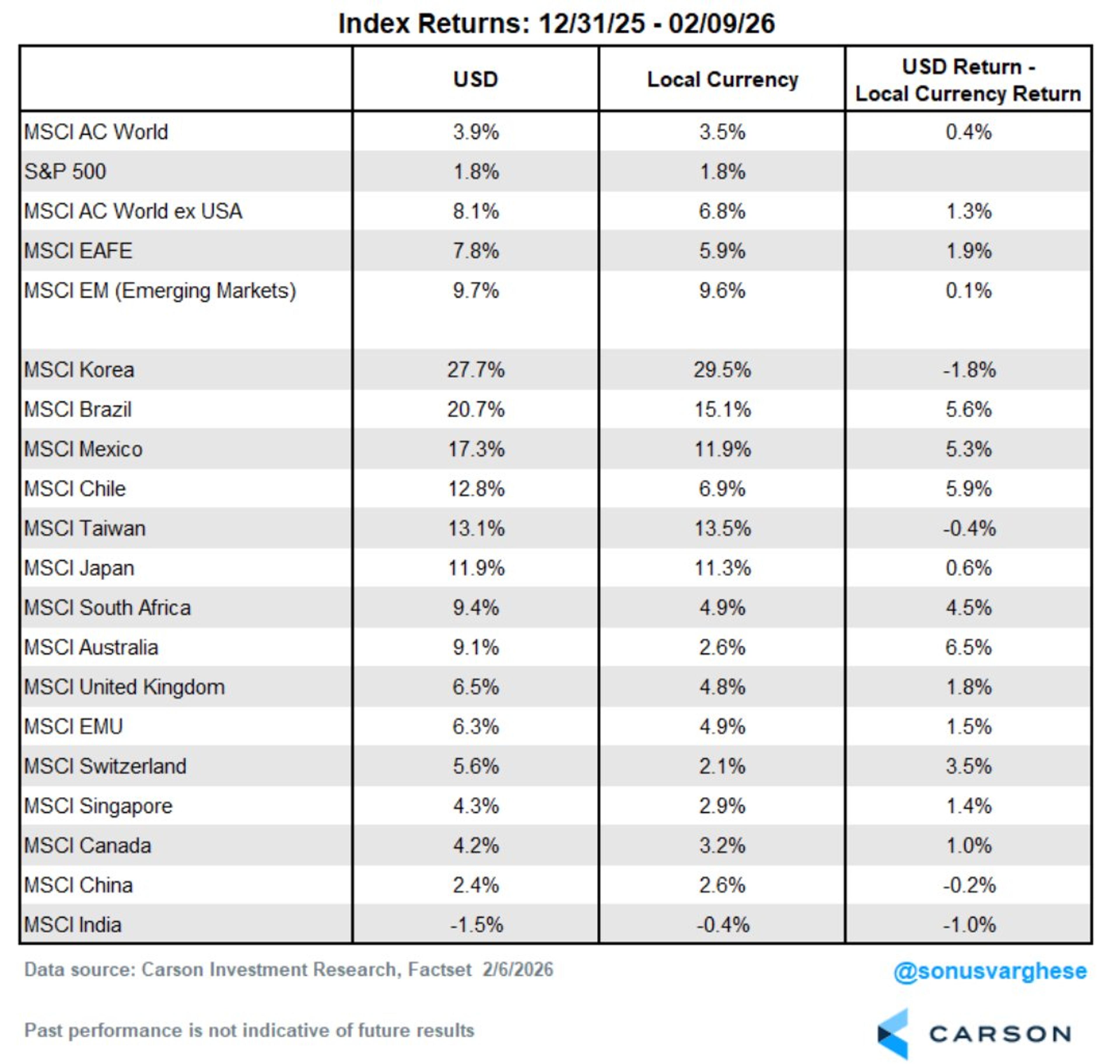

Global Equities Outpacing US in 2026, Stay Overweight

"It is deja vu all over again." Yogi Berra The US stock market is doing fine, but the rest of the world is soaring so far in '26. This is similar to what we saw last year and is a big...

By Ryan Detrick

Blog•Feb 10, 2026

Emerging Markets Continuing To Emerge

The US MSCI index has underperformed global peers in 2025, ending a year of relative strength. Investors are shifting toward high‑growth emerging‑market stocks such as South Korea, Brazil, Mexico, and Taiwan, while Japan rallied 5.7% after a decisive election. The...

By Yardeni QuickTakes

Social•Feb 10, 2026

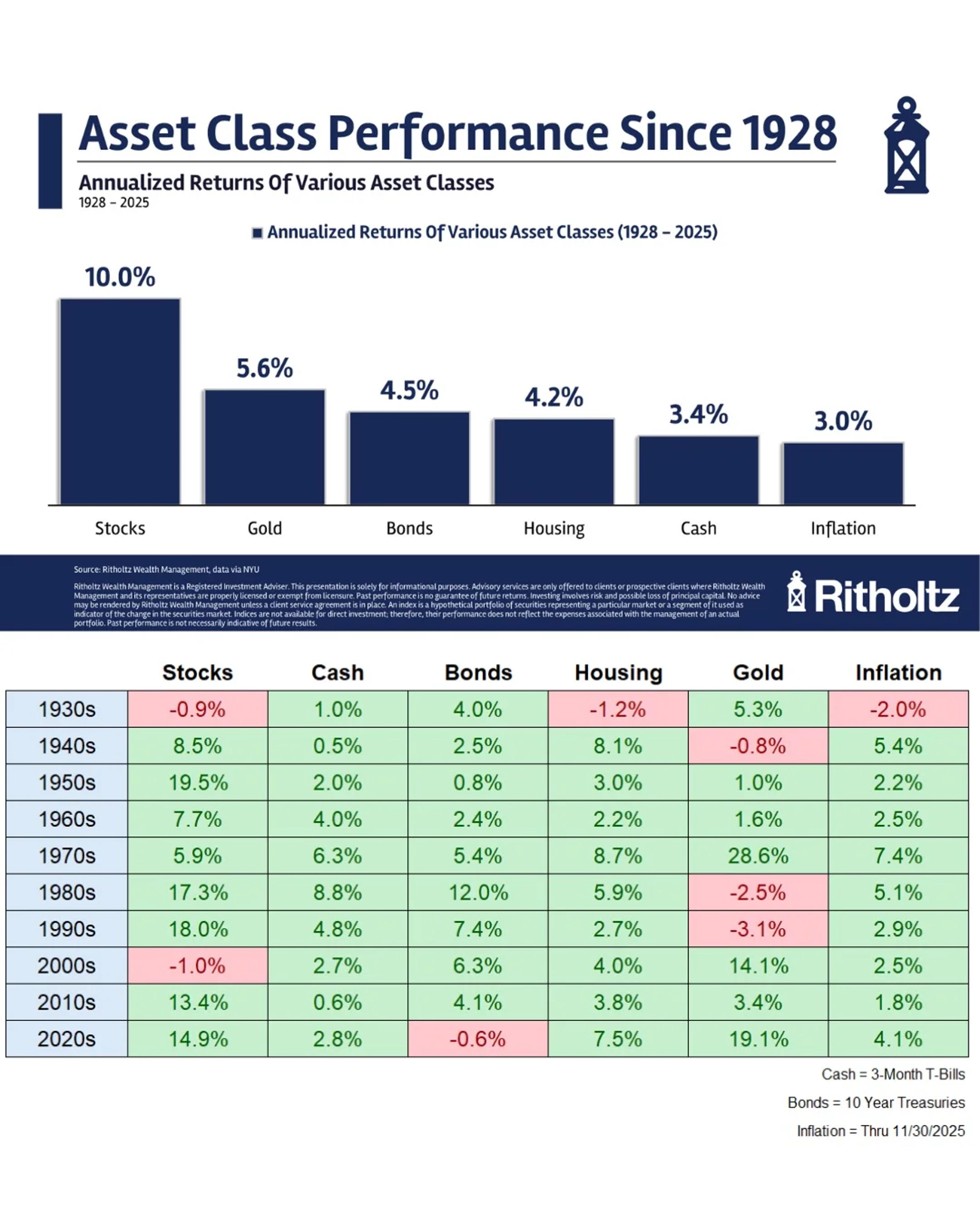

US Stocks Lead 97 Years of Superior Returns

𝐇𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐑𝐞𝐭𝐮𝐫𝐧𝐬 𝐅𝐨𝐫 𝐔𝐒 𝐒𝐭𝐨𝐜𝐤𝐬, 𝐁𝐨𝐧𝐝𝐬, 𝐂𝐚𝐬𝐡, 𝐇𝐨𝐮𝐬𝐢𝐧𝐠 & 𝐆𝐨𝐥𝐝 (𝟐𝟎𝟐𝟓) CTTO: Ben Carlson — https://awealthofcommonsense.com/2026/01/historical-returns-for-stocks-bonds-cash-housing-gold-2025/ The US, which currently is 60% of the global equity market, continues to influence investment portfolios worldwide, such as endowments and retirement funds. And for over...

By Evan Louise Madriñan

Blog•Feb 10, 2026

Despite 4 Years of Mass-Layoffs at Alphabet & Amazon, Headcount Rose in 2025, Nearly Flat with Peak, as Hiring Continued

Alphabet’s 2025 year‑end headcount rose by 7,497 employees, barely below its 2023 peak, while Amazon added roughly 20,000 workers to reach 1.576 million, just 2% shy of its 2021 high. Both companies experienced massive hiring surges in 2020‑21—Alphabet grew 60% and...

By Wolf Street

Social•Feb 10, 2026

S&P 500 Adds $250 B, Near Record High

MARKET RECAP 📈 The S&P 500 gained over $250 billion in market cap today and is now less than 1% away from a new record high 😳📈 What the heck is going on?!? Let’s talk about it 🗣️

By Peter Tuchman (Einstein of Wall Street)

Social•Feb 10, 2026

Private-Sector Wages Barely Slowed, up 3.38% YoY

ECI: Private-sector pay growth decelerated ever so slightly last year. Wages and salaries for private sector workers ex-incentive paid occupations was +3.38% in Q4 from a year earlier, unchanged from Q3. https://t.co/769ycb4jwP

By Nick Timiraos

Blog•Feb 9, 2026

Will Job Losses Spoil America’s ‘Goldilocks Plus’ Economy?

The United States continues to be described as a ‘Goldilocks Plus’ economy, balancing low inflation with solid growth. Recent data show the labor market still tight, but a wave of layoffs in technology and manufacturing raises concerns. Analysts warn that...

By Heisenberg Report

Social•Feb 10, 2026

COIN Bounces Off $145 Support, Aligns With Low Targets

Can't help but notice $COIN is bouncing off major league support around $145, lining up well with the Sep '24 and Mar '25 lows. Previous lows have been confirmed with a bullish crossover from weekly PPO. But dang...

By David Keller, CMT

Social•Feb 10, 2026

Software Multiples Hit 2014 Lows Amid AI Fears

Software earnings have been quite resilient, yet prices have collapsed over AI worries. As a result, multiples are the cheapest they've been since 2014. Sometimes things are cheap for a reason, but what if this is another DeepSeek moment? Nice charts...

By Ryan Detrick

Blog•Feb 9, 2026

The Biggest Buyer Of US Stocks Isn’t Going Away

Investors are confronting a new capital‑allocation landscape as hyper‑scale cloud firms pour record capex into AI infrastructure, squeezing the cash traditionally earmarked for share buybacks. The article argues that despite this shift, the market’s largest shareholder – passive index funds...

By Heisenberg Report

Social•Feb 10, 2026

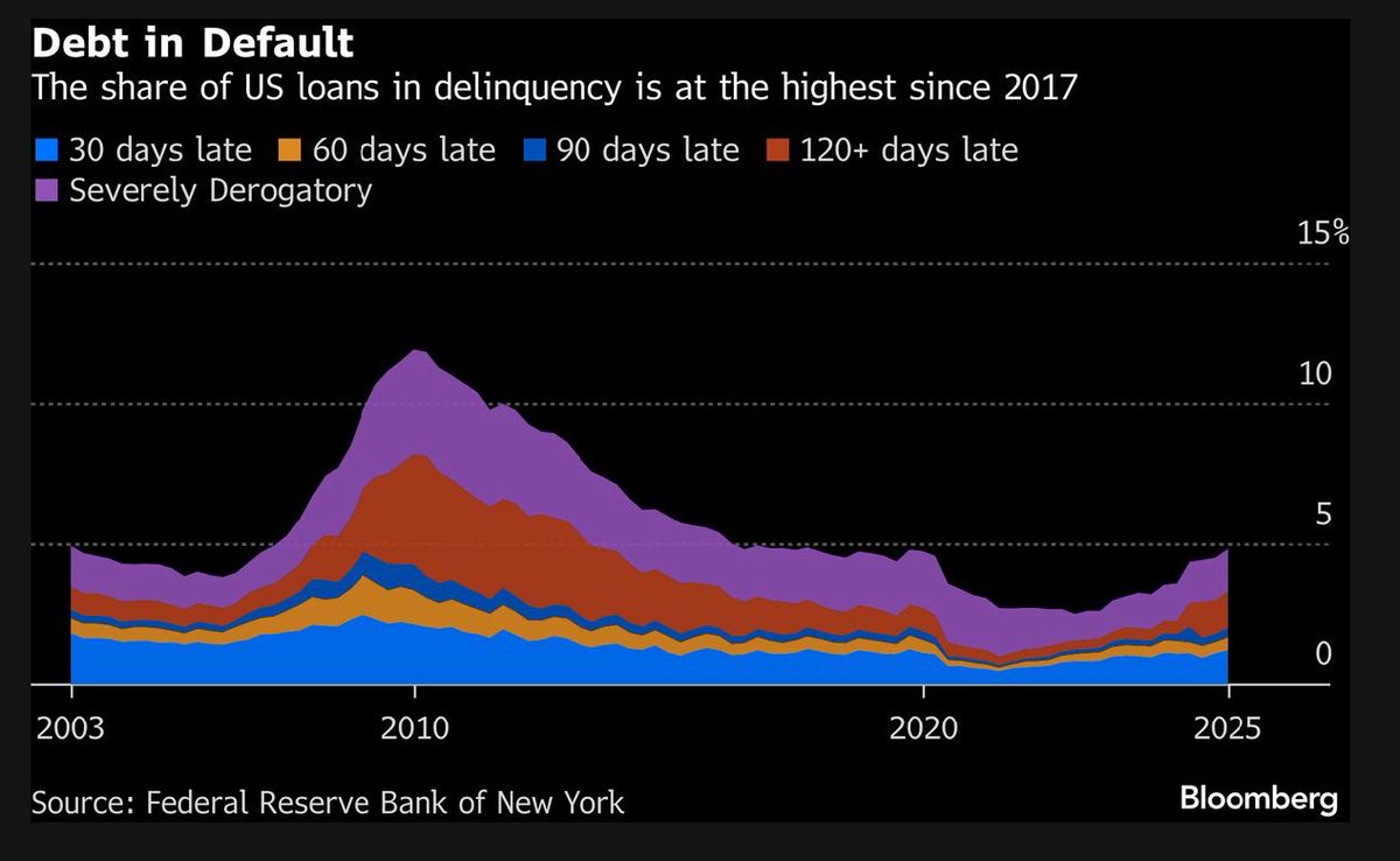

Holiday Sales Slump and Rising Delinquencies Hit Young, Low‑Income Americans

The one-two punch today of highly disappointing holiday retail sales and the highest consumer delinquencies since 2017 paints a bleak picture for lower-income and younger Americans. https://t.co/Bd2eX18BAU https://t.co/H1biY6UCIL

By Lisa Abramowicz

Social•Feb 10, 2026

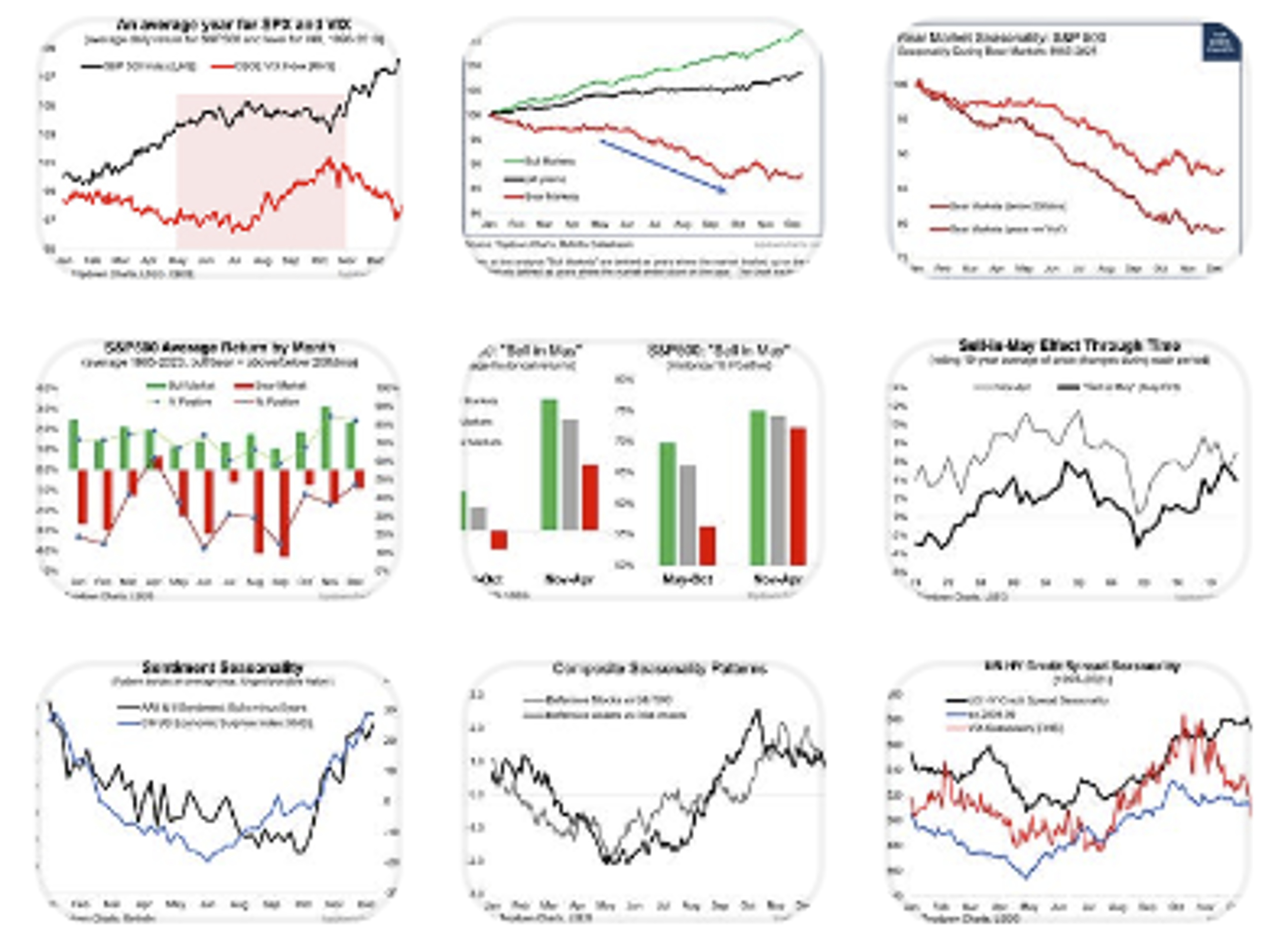

Weekly ChartStorm Reveals Hidden Stock Market Seasonality Angles

You may think you know all about stockmarket seasonality... but this special focus piece from the Weekly ChartStorm lays out a few more angles and details that you might not have considered before: https://t.co/5sf2QCC8pE https://t.co/XBuZIufwiB

By Callum Thomas

Blog•Feb 9, 2026

Software Company monday.com Plunges 22% Today, -82% From High, -50% From IPO Price, Into Our Imploded Stocks

Monday.com’s shares tumbled 22% to about $76.70 after its earnings release, marking a record‑low close. The stock is now 82% below its November 2021 peak and 51% beneath the $155 IPO price. While Q4 revenue rose 25% to $334 million and beat...

By Wolf Street

Social•Feb 10, 2026

Top Picks: Hundreds of Weekly Charts Highlighted

Our team probably creates a couple hundred charts each week. Here are some of our favorites from last week in the @CarsonResearch Charts of the Week. https://t.co/UIFr74RPu4

By Ryan Detrick

Social•Feb 10, 2026

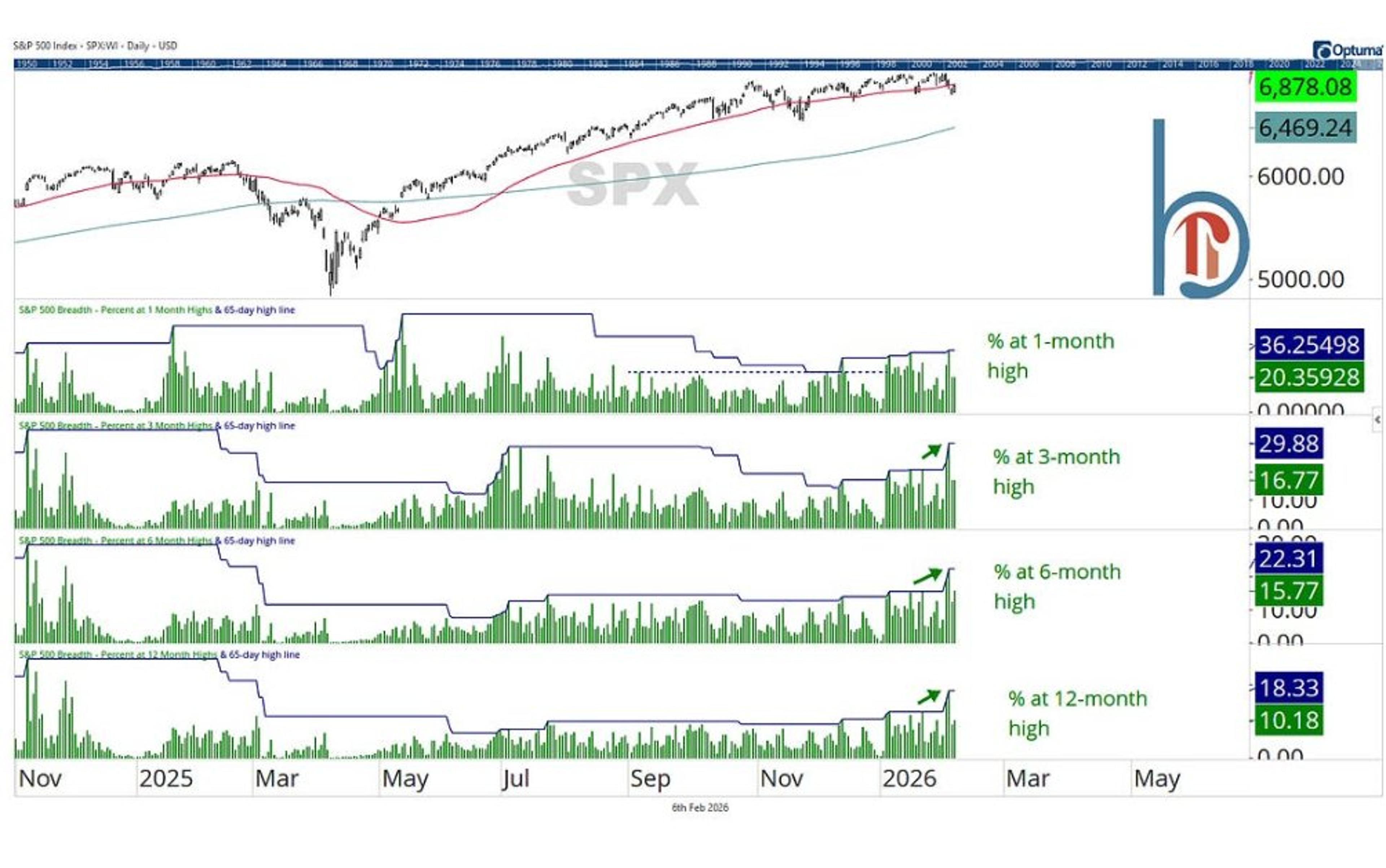

Market

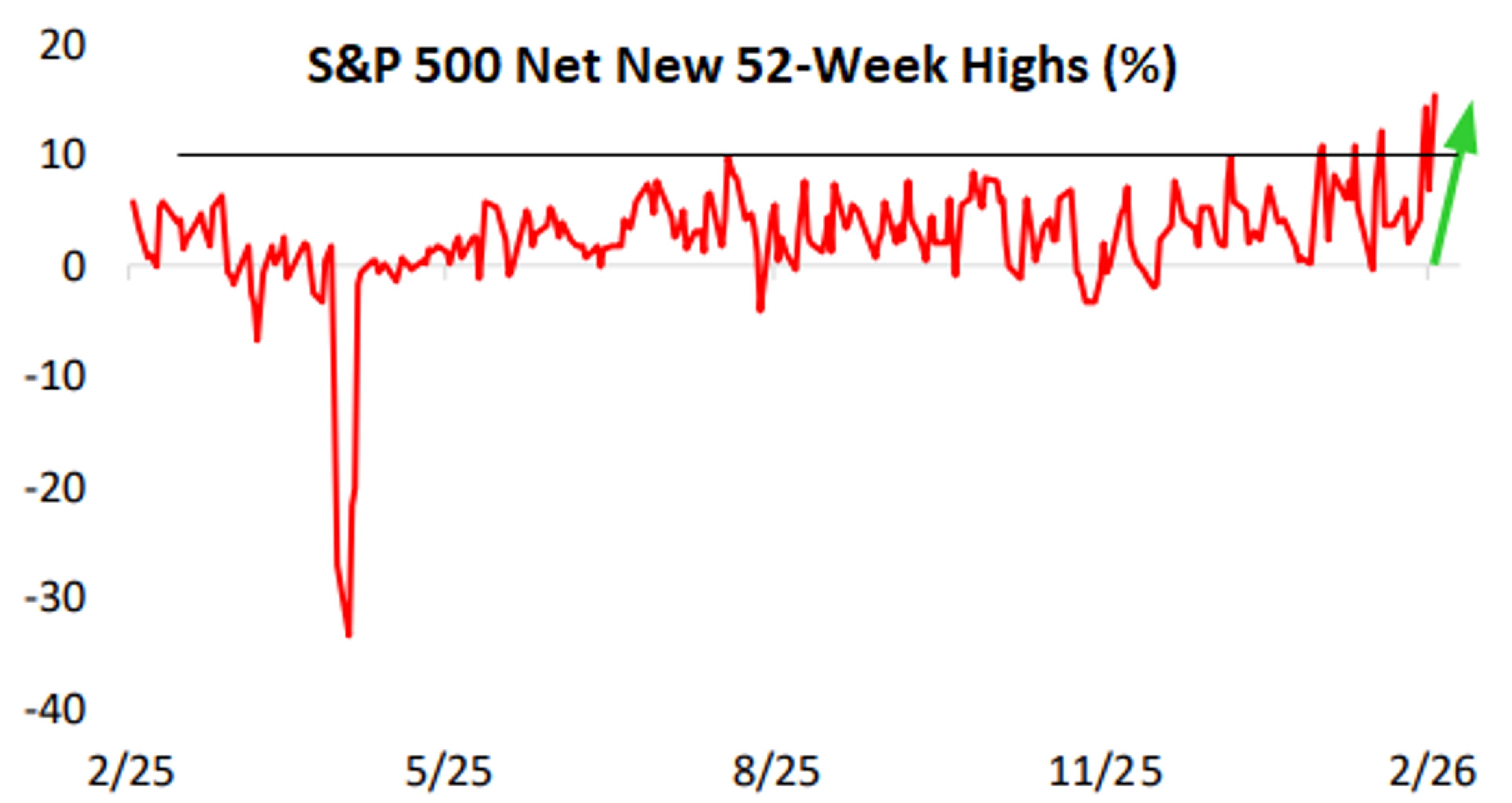

Great analysis in his note this week on some positives and negatives from @scottcharts. But breadth continues to be the one big reason to expect this bull to continue imo. https://t.co/WO4e9HXrem

By Ryan Detrick

Social•Feb 10, 2026

Doubling Down: Shorting QQQ to Complement SPY Bet

Adding Some QQQ to My SPY Short @TheStreetPro I just shorted (QQQ) (to add to my (SPY) short earlier this morning): * QQQ $615.74 By Doug Kass Feb 10, 2026 9:26 AM EST

By Doug Kass

Social•Feb 10, 2026

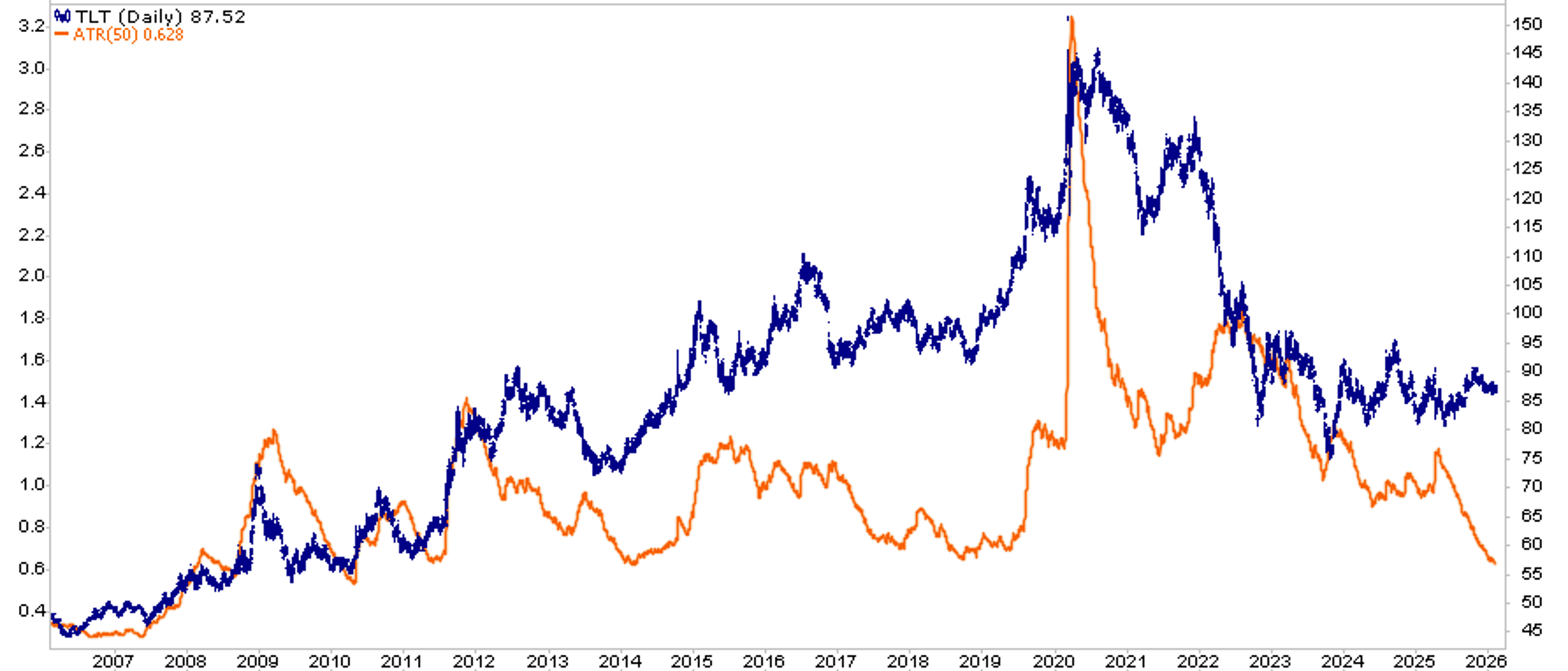

TLT's 15-Year Low ATR Signals Potential Breakout

$TLT : The Average True Range (orange) is now the lowest in over 15 years. Something has to give. Might the plummeting @truflation readings be a clue to which direction a breakout might occur? https://t.co/0pEENxYpXs

By Michael Lebowitz

Social•Feb 10, 2026

US Stocks Look Strong, Yet Lag Global Peers

"The US stock market, while it looks strong, is actually much weaker than almost any other industrialized country.... So while we're doing well… everyone else is doing even better." https://t.co/7KavXe5LXh

By Justin Wolfers

Social•Feb 10, 2026

December Retail Sales Stall at 0%, Missing Forecast

December retail sales 0% vs. +0.4% est. & +0.6% prior; control group -0.1% vs. +0.2% prior (rev down from +0.4%); ex-autos 0% vs. +0.4% prior (rev down from +0.5%) https://t.co/BbJwHL35ne

By Liz Ann Sonders

Social•Feb 10, 2026

Small Business Optimism Falls, Uncertainty Rises

January @NFIB Small Business Optimism Index down to 99.3 vs. 99.8 est. & 99.5 prior … net % of respondents expecting a better economy ticked down to 21%; percentage saying it’s a good time to expand rose to 15%; uncertainty...

By Liz Ann Sonders

Social•Feb 10, 2026

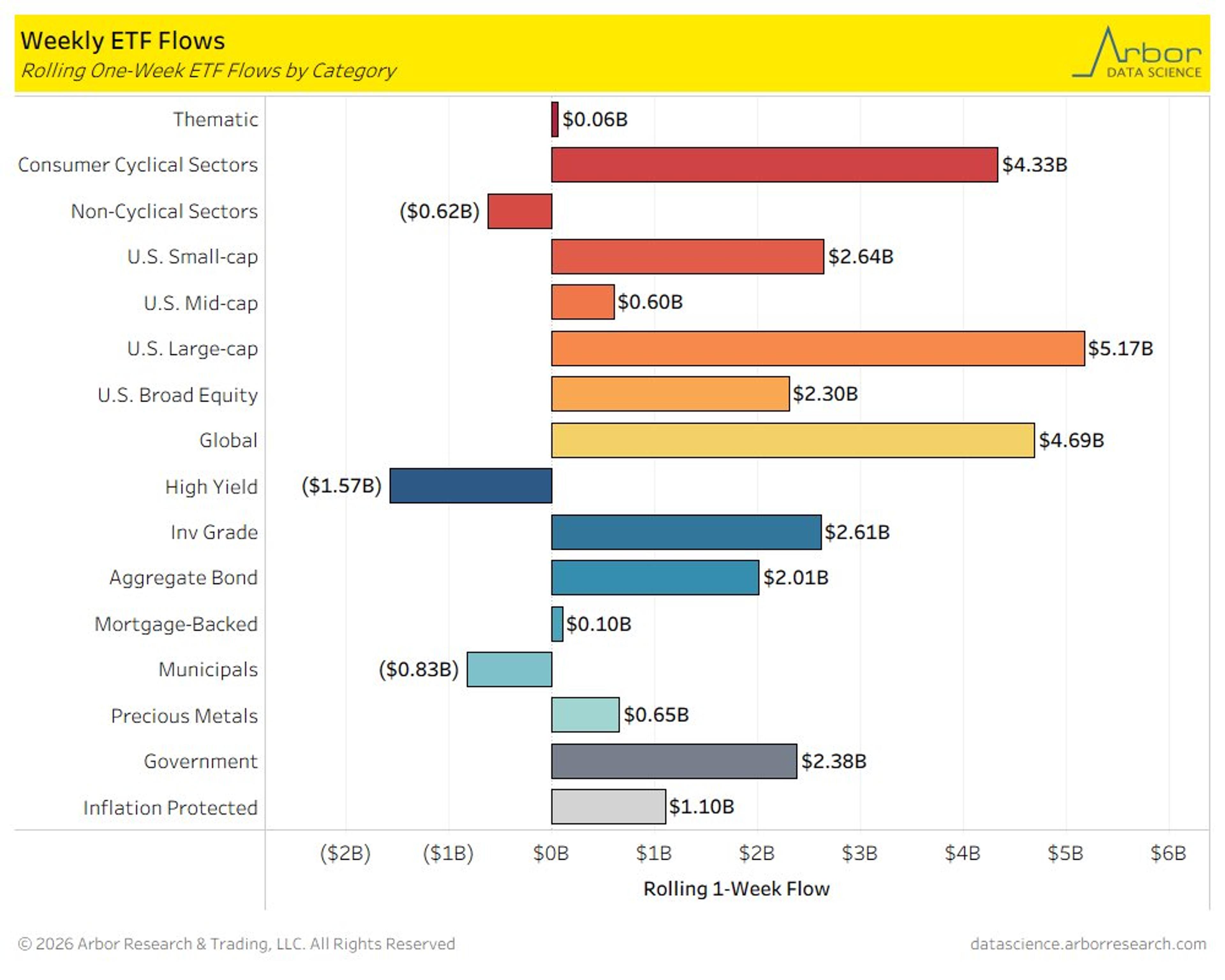

U.S. Large Caps Lead Inflows; High‑Yield Bonds Lose Ground

U.S. large caps dominated inflows last week, followed by global equities and consumer cyclicals ... high yield bonds saw most outflows, but broader fixed income universe was still positive @DataArbor https://t.co/l0soXmQF4S

By Liz Ann Sonders

Social•Feb 10, 2026

Household Pessimism on Finances Rises, Stays Elevated

Share of households expecting to be in a worse financial situation a year from now ticked up in January and has been elevated over past year per @NewYorkFed https://t.co/fGqXylhwzD

By Liz Ann Sonders

Social•Feb 10, 2026

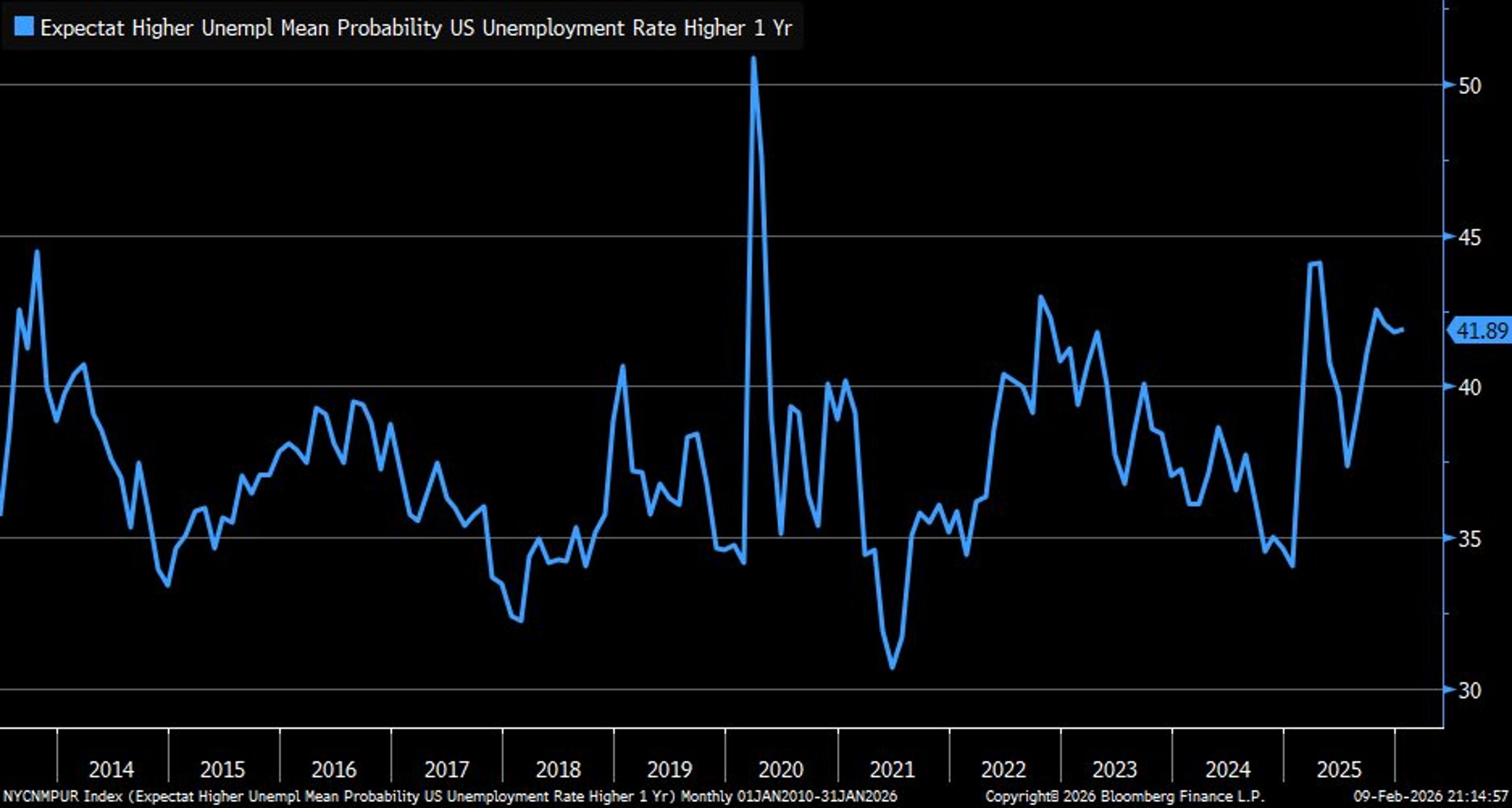

Nearly 42% Expect Rising Unemployment, Survey Shows

Consumers still showing concerns over labor market, with average of nearly 42% expecting higher unemployment in next year per January @NewYorkFed survey https://t.co/ykN7Bdc2C0

By Liz Ann Sonders

Social•Feb 10, 2026

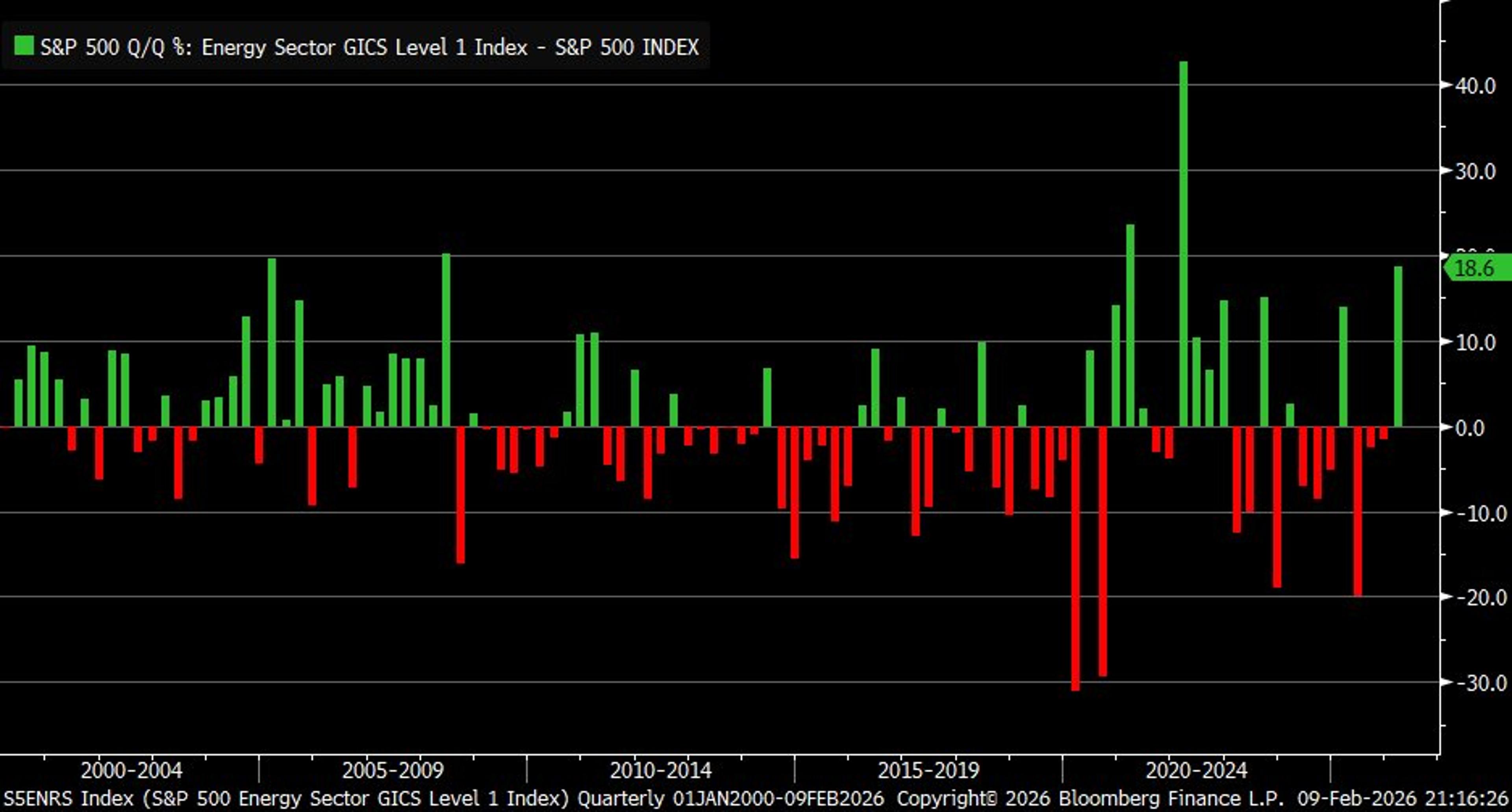

Energy Sector Outpaces S&P 500 by 19 Points.

Quarter-to-date, Energy sector is outpacing S&P 500 by nearly 19 percentage points … best since first quarter of 2022 and one of best performance spreads (as of now) since 2000 [Past performance is no guarantee of future results] https://t.co/1vvb9Qf0Mh

By Liz Ann Sonders

Social•Feb 10, 2026

Vanguard's $70B ETF Inflows Rank Top Three

Vanguard has already taken in $70b in ETF flows to start year, that's nearly $3b a day and more than all but 3 issuers took in last year. If VOO alone were an issuer it would be in 3rd place...

By Eric Balchunas

Social•Feb 10, 2026

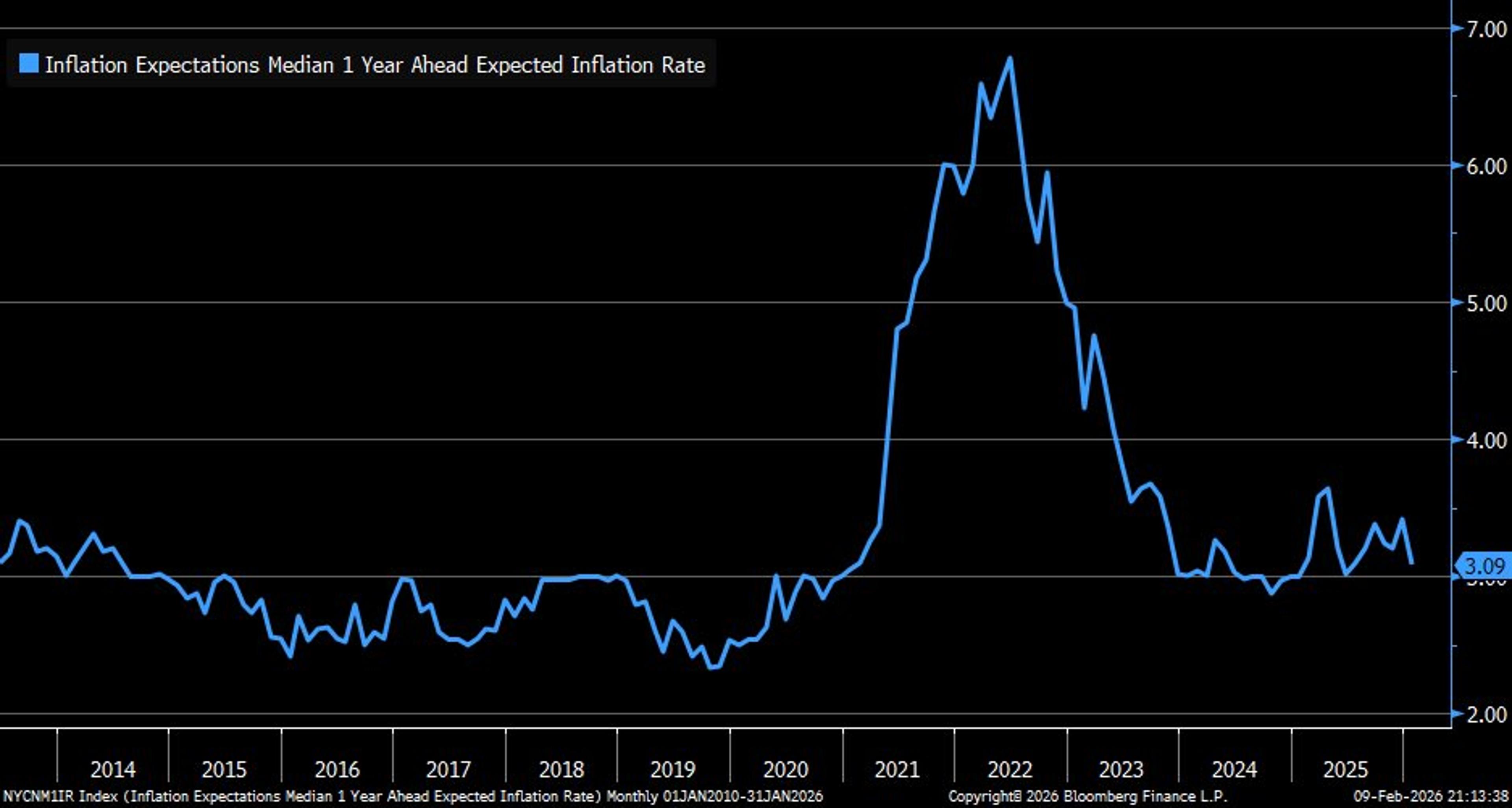

Consumers' 1‑Year Inflation Expectation Drops to 3.09%

Per @NewYorkFed survey, as of January, consumers’ median 1y inflation expectations moved down to 3.09% https://t.co/y6Jab93CyT

By Liz Ann Sonders

Social•Feb 10, 2026

SPX Futures Rise, Bulls Hold Above 6900, Target 7002

$SPX futures +10 after Friday’s action put active bulls back in control and yesterday’s dip was bought off 6902—7002 remains the ATH pivot into Wednesday’s jobs report. https://t.co/bUhLX4Ywid

By Scott Redler

Social•Feb 10, 2026

Infrastructure Software Set for Multi-Month Rally as App Vendors Falter

Application software vendors are struggling and providing weak guidance, quality infrastructure software firms' revenue is accelerating. Infrastructure software vendors are attractively valued now and their stocks appear poised for a multi-month rally.

By Puru Saxena

Social•Feb 10, 2026

Live Premarket Picks: NVDA, TSLA, IBIT, SPY

⏰ Scott Redler’s #630club - LIVE Premarket Stock Update $NVDA $TSLA $IBIT $SPY ➡️ Free VIP List Newsletter: https://t.co/88cKgbrKKl https://t.co/K8dY5tEQml

By Scott Redler

Social•Feb 10, 2026

Nvidia’s Value Outpaces IBM with Far Fewer Employees

In 1985, IBM was America’s most valuable company & employed nearly 400,000. Today, Nvidia is nearly 20 times as valuable and five times as profitable as IBM was yet it employs roughly a 10th as many people. https://t.co/indMwMz0TO @greg_ip https://t.co/HDl995cUhw

By Lisa Abramowicz

Social•Feb 10, 2026

Harvest Losses to Acquire Google at $101

no, but may harvest the loss to pick up the google 100 at 101. #theyieldbook

By Tom Keene

Social•Feb 10, 2026

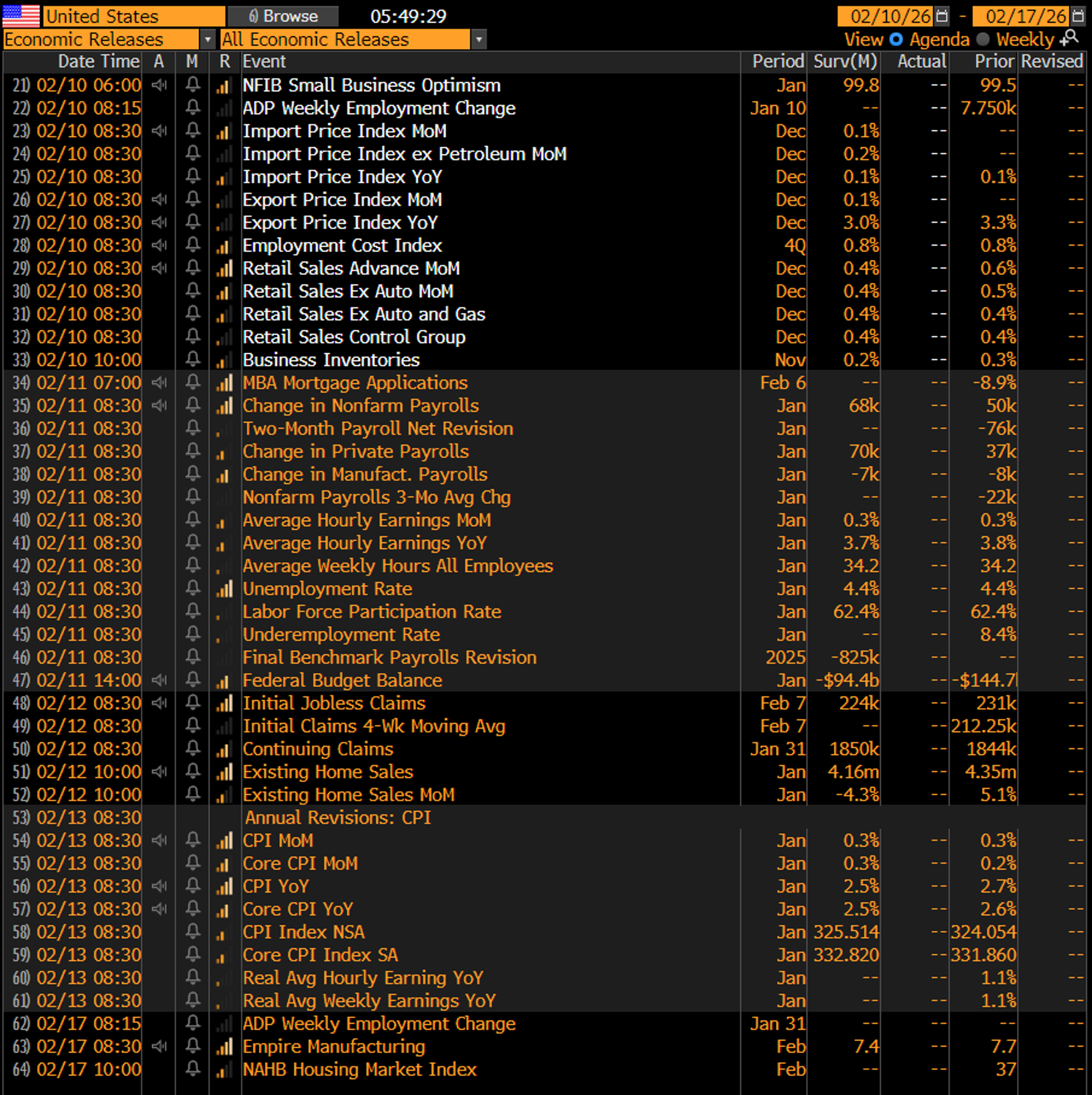

Jobs Data Wednesday, CPI Hits Friday

All the data coming for the rest of the week. We're going to have Jobs Wednesday and then CPI Friday https://t.co/8DDq0vkOvD

By Joe Weisenthal

Social•Feb 10, 2026

Markets Could Slip If Data Undermines Fed Cut Hopes

Stock markets may sour if this week’s US economic data casts doubt on Fed rate cut speculation. #stockmarkets #Fed #Economy #InterestRates #USD #Macro #trading https://t.co/ZEfchApMC0

By Ilya Spivak

Social•Feb 9, 2026

Tech Rebounds, Commodities Surge as Growth Revives

Markets pushed higher to start the week, but the rotation underneath the surface is telling a more interesting story. Tech bounced, commodities ripped, and growth showed signs of life again. In today’s CHART THIS, I walk through $SPX just below 7000,...

By David Keller, CMT

Social•Feb 9, 2026

Pick Fed Chair by Sound Economic Reasoning, Not Politics

"Thus, the way to choose a good Federal Reserve chair is to read what candidates have said about how the economy operates and ask them about their economic beliefs. If what a candidate says is unrealistic or poorly reasoned, move...

By Claudia Sahm

Social•Feb 9, 2026

Bears Brace for NFP Wednesday and CPI Friday

Neil does a great job with the week ahead ... bears watching as we head into NFP Wed & CPI Fri.

By Samantha LaDuc

Social•Feb 9, 2026

Cyclical Growth Rises While Inflation Falls—A Rare Forecast

Our nowcasts suggest that cyclical growth is going up and inflation is going down. No one forecasts this cocktail

By Andreas Steno Larsen

Social•Feb 9, 2026

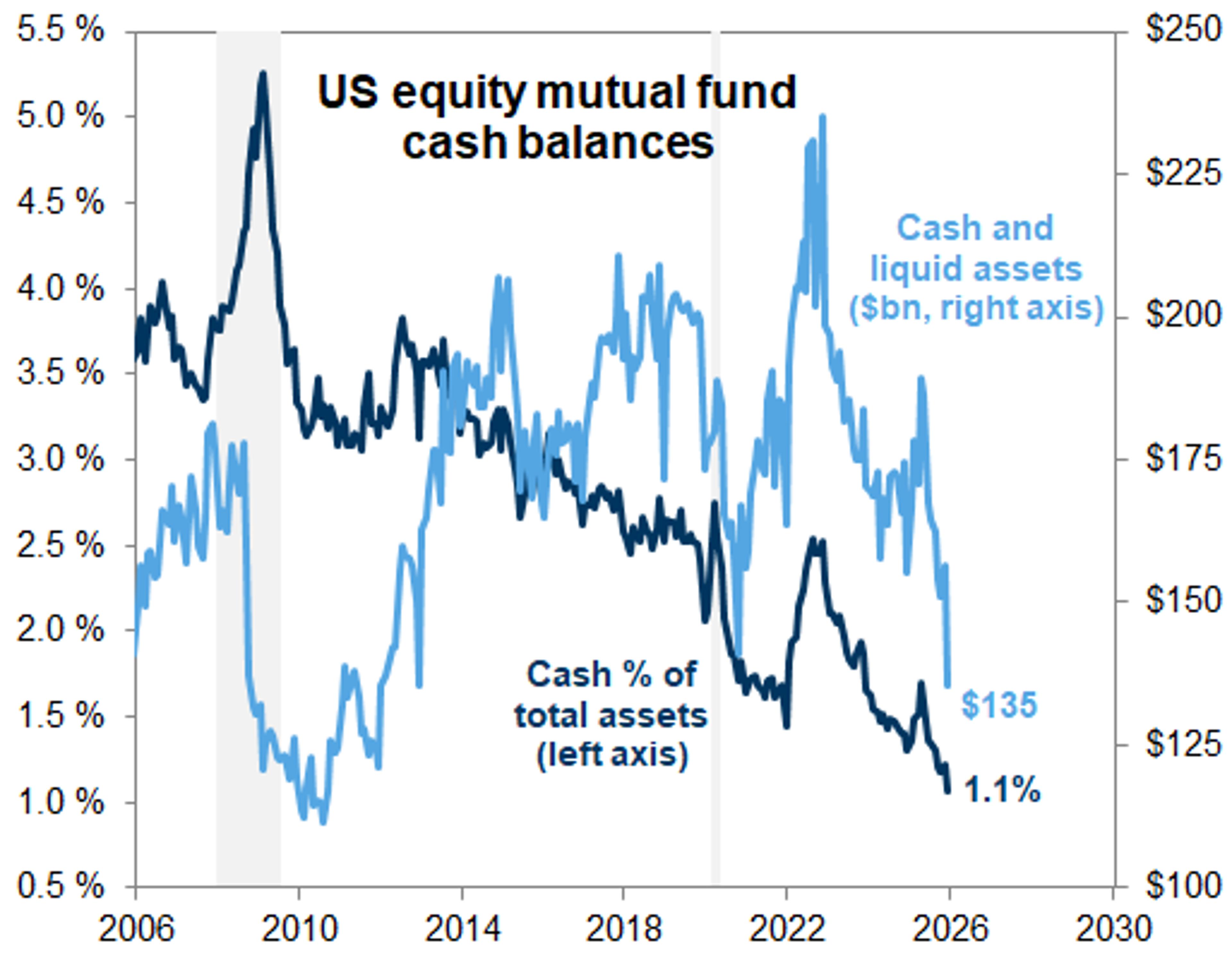

US Equity Mutual Funds Hold Record Low Cash

Mutual funds are all in on the stock market At the start of 2026, US equity mutual funds held just 1.1% of asset in cash, the lowest level in 20 years of data history --Goldman https://t.co/BWZ5dGYfjM

By Gunjan Banerji

Social•Feb 9, 2026

Seven Firms Command 35% of SPX Investment Dollars

Employment in S&P 500 companies is 18% of total US employment, but 35 cents of every dollar that goes into the SPX goes to 7 companies. This is a market structure problem and a major issue with our 401k system.

By Tyler Neville

Social•Feb 9, 2026

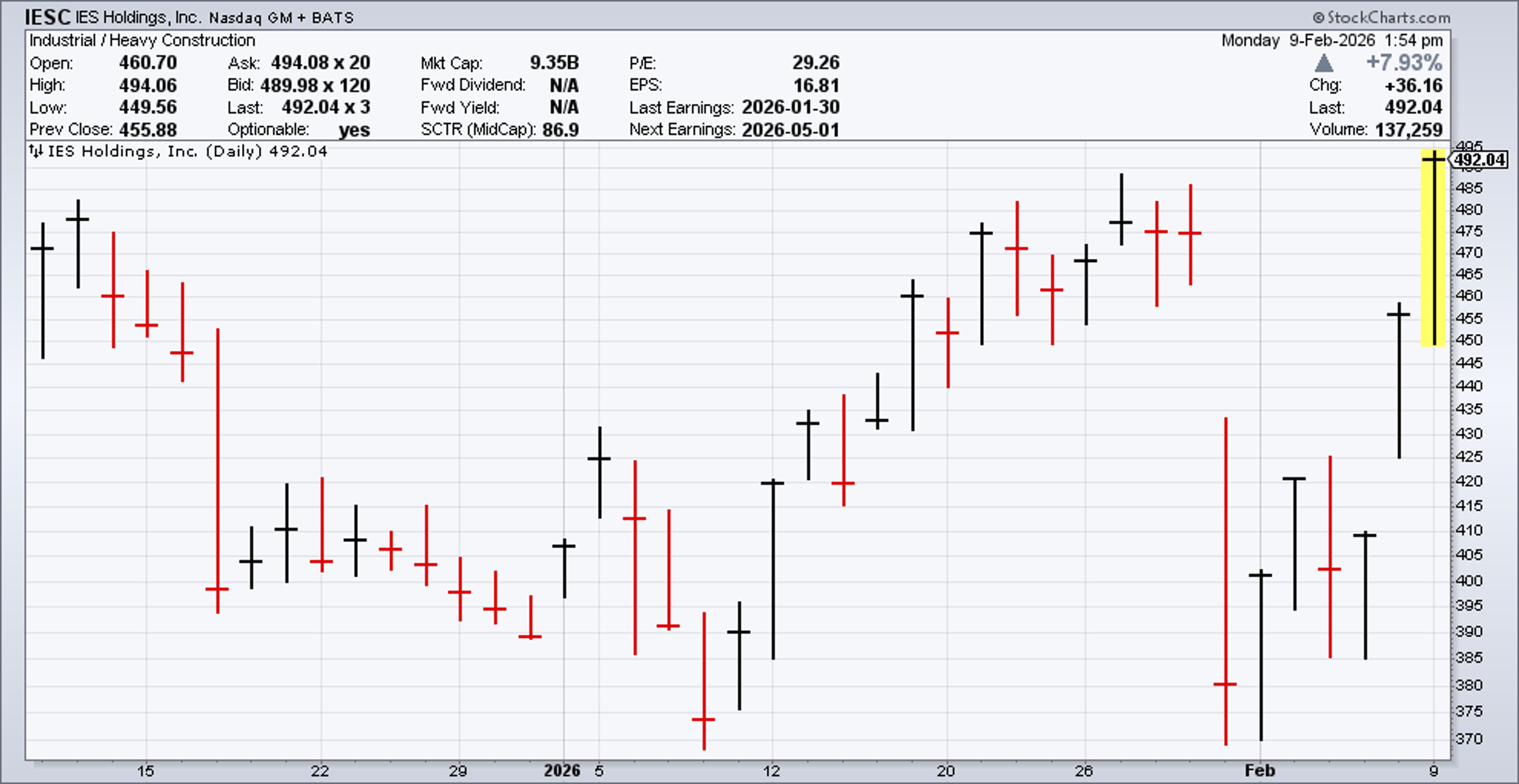

IESC Rebounds, Recovers 20% Loss and More

After its last earnings report, $IESC dropped 20%. It's made it all back and then some. https://t.co/hebBMdjVup

By Eddy Elfenbein

Social•Feb 9, 2026

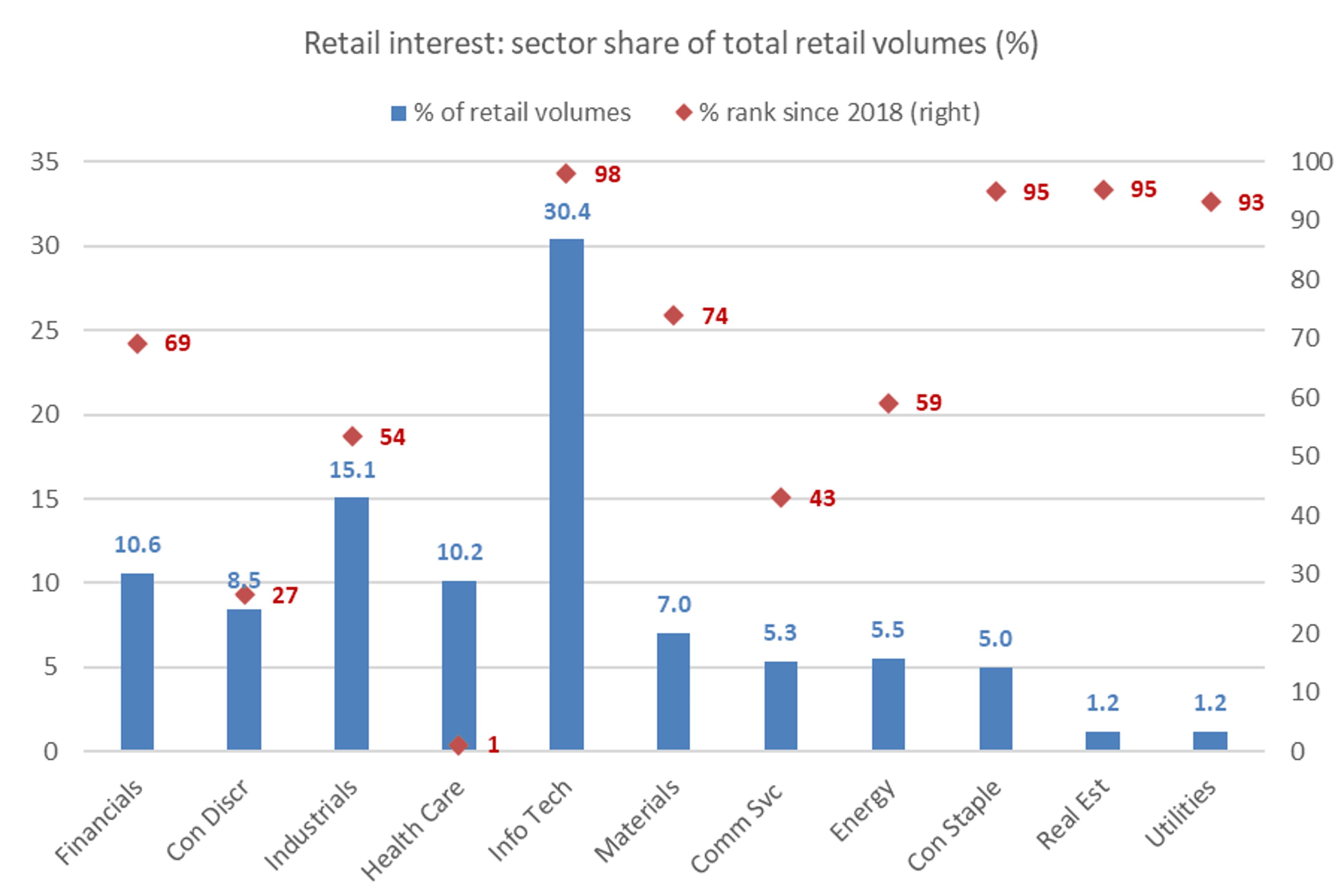

Tech Trades Hit 30% of Retail Volume, Highest Since 2018

Trading in the tech sector makes up 30% of retail trading volumes--one of the highest shares since 2018 --Citi https://t.co/6pvw7muvfj

By Gunjan Banerji

Social•Feb 9, 2026

Weekly S&P 500 ChartStorm Highlights Market Trends

ICYMI: Weekly S&P500 ChartStorm blog post https://t.co/eQY6d47hAk Thanks + follow reco to chart sources @topdowncharts @MarketCharts @MikeZaccardi @BlakeMillardCFA @WillieDelwiche @alphacharts @AugurInfinity @SnippetFinance @EricBalchunas @TuttleCapital @Todd_Sohn

By Callum Thomas

Social•Feb 9, 2026

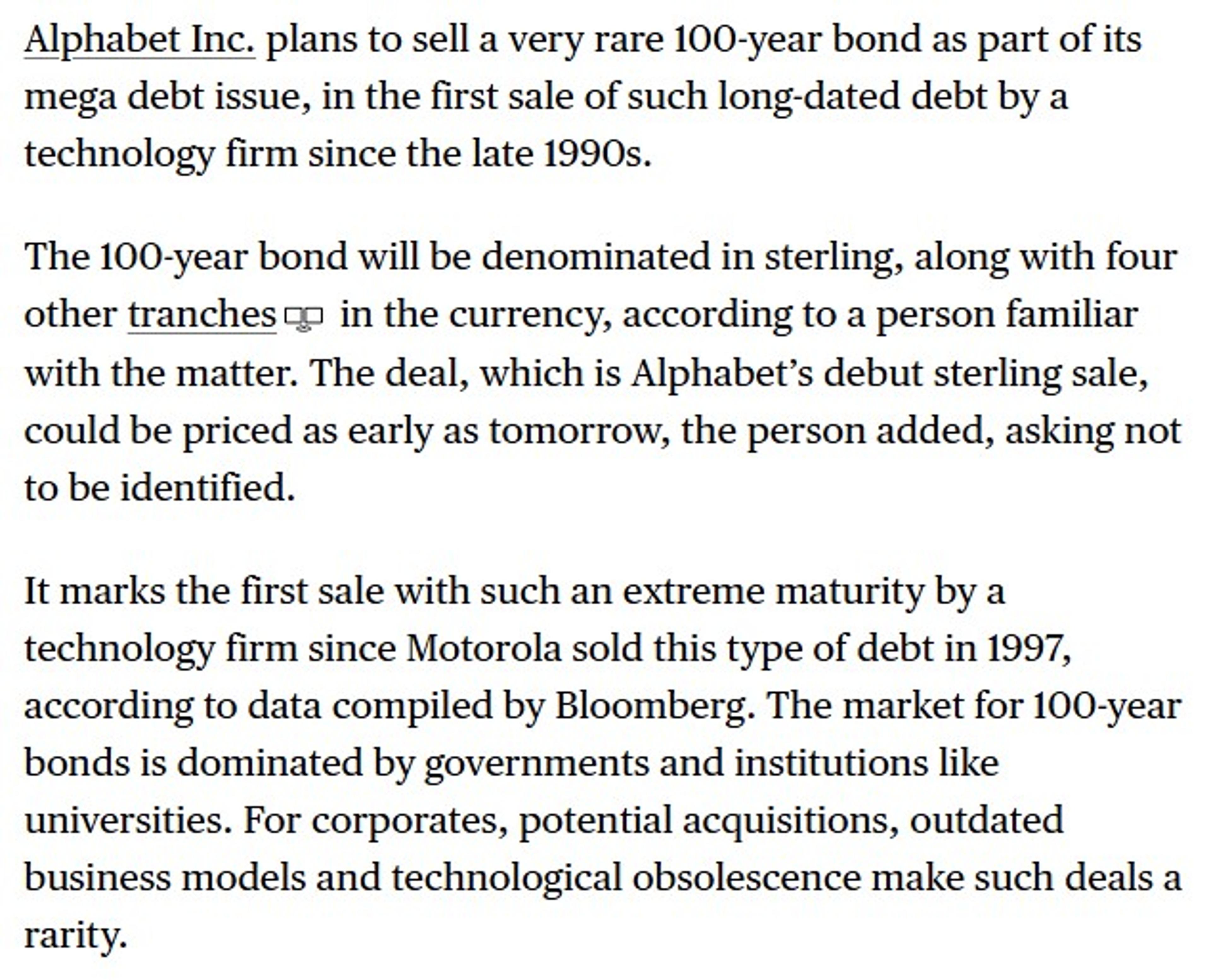

Tech's First 100-Year Bond Since Motorola 1997

The last time a tech company announced a 100-year bond, it was Motorola in 1997 https://t.co/HKkDro85Ac https://t.co/w2S75DaL2J

By Joe Weisenthal

Social•Feb 9, 2026

Retail Inflows Hit Six-Year High on Furlough, Tax Refunds

JPM: "Similar to the risk-on trend seen among institutional investors, retail investor flows have been the strongest in the last six years, likely due to furlough payments and anticipated larger tax refunds of ~$600/household this year"

By Gunjan Banerji

Social•Feb 9, 2026

S&P 500 New 52‑Week Highs Reach Year‑

The percentage of stocks in the S&P 500 making new 52-week highs has been expanding and just hit its highest level in the last year to end last week--@bespokeinvest https://t.co/BcNw0xKEmG

By Gunjan Banerji