🎯Today's American Stocks Pulse

Updated 1h agoWhat's happening: US GDP Slows to 1.4% as Legislative Gridlock Saps Growth

The economy expanded at an annualized 1.4% in the fourth quarter of 2025, roughly half of analysts’ expectations and far below the 4.4% pace recorded the prior quarter. The slowdown marks the slowest expansion since Q1 2024 and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

Blog•Feb 10, 2026

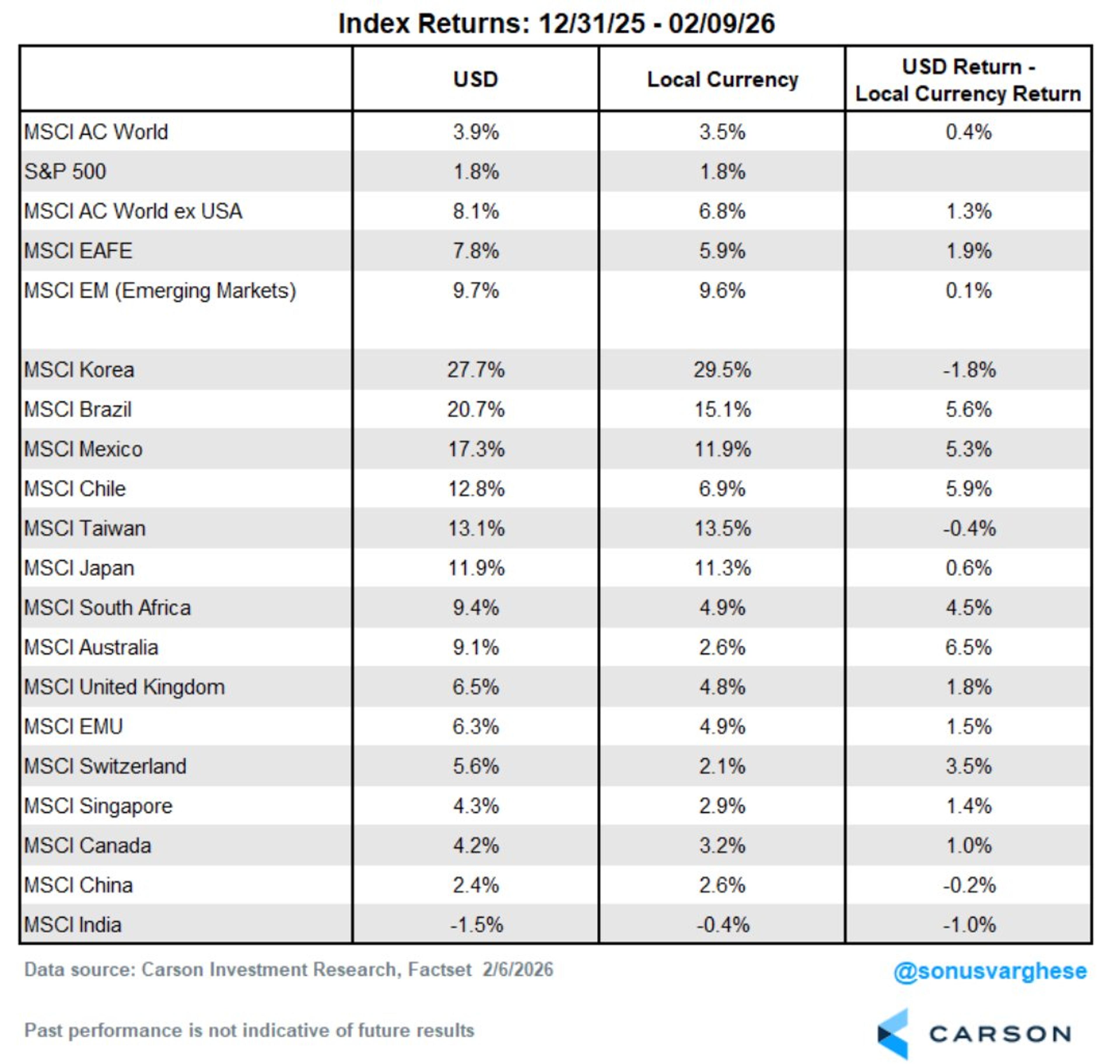

Emerging Markets Continuing To Emerge

The US MSCI index has underperformed global peers in 2025, ending a year of relative strength. Investors are shifting toward high‑growth emerging‑market stocks such as South Korea, Brazil, Mexico, and Taiwan, while Japan rallied 5.7% after a decisive election. The US’s share of the All‑Country World MSCI fell from its historic 65% weighting, prompting a rebalancing away from domestic equities. Despite the trend, foreign capital continues to view the United States as an attractive long‑term destination.

By Yardeni QuickTakes

Social•Feb 10, 2026

Global Equities Outpacing US in 2026, Stay Overweight

"It is deja vu all over again." Yogi Berra The US stock market is doing fine, but the rest of the world is soaring so far in '26. This is similar to what we saw last year and is a big...

By Ryan Detrick

Social•Feb 10, 2026

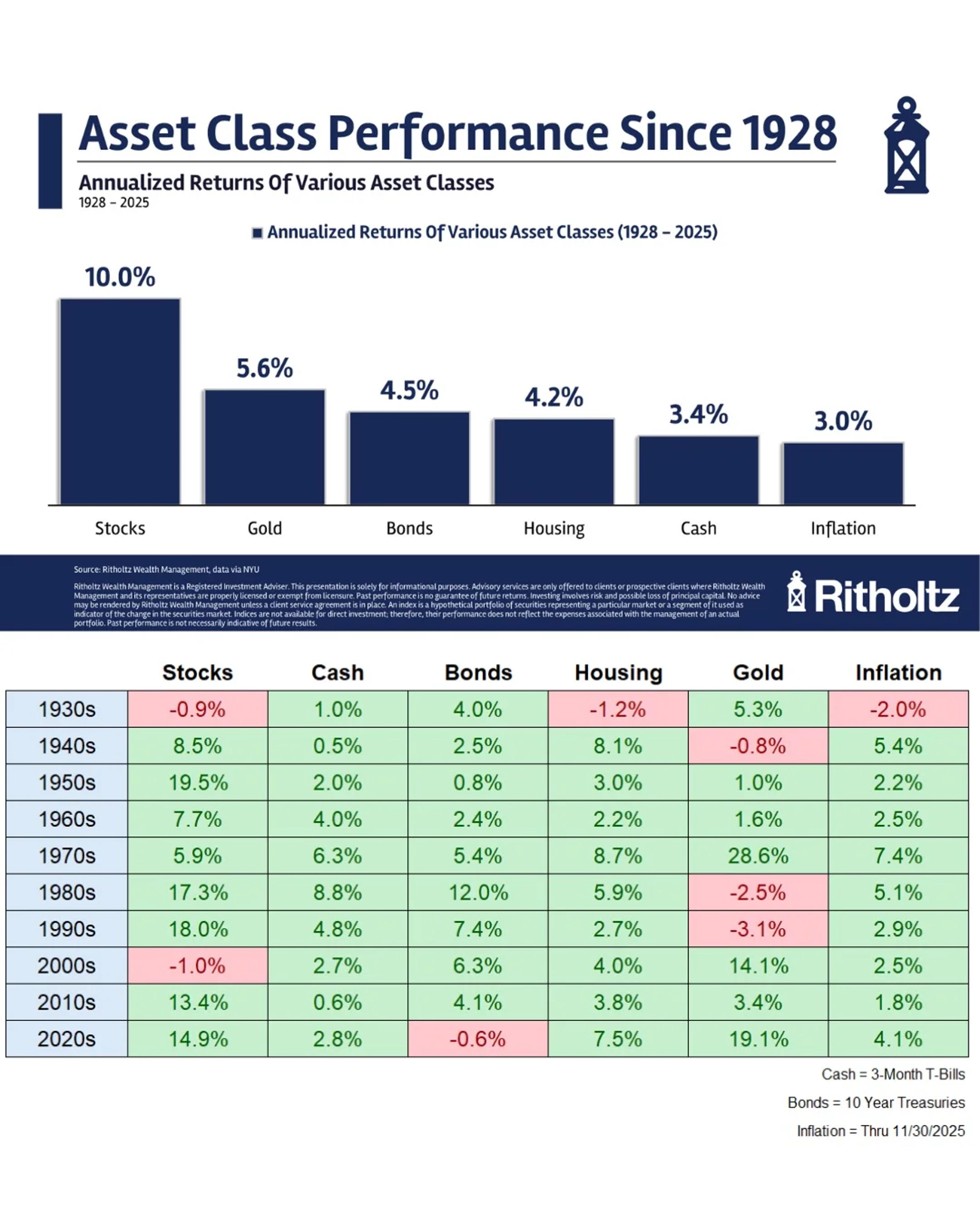

US Stocks Lead 97 Years of Superior Returns

𝐇𝐢𝐬𝐭𝐨𝐫𝐢𝐜𝐚𝐥 𝐑𝐞𝐭𝐮𝐫𝐧𝐬 𝐅𝐨𝐫 𝐔𝐒 𝐒𝐭𝐨𝐜𝐤𝐬, 𝐁𝐨𝐧𝐝𝐬, 𝐂𝐚𝐬𝐡, 𝐇𝐨𝐮𝐬𝐢𝐧𝐠 & 𝐆𝐨𝐥𝐝 (𝟐𝟎𝟐𝟓) CTTO: Ben Carlson — https://awealthofcommonsense.com/2026/01/historical-returns-for-stocks-bonds-cash-housing-gold-2025/ The US, which currently is 60% of the global equity market, continues to influence investment portfolios worldwide, such as endowments and retirement funds. And for over...

By Evan Louise Madriñan

Blog•Feb 10, 2026

Despite 4 Years of Mass-Layoffs at Alphabet & Amazon, Headcount Rose in 2025, Nearly Flat with Peak, as Hiring Continued

Alphabet’s 2025 year‑end headcount rose by 7,497 employees, barely below its 2023 peak, while Amazon added roughly 20,000 workers to reach 1.576 million, just 2% shy of its 2021 high. Both companies experienced massive hiring surges in 2020‑21—Alphabet grew 60% and...

By Wolf Street

Social•Feb 10, 2026

S&P 500 Adds $250 B, Near Record High

MARKET RECAP 📈 The S&P 500 gained over $250 billion in market cap today and is now less than 1% away from a new record high 😳📈 What the heck is going on?!? Let’s talk about it 🗣️

By Peter Tuchman (Einstein of Wall Street)

Social•Feb 10, 2026

Live Premarket Picks: NVDA, TSLA, IBIT, SPY

⏰ Scott Redler’s #630club - LIVE Premarket Stock Update $NVDA $TSLA $IBIT $SPY ➡️ Free VIP List Newsletter: https://t.co/88cKgbrKKl https://t.co/K8dY5tEQml

By Scott Redler

Blog•Feb 9, 2026

Will Job Losses Spoil America’s ‘Goldilocks Plus’ Economy?

The United States continues to be described as a ‘Goldilocks Plus’ economy, balancing low inflation with solid growth. Recent data show the labor market still tight, but a wave of layoffs in technology and manufacturing raises concerns. Analysts warn that...

By Heisenberg Report

Social•Feb 10, 2026

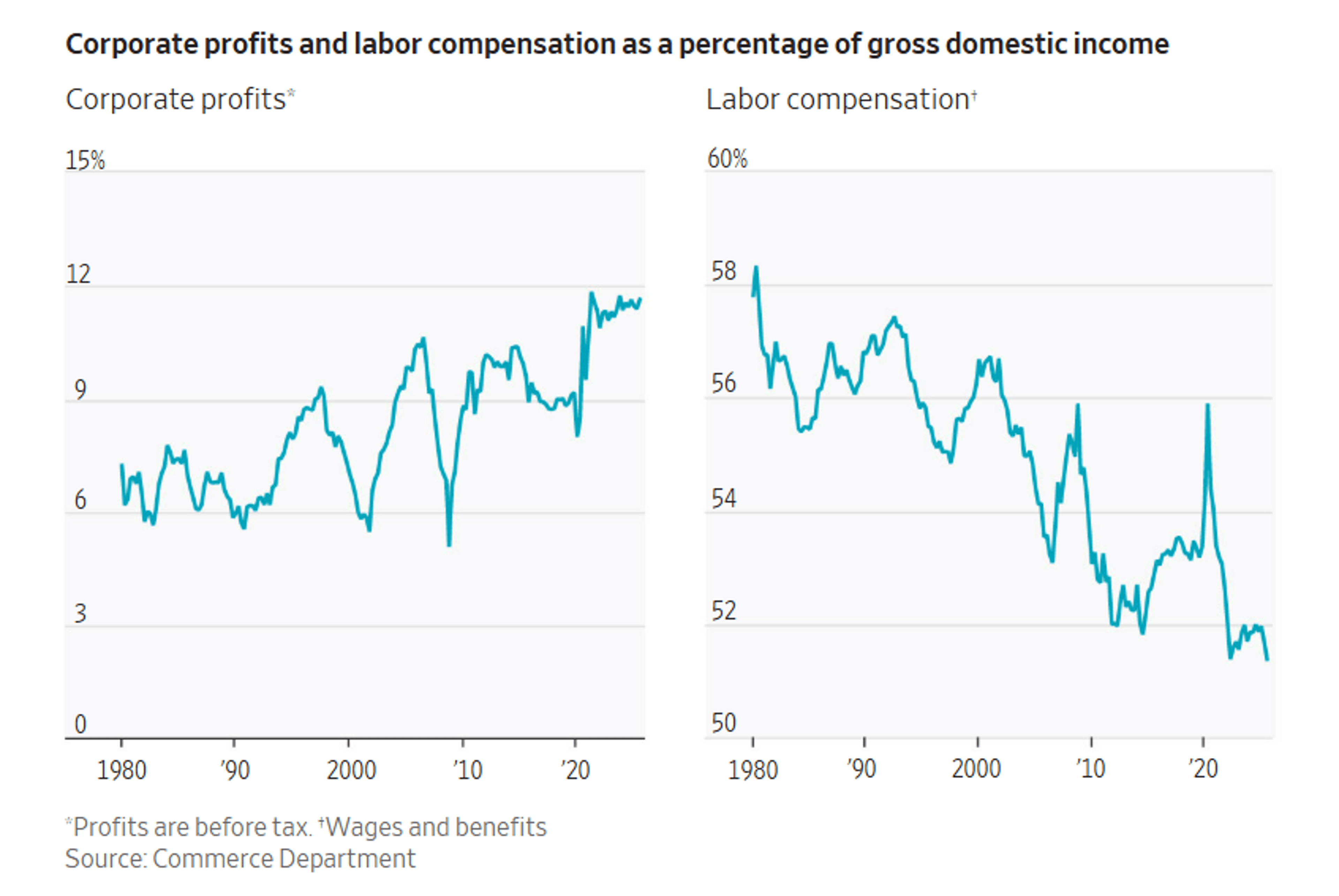

Nvidia’s Value Outpaces IBM with Far Fewer Employees

In 1985, IBM was America’s most valuable company & employed nearly 400,000. Today, Nvidia is nearly 20 times as valuable and five times as profitable as IBM was yet it employs roughly a 10th as many people. https://t.co/indMwMz0TO @greg_ip https://t.co/HDl995cUhw

By Lisa Abramowicz

Social•Feb 10, 2026

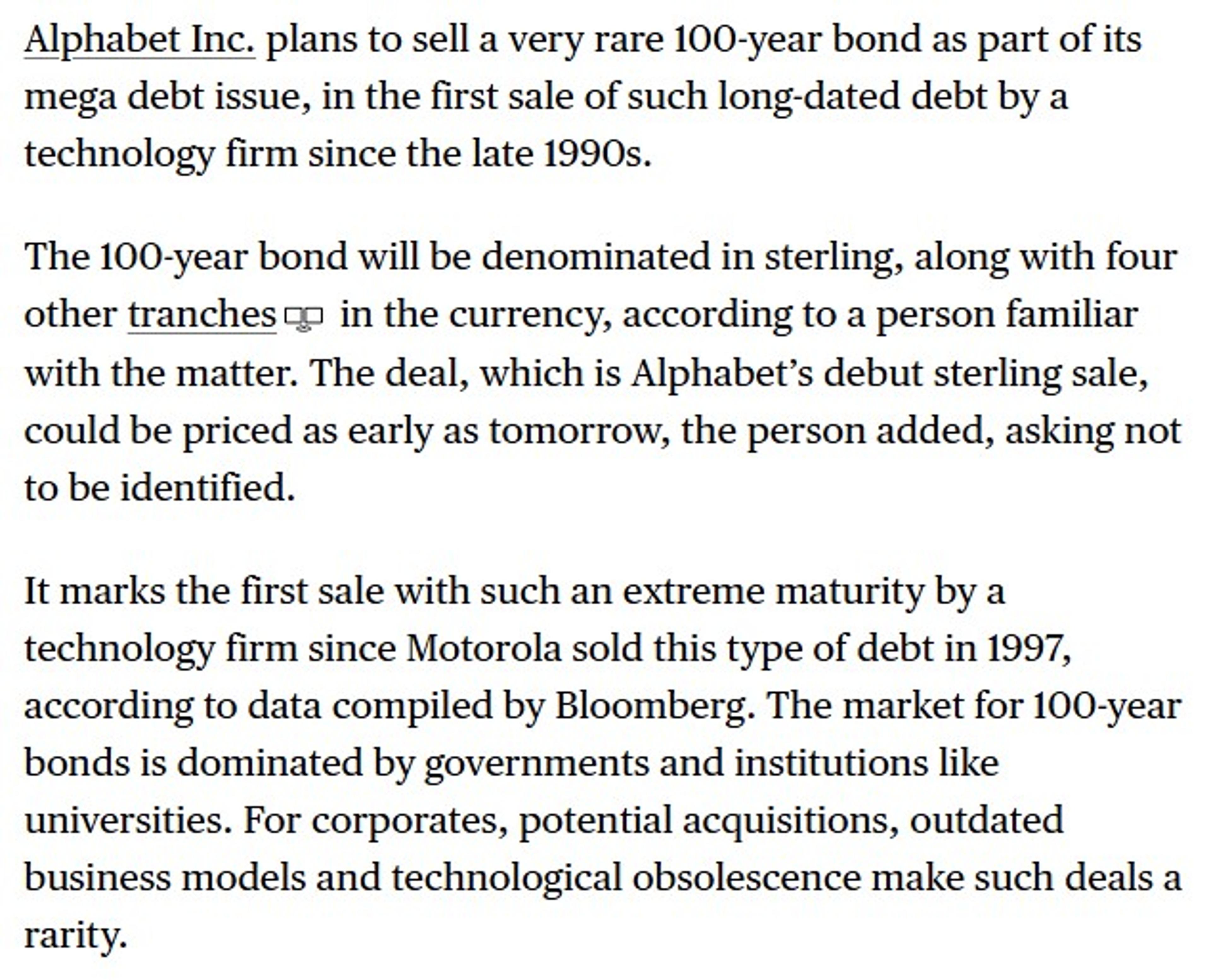

Harvest Losses to Acquire Google at $101

no, but may harvest the loss to pick up the google 100 at 101. #theyieldbook

By Tom Keene

Blog•Feb 9, 2026

The Biggest Buyer Of US Stocks Isn’t Going Away

Investors are confronting a new capital‑allocation landscape as hyper‑scale cloud firms pour record capex into AI infrastructure, squeezing the cash traditionally earmarked for share buybacks. The article argues that despite this shift, the market’s largest shareholder – passive index funds...

By Heisenberg Report

Social•Feb 10, 2026

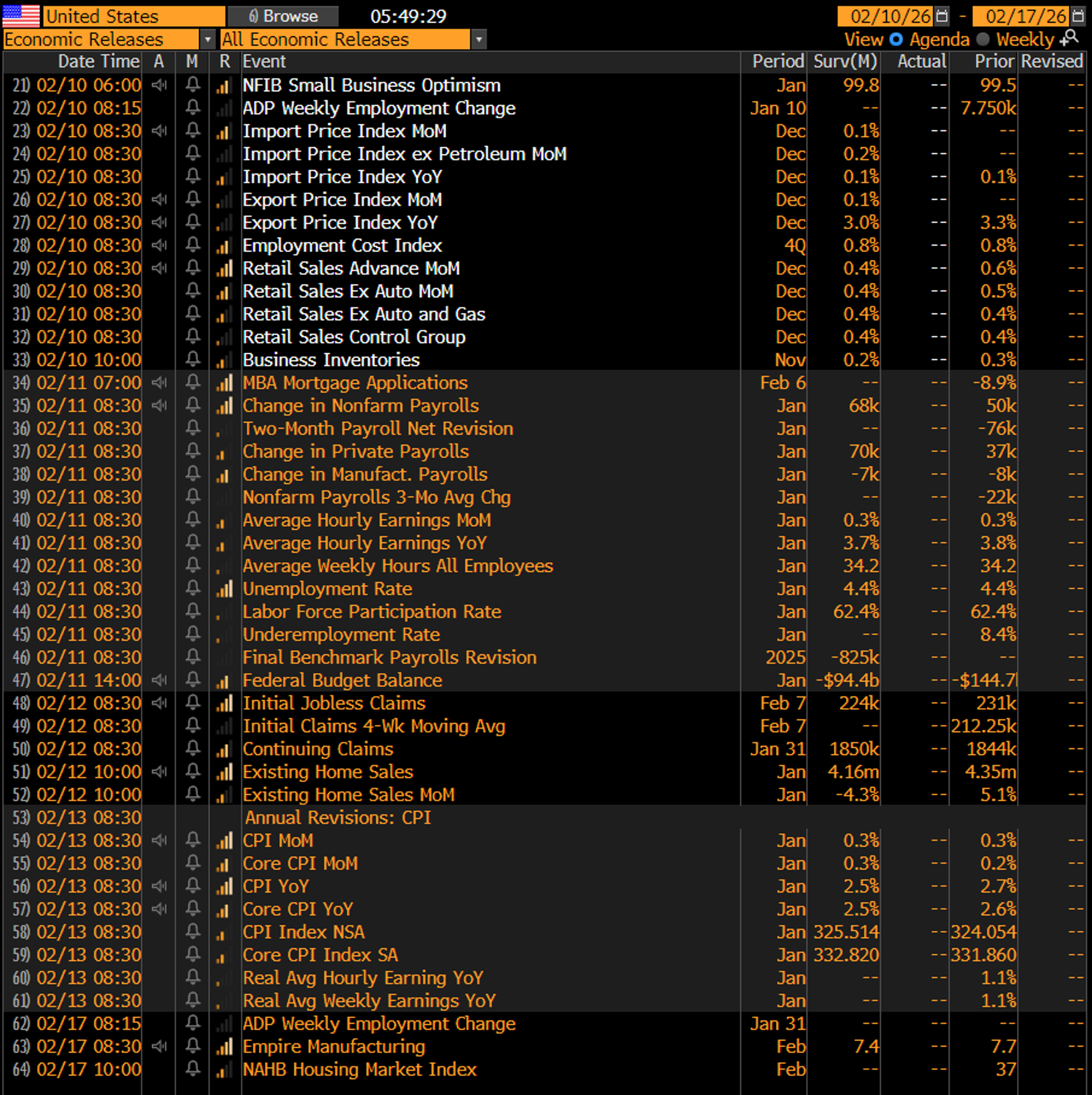

Jobs Data Wednesday, CPI Hits Friday

All the data coming for the rest of the week. We're going to have Jobs Wednesday and then CPI Friday https://t.co/8DDq0vkOvD

By Joe Weisenthal

Social•Feb 10, 2026

Markets Could Slip If Data Undermines Fed Cut Hopes

Stock markets may sour if this week’s US economic data casts doubt on Fed rate cut speculation. #stockmarkets #Fed #Economy #InterestRates #USD #Macro #trading https://t.co/ZEfchApMC0

By Ilya Spivak

Blog•Feb 9, 2026

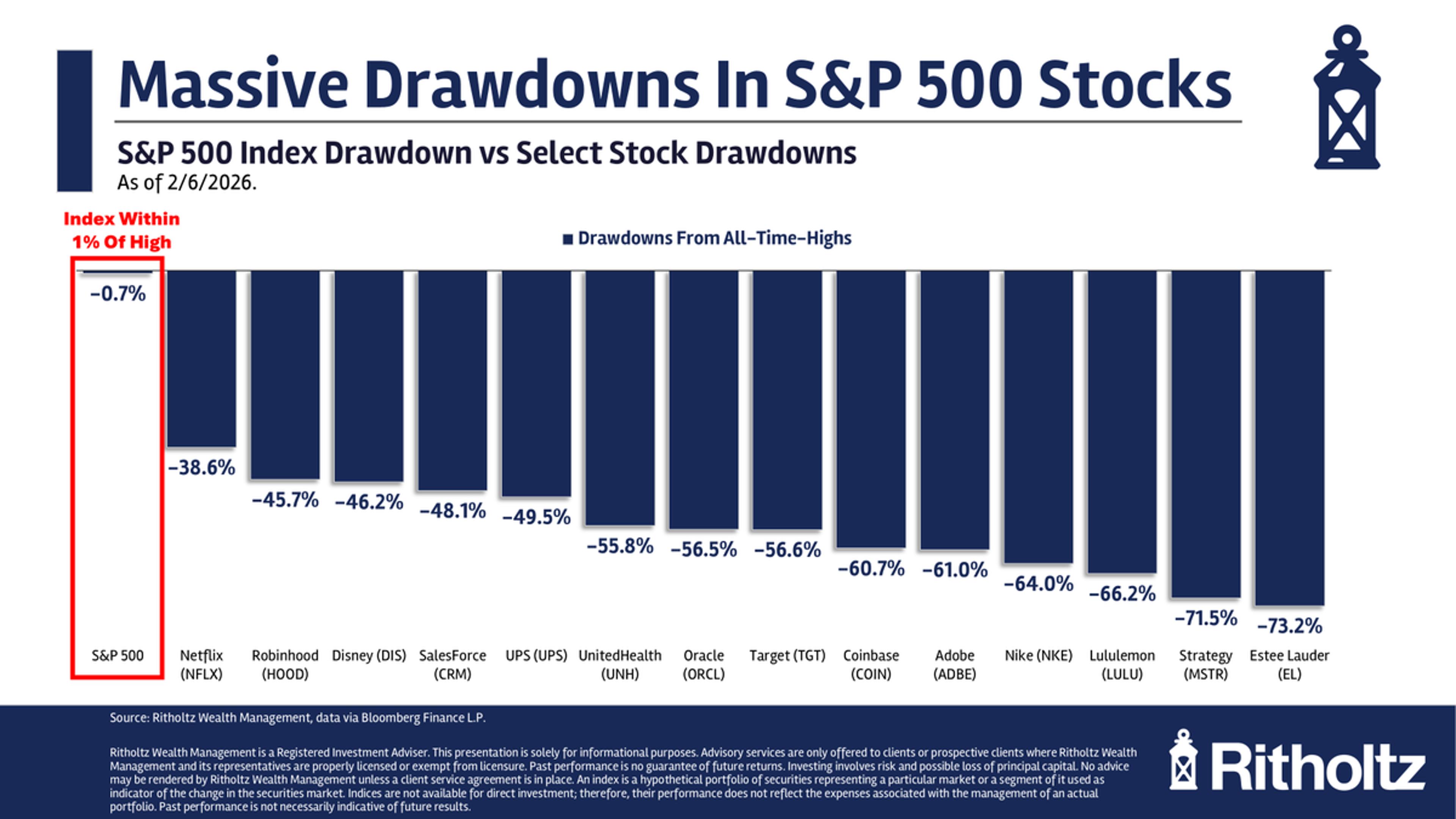

Software Company monday.com Plunges 22% Today, -82% From High, -50% From IPO Price, Into Our Imploded Stocks

Monday.com’s shares tumbled 22% to about $76.70 after its earnings release, marking a record‑low close. The stock is now 82% below its November 2021 peak and 51% beneath the $155 IPO price. While Q4 revenue rose 25% to $334 million and beat...

By Wolf Street

Social•Feb 9, 2026

Tech Rebounds, Commodities Surge as Growth Revives

Markets pushed higher to start the week, but the rotation underneath the surface is telling a more interesting story. Tech bounced, commodities ripped, and growth showed signs of life again. In today’s CHART THIS, I walk through $SPX just below 7000,...

By David Keller, CMT

Social•Feb 9, 2026

Pick Fed Chair by Sound Economic Reasoning, Not Politics

"Thus, the way to choose a good Federal Reserve chair is to read what candidates have said about how the economy operates and ask them about their economic beliefs. If what a candidate says is unrealistic or poorly reasoned, move...

By Claudia Sahm

Blog•Feb 9, 2026

A New Oil Era—Or Just Noise? The Venezuela Factor Lifts Big Oil

Big Oil’s XLE ETF has surged 19.1% year‑to‑date, outpacing the clean‑energy ICLN’s 13.2% gain. The rally follows the Trump administration’s move to ease sanctions on Venezuela, a country with the world’s largest proven oil reserves. While the prospect of tapping...

By The Capital Spectator

Social•Feb 9, 2026

Inflation-Adjusted S&P Still Below 1966 Peak After 25 Years

Today is the 60th anniversary of the great crash -- but little noticed. The S&P 500 peaked at 94.06 on February 9, 1966. The market did surpass that peak but not adjusted for inflation. 25 years later and the inflation...

By Eddy Elfenbein

Social•Feb 9, 2026

GE Vernova: High‑Conviction Buy with 32% Upside

GEV - GE Vernova Current Price: $794.20 Intrinsic Value Range: $720–$950 Rating: BUY (High Conviction, but tactically vulnerable near-term) 12-Month Price Targets: Bull Case: $1,050 (+32%) — accelerated gas turbine orders, Electrification margin beats, data center capex surge Base Case: $900 (+13%) — normalized execution, mid-teens...

By my.stock.research

Blog•Feb 9, 2026

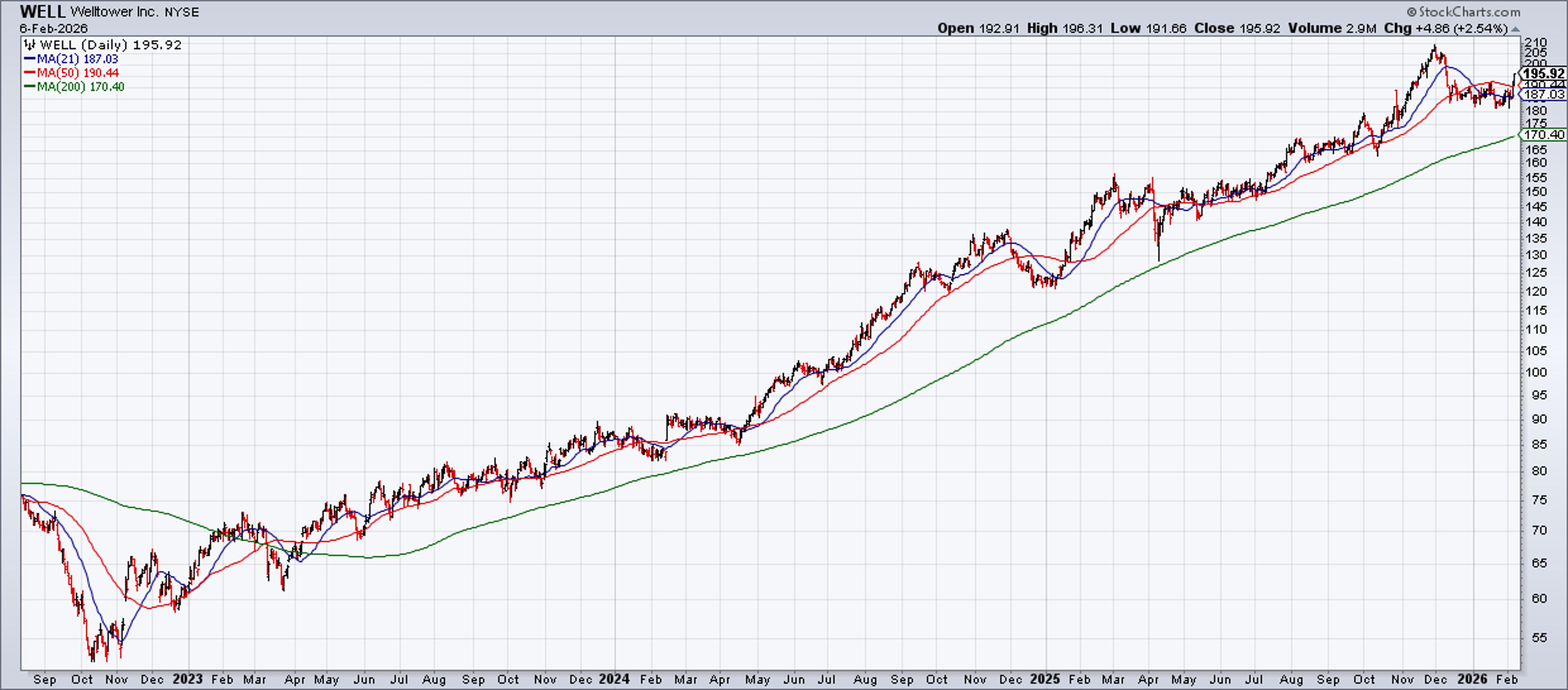

WELL: What To Do When Your Stock Gets Overvalued

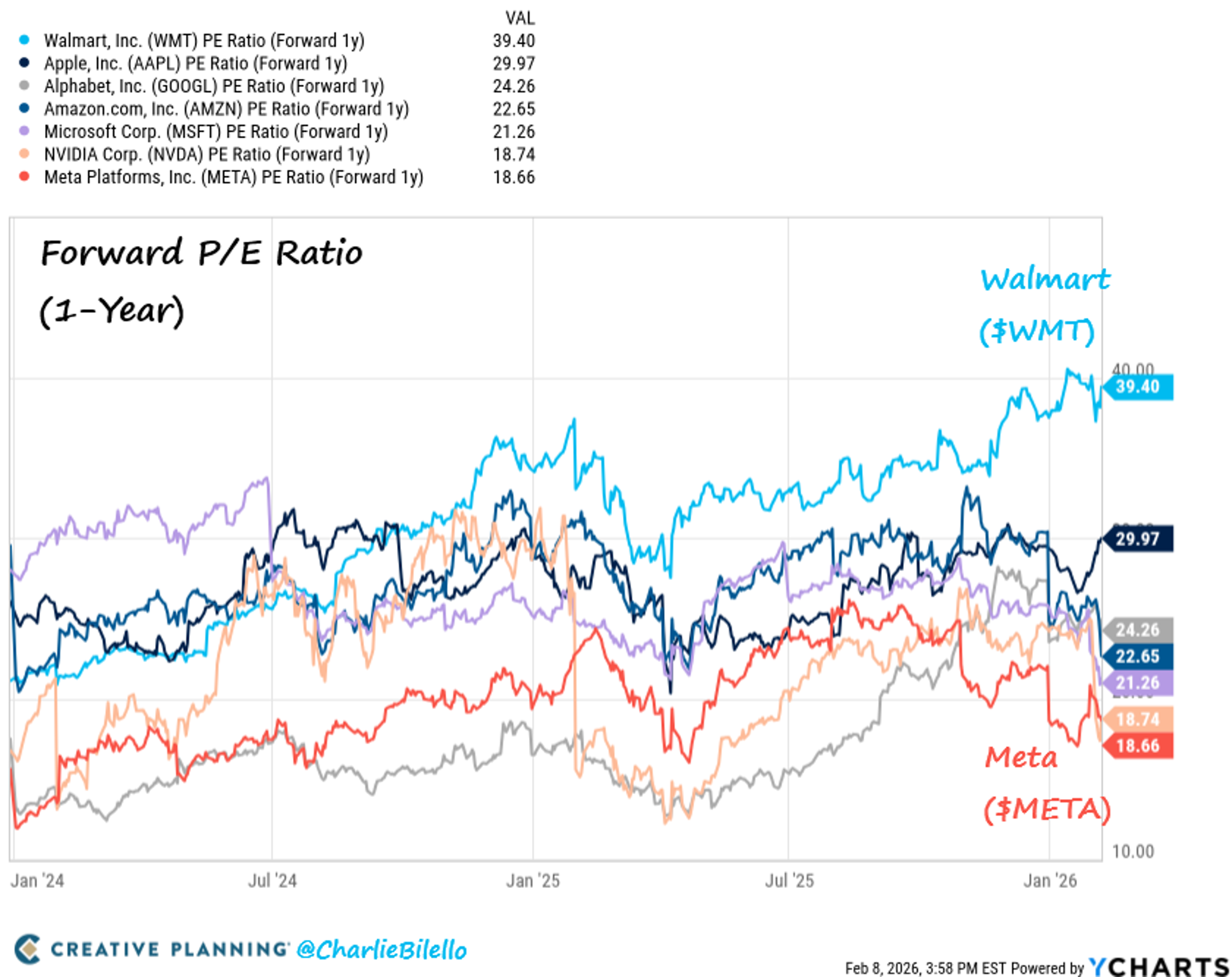

The author revisits his "Buy right and sit tight" philosophy after confronting overvaluation in two holdings—Walmart (WMT) and senior‑housing REIT Welltower (WELL). While Walmart’s stock surged to a 50x forward P/E, the author sold too early, missing upside, yet still...

By Top Gun Financial Blog

Social•Feb 9, 2026

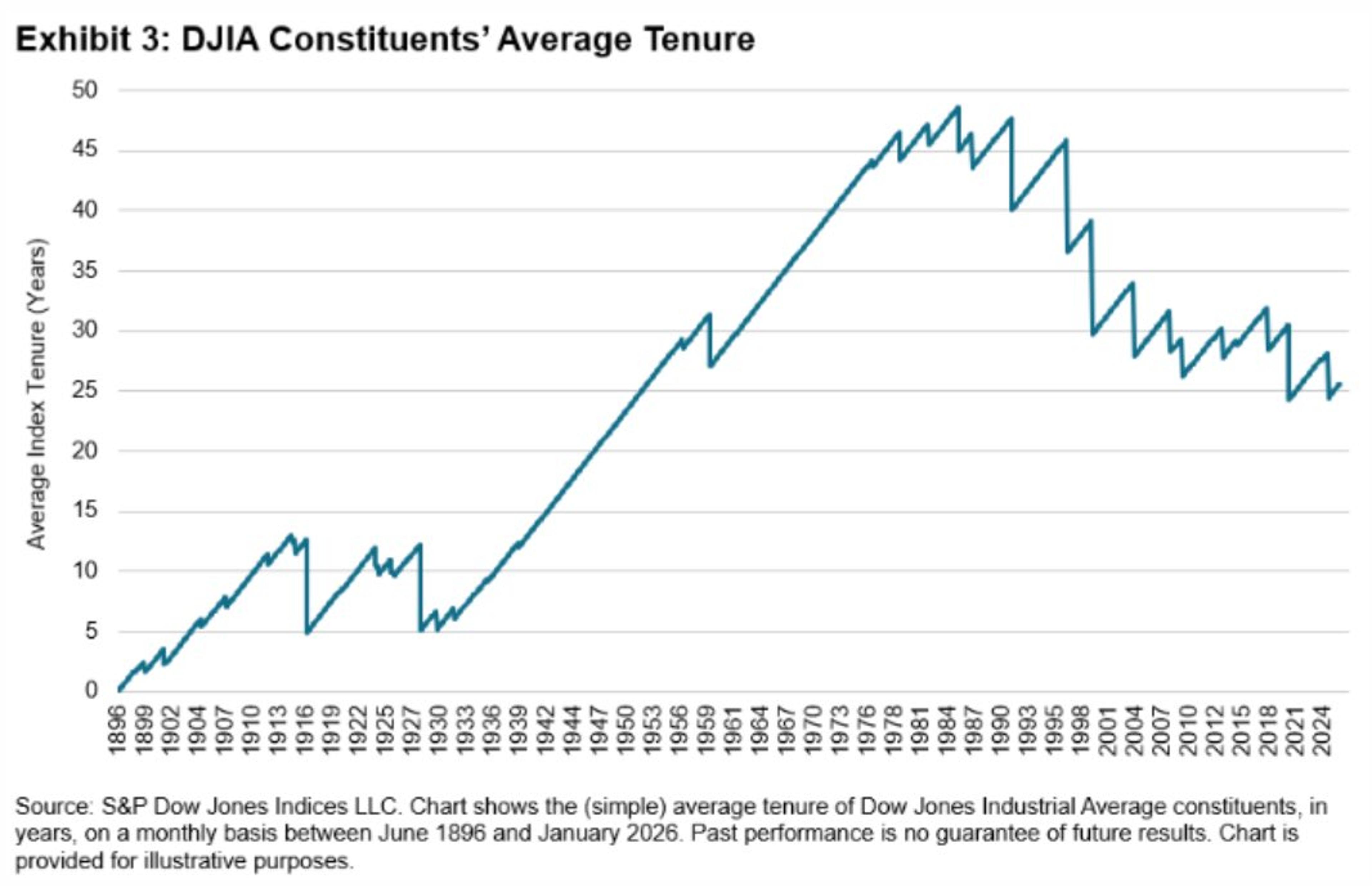

All Major S&P Indices Hit Records, Dow Tops 50,000

S&P 500 Equal Weight, S&P MidCap 400, and S&P SmallCap 600 all hit records on Friday, and so did Dow, which also surpassed 50,000 level for first time ever Friday; although Dow is almost 130 years old, it has evolved over decades ensuring...

By Liz Ann Sonders

Social•Feb 9, 2026

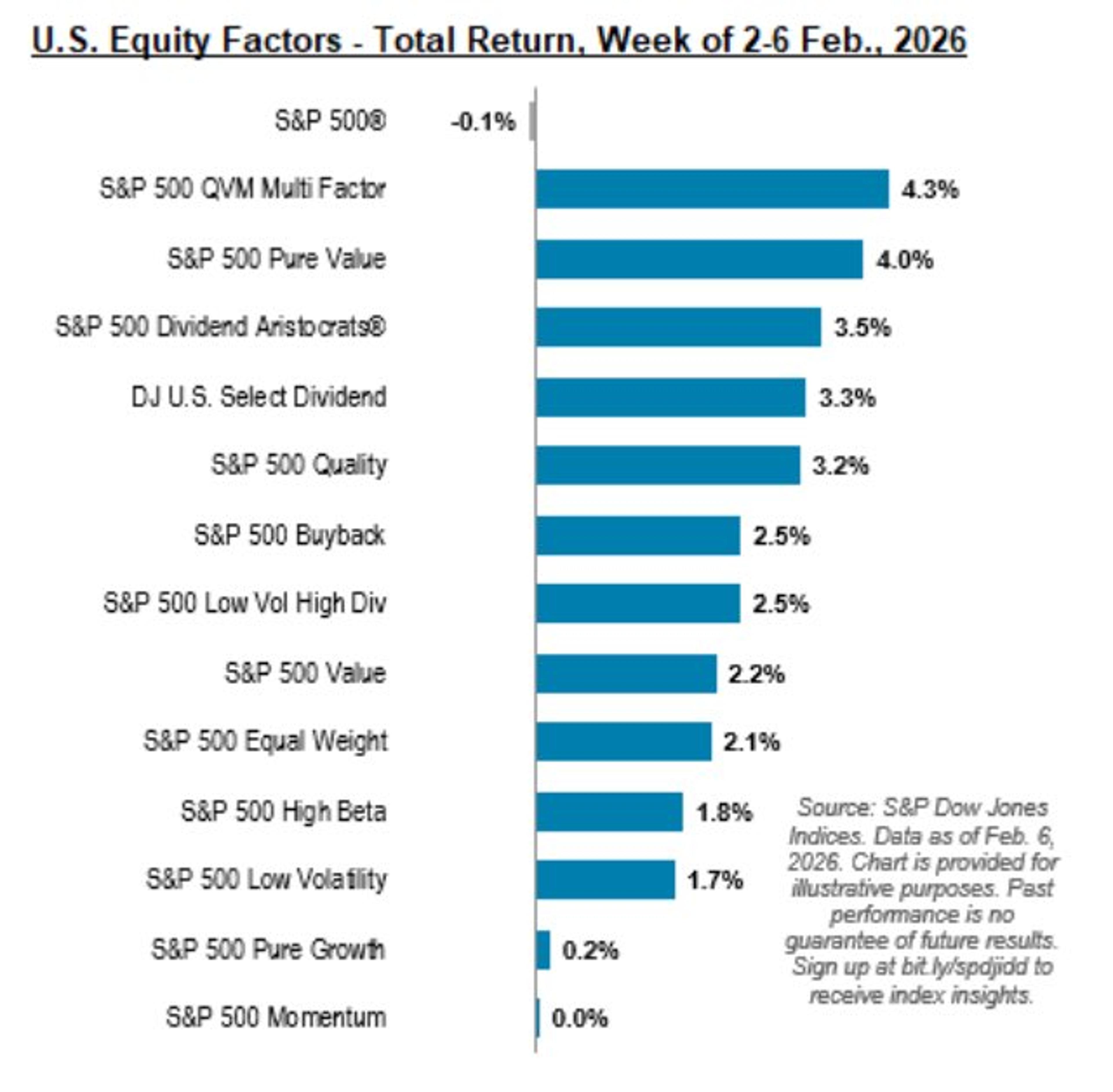

Value Soars, Growth Falters; Dividends Rise, Momentum Flat

Flight to value was unmistakable last week in factors; S&P 500 Pure Value +4.0%, while S&P 500 Growth slumped 2.1%; yield-seeking behavior also dominant theme, with S&P 500 Dividend Aristocrats and Dow Jones U.S. Select Dividend index +3.5% and +3.3% respectively; Momentum (powerful driver in past several...

By Liz Ann Sonders

Blog•Feb 8, 2026

America’s Tarnished Statistics Agency Takes Center Stage

The U.S. Census Bureau, long criticized for data gaps, is now thrust into the national spotlight as Congress debates a 15% budget cut for FY2027. Lawmakers argue the agency’s methodology has become politicized, citing recent appointments that could sway demographic...

By Heisenberg Report

Social•Feb 9, 2026

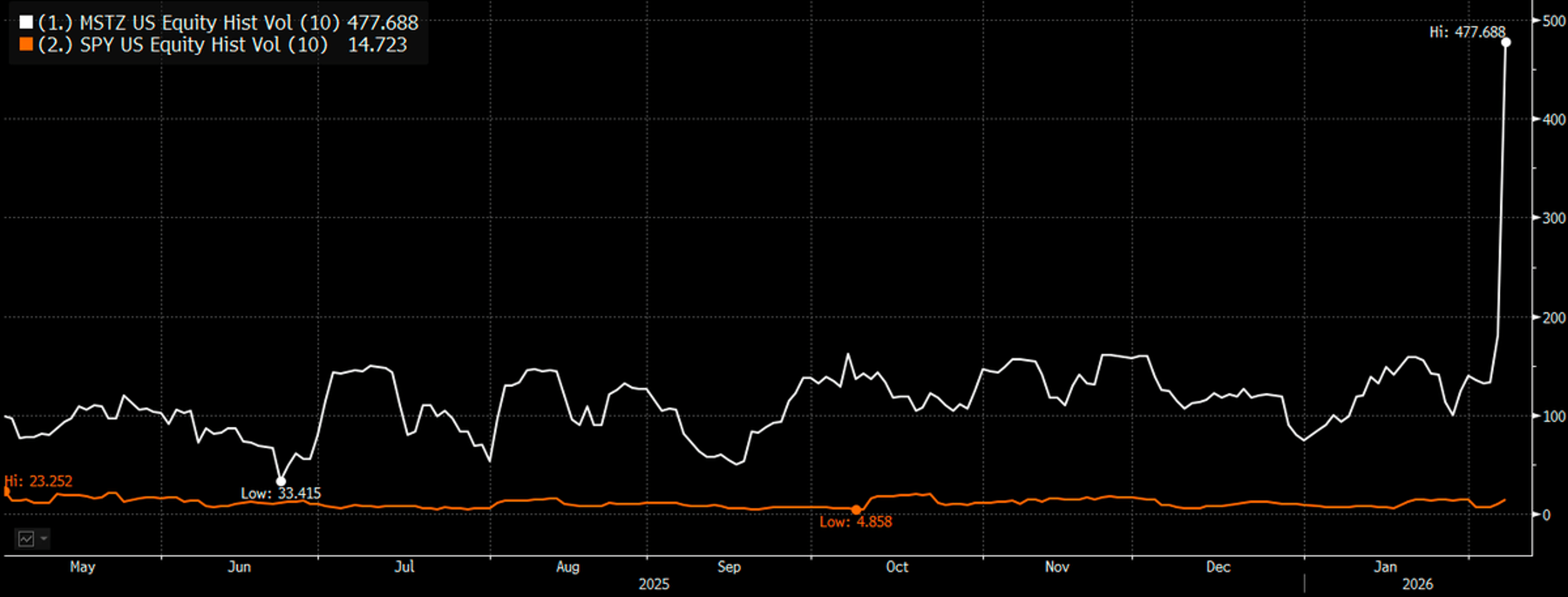

MSTZ Hits Potential Record 477% Volatility Surge

Total eruption in the 10-day volatility of $MSTZ (-2x Strategy).. 477% may be an all time ETF record (I added $SPY for perspective), it's higher than $QBTX which got to 433% at one point. Crazy high vol is like degen...

By Eric Balchunas

Social•Feb 9, 2026

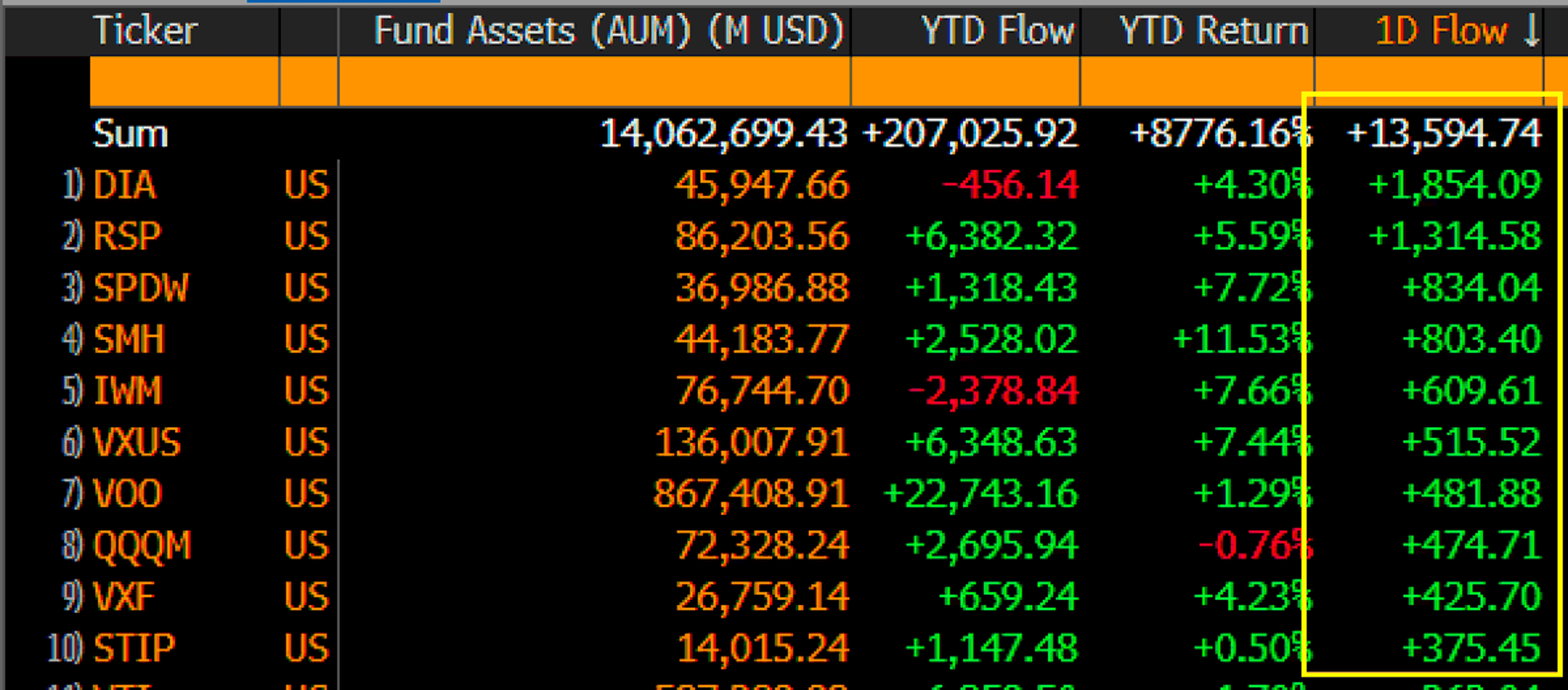

Dow’s DIA Leads Flows, Poised for 2026 Rotation

$DIA leading all flows on Friday as the Dow Jones hits ATH and is running laps around SPX this year. This index is equiv of a rotary phone, price-weighted, invented when Grover Cleveland was POTUS, but it could be...

By Eric Balchunas

Podcast•Feb 7, 2026•7 min

Week in Review: Friday Flip

The episode reviews a dramatic market swing after a tough week for tech, highlighting the Dow’s historic breach of 50,000 points and a rapid rebound in chip stocks as investors shift from AI‑related anxiety to value‑focused buying. Analysts explain that...

By Reuters Morning Bid

Social•Feb 9, 2026

Bears Brace for NFP Wednesday and CPI Friday

Neil does a great job with the week ahead ... bears watching as we head into NFP Wed & CPI Fri.

By Samantha LaDuc

Social•Feb 9, 2026

Cyclical Growth Rises While Inflation Falls—A Rare Forecast

Our nowcasts suggest that cyclical growth is going up and inflation is going down. No one forecasts this cocktail

By Andreas Steno Larsen

Blog•Feb 7, 2026

DEEP DIVE: Meet Kevin Warsh

President Donald Trump nominated former Fed governor Kevin Warsh to succeed Jerome Powell as chair in May. Warsh, praised for his professional pedigree and youthful appearance, is expected to secure a smooth Senate confirmation once the president ends his criticism...

By Yardeni QuickTakes

Social•Feb 9, 2026

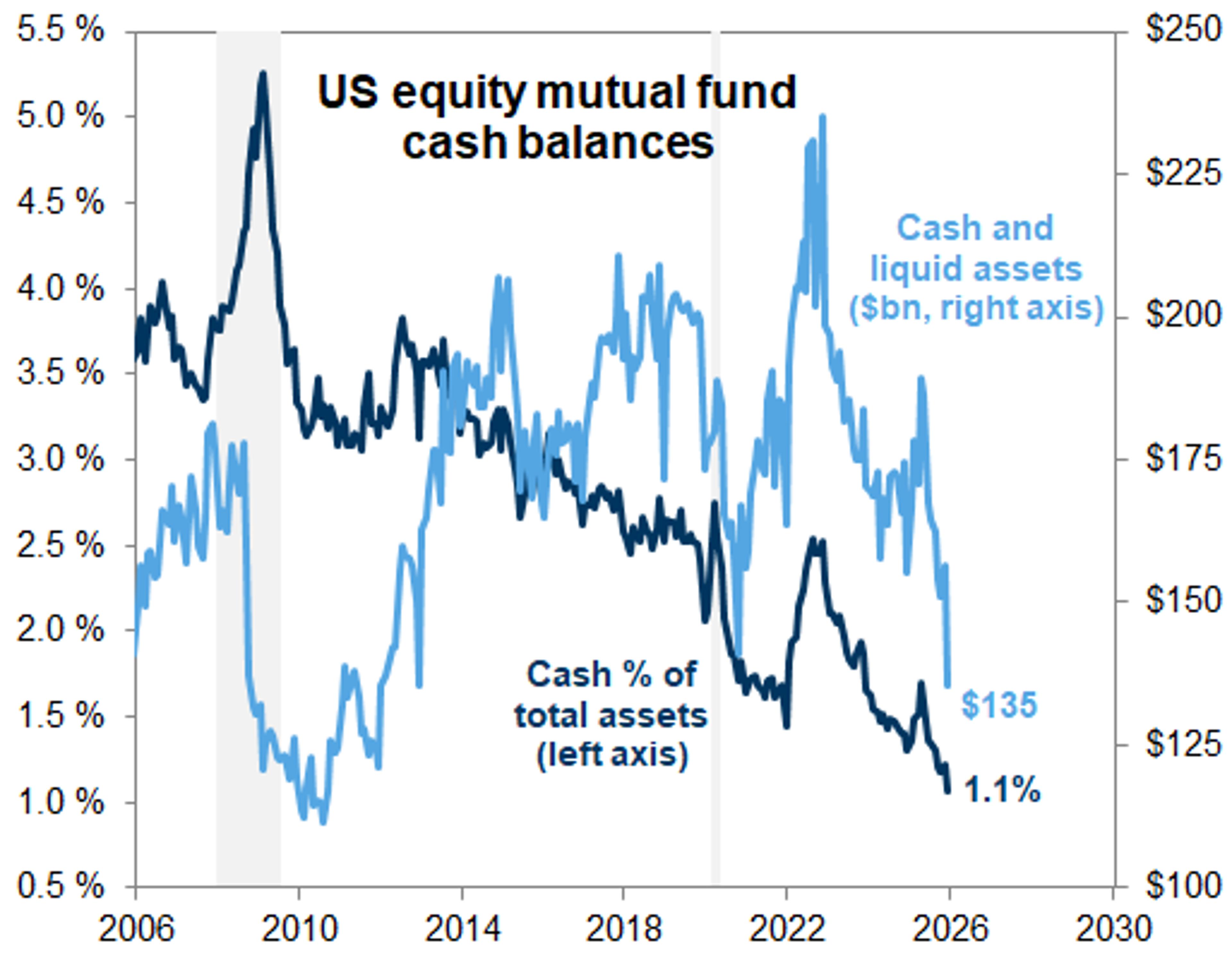

US Equity Mutual Funds Hold Record Low Cash

Mutual funds are all in on the stock market At the start of 2026, US equity mutual funds held just 1.1% of asset in cash, the lowest level in 20 years of data history --Goldman https://t.co/BWZ5dGYfjM

By Gunjan Banerji

Social•Feb 9, 2026

Seven Firms Command 35% of SPX Investment Dollars

Employment in S&P 500 companies is 18% of total US employment, but 35 cents of every dollar that goes into the SPX goes to 7 companies. This is a market structure problem and a major issue with our 401k system.

By Tyler Neville

Blog•Feb 6, 2026

Here We Go Again on Inflation: Used Vehicle Prices Jump in January, Expected to Jump More in Record Tax-Refund Season

Used‑vehicle auction prices surged 2.4% in January, outpacing the typical 0.4% seasonal gain, as Manheim reports stronger retail demand and tighter wholesale supply. Larger-than‑usual tax refunds, driven by new 2025 tax credits, are fueling bigger down‑payments and pushing prices higher....

By Wolf Street

Social•Feb 9, 2026

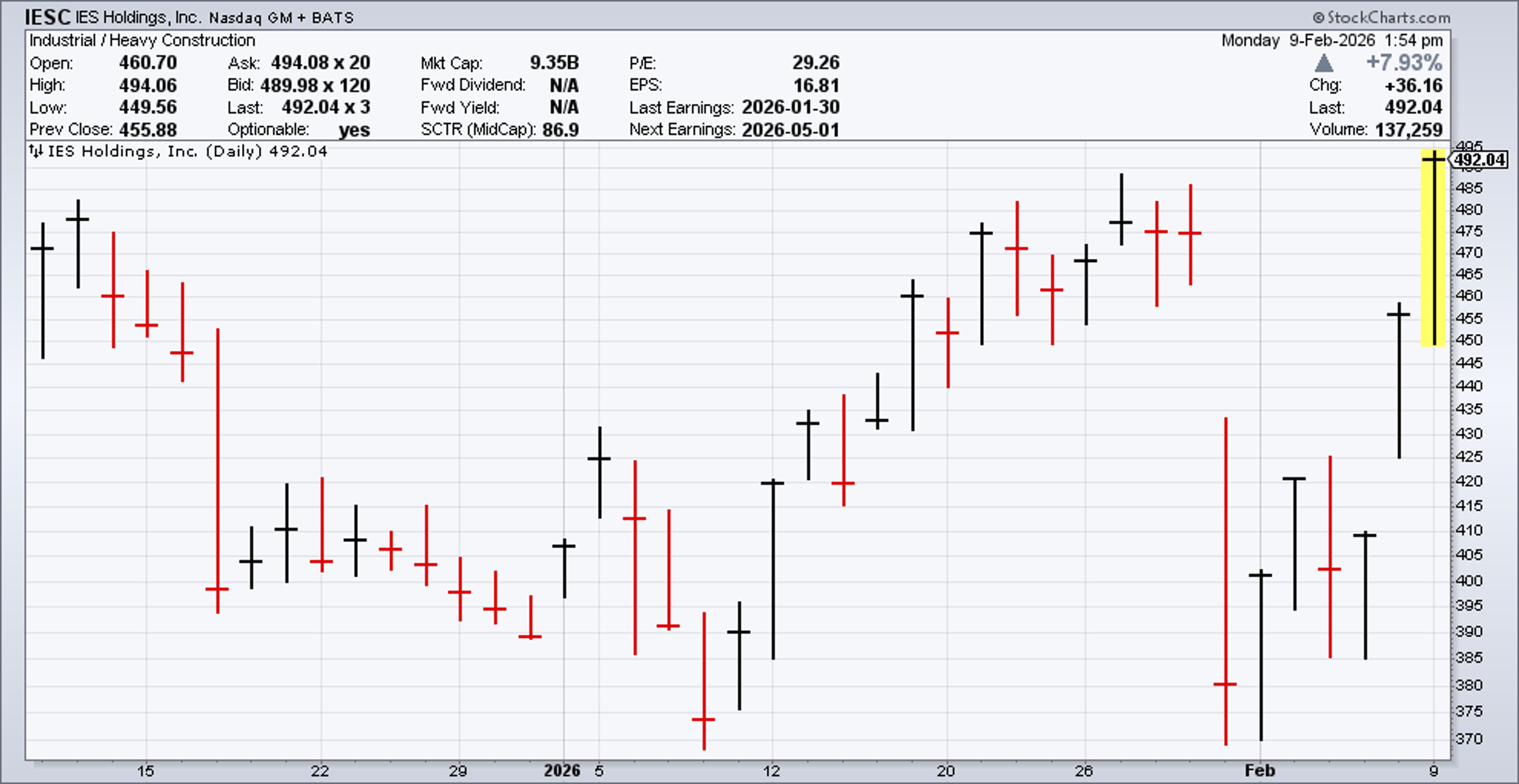

IESC Rebounds, Recovers 20% Loss and More

After its last earnings report, $IESC dropped 20%. It's made it all back and then some. https://t.co/hebBMdjVup

By Eddy Elfenbein

Social•Feb 9, 2026

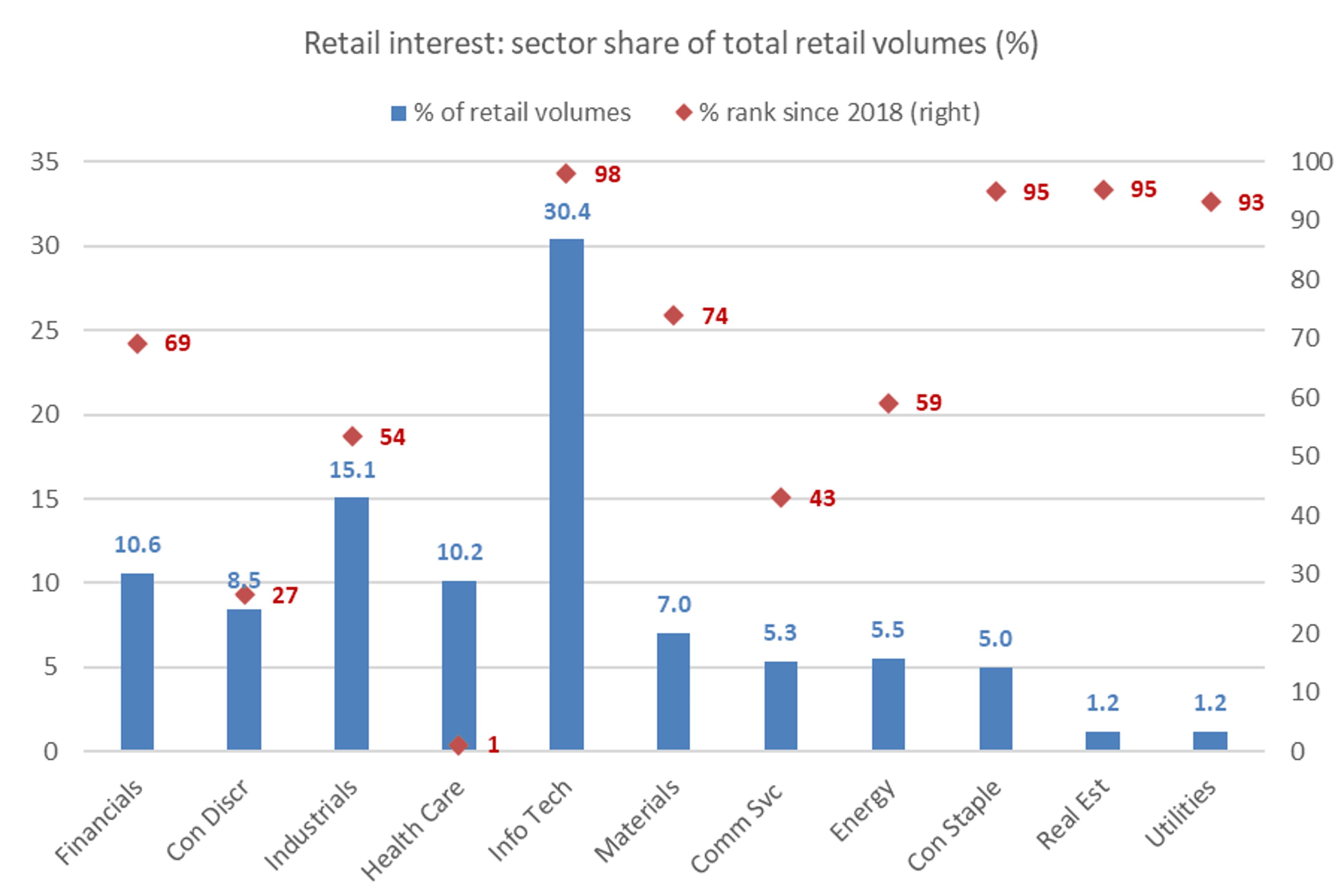

Tech Trades Hit 30% of Retail Volume, Highest Since 2018

Trading in the tech sector makes up 30% of retail trading volumes--one of the highest shares since 2018 --Citi https://t.co/6pvw7muvfj

By Gunjan Banerji

Blog•Feb 6, 2026

Mini Tech Wreck Or Repeat Of The Big One?

Technology stocks have tumbled sharply, prompting fears of a repeat of the 2000‑2002 tech bust. Analysts argue the current landscape differs, as major hyperscalers—Alphabet, Amazon, Microsoft, and Meta—are slated to spend roughly $650 billion on AI infrastructure by 2026, with the...

By Yardeni QuickTakes

Social•Feb 9, 2026

Weekly S&P 500 ChartStorm Highlights Market Trends

ICYMI: Weekly S&P500 ChartStorm blog post https://t.co/eQY6d47hAk Thanks + follow reco to chart sources @topdowncharts @MarketCharts @MikeZaccardi @BlakeMillardCFA @WillieDelwiche @alphacharts @AugurInfinity @SnippetFinance @EricBalchunas @TuttleCapital @Todd_Sohn

By Callum Thomas

Social•Feb 9, 2026

Tech's First 100-Year Bond Since Motorola 1997

The last time a tech company announced a 100-year bond, it was Motorola in 1997 https://t.co/HKkDro85Ac https://t.co/w2S75DaL2J

By Joe Weisenthal

Podcast•Feb 6, 2026•6 min

AI Hangover

The episode examines the sudden shift in market sentiment toward AI, moving from optimism to caution as investors question who truly benefits from the technology. It highlights emerging signs of a softer jobs market, including delayed employment data and rising...

By Reuters Morning Bid

Social•Feb 9, 2026

Retail Inflows Hit Six-Year High on Furlough, Tax Refunds

JPM: "Similar to the risk-on trend seen among institutional investors, retail investor flows have been the strongest in the last six years, likely due to furlough payments and anticipated larger tax refunds of ~$600/household this year"

By Gunjan Banerji

Social•Feb 9, 2026

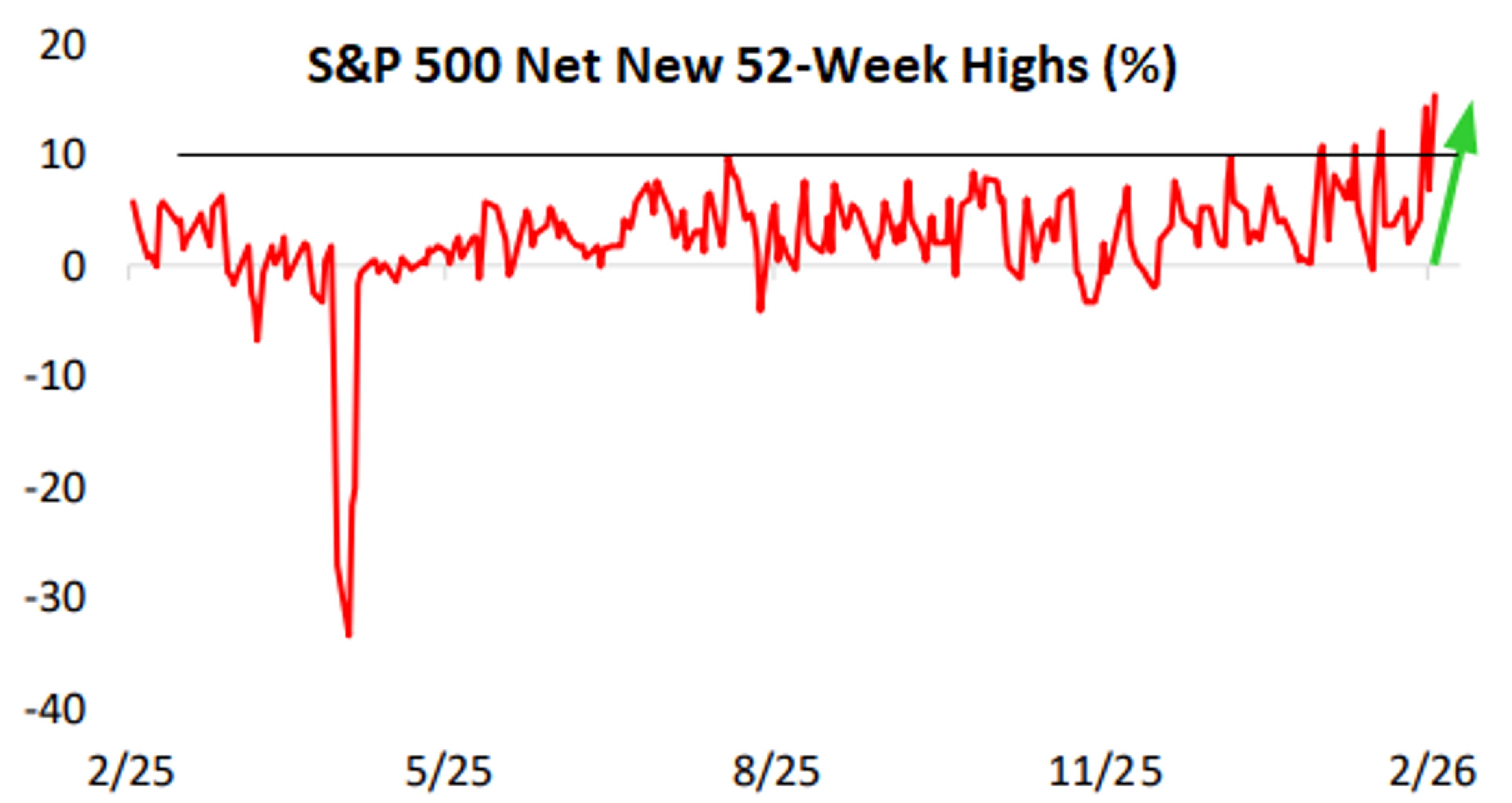

S&P 500 New 52‑Week Highs Reach Year‑

The percentage of stocks in the S&P 500 making new 52-week highs has been expanding and just hit its highest level in the last year to end last week--@bespokeinvest https://t.co/BcNw0xKEmG

By Gunjan Banerji

Blog•Feb 6, 2026

PYPL Is Too Cheap And Will Reward Patient Shareholders

PayPal (PYPL) is trading at a steep discount, with its stock price near $40 representing a 7.6‑times earnings multiple. The company plans a $6 billion share‑repurchase program in 2026 that could retire roughly 16% of its diluted shares, boosting earnings per...

By Top Gun Financial Blog

Social•Feb 9, 2026

Live MRKT Call: Japan, Jobs, and $JETS Insights

New week, new MRKT Call with Dan, @GuyAdami & @CarterBWorth We're talking Japan, Jobs and $JETS LIVE at 11am ET over on YouTube ⤵️ https://t.co/7WiuWoxeXK https://t.co/5yktisUdAm

By Dan Nathan

Social•Feb 9, 2026

Fed's 175‑bp Cuts Signal Looming Dovish Pivot

175 basis points in cuts since September 2024 in response to labor market weakness. That's not ignoring.

By Claudia Sahm

Blog•Feb 5, 2026

Moderate Growth Still Expected For Delayed US Q4 GDP Report

The delayed fourth‑quarter GDP report, slated for Feb 20, is nowcast at a 2.7% annualized expansion, a slowdown from the 4.4% pace recorded in Q3 but still indicating resilience. Complementary data from the Dallas Fed’s Weekly Economic Index and recent PMI...

By The Capital Spectator

Social•Feb 9, 2026

Walmart Tops Forward P/E; Tech Stocks Cheaper

Forward P/E Ratios... Walmart $WMT: 39 Apple $AAPL: 30 Google $GOOGL: 24 Amazon $AMZN: 23 Microsoft $MSFT: 21 Nvidia $NVDA: 19 Meta $META: 19 https://t.co/BSywhjbEV0

By Charlie Bilello

Social•Feb 9, 2026

Tech Titans Plunge, All Below All‑Time High

% Below All-Time High S&P 500 $SPY: -1% Microsoft $MSFT: -26% Palo Alto Networks $PANW: -28% CrowdStrike $CRWD: -29% Synopsys $SNPS: -34% Palantir $PLTR: -34% Intuit $INTU: -45% AppLovin $APP: -45% Salesforce $CRM: -48% Oracle $ORCL: -56% ServiceNow $NOW: -57% Adobe $ADBE: -61%

By Charlie Bilello

Social•Feb 9, 2026

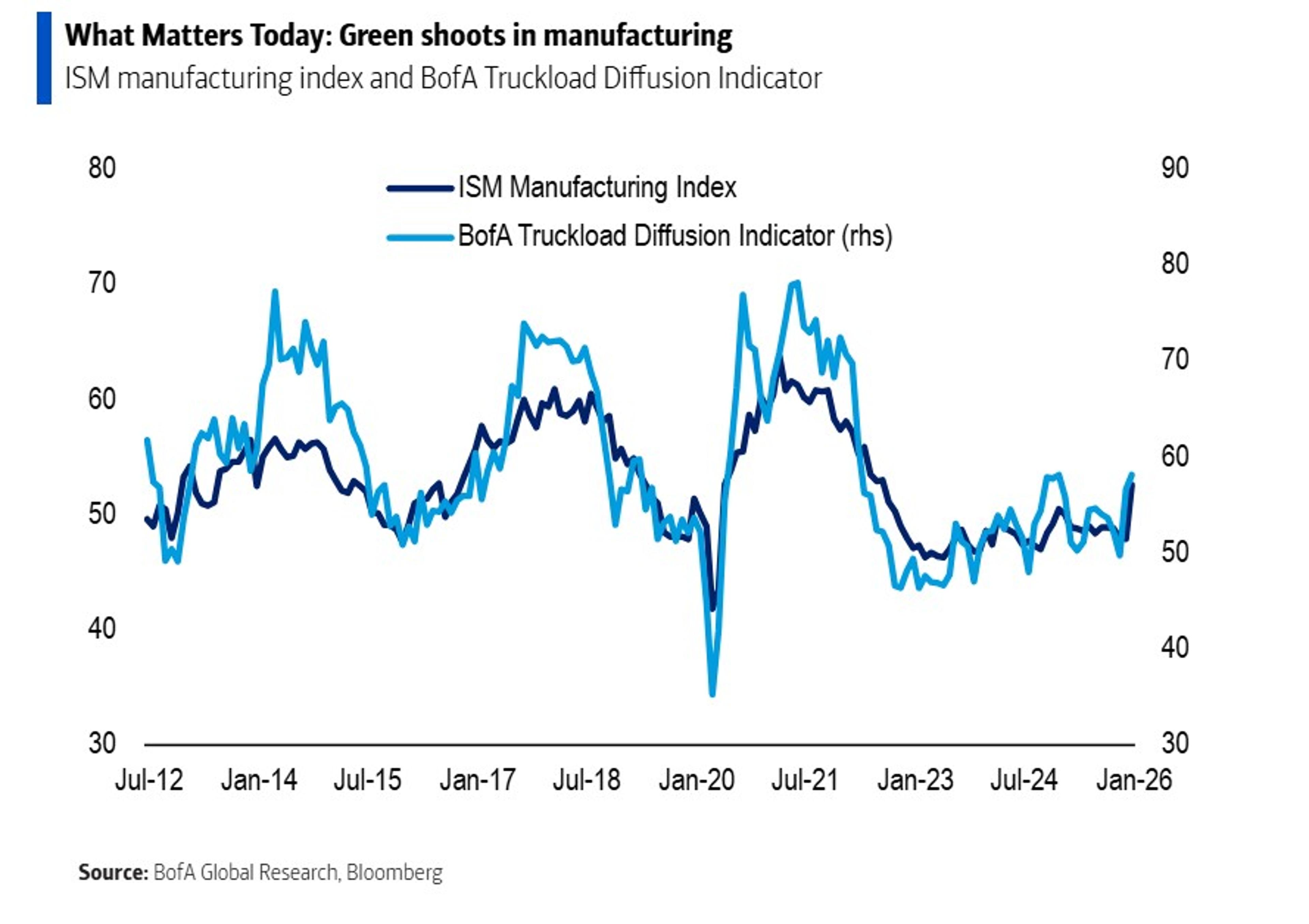

Bank of America Data Validates ISM Trucking Surge

Bank of America's own measure of trucking activity confirms the uptick in the ISMs https://t.co/BLUrghpS3Q

By Joe Weisenthal

Social•Feb 9, 2026

Broad Market Peaks, but Concentrated Bets Can Crash

The stock market is more or less at all-time highs Same with small caps & foreign stocks Yet many name-brand companies are getting nuked right now Concentrated positions are very fun on the upside They can also wreck you on the downside https://t.co/Ng2WpRK35K https://t.co/nMR87p0Tgx

By Ben Carlson

Social•Feb 9, 2026

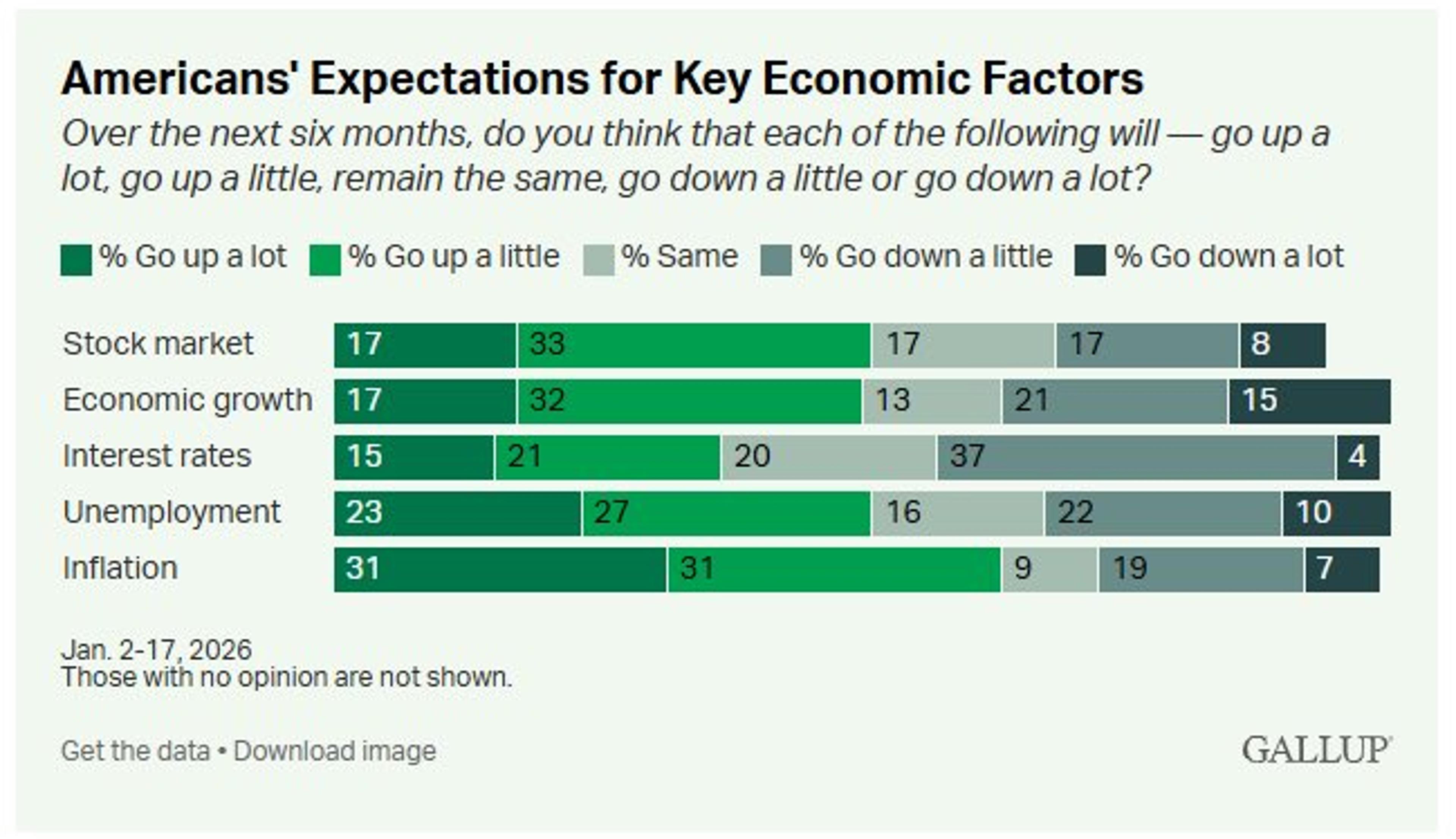

Americans Optimistic About Market, yet Foresee Rising Inflation, Unemployment

Americans expect the stock market (50%) and economy (49%) to improve over the next six months but predict higher inflation (62%) and unemployment (50%) @Gallup https://t.co/n8pQ2GIAHd

By Liz Ann Sonders

Social•Feb 9, 2026

Recent Trade Unwind Unlikely to Spark Broad Selloff, Say HSBC

HSBC's Kettner: "Last week's rotation and unwinding of popular trades is unlikely to trigger a broad selloff – we stay constructive" DB's Reid on how this feels like 2000, when "an enormous rotation after the tech bubble burst" was enough to...

By Lisa Abramowicz

Social•Feb 9, 2026

Salesforce, ServiceNow Rejoin AI 30 Amid Market Panic

We are adding Salesforce and ServiceNow to the IVES AI 30 list after taking them off in early December with this software Armageddon sell-off the last few weeks assuming software/tech behemoths like Salesforce and ServiceNow are structurally broken…and we strongly...

By Dan Ives