Social•Feb 18, 2026

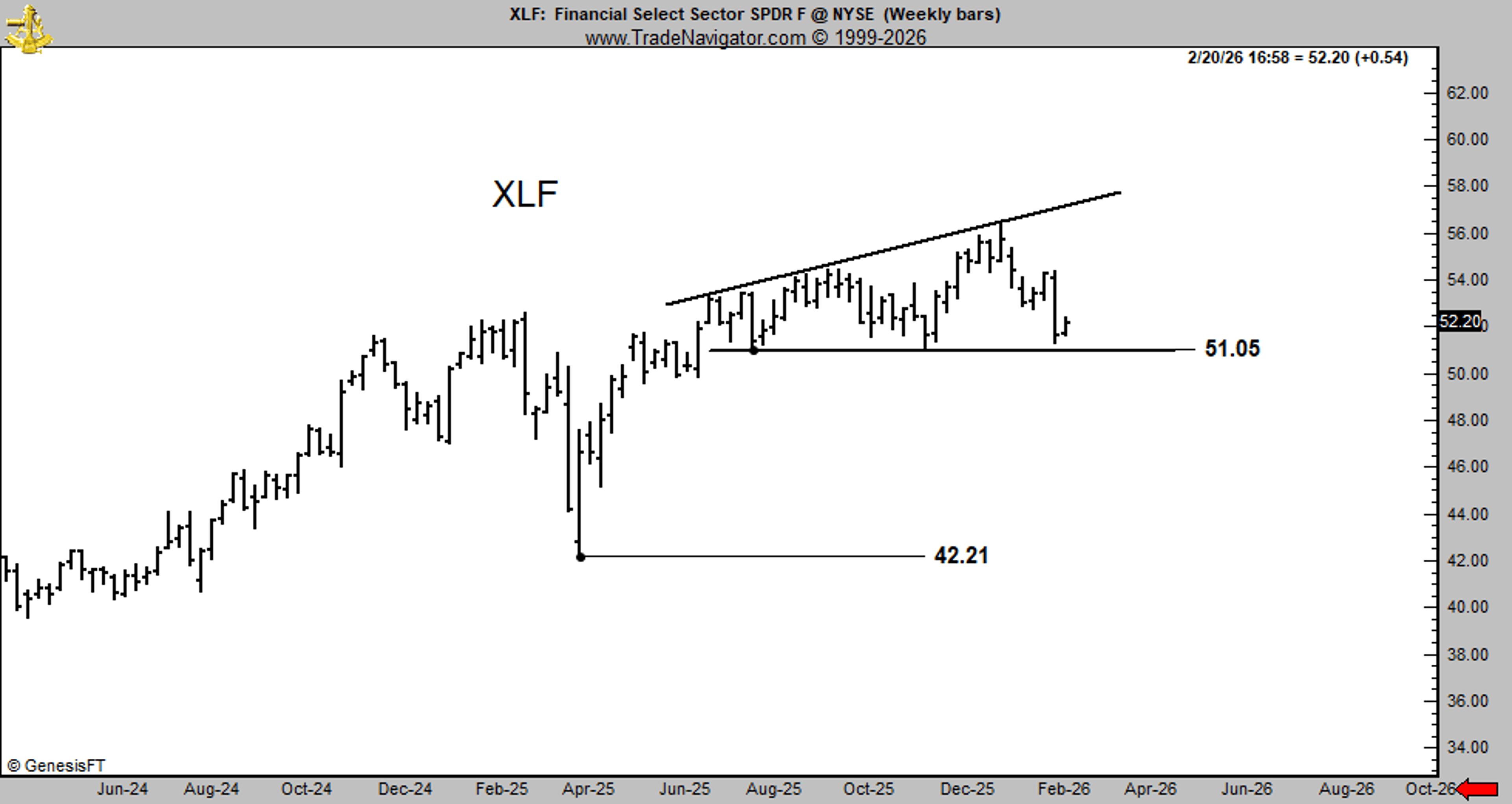

Right‑angled Broadening Pattern Signals Bearish Outlook

The rules of classical charting principles have been lost to the younger generations. This is a right angled broadening pattern. According to E&M, 5th edition, page 149, the pattern has bearish implications regardless of which boundary is horizontal $XLF Don't shoot the messenger

By Peter Brandt

Social•Feb 17, 2026

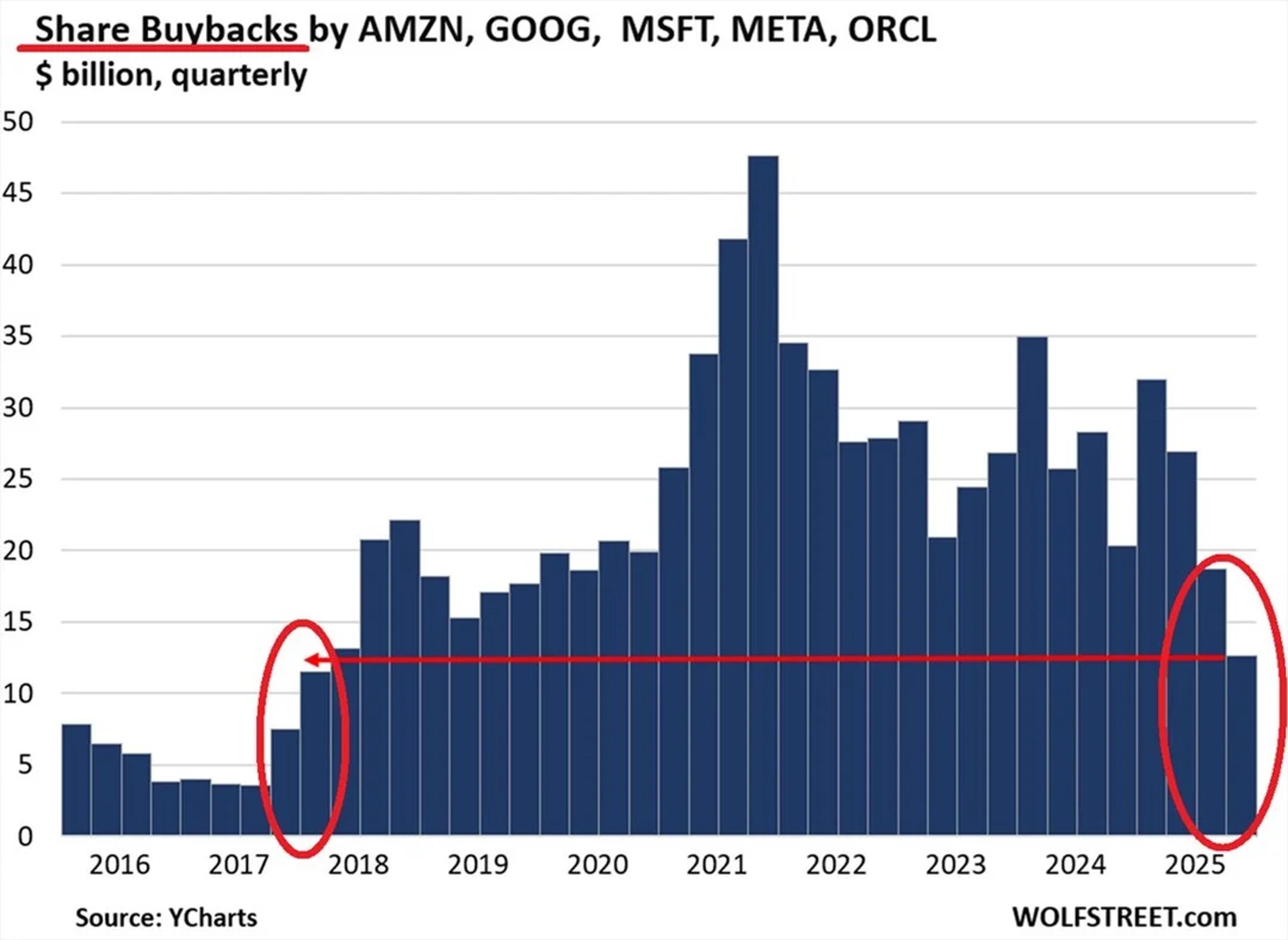

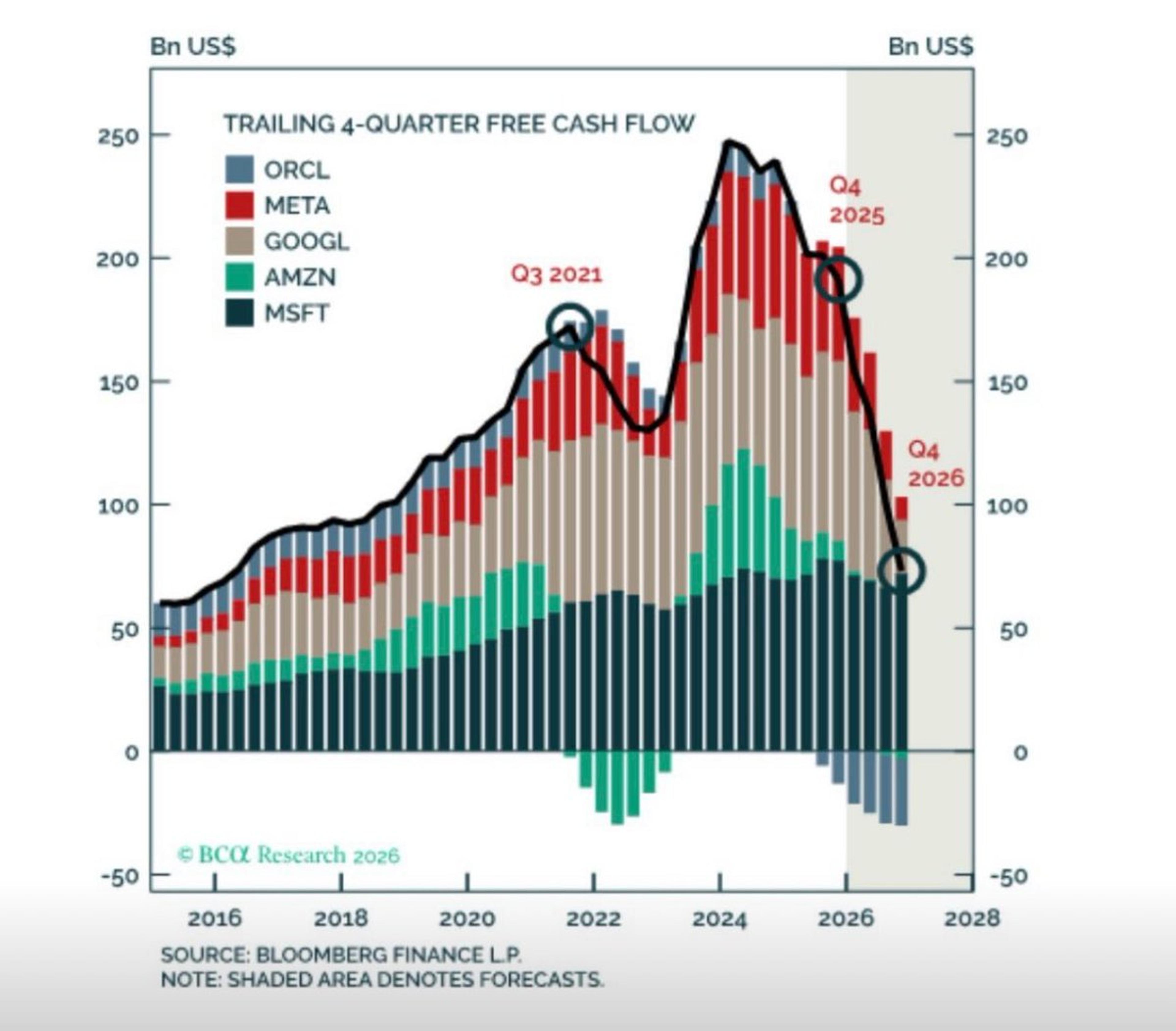

Big Tech Cuts Buybacks, Shifts to AI Spending

‼️The largest US stock buyer since 2009 is STEPPING BACK: Combined buybacks by Amazon, Alphabet, Microsoft, Meta, and Oracle fell to $12.6 billion in Q4 2025, the lowest in 7 YEARS. This marks the 3rd quarterly decline, a -70% DROP from the...

By Global Markets Investor (newsletter author)

Social•Feb 17, 2026

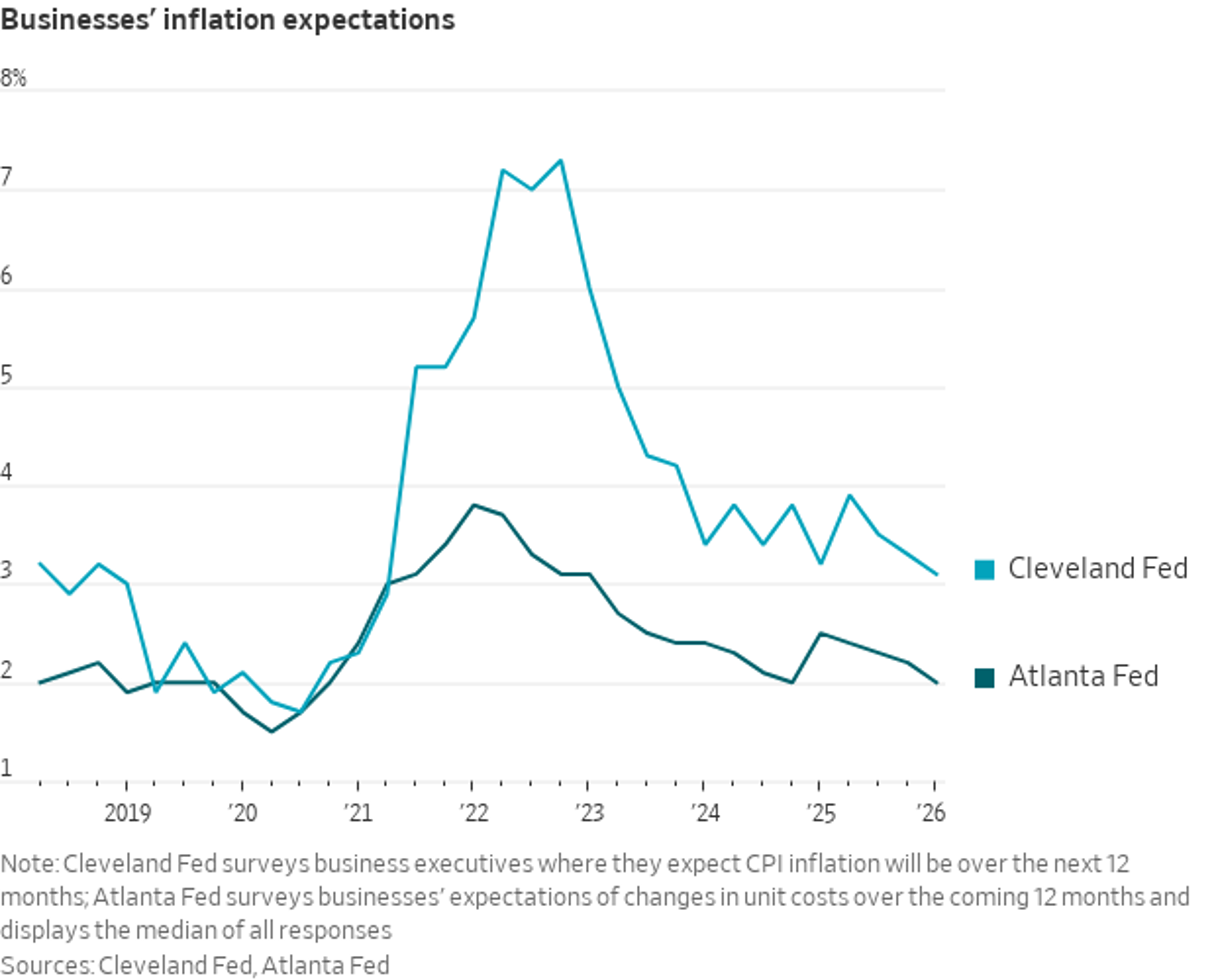

Business Inflation Expectations Return to Pre‑Pandemic Levels

Two different measures of business inflation expectations have essentially returned to pre-pandemic levels. The Atlanta Fed survey (dark line), which asks businesses how much they expect their own unit costs to change, is back at 2%—right where it was in 2019....

By Nick Timiraos

Social•Feb 17, 2026

Dollar Up Shows Unchanged Signal Amid Correlation Risk

If there was something else to "dig into", I would have. Dollar Up has its implied Correlation Risk today. I'll do what the signal does. It didn't change.

By Keith McCullough

Social•Feb 17, 2026

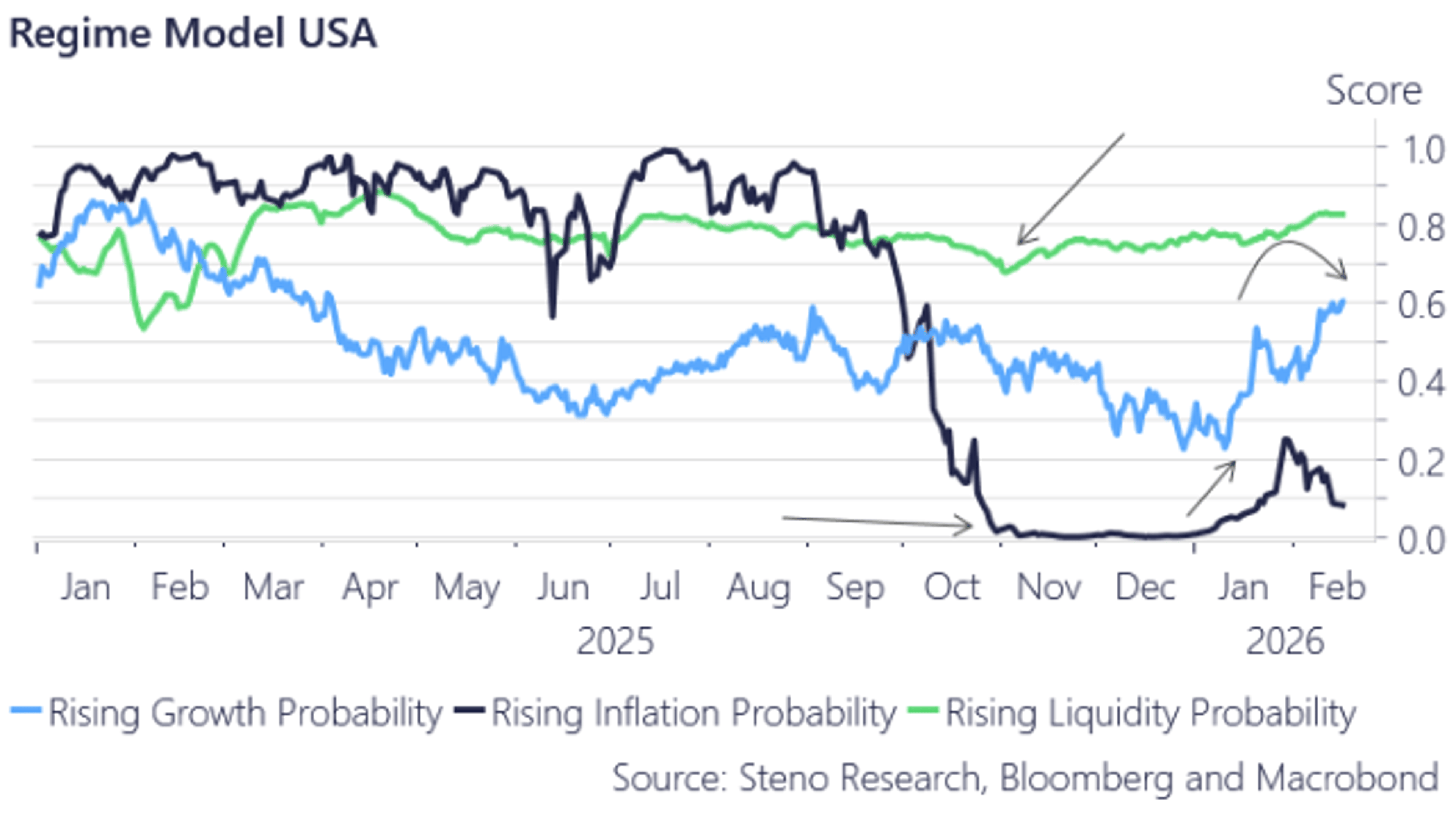

Nowcast IQ Predicts US Growth Despite Market Pessimism

A few of our weekly inputs have come in for US growth. We continue to rebound hard cyclically. EURUSD down, US assets (soon) up, and ISM PMI towards 60 by summer. Our Nowcast IQ is telling a VERY contrarian story to...

By Andreas Steno Larsen

Social•Feb 17, 2026

Retail Favorites, IPO Timing, and Base Rates Explained

🔬 Research links: the stocks retail investors favor, the impact of IPO timing, and why base rates matter so much. https://t.co/cjmTGAY0wz chart: https://t.co/rvyduDs39u https://t.co/EKv26rorKm

By Tadas Viskanta

Social•Feb 17, 2026

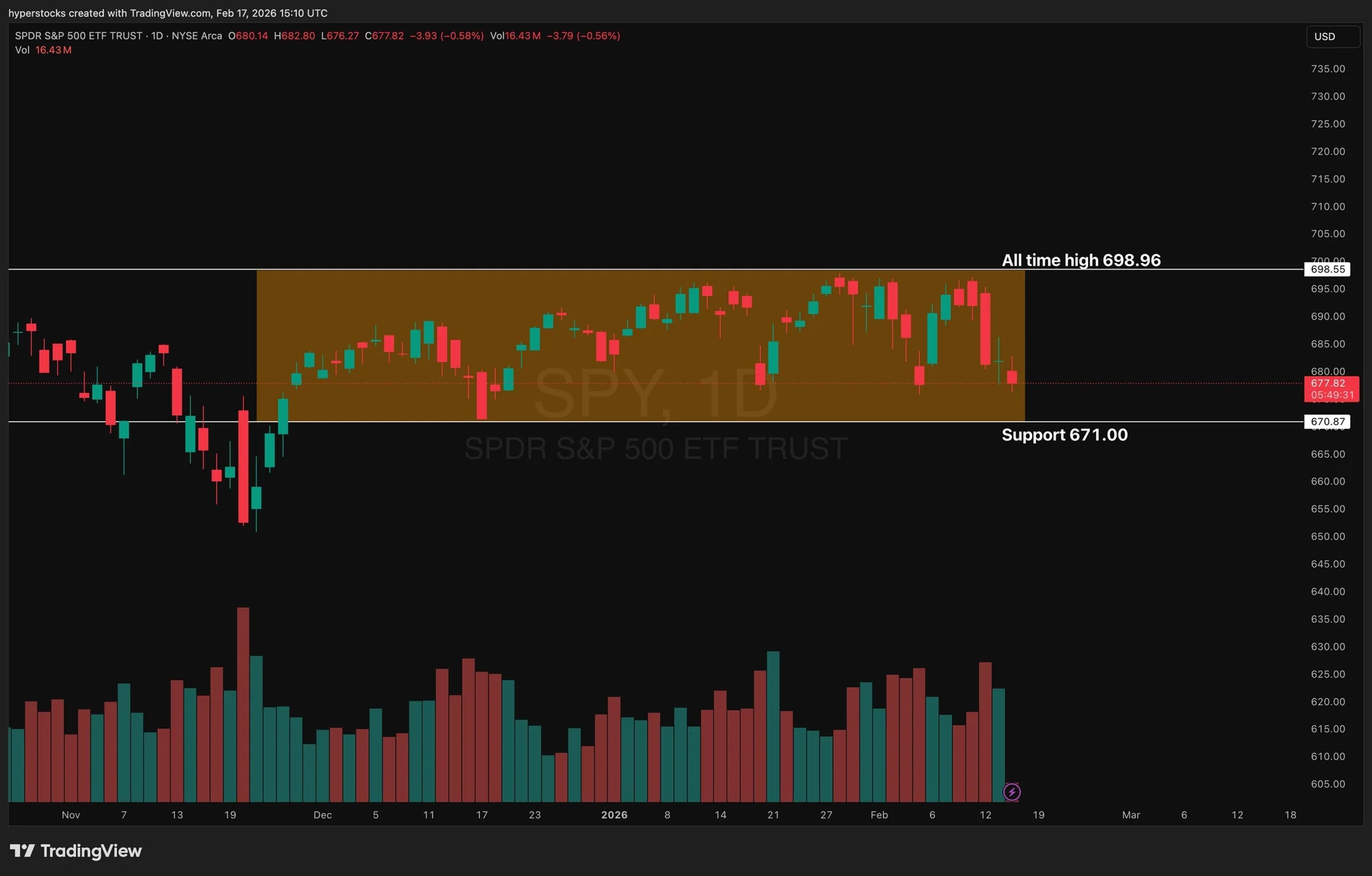

SPY Poised to Break November Range Amid Key Data

Is it finally the week $SPY breaks this range? Stuck here since November. Reports scheduled this week: - U.S. Trade Deficit Report (Thu) - GDP (Fri) - Inflation Report (Fri) - Consumer Sentiment (Fri)

By Hyperstocks

Social•Feb 17, 2026

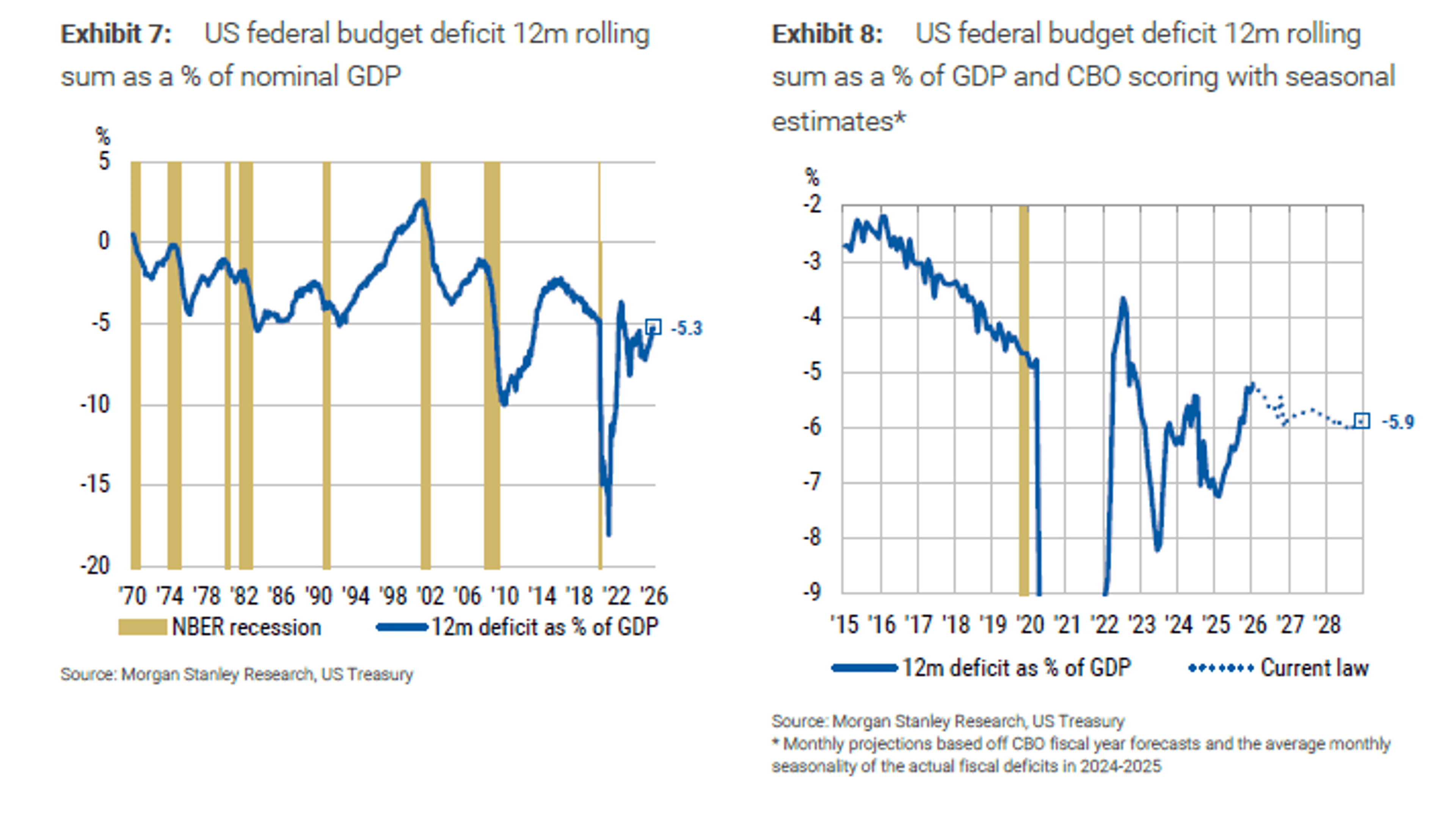

New Projections Quiet Bond Vigilantes, Ease Debt Fears

New US deficit and growth projections ""suggest a quiet period ahead for bond vigilantes and others who hand-wring over the unsustainable nature of the US debt and the inevitable market revolt – the Godot for which they have waited impatiently...

By Lisa Abramowicz

Social•Feb 17, 2026

Watch MU’s $386 Support to Gauge Memory Group Strength

📺 IS THE MEMORY GROUP STILL “SPECIAL”? $MU, $SNDK, and $WDC were some of the strongest names in the market recently. The key question is whether this group can maintain its leadership while broader tech faces downside pressure. $MU trade framework: – If $MU...

By Scott Redler

Social•Feb 17, 2026

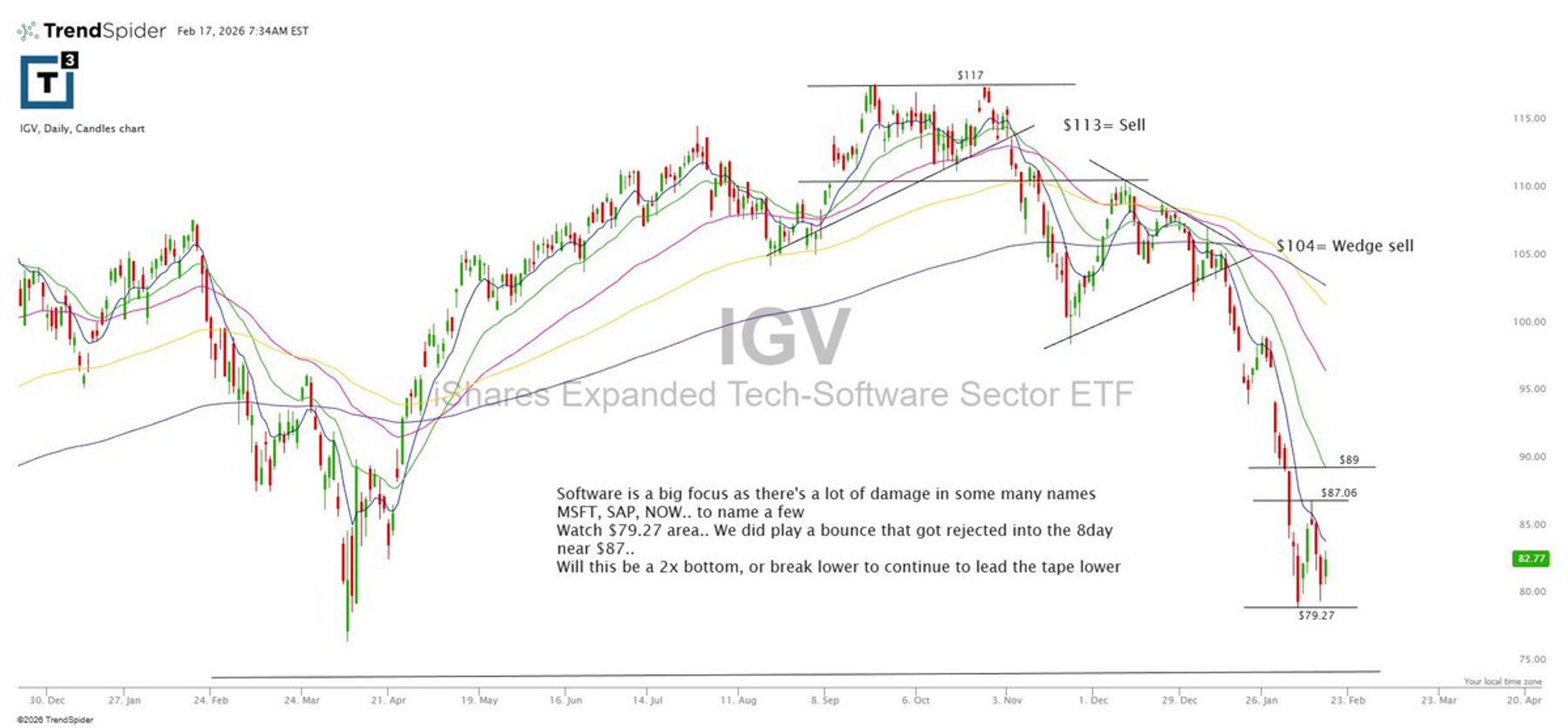

IGV Bottom? Watch

Did we get a 2X bottom in $IGV or does it take another leg lower. $orcl worth a look if software tries to hold last weeks low https://t.co/bmeM49XP1F

By Scott Redler

Social•Feb 17, 2026

Market Awaiting Decisive Breakout: Support or Resistance?

📺 THIS MARKET NEEDS RESOLUTION The market is stuck in a range. Breakouts fail, breakdowns bounce, and both longs and shorts get frustrated. We need a decisive move that breaks the range and sticks. That could mean: 🔻 A clean break below support $QQQ...

By Scott Redler

Social•Feb 17, 2026

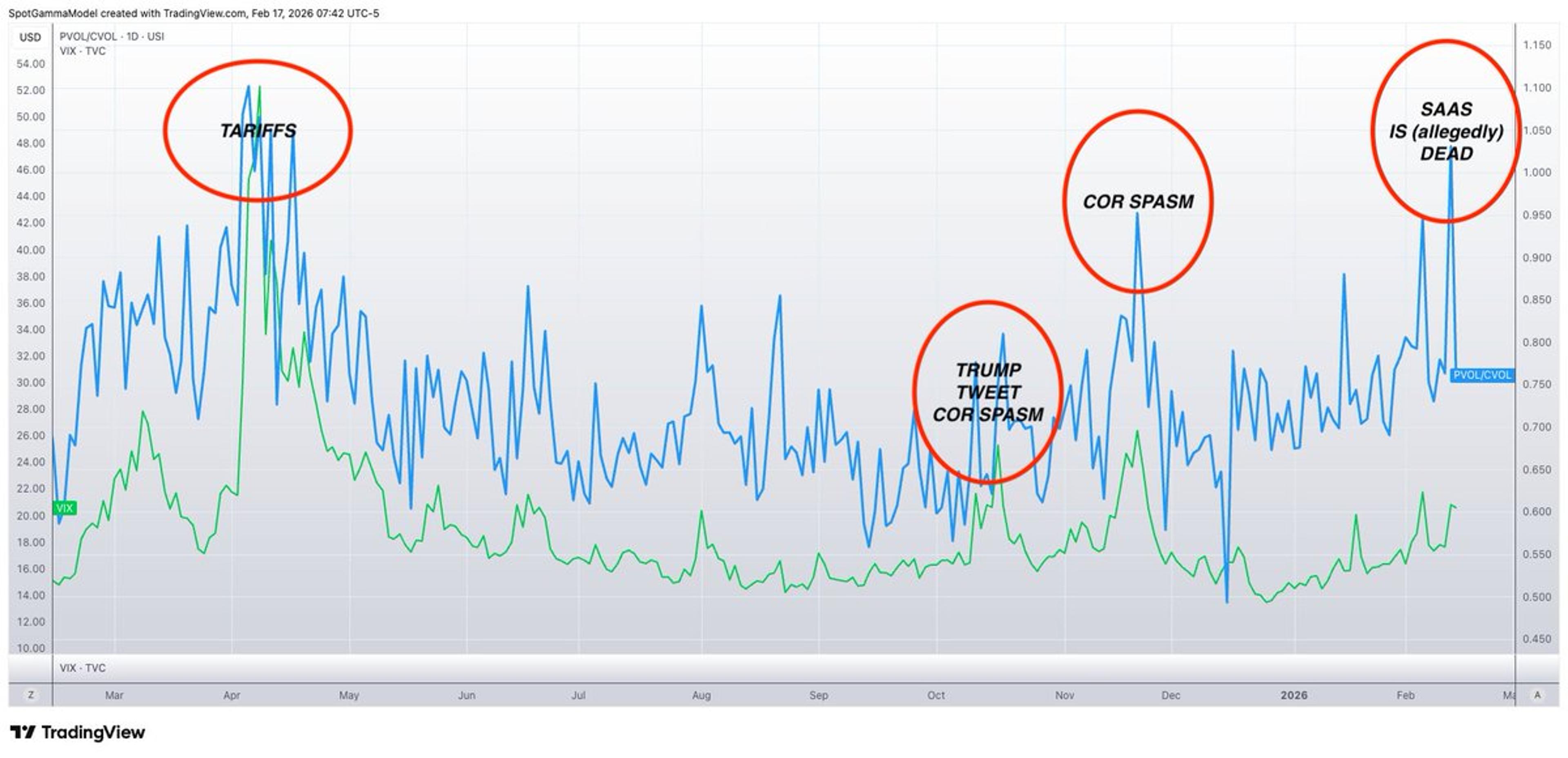

VIX Lags Behind Single‑Stock PC Ratio Indicator

In the spirit of committing chart crimes, here is the single stock PC ratio vs the VIX (green). VIX, a proxy for SPX IV, is clearly lagging. Likely unrelated is that VIX exp is tomorrow... https://t.co/ygiUeMv38z

By Brent Kochuba

Social•Feb 17, 2026

SPX Below 50‑Day MA, Support at 6780‑6790

$SPX is now below the 8/21/50day. The longer we sit under 6880ish the higher the odds we see lower prices. A reclaim back above there keeps this range action intact, while 6780–6790 remains the key major support zone. https://t.co/Zmq5a33GXE

By Scott Redler

Social•Feb 17, 2026

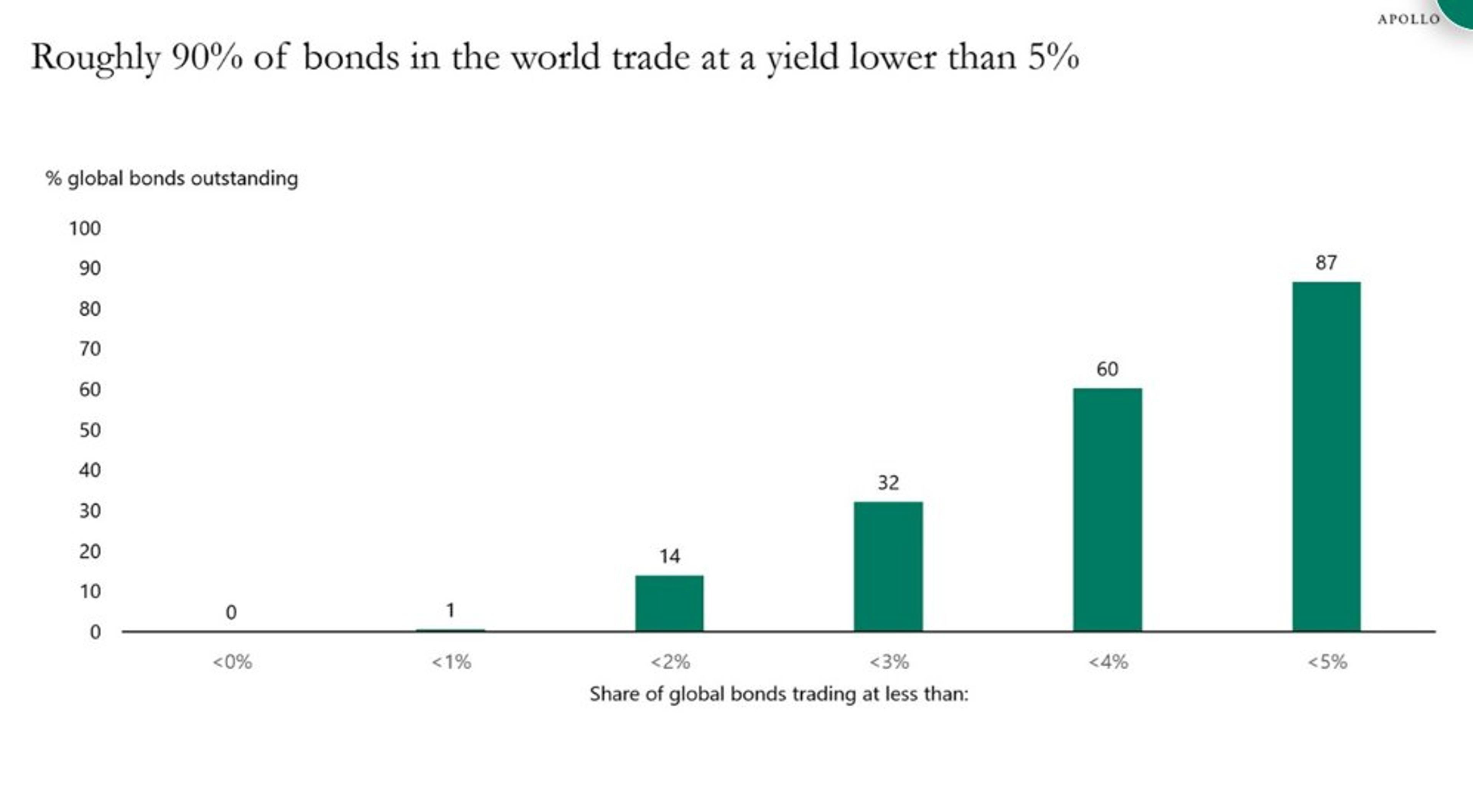

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

Social•Feb 17, 2026

Institutional Sentiment Swings Rapidly Amid AI Disruption Fears

This week’s episode explores a dramatic shift in sentiment that unfolded in just a few days. Emily and Michael are joined by Jay Glickson (Macro Sales) to discuss what institutional investors are saying, how AI disruption fears are shaping their...

By Michael Kantro

Social•Feb 17, 2026

Nvidia

"AI Revolution" - Nvidia unchanged since July, off 3% in 2026. Street Research $NVDA at $181 Buys 92.8% ...

By Lawrence McDonald

Social•Feb 17, 2026

Foreign Investment Steady, US Stocks Slightly Lagging

Balanced take from Bob. While the headline may be different than my "get out" thesis. The meat says the same. Flows suggest marginally weaker dollar and relative underperformance of U.S. stocks vs ROW. Don't panic out...

By Andy Constan

Social•Feb 16, 2026

AI Accelerates Market Signal Turnover and Degradation

One thing I feel strongly about regarding AI is that, when it comes to trading, we are going to witness a streamlined cycle of signal degradation. Classical signals will become crowded very quickly. The market will rotate through those cycles faster...

By Kris Sidial

Social•Feb 16, 2026

Low‑end Apple Releases Spark Brief Sales Bump

Agree with Mark. March 4 will likely be highlighted by a low-end MacBook and maybe a new lower-priced iPhone 17e (the 16e came out a year ago). Siri won't be addressed. My take: The low-end products have historically led to a...

By Gene Munster

Social•Feb 16, 2026

2025 Profitability Snapshot: Sector Returns & Excess Gains

In my sixth data update, I look at business profitability in 2025, across sectors, industries and regions, scaled to revenues (profit margins) and to invested capital (accounting returns). I use the latter to compute and compare excess returns. https://t.co/L3PDmph4VA

By Aswath Damodaran

Social•Feb 16, 2026

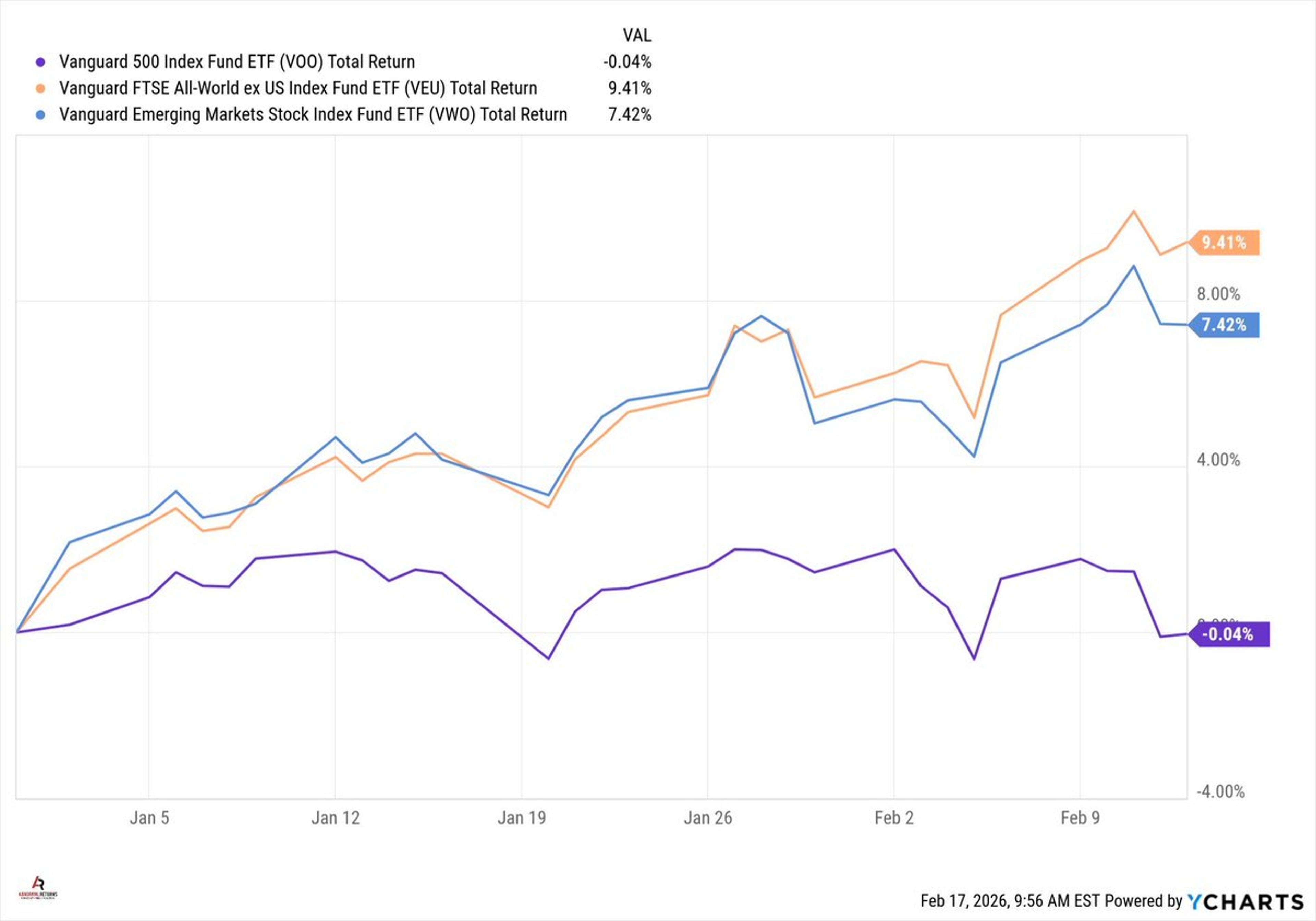

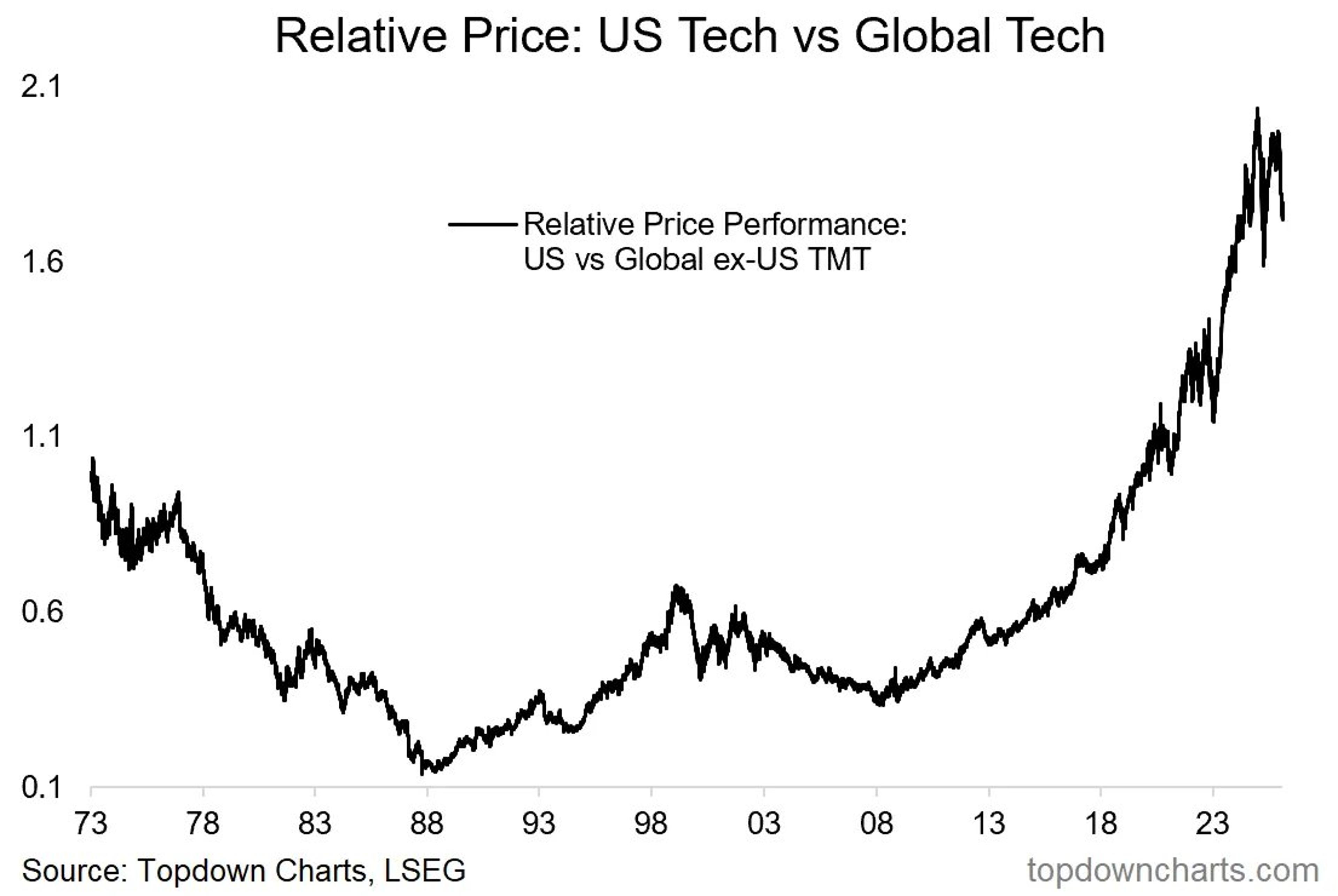

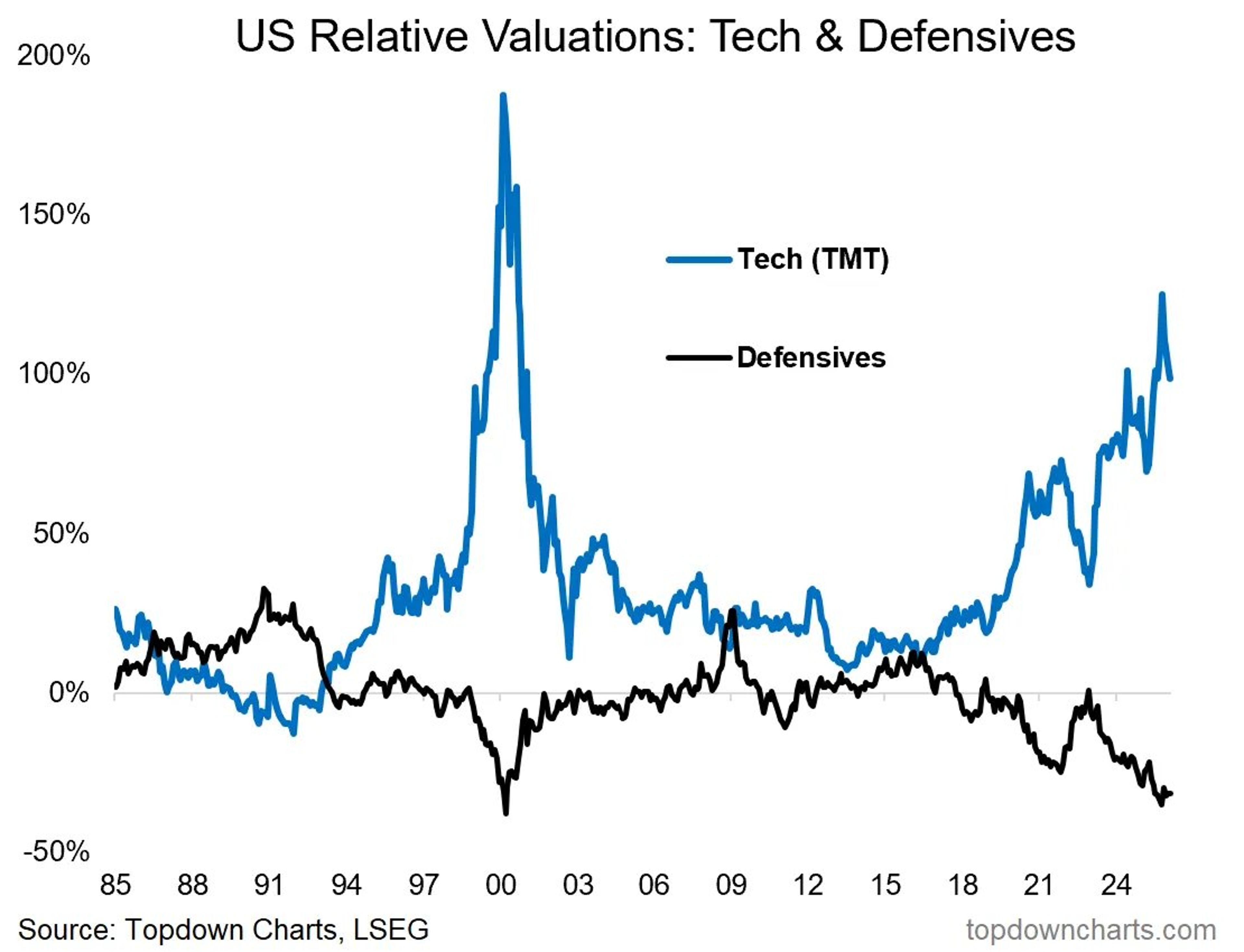

US Tech Dominance Fades as Global Rotation Shifts

This chart captures the 2 most important themes in the Stockmarket right now. 1. Global vs US rotation 2. Top in tech stocks For the past 17-years US Tech stocks have dominated global markets, but that is starting to change... https://t.co/6DhUXusR6C

By Callum Thomas

Social•Feb 16, 2026

Investors Shift From S&P 500 to Alternatives, Gains Accelerate

Rotation away from S&P500 (flat on the year) into other assets like foreign stocks, US value, etc up 10-15% seems to be accelerating...

By Meb Faber

Social•Feb 16, 2026

Weekly S&P 500 Chart Review Highlights Key Trends

ICYMI: Weekly S&P500 #ChartStorm blog post https://t.co/B5a4uBC2Q4 Thanks + follow reco to chart sources @MarketCharts @topdowncharts @dailychartbook @MauiBoyMacro @KobeissiLetter @StealthQE4 @HayekAndKeynes

By Callum Thomas

Social•Feb 16, 2026

Sector Rotation Ends; Brace for Upcoming Volatility

Given I timed the sector rotation with precision in Nov & said it would likely run until Feb, and we are here, I'm gonna share what else I also told clients: IN LIEU OF SECTOR ROTATION, THERE WILL BE VOLATILITY™️😉

By Samantha LaDuc

Social•Feb 16, 2026

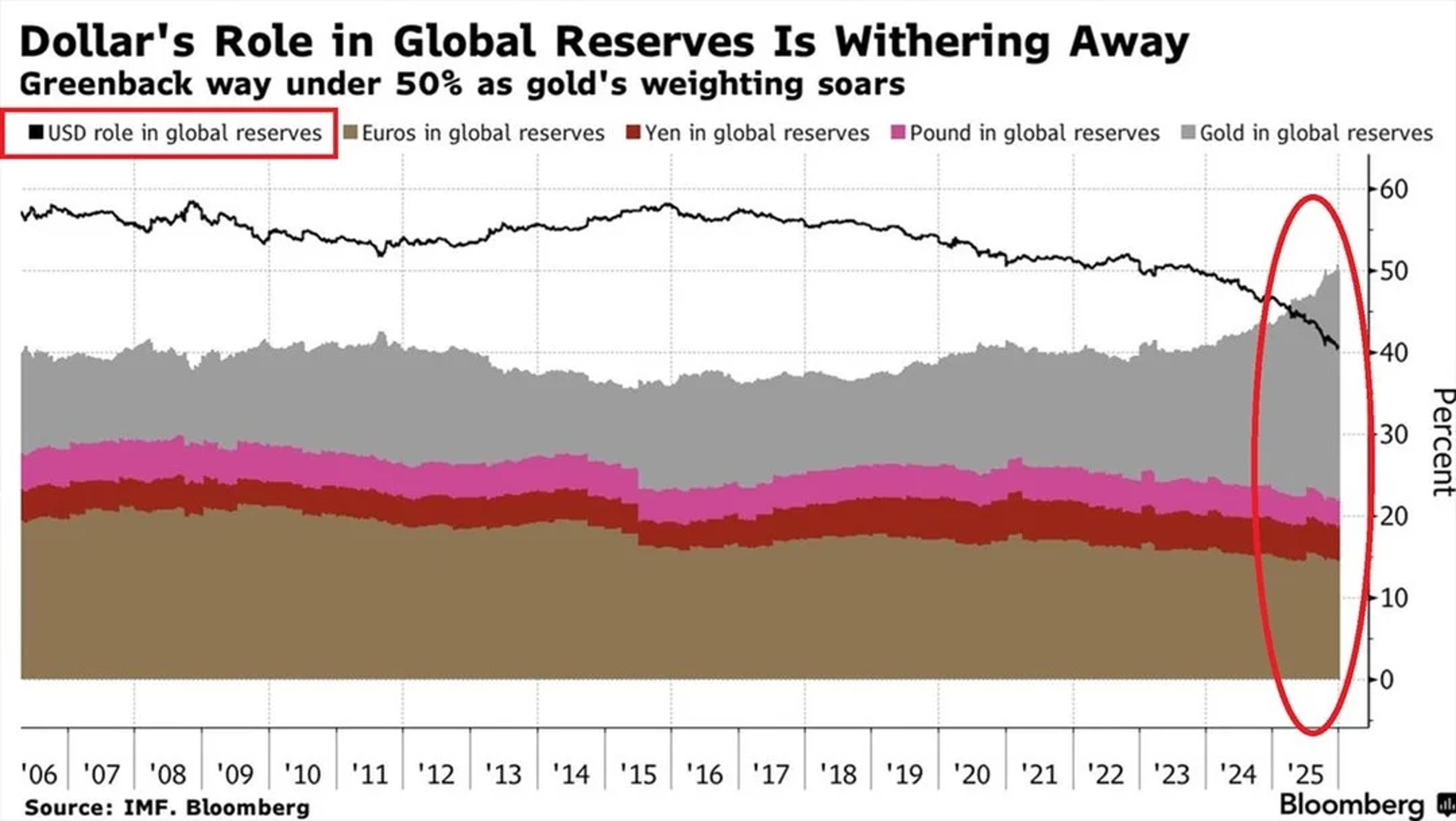

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

Warsh May Threaten Fed Stability Despite Doubtful Capability

Good piece. Warsh would be a fundamental break from the Bernanke, Yellen, and Powell Feds if he carried out his views. Do I think he’s capable of pulling that off? Not really. Do I think he might try to and...

By Claudia Sahm

Social•Feb 16, 2026

Metal Volatility Reveals Hidden Market Shifts

Metal Volatility Changed Everything $GLD $SLV $BTCUSD $SPX $QQQ $IGV $XLK Sharp volatility in gold, silver, crypto and equities was easier to spot than most think. And why I study sector rotation, options structure, and investor confidence. https://t.co/PYmLxcJSCJ

By Samantha LaDuc

Social•Feb 16, 2026

US Growth Decouples From Jobs, Entering Uncharted Territory

Via the Financial Times: My thoughts on why US "jobless growth" may have entered uncharted territory. The decoupling of US growth from employment looks more persistent—and consequential—than the three previous episodes we've seen over the last 40 years: https://www.ft.com/content/298a38bb-4cc1-44f3-bd62-6aff25d58b94 #economy #jobs #employment #unemployment #growth...

By Mohamed El‑Erian

Social•Feb 16, 2026

Chamath's SPACs Crash: All Lose Over 90%

Meanwhile Chamath Palihapitiya’s SPAC track record - Chamath became the face of the SPAC boom through his Social Capital Hedosophia deals. Their performance since? • $SPCE: −95% • $OPEN: −98% • $CLOV: −90% • $SOFI: −45% • $AKLI: −95% •...

By Doug Kass

Social•Feb 16, 2026

Institutional Cash at Historic Low Triggers Global Sell Signal

🚨Global equities 'SELL SIGNAL' was triggered for the 7th month STRAIGHT: Institutional investors' cash as a share of assets fell to 3.2% in January, the lowest EVER. Cash allocations at or below 4% indicate a SELL SIGNAL for world stocks.👇 https://globalmarketsinvestor.beehiiv.com/p/us-stocks-ended-the-week-mixed-after-a-powerful-rebound-on-friday-weekly-market-recap-trading-week-0

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

Flat Index Hides Underlying Market Turbulence

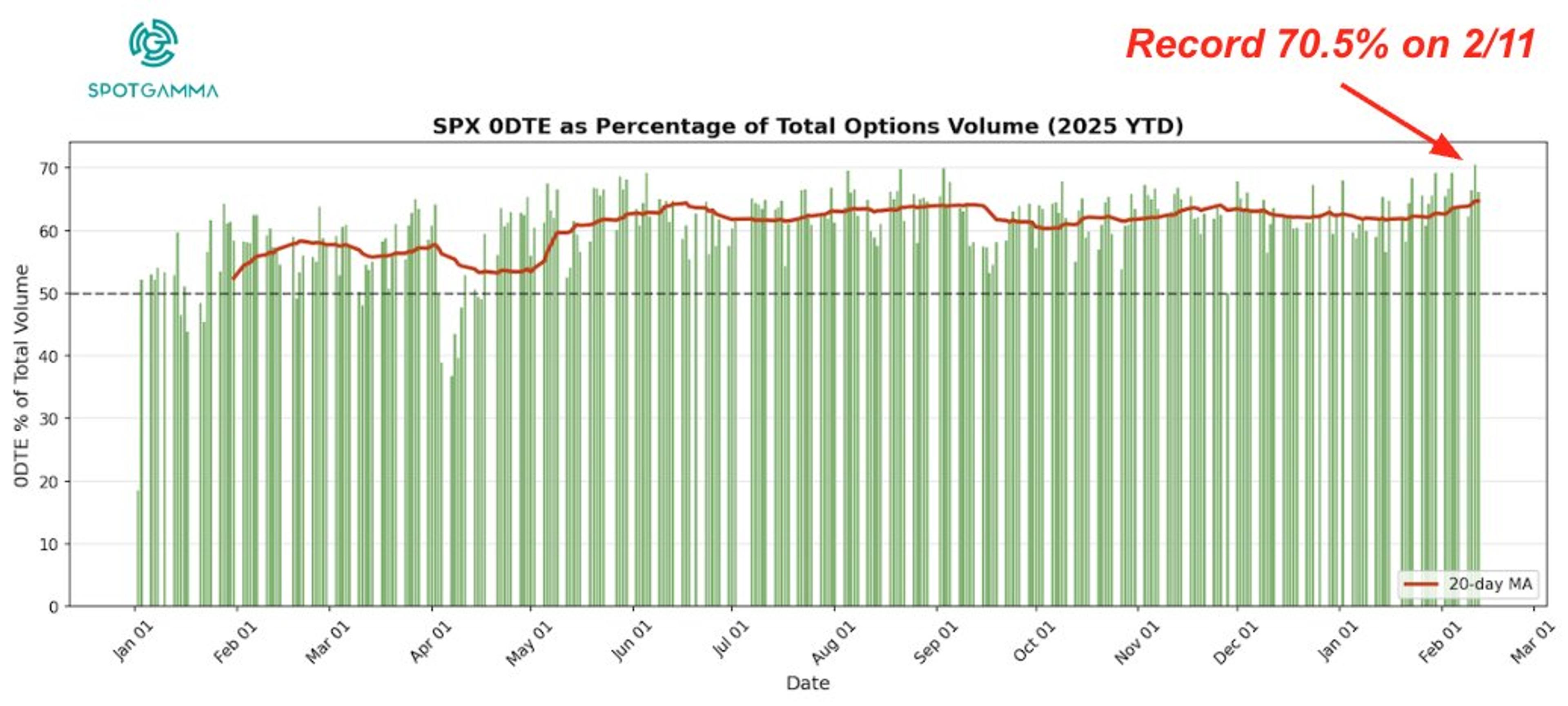

Flat Index Masks Hidden Chaos A guest contribution post by our partners at SpotGamma https://t.co/XlP50y4c9B

By Samantha LaDuc

Social•Feb 16, 2026

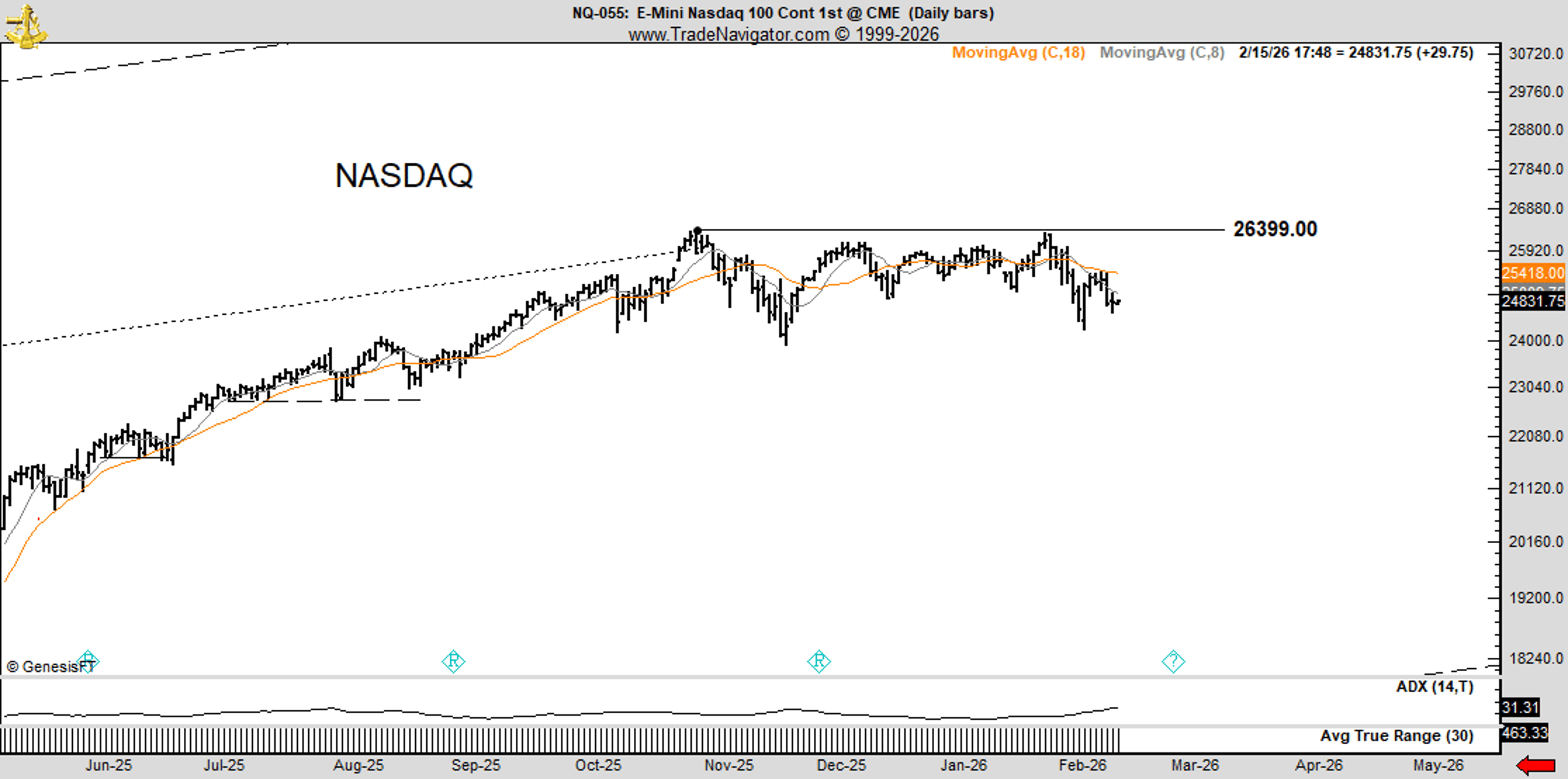

NQ Needs 26,800 Consolidation to Avoid Wyckoff Distribution

Unless and until NQ can consolidate above 26,800 there is a distinct possibility (50% Bayesian view) that this chart displays classic Wyckoff distribution For me the jury is still undecided @NQ_F $QQQ https://t.co/NdTFclpl7U

By Peter Brandt

Social•Feb 15, 2026

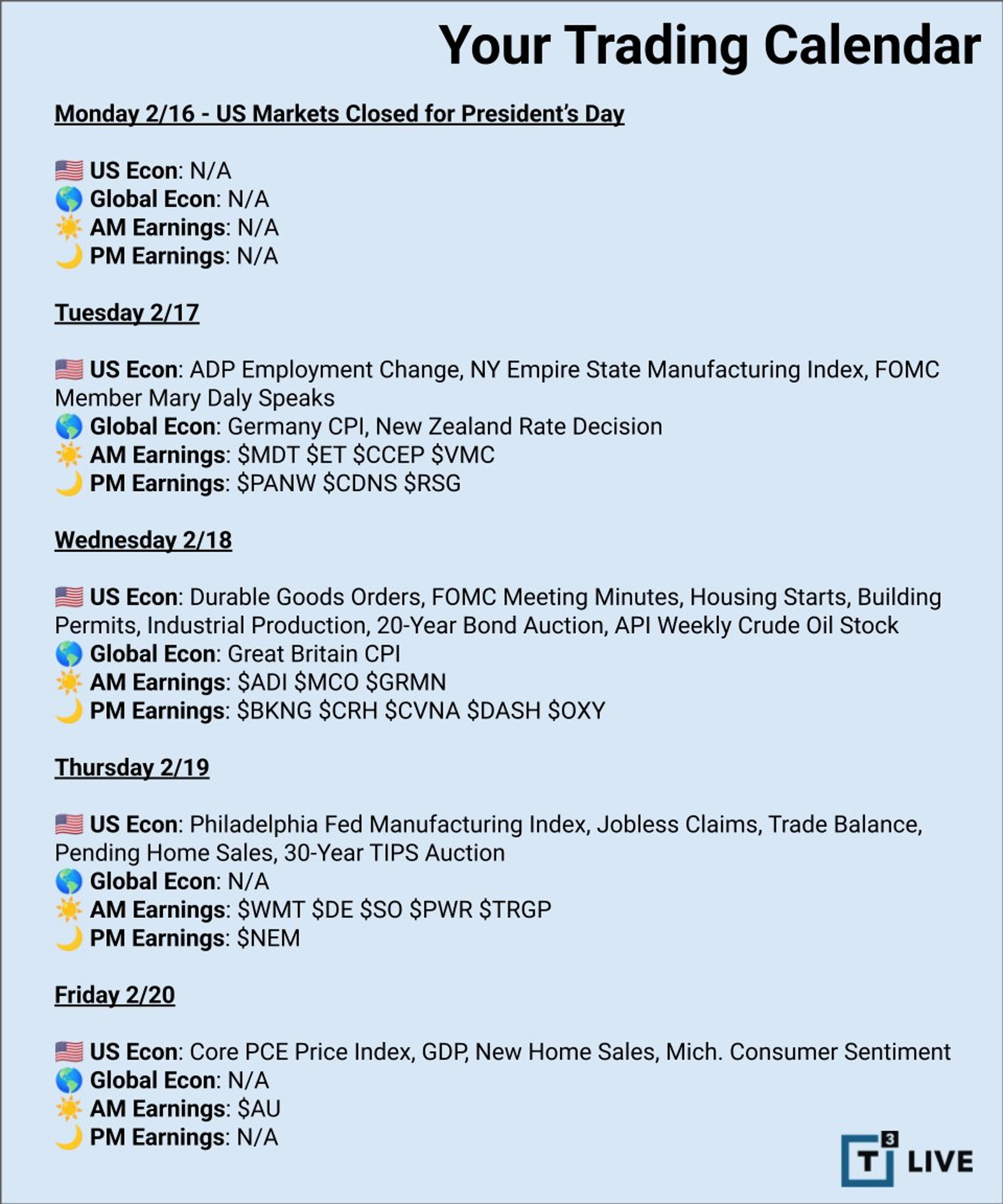

FOMC Minutes May Spark Q1 Market Shift

dailyanalysts 🚨 WEEK AHEAD ALERT: Feb 16-21 🚨 Three catalysts could define your portfolio's Q1. Markets closed Monday for Presidents' Day, but Tuesday through Friday is packed with market-moving data. S&P 500 is flat YTD. Nasdaq down 3%. Consumer confidence at DECADE LOWS. Here's...

By dailyanalysts

Social•Feb 15, 2026

S&P's Calm Mask Hiding Rising Dispersion and Volatility

The S&P 500 may appear calm on the surface, yet index-stock dispersion has increased dramatically and SPX has now slipped below the critical 6,900 level. With put skew rising and VIX expiration ahead, volatility risk is building. Read our latest...

By Brent Kochuba

Social•Feb 15, 2026

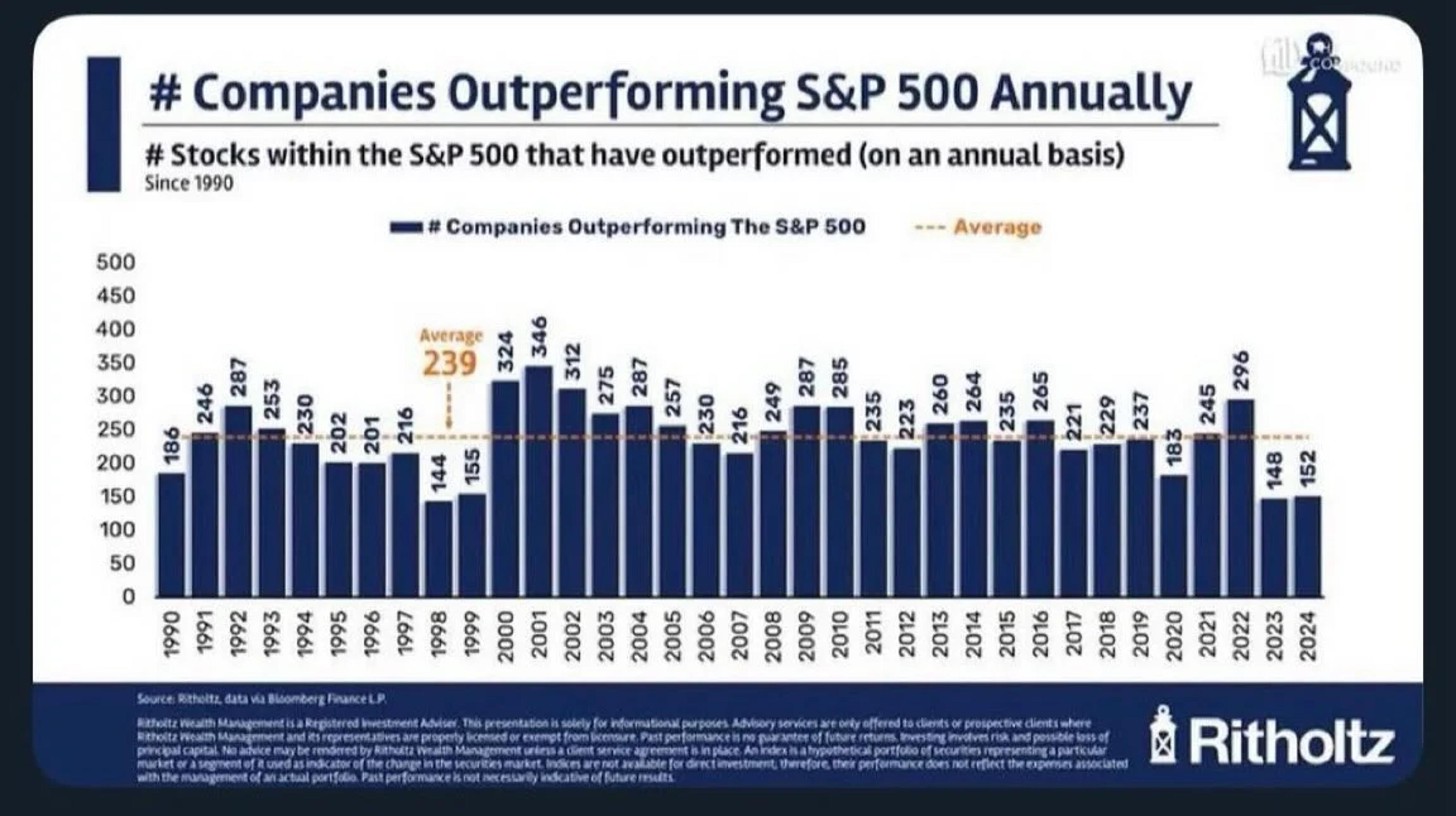

Tech Pullback Could Let Most S&P 500 Outperform

We have the potential to see a large portion of S&P 500 companies out perform in 2026. With the top 10 stocks making up around 40% of the index, even a slight pullback in tech would make this quite easy.

By Dividendology

Social•Feb 15, 2026

Semis Surge While Tech Splits Into Winners, Losers

If all you knew was that semis were up double digits, you'd never expect tech to be this weak. It is like tech is being split into two groups, the stuff that goes up and the stuff that goes down.

By Ryan Detrick

Social•Feb 15, 2026

Upcoming Week Packed with GDP, PCE, FOMC Insights

Get my newsletter Tuesday morning: https://t.co/dSU3TT2kZX Busy week coming with GDP, Core PCE, FOMC Minutes $PANW $ADI $WMT $DE https://t.co/7mNeUbi7R9

By Scott Redler

Social•Feb 15, 2026

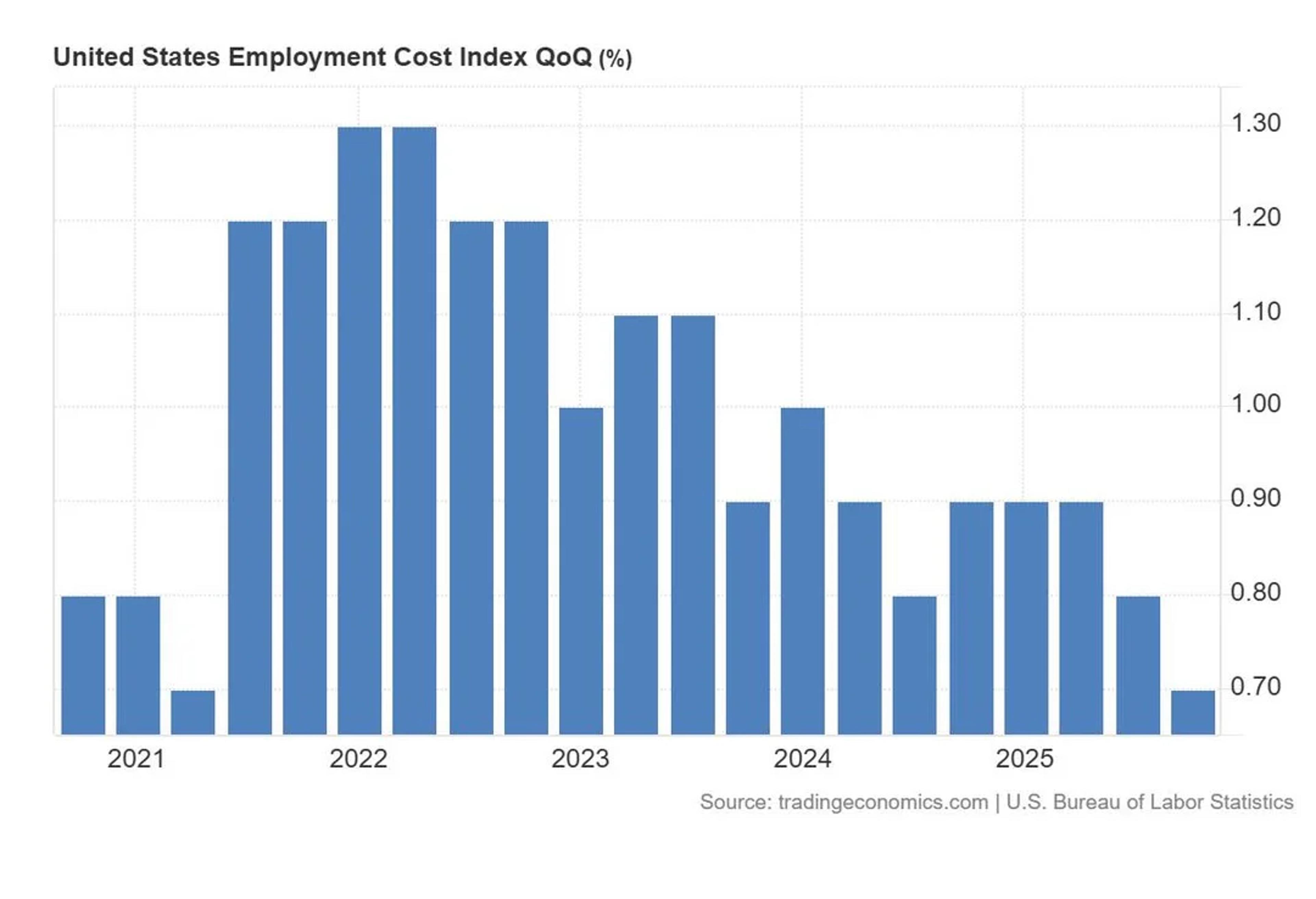

US Employment Costs Rise 0.7%, Lowest Since 2021

US employment costs rose 0.7% in the fourth quarter of 2025, just under forecasts of 0.8%, and the lowest level since Q2 2021.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 15, 2026

Tech Pressure Rises, Defensives Gain Amid Market Crossroads

Learnings and conclusions from this week’s charts: 1. Tech stocks (particularly software) remain under pressure. 2. Investor exposure to tech is at historically elevated levels. 3. Surging tech capex is coming at the cost of buybacks. 4. Private equity stocks are also coming under...

By Callum Thomas

Social•Feb 15, 2026

Young Investors' Account Transfers Triple in a Decade

The share of people 25 to 39 years old making annual transfers to investment accounts more than **tripled** between 2013 and 2023 to 14.4 percent, outpacing increases for those 40 and over -- JPMorgan Chase Institute https://t.co/gcJCu02dAu @WSJmarkets

By Gunjan Banerji

Social•Feb 15, 2026

0DTE Options Dominate SPX Volume at 70.5% Record

SPX 0DTE set a record at 70.5% percent of total SPX volume on 2/11. https://t.co/Mt3ulp1iSt

By Brent Kochuba

Social•Feb 15, 2026

U.S. Economy Near Soft Landing Amid Multiple Risks

This isn’t a victory lap, and it isn’t a doom story. The U.S. economy is closer to a soft landing than it’s been in some time, and there are real risks that could undo it from multiple directions. I try...

By Nick Timiraos

Social•Feb 15, 2026

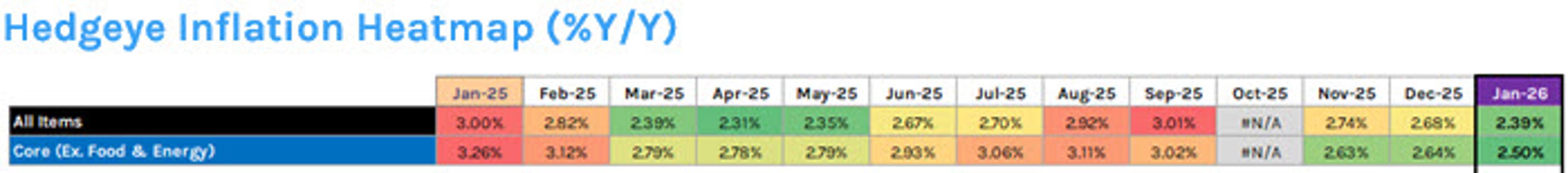

Hedgeye Nowcast Predicts Slowing Inflation, Yields Drop, Gold Rises

Hedgeye's Models vs. The Fed Reminder on the Hedgeye Nowcast for SLOWING US Inflation (which drove Bond Yields lower and Gold higher late this wk) Our monthly inflation nowcast is a weekly publication which augments our existing quarterly nowcast by offering a...

By Keith McCullough

Social•Feb 15, 2026

Strategists Misread CapEx, Overhype Free Cash Flow

I love how boomer strategists present the chart on free cash flows from the Mag 7 as rocket science. We learned on the first days at university that CapEx means less FCF in that year. Do these guys understand anything whatsoever...

By Andreas Steno Larsen

Social•Feb 14, 2026

Predicting Silver’s Peak and the Next Market

How I Called The Top In Silver & What Comes Next $GLD $SLV $GDX $SIL We also about my yen monetization framework, oil, AI-driven software disruption & timing a historic rotation into large-cap value. https://t.co/0A5l9bLx9C

By Samantha LaDuc

Social•Feb 14, 2026

USD Poised to Rise if Congress Regains Tariff Control

Wouldn’t that be something: $NVDA earnings 25th with SCOTUS decision on tariffs anytime after 20th… #IEEPA USD bullish in the short term if they hand back tariff control to Congress 🎰 $VIX

By Samantha LaDuc

Social•Feb 14, 2026

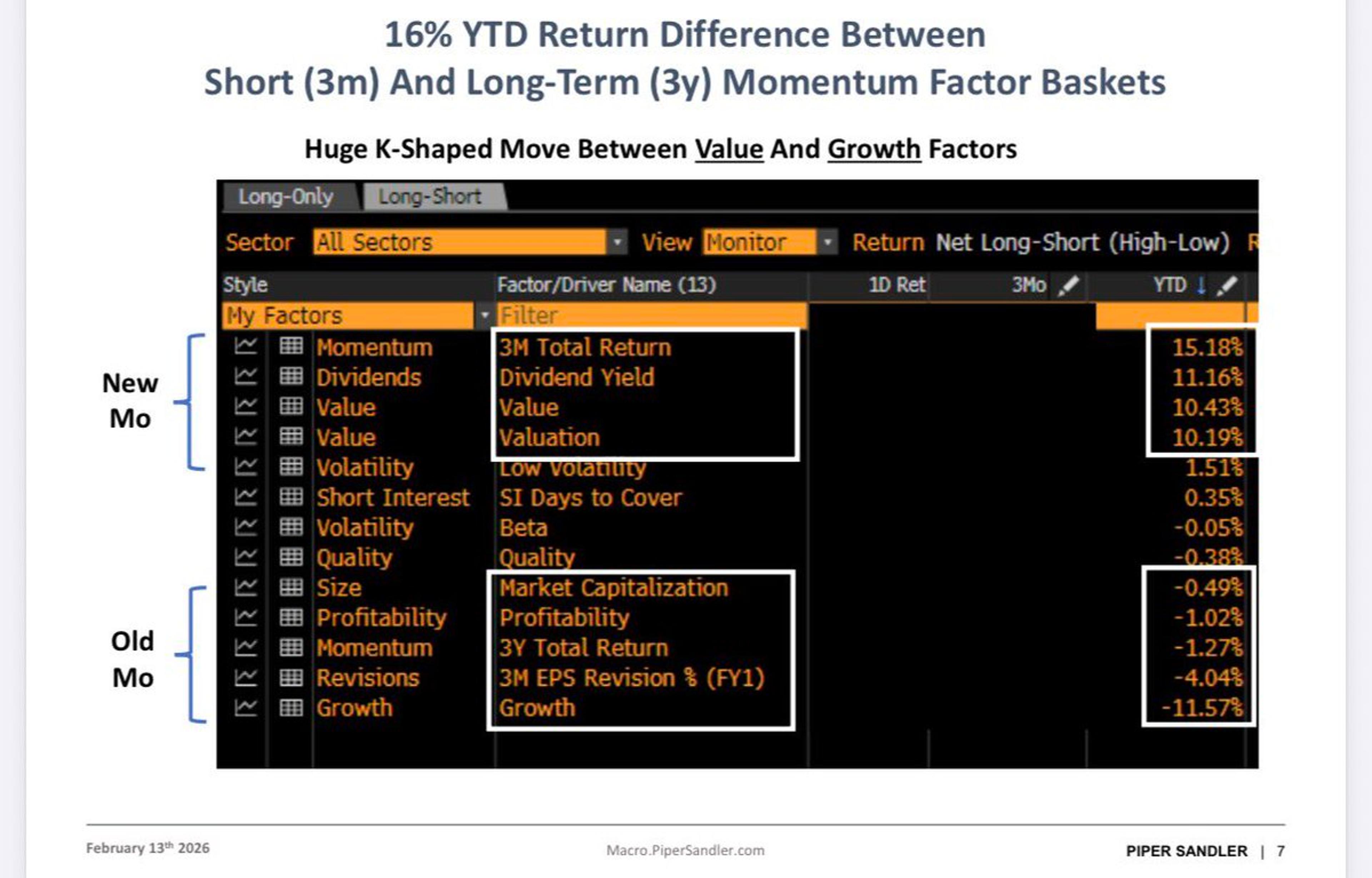

Value Tilt Gains as Momentum Spread Widens 16%

Classic monotonic pattern. When you see this pattern you know with a higher degree of certainty that it is one of THE drivers of how investors are positioning their portfolios. We’ve been recommending a value tilt since last fall, as...

By Michael Kantro

Social•Feb 14, 2026

Stocks Are only Cheap During Economic or Business Crises

There are really only two times when stocks become "cheap": collectively, - usually when the health of the economy is in question, - and, more narrowly, when the viability of a business or its industry is in question. You...

By Lawrence Hamtil

Social•Feb 14, 2026

Energy Leads US Sector Gains; Financials Fall

🇺🇸 US Sector Performance in 2026 📈 $XLE Energy up 22% $XLB Basic Materials up 18% $XLP Consumer Defensive up 16% $XLI industrials up 12.8% $XLU Utilities up 9% $XLRE Real Estate up 8% $XLV Healthcare up 2% $XLY Consumer Retail -2% $XLK Technology -2.5% $XLF Financials -5%

By Peter Sin Guili

Social•Feb 14, 2026

Debate: Should S&P Reclassify HOOD to Gaming?

Should S&P move $HOOD from Financial Services to Gaming? Put it in an entirely different GICS category? @RealJimChanos

By Barry Ritholtz