Social•Feb 20, 2026

Equity Risk Discount Signals Overvalued Market Amid Turmoil

An equity risk premium which has recently turned into an equity risk discount. (Historically, an awful launnching pad for future returns) Policy turmoil, slowing domestic economic growth, sticky inflation, circular financing deals in AI (holding up the econ data) and traditional valuations in the 98%-tile. Yet the sunshine boys on the show are all positive. To quote drawdown.. "LOL" It is becoming a joke but it is never too late.. @KeithMcCullough @gnoble79 @dougkass @HalftimeReport

By Doug Kass

Social•Feb 20, 2026

S&P Reverses Gains, Slides Downward After Recent Surge

S and P now down on the day (reversing 45 handles in last few minutes) From an hour ago... on @thestreetpro Dougie Kass Ludacris Day? @dougkass

By Doug Kass

Social•Feb 20, 2026

High Valuations Test Market Resilience in 2026

Markets flat near the highs + valuations near the upper end of history. Tom Martin of Globalt breaks down what that actually means—and what could sustain (or break) it in 2026! Our latest episode of the Market Misbehavior podcast: https://t.co/nA9bmU87rf...

By David Keller, CMT

Social•Feb 20, 2026

Ex‑US Value Soars, Advisors Still Underweight Benchmark

Value ex-US ripping again this year, spreading to US value too. Not a lot of discussion about it in my world yet. Every advisor we speak to still way underallocated relative to benchmark...

By Meb Faber

Social•Feb 20, 2026

Accounting Rules Reveal Shutdown’s Massive Real GDP Loss

A fun(?) 🧵 on how nerdy government accounting rules had a big impact on Q4 GDP. And how they reflect how wasteful the 43-day government shutdown was. TL;DR: Small reduction in nominal federal spending in Q4. But a big decline in...

By Jason Furman

Social•Feb 20, 2026

AI Connectivity Group Ends Week on Fire

TTMI, GLW, COHR, LITE, CIEN, FN AI connectivity group stays super hot to close the week

By Joe Kunkle

Social•Feb 20, 2026

Gold Rises With Stocks, Breaking Inverse Trend

🚨 GOLD DEEP DIVE | FEB 20, 2026 🚨 Gold: $5,048/oz (+1.25% today | +71.82% YoY) Silver: $81.94 (+151% YoY) GDX Miners ETF: $104.23 (+21% YTD) The most telling signal: gold is surging today while stocks ALSO rally on the Supreme Court tariff ruling....

By dailyanalysts

Social•Feb 20, 2026

Amazon Clears $207, Targets $210+ After $197 Pivot

$amzn nice week. RDR Tuesday around $197 pivot. Cleared $207 and now it’s $210+ to manage.

By Scott Redler

Social•Feb 20, 2026

GE Call Spreads Double, Extra Time Boosts Returns

$GE Feb 330/350 call spreads from earnings snapshots now near $13 from $7, often pays to give extra time when playing a high quality name

By Joe Kunkle

Social•Feb 20, 2026

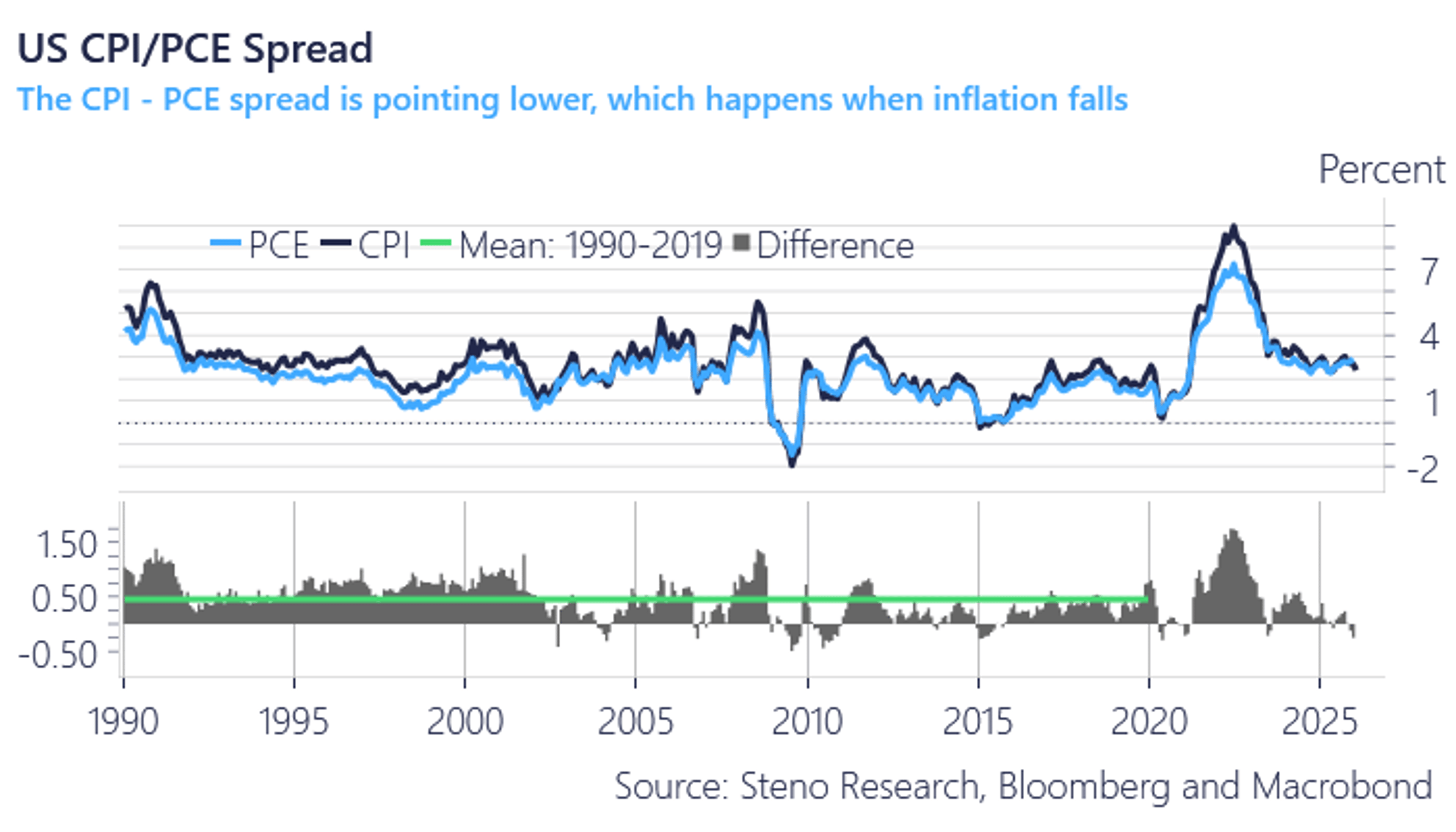

Falling CPI‑PCE Spread Signals Declining Inflation, Defying Q4 GDP

When the CPI-PCE spread heads lower (the spread is cyclical), it is because inflation is going lower. CPI is what matters.. End of discussion The economy is currently doing the opposite of that Q4 GDP report https://t.co/xBUcAxE1EP

By Andreas Steno Larsen

Social•Feb 20, 2026

First‑Round Knockout: YTD Dominance Over Competitors

CHART OF THE DAY: This Is A First Round Knockout, YTD We Are Crushing The Competition https://t.co/ohQwlRHqY4 via @hedgeye

By Keith McCullough

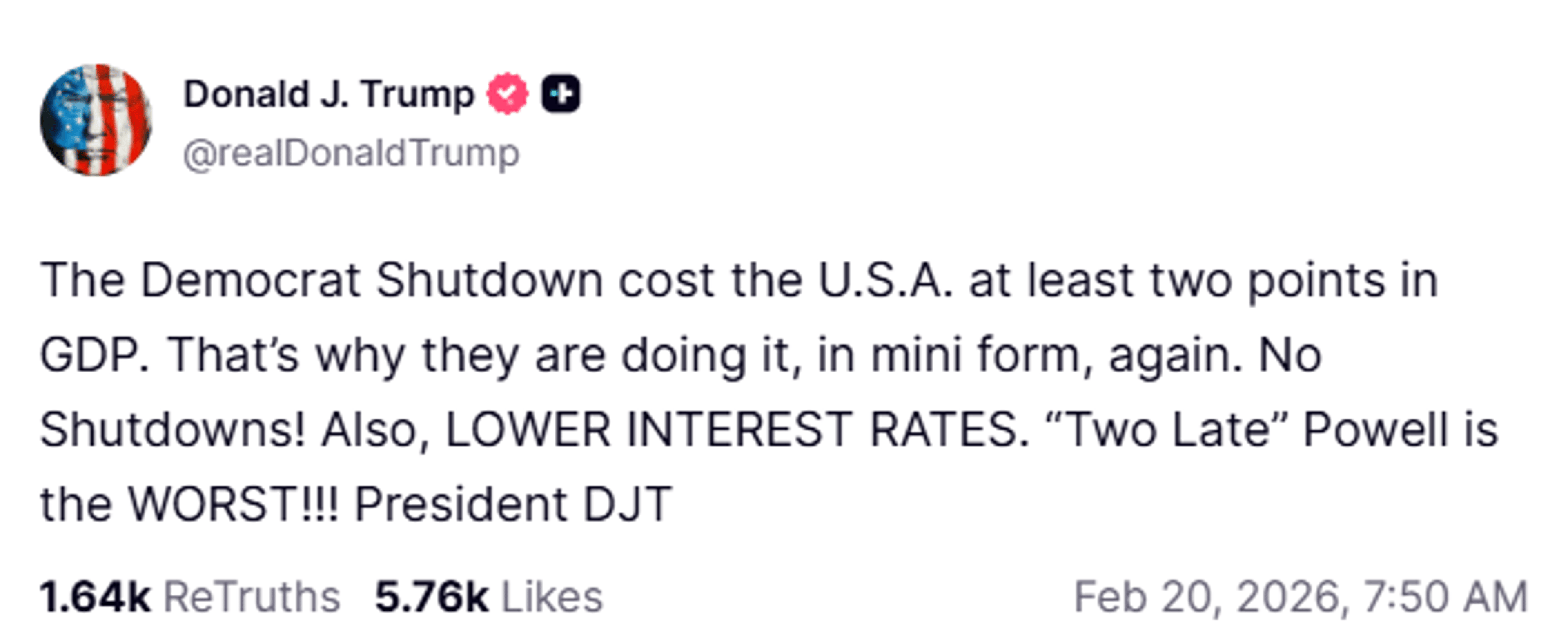

Social•Feb 20, 2026

Core PCE Near Target; Fed Cuts Still Unlikely

Q4/Q4 core PCE inflation was 2.9% last year (vs. 3.0% in 2024). Trump's statement on the GDP report includes a parenthetical jab at the Fed chair, but there's not much of anything in this report that tells the Fed it...

By Nick Timiraos

Social•Feb 20, 2026

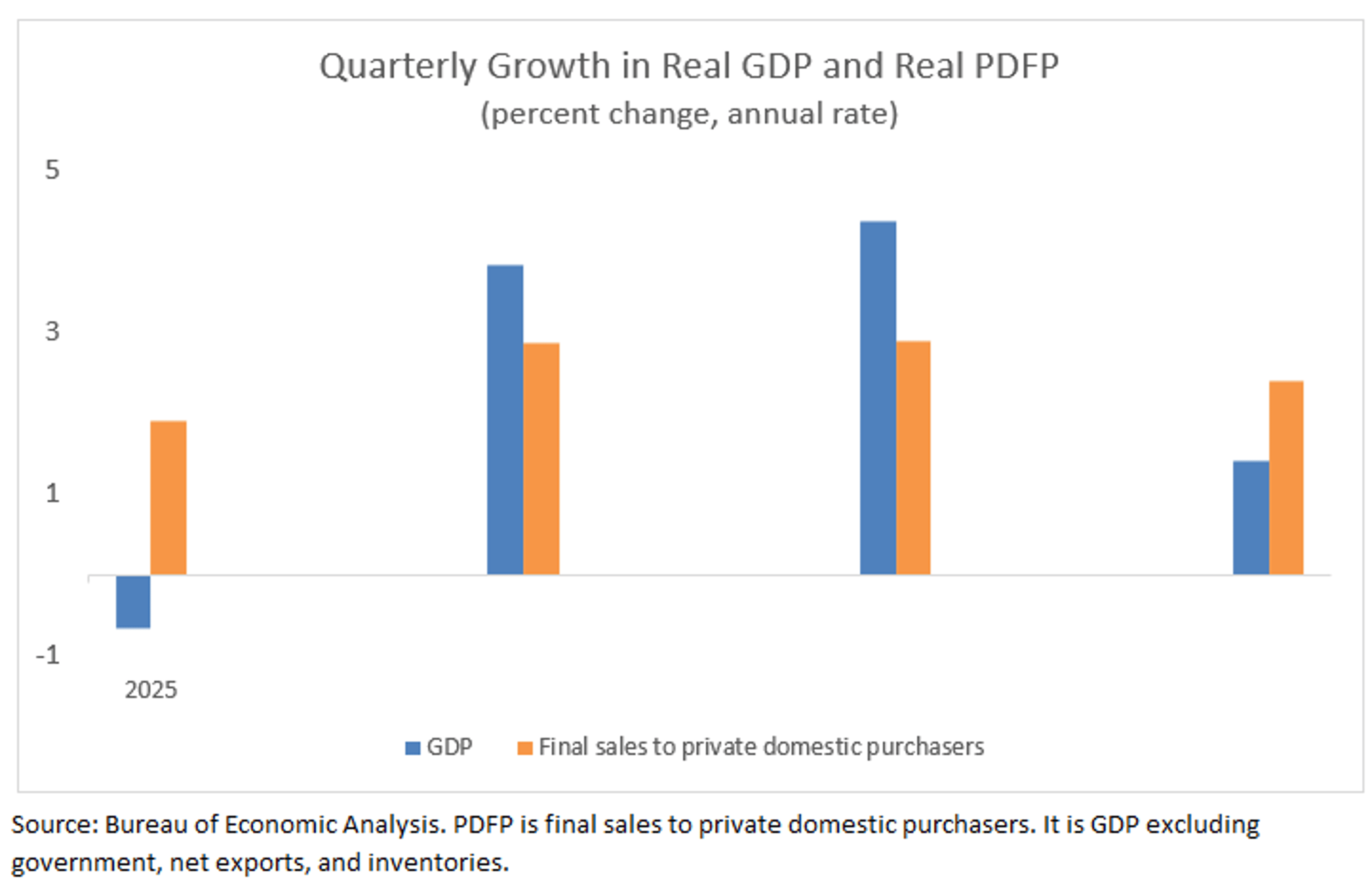

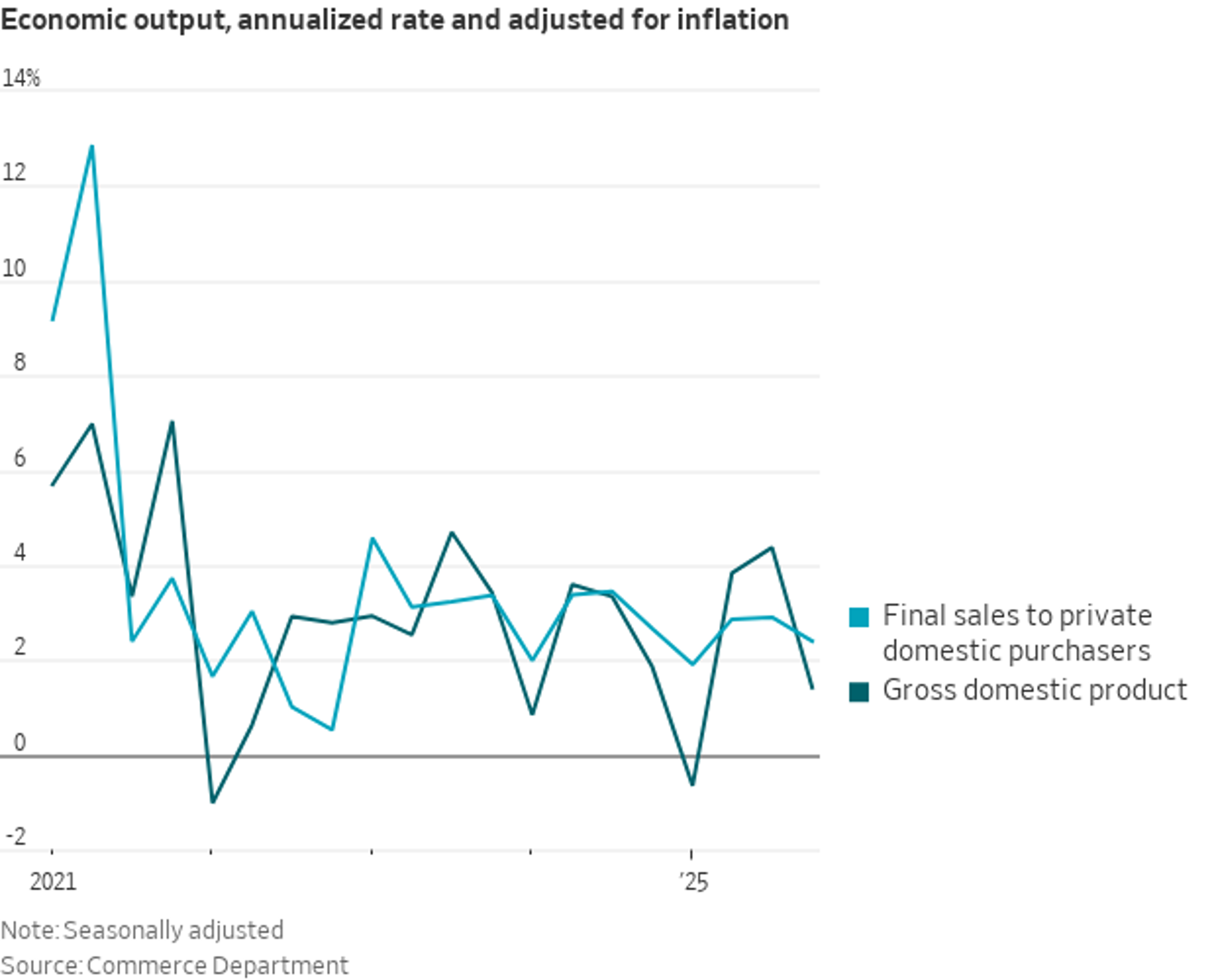

2025 GDP Volatile, PDFP Shows Steady Growth

Did 2025 feel like a wild ride? GDP feels your pain. The quarterly swings were big and short-lived. PDFP, which focuses on consumption and private fixed investment, showed more even, solid gains. https://t.co/LlVwQ7yna5

By Claudia Sahm

Social•Feb 20, 2026

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

Social•Feb 20, 2026

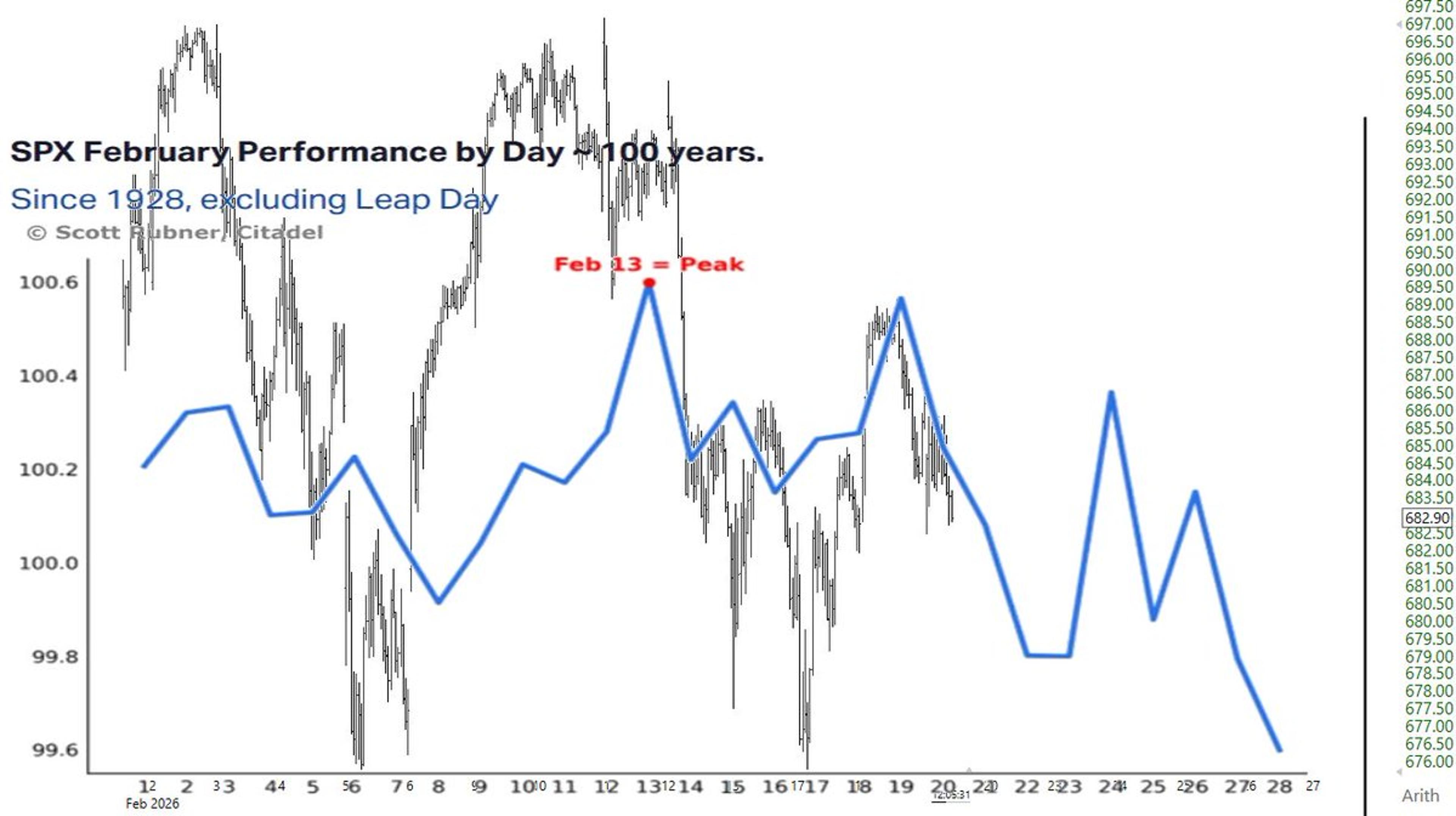

Current Feb Mirrors Century‑Long SPY Performance Trends

$SPX.X $SPY Feb performance by day 100 years overlaid on MTD action of SPY https://t.co/x1W4uABOCj

By Brian Shannon, CMT