🎯Today's American Stocks Pulse

Updated 7m agoWhat's happening: Booking Holdings launches 25‑for‑1 stock split as earnings surge

Booking Holdings announced a 25‑for‑1 forward stock split, converting each share into 25 shares, effective April 6 2026. The move follows a Q4 report showing $6.3 billion revenue, 38% EPS growth, and a dividend increase to $10.50 per share.

News•Feb 20, 2026

Jim Cramer's Top 10 Things to Watch in the Stock Market Friday

Jim Cramer highlighted ten market catalysts for Friday, Feb 20, ranging from macro data to individual stocks. Weak Q4 GDP growth at 1.4% pushed futures lower, while Texas Roadhouse rallied over 3% on a strong Q1 outlook. GE Aerospace received a buy initiation with a 27% upside target, and Klarna reported a disastrous quarter, prompting sharp price‑target cuts. Other notable moves included Blue Owl loan sales, CrowdStrike’s target reduction, and Live Nation’s earnings beat.

By CNBC – US Top News & Analysis

Social•Feb 20, 2026

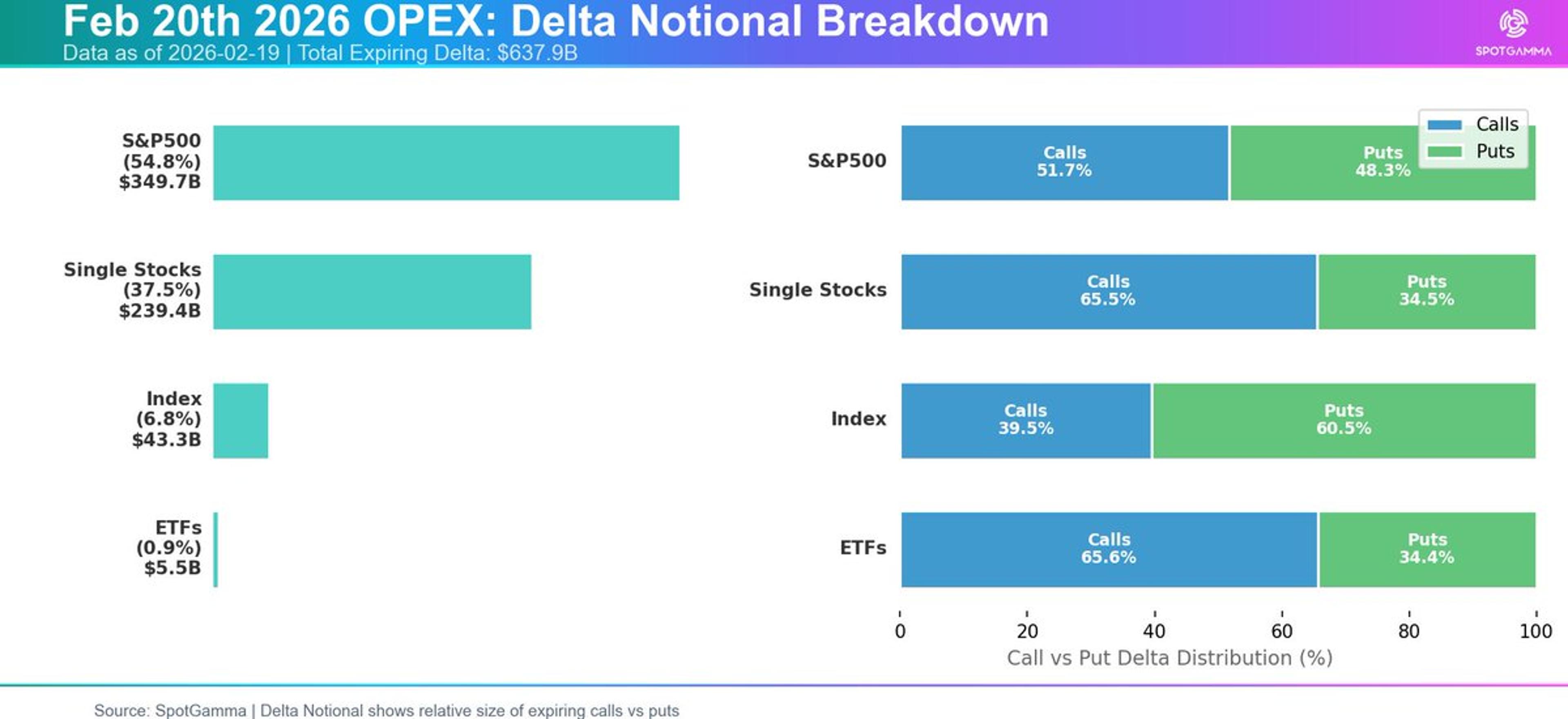

Balanced OPEX Shows No Clear Call or Put Dominance

This OPEX is a fairly standard size OPEX, with about $600 bn on delta expiring. That's ~1/2 of a quarterly OPEX. You can see that calls and puts are relatively equal in size (right side), which makes sense based off...

By Brent Kochuba

Social•Feb 20, 2026

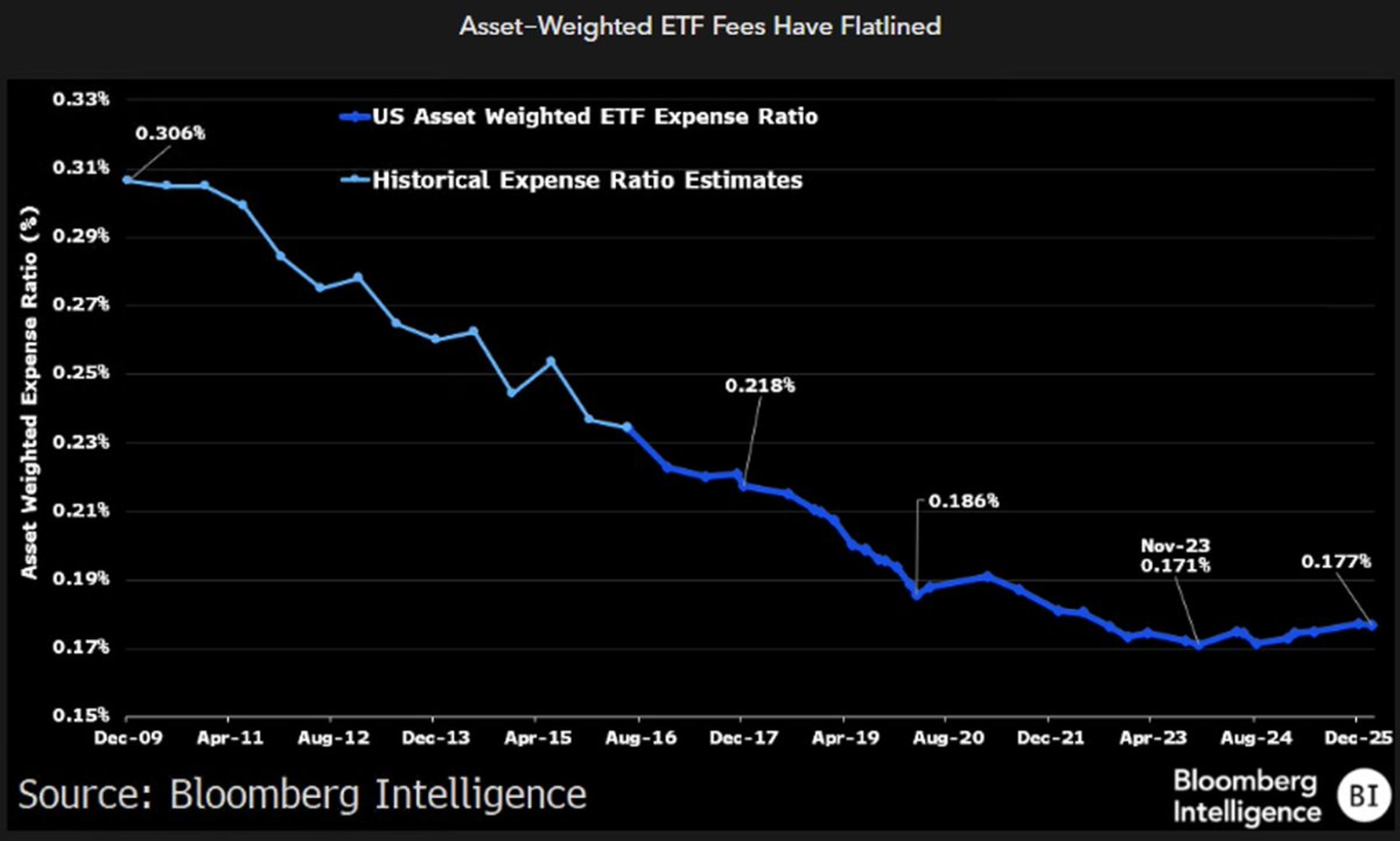

ETF Fees Halt Decline as Higher‑cost Products Gain Traction

The race to zero has hit a wall as the asset weighted average ETF fee has finally stopped its descent and even reversed a bit (this chart is one of the scariest, albeit slow moving ones for Wall St, equiv...

By Eric Balchunas

News•Feb 20, 2026

Can US Small Caps Survive the Software Selloff?

US software megacaps have slumped roughly 30% this year, dragging the S&P 500 to a modest 0.5% gain, while the MSCI ACWI ex‑USA rose 9.1%. By contrast, the S&P 600 small‑cap index posted a 7.9% rise, narrowing the performance gap with global...

By MoneyWeek – All

Podcast•Feb 20, 2026•7 min

Shutdown Shadow

The episode examines the impact of the 43‑day government shutdown on U.S. GDP reporting, noting that growth is still projected to be robust despite the delay. It discusses emerging signs that higher‑income households are curbing discretionary spending and outlines what...

By Reuters Morning Bid

Social•Feb 20, 2026

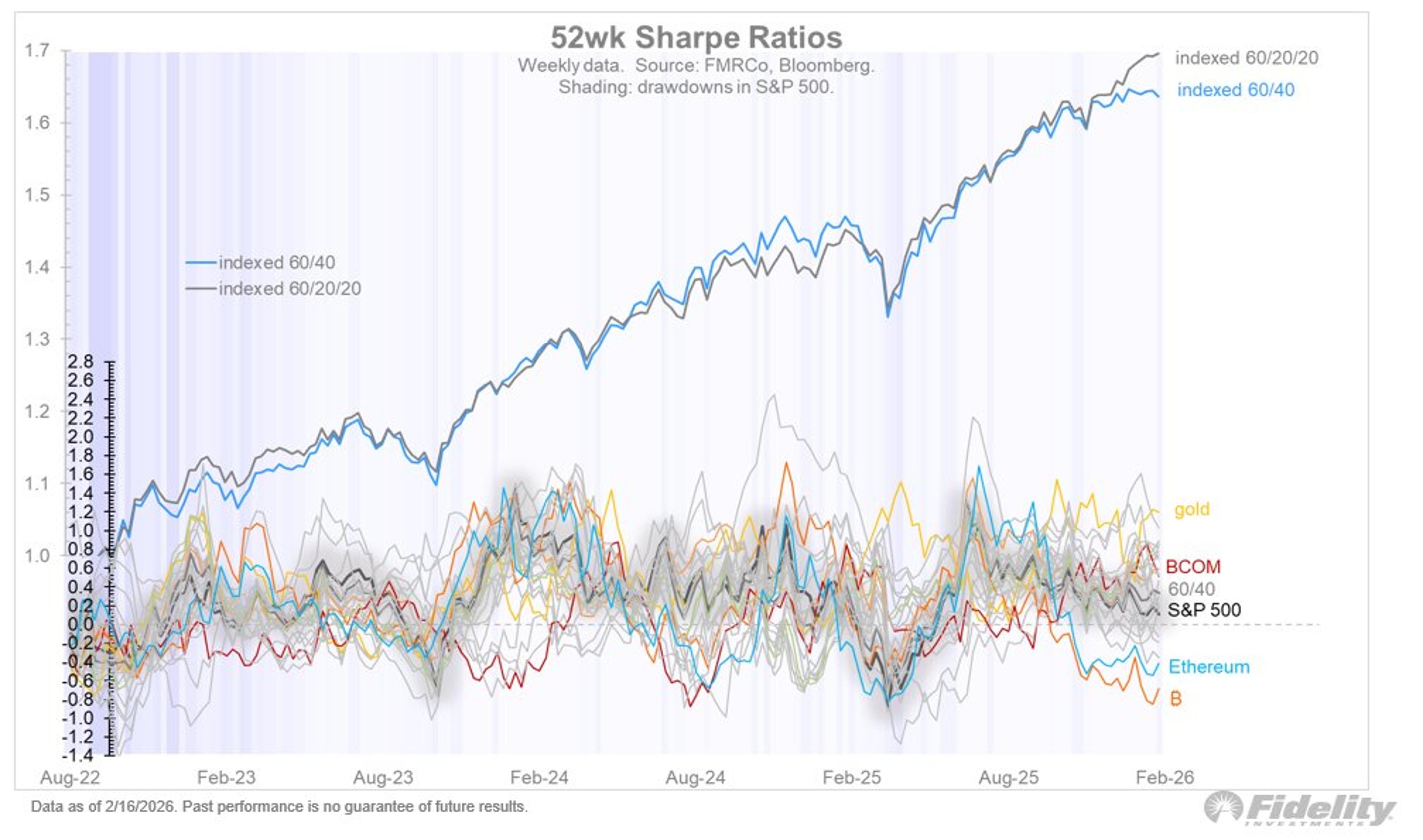

Gold Tops Sharpe Rankings; Bitcoin Shows Hopeful Higher Low

For the spectrum of asset classes that I track, equities remain in the middle with modest 52-week Sharpe Ratios, while gold remains on top and Bitcoin at the bottom. Gold continues to exhibit very resilient behavior, recovering quickly from corrections. This...

By Jurrien Timmer

Social•Feb 20, 2026

Software’s Value Mispriced; Embedded Platforms Gain From AI

Software Is Not Dead. It’s Being Mispriced. AI disruption fears, multiple compression, and why embedded platforms may be the real beneficiaries of automation. Read here: https://www.leadlagreport.com/p/software-is-not-dead-its-being-mispriced

By Michael A. Gayed, CFA (Lead-Lag Report)

Blog•Feb 20, 2026

M'tourist Private Feed Recap

In this private feed episode, Kevin Muir reviews the latest macroeconomic data and market trends, focusing on recent inflation reports, central bank policy shifts, and emerging market dynamics. He highlights how unexpected CPI readings are reshaping bond yields and discusses...

By The MacroTourist

Social•Feb 20, 2026

US Stock Market Hits Record Concentration: Top 10 Own 40%

🚨US market concentration BUBBLE in one chart: The top 10 US stocks make up a record 40% of the S&P 500 market value. At the same time, the weight of the largest stock in the S&P 500 relative to the 75th percentile...

By Global Markets Investor (newsletter author)

Social•Feb 20, 2026

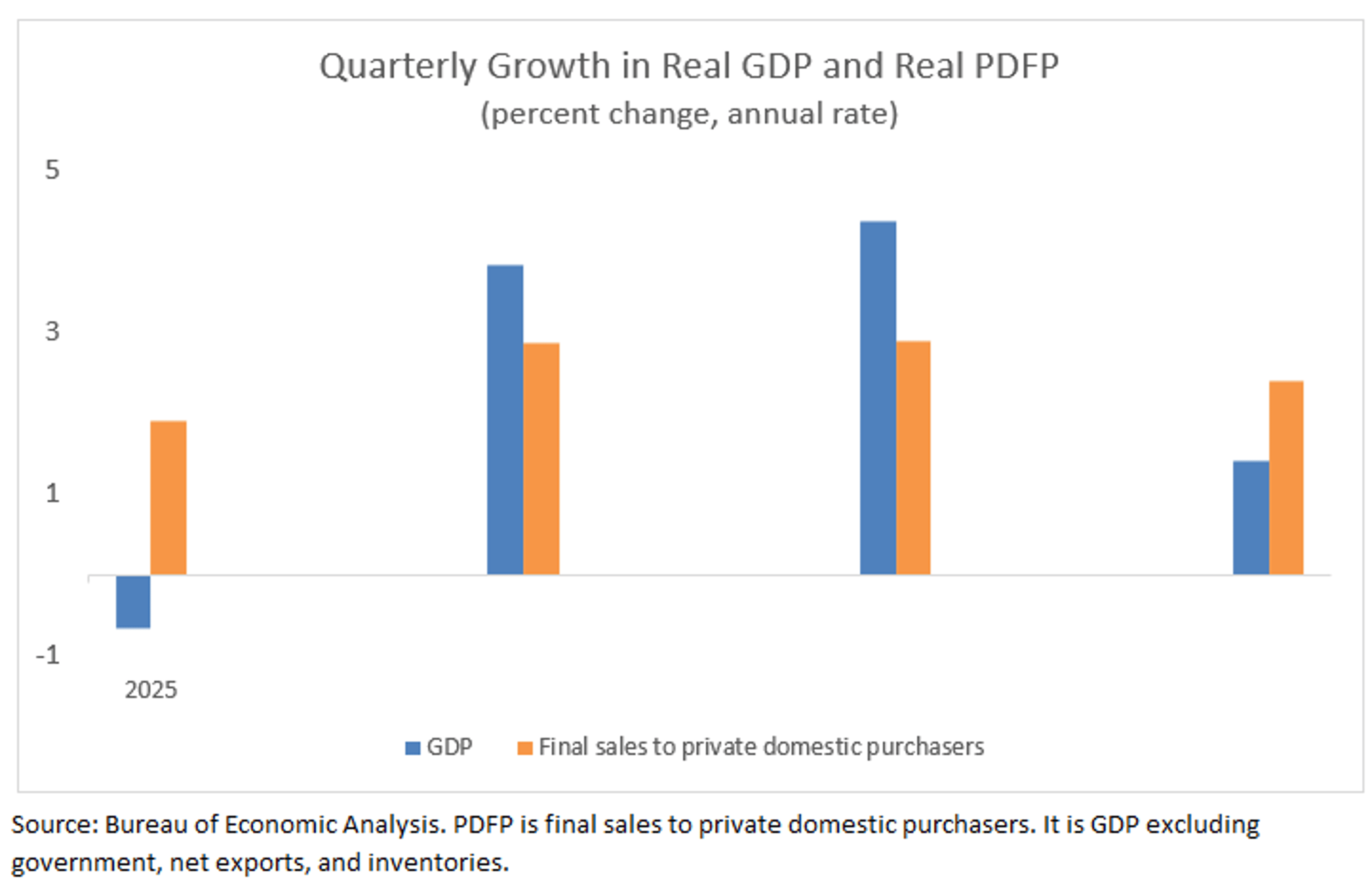

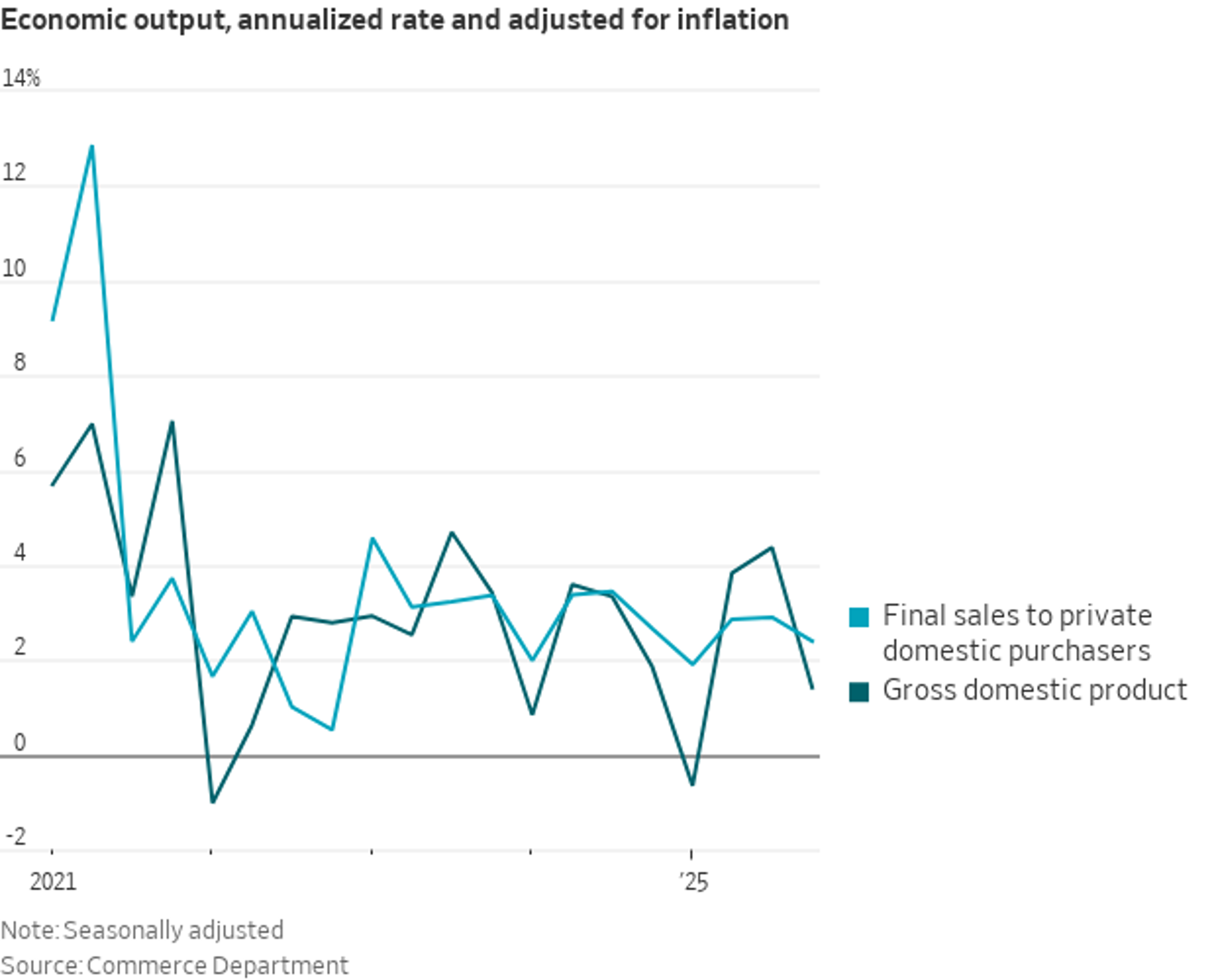

2025 GDP Volatile, PDFP Shows Steady Growth

Did 2025 feel like a wild ride? GDP feels your pain. The quarterly swings were big and short-lived. PDFP, which focuses on consumption and private fixed investment, showed more even, solid gains. https://t.co/LlVwQ7yna5

By Claudia Sahm

News•Feb 19, 2026

Booking Holdings Announces a Massive 25-for-1 Stock Split. Here's What Investors Need to Know

Booking Holdings announced its first-ever forward stock split, converting each share into 25 shares. The 25‑for‑1 split will take effect on April 6, 2026, after distribution on April 2, with shares trading on a split‑adjusted basis. The move follows a...

By Motley Fool Investing

Social•Feb 20, 2026

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

Social•Feb 20, 2026

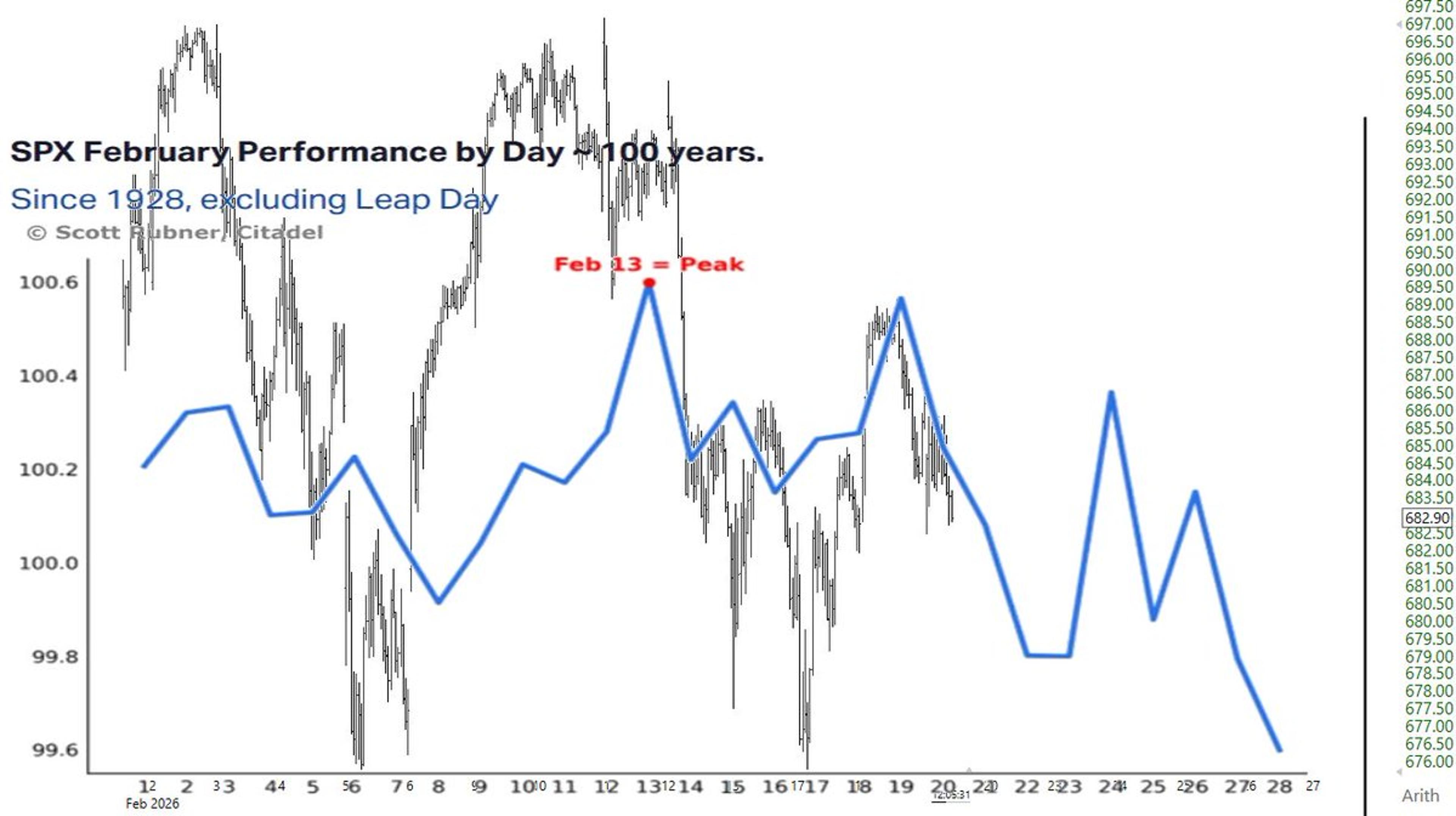

Current Feb Mirrors Century‑Long SPY Performance Trends

$SPX.X $SPY Feb performance by day 100 years overlaid on MTD action of SPY https://t.co/x1W4uABOCj

By Brian Shannon, CMT

News•Feb 19, 2026

Stocks Slide as Traders Assess Walmart Earnings, Potential Iran Conflict: Live Updates

U.S. stock futures were largely flat on Wednesday night after the major indexes posted gains, with the Dow down 0.09%, the S&P 500 down 0.09% and the Nasdaq down 0.1%. Investors focused on Walmart’s upcoming fourth‑quarter earnings, a widely watched...

By CNBC – Markets

Social•Feb 20, 2026

Short the Rips, Buy the Dips: Grinder’s Strategy

Grinder on the short side of the Indices for several months. Short the rips, buy the dips... for now, Bill. @DougKass

By Doug Kass

Social•Feb 20, 2026

Trump’s 5.4% GDP Claim Was Just a Model

Remember when Trump was bragging about Q4 GDP growth, quoting a 5.4% rate? That was the Atlanta Fed's GDPNow model, not the actual. Now we have the actual: 1.4%. Moral: Don't take GDP "trackers" or anyone citing them, remotely seriously....

By Ian Shepherdson

News•Feb 19, 2026

What’s Behind a Big Jump in January Property Tech Funding

Property‑tech companies secured roughly $1.7 billion in January 2026, a 176 % jump from the same month a year earlier. The average deal size more than doubled to about $34 million, reflecting a shift toward larger, later‑stage rounds. Generative AI is identified as...

By CNBC – Markets

Social•Feb 20, 2026

VWAP Highlights Week-Long Choppiness Across Major Indices

The 🔵WTD ⚓️VWAP tells the story of the choppy week in $ES_F $SPY $NQ_F $QQQ https://t.co/ihrFlZV1FZ

By Brian Shannon, CMT

Social•Feb 20, 2026

Friday's Top Reads: Power Shifts Across Media, Finance, Politics

10 Friday AM Reads: -Netflix Calls Paramount's Bluff -401k Takeover: Private Equity Muscles In -Billionaires' Low Taxes' Problem for the Economy -Quiet Architect of Trump's Global Trade War -The End of the Office -The US Coup: One Year On -U2 Propaganda Days of Ash https://t.co/cSpLOtlpzu

By Barry Ritholtz

News•Feb 19, 2026

Dow Jones, S&P 500, Nasdaq Drop Amid Walmart's Muted Outlook, AI-Related Concerns — Details Here

U.S. equity indexes slipped on February 19 as Walmart issued a muted earnings outlook and investors grew uneasy about artificial‑intelligence regulatory risks. The Dow Jones fell about 0.8%, the S&P 500 dropped 0.7%, and the Nasdaq slipped roughly 0.9%. Walmart’s guidance...

By Mint (LiveMint) – Markets

Social•Feb 20, 2026

Live Daily Pre‑Market Independent Research Available Now

We're on a LIVE wire with the only Independent Research you can get PRE MARKET daily

By Keith McCullough

Social•Feb 20, 2026

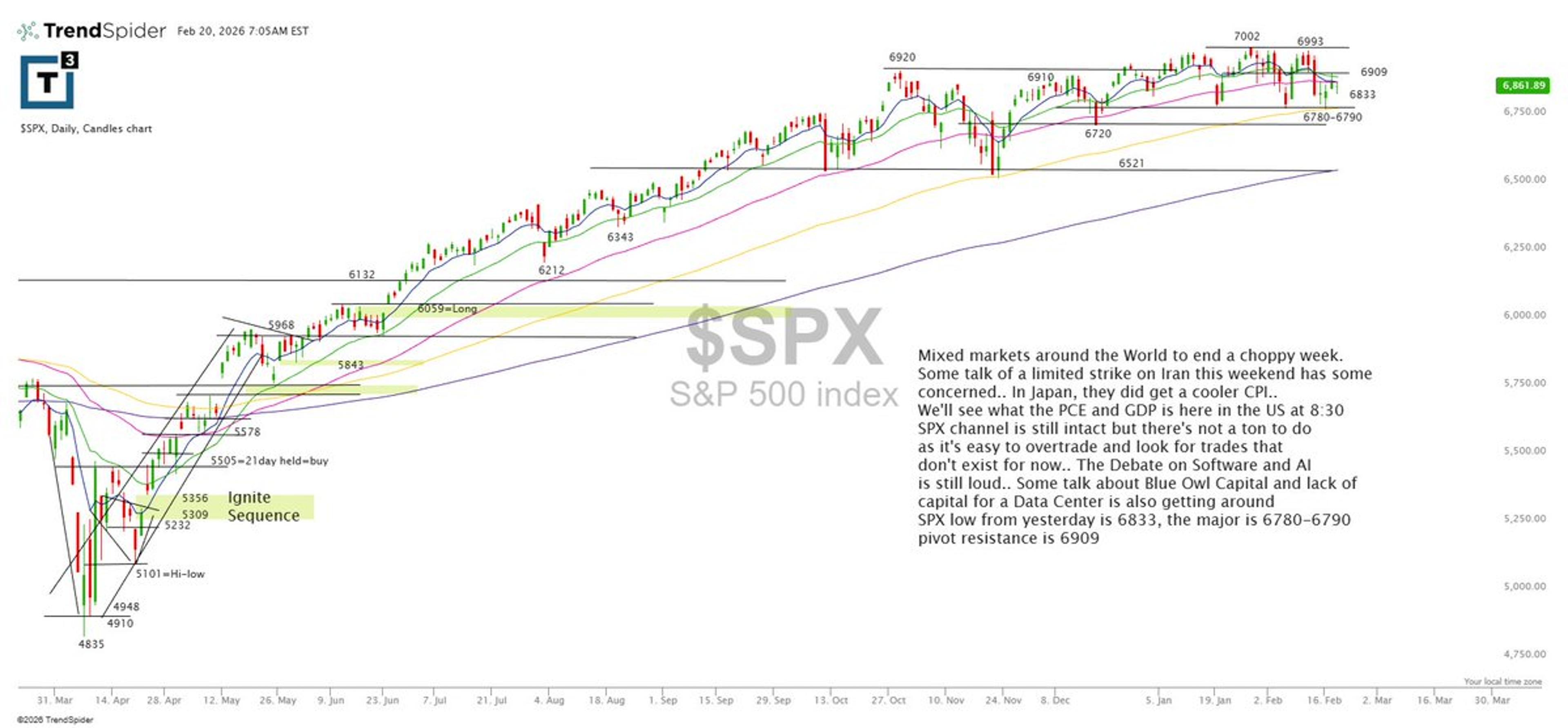

SPX Holds Channel—Stay Selective, Await Clean Setups

$SPX is still holding its channel, it’s an easy tape to overtrade, so stay selective and wait for clean setups. Key levels: support 6780–6790, yesterday’s low 6833, and pivot resistance 6909, with PCE and GDP on deck at 8:30. https://t.co/lvzBNkDdkK

By Scott Redler

News•Feb 19, 2026

Elizabeth Warren Has Questions About the Shake-Up Inside the Fed’s Banking Regulator

Senator Elizabeth Warren wrote to Federal Reserve Vice Chair for Supervision Michelle Bowman demanding details on recent internal changes within the Fed’s banking‑supervision division, including reported job cuts and the sidelining of senior examiners. The request also asks for a...

By The Wall Street Journal – Markets

Social•Feb 20, 2026

Live Premarket Picks: NVDA, TSLA, IBIT, SPY

⏰Scott Redler’s #630club - LIVE Premarket Stock Update $NVDA $TSLA $IBIT $SPY 📷 Free VIP List Newsletter: https://t.co/EW4O2nbz8N https://t.co/LuYuPCBRLU

By Scott Redler

Social•Feb 20, 2026

Rising PMI Could Spark Market Melt‑Down, Delay Fed Cuts

Will the stock market melt down if the US economy heats up, banishing traders' hopes for Fed rate cuts? All eyes turn to PMI data to find out. #stockmarkets #USD #fed #pmi #economy #interestrates #macro #trading https://t.co/fgEbuQrjnq

By Ilya Spivak

News•Feb 19, 2026

Tech, Media & Telecom Roundup: Market Talk

Bitcoin rose 1.4% to $67,202 after reports Nvidia will supply Meta with large‑quantity processors, lifting tech and semiconductor stocks. Jefferies highlighted Chinese AI startup MiniMax’s strong model performance and cost‑effective architecture, initiating coverage with a buy rating and a HK$1,118...

By The Wall Street Journal – Markets

Social•Feb 19, 2026

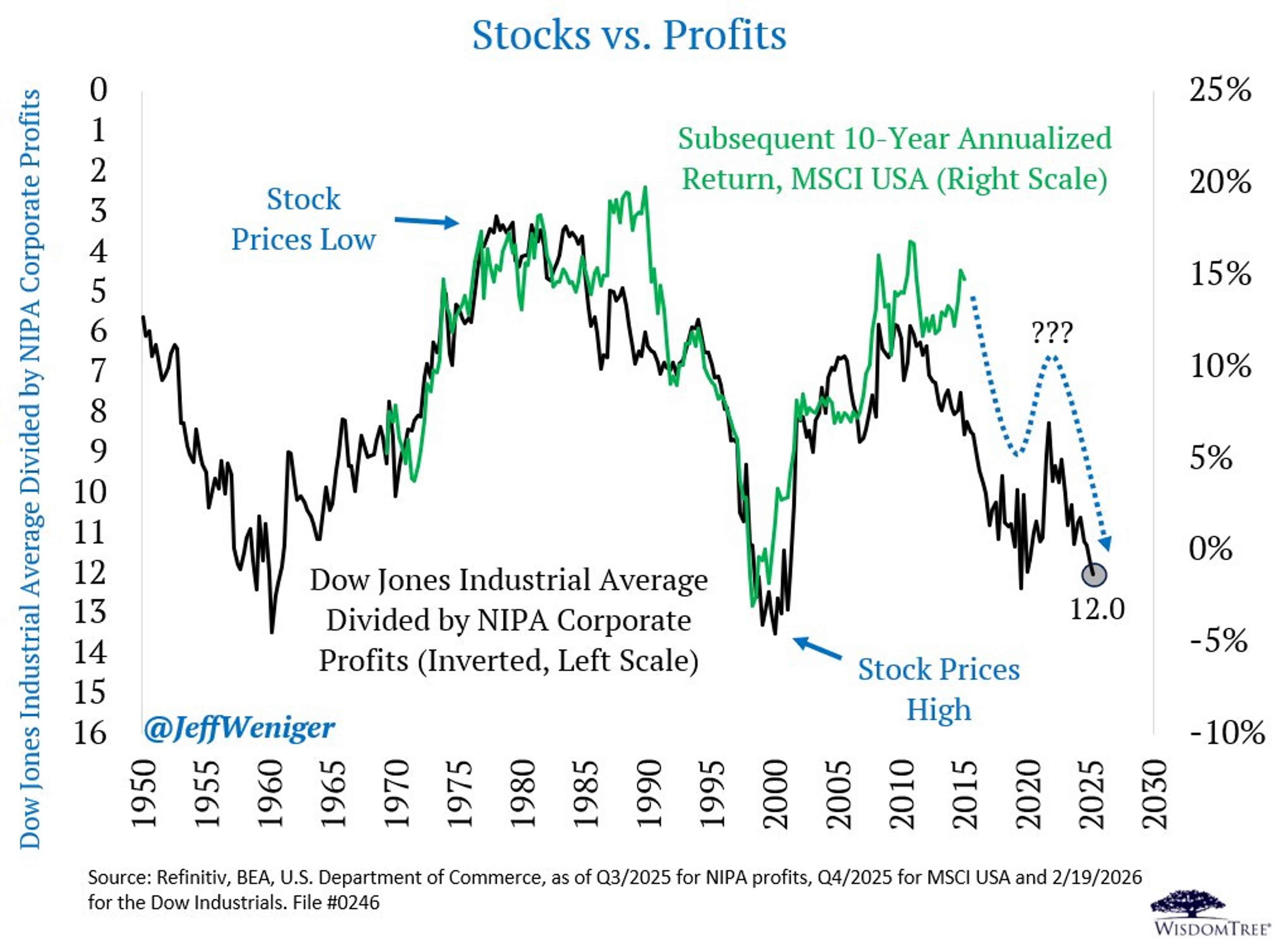

Energy and Materials Surge as Tech Falters in 2026

This is a pretty cool chart to show your investment committee. A classic stock price-to-corporate profits image that reveals extended conditions reminiscent of the turn of the century. If this chart has any prescience, we should remember that the leaders...

By Jeff Weniger

Social•Feb 19, 2026

Growth-to-Value Rotation Shifts Money to Cyclicals and Defensives

“Yes, THAT growth-to-value sector rotation I called in November to last through Feb before volatility Mar into May. THAT was my call and it’s still in play before a massive de-risking in MAG7 and SaaS unwind showed up along with...

By Samantha LaDuc

News•Feb 19, 2026

Stock Market Today: Dow Slips; Oil Prices Hit Highest Since Summer

The Dow Jones slipped Thursday as investors weighed fresh earnings reports and a sharp rally in oil prices. Brent crude surged up to $72 a barrel, its highest level since the summer, driven by heightened geopolitical tension surrounding U.S. naval...

By The Wall Street Journal – Markets

Social•Feb 19, 2026

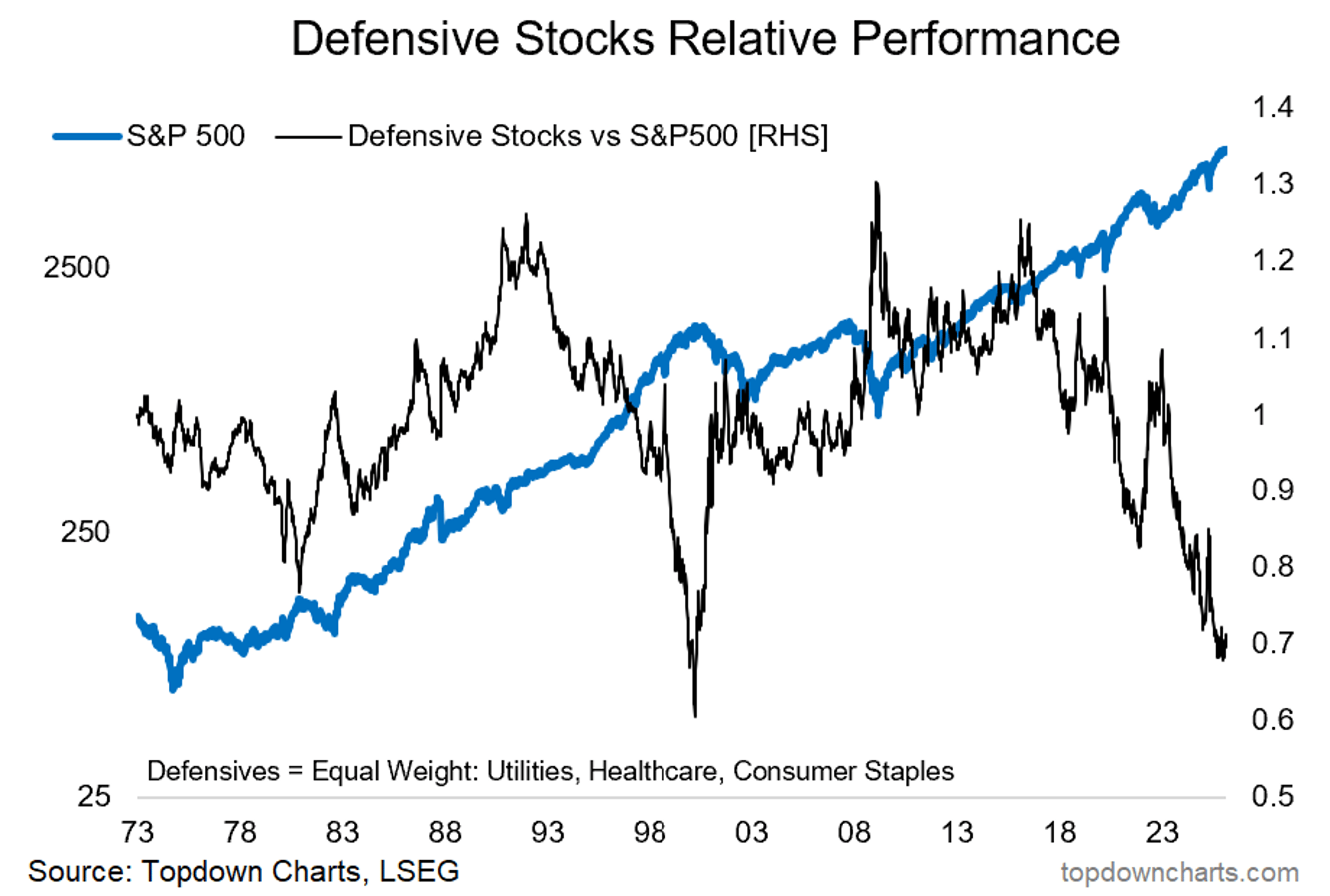

Consumer Staples Lead 2026 with Record‑Breaking 13% Jump

The consumer staples sector is off to its best start to a calendar year BY FAR. $XLP is up 13.3% so far in 2026. Next best year is 2013 at 7.8%.

By ETF Focus

Social•Feb 19, 2026

China Cuts US Treasury Holdings to Crisis Low

🚨Chinese officials had urged banks to limit purchases of US government bonds, and instructed those with high exposure to SELL their positions. Data shows China’s holdings of US Treasuries fell to $682.6 billion, the lowest since the Financial Crisis.👇 https://globalmarketsinvestor.beehiiv.com/p/is-the-us-dollar-gradually-losing-its-safe-haven-status

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

Rising Capex May Curb Buybacks, Pressure Valuations

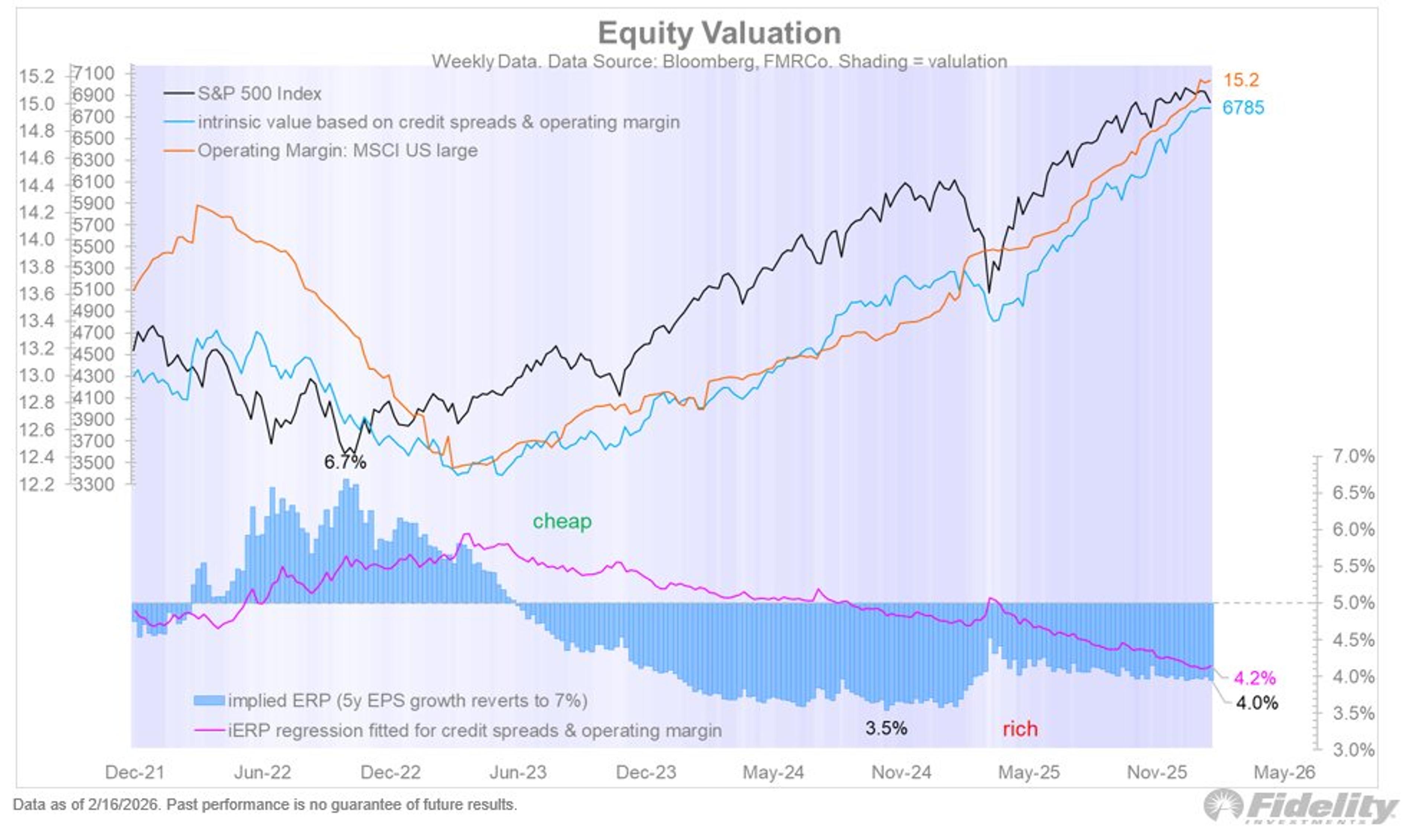

With credit spreads low and profit margins seemingly on the rise, valuations seem OK at current levels. These two variables are important drivers for the equity risk premium, which is currently at 4.0% according to my version of the DCF...

By Jurrien Timmer

Social•Feb 19, 2026

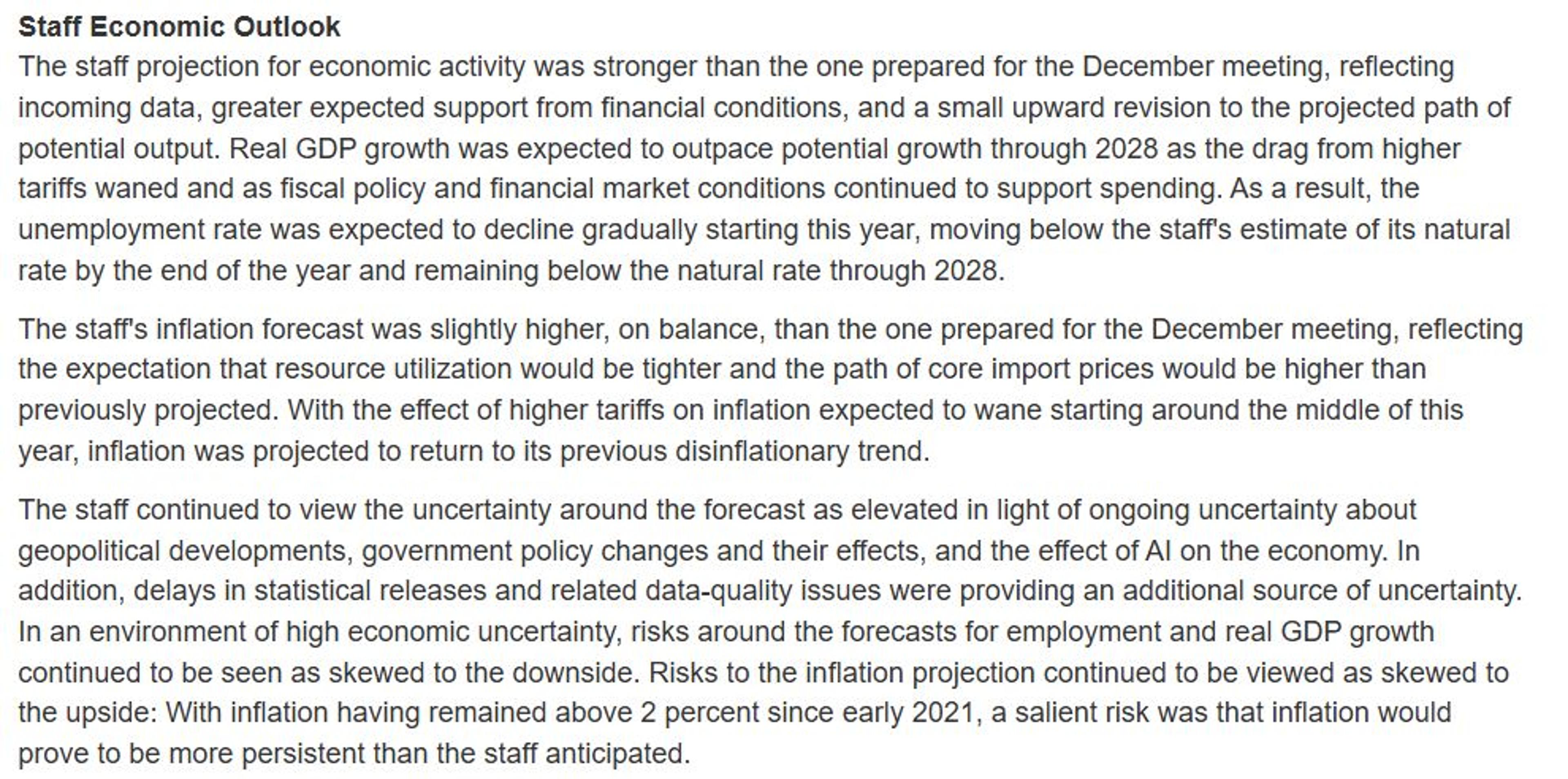

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Social•Feb 19, 2026

Robinhood’s Earnings Expose Risks for $HOOD Investors

If you’re a $HOOD investor, you’ve probably suffered a wild ride in recent months. The company just issued its latest earnings, which reminded the market of the dangers of Robinhood’s business model.

By Hyperstocks

Social•Feb 19, 2026

Defensives Hit Dot‑Com Lows, Poised for Rally

Chart of the Week - Defensives With tech in trouble (+a number of macro risks lurking on the horizon), defensives are starting to look interesting… Defensives (i.e. an equal-weighted basket of: Utilities, Healthcare, Consumer Staples) are turning up vs the S&P500 —after...

By Callum Thomas

Social•Feb 19, 2026

Big Tech Lagged S&P; Past Winners Not Guaranteed

S&P 500 is up 77% over the last 5 years. These tech stocks didn't beat it: Amazon: +27% Netflix: +46% And these stocks got destroyed: Nike: -55% Disney: -42% PayPal: -86% Shopify: -18% Past winners aren't always future winners.

By The Market Hustle

Social•Feb 19, 2026

SPX Flat While DE Soars, Oil Breaks Out, COIN Spikes

$SPX is still stuck between 6800 and 7000. But under the surface, $DE exploded higher on earnings, $CVX and $COP broke out with crude oil, and $COIN is showing amplified volatility vs #Bitcoin. Here’s what I’m watching next: https://t.co/bQnwyKMJeh https://t.co/v7DLLL1mYC

By David Keller, CMT

Social•Feb 19, 2026

HG Delivers Strong Results and Special Dividend

$HG been a nice newer issue in Financials, just announced results and special divvy https://t.co/1as8xwX6bo

By Joe Kunkle

Social•Feb 19, 2026

McGough’s CVNA Sell Call Beats CNBC’s Coverage

Great SELL call by McGough @HedgeyeRetail on $CVNA that CNBC failed, once again, to cover

By Keith McCullough

Social•Feb 19, 2026

Small‑cap Outlook Dim Amid Credit Crunch, AI Slowdown

Asking for a friend how small caps are going to perform after everyone piled in long behind the economic reacceleration trade while private credit implodes, the AI capex buffer declines and the Fed remains on hold...

By Quinn Thompson

Social•Feb 19, 2026

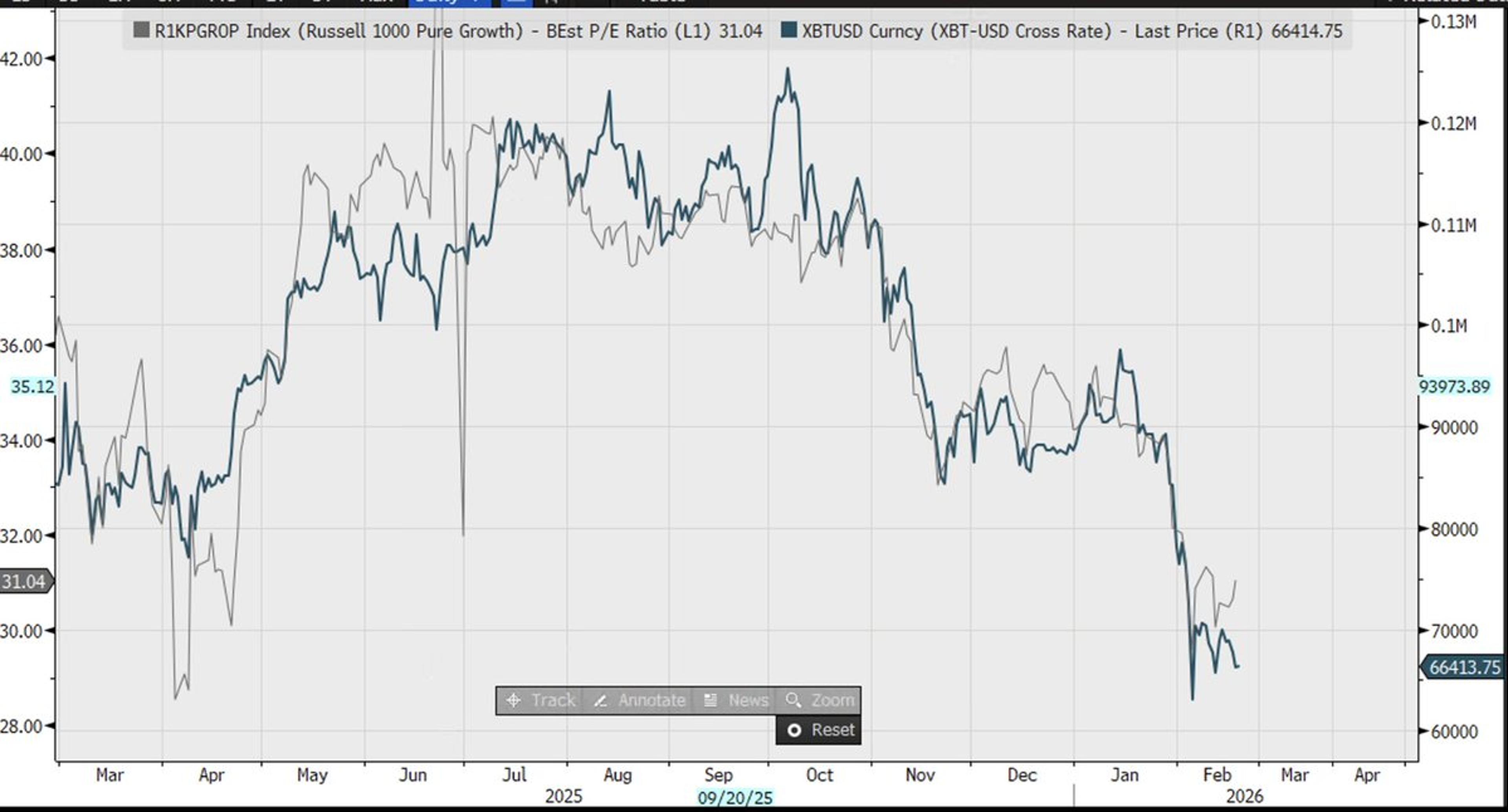

Long‑duration Assets Like Bitcoin, Growth Stocks Lose Favor

Bitcoin's drop has coincided with a decline in the Russell 1000's Pure Growth P/E. What do they have in common? Both are long-duration, and are being shunned during the underlying rotation into shorter-duration (cyclical) securities (think value, dividend payers, Energy...

By Michael Kantro

Social•Feb 19, 2026

Confirm Bearish RSI Divergences with Price Levels Before Acting

Bearish RSI divergences can hint at a major top — but only if price & key levels confirm. Momentum can fade while price still grinds higher. Patience & confirmation are essential. My latest article on @StockCharts: https://t.co/sDlIJ3WADG

By David Keller, CMT

Social•Feb 18, 2026

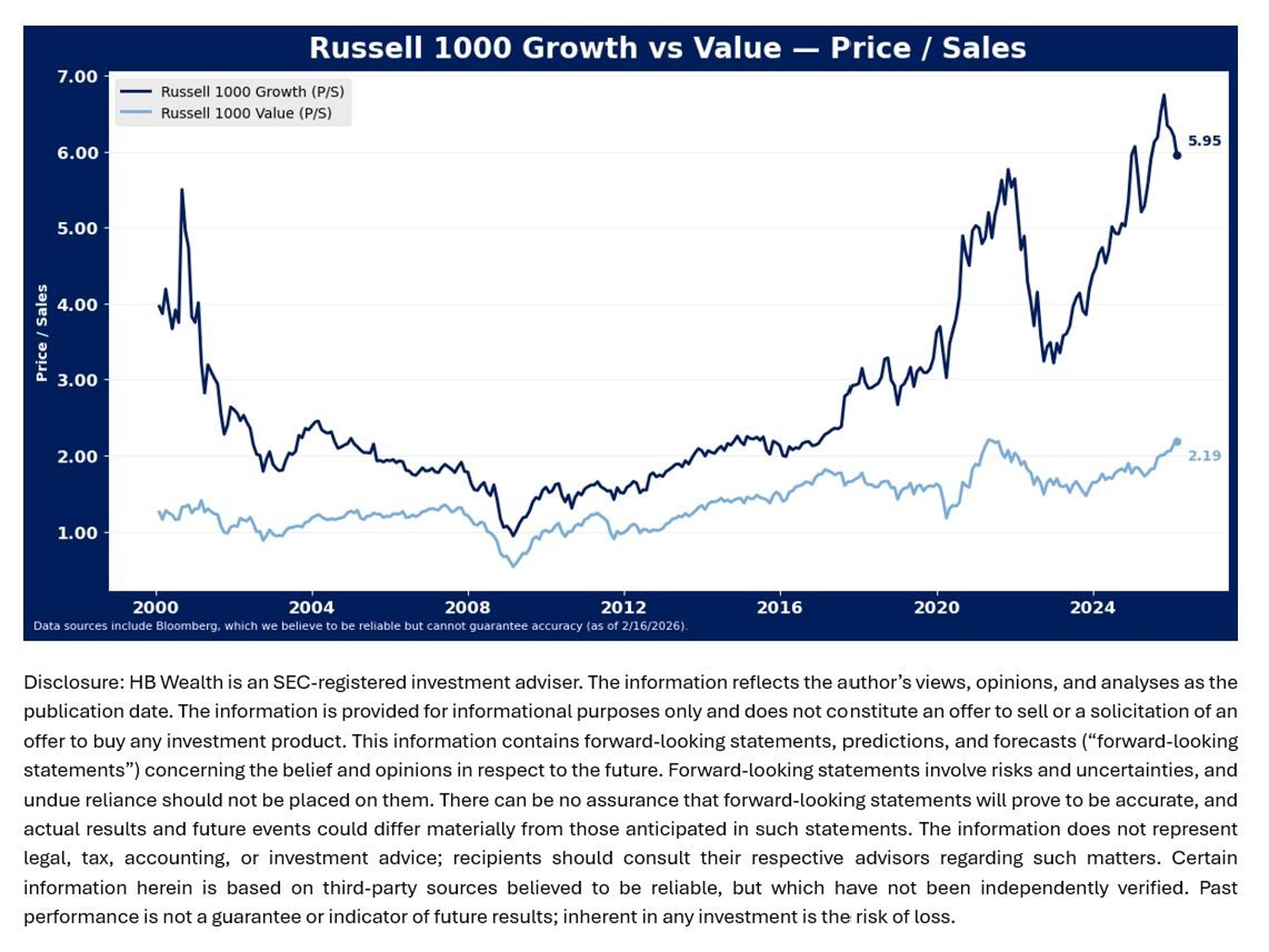

US Large‑Cap Valuations Still Overpriced, Risks Loom

Recent rotation has helped resolve some of U.S. large cap stocks’ valuation excesses, but risks remain to the downside for U.S. multiples. Large cap growth’s sales multiple is still near its all-time high, at about 6X, and growth’s earnings multiple may...

By Gina Martin Adams, CMT, CFA

Social•Feb 18, 2026

Software Stocks Face Fear‑Driven Selloff, Not Real Decline

Software is getting hit on fear of substitution more than evidence of structural deterioration in enterprise spending. When price action gets ahead of reality, the re-rating can be violent if the narrative cools.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 18, 2026

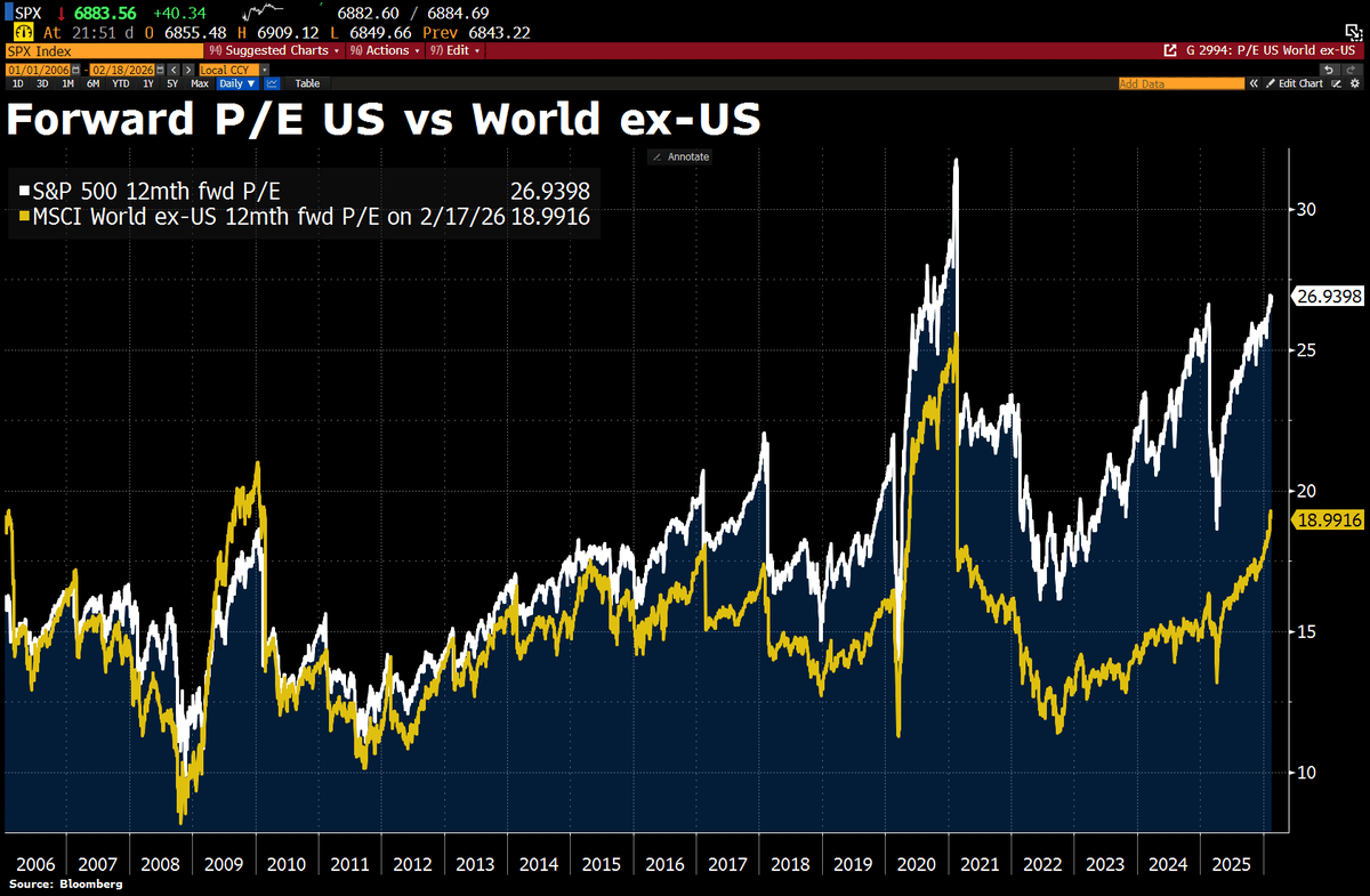

US Stock Premium at Risk as Tech Capex Rises

Although global markets have narrowed the gap with the US in recent weeks, US equities still trade at a roughly 40% valuation premium to the rest of the world. That premium could shrink further if big tech companies lose their...

By Holger Zschaepitz

Social•Feb 18, 2026

Analyst's PANW Recommendation Misses, Stock Tanks

I was astonished that Bryn Talkington's feet were not held to the fire today after she recommended (confidentally) $PANW yesterday. Four hours later the company guided lower and the stock tanked. Does the network basically not give a shit (about their most...

By Doug Kass

Social•Feb 18, 2026

Retail Shorts Ahead as High‑Income Spending Slips

The show panelists (don't be shocked, they are bullish) love retail/consumer stocks - we shorted $COST and $WMT in the last 24 hours. We are looking for more consumer shorts. We believe lower home and stock prices will take away from the...

By Doug Kass

Social•Feb 18, 2026

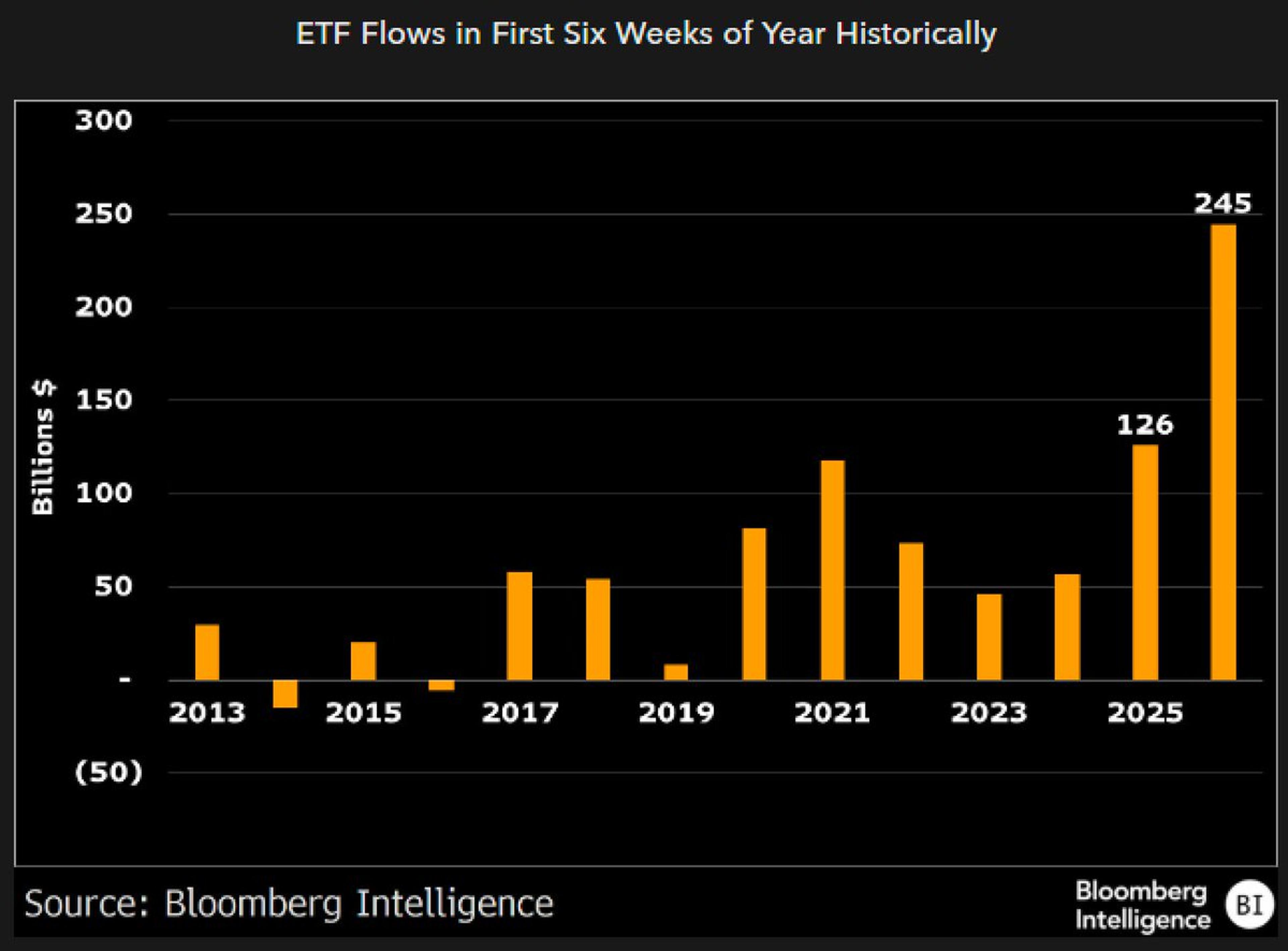

ETF Inflows Double Historic Pace in First Six Weeks

Here's ETF flows for the first six weeks of the year historically. This year is off to the best start almost by double. One reason is growing depth of cash vacuum cleaners. VOO, SPYM hoovering as always but there's already...

By Eric Balchunas

Social•Feb 18, 2026

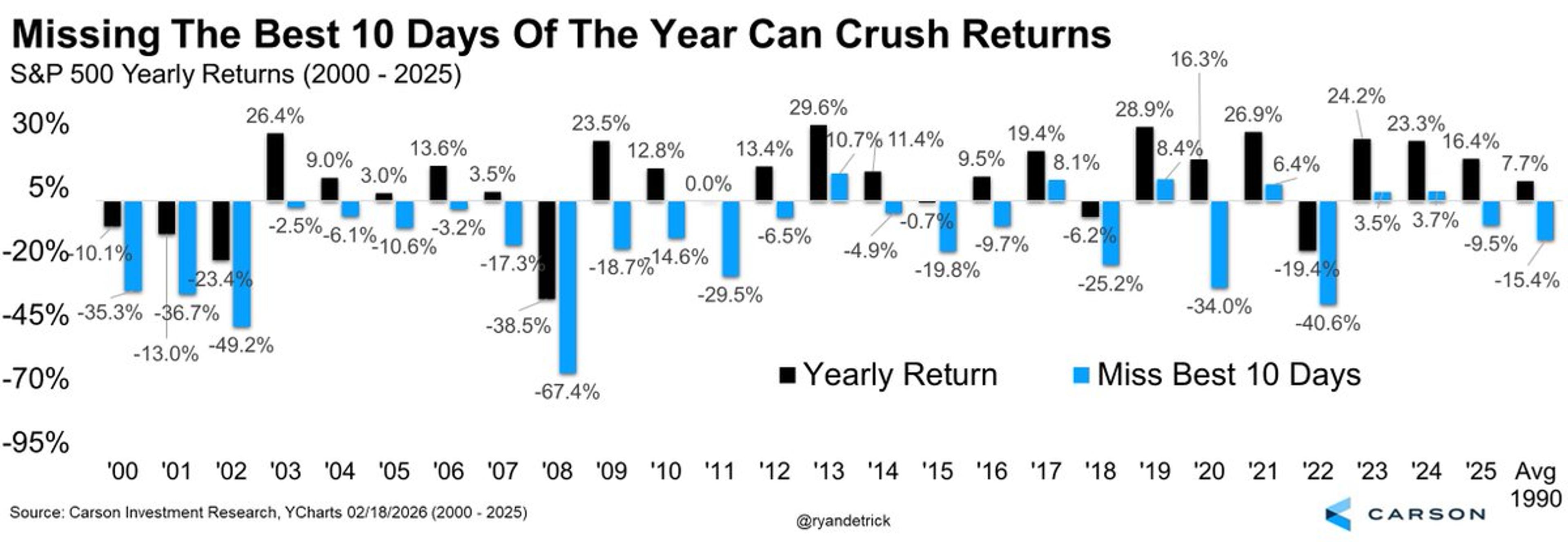

Missing Top 10 Days Slashes Stock Returns

Last year, the S&P 500 gained 16.4%, but if you missed the best 10 days that dropped to minus 9.5%. Since '90, stocks have gained 7.7% a year, but if you missed the 10 best days each year? It goes down...

By Ryan Detrick

Social•Feb 18, 2026

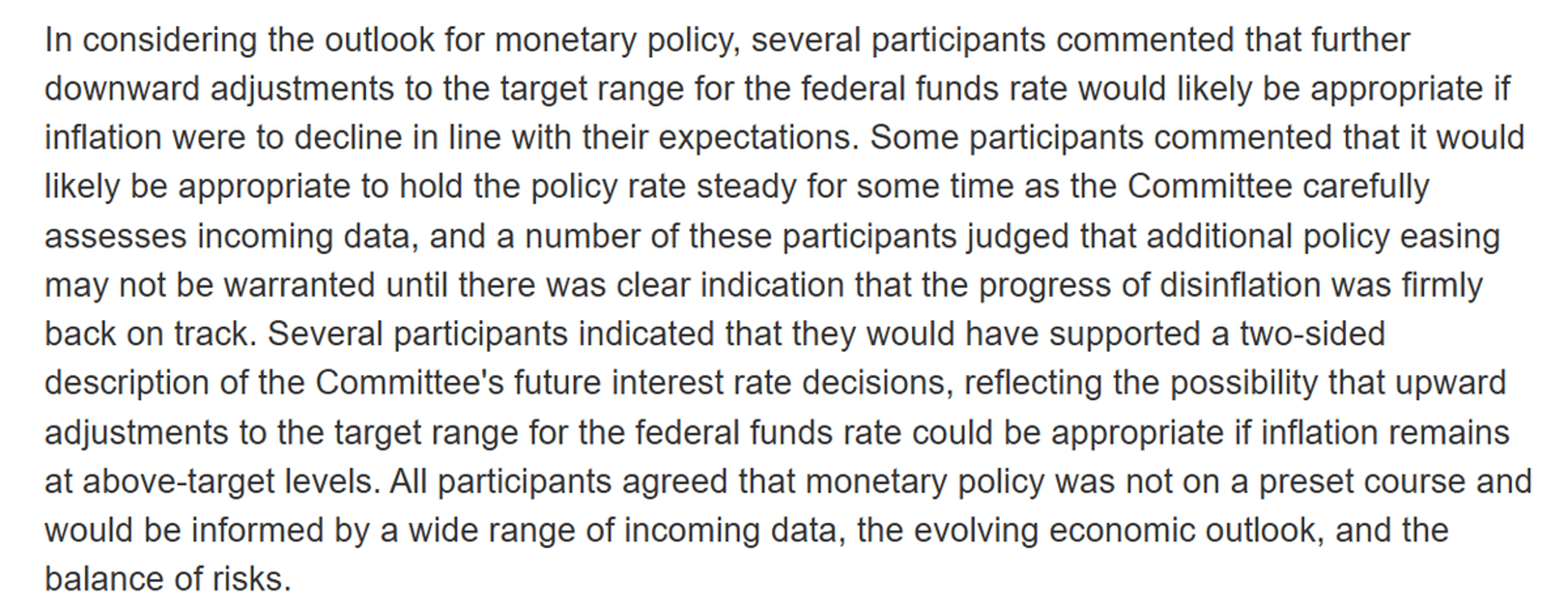

FOMC Minutes Reveal Split Views: Cut, Hold, or Hike

Key paragraph of the FOMC minutes from January. (I am honestly a bit confused by the 'minutes math.') The main takeaway is that there is considerable disagreement. Cut, hold, and (even possibly) hike all got a nod. https://t.co/eV9ldjldl1 https://t.co/K53g1yqKJ8

By Claudia Sahm